The Greatest Risk Next Year Is That The Fed Gets Its Way

Authored by Simon White, Bloomberg macro strategist,

The market’s view for next year is now pretty consistent:

-

inflation will keep falling at its current pace;

-

the Fed will exercise a relatively large pivot later next year and into 2024;

-

the economy will avoid a recession (even though most forecasters expect one);

-

and stocks will remain in a bear market.

The main unpriced risks are that:

-

inflation stops falling as quickly as it has been and the Fed pushes through its “higher-for-longer” agenda, which would lead to sharp falls in stocks and bonds, and higher equity volatility; or

-

we get a recession, and this happens much faster than expected.

The first is unlikely.

Fixings from inflation swaps (as inferred by Bloomberg calculations) show that monthly y/y headline CPI prints should steadily fall all next year to under 2.5% by November, which accords with several other leading indicators.

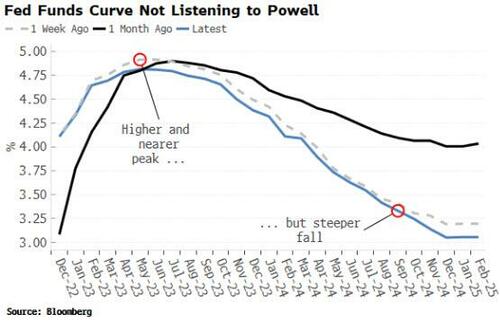

Secondly, this year the Fed has stated its desire that rates will remain restrictive for some time, but to no avail. Generally the market has heeded the Fed’s calls for a higher peak Fed Funds, but then it has implied that the Fed will have to make an even deeper and faster about-turn.

This is the greatest “unexpected”, endogenous risk facing markets: that the Fed is able to ram home its “higher for longer” preference. However, without a sudden change to the expected inflation path next year, it’s hard to see how the Fed will be able to do this. Still, its unexpectedness means this is where the greatest trading opportunities lie — i.e. much weaker stocks than current bearish expectations, rising equity volatility, and higher bond yields and steeper curves.

The more likely risk, but one still not yet fully priced, is if we get a recession.

The market continues to infer the anticipated Fed pivot (about 180 bps of cuts over 2023/24) is enough to dodge a recession, with equities currently behaving as if they are in a bear market that does not coincide with one.

A final downside risk facing markets is that recessions tend to come on abruptly, leading to a much deeper and faster Fed pivot than is now priced.

Tyler Durden

Thu, 12/15/2022 – 12:00

https://www.zerohedge.com/markets/greatest-risk-next-year-fed-gets-its-way