Category: TECHNOLOGY

Reddit will allow users to upload NSFW images from desktop

Reddit announced Thursday that it will now allow users to upload NSFW images from desktops in adult communities. The feature was already available on the social network’s mobile app.

The company made the announcement on the r/modnews subreddit, saying that this step will bring feature parity across platforms.

“This now gives us feature parity with our mobile apps, which (as you know) already has this functionality. You must set your community to 18+ if your community’s content will primarily be not safe for work (NSFW),” the company said.

Reddit’s announcement comes days after Imgur said that the image hosting platform was banning explicit photos from May 15. At that time, the company said that explicit content formed a risk to Imgur’s “community and its business”. Banning this type of content would “protect the future of the Imgur community.”

Many of Reddit’s communities rely on Imgur’s hosting services. However, the social network allowing native NSFW uploads through desktop might be the most logical solution going forward.

Image hosting is not the only hurdle for NSFW communities. Last month, when Reddit announced that it will start charging for its API, the company also said that it will limit access to mature content available through its API. This would directly impact the experience on third-party Reddit apps. In yesterday’s announcement about desktop upload for NSFW images, a Reddit staff members

Reddit will allow users to upload NSFW images from desktop by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/05/12/reddit-will-allow-users-to-upload-nsfw-images-from-desktop/

TechCrunch Disrupt early-bird sale ends today

It’s all come down to this, the final day of our TechCrunch Disrupt 2023 early-bird sale. We’re not here to judge; we’re simply here to remind you that procrastination is neither your friend nor kind to your wallet.

Last day to early-bird your way to TechCrunch Disrupt 2023

Your last chance to save up to $800 on Disrupt passes ends tonight, Friday May 12, at 11:59 p.m. PDT. You’ll pay less for every pass level, but only if you buy your pass before the deadline. Like, right now. Look how much you’ll save:

- General Admission: $450. Full Price: $1,250

- Founder: $350. Full Price: $1,175

- Investor: $450. Full Price: $1,250

- Nonprofit: $95. Full Price: $275

- Student: $95. Full Price: $275

- Expo+: $45. Full Price: $195

Available for select pass types: Save 15% when you purchase for a group of four to nine people. Need passes for a group of 10 or more? Email events@techcrunch.com for assistance.

Why startups love TechCrunch Disrupt

What do you stand to gain from going to Disrupt? Here’s what your contemporaries have to say about their experience:

“Disrupt is laser focused on startups. I’m just starting my own company, and attending Disrupt was an incredible opportunity to connect with companies and learn from the best people in the industry.” — Anirudh Murali, co-founder and CEO, Economize.

“Disrupt is highly valuable for anyone in the idea stage all the way through to having raised angel money. Soak up the pitch deck teardowns and the VC presentations. They’re telling you what they’re looking for, what motivates them, what pushes them to contact you for a meeting. And that’s exactly what every startup raising capital needs to know.” — Michael McCarthy, CEO, Repositax.

“At its heart, Disrupt brings companies together, it allows people to share ideas, talk about them and explore opportunities. If you’re thinking about attending Disrupt, I say go. It’s an important part of growing as a startup.” — Jessica McLean, director of marketing and communications, Infinite-Compute.

TechCrunch Disrupt will take place in San Francisco on September 19–21. This is your last chance to save up to $800. Buy your pass by 11:59 p.m. PDT today, May 12! C’mon, early-bird your way to Disrupt!

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2023? Contact our sponsorship sales team by filling out this form.

TechCrunch Disrupt early-bird sale ends today by Lauren Simonds originally published on TechCrunch

https://techcrunch.com/2023/05/12/last-day-early-bird-passes-techcrunch-disrupt-2023/

TikTok turns up on the volume on its music play with NewMusic search feature

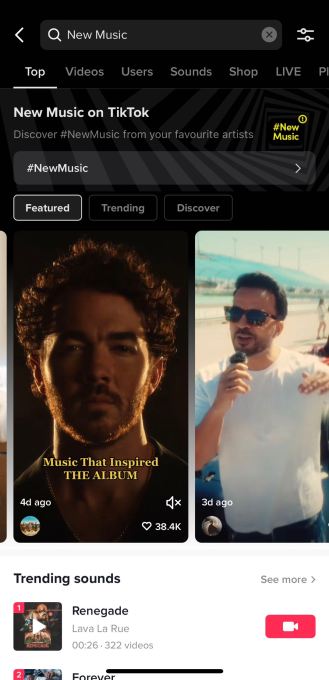

TikTok has upended how music is discovered, used and consumed these days; now, its long-term effort to build a business around that is getting a boost. The Bytedance-owned app today announced a search feature called “NewMusic”, which users can use to find new tracks, and artists can use to promote them.

To see new music under “NewMusic” you enter NewMusic in the search bar and from there you can click on the dedicated hub and hashtag.

To be completely clear, TikTok has built out a new search and discovery experience for hearing new music — one that it’s kicking off with endorsements from artists big with its core user base, including the Jonas Brothers and Miguel.

But it’s not building this out of thin air. NewMusic the hashtag already had 18 billion views before today’s launch, TikTok said. The launch is giving that a boost for sure: as of this writing, according to my TikTok app, that view figure is now up to 19.1 billion.

TikTok’s music roots go to the very DNA of the app itself, which first came to life as Musical.ly and was focused on user-generated videos of people, a lot of them teens and other younger users, lip-synching various tunes.

Musical.ly eventually merged into TikTok after Bytedance acquired it, reportedly for $1 billion, and then, amped with a ridiculously successful recommendation algorithm, a lick of a sticky user interface, and a shower of creative variations on the concept from users themselves, it all really took off to become what we know today. Throughout that, music has been the beating drum of the app, though.

Funnily enough, given TikTok’s massive impact on the music sphere — not only is a must-do for artists marketing their music, but it’s created hits and hitmakers out of thin air when tracks are used in posts that go viral; and it’s even pushed other stalwarts in the streaming space to totally rethink their own interfaces, making them more TikTok-like to boost appeal and engagement — it’s ironic that the company has somewhat danced around its own place in the music industry.

It was reported by Bloomberg in November that all the big labels were looking to renegotiate their TikTok deals — they want more royalties, naturally — although it’s not clear that has yet had a resolution.

Bydance has built a music-centered app, Resso, but that has to date only launched in three markets, India, Indonesia and Brazil, and has recently put up a paywall to turn the screws on who’s really using it.

A report from the WSJ last year noted that Bytedance is looking to expand that. However, with so many questions hanging over the app and the parent company and how it’s used, or might be shut down, in markets like the U.S. over security issues, that may well mean that developments on that front might not be so quick.

And there are other controversies that are unlikely to fade away any time soon. AI-based music, for one, is something that likely will be a thorn in the side of many labels and artists if they feel like their IP’s been lifted.

Bytedance has had an interest in AI how it might play a role in music for a while, though. Given how that whole area is unfolding today, several years ago it made a very prescient move to acquire Jukedeck, an early player in the generative AI music space.

But looking just at how music is discovered and consumed today, the company — parent and app — clearly sees huge opportunities for itself as vehicle for marketing and more. Witness the standalone SoundOn distribution service it’s built and released in several markets, including biggies like the U.S.

Our world today is awash in a veritable cacophony of information vying for our attention, and search has become the killer app: give people a way to pull out music from the noise (or, more literally, find things that they want to find), and you win the internet. That’s something that TikTok and parent Bytedance definitely understand with their own novel approach to search and discovery.

“We are thrilled to launch the #NewMusic Hub, a global discovery platform that celebrates and champions artists of all genres, from up-and-coming talent to international superstars,” said Paul Hourican, Global Head of Music Operations at TikTok, in a statement. “TikTok is already a destination for artists who want to preview their newest works, and for music fans looking to discover new music, and this new feature will give artists a new way to connect with our global community. It presents an exciting opportunity to inspire artist creativity, spark connections, and foster a diverse musical landscape that embraces the unique talents and passions of artists and fans worldwide.”

We’ve asked TikTok some questions about the NewMusic search feature, including what kind of sponsorship is baked into the platform, or whether it will ever have any if there is none now; how it will link up with buying tracks on site or via third parties; and how one gets sifted to the top of the search pile. We’ll update as we learn more.

TikTok turns up on the volume on its music play with NewMusic search feature by Ingrid Lunden originally published on TechCrunch

Toyota Japan exposed data on millions of vehicles for a decade

Toyota Japan has apologized after admitting to leaving millions of customers’ vehicle details on the public internet for a decade.

The car maker said in a notice that it will notify about 2.15 million customers whose personal and vehicle information were left exposed to the internet after a “cloud misconfiguration” was discovered recently in April. Toyota said that the exposed data includes: registered email addresses; vehicle-unique chassis and navigation terminal numbers; the location of vehicles and what time they were there; and videos from the vehicle’s “drive recorder” which records footage from the car.

Toyota said the data spilling from its Connected Cloud (TC) was initially exposed in November 2013, but pertains only to vehicles in Japan, according to the company.

The company’s connected service provides Toyota customers with information about their vehicle, provides in-car entertainment services, and helps to notify authorities in the event of an accident or breakdown.

Lexus car owners who signed up to the G-Link service are also affected.

Toyota said the data was secured, but has not seen any reports that the data was obtained or maliciously used. It’s not clear if Toyota has the logging in place to detect what, if any, data was exfiltrated from its network. Toyota said in its statement that it would introduce a system to monitor its cloud, suggesting its existing efforts were insufficient.

In 2022, Toyota admitted it exposed about 300,000 customer email addresses for close to five years after a subcontractor inadvertently uploaded part of the company’s source code to the internet. That data included a private key that stored customer email addresses.

Do you know more about the Toyota security lapse? Do you work at Toyota? You can contact Zack Whittaker on Signal at +1 646-755-8849 or zack.whittaker@techcrunch.com. You can also share files and documents with TechCrunch via our SecureDrop.

Toyota Japan exposed data on millions of vehicles for a decade by Zack Whittaker originally published on TechCrunch

https://techcrunch.com/2023/05/12/toyota-japan-exposed-millions-locations-videos/

Hackers stole passwords of Worldcoin Orb operators

Hackers have installed password-stealing malware on the devices of multiple Worldcoin Orb operators, TechCrunch has learned, giving them full access to the Worldcoin operator dashboard.

Worldcoin, founded by Sam Altman, says it is creating a “collectively owned global currency that will be distributed fairly to as many people as possible,” according to the company’s website. The company does this by giving away tokens. Those interested in joining the financial network must first hand over their biometric data in exchange for those tokens.

A person’s biometrics are captured by the Worldcoin Orb, a spherical “Black Mirror”-esque imaging device that captures users’ irises and high-resolution images of their bodies and face, according to Worldcoin. Those interested must first visit an “Orb operator,” who are recruited and contracted by Worldcoin, and earn money for every person they sign up.

These operators have access to an online portal and an app, where they can track information, such as earnings, uptime, sign-ups, operator ratings and other metrics.

TechCrunch has learned that several Worldcoin operators had their personal devices compromised by password-stealing malware, such as the RedLine information stealer, to steal all of the credentials saved in their browser — including login details for the operator app.

Requesting anonymity, a security researcher told TechCrunch that the credentials of at least seven Orb operators had been listed on the dark web in the past six months. These include credentials that give hackers full access to the Worldcoin Orb operator dashboard, which TechCrunch has learned does not require any form of two-factor or multi-factor authentication.

The security researcher told TechCrunch that it’s unlikely that the operators were specifically targeted. Rather, the researcher said, it was instead likely the result of downloading bad software on their computers while having sensitive credentials saved in their browsers.

Orb dashboards contain data including onboarding and training documents, and support requests filed by other Orb operators, according to screenshots seen by TechCrunch, though it’s unclear exactly to what extent user data is accessible by the operator. Past reporting found that information collected by operators includes email addresses, phone numbers, and scans of national ID cards in some regions.

Worldcoin spokesperson Jannick Preiwisch told TechCrunch that an internal investigation concluded that “no sensitive or personal user data” was accessed or compromised. Preiwisch added that no sensitive data is ever accessible to the Orb operator and that any biometric data capture is encrypted both at-rest and in-transit.

“We take any and all claims regarding the security and integrity of our systems seriously and immediately conducted an investigation upon receiving an inquiry from TechCrunch on such matters.” Preiwisch added that the company had reset all logins for Worldcoin operators out of an “abundance of caution,” and has accelerated the rollout of 2FA for the Worldcoin operator app.

According to its own data, Worldcoin has surpassed one million sign-ups and has between 100 and 200 Orbs operational at any given time.

Hackers stole passwords of Worldcoin Orb operators by Carly Page originally published on TechCrunch

https://techcrunch.com/2023/05/12/hackers-stole-passwords-of-worldcoin-orb-operators/

Elon Musk’s Twitter: Everything you need to know, from layoffs to verification

Welcome to Elon Musk’s Twitter, where the rules are made up and the check marks don’t matter.

The Tesla and SpaceX CEO first announced his bid to buy Twitter in April 2022, zealously driven to rid the platform of spam bots and protect free speech.

“This is just my strong, intuitive sense that having a public platform that is maximally trusted and broadly inclusive is extremely important to the future of civilization,” Musk said at a TED conference on the day he made his offer. “I don’t care about the economics at all.”

Even for one of the richest men in the world, $44 billion is a lot of money to cough up to buy a middling social platform. Despite his fervent declarations about expanding “the scope and scale of consciousness” through public discourse, the billionaire got cold feet. A month later in May, he tried to kill the deal, claiming that Twitter had more bots than its public filings let on. After a truly chaotic legal discovery process, which even included some embarrassing texts, Musk was forced to seal the deal. By October, the platform was his.

Since Musk bought Twitter and took the company private, the news around the microblogging platform has been a whirlwind, rife with verification chaos, API access shakeups, ban reversals and staggering layoffs. Most recently, Musk tweeted that he will transition from his role as Twitter CEO to serving as its executive chair and CTO.

If you’re just catching up, here’s a complete timeline of what’s going down at the bird app, starting with the most recent news:

May 2023

The rumors are confirmed: NBCU’s leader Linda Yaccarino as the next CEO of Twitter

Musk confirmed Yaccarino’s new role in a tweet this morning (May 12), a day after he announced that he had completed his search for a new CEO.

Elon Musk tweets that he has found a new Twitter CEO

“Excited to announce that I’ve a new CEO for X/Twitter,” Musk wrote in a tweet on May 11. “She will be starting in ~6 weeks! My role will transition to being exec chair & CTO, overseeing product, software & sysops.”

Twitter released its first version of encrypted DMs

Currently, this feature is only available to verified Blue users or accounts associated with verified organizations. Additionally, the encryption feature isn’t compatible with group messages and Twitter doesn’t offer protection against man-in-the-middle attacks.

Twitter now allows you to react to DMs with emojis

Twitter has introduced a new feature that lets users choose almost any emoji to react to a DM in a conversation. Previously, the company allowed you to react to only the most recent DM with only a select set of emojis. CEO Elon Musk tweeted that the new feature is rolling out with the latest app update.

Twitter is purging old accounts and freeing up desired usernames, according to Elon Musk

According to recent tweets by Twitter owner Elon Musk, Twitter is purging inactive accounts that have had “no activity at all for several years.”

We’re purging accounts that have had no activity at all for several years, so you will probably see follower count drop

— Elon Musk (@elonmusk) May 8, 2023

Twitter is contemplating a cheaper verification plan for organizations

Twitter is thinking about an organizational verification plan that doesn’t cost $1,000 a month. Over the Cinco de Mayo weekend, Elon Musk said on Twitter that the company is working on a cheaper plan for small businesses, but didn’t give any details about the cost.

We will have a lower cost tier for small businesses, but need to manage the onboarding of organizations carefully to prevent fraud.

The $1000/month is meant for larger organizations.

— Elon Musk (@elonmusk) May 6, 2023

Twitter confirmed Circle tweets were temporarily not private

Twitter confirmed a security error that made Circle tweets surface publicly. TechCrunch reported the glitch in early April, but the platform confirmed the issue May 5 in an email sent to Twitter Circle users.

“In April 2023, a security incident may have allowed users outside of your Twitter Circle to see tweets that should have otherwise been limited to the Circle to which you were posting,” the email said. Twitter claims that the bug has now been fixed, and that the team knows what caused it.

Twitter makes its API free for public announcement accounts

Twitter announced on May 2 that it is making its API free for verified government or public-owned services posting about public utility alerts such as weather alerts, transportation information and emergency warnings. This comes a month after the company announced its new API pricing tiers.

Twitter is randomly logging out users

After reporting earlier that Twitter was experiencing a bug that was allowing people to edit their bios to briefly regain their Verified checkmarks, the Twitter website this afternoon has begun to forcefully log out users at random. There are a number of complaints about the problem on Twitter itself, indicating that at least some are able to get back in after being booted from the site.

The issue appears to be impacting desktop users at this time who are using Twitter via the web. Some claim they’re being logged out repeatedly.

A bug on Twitter causes legacy blue checks to reappear by updating your Twitter bio

It doesn’t seem to matter what text you’re adding to your bio — TechCrunch reporter Amanda Silberling added a few spaces, then got her check back for a moment. It even showed up with the old text that designates that she is “notable in government, news, entertainment, or another designated category,” and she did not, in fact, pay for this. But once you refresh the page it disappears. In fact, it’s unclear whether anyone else can even see your check briefly reappear.

April 2023

EU warns Twitter over disinformation

Twitter was confirmed April 25 as one of 19 major tech platforms subject to centralized oversight by the European Union’s executive starting this fall, when so-called very large online platforms (VLOPs) are expected to be compliant with the Digital Services Act (DSA). But the Commission has not wasted any time warning the Elon Musk-owned social network that things aren’t looking good for staying on the right side of the incoming law.

In a pair of tweets, Vera Jourova, the EU’s values and transparency VP, warned of “yet another negative sign” by Twitter — accusing the platform under Musk of “not making digital information space any safer and free from the Kremlin #disinformation & malicious influence”.

Twitter now shows labels on tweets with reduced visibility

Twitter said that labels will be shown to both authors and viewers. Usually, these tweets will show text such as “Visibility limited: this Tweet may violate Twitter’s rules against Hateful Conduct.”

Twitter’s enforcement policy says that tweets with such labels will not show up in search results, recommendations or timelines — those tweets will be hidden in both the “For You” and “Following timelines. Additionally, there will be no ads placed adjacent to posts with reduced visibility.

Twitter restored Blue verification mark for top accounts, even if they didn’t pay for Twitter Blue

Over the April 21st weekend, multiple top accounts (with more than 1 million followers) got their verification marks back. However, many of them, including writer Neil Gaiman, footballer Riyad Mahrez, musician Lil Nas X, actress Janel Parrish Long and British TV presenter Richard Osman said that they didn’t pay for the blue badge.

In March, The New York Times reported that Twitter was considering handing out a free verification mark to the top 10,000 brands and companies. It’s not clear if Twitter is applying the same policy to personal accounts.

Twitter removes ‘government-funded’ news labels

Twitter has removed “government-funded media” labels on all accounts, from NPR to the Chinese state-affiliated Xinhua News. Twitter even appears to have deleted its web page explaining the “government-funded media” labels.

Twitter sends an email seemingly requiring advertisers to have a verified checkmark

Several Twitter users have posted screenshots of an email reportedly sent by Twitter, which states that starting from April 21, verified checkmarks are required to continue running ads on the platform.

WOW… Twitter is now telling advertisers it MUST subscribe to Twitter Blue or Verified Organisations to continue running ads! pic.twitter.com/4DrDu82Zi0

— Matt Navarra (@MattNavarra) April 21, 2023

Twitter officially kills legacy blue checkmarks on 4/20

With the legacy checks gone, Twitter will have verification marks only for paid users and businesses, as well as government entities and officials. Now if a user sees a blue check mark and clicks on it, the label reads: “This account is verified because they are subscribed to Twitter Blue and verified their phone number.”

Microsoft drops Twitter from its advertising platform

Microsoft is dropping Twitter from its advertising platform starting on April 25, nearly two months after Twitter announced that it will begin charging a minimum of $42,000 per month to users of its API, including enterprises and research institutions. The moves mean users will no longer be able to access their Twitter account, or create, schedule or otherwise manage tweets through Microsoft’s free social media management service.

Twitter owner Elon Musk threatened to take legal action:

They trained illegally using Twitter data. Lawsuit time.

— Elon Musk (@elonmusk) April 19, 2023

Twitter quietly removes policy against misgendering trans people

Twitter updated its content moderation guidelines regarding hateful content, removing a policy that prohibited the targeted deadnaming or misgendering of transgender people. Enacted in 2018, the policy explicitly stated that it violated Twitter’s rules to repeatedly and purposefully call a transgender person by the wrong name or pronouns.

Twitter to label tweets that get downranked for violating its hate speech policy

Twitter plans to “soon” begin adding visible labels on tweets that have been identified as potentially violating its policies, which has impacted their visibility. It did not say when exactly the system would be fully rolled out across its network.

Typically, when tweets violate Twitter’s policies, one of the actions the company can take is to limit the reach of those tweets — or something it calls “visibility filtering.” In these scenarios, the tweets remain online but become less discoverable, as they’re excluded from areas like search results, trends, recommended notifications, For You and Following timelines, and more.

Historically, the wider public would not necessarily know if a tweet had been moderated in this way. Now Twitter says that will change.

Twitter introduces 10,000-character-long tweets for Blue subscribers

Twitter’s new feature will let Blue subscribers post 10,000-character-long posts — as if the social network is trying to compete with a rival newsletter platform. Twitter has also added support for bold and italic text formatting.

Long-form writing is also not entirely new. Last June, the company introduced a program called Twitter Notes for select writers. However, that program was shut down under Musk. After taking over the company he also killed newsletter tool Revue, a startup Twitter had acquired in 2021.

NPR, PBS and a handful of other news organizations bail on Twitter as Musk meddles with account labels

A PBS spokesperson confirmed to Axios that PBS had “no plans to resume tweeting” after Twitter gave it a murky “government-funded media” label over the weekend. A few other news entities appeared to have followed suit, including the prominent Boston NPR affiliate WBUR, Hawaii Public Radio and LA-based local news source LAist.

The Australian Broadcasting Company (ABC Australia), Australia’s Special Broadcasting Service (SBS), New Zealand’s public broadcaster RNZ, Sweden’s SR Ekot and SVT, and Catalonia’s TV3.cat a were labeled “government-funded media” weeks later.

Twitter partners with eToro to show real-time stock and crypto information

This expands upon the social network’s Cashtag feature, which provided info about a limited number of stocks and crypto coins through TradingView data.

The new partnership with eToro goes beyond just displaying information. It also redirects users to the eToro site where they can engage in trading. If you search for a stock on Twitter, you will see a button saying “View on eToro,” which redirects to the site.

Very excited to be launching a new $Cashtags partnership with @Twitter which will enable Twitter users to see real-time prices for a much wider range of stocks, crypto & other assets as well as having the option to invest through eToro. @elonmusk https://t.co/Iv2q9iNxbf

— eToro (@eToro) April 13, 2023

Elon Musk says he only bought Twitter because he thought he’d be forced to

Elon Musk gave a rare interview to an actual reporter late on Tuesday, speaking to BBC reporter James Clayton on Twitter Spaces. During the interview, Clayton pressed Musk on whether his purchase of Twitter was, in the end, something he went through with willingly, or whether it was something he did because the active court case at the time in which Twitter was trying to force him to go through with the sale was going badly.

The answer was that Musk did indeed only do the deal because he believed legally, he was going to be forced to do so anyway.

Elon Musk says Twitter will officially remove legacy checkmarks on 4/20

This is the “final date,” he said in a tweet. If the move goes through, Twitter will have verification marks only for paid users and businesses, and government entities and officials.

Final date for removing legacy Blue checks is 4/20

— Elon Musk (@elonmusk) April 11, 2023

Twitter, Inc. is now X Corp.

Twitter, Inc. is now called X Corp., according to a court filing in California.

Since Twitter is no longer a public company, it does not have to report updates like name changes to the SEC. But in any case, the new name was spotted in an April 4 document related to far-right activist Laura Loomer’s lawsuit against Twitter and Facebook.

“Twitter, Inc. has been merged into X Corp. and no longer exists,” the document states.

Ex-Twitter CEO and other execs sue firm over unpaid legal bills

The lawsuit, filed in Delaware Chancery Court, alleged that Twitter has to pay more than $1 million to the former executives for legal bills they incurred while at the company to respond to requests by the Department of Justice and Securities and Exchange Commission.

Twitter Circle tweets aren’t that private

Numerous Twitter users reported a bug on April 10 in which Circle tweets are surfacing on the algorithmically generated For You timeline. That means that your supposedly private posts might breach containment to reach an unintended audience, which could quickly spark some uncomfortable situations.

TechCrunch has spoken to multiple users who have also experienced this glitch firsthand; many more have reported the glitch in their tweets. Most often, it seems that Circle tweets are being surfaced in the For You timeline to users who follow the poster, but are not in their Circle. Others have reported that their Circle tweets are reaching even further than those who follow them.

A year later, Twitter is now resurfacing official Russian accounts in search results

The Elon Musk-owned platform has resumed surfacing accounts of Vladimir Putin and the Russian Embassy in search results. A former Twitter employee told the publication that this move is likely because of a policy change.

Twitter won’t let you retweet, like or reply to Substack links

Twitter is censoring Substack links by making the posts impossible to reply to, like or retweet. While quote-tweeting works, simply pressing the retweet button surfaces an error message: “Some actions on this Tweet have been disabled by Twitter.”

You didn’t hear this from us, but if you link to a Substack via a redirected URL, it seems to post without restrictions.

Twitter Blue subscribers will now be shown ‘half ads’ on the platform

Twitter is rolling out additional features for Blue subscribers including showing 50% of ads in their timeline compared to non-paid users and a visibility boost in search.

“As you scroll, you will see approximately twice as many organic or non-promoted Tweets placed in between promoted Tweets or ads. There may be times when there are more or fewer non-promoted Tweets between promoted Tweets,” Twitter’s description of the feature says.

While Twitter is claiming to reduce ads on paid subscribers’ feeds, it is hard to prove if they are actually seeing fewer ads apart from anecdotal experiences.

Twitter singles NPR out with misleading state-backed media label

NPR’s Twitter account on the platform now comes with a tag denoting it as “US state-affiliated media.” But NPR doesn’t meet Twitter’s own definition for a state-affiliated account:

State-affiliated media is defined as outlets where the state exercises control over editorial content through financial resources, direct or indirect political pressures, and/or control over production and distribution…

State-financed media organizations with editorial independence, like the BBC in the UK for example, are not defined as state-affiliated media for the purposes of this policy.

GET REKT @NPR

Nicely done, @elonmusk

pic.twitter.com/jvX15QWSf5

— Benny Johnson (@bennyjohnson) April 5, 2023

NPR later announced that it will no longer be posting content to its 52 official Twitter feeds, becoming the first major news organization to go silent on the social media platform.

Twitter’s verification changes feel like an accidental April Fools’ joke

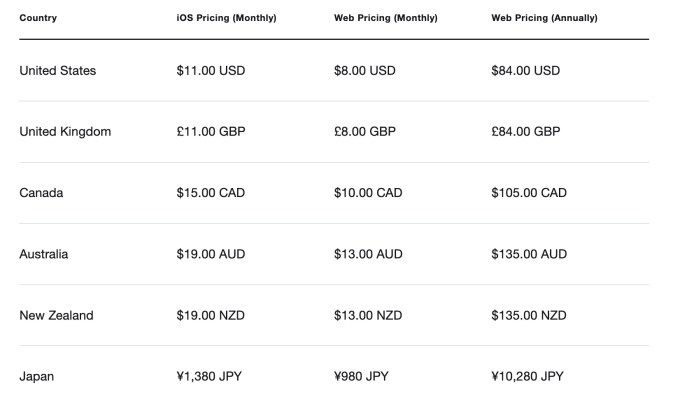

Musk had claimed that starting on April 1, blue checkmarks that previously indicated that an account was legitimate, verified and notable would be maintained only for those who have a subscription to Twitter Blue. The change would be part of a wider push for Twitter to gate previously free features, and bundle new ones, under the $8 per month Twitter Blue subscription, which costs $11 on iOS and Android devices.

As numerous celebrities and businesses spoke out to say they wouldn’t pay the $8 fee, it appeared that removing so many blue checks would be easier said than done. Instead, Twitter merely updated the text accompanying a blue check to make it unclear whether someone was verified for being notable, or for paying for Twitter Blue. In an ultimate act of pettiness, Twitter removed The New York Times’ verification check when the news giant said it wouldn’t pay for verification.

Based on early returns, the revamped Twitter Blue has yet to contribute significantly to Twitter’s bottom line, with just $11 million generated from mobile signups in its first three months.

March 2023

Twitter announces new API tiers; free, basic and enterprise levels

The three API tiers include a free level meant for content posting bots, a $100/month basic level and a costly enterprise level. Subscribing to any level gets access to the Ads API at no additional cost.

Twitter mentioned that over the next 30 days, the company will discontinue old access levels, including Standard (for v1.1), Essential and Elevated (for v2), and Premium.

Developers remain unhappy with Twitter’s new API structure.

Introducing a new form of Free (v2) access for write-only use cases and those testing the Twitter API with 1,500 Tweets/month at the app level, media upload endpoints, and Login with Twitter.

Get startedhttps://t.co/CqCRD3vbE5

— Twitter Dev (@TwitterDev) March 29, 2023

Elon Musk says Twitter will only show verified accounts on its “For You” timeline starting April 15

Musk justified the move by saying this was the “only realistic way to address advanced AI bot swarms taking over.”

Starting April 15th, only verified accounts will be eligible to be in For You recommendations.

The is the only realistic way to address advanced AI bot swarms taking over. It is otherwise a hopeless losing battle.

Voting in polls will require verification for same reason.

— Elon Musk (@elonmusk) March 27, 2023

New Twitter accounts now have to wait only 30 days to purchase Twitter Blue

Twitter decreases the wait to purchase Twitter Blue for newly created Twitter accounts from 90 days to 30 days.

“New subscriptions to Twitter Blue are available globally on web, iOS, or Android. Not all features are available on all platforms. Newly created Twitter accounts will not be able to subscribe to Twitter Blue for 30 days. We may also impose waiting periods for new accounts in the future at our discretion, and without notice,” the Twitter Blue page reads.

Twitter to kill ‘legacy’ blue checks on April 1

Twitter announced that the removal of legacy blue checkmarks will begin April 1 for users that are not subscribed to Twitter Blue.

Elon tweeted back in December that the company will remove legacy checkmarks “in a few months.” After that, users with legacy blue checks had been seeing a pop-up when they clicked on their checkmark, which read, “This is a legacy verified account. It may or may not be notable.” But once Twitter botched this removal of checkmarks, they changed the copy again — as of now, users cannot distinguish whether someone has a checkmark because they paid, or because they were deemed notable.

On April 1st, we will begin winding down our legacy verified program and removing legacy verified checkmarks. To keep your blue checkmark on Twitter, individuals can sign up for Twitter Blue herehttps://t.co/gzpCcwOpLp

Organizations can sign up for https://t.co/RlN5BbuGA3…

— Twitter Verified (@verified) March 23, 2023

Twitter’s privacy-preserving Tor service goes dark

Twitter’s Tor service, a version of the site that could be accessed even in countries where the social network is banned, has gone dark after the company failed to renew its certificate, which expired on March 6.

Pavel Zoneff, director of strategic communications at the Tor Project, told TechCrunch that the site “is no longer available seemingly with no plans to renew.”

Twitter Blue is now available in more than 20 countries

This expansion makes the social network’s subscription service available in more than 35 countries across the world.

These countries include Netherlands, Poland, Ireland, Belgium, Sweden, Romania, Czech Republic, Finland, Denmark, Greece, Austria, Hungary, Bulgaria, Lithuania, Slovakia, Latvia, Slovenia, Estonia, Croatia, Luxembourg, Malta and Cyprus.

February 2023

Layoffs continue

Twitter laid off more than 200 employees in its fourth round of cuts, including loyalist Esther Crawford — the chief executive of Twitter payments who oversaw the company’s Twitter Blue verification subscription.

Twitter’s staff is down from about 7,500 employees to less than 2,000 since Musk.

Lots of speculation among ex employees that Musk must be about to install a whole new regime and that’s why he is cleaning house. Otherwise the cuts don’t make sense. “Hard to keep the lights on with the people who are still left,” one ex manager told me.

— Alex Heath (@alexeheath) February 26, 2023

One of the numerous rounds of cuts eliminated the platform’s entire accessibility team. Senator Ed Markey (D-MA) called on Elon Musk to bring the accessibility team back in an open letter. Markey requested a response by March 17.

Twitter allows cannabis ads in states where it’s legal

After updating its ad policy on February 15, Twitter became the first social media app in the U.S. to allow cannabis advertising. Cannabis ads will run on Twitter in U.S. states where cannabis is legal and in Canada.

Twitter delays launch of its new API platform…again

The initial date set to cut free access to Twitter’s API was February 9, which was then extended to February 13. Now, the social network has delayed the shutdown again, this time with no date set.

There has been an immense amount of enthusiasm for the upcoming changes with Twitter API. As part of our efforts to create an optimal experience for the developer community, we will be delaying the launch of our new API platform by a few more days.

More information to follow…

— Twitter Dev (@TwitterDev) February 13, 2023

The delay jeopardizes the plans of developers and startups building tools around the Twitter API as they wouldn’t have any clarity on future spending and budget allocation on the developer platform.

Twitter’s basic tier of its API will cost $100 per month

The company originally planned to shut down free access to its API on February 9. Now it has extended this deadline to February 13. Twitter said that it will charge $100 per month for the basic tier of API. This will get developers access to a “low level of API usage,” as well as the Ads API.

We have been busy with some updates to the Twitter API so you can continue to build and innovate with us.

We’re excited to announce an extension of the current free Twitter API access through February 13. Here’s what we’re shipping then

— Twitter Dev (@TwitterDev) February 8, 2023

When developers trying to seek clarity around the new API rules went to the developer forum website, they found that the site had been put behind a login. The forum was finally accessible four days later on February 13.

Twitter Blue introduces 4,000-character tweets

Twitter announced the ability to post longer tweets for paid users on February 8. Instead of being limited to 280 characters, paying Blue subscribers can post tweets that are up to 4,000 characters.

While only Twitter Blue subscribers can post long tweets, all users will be able to read them. You will see only the first 280 characters on the timeline, and if you want to read more, you can click on “Show more.”

need more than 280 characters to express yourself?

we know that lots of you do… and while we love a good thread, sometimes you just want to Tweet everything all at once. we get that.

so we’re introducing longer Tweets! you’re gonna want to check this out. tap this

…

— Twitter Blue (@TwitterBlue) February 8, 2023

Elon Musk claims Twitter will start sharing ad revenue with creators

Elon Musk announced in a tweet on February 3 that the company would soon begin sharing advertising revenue with creators on the platform for the first time. He follows up the announcement with a catch: Eligible users must be signed up for Twitter Blue.

Payouts have yet to reach creators’ wallets.

More monetization pushes: Twitter Blue expands new countries, brings back Spaces curation

Twitter Blue subscriptions are now available in Saudi Arabia, France, Germany, Italy, Portugal and Spain, making it 12 regions in total to which users can subscribe to it as of February 2. On February 8, Twitter Blue extended services further to India, Indonesia and Brazil.

Twitter also announced launching a new Spaces tab with curated stations for live and recorded spaces, along with podcasts. The social network is making podcasts available only to Blue subscribers and “some people on Twitter for iOS and Twitter for Android apps.”

Twitter to end free access to its API

Twitter will discontinue offering free access to the Twitter API starting February 9 and will launch a paid version, Twitter said as it looks for more avenues to monetize the platform.

Starting February 9, we will no longer support free access to the Twitter API, both v2 and v1.1. A paid basic tier will be available instead

— Twitter Dev (@TwitterDev) February 2, 2023

A week later and days before the February 9 deadline, Elon Musk said that after getting feedback from developers, Twitter will provide a write-only API for “bots providing good content that is free.”

Twitter discontinues CoTweets

Twitter announced February 1 that it is discontinuing CoTweeting, a feature that allowed two users to co-author a tweet. Users will be able to view the set of co-tweets for a month. After that, they will be automatically converted to retweets on the co-author’s profile.

January 2023

Twitter partners with DoubleVerify and IAS on brand safety initiative

Due to declining ad revenue and advertiser exits, Twitter announced on January 25 that it has teamed up with adtech companies DoubleVerify and Integral Ad Science (IAS) to tell advertisers if their ad is placed around inappropriate content. The program, available first for U.S.-based advertising campaigns, allows brands to analyze the content adjacent to — primarily tweets above and below the ad — all types of ads, including promoted tweets.

Twitter rolls out its bookmark feature on iOS

The new design displays the bookmark button under the expanded tweet view, making it easier to add a post to your bookmarks.

Before the change, you had to tap on the share button to open the sharing card and then tap on the bookmark option to save a tweet. In addition to the new button, as soon as you tap on the button, you will see a banner at the top of the screen that says “Show all bookmarks.”

The option is currently visible only on the iOS app, but we can expect that Twitter will roll this out to Android and the web soon.

Image Credits: Twitter

Twitter quietly bans third-party clients

After cutting off prominent app makers like Tweetbot and Twitterific, Twitter quietly updated its developer terms to ban third-party clients altogether on January 19.

The “restrictions” section of Twitter’s developer agreement was updated with a clause prohibiting “use or access the Licensed Materials to create or attempt to create a substitute or similar service or product to the Twitter Applications.” Earlier in the week, Twitter said that it was “enforcing long-standing API rules” in disallowing clients access to its platform but didn’t cite which specific rules developers were violating.

As a result, third-party Twitter clients began offloading their apps from App Stores.

Twitter now offers an annual Blue subscription

Users now have a chance to get a discount for $84/year if they purchase an annual Blue subscription on the web.

Twitter Blue, including the new annual plan, is currently available in the U.S., the U.K., Canada, Australia, New Zealand and Japan.

Image Credits: Twitter

Twitter HQ furniture auctions

In a strange attempt to make money, Twitter is auctioning off surplus office furniture (auction is now closed) that it doesn’t need anymore, now that thousands of employees have either left the company or been laid off. When you’re rapidly losing advertisers and apparently not paying your rent, why not go for the hail mary?

Twitter makes algorithmic “For You” timeline the default

The company has tried to pull this stunt previously, only to give the option to switch back to a chronological timeline after a lot of backlashes.

What’s different this time? The Elon Musk-led company is now showing both algorithmic and chronological feeds side-by-side. Users can switch between them by swiping on their phone screens. Until now, users had to tap on the sparkle icon in the top-right corner to switch between the “Home” and “Latest” timelines. Twitter is justifying its latest change by saying that users can now easily swipe between the renamed “For You” and “Following” timelines.

- January 13: Twitter rolled out the dual-timeline update to the web but at that time the social network used to remember your choice.

- January 20: The company made the “For You” feed default on the web when users first opened Twitter in a tab or refreshed the page.

- January 24: Now, Twitter remembers your choices again.

- February 7: Twitter remembers your choices again on iOS and Android, too.

You can now easily switch between “For you” and “Following” on web. Android coming soon

— Twitter Support (@TwitterSupport) January 13, 2023

Twitter’s advanced search filters for mobile are said to be coming soon

According to social media analyst Matt Navarra, Twitter’s advanced search filters for mobile are coming soon.

Here’s what it looks like:

NEW! Twitter Advanced Search feature on iOS is coming soon

https://t.co/ae56yE3JTU pic.twitter.com/xbQUpQJAlS

— Matt Navarra (@MattNavarra) January 4, 2023

Twitter lifts the political ad ban to bolster revenue

The company originally enforced the ban back in 2019. At that time, it said that “political message reach should be earned, not bought.” Twitter charted a different path from other social networks like Facebook and Instagram, which allowed political ads.

Twitter’s announcement to lift the political ad ban comes at a time when advertisers have been pulling back spending on the platform, and the company has been cutting down its internal revenue projections.

December 2022

Twitter Blue users can now upload 60-minute videos

On December 23, Twitter updated the Twitter Blue page declaring that subscribers can now upload 60-minute videos from the web at 1080p resolution and 2GB in file size.

Twitter layoffs continue, impacting employees in public policy, engineering

According to posts on Twitter and LinkedIn from a former public policy employee on December 22, Twitter cut half of its public policy team.

Twitter also laid off some engineers in infrastructure via email on December 16. Across all of Twitter, it’s estimated that about 75% of employees have either chosen to leave or have been laid off since Elon Musk took ownership of the company in October.

Twitter now displays stock and cryptocurrency prices directly in search results

To access the new feature, users have to just type the dollar symbol followed by the relevant ticker symbol, e.g. “$GOOG” or “$ETH” (minus the quote marks), in the search bar and Twitter will display the current price. This also works without using the $ symbol in some instances, but it’s less consistent and doesn’t always return the stock or crypto prices as requested.

If someone wants to know more details about a stock or cryptocurrency, they can hit the “View on Robinhood” button.

$Cashtags, now with data

$SPY

pic.twitter.com/XgOK6gf02E

— Twitter Business (@TwitterBusiness) December 21, 2022

Twitter now shows how many people view your tweets

A tweet’s View Count will be visible to everyone, not just the owner of the account.

“Twitter is rolling out View Count, so you can see how many times a tweet has been seen! This is normal for video,” Elon Musk wrote in a tweet. “Shows how much more alive Twitter is than it may seem, as over 90% of Twitter users read, but don’t tweet, reply or like, as those are public actions.”

Twitter Blue for Business now allows companies to identify their employees

Twitter’s product manager Esther Crawford said the social media platform is launching a pilot program for Blue for Business with select businesses. The company plans to expand this to more organizations next year.

We’re launching the pilot of Blue for Business so beginning today you’ll start seeing company badges on select profiles. We’ll soon be expanding the program and look forward to having more businesses added in the new year! https://t.co/ytnMRO5rcE

— Esther Crawford

(@esthercrawford) December 19, 2022

Twitter goes on an account suspension spree, including prominent journalists

A day after Twitter crafted a new policy to explain its decision to ban an account that tracks Elon Musk’s private jet, Twitter also suspended its open source competitor Mastodon from the service.

Within the same day, Twitter suspended a number of prominent journalists on the platform without warning. “Same doxxing rules apply to ‘journalists’ as to everyone else,” Elon Musk tweeted in a reply about the journalists’ suspensions.

Twitter seemingly had a glitch that allowed banned users to still participate in Twitter Spaces. A group of the banned journalists started a group conversation on Spaces where Musk himself joined in. Shortly after, Twitter pulled its Spaces group audio feature temporarily.

Twitter shuts down Revue, its newsletter platform

Revue, the newsletter platform acquired by Twitter in January 2021, sent a message to newsletter writers on December 14 declaring, “We’ve made the difficult decision to shut down Revue.” Writers had until January 18, 2023 to retrieve their data before everything was deleted.

Twitter disperses the Trust & Safety Council

Twitter dispersed the advisory group consisting of roughly 100 independent researchers and human rights activists from around the world. The council members received an email on Monday, December 12 from Twitter saying that the Trust & Safety Council is “not the best structure” to get external insights into the company product and policy strategy.

Elon Musk says Twitter will remove all legacy verifications ‘in a few months’

Twitter will remove all legacy blue checkmarks “in a few months,” Elon Musk tweeted on December 12. Before Musk bought Twitter, checkmarks were used to verify individuals and entities as active, authentic and notable accounts of interest.

This past week, many blue checkmark holders have been seeing a pop-up when they click on their blue checkmark that reads, “This is a legacy verified account. It may or may not be notable.”

Twitter Blue relaunches with new verification process, plus Blue for Business

Twitter is officially bringing back the Twitter Blue subscription on December 12, starting in five countries before rapidly expanding to others. Twitter updated its terms to specify that users will need to verify their phone numbers before purchasing the Twitter Blue subscription.

Web sign-ups will cost $8 per month and iOS sign ups will cost $11 per month for “access to subscriber-only features, including the blue checkmark,” per a tweet from the company account. Twitter Blue became available on Android at the same price as iOS in January 2023.

In addition to the relaunch of Twitter Blue, the company also began rolling out a new offering called Blue for Business that adds a gold checkmark to company accounts.

Twitter rolls out its Community Notes feature globally

Twitter announced Community Notes, previously known as Birdwatch, are now visible around the world. Community Notes is the social media giant’s crowdsourced fact-checking system.

Moderators who are part of the program can add notes to tweets to add context and users can then vote if they determine the context to be helpful. Prior to this global expansion, Community Notes were only visible to users in the U.S. Twitter added moderators from the U.K., Ireland, Australia and New Zealand in January 2023.

Twitter announces charging $11 on iOS for Blue subscription to offset App Store fees

When Twitter launched its new subscription plan with a verification mark on November 9, it charged users $7.99 per month. In an attempt to offset App Store fees, Twitter is charging iOS users $11 for the new subscription plan — though the Twitter Blue plan is on halt.

November 2022

Twitter’s Community Notes updated to better address ‘low quality’ contributions

The platform’s crowdsourced fact-checking system, Community Notes, are notes written by Twitter users that are appended to tweets to provide further clarification and context.

The Community Notes algorithm change involves scoring notes where contributors explain why a tweet shouldn’t be deemed misleading.

Twitter announces a new multicolored verification system

Elon Musk announces that Twitter will tentatively roll out a new multicolored verification system where companies will get a gold checkmark, government officials will get a grey checkmark and the blue checkmark will be dedicated to individuals even if they are not celebrities. That means the blue checkmark will be used with legacy verified accounts and folks who buy Twitter’s proposed $8 per month paid plan.

If you’re confused about all the checkmarks, you’re not alone. Here’s a quick guide on what each checkmark and badge means on Twitter.

Twitter Blue verification chaos ensues

On November 9, Twitter CEO Elon Musk floated changes to Twitter’s system for verifying user accounts, including charging $8 per month for it. The social media company seemingly began rolling out a new tier of Twitter Blue, its premium subscription service. According to a tweet by Esther Crawford, a former product lead at Twitter, the new Twitter Blue plan wasn’t yet live, but some users saw notifications as part of a live test.

The new Blue isn’t live yet — the sprint to our launch continues but some folks may see us making updates because we are testing and pushing changes in real-time. The Twitter team is legendary.

New Blue… coming soon! https://t.co/ewTSTjx3t7

— Esther Crawford

(@esthercrawford) November 5, 2022

Twitter also launched grey-colored official checkmarks for notable accounts such as companies and politicians. But within hours of the launch, Elon Musk killed it. Crawford clarified that the grey “Official” labels are still going out as part of the new Twitter Blue product.

The new $8 Twitter Blue plan began rolling out to iOS users in the U.S., Canada, Australia, New Zealand and the U.K with the only feature available at the time being the blue “verified” checkmark. This caused a number of fake accounts pretending to be celebrities, brands and otherwise influential people to create accounts and spread misinformation.

The Twitter exodus begins with mass layoffs and exits

Elon Musk laid off 3,700 people from Twitter on November 3, almost half its staff, shortly after completing the acquisition. Twitter was sued in a class action lawsuit in response to not giving employees advance notice of a mass layoff, alleging Twitter violated worker protection laws.

A week later, Twitter reached out to some former employees to return as they were laid off “by mistake.”

In addition to layoffs, a round of executive departures also swept through the company. In Musk’s first email to his new staff, he talked about ending remote work and making the fight against spam a priority.

October 2022

Elon Musk is revamping Twitter’s verification system

Twitter begins overhauling a new and more expensive version of Twitter Blue, the platform’s paid plan, that will reportedly cost $19.99 per month and give users a verified badge. At the time, Twitter Blue cost $4.99 per month in the U.S.

According to a report from The Verge, Twitter plans to remove verification badges from current holders if they don’t pay for Twitter Blue within 90 days of launching the new verification system.

Elon Musk officially owns Twitter

Elon Musk closed on his $44 billion acquisition of Twitter on October 27, 2022. The deal came after months of legal drama, bad memes and will-they-or-won’t-they-chaos. After sealing the deal, Musk took Twitter private and began clearing house. On day one, he fired former CEO Parag Agrawal, CFO Ned Segal, General Counsel Sean Edgett and Head of Legal, Trust and Safety Vijaya Gadde.

Elon Musk’s Twitter: Everything you need to know, from layoffs to verification by Amanda Silberling originally published on TechCrunch

Major decision on the legality of Facebook’s EU-US data transfers is due to be adopted today

Reminder: Today is the deadline for the Meta’s lead privacy regulator in Europe to adopt a final decision on a nearly decade-long complaint against Facebook’s transfers of personal data from the EU to the US that could see the company ordered to stop the flow of data.

The Irish Data Protection Commission (DPC) confirmed to TechCrunch it will adopt its final decision today.

However we understand there will be further delay (of just over a week) before the decision is made public. The date we’ve been told the order will officially be published is May 22 — assuming details do not leak out beforehand.

The delay in publishing the adopted decision is because Meta will be given time to review the document to identify confidential and/or commercially sensitive info it may want redacted, we were told, and owing to a public holiday affecting another involved EU regulator.

The May 12th date for adoption of the DPC’s final decision on the complaint follows a timetable set by a dispute resolution decision taken by the European Data Protection Board last month.

Applying mechanisms baked into the General Data Protection Regulation (GDPR), the Board stepped in to settle disagreement between a number of EU regulators over the substance of the decision — taking a binding decision on Meta’s transfers and giving the DPC one month to implement it.

We don’t yet know what’s been decided since the Board’s dispute resolution decision has not been made public as we’re waiting on the final DPC decision (which will implement it) — so the fate of Facebook’s European data flows still hangs in the balance.

That said, Meta is widely expected to be ordered to suspend data flows, given the company received a preliminary suspension order from the DPC, back in fall 2020.

At that time the company obtained a stay on the DPC’s procedure which helped delay the GDPR enforcement timetable until the Irish courts dismissed Meta’s challenge. Further delays kicked in later, when the DPC’s draft decision on the case faced objections from other EU data protection authorities — with those disputes settled finally by the EDPB’s binding decision last month.

This means the regulatory process is at least running out of road (but expect Meta to challenge any suspension order in the Irish courts).

The company has continuously sought to play down the saga — claiming in its last statement that it “relates to a historic conflict of EU and US law, which is in the process of being resolved”. Which is a reference to a draft agreement between EU and US lawmakers for a new high level transatlantic data transfer framework aimed at resolving the conflict between US surveillance practices and EU data protection rights.

However this EU-US Data Privacy Framework, as the agreement has been named, is still in the process of being reviewed by EU institutions which have raised concerns that it does not have strong enough safeguards. And, just this week lawmakers, in the European Parliament reiterated a call for the Commission to take more time to improve the proposal — suggesting there could be further delays in adoption of an agreement Meta appears to be banking on to save its data transfers bacon.

While the data suspension question is the headline issue for this GDPR case, other major elements to look out for in Ireland’s final decision later this month include whether or not Meta will be ordered to delete European users data if it’s found to have been unlawfully transferred to the US.

Back in March, MLex reported that at least two data protection authorities were pushing for that — and that Meta was lobbying EU institutions against any such move.

Add to that, leaked internal documents last year suggested the tech giant’s data management practices are, to put it politely, a mess. So how easily Meta could identify and isolate European users’ data, if ordered to delete it, is one big (expensive) consideration/complication.

Why is this such a huge deal? Well as a reminder, we’ve recently learned in federal court discovery that Facebook appears to have no way to retroactively fully purge users’ data. They said it will take as much as a year to pull all data for a user. This leaked doc got to it. 2/4 pic.twitter.com/g9kTTsYklY

— Jason Kint (@jason_kint) May 11, 2023

Meta could also of course be issued with a fine if it’s found to have unlawfully transferred data.

The GDPR allows for penalties of up to 4% of global annual turnover, although — to date — Meta has had considerable success at being fined far less than the theoretical maximum.

Privacy rights advocacy group, noyb — whose founder, Max Schrems, is behind the complaint against Facebook’s EU-US data flows — wrote to the EDPB in January to complain over the size of a fine the DPC hit it with at the start of this year, over unlawful ads data processing, arguing the €390 million penalty was paltry vs the scale of the infringements (in fact he suggested it fell short by more than €3.5BN).

Ireland had actually proposed a far lower level of fine for that breach — of between €28M to €36M — but the regulator was forced to increase it in order to implement the EDPB’s binding decision.

Without that Board intervention Meta would have faced even weaker GDPR enforcement for unlawfully processing millions of Europeans’ personal data for behavioral advertising. So it will be interesting to see what level of penalty (if any) is included in Ireland’s final decision on Facebook’s data transfers.

That said, financial penalties imposed on tech giants are typically less interesting than operational orders which have the chance to force changes to abusive business models. And while Meta is still data-mining European users for behavioral ad targeting it was at least forced to offer an opt out as a result of the aforementioned GDPR enforcement. Something it has never offered before.

How Meta might be forced to amend its business model to fix unlawful transatlantic data transfers is an open question.

But there’s no doubt it will throw everything it’s got at fighting any order to suspend in the courts so it may well find a way to delay having to for act long enough for the goalposts to be moved by the arrival of a new US data adequacy agreement.

If not, the costs will be real.

In an earnings call with investors last month the company admitted that an order to suspend data flows from Europe could hit 10% of its global ad revenue.

Obviously it’s hoping it does not come to that — and banking on the new EU-US data transfer mechanism being adopted just in the nick of time. (A company spokesman declined to discuss contingencies if it is ordered to suspend data flows, pointing back to the “progress” policymakers have made towards a new pact.)

But even if the high level deal arrives soon enough to prevent a Facebook shut down in Europe from happening this year, Schrems suggests the new high level framework is “likely” to be struck down by the bloc’s top court, as the two predecessor arrangements were — so he estimates Meta would only buy itself another “two years or so” before the issue rears its head again.

For a longer term solution, he has suggested Meta will need to federate Facebook’s infrastructure. But such a major retooling of its business would obviously be very expensive too.

Major decision on the legality of Facebook’s EU-US data transfers is due to be adopted today by Natasha Lomas originally published on TechCrunch

https://techcrunch.com/2023/05/12/facebook-data-transfers-final-gdpr-decision-adoption/

Elon Musk appoints new Twitter CEO, NBCU’s Linda Yaccarino

The rumors are true: Elon Musk has chosen NBCU leader Linda Yaccarino as the next CEO of Twitter.

Musk confirmed Yaccarino’s new role in a tweet this morning, a day after he announced that he had completed his search for a new CEO.

“Looking forward to working with Linda to transform this platform into X, the everything app,” wrote Musk.

I am excited to welcome Linda Yaccarino as the new CEO of Twitter!@LindaYacc will focus primarily on business operations, while I focus on product design & new technology.

Looking forward to working with Linda to transform this platform into X, the everything app. https://t.co/TiSJtTWuky

— Elon Musk (@elonmusk) May 12, 2023

Yaccarino announced on Friday morning that she was leaving her role as Chariman of Global Advertising & Partnerships at NBCU.

It’s smart to put a well-known advertising executive at the helm of Twitter, since Musk’s leadership has tanked that key facet of Twitter’s business. Musk said he will stay on as chairman and “CTO, overseeing product, software & sysops.” With erratic content moderation policies and inconsistent, sometimes misleading verification systems, Twitter has bled advertisers. The company has also laid off critical teams for revenue generations, like its sales team.

Musk and Yaccarino already seem to have a bit of a rapport. Last month, Yaccarino interviewed Musk at an advertising conference in Miami, where she seemed complimentary of the business mogul.

“Elon has committed to being accessible to everyone for continual feedback,” she said on stage. “He’s also opened up himself to also participate in the new transparency and safety rules he posted yesterday. Just remember, freedom of speech does not mean freedom of reach.”

She also pointed out to Elon that “the people in this room are [Twitter’s] path to profitability.” Since its inception, Twitter’s most effective way to make money has been advertising, and Musk’s attempts to monetize the blue check have not been successful.

We don’t know whether the two of them were in negotiations at the time, but Yaccarino seemed motivated to sanitize the Twitter brand, encouraging audience members to voice their concerns to Musk in an Q&A. She echoed Musk’s viewpoint on freedom of speech as it pertains to advertisers, which is that freedom of speech doesn’t mean “freedom of reach.”

“If freedom of speech, as he says, is the bedrock of this country, I’m not sure there’s anyone in this room who could disagree with that,” Yaccarino said when interviewing Musk. “Could I get a round of applause for that?”

This story is developing…

Elon Musk appoints new Twitter CEO, NBCU’s Linda Yaccarino by Amanda Silberling originally published on TechCrunch

https://techcrunch.com/2023/05/12/elon-musk-appoints-new-twitter-ceo-nbcus-linda-yaccarino/

Elon Musk Says NBCUniversal Ad Boss Linda Yaccarino Is Twitter’s New CEO

NBCU earlier announced she was leaving, effective immediately.

https://www.wsj.com/articles/linda-yaccarino-new-twitter-ceo-42a4f206?mod=rss_Technology

Pale Blue Dot continues investing in its climate vision, with a second, $100M fund

Larsson, Lindvall, and Jakobsson are all former startup founders themselves, giving them a strong founder focus in the companies where they choose to invest. They are also the only members of the investment team, which doesn’t have a hierarchy. Any startup that is offered a meeting with the GPs meets with all three of them. If they choose to make an investment, then the founders can expect the GPs to work closely with them to help their startups grow and flourish.

Sweden-based VC fund Pale Blue Dot bounced onto the scene in 2020 with a €53 million fund to help climate-focused startups. This fund grew again by €34 million in April 2021, and after deploying investments into 28 climate-forward companies, the investor this week announced it has officially closed its second fund. This one is valued at €93 million (approximately $101 million at today’s valuation), with the same thesis in mind: to support climate tech-oriented startups.

Founded by general partners Joel Larsson, Heidi Lindvall and Hampus Jakobsson, Pale Blue Dot looks to make pre-seed and seed investments in European-based companies, although it is open to deals from the U.S., too.

“Climate tech is here to stay,” says Lindvall in a statement to TechCrunch. “As long as the climate crisis has not been solved, we will need to keep investing more money into tech solutions. This space will continue to see accelerated growth as individuals, corporates and governments try to figure out how to decarbonise and prepare for a new world.”

The firm prefers to lead rounds, writing checks between €500,000 and €2 million. Out of its 28 investments to date, the firm highlights some examples of what it is looking for in the form of Phytoform, a British-U.S. biotech-agritech business, climate risk data analytics firm Climate X; U.K.-based logistics company Hived, Danish EV charging platform Monta and French fintech firm Green Got. There remain a few investments to be made from the first fund before the firm officially starts deploying funds out of its second investment vehicle. The GPs are aiming to invest in 35 startups with this fund, in sectors such as food and agtech, industry, mobility and fintech, provided that they are focused on making a positive difference toward climate change.

The Pale Blue Dot team. Image Credits: Pale Blue Dot

Larsson, Lindvall, and Jakobsson are all former startup founders themselves, giving them a strong founder focus in the companies where they choose to invest. They are also the only members of the investment team, which doesn’t have a hierarchy. Any startup that is offered a meeting with the GPs meets with all three of them. If they choose to make an investment, then the founders can expect the GPs to work closely with them to help their startups grow and flourish.

“Receiving interest and recognition from the industry is good,” said Jakobsson, “but the fact that amazing founders keep picking us to be their partners on their journeys is the biggest vote of confidence and why we get up in the morning.”

The new €93 million fund has been created with investment from serial entrepreneurs, family offices and institutional investors from Europe and the U.S. Roughly two-thirds of the second fund’s LPs were LPs in the first fund, with the new LPs having been invited to join.

Pale Blue Dot tells TechCrunch it is eager to meet with ambitious founders from a diversity of backgrounds who are seeking to tackle climate change with their startups.

Pale Blue Dot continues investing in its climate vision, with a second, $100M fund by Haje Jan Kamps originally published on TechCrunch

Very excited to be launching a new $Cashtags partnership with

Very excited to be launching a new $Cashtags partnership with