Will The JPMorgan “3835 Collar” Support Markets This Week

After some wild moves in early and mid-December, the last four days of trading in 2022 should be a muted affair, with few notable macro/econ events or newsflow, and with technicals driving any year-end volatility.

So what should one watch for?

According to SpotGamma, major resistance remains at 3900, while support can found at 3850, the previously discussed JPMorgan “vol killing” collar at 3835, and eventually 3800. here, SpotGamma remains of the opinion that the S&P holds the 3800-3900 into Friday, 12/30 OPEX, and “for this week, this suggest that SPX moves to either side of this range should mean revert back into the 3835-3850 area.”

Some more details on the key technical levels:

Key levels match in the SPY, which generally has a larger gamma position than SPX. The big difference is that the SPX Put Wall is at 3800, while it is 375 for SPY (3665SPX). For this reason we see 3765SPX/375SPY as a maximum low end into 12/30. If that area is tested, we would anticipate a bounce back toward 3800 (as with last week).

What about the week’s big technical event, the JPM collar?

According to SpotGamma, there are shifting dynamics around the JPM collar call after this long weekend: for one, gamma is more concentrated now at the 3835 strike, but has less pull farther away. This can be seen from the example profile shown below. Last week (blue line) had a peak gamma near .003, while this week the peak gamma is near .004 (green, red). Again, this implies the pin is stronger in the 3835 area, but has less pull at the wings of 3990 and

However, as outlined at the top, SG’s models also show large gamma strikes at 3800 and 3900 which should serve to strengthen the support/resistance at the weakened “gamma wings” of the 3835 call. This all serves to keep the S&P inside of a 3800-3900 box.

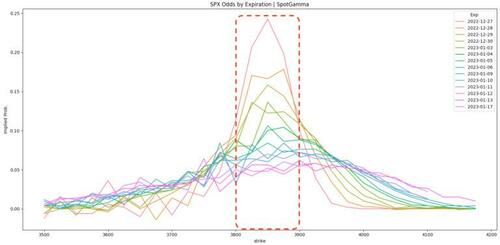

Indeed, the market appears to be favoring this range, too, and all this is shown in the chart below which SpotGamma estimates the odds of the S&P closing at various strikes, on a given expiration date. This is derived from current options prices, and you can see that the market prices strong odds that the S&P will close inside of this 3800-3900 range into 12/30.

Finally, the most vivid example of the JPM collar in action came just after 10am ET this morning when stocks slumped sharply in a low volume and liquidity air pocket and then stopped the drop just inches away from the 3835 level, before reversing sharply lower.

Beyond December and looking into 2023, SpotGamma believes that January will feature much more relative movement (volatility), as the pin is pulled on the 3835 area with 12/30 expiration (and as the “January effect” is no longer a driver of returns as discussed here). Further, there remains a significant catalyst with the very large equity expiration on January.

Tyler Durden

Tue, 12/27/2022 – 12:10

https://www.zerohedge.com/markets/will-jpmorgan-3835-collar-strike-support-markets-week