Category: TECHNOLOGY

Zipline unveils cute little droid to make drone delivery more accurate

Zipline unveiled its next generation electric autonomous drone platform Wednesday that includes an updated drone as well as a more accurate method of delivering parcels to a customer’s home.

Zipline historically has parachuted packages from the sky and onto a target area roughly the size of a couple of parking spaces. Now, Zipline is introducing its droid, a vessel about the size of a small duffle bag, that autonomously maneuvers down a tether from the drone, steers to the target location, and gently empties its contents before being zipped back up into the drone.

“Just like modern cars use sensors and cameras to understand the world around it, our droid will have a robust onboard sensor suite, including GPS and visual sensors, which it will use to maneuver and help ensure a delivery site is free from kids, dogs or other obstacles,” Jo Mardall, head of engineering at Zipline, told TechCrunch, noting that a similar sensor suite helps guide the P2 Zip, the next-generation drone.

The droid’s three fans help it to combat changes in wind or other environmental factors for more accurate delivery — Zipline says it has been able to narrow down the drop zone to within 2 meters, or around 6.5 feet.

The P2 can carry a 6 to 8 pound payload and has a 10-mile service radius when delivering a package and coming straight back to a single dock. Like Zipline’s previous drone version, the P2 is a fixed-wing aircraft. However, it also comes with four propellers that allow the vehicle to hover in mid-air and engage in vertical takeoff and landing. This not only helps with delivery, but also fulfilment.

The new delivery platform includes docking and charging hardware that can be attached to the outside of any building or set up as a freestanding structure. When the drones return from a delivery, they’ll dock themselves, release their empty droid, take on a new one, and then fly back off to do another delivery. Zipline also designed an accompanying software that can be integrated with third-party inventory management and ordering systems, as well as an app that lets customers and companies track orders “to the second.”

“We have built the closest thing to teleportation ever created – a smooth, ultrafast, convenient, and truly magical autonomous logistics system that serves all people equally, wherever they are,” said Keller Rinaudo Cliffton, co-founder and CEO of Zipline, in a statement.

A few businesses have already committed to the updated service, such as fast casual salad bowl chain Sweetgreen, although Zipline didn’t provide specifics as to when or where those deliveries will begin. Michigan Medicine is another new customer that hopes to double the number of prescriptions it fills each year through its in-house pharmacy.

Intermountain Health in the Salt Lake City metro area is expanding on its partnership which began last October to include the new service. Existing customer MultiCare Health System in Washington will also use the new platform to speed up diagnostics and deliver prescriptions and medical device throughout its hospitals, doctors’ offices and labs.

Finally, the government of Rwanda, Zipline’s first customer, will expand its partnership with Zipline to more accurately deliver to homes, hotels and health facilities in Kigali to start, and then beyond.

Zipline said it will continue to offer its original delivery service with parachutes alongside the new service, as they complement each other and can solve for different use cases.

“We’re excited about this new platform because we think it’s the best delivery experience. Not just the best drone delivery experience, but the best delivery experience,” said Wyrobek.

Zipline is aiming for its first customer deployment of the new system by early next year. The company plans to conduct over 10,000 flight tests this year using about 100 aircraft.

Zipline unveils cute little droid to make drone delivery more accurate by Rebecca Bellan originally published on TechCrunch

Zed raises $10M for a code editor built for collaboration

Code editors are complex and demanding pieces of software, but from a business standpoint, they’re notoriously difficult to monetize. At the same time, they haven’t kept pace with recent trends like work-from-home collaboration.

At least, that’s how Nathan Sobo sees it. “Coding is inherently social, yet the tools available for talking about code limit the pace and scope of conversations, and this friction is hampering the productivity of our industry,” he told TechCrunch in an email interview. “I believe the only path forward is to integrate collaboration into the authoring environment as a first-class concern, much like the transition that has already occurred in design with Figma or in prose with Google Docs.”

Sobo might not be a household name. But he was a member of the Atom editor team at GitHub, which worked on the (now-deprecated) Atom code editor. Now, he’s launching Zed, a code editor focused on “multiplayer” experiences, performance and a streamlined, minimalist design.

Sobo teamed up with Antonio Scandurra and Max Brunsfeld — fellow Atom contributors — to co-launch Zed. Sobo describes Zed as the culmination of a “decade-long” quest to improve the way software is developed.

“In 2019, Antonio and I decided that in order to achieve our vision of building the ultimate code editor and collaboration platform, we needed to start over with a new technical foundation,” Sobo said. “We worked on Zed during nights and weekends until spring of 2021, when we raised a seed round and started Zed Industries, and we’ve been focused on building Zed since.”

Sobo asserts that Zed’s key differentiators are performance, design and multiplayer editing. It’s designed to minimize distractions and “fade into the background” to make it easier to focus on code, Sobo says. And it offers tools intended to make it simpler to invite teammates into a workspace so they can navigate it together.

With Zed, when users join a teammate’s project, they can edit the code as if it’s on their local machine. Users can call another Zed user from the built-in contacts panel or jump to a teammate’s location to follow them around the code. They can also use Zed’s built-in screen-sharing tool to follow someone outside of the platform to view documentation or experiment with an app in development.

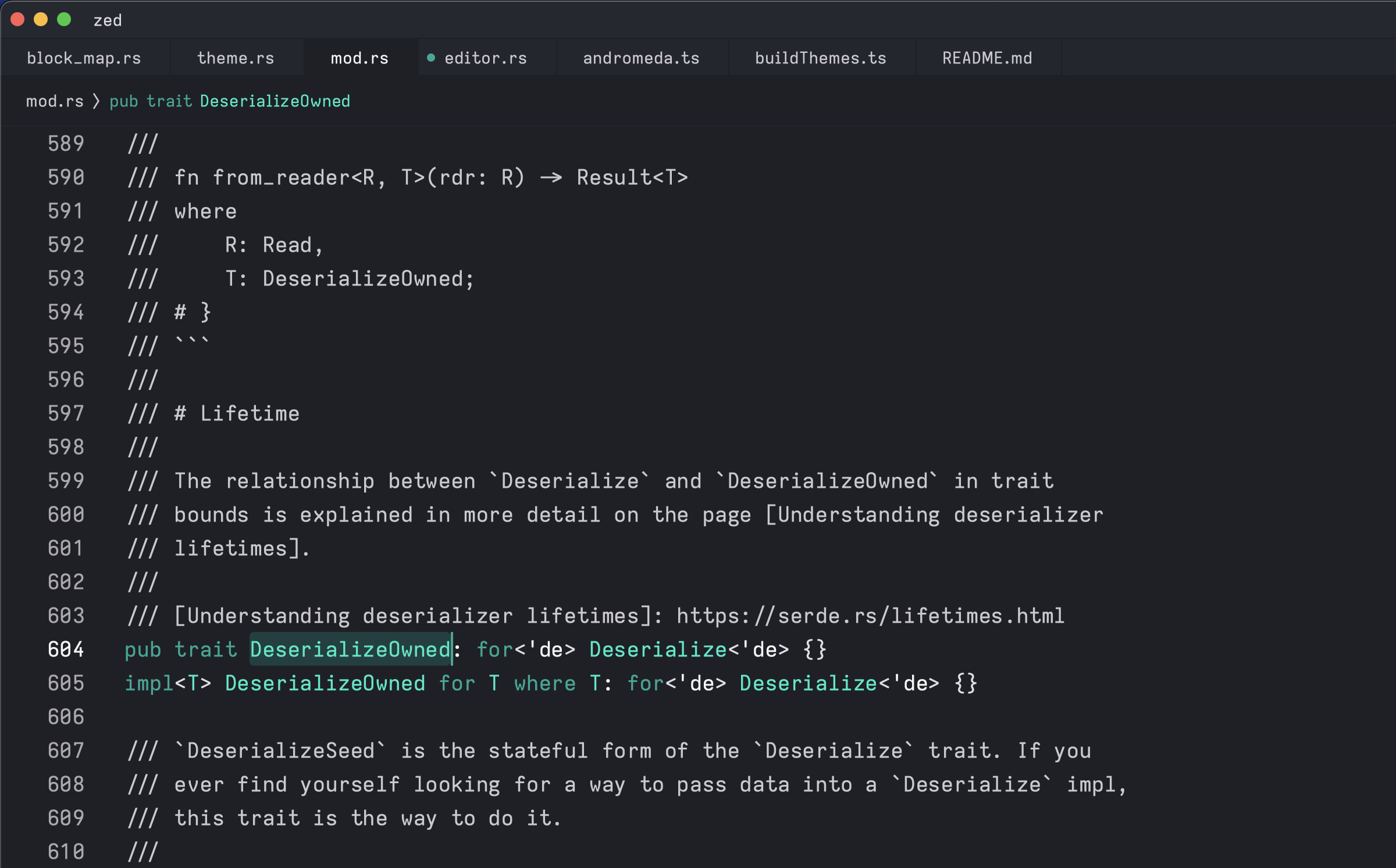

Zed’s code editing interface. Image Creditrs: Zed

“Ultimately, Zed is a software collaboration platform disguised as a world-class code editor. Our objective is for Zed to become the standard platform for open source software development and the go-to tool for software teams,” Sobo added.

Even if Zed delivers as great an experience as Sobo claims it does, I wonder whether it’ll be able to break into the crowded market for IDEs. According to Stack Overflow’s 2022 developer survey, Visual Studio Code remains far and away the most popular IDE, with 74.48% of respondents saying that it’s their preferred platform. The second-most-popular choice — IntelliJ — was a distant second, with 27.97% of the votes.

Zed also isn’t the only IDE upstart on the block. There’s Stackblitz, for example, which recently raised $7.9 million to further develop its browser-based IDE.

But investors are buying into the vision, it seems. Zed today closed a $10 million Series A led by Redpoint Ventures with participation from Root Ventures, Matchstick Ventures and V1.VC, as well as angels including Figma’s Dylan Field and GitHub’s Tom Preston Werner. Valuing Zed at $40 million, the fresh cash brings the startup’s total investment to roughly $12.5 million.

Redpoint’s Patrick Chase was especially complimentary. In an email, he said: “Zed’s mission is to allow engineers to get their ideas into code as fast as possible, or as they would say ‘code at the speed of thought.’ This means a lightning fast editor, seamless team collaboration, and much more in the future. No team is better equipped to solve this complex set of problems than the team behind Zed — the current version of Zed is the culmination of nearly two years of focused development but nearly 16 years of obsessing over how to build a better editor.”

Seven-employee Zed plans to make money primarily through a service-based model. It’s currently pre-revenue and launching in beta to start. But Sobo says that during the private alpha, the waiting list grew to as long as 12,000 people and that there are roughly 800 active users coding with Zed each week (through the alpha).

“The pandemic has helped us by accelerating the industry’s shift to remote development. With fewer opportunities to interact in person, software developers are experiencing the limitations of current collaboration technologies more acutely,” Sobo said. “Zed is built for a new way of working in which conversations around code are richer, and interactions are more human and connected. This new way of working accelerates the progress of software development itself. “

Zed raises $10M for a code editor built for collaboration by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/03/15/zed-code-editor-raises-10m/

KuCoin and Circle back Chinese yuan-pegged stablecoin in $10M round

Circle Ventures, the venture arm of the USDC issuer Circle, has invested in an offshore Chinese yuan-backed stablecoin project, CNHC.

It’s hard to overlook the timing and strategic significance of the tie-up. In a matter of several years, stablecoins have grown from a fringe category into a more than $130 billion market. These digital coins are typically backed by traditional assets like the U.S. dollar and are designed to offer a less volatile way to trade than, say, Bitcoin and Ethereum.

As the stablecoin industry booms, hierarchy starts to form, mirroring the traditional USD-dominated financial world. Currently, over 99% of the existing stablecoins are backed by USD, and CNHC represents one of the few attempts to challenge USD dominance in the blockchain world.

Circle itself has been facing troubles since March. It was hit first by Silvergate’s closure and later by Silicon Valley Bank’s implosion. News surfaced that the stablecoin issuer had held reserve deposits at both banks. Over the past week, USDC briefly depegged from its $1 target value.

It’s unclear how big a stake Circle Ventures has in CNHC, which is a Cayman Islands-registered, cross-border payment service provider. But the move to establish some presence in the East could be a good hedging bet for the Boston-based crypto startup.

CNHC’s latest funding round totals $10 million and was led by KuCoin, currently the fourth biggest crypto exchange in the world. IDG Capital and Circle Ventures were participating investors.

Crypto in Hong Kong

While the USD-dominated stablecoin world has matured and become closely regulated, the yuan-backed sphere has only begun to take shape. The movement is happening in Hong Kong, which has historically been the largest offshore yuan center.

In 2009, the city set up a yuan settlement scheme, paving the way for the gradual internationalization of the currency. This move was marked by the creation of the offshore currency CNH, with the ‘H’ standing for Hong Kong, to differentiate from the onshore CNY.

In the past few years, the city’s status as Asia’s financial hub has been shaken by geopolitical events. But there are signs that it is trying to restore investor confidence.

Most notably, it’s relaxing rules around crypto-based finance. In late February, the city proposed a series of rules that could allow retail investors to trade major cryptocurrencies like Ethereum and Bitcoin, a stark contrast to mainland China’s crackdown on all forms of crypto transactions.

CNHC’s namesake stablecoin was born to ride the region’s new wave of crypto regulations. The startup, which was founded in early 2021, is setting up its headquarters in Hong Kong.

“The development of regulated stablecoins is positive to Hong Kong as an international financial center,” says Curt Shi, founding partner of a new Hong Kong-based web3 venture capital firm Prodigital Future Fund. “Improved transparency and better investor protection are where Hong Kong is going, and I assume more traditional banks may join as issuers.”

USD alternative

As a 1:1 fully collateralized stablecoin backed by offshore Chinese yuan, CNHC needs approval from the Hong Kong Monetary Authority and is obliged to submit audit reports at the local government’s request, the company told TechCrunch.

The stablecoin issuer has also built up a trust structure to custody collateralized fiat currency and a framework for KYC (know-your-customer) and AML (anti-money laundering).

CNHC can be redeemed into fiat offshore yuan on the stablecoin’s platform. To convert into other currencies like USD, EUR and GBP, CNHC is working with partners in different countries.

CNHC is issued on Ethereum and Conflux, a KuCoin-backed blockchain that boasts speedy and low-fee transactions. Conflux is also one of a kind as it claims to be the only regulatory-compliant public, permissionless blockchain in China. The Chinese blockchain was planning to move its headquarters to Hong Kong, its co-founder said at an event in January.

Other crypto firms are also creating yuan-pegged stablecoins. In December, crypto billionaire Justin Sun’s blockchain Tron welcomed offshore Chinese yuan-pegged TCNH.

Founded in early 2021 by Jack Chou and Joy Cham, CNHC has been helping Chinese exporters collect payments from developing countries, where banking and other traditional financial institutions are underdeveloped, using stablecoins. In 2022, the company processed $40-50 million in monthly transactions via the USD-pegged USDT and USDC as well as the CNHC stablecoin.

KuCoin and Circle back Chinese yuan-pegged stablecoin in $10M round by Rita Liao originally published on TechCrunch

https://techcrunch.com/2023/03/15/circle-kucoin-chinese-yuan-stablecoin/

The trailer for “BlackBerry” just dropped, and you have to watch it

Everyone has a story about their first BlackBerry. But no one cares if you had a 6230, Bold 9700, or, 7130e. They were groundbreaking phones for a time, and this upcoming movie gives a backstory. It stars Jay Baruchel and Glenn Howerton, and I think it answers why the BlackBerry service used to crash all the time.

The movie is based on 2015 book “Losing the Signal: The Untold Story Behind the Extraordinary Rise and Spectacular Fall of BlackBerry”. It’s scheduled for a theatrical release on May 12, 2023.

The trailer for “BlackBerry” just dropped, and you have to watch it by Matt Burns originally published on TechCrunch

https://techcrunch.com/2023/03/15/the-trailer-for-blackberry-just-dropped-and-you-have-to-watch-it/

UK Spring Budget: Chancellor plans £1M annual AI prize, quantum investments, and a new £900M ‘exascale’ computer

The U.K.’s Chancellor of the Exchequer Jeremy Hunt’s spring budget — delivered on the same day that teachers, transportation workers, civil servants and others were on strike across the country — sought to strike a note of its own: optimism in the face of many signals to the contrary. With the U.K. narrowly predicted to avoid a recession this year and next, Hunt also used the moment to announce a string of funding injections into the country’s technology sector, including a new quantum computing hub; an annual £1 million prize called the “Manchester Prize” for AI research; and £3 billion in investments in “high growth” business in the next 10 years.

The announcements are coming in the wake of the Silicon Valley Bank crisis — the company’s U.K. subsidiary was snapped up by incumbent HSBC earlier this week as one part of that — and it underscores the potential role government plays to complement and bolster what’s playing out in the private sector. Whether the U.K. sticks to the plans laid out today, how those might shift with a change in government, and whether the sums it’s committing make a dent in the global tech economy, remain to be seen.

High-growth investments

The government’s been running its own investment operation, called British Patient Capital, since 2018, with a commitment to pump £2.5 billion into high-growth U.K. businesses to boost their fundraising activities and to help close the gap between the U.K. and leading countries like the U.S. when it comes to funding. That has seen the firm, which is part of the British Business Bank, back companies like CyberSmart and Quantum Motion, as well as indirectly in separate funds investing along the same thesis. Today Hunt said that British Patient Capital would get a further £3 billion in funding to invest for the next 10 years, with a focus on R&D-intensive industries.

Alongside this, Hunt said that the Local Government Pension Scheme, which has assets of £364 billion, will be orienting more funds into investing in innovative companies “and other productive assets”. Pension schemes in countries like Canada have been some of the biggest indirect and direct investors in startups (and not just startups in Canada) so this is an interesting development. Hunt also announced “a new Long-term Investment for Technology and Science (LIFTS) initiative,” which is described as a “competition” to encourage other pension fund-related investing initiatives. This seemed a little fluffy, so we’ll have to see what comes of this, and whether others bite at the idea.

Quantum leap

Another big tech focus in the budget today was quantum technology — an area full of promise because of the jump that it will offer in terms of computing power; but also elusive, since a lot of its best ideas are still largely theoretical. That makes putting a lot of investment into startups and academic research focused on quantum computing a risky but potentially very lucrative bet, and one perhaps best suited for a public body to be making, given how early but foundational some of the work has been and will be.

To that end, the U.K. is setting some ambitious targets here, with plans to invest up to £2.5 billion over the next 10 years on quantum. That funding will cover not just engineering and research investments, but also funding for businesses that are investing in quantum technologies and pilot projects, as well as investment into the first steps of what quantum technology regulation might look like.

It also plans to put £900 million into the building of what it described as a “exascale supercomputer” to work on research and run projects. It’s notable that this wasn’t described as a quantum computer, and it may well not be. Likely there will be debates and bids for different approaches when and if this project takes shape.

Manchester Prize

A lot of the heart and soul of how technology has evolved over the last decade has been in the world of startups and technology companies rather than in research labs attached to universities. With the big downturn in venture funding, and the pressure we’re seeing on both private and publicly-traded tech companies, it will be interesting to see if the next ten years’ most interesting innovations are still among those companies, or if they do shift back to the slightly safer terrain of academia.

The government is hedging its bets to some extent with tranches of funding that could see money landing on both sides of that innovation landscape.

Prominent here will be a new £1 million award that it will be giving out called the “Manchester Prize”, Hunt said, which will be given out annually for the next 10 years to researchers that “drive progress in critical areas of AI. While £1 million feels like small change in the world of startups, it’s a massive sum for most (not all!) academics and researchers. It’s notable that the idea of the prize is focused on AI rather than other technologies. That really points to what a hold AI has on public discourse in technology and beyond right now.

The U.K. is doing this in part, it says, because it believes it needs to invest in its own “sovereign capability” around its own AI foundation models, which points to what kinds of AI research might be most likely to win the annual prizes. AI feels like a fast-moving target right now, and it’s really not clear what kinds of economic or social implications it will have in the short, medium or longer terms. The government also plans to establish a task force to help advise it on future strategy in this area, too.

Another big area of investment will be accelerators: there are plans to invest £100 million to grow three “innovation clusters” in Manchester, Birmingham and Glasgow, and to specifically tap 26 R&D projects respectively to boost AI, health and medicine and quantum across the three cities.

All in all, a lot of promises, and it will take getting budgets approved and consistent agreement across multiple leaders and stakeholders (and most likely political parties and governments) to push many of these commitments through. And yes, there remains the question of whether state support will give the tech industry the fuel and more importantly the confidence it needs to grow.

Even just out of the gate, the opposition Labour party criticized Hunt’s focus and solutions.

Labour leader Kier Starmer summed up the U.K. as “Stuck in the waiting room with only a sticking plaster,” a reference to the underfunding of the country’s health service, and re-upped the point by describing the country as “The sick man of Europe once again.”

UK Spring Budget: Chancellor plans £1M annual AI prize, quantum investments, and a new £900M ‘exascale’ computer by Ingrid Lunden originally published on TechCrunch

AI’s ascendance seems unfazed by SVB mess

Good morning, Exchange crew! This installment will be brief because I have to finish prepping for today’s TechCrunch Live with Arianna Huffington of Thrive Global and Mamoon Hamid of Kleiner Perkins. Since we scheduled the conversation, a few things have happened, so I need to retool my notes and questions.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

The tech-narrative whiplash is actually what I want to talk about this morning. Now that the initial shock waves of the Silicon Valley Bank crisis have seemingly settled, tech news has reverted to type. If you read TechCrunch today, you can find meal delivery startups, chip news, funding rounds and a lot of AI news. Call it a return to industry optimism, even if the ground underneath the positive vibes is still a bit shaky.

The AI bit, though, has me utterly captivated. The more I read into recent advancements in the AI world, the more it appears that the tools that consumers and tech folks are playing with are not gimmicks sitting atop little substance, but instead lots of substance with some gimmicks resting on top.

By that, I mean that the consumer-popular stuff like using ChatGPT to, say, power the narrative for your next Crusader Kings run-through or having similar tools write silly song lyrics seems not to be the core innovation; what is underneath the consumer-friendly stuff is the real deal.

A lot is going on at once. From the recent release of large language model GPT-4 to the popularity and rapid rollout of new AI-powered search tools to companies like Quora and Duolingo finding ways to leverage the tech, we’re seeing both the speedy development of AI tech and quick commercialization.

AI’s ascendance seems unfazed by SVB mess by Alex Wilhelm originally published on TechCrunch

https://techcrunch.com/2023/03/15/svb-artificial-intelligence-progress/

Police shut down dark web crypto laundering service linked to FTX hack

An international coalition of law enforcement agencies announced on Wednesday that it had taken down the popular dark web crypto laundering service ChipMixer, seizing more than $46 million in crypto and terabytes of server data.

The service, for example, was used last year by the attacker who stole funds from the now failed crypto exchange FTX, as well as by several ransomware groups.

“The platform and the criminal content have been seized,” ChipMixer’s website now reads.

“The ChipMixer software blocked the blockchain trail of the funds, making it attractive for cybercriminals looking to launder illegal proceeds from criminal activities such as drug trafficking, weapons trafficking, ransomware attacks, and payment card fraud,” Europol wrote in a press release. “Deposited funds would be turned into ‘chips’ (small tokens with equivalent value), which were then mixed together – thereby anonymizing all trails to where the initial funds originated.”

ChipMixer launched in mid-2017 and, according to Europol, it was allegedly used to facilitate the laundering of 152,000 Bitcoins, worth almost $2.5 billion.

Blockchain analysis firm Elliptic’s estimates that ChipMixer has been used to launder over $844 million in Bitcoin, “including at least $666 million from thefts,” according to Tom Robinson, the company’s co-founder and chief scientist.

“ChipMixer was one of a variety of mixers used to launder proceeds of hacks perpetrated by North Korea’s Lazarus Group. The mixer has also been used by ransomware gangs and darknet drug vendors,” Robinson said in an email.

The service was popular with hackers, as it was used by ransomware groups such as LockBit, Mamba, and SunCrypt, according to Europol.

The operation was coordinated by Europol working with Belgium’s Federal Police; Germany’s Federal Criminal Police Office, and General Prosecutors Office Frankfurt-Main; Poland’s Central Cybercrime Bureau; Switzerland’s Cantonal Police of Zurich; and in the U.S. the Federal Bureau of Investigation and ICE Homeland Security Investigations.

Corrected the value of laundered bitcoin as billions, not millions, due to an editor’s error. ZW

Do you have more information about crypto hacks or crypto mixing services? We’d love to hear from you. From a non-work device, you can contact Lorenzo Franceschi-Bicchierai securely on Signal at +1 917 257 1382, or via Wickr, Telegram and Wire @lorenzofb, or email lorenzo@techcrunch.com. You can also contact TechCrunch via SecureDrop.

Police shut down dark web crypto laundering service linked to FTX hack by Lorenzo Franceschi-Bicchierai originally published on TechCrunch

Snapchat adds new parental controls that block ‘sensitive’ and ‘suggestive’ content from viewing by teens

Snapchat launched parental controls on its app last year through the new ‘Family Center’ feature. Today, the company announced through a post on its online Privacy and Safety Hub it will now add content filtering capabilities that will allow parents to restrict teens from being exposed to content identified as sensitive or suggestive.

To enable the feature, parents can toggle on the “Restric Sensitive Content” filter in Snapchat’s Family Center. Once enabled, teens will no longer see the blocked content on Stories and Spotlight — the platform’s short video section. The text under the toggle specifies that turning on this filter won’t have an impact on content shared in Chat, Snaps, and Search.

Accompanying this change, Snapchat is also publishing its content guidelines for the first time to give creators on Stories and Spotlight more insights into what kind of posts may be recommended on its platform and what content will now be considered “sensitive” under its community guidelines. The platform said that it had shared these guidelines with a set of creators under the Snap Stars program and with its media partners, but now the company is making them available to everyone through a page on its website.

The company already prohibits content like hateful content, terrorism, violent extremism, illegal activity, harmful false or deceptive information, harassment and bullying, threats of violence, and more from appearing on its platform. But now, the guidelines specify what content under various categories will be considered “sensitive.” This is content that may be eligible for recommendation but may be blocked from teen users under these new controls, or from others on the app based on their age, location or personal preferences.

For example, under the sexual content category, Snap explains that content will be considered “sensitive” if it includes “all nudity, as well as all depictions of sexual activity, even if clothed, and even if the imagery is not real” (such as in the case of AI images, as well as “explicit language” describing sex acts and other things related to sex, like sex work, taboos, genitalia, sex toy, “overtly suggestive imagery,” “insensitive or demeaning sexual content” and “manipulated media.”

It addresses what will be considered sensitive in other categories as well, including harassment, disturbing or violent content, false or deceptive info, illegal or regulated activities, hateful content, terrorism and violent extremism, and commercial content (overt solicitation to buy from non-approved creators). This includes a range of content, like depictions of drugs, engagement bait (“wait for it”), self-harm, body modifications, gore, violence in the news, graphic imagery of human physical maladies, animal suffering, sensationalized coverage of distributing incidents, like violent or sexual crimes, dangerous behavior, and much, much more.

The changes come long after a 2021 Congressional hearing where Snap was grilled about showing adult-related content in the app’s Discover feed such as invites to sexualized video games, and articles about going to bars or porn. As Senators rightly pointed out, Snap’s app was listed as 12+ in the App Store but the content it was sharing was clearly intended for a more adult audience. Even the video games it advertised, in some cases, were rated as being aimed at older users.

“We hope these new tools and guidelines help parents, caregivers, trusted adults and teens not only personalize their Snapchat experience, but empower them to have productive conversations about their online experiences,” the social media company said in a blog post.

However, while the new feature may go a long way to limit sensitive content from teen viewers in some areas, it doesn’t tackle one of the areas Congress had called out — the Discover feed. Here, Snap features publisher content, including those who publish content that could be considered “sensitive” under its guidelines. It’s frankly a lot of clickbait. And yet this area is not being addressed with the new controls.

Plus, the feature requires parents to take action by turning on a toggle they likely know nothing about.

In short, this is another example of how the lack of legislation and regulations regarding social media companies has led to self-policing, which doesn’t go far enough to protect young users from harm.

In addition to the content controls, Snap said that it is working on adding tools to give parents more “visibility and control” around teens’ usage of the new My AI chatbot.

Last month, the social network launched this chatbot powered by Open AI’s GPT tech under the Snapchat+ subscription. Incidentally, Snapchat’s announcement comes after the chatbot went rogue while chatting with a Washington Post columnist pretending to be a teen. The bot allegedly advised the columnist about hiding the smell of pot and alcohol while having a birthday party. Separately, researchers at the Center for Humane Technology found that the bot gave sex advice to a user pretending to be 13 years old.

The additional tools targeting the chatbot have not yet been rolled out.

Snapchat adds new parental controls that block ‘sensitive’ and ‘suggestive’ content from viewing by teens by Ivan Mehta originally published on TechCrunch

One founder’s account of what’s left behind from SVB’s crash

Hello, and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

This is our Wednesday show, where we niche down to a single person, think about their work and unpack the rest. This week, Natasha interviewed Series CEO Brexton Pham, who has been building a full-stack enterprise platform for institutions and enterprises since March 2021. Brexton was pushed out of stealth this week in the wake of Silicon Valley Bank’s crash, which of course was the main topic of our conversation. What else did you expect?

Here’s what we got into:

- How much trust do our banks deserve today, and how much has reasonable trust fallen in recent weeks?

- How startups can (and should) start diversifying their banks

- What questions Series and its competitors are getting from investors today

- The long-term impacts beyond SVB

Brexton also did a fantastic job of helping us zoom out and take a look at the past week from a refreshingly non-tech angle.

Follow us on Twitter @EquityPod for live updates, and as always, the Equity crew will be back to unpack the week’s headlines on Friday.

For episode transcripts and more, head to Equity’s Simplecast website.

Equity drops at 7:00 a.m. PT every Monday, Wednesday and Friday, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts. TechCrunch also has a great show on crypto, a show that interviews founders, one that details how our stories come together and more!

One founder’s account of what’s left behind from SVB’s crash by Theresa Loconsolo originally published on TechCrunch

https://techcrunch.com/2023/03/15/one-founders-account-of-whats-left-behind-from-svbs-crash/

T-Mobile to acquire Ryan Reynolds’ Mint Mobile in $1.35 billion deal

T-Mobile is acquiring Mint Mobile, the budget-friendly wireless provider partially owned by Ryan Reynolds in a deal valued at up to $1.35 billion, the company announced on Wednesday. The move indicates that T-Mobile is looking to boost its prepaid offerings.

In a blog post, T-Mobile said it reached a deal to acquire Ka’ena Corporation, the parent company to prepaid wireless brands Mint Mobile and Ultra Mobile, as well as wireless wholesaler Plum for a maximum of $1.35 billion in a combination of 39% cash and 61% stock. The final purchase price will be based on Mint’s performance during certain periods before and after the closing. T-Mobile expects to close the deal later this year.

“Mint has built an incredibly successful digital direct-to-consumer business that continues to deliver for customers on the Un-carrier’s leading 5G network and now we are excited to use our scale and owners’ economics to help supercharge it – and Ultra Mobile – into the future,” said T-Mobile CEO Mike Sievert in a statement. “Over the long-term, we’ll also benefit from applying the marketing formula Mint has become famous for across more parts of T-Mobile. We think customers are really going to win with a more competitive and expansive Mint and Ultra.”

Sievert said in a video posted on Wednesday that the company will retain Mint’s $15 per month pricing.

I only want the best for Mint Mobile customers. Think I’ve found it. pic.twitter.com/nSNmGKLmN2

— Ryan Reynolds (@VancityReynolds) March 15, 2023

Following the deal’s close, Ryan Reynolds will continue on in his creative role on behalf of Mint and continue appearing in commercials. Mint founders, David Glickman and Rizwan Kassim, will remain onboard at T-Mobile to manage the brands, which will generally operate as a separate business unit.

T-Mobile began considering its purchase of Mint Mobile in January, according to a report from Bloomberg.

Mint Mobile doesn’t have any physical retail stores, as its businesses operates entirely online. The carrier’s service is already provided by T-Mobile as part of a wholesale network-sharing agreement. For context, Mint Mobile is a mobile virtual network operator (MVNO), which means that it buys wholesale access to a wireless network instead of owning and operating it.

T-Mobile is acquiring Mint Mobile’s sales, marketing, digital, and service operations, and plans to use its supplier relationships and distribution scale to help the brands to grow and offer competitive pricing and greater device inventory to more consumers. The company will also leverage Mint’s digital D2C marketing to reach new customer segments and geographies.

The company says Mint Mobile and Ultra Mobile join its current prepaid service offerings, which include Metro by T-Mobile, T-Mobile branded prepaid and Connect by T-Mobile.

T-Mobile to acquire Ryan Reynolds’ Mint Mobile in $1.35 billion deal by Aisha Malik originally published on TechCrunch