Unprecedented Liquidations Lead To Historic Collapse In Investors’ Oil Exposure

By John Kemp, senior market analyst

Portfolio investors sold petroleum heavily for the third week running as fears about disruption to crude oil flows from the price cap on Russia’s exports receded.

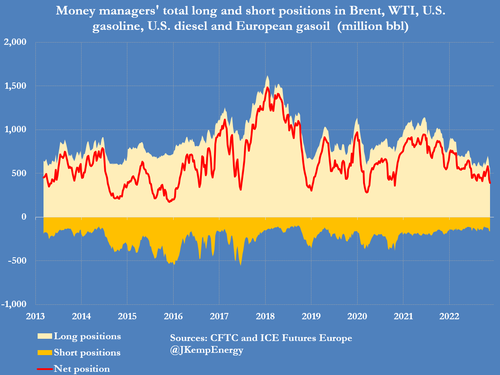

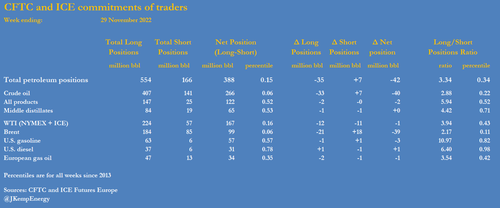

Hedge funds and other money managers sold the equivalent of 42 million barrels in the six most important oil-related futures and options contracts over the seven days ending on Nov. 29.

Sales over the three most recent weeks totalled 190 million barrels, more than reversing the 169 million barrels purchased over the previous six weeks in October and early November. As Bloomberg adds, money managers have trimmed positioning in Nymex crude for three weeks in a row. A breakdown of the data show the drop in positions is mostly from money managers cutting long exposure, rather than an abrupt short-covering.

In the latest week, sales were again concentrated in crude (-40 million barrels), especially Brent (-39 million), with only insignificant changes in other contracts.

Brent is the contract with the most direct exposure to the crude exports from Russia subject to the price cap announced by the United States, the European Union and their allies on Dec. 2.

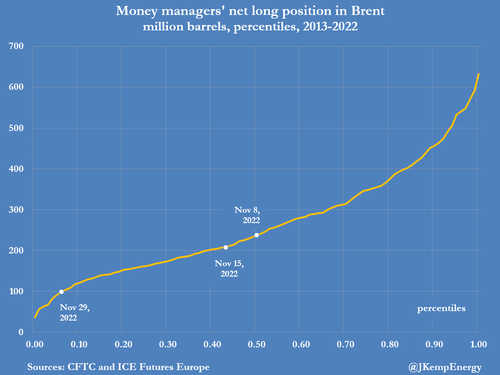

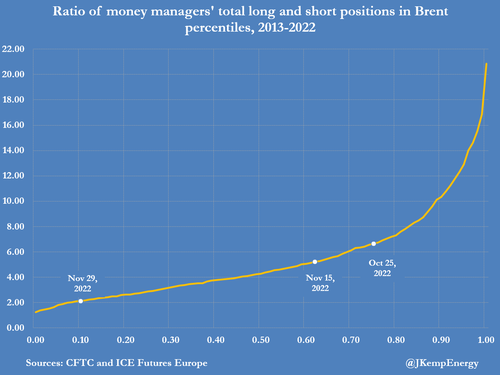

Fund managers cut their net position in Brent to just 99 million barrels (6th percentile for all weeks since 2013) last week from 238 million barrels (50th percentile) on Nov. 8.

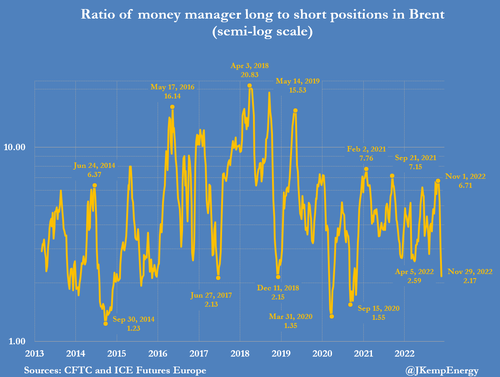

Bullish long positions outnumbered bearish short ones in Brent by a ratio of just 2.17:1 (11th percentile), down from 6.74:1 in late October (76th percentile).

The long-short ratio is the lowest for two years since November 2020, before the first successful coronavirus vaccines were announced a few weeks later.

Fears the price cap would reduce global crude supplies appear to have prompted a wave of buying in both physical and paper markets throughout late September and early October.

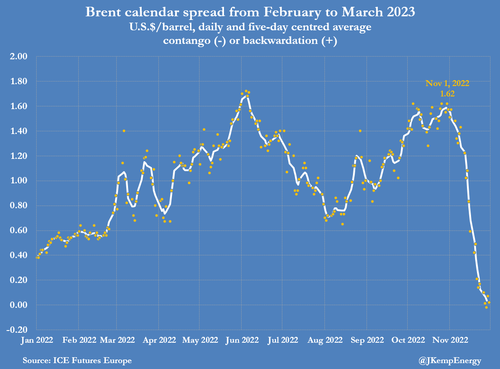

Precautionary buying drove front-month Brent futures up to a high of almost $99 per barrel on Nov. 4 from just $84 on Sept. 26. It also helped keep the futures market in a steep six-month backwardation.

But as it became clear the cap would be set at a relatively high level, with a relaxed approach to enforcement, this buying has reversed, causing prices and spreads to fall sharply.

With the risk from the price cap removed, for now investors’ attention has returned to the weak outlook for the economy and oil consumption in 2023.

Tyler Durden

Mon, 12/05/2022 – 14:21