Category: TECHNOLOGY

Messaging app Viber launches Payments, a new digital wallet for paying bills, money transfers and buying goods

Viber, the messaging app owned by Japanese e-commerce giant Rakuten, has long been dancing around the area of fintech, launching services like money transfer and chatbot payments in various countries over the years. Now, it is making a move to double down on that strategy: it’s launching Payments on Viber — a new service that will let users set up digital wallets tied to their Viber accounts.

Linked to other bank accounts as well as Visa and Mastercard, Payments wallets can in turn be used to make bill payments and buy goods, as well as transfer money to other individuals. Peer-to-peer transfers will be the first of these services to launch, and these will be free. Services like payments to businesses like will have some fees attached.

The service is being launched first in two markets — Germany and Greece — with the plan being to extend that to the rest of Europe, and then Viber’s wider global footprint of 180 countries, this year and next.

Viber CEO Ofir Eyal said the reasons for starting with these two countries first were strategic.

Greece is what he described as a “purple country”, where Viber is installed on the phones of some 91% of smartphone users in the country, working out to 7 million Viber users in a population of 10.7 million, and making P2P transfer more viable (there is an option to transfer money to non-Viber users, but it is less seamless, he said).

Germany, meanwhile has just 3 million Viber users, but Eyal described it as a “strong corridor” for transfers to Greece. Viber also happened to win a security award there recently, he said, “so brand perception is strong.”

For now, Viber’s pre-existing payment services — such as chatbot payments — will continue to stay in place where they are live — mainly Ukraine, Bulgaria and Hungary, Eyal said. These have to date facilitated “millions” of transfers, but as Payments expands, they will gradually be wound down with Payments functionality replacing them.

Viber has a large team of engineers working on its app — in addition to voice and video calls and text messaging, it provides a complement of other media and third-party integrations for users. But interestingly, this turn to fintech is being done in partnership with an outside partner.

Rapyd, the “fintech-as-a-service” startup that provides a wide variety of embedded financial services by way of APIs to a host of other companies, is powering Payments in the two initial launch countries. Eyal noted that Viber might work with Rapyd in other markets, too, or it might opt for other partners. He also noted that Rakuten is not investing in Rapyd, nor does it have plans to. Viber might also incorporate services from Rakuten itself or companies that Rakuten does invest in as Payments and Viber’s fintech ambitions overall expand, he added. Viber is not handing the whole operation to Rapyd: it will be providing tech and data to fill out “KYC” aspects …read more

Butlr lands new cash to put people-detecting sensors in the office

One key advantage of Butlr’s sensors is that they preserves privacy, claims Deng. The palm-sized hardware captures only “temperature pixels” and nothing else, unlike, say, cameras.

“There are various sensing modalities to understand space occupancy and utilization, ranging from the old-school time and utilization studies (i.e., consultants with clipboards and clickers) to using Wi-Fi access points to cameras and more exotic lidar solutions,” Deng continued. “Each sensing modality has its advantages and limitations due to physics. The reason customers are choosing Butlr has to do with privacy, cost of ownership, time to value and flexibility.”

It’s worth noting that Butlr isn’t totally unique in its privacy-preserving approach.

Butlr, an MIT Media Lab spinout developing sensors that use body heat to estimate office occupancy, today announced that it raised $20 million in a Series A round with participation from Carrier Global Corporation (a strategic investor), Tiger Global, Primetime Partners, E14, Unionlabs, Hyperplane and Tectonic Ventures. Co-founder and CEO Honghao Deng said that the proceeds will support product development and expanding Butlr’s 50-person workforce, specifically its go-to-market team.

Deng asserts that many companies are flying blind when it comes to real estate. While they added heads during the pandemic, they now face economic headwinds that could — or already have — prompted hiring freezes and layoffs. With the lack of clarity on whether they should lease more space, reduce their footprint, use co-working spaces or all of the above, Deng said, it’s resulting in paused construction and office redesigns as companies figure how to accommodate employees’ needs while cutting costs.

According to a March AT&T poll, 72% of businesses lack clear hybrid work strategy.

“The pandemic brought home the need to understand occupancy and utilization data for real estate executives,” Deng told TechCrunch in an email interview. “Whereas pre-pandemic, they could assume everyone would be in every day of the week, that’s no longer the case. Real estate and workplace executives need to establish a new baseline and make data-driven decisions given the dollars at risk with regard to office space and employee productivity.”

He points to Butlr’s technology as the solution, which uses thermal sensing and AI to provide data on space occupancy and historical activity. The company’s sensors — which Deng and Butlr’s other co-founder, Jiani Zeng, developed while at MIT — don’t require networking equipment other than a Wi-Fi connection and hub and have a claimed “multiyear” battery life. Via a cloud dashboard and API, Butlr displays information like which areas of an office are the busiest and how many people have entered and exited a space.

One of Butlr’s temperature sensors. Image Credits: Butlr

One key advantage of Butlr’s sensors is that they preserves privacy, claims Deng. The palm-sized hardware captures only “temperature pixels” and nothing else, unlike, say, cameras.

“There are various sensing modalities to understand space occupancy and utilization, ranging from the old-school time and utilization studies (i.e., consultants with clipboards and clickers) to using Wi-Fi access points to cameras and more exotic lidar solutions,” Deng continued. “Each sensing modality has its advantages and limitations due to physics. The reason customers are choosing Butlr has to do with privacy, cost of ownership, time to value and flexibility.”

It’s worth noting that Butlr isn’t totally unique in its privacy-preserving approach. Density, a competitor, has long claimed that its sensors can only capture occupancy data and not information that might be used to identify a person.

Still, Deng says that Butlr’s hardware design and space-designing software was what won over many of its early customers.

“Commercial real estate and senior living are the first two industries to embrace Butlr’s technology, and the company …read more

Cordial, which personalizes and automates cross-channel messaging campaigns, raises $50M

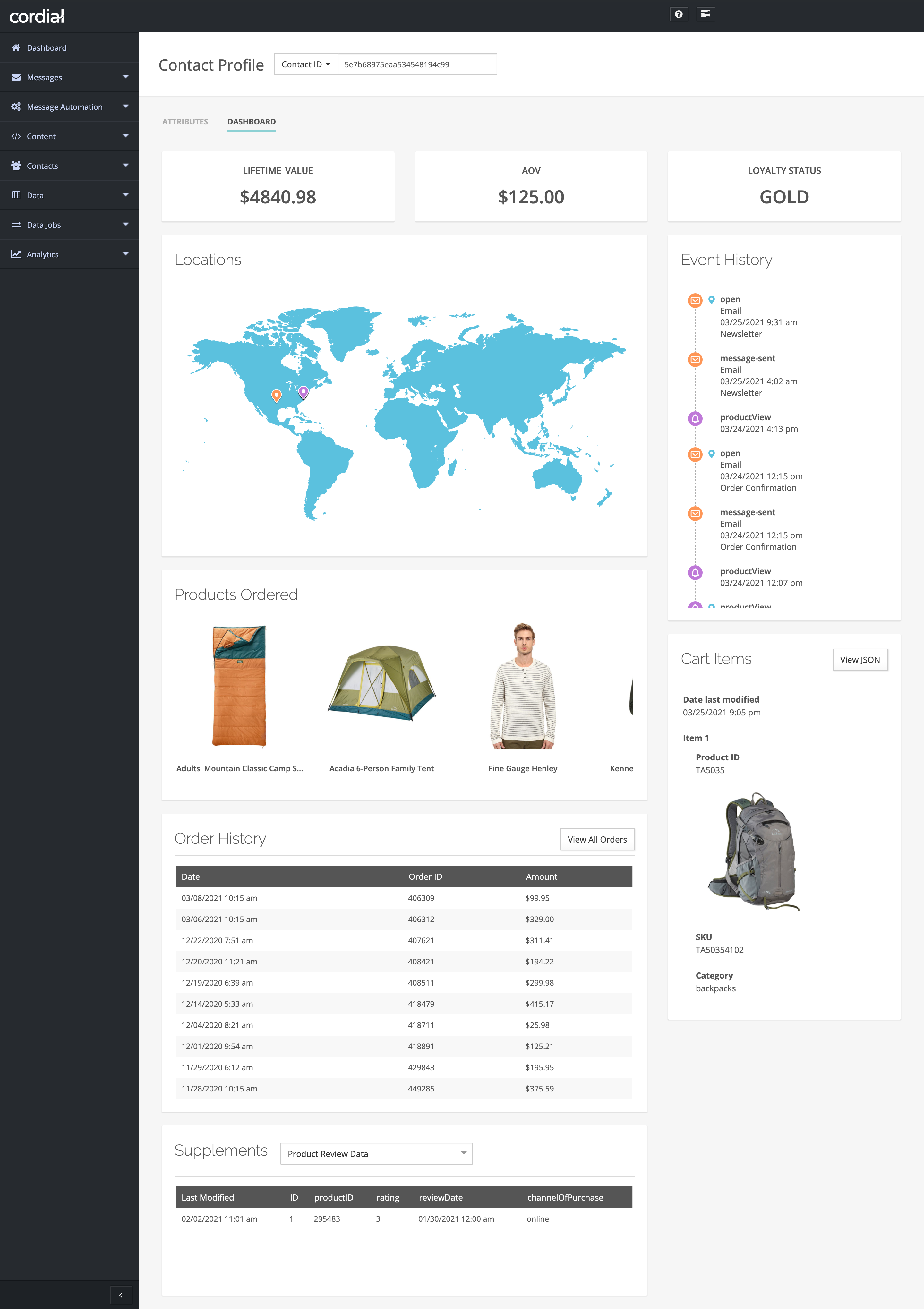

Cordial supports A/B experiments, automatically updating messages to include better-performing content aligned with KPIs like revenue, gross margin and clicks. Out-of-the-box models attempt to predict everything from churn propensity (i.e., the likelihood of a customer to leave) to product affinity (i.e., a customer’s liking for a product), or users can build custom models and automation triggers based on their business needs, rules and inputs.

“Cordial has extensively emphasized and invested in machine learning throughout the platform, using customizable models for each client,” Swift said. “Clients can view or set the top predictors in each model to ensure they have a clear understanding of how Cordial’s machine learning is working … We believe that clients should have full access and be able to easily understand how our models work to ensure a trusting relationship and to avoid the “black-box” approach of most broad-based, generic AI.”

When asked who he sees as Cordial’s closest rivals, Swift named Braze and

Cordial, a cross-channel marketing and data management platform, today announced that it closed a $50 million Series C funding round led by NewSpring, with participation from new investor ABS Capital. Jeremy Swift, Cordial’s CEO and co-founder, said that the fresh capital will be used to expand the company’s global footprint, launch new platform features and nearly double headcount by the end of the year.

In Swift’s view, customers today expect highly personalized messaging in exchange for the first-party data they share. McKinsey agrees — according to a 2021 survey by the firm, 71% of consumers expect companies to deliver personalized interactions and 76% get frustrated when this doesn’t happen. To meet expectations, marketers must be able to go beyond simply aggregating data to power messaging that wins and keeps customers, Swift says.

Another challenge is striking the right balance between thorough outreach and giving customers some breathing room. It’s not easy. In a 2017 survey from Campaigner, nearly half (49%) of consumers said they receive too many emails from business owners and marketers and three in 10 said they wanted to hear from a brand once a month or less.

“Consumers aren’t tuning into the same old, cyclical outbound messages from brands, nor are they buying in the same way they used to … Having all of your customer data available in real-time when sending a message — via email, SMS, mobile, social, and more — has never been more important,” Swift told TechCrunch in an email interview. “Legacy email service providers (ESPs) are trying to acquire businesses to shore up their lack of messaging and data capabilities, but they’re just accumulating point solutions that end up providing a clunky user experience without the capability of truly real-time marketing execution.”

Seeing an opportunity to “inspire more thoughtful communication” between brands and consumers, Swift co-founded Cordial in 2014 with Adam Gillespie, Chris McGreal and David Baker. Gillespie and McGreal had previously worked together with Swift to build BlueHornet, an ESP that was later acquired by Digital River.

“Our hindsight within the ESP market has paid huge dividends to anticipate what marketers would need and want for the future, far ahead of the competition,” Swift said. “We believed that there had to be a better solution for marketers to engage their customers in personal, relevant ways.”

Cordial is the fruit of their labor, offering tools for orchestrating marketing across channels, including email, SMS and mobile apps. The platform brings together data from multiple sources (e.g., cloud storage, rest APIs) to create AI models that automate campaigns, letting marketers connect customers to known profiles for an improved customer experience.

The Cordial central dashboard. Image Credits: Cordial

Cordial supports A/B experiments, automatically updating messages to include better-performing content aligned with KPIs like revenue, gross margin and clicks. Out-of-the-box models attempt to predict everything from churn propensity (i.e., the likelihood of a customer to leave) to product affinity (i.e., a customer’s liking for a product), or users can build custom …read more

Snyk adds policy-based code security to its arsenal

Last year was a pretty good one for Snyk, a Boston-based security company. It raised a hefty $530 million on a $8.5 billion valuation, and with that kind of money in the bank, it’s probably not surprising that it went shopping. In February, it bought developer-focused cloud security company Fugue for an undisclosed amount.

Today, Snyk announced a new developer-centered cloud security product at AWS re:Inforce in Boston. The product’s policy engine enables security teams to hard code complex rules into the system to fix problems before they become an issue, and it’s based on the technology that Fugue brought to the company.

Former Fugue CEO and co-founder Josh Stella, who is now chief architect at Snyk, says when Snyk’s co-founder Guy Podjarny approached him last year, they bonded over the idea of putting developers at the center of the security solution. “We got into a conversation about how in both of our views the future of security would be focused on developers, the builders of systems,” he said.

He says when you look at some of the major breaches in recent years, they typically have involved system-level security issues that the solution his company brought to Snyk is designed to prevent. “Our unified policy engine will allow both developers and security practitioners to share an understanding through policy code of what is safe and secure. And that allows us at Snyk to share with all of our customers what we know is safe or unsafe,” he said.

He says this goes beyond the protoypical kind of use case of an Amazon S3 bucket being left exposed, which he says is rarely as simply as a misconfiguration. “Very often it’s a little more nuanced than that and it’s some combination of how the application works in the application code, how the IAM (identity and access management) privileges are configured, and how the S3 bucket is configured,” he said.

“And our approach to our policy engine allows us to look across those things, which is where the real vulnerabilities tend to lie, and where they get exploited.”

He said that from the beginning the idea was to integrate this solution into the Snyk platform. Snyk CEO Peter McKay says that Fugue’s technology really enhances the company’s product set, and adds a critical component.

“We needed to become more developer centric, and we looked at that market. We saw really one company that we thought was the most developer centric, which was Fugue, and [acquiring them] allowed us to bring their capabilities into our platform, which allowed us to offer the fifth product [in our product portfolio],” he said.

The product is available to a limited group of customers starting today with general availability expected later this year. And even though they are announcing it at an Amazon security event, it will work on all major cloud platforms.

https://techcrunch.com/2022/07/26/snyk-adds-policy-based-code-security-to-its-arsenal/

Private equity descends on Chartbeat

Chartbeat, a website that tells publishers about their readers, is getting the private equity treatment.

Launched out of Betaworks in 2009, the service offered real-time analytics back when Google Analytics made you wait 24 hours to see who was clicking around your site. Eons later, private equity firm Cuadrilla Capital has swooped in to buy it, Chartbeat chief executive John Saroff said on Twitter today. The CEO added that Chartbeat’s staff, including leadership, will stick around following the deal.

Axios, which broke the news, reports the deal will let Chartbeat “build a suite of products that help media companies grow their businesses, in addition to helping shape their editorial strategies.” Ah, yes, private equity — the institution known for helping media companies grow.

Betaworks is headquartered in New York, and known for its early investments in Twitter and Tumblr, and for incubating services like Giphy and Bit.ly.

Since launching last year, Santa Barbara-based Cuadrilla has snapped up two other data firmsAgilence and InfoDesk.

https://techcrunch.com/2022/07/25/private-equity-vulture-chartbeat/

Disney+ revives ‘Daredevil’ after Netflix canceled it four years ago

During Hall H’s presentation at Comic-Con this Saturday, Marvel Studios president Kevin Feige announced “Daredevil: Born Again,” a new series for Disney+ that stars Charlie Cox as Daredevil and Vincent D’Onofrio as Kingpin. “Born Again” will get an 18-episode first season and will stream on Disney+ in the spring of 2024.

It’s unclear at this time who else will be cast in the series, but it would be nice to see Deborah Ann Woll reprising her role as Karen Page.

The announcement will be a relief to some fans who were disappointed after Netflix canceled “Daredevil” in 2018.

Known as The Man Without Fear, Cox first portrayed the title character on Netflix for three seasons and a total of 39 episodes. The series cancellation was due to Disney pulling back rights to film and television projects licensed to Netflix. The streamer had no choice but to pull the plug on all Marvel titles like “Luke Cage” and “Iron Fist,” which moved to Disney+ in March.

Netflix is currently in need of strong shows after losing an astounding 970,000 subscribers this quarter.

News that Disney had plans to revive “Daredevil” was first reported in May. Erik Olsen, the showrunner for the Netflix series, celebrated the news on Twitter, praising the cast and fanbase as some of the best ever.

It was also reported over the weekend that Cox may voice the title character in Disney+’s upcoming animated series “Spider-Man: Freshman Year.” Plus, the actor made an appearance as the attorney/crimefighter in the recent trailer for “She-Hulk: Attorney at Law.”

As the Marvel Cinematic Universe approaches the end of its Phase 4, Marvel announced that Phase 5 will be known as “The Multiverse Saga.” Fans will get “Black Panther: Wakanda Forever” as the last Phase 4 film.

With Phase 5, Marvel will release “Blade,” “Guardians of the Galaxy Volume 3,” “Secret Invasion,” “Agatha: Coven of Chaos,” “Ironheart,” “Echo,” “Thunderbolts,” “Captain America: New World Order,” “The Marvels,” and “Ant-Man and The Wasp: Quantumania.” Disney+ will also get a second season of “Loki.” The new “Daredevil series is a part of Phase 5.

Phase 6 will include “Fantastic Four,” “Avengers: Secret Wars,” and “Avengers: The Kang Dynasty.”

https://techcrunch.com/2022/07/25/disney-revives-daredevil-after-netflix-canceled-it-four-years-ago/

Crypto valuations may sink until September as VCs play a waiting game

Tons of capital has been raised across the crypto industry in recent months, but there has been a noticeable pause in deployment. That might change in the coming months.

As it’s taken longer to close crypto VC deals, valuations across the industry have dropped, according to David Nage, venture capital portfolio manager at Arca.

Some VCs are taking advantage of this time as the market remains investor-friendly, while others are waiting just a bit longer to push out capital.

“There’s been this kind of viral dialogue that sometime around September, valuations are gonna come down even more significantly and it’s just gonna be a frenzy,” Nage said.

Even though there might be a waiting game happening right now, the total amount of capital going into crypto is still up from the year-ago period. Capital raised in the digital asset sector rose nearly 35% from $6.08 billion during the second quarter of 2021 to $8.13 billion in the second quarter of 2022, according to data compiled on PitchBook.

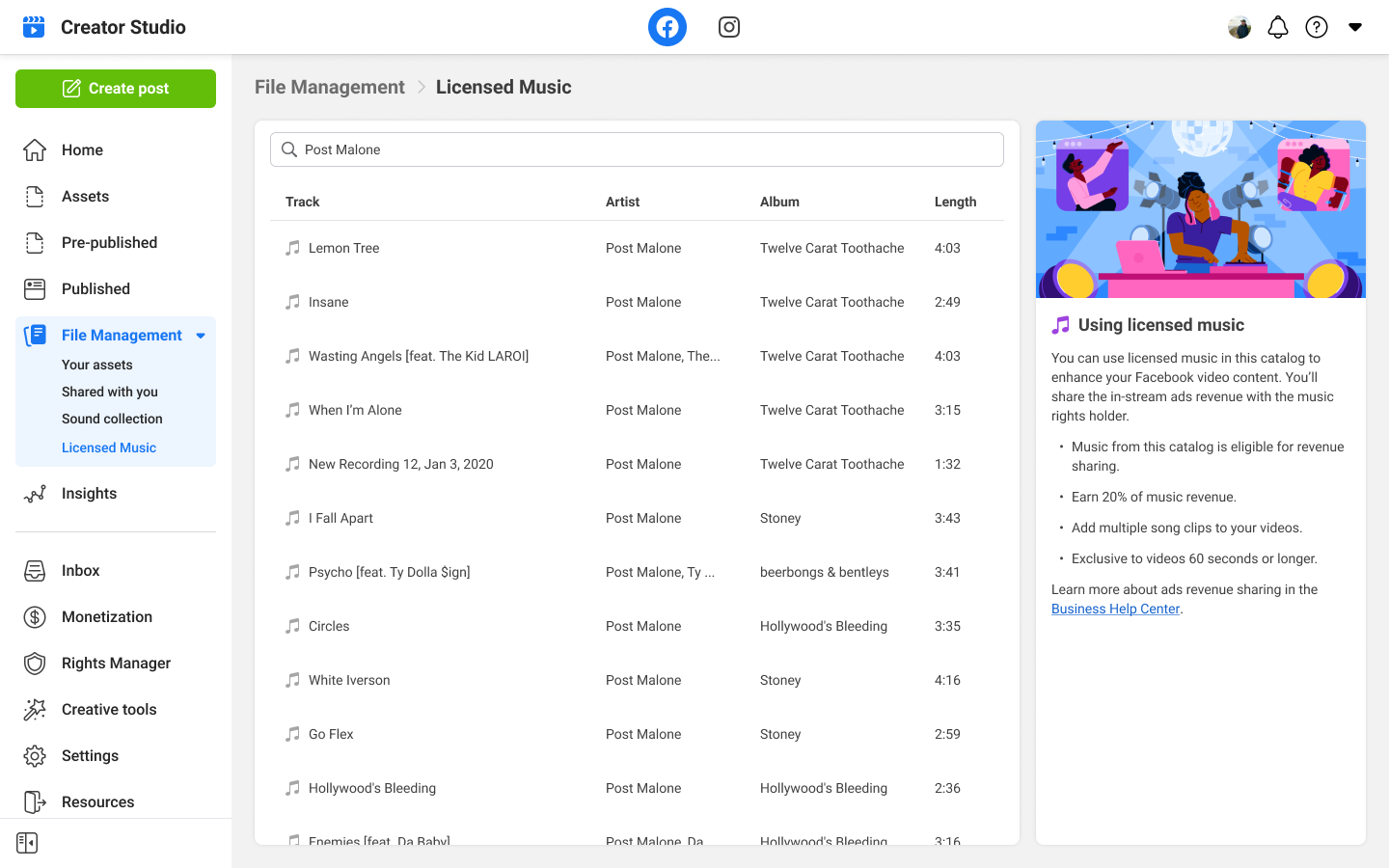

Creators on Facebook can now earn money through videos that use licensed music

Meta announced today that creators on Facebook can now earn money through their Facebook videos that use licensed music. The company is launching “Music Revenue Sharing” to allow video creators to include licensed music in their videos on Facebook and earn a share of in-stream ad revenue. The company says this opens up a new way for both creators and music rights holders to earn money. Although creators have been able to use licensed music in videos, they haven’t been able to monetize them until now.

With this new feature, whenever a creator uses licensed music in their videos on Facebook that are 60 seconds or longer, they can earn money on certain videos through in-stream ads. Creators will receive 20% revenue share on eligible videos, with a separate share going to rights holders and to Meta, though the company declined to share specifics.

Meta says Facebook Reels are not eligible for monetization through Music Revenue Sharing at this time. It’s possible that the company may expand Music Revenue Sharing to Reels in the future.

To be eligible for Music Revenue Sharing, creators must be eligible for in-stream ads and meet Facebook’s monetization eligibility standards. The featured song used in a video must also be part of the Licensed Music library, which contains all eligible songs for Music Revenue Sharing. Eligible songs include popular songs from artists like Post Malone, Tove Lo, Grupo La Cumbia, Leah Kate and Bicep, among others. Lastly, Meta notes that there must also be a visual component in the video and that the licensed music itself cannot be the primary purpose of the video.

Image Credits: Meta

Creators can identify the eligible songs that have been approved for monetization through Music Revenue Sharing by accessing the Licensed Music library within Creator Studio.

Once you upload your video to your Facebook page, you’ll see a notification within Creator Studio and your Support Inbox notifying you if the song is eligible for Music Revenue sharing. When the video is published to your Page, you’ll receive a notification confirming that your video is earning and sharing revenue. Creators can monitor their progress on expected earnings from in-stream ads in Creator Studio.

Music Revenue Sharing will start rolling out today to video creators globally, Meta says. To start, eligible videos will monetize from in-stream ads in the United States and will then expand to the rest of the world where music is available on Facebook in the coming months. Meta also says it will continue to work with its music partners to expand the Licensed Music library to include more licensed songs. The company also plans to build out more ways for people to share and connect through videos on Facebook.

Meta says this feature is made possible by Rights Manager, a video, audio and image-matching tool developed at Meta that is designed to help content owners protect their rights and manage their content.

Can a baby’s cry identify neurological disorders? Ubenwa says ‘yes’

When Charles Onu’s cousin was born with birth asphyxia and later developed a hearing condition, the seed for Ubenwa, an audio biometric company geared at identifying neurological disorders in infants, was also planted.

Onu, CEO and co-founder, said he hopes Ubenwa will change the way physicians provide care to infants.

“We’re trying to bring the world to a point where infant cries are considered to be a vital sign just as much as we would consider their heart rate to be a vital sign,” he explained in an interview with TechCrunch.

After Onu graduated with his undergrad in engineering he volunteered with health-based NGO’s and saw more cases like his cousin’s — though some were far grimmer.

The Montreal-based company uses an infant’s cry to determine if it falls within the range of having signs of a neurological condition. Crying audio is collected at partner hospitals, internationally, and then categorized into what is considered normal or abnormal. From there, the company can predict whether a child may be suffering from a potential disorder.

For now, the AI-powered software only identifies early signs of birth asphyxia, and can potentially determine learning milestones based on cry triggers. According to Onu, the company is hoping to evolve the technology to identify congenital heart disease.

It should be noted that a recent Stanford University study identified that some FDA approved AI medical devices are “not adequately” evaluated and there are no best practices set for the development of these technologies.

But to Ubenwa’s credit, they are performing studies in pursuit of building out the case for the science behind their tech further still.

For those actually using the application, they record the baby crying and then receive weekly summaries of patterns. If there is an abnormality detected, the application notifies the user and provides data to share with doctors.

“Today, doctors use physical assessment to look at eyelids, look at the skin tone, and so on and so forth,” Onu said. “If [doctors] are really worried it could be with an MRI or a brain MRI machine because that’s the ultimate standard, but we don’t live in an MRI machine every day. That is costly. With simple cry analysis you can track neurological biomarkers on an ongoing basis, non invasively.”

Despite the company being based out of Canada, they have additional operations in Nigeria (where Onu is originally from) and Brazil. The company partners with hospitals in those regions in order to get larger sample sizes for their data. Despite the fact that users will be recording cries, Onu said, those cries will not be collected and store: Analysis of the cries will be matched to their existing database.

Although Ubenwa has a focus on an infant’s cry, other companies are using audio biometrics to help diagnose other conditions, but typically for an older age group. StethoMe says they use breath to identify air pathway disorders in children and share that data with physicians. Similarly, Ellipsis Health claims to use voice biomarkers to diagnose depression in patients.

To date, …read more

https://techcrunch.com/2022/07/25/can-a-babys-cry-identify-neurological-disorders-ubenwa-says-yes/

Only five days left to save up to $1,300 on passes to Disrupt

Building a startup takes money. Not exactly a newsflash, is it? At a time when every dollar counts, this is a reminder that you have only five days left to take advantage of early-bird pricing on passes to TechCrunch Disrupt on October 18–20.

The early bird flies the coop on July 29 at 11:59 p.m. PDT. Buy your pass before the deadline expires and save up to $1,300.

Disrupt amounts to three days of masterclasses in the art and science of building, funding, launching and scaling successful early-stage startups. That’s not just us honking our own horn. Listen to what other attendees say about why Disrupt matters.

“Tech startups go to Disrupt to show off their stuff. It’s the perfect place to scope out the competition, network with potential investors, get a feel for how other companies position themselves and to see what’s trending.” — Jessica McLean, director of Marketing and Communications, Infinite-Compute.

“Disrupt is a great sweet spot, and highly valuable, for anyone in the idea stage all the way through to having raised some angel money. Soak up the pitch feedback sessions and the VC presentations. They’re telling you what they’re looking for, what motivates them, what pushes them to contact you for a meeting. And that’s exactly what every startup raising capital needs to know.” — Michael McCarthy, CEO, Repositax.

“Disrupt was a great place to look for potential partners beyond our blockchain world. We got to meet and collaborate with founders in complementary technologies like IoT and AI. Building those relationships will help all of us provide customers with better solutions. It’s a win-win.” — Joel Neidig, founder of SIMBA Chain.

Yep, there’s plenty of opportunity waiting for you at Disrupt. Here’s just a quick taste of what you can expect.

- Learn how to raise your first dollars

- Apply to the Startup Battlefield 200 for a free, perk-packed VIP experience and a shot at $100,000 — but hurry! Submit your application before July 31 at 11:59 p.m. PDT.

- Check out all the different ways to network.

- Explore crypto’s changing landscape.

TechCrunch Disrupt 2022 takes place in San Francisco on October 18–20 with an online day on October 21. Make every dollar count. Buy your pass before the early-bird deal disappears on July 29 at 11:59 p.m. PDT and save up to $1,300.

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2022? Contact our sponsorship sales team by filling out this form.

https://techcrunch.com/2022/07/25/only-five-days-left-to-save-up-to-1300-on-passes-to-disrupt/