Final Q3 GDP Comes Unexpectedly Hot At 3.2%, Well Above 2.9% Estimate

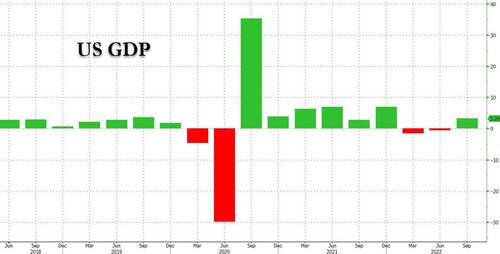

After the US economy plum

bed a technical recession in the first half on the back of a trade and inventory drag in Q1 and Q2 respectively, which pushed GDP negative in H1 but which was never recognized by the NBER, moments ago the BEA reported its final estimate of Q3 GDP which came in even hotter than previously expected, rising at a 3.240% rate, above the 2.930% estimated one month ago and well above the 2.57% initial estimate reported in October, mostly on the back of another upward revision in personal consumption.

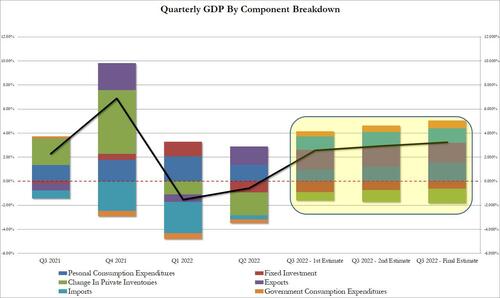

The update from the “second” estimate reflected upward revisions to consumer spending, which rose 2.3% in Q3 up from 1.7% in the previous estimate and up from 2.0% in Q2, as well as upward revisions to business investment, and state and local government that were partly offset by downward revisions to inventory investment and exports.

Here is the breakdown:

- Personal consumption contributed 1.54% to the 3.240% GDP bottom line, up from 1.18% in the 2nd estimate and up from 0.97% in the 1st Q3 GDP estimate

- Fixed investment subtracted 0.62% in Q3, a smaller reduction than the -0.74% in the second estimate

- The change in private inventories however took off a bigger chunk, subtracting -1.19% from the final Q3 GDP, up from -0.97% previously.

- Net trade added 2.86% to the bottom-line GDP print (1.65% to exports, 1.19% imports), slightly below the 2.93% in the second estimate.

- Finally, government consumption added 0.65% to the bottom line print, up from 0.53% seen in last month’s revision.

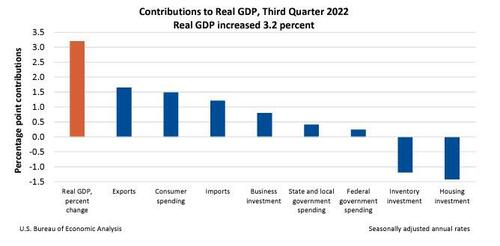

Looking at the bigger picture, the third-quarter increase in real GDP reflected increases in exports, consumer spending, business investment, and government spending that were partly offset by decreases in housing investment and inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased.

- The increase in exports reflected both goods (led by industrial supplies and materials, “other” goods, and nonautomotive capital goods) and services (led by “other” business services and travel

- The increase in consumer spending reflected an increase in services (led by health care and “other” services) that was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages).

- The increase in business investment reflected increases in equipment and intellectual property products that were partly offset by a decrease in structures.

- The increase in government spending reflected increases in state and local as well as federal (both defense and nondefense spending).

- The decrease in housing investment was led by new single-family housing construction and brokers’ commissions.

- The decrease in private inventory investment was led by retail trade (mainly clothing and accessory stores, other general merchandise stores, and “other” retailers).

- The decrease in imports reflected a decrease in goods (led by consumer goods) and services (led by transport)

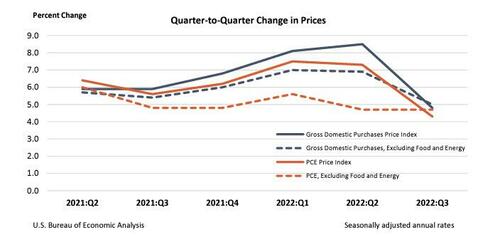

Strong GDP also meant higher inflation, and the GDP price index was revised up from 4.3% to 4.4% in Q3 (also higher than the 4.3% estimate), if below the 9.0% prior quarter. Core PCE Q/Q rose 4.7% in 3Q, also higher than the 4.6% in the previous estimate and 4.6% consensus estimate for the final print.

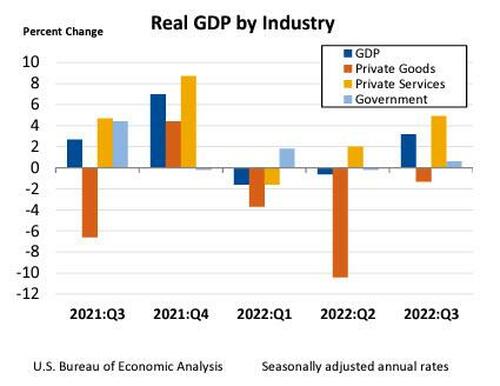

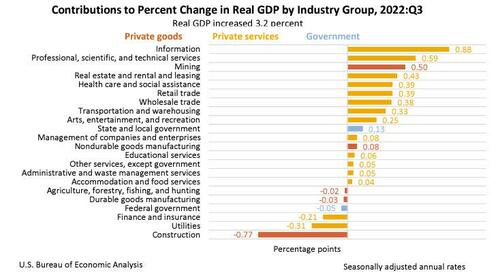

Today’s release includes estimates of GDP by industry, or value added—a measure of an industry’s contribution to GDP. Private services-producing industries increased 4.9 percent, government increased 0.6 percent, and private goods-producing industries decreased 1.3 percent. Overall, 16 of 22 industry groups contributed to the third-quarter increase in real GDP.

- The increase in private services-producing industries primarily reflected increases in information (led by data processing, internet publishing, and other information services); professional, scientific, and technical services; and real estate and rental and leasing (led by real estate). Partly offsetting these increases were decreases in utilities as well as finance and insurance (led by Federal Reserve banks, credit intermediation, and related activities).

- The increase in government reflected an increase in state and local government that was partly offset by a decrease in federal government.

- The decrease in private goods-producing industries primarily reflected a decrease in construction that was partly offset by an increase in mining

Tyler Durden

Thu, 12/22/2022 – 08:55

https://www.zerohedge.com/markets/final-q3-gdp-comes-unexpectedly-hot-32-well-above-29-estimate