Bulls Give Thanks As Big-Tech, Bonds, Bitcoin, & Bullion Bounce

Solid durable goods data sparked weakness in stocks (good news is bad news), but really ugly recessionary PMI prints prompted the ‘bad news is good news’ reaction in stocks and sent them soaring. But all those gains were erased when Europe closed. Then it was up to The Fed’s Minutes which appeared to confirm the higher for longer ‘pause’ idea that was considered in the actual FOMC statement before Powell pissed in the punchbowl.

Putting it all together, Fed rate trajectory expectations shifted dovishly with the terminal rate falling and subsequent rate-cut expectations rising…

Source: Bloomberg

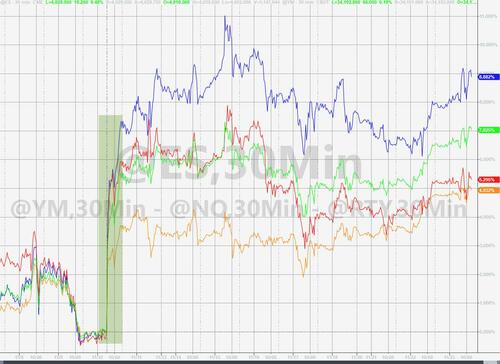

That helped spur a rally in stocks (led by the longest duration tech names). Nasdaq ended the day up 1%, S&P up 0.5% and Dow up 0.3%…

The Nasdaq is up around 9% since the CPI print, S&P up 7%, and Dow up around 5%…

The last two days have seen shorts squeezed once again…

Source: Bloomberg

And bonds were also bid with the long-end outperforming on the day (30Y -8bps, 2Y -3bps), extending the curve’s flattening/inversion…

Source: Bloomberg

The dollar tumbled back to one-week lows on the dovish FOMC Minutes and weak data this morning…

Source: Bloomberg

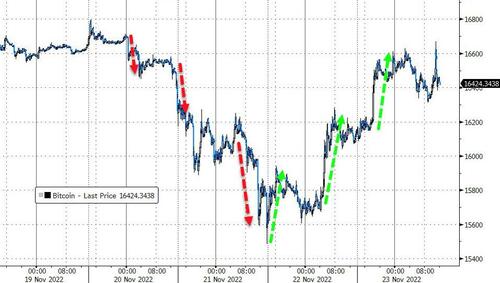

Notably Bitcoin has rallied back above $16,600, erasing the losses from the FTX Hacker dumps…

Source: Bloomberg

And Ethereum (where most of the dumping hit) has retraced a lot of the losses…

Source: Bloomberg

Gold gained on the day, despite a spike lower on the ‘good’ durable goods print, back to unchanged on the week…

Source: Bloomberg

Oil prices were the odd ones out as they fell after reports of discussions around the Russian oil price cap farce. WTI tumbled over 4% back to a $77 handle, extending losses on DOE reports of large product inventory builds…

Finally, since last Thanksgiving the dollar is up around 10%, gold has held its value while stocks and bonds have crashed around 25-30%. Crypto has been a bloodbath….

Source: Bloomberg

Additionally, VIX tanked back to a 20 handle today ahead of the long weekend – the lowest in 3 months…

But, we note that skew is starting to rise, suggesting a bid for downside protection

Source: Bloomberg

It seems that upside FOMO-crash hedges are being unwound (downward pressure on VIX) as investors rotate to downside fears.

Tyler Durden

Wed, 11/23/2022 – 16:01

https://www.zerohedge.com/markets/bulls-give-thanks-big-tech-bonds-bitcoin-bullion-bounce