The Fed Sent $76BN To Treasury In 2022; It Is Now Sending $650 Million To Banks Every Day Instead

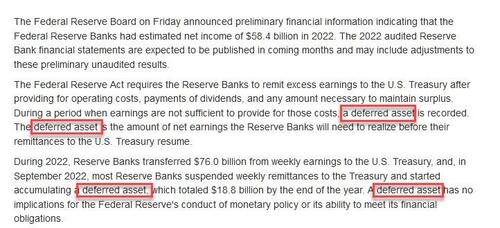

The Federal Reserve announced on Friday that it sent $76 billion in profits to the US Treasury last year, though those transfers stopped in September when its income turned negative and the Fed started accumulating a massive, multi-billion loss which totaled $18.8 billion by the end of the year, and which has only grown exponentially every since. Only the Fed was quick to correct any misperception associated with calling its massive wealth transfer a loss – after all, the genius brain trust of career academics at the Fed could never be associated with such a pedestrian concepts as a “loss” as that would tarnish its brilliance and imply the need for a bailout by Congress, similar to what happened in the UK – and opted for the term “deferred asset” which supposedly “has no implications for the Federal Reserve’s conduct of monetary policy or its ability to meet its financial obligations”; and after all, the Fed can always print whatever money it needs to plug the “deferred asset” hole.

The remitted amount was down from $109 billion remitted in 2021 and $87 billion in 2020.

Incidentally, while the Fed is all hip with the proper bailout vernacular and the correct usage of less politically-charged synonyms, the UK still has to realize that calling a central bank loss a “loss” is not a good idea as it implies, well, losing and suggests bailouts are imminent, as this FT article shows.

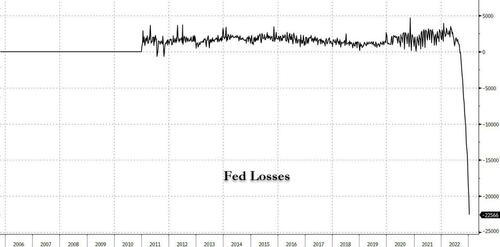

The Fed’s circular check-kiting scheme, where it was collecting interest on the Treasurys and MBS it bought under QE (allowing the government to fund its deficit in the process) ended in in March when the Fed started hiking rates, and the Fed’s clever scheme to fund the US budget deficit in yet another creative way (by sending Treasury the interest collected from the bonds purchased under QE) was nuked as that’s when the losses deferred asset first appeared, and have since grown to a massive $22.6 billion.

The losses were the result of the Fed’s own rate hikes, which increased the amount of interest the Fed has to pay to banks on their deposits and to money market funds that make overnight loans to the Fed. Its net income plummeted, and the interest earned from its bond holdings was eventually not enough to offset the costs.

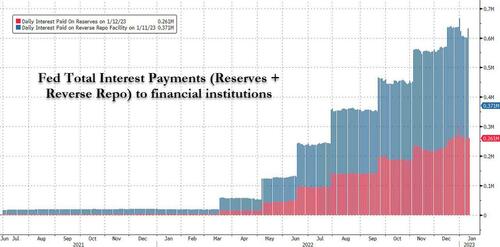

In other words, the Fed remains a fund flow passthru vehicle, only instead of remitting the interest collected from QE to the Treasury, it is paying the banks instead.

How much is the Fed paying banks? Simple: there is currently $2.18TN in reverse repos parked at the Fed which receive interest at the effective Fed Funds rate (4.33% today), as well as $3.08 trillion in reserves, which are paid at the Interest On Reserve Balances rate (4.40%). Add it across, and we get approximately $650 million in daily interest which the Fed pays to dozens of foreign and domestic banks and other financial institutions.

Earlier, we asked everyone’s favorite Indian and undisputed Peoples’ Champion and crusader against all that is not socialist, Liz Warren, when this unprecedented bank subsidy – which could feed, clothe and shelter millions of homeless Americans for years, would be addressed by Congress – after all this matter is precisely in her wheelhouse, or at least we can all pretend it is…

hey @ewarren when will you talk about how the Fed is paying banks $650 million in interest EVERY DAY? Or is it easier to distract the masses with bitcoin and gas stoves? pic.twitter.com/zGzuF6ZpCB

— zerohedge (@zerohedge) January 13, 2023

… but we are confident that there are other much more important matters such as gas stoves and bitcoin criminals that the Senator would much rather distract the population with.

Tyler Durden

Fri, 01/13/2023 – 15:00