Stocks Puke Back All Post-Powell Gains As Yield Curve Inversion Deepens

Weakening exports prompted a wider trade deficit in the US, but aside from that, there was little of note to driven today’s significant market moves – aside from a realization that Powell really didn’t say anything new last week and FOMO is all we have left to rely to ignite momentum and allow 0DTE traders to earn a buck (or lose $10).

Most notably today was the pessimism from several bank CEOs who all suggested varying levels of recession in 2023 (and a weakening consumer).

The yield curve continues to flatten deeper and deeper into inversion with The Fed’s most proven recessionary signal (3m10y) now is most inverted since 1981…

Source: Bloomberg

NOTE – it’s never inverted without a subsequent recession.

Even more specifically, Jay Powell’s favorite curve indicator – 18m fwd 3m bill yield spread to spot 3m bill yield is now notably inverted…

Source: Bloomberg

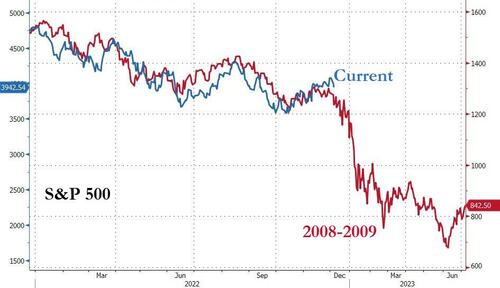

All the US majors puked hard today with Nasdaq down 2.5% at its worst (Dow was the prettiest horse in today’s glue factory). A late day profit-taking snatch put some lipstick on the ugly pig of a day…

The US majors are down in 7 of the last 8 days – the only up-day was during Powell’s address last Wednesday.

All of the post-Powell gains have been wiped out rather aggressively…

The S&P tumbled back to its 100DMA and found some support…

At the sector level, Energy and Financials are down the most since before Powell while Utes are holding gains…

Source: Bloomberg

Treasury yields were lower across the curve with the long-end outperforming (30Y -6bps, 2Y -3bps). Since Powell’s speech, the long-end is outperforming (30Y -27bps, 2Y -12bps)…

Source: Bloomberg

The 10Y yields is back testing down to 3.50%, the pre-payrolls levels from Friday…

Source: Bloomberg

The dollar extended gains, back above its 200DMA…

Source: Bloomberg

Bitcoin was quiet for once, hovering around $17,000…

Source: Bloomberg

The Bloomberg Commodity Index fell for a 3rd day hitting its lowest since February…

Source: Bloomberg

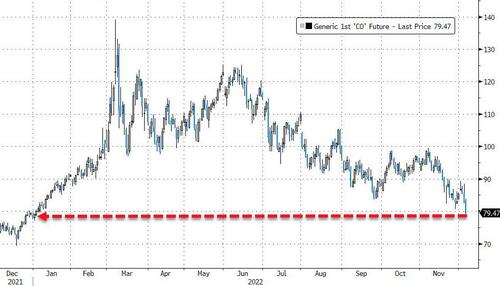

Brent crude fell back below $80 (for the first time since early January) despite Russia’s discussions of a price floor to counter G-7’s price-cap…

Source: Bloomberg

WTI crashed to a $3 handle as US boosted its 2023 oil production forecast (in what can only be seen as a politically-driven move given the previous forecast drop)…

NatGas tumbled for the 6th straight day (down almost 30% in that time)…

Source: Bloomberg

Gold was flat on the day, holding just below $1800…

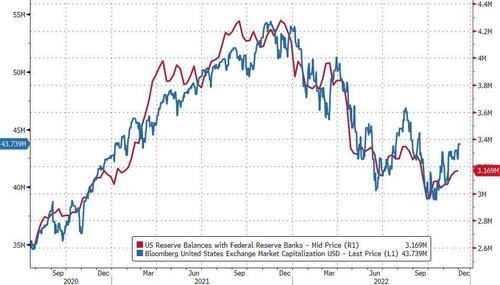

Finally, the US equity market capitalization continues to track the Fed balance sheet (reserves), and Powell shows no signs of reducing QT any time soon…

Source: Bloomberg

Is this the rollover we’ve been waiting for?

Source: Bloomberg

Maybe that catch down will normalize financial conditions with The Fed’s rate-hikes (as Goldman warns “ultimately we think the recent market moves could prove self-defeating”)…

Source: Bloomberg

As painful as that maybe, it is perhaps the only thing that will allow Powell to pivot.

Tyler Durden

Tue, 12/06/2022 – 16:00