Category: TECHNOLOGY

Meta content review partner Sama told by court to pay moderators

Meta’s content moderation partner in Africa, Sama, was earlier today compelled by a Kenyan court to pay April salaries to a section of moderators it had left out. The direction comes days after moderators picketed at Sama headquarters in Kenya demanding April pay.

The court gave the orders following an urgent application filed on April 27 on behalf of the moderators, seeking to have Sama compelled to pay their salaries and observe orders issued in March.

About 184 moderators sued Sama for allegedly laying them off unlawfully, after it wound down its content review arm in March, and Majorel, the social media giant’s new partner in Africa, for blacklisting on instruction by Meta.

Today, the judge directed “Sama to continue paying the petitioners being Facebook moderators…and within the terms of the orders given by court.”

The court issued temporary orders on March 21 barring Sama from effecting any form of redundancy, and Meta from engaging Majorel. Majorel was also instructed to refrain from blacklisting ex-Sama moderators.

The court directed Sama to continue reviewing content on Meta’s platforms, and to be its sole provider in Africa pending determination of the case. However, Sama sent the moderators on compulsory leave in April saying it had no work for them as its contract with Meta had expired.

The moderators filed the suit in March alleging that Sama failed to issue redundancy notices, as required by Kenyan law, that the moderators were not issued with a 30-day termination notice, and that their terminal dues were pegged on their signing of non-disclosure documents among other claims. Sama says it observed the Kenyan law, including giving the employees enough notice.

Sama announced in January that it was dropping Meta’s contract and content review services, laying off 260 people in the process, to concentrate on labeling work (computer vision data annotation). This came months after another lawsuit was filed in Kenya by its former content moderator, Daniel Motaung.

Motuang, a South African, had accused Sama and Meta of forced labor and human trafficking, unfair labor relations, union busting and failure to provide “adequate” mental health and psychosocial support. He was allegedly laid off for organizing a 2019 strike and trying to unionize Sama’s employees. Sama and Majorel moderators earlier this week voted to form a union.

Meta content review partner Sama told by court to pay moderators by Annie Njanja originally published on TechCrunch

https://techcrunch.com/2023/05/11/meta-content-review-partner-sama-told-by-court-to-pay-moderators/

Google enables Chromebook app streaming for select Pixel and Xiaomi devices

Among the slew of announcements at Google I/O, the tech giant revealed that it has enabled app streaming through Phone Hub in ChromeOS Beta. The feature allows you to use different apps from your Android phone right in a dedicated window on your Chromebook. Once Phone Hub is enabled, you can do things like check your phone notifications, find open tabs, and stream apps from your mobile Chrome browser on your Chromebook.

In its support page for the feature, Google notes that app streaming is compatible with the “Pixel 4A and higher that runs Android version 13 or later.” As for non-Pixel phones, app streaming is only compatible the Xiaomi 12T, 12T Pro, 13, and 13 Pro also running Android 13 or later.

You can stream apps by clicking a messaging app notification or browsing the Hub’s “Recent Apps” section after you’ve opened an app on your mobile device. You can also launch an app stream through “All Apps,” which you can access through the Recent Apps list in Phone Hub.

“You can now complete quick tasks like replying to a conversation, checking on the status of a rideshare or delivery, and editing your shopping list by streaming your Android phone’s apps on your Chromebook,” Google wrote in a blog post. “To use App Streaming, make sure that Phone Hub is enabled on your Chromebook.”

You can use your Chromebook’s trackpad to zoom in and out on an app in the same way you would on the phone’s touchscreen. If your Chromebook has touch support, you can use the touch screen to interact with the streamed app.

Google also notes that both your phone and Chromebook have to share the same Wi-Fi network and the two devices must be close to each other. You can also “use Instant Tethering to put both devices on the same local area network if your current network environment doesn’t support app streaming.” App streaming might be terminated if you become inactive, your mobile device is too far away from your Chromebook or if there are connection errors.

The functionality is a welcome one, as it can help you avoid having to switch between devices when completing certain tasks. Chromebook Android app streaming is available on the ChromeOS beta channel.

Google enables Chromebook app streaming for select Pixel and Xiaomi devices by Aisha Malik originally published on TechCrunch

Hyundai Motor to invest $2.45bn in India by 2032 to boost EV ecosystem

Hyundai Motor has announced that it plans to invest $2.45 billion (200 billion Indian rupees) over the next ten years in the southern Indian state of Tamil Nadu to bolster its plans for electric vehicles in the country.

On Thursday, the South Korean company signed an agreement (a memorandum of understanding) with the state government of Tamil Nadu detailing its investment. It will lead to an increased production capacity at the company’s facility in Sriperumbudur — Chennai’s automotive corridor.

Hyundai Motor India, the company’s India subsidiary, will also assemble EV battery packs and install 100 charging stations for EVs. Those charging stations will be a combination of dual ultra-fast and single faster-charging stations and they will be installed across the state over the next five years.

“The long-term investment will help enhance our manufacturing capability and also increase the production volume at our plant in Sriperumbudur, enabling us to make the best electric and ICE [Internal Combustion Engine] vehicles in Tamil Nadu for the rest of the world,” Hyundai Motor India managing director Unsoo Kim said at a press conference.

The carmaker currently has a capacity of 775,000 vehicles per year at its Chennai factory that it plans to increase to 850,000. However, the exact timeline for the expansion is yet to be disclosed.

Almost 6% of all the EV vehicles manufactured in India are sold in Tamil Nadu, the state government’s industries minister TRB Raja said at the conference. He added that 35% of country’s the automobile industry is based in the southern state.

Tamil Nadu’s Chennai, which is also called the Detroit of India, is a hub for automobile companies. It includes manufacturing facilities of various four- and two-wheeler makers including Renault-Nissan, Mitsubishi Motors, Yamaha and Royal Enfield — among others. The city also has showrooms for luxury car companies including BMW and Mercedes Benz.

Hyundai’s investment announcement comes just a day after China’s MG Motor announced its plans to dilute existing Chinese shareholding by selling shares and invest over $611 million to set up a second plant in India, the world’s third-largest car market. MG Motor also recently introduced its affordable EV called MG Comet in the country to attract young commuters.

Currently, India is an emerging EV market, with a handful of companies offering their electric cars. The country’s EVs cumulatively make merely 1% of its total four-wheeler sales. However, the Indian government is pushing to expand EV adoption by incentivizing automobile companies and subsidizing consumers.

Hyundai Motor to invest $2.45bn in India by 2032 to boost EV ecosystem by Jagmeet Singh originally published on TechCrunch

https://techcrunch.com/2023/05/11/hyundai-motor-india-investment-ev/

Peloton recalls millions of exercise bikes after reports of injuries

Peloton is recalling roughly 2.2 million exercise bikes over safety concerns, several outlets reported this morning.

The reason is a faulty assembly, according to a release by the U.S. Consumer Product Safety Commission (CPSC). The bike — Bike Model PL01 — can “break during use, posing fall and injury hazards to the user,” the agency says, citing the over-two-dozen reports Peloton has received about the seat post breaking and detaching during use.

The bike model impacted by the recall was manufactured in Taiwan and sold in the U.S. between January 2018 and May 2023 at Peloton, Dick’s Sporting Goods and Amazon. It can be identified by a label on the inside front fork, near its flywheel or non-swivel display, or by the red “P” logo and Peloton brand name in white on the frame.

The CPSC says that there’s been 13 reports of injuries on the bike so far, including a fractured wrist, lacerations and bruises.

“Consumers should immediately stop using the recalled exercise bikes and contact Peloton for a free repair,” the CPSC release said. “Peloton is offering consumers a free seat post that can be self-installed.”

The recall comes just over a year after Peloton began outsourcing the production of its bikes and treadmills following its decision to pull the plug on a $400 million manufacturing facility. It’s the company’s second recall in the past several years, after a child’s death and other problems forced it to recall 125,000 of its Tread and Tread+ treadmills. (Initially, Peloton called the CPSC’s findings “inaccurate and misleading,” but changed its tune in light of the high-profile accidents.)

The recalls have been quite damaging for Peloton, which has struggled to maintain sales momentum after pandemic-era business tapered off. The company estimated that the Tread and Tread+ recalls cost it approximately $165 million, including $105 million for ending deliveries on the impacted products and $50 million for full refunds.

Peloton recalls millions of exercise bikes after reports of injuries by Kyle Wiggers originally published on TechCrunch

AMP Robotics attracts investment from Microsoft’s Climate Innovation Fund

AMP Robotics, a Denver, Colorado-based startup creating robotic systems that can automatically sort recyclable material, today announced that it extended its Series C round to $99 million, thanks to an investment from Microsoft’s Climate Innovation Fund. That’s up from $91 million when the round closed in November.

The extended Series C, which saw participation investors including Congruent Ventures and Wellington Management (who co-led), Blue Earth Capital, Sidewalk Infrastructure Partners, Tao Capital Partners, XN, Sequoia Capital, GV, Range Ventures and Valor Equity Partners, brings AMP’s total raised to around $178 million.

“The capital is helping us scale our operations, including deploying technology solutions to retrofit existing recycling infrastructure and expanding new infrastructure based on our application of AI-powered automation,” founder and CEO Matanya Horowitz told TechCrunch via email.

Horowitz founded AMP in 2014 after earning his Ph.D. from Caltech. While pursuing his doctorate, he says he saw how powerful computer vision was becoming, and began exploring different areas where the technology could be most useful — including recycling.

“After visiting a recycling facility and seeing not only how demanding conditions were, but how challenging of a working environment it could be, I recognized this industry was a compelling opportunity for robotics,” Horowitz said. “The convergence of machine learning and robotics offered compelling opportunities to automate what had historically been tasks that were labor intensive, high cost, inconsistent and limiting.”

A sorter machine from AMP Robotics.

It’s also lucrative. The recycling industry contributes nearly $117 billion to the U.S. economy, according to the Institute of Scrap Recycling Industries, and the industry processes 130 million metric tons of valuable commodities annually.

Horowitz asserts that landfilled plastics represent significant losses to the U.S. economy — an average of around $7.2 billion in 2019, per the Department of Energy (DoE). Of the estimated 44 million metric tons of plastic waste managed domestically in 2019, approximately 86% was landfilled, 9% was combusted and 5% was recycled, according to the DoE.

The recovery of U.S. plastic packaging and food-service plastic alone could represent a pool of earnings of $2 billion to $4 billion per year, Horowitz estimates.

AMP’s primary customers are recycling facilities, who use the startup’s flagship product, a robotic sorting system called AMP Cortex, to sort, pick and reclaim plastics, cardboard, paper, cans, cartons and other containers and packaging types. AMP claims that Cortex can perform 80 to 120 picks per minute while remaining accurate with respect to what it’s sorting where.

Recently, AMP, which employs a team of around 200 people, unveiled a more compact solution dubbed AMP Cortex-C alongside an integrated, standalone facility offering for waste management companies. Horowitz says that the company’s robotic fleet of around 275 is now deployed in over 100 centers including several owned by Waste Connections, its largest customer, and that AMP’s AI platform has identified over 75 billion objects to date.

“Our broad product suite directly deals with the core challenges of operating recycling facilities, and we have some other amazing technology soon to come,” Horowitz added. “We have a number of larger opportunities in front of us, from opportunities in Europe and across the world, to large, fleet-wide deployments of robots and deployment of fully automated sorting facilities. The capital helps us build the technologies and team to support these opportunities.”

On the subject, AMP plans to grow its secondary sortation business in the U.S. across its three production facilities in the Denver, Atlanta and Cleveland metro areas. In addition to providing robotics infrastructure and software to customers, AMP resells recyclable commodities like bespoke chemical and polymer blends to end-market buyers.

AMP Robotics attracts investment from Microsoft’s Climate Innovation Fund by Kyle Wiggers originally published on TechCrunch

SoftBank Says Goodbye to Alibaba, Hello to More AI Investments

The Japanese tech investor said it was ready to go on the offensive again with its eye on artificial-intelligence companies.

AI2 is developing a large language model optimized for science

PaLM 2. GPT-4. The list of text-generating AI practically grows by the day.

Most of these models are walled behind APIs, making it impossible for researchers to see exactly what makes them tick. But increasingly, community efforts are yielding open source AI that’s as sophisticated, if not more so, than their commercial counterparts.

The latest of these efforts is the Open Language Model, a large language model set to be released by the nonprofit Allen Institute for AI Research (AI2) sometime in 2024. Open Language Model, or OLMo for short, is being developed in collaboration with AMD and the Large Unified Modern Infrastructure consortium, which provides supercomputing power for training and education, as well as Surge AI and MosaicML (which are providing data and training code).

“The research and technology communities need access to open language models to advance this science,” Hanna Hajishirzi, the senior director of NLP research at AI2, told TechCrunch in an email interview. “With OLMo, we are working to close the gap between public and private research capabilities and knowledge by building a competitive language model.”

One might wonder — including this reporter — why AI2 felt the need to develop an open language model when there’s already several to choose from (see Bloom, Meta’s LLaMA, etc.). The way Hajishirzi sees it, while the open source releases to date have been valuable and even boundary-pushing, they’ve missed the mark in various ways.

AI2 sees OLMo as a platform, not just a model — one that’ll allow the research community to take each component AI2 creates and either use it themselves or seek to improve it. Everything AI2 makes for OLMo will be openly available, Hajishirzi says, including a public demo, training data set and API, and documented with “very limited” exceptions under “suitable” licensing.

“We’re building OLMo to create greater access for the AI research community to work directly on language models,” Hajishirzi said. “We believe the broad availability of all aspects of OLMo will enable the research community to take what we are creating and work to improve it. Our ultimate goal is to collaboratively build the best open language model in the world.”

OLMo’s other differentiator, according to Noah Smith, senior director of NLP research at AI2, is a focus on enabling the model to better leverage and understand textbooks and academic papers as opposed to, say, code. There’s been other attempts at this, like Meta’s infamous Galactica model. But Hajishirzi believes that AI2’s work in academia and the tools it’s developed for research, like Semantic Scholar, will help make OLMo “uniquely suited” for scientific and academic applications.

“We believe OLMo has the potential to be something really special in the field, especially in a landscape where many are rushing to cash in on interest in generative AI models,” Smith said. “AI2’s unique ability to act as third party experts gives us an opportunity to work not only with our own world-class expertise but collaborate with the strongest minds in the industry. As a result, we think our rigorous, documented approach will set the stage for building the next generation of safe, effective AI technologies.”

That’s a nice sentiment, to be sure. But what about the thorny ethical and legal issues around training — and releasing — generative AI? The debate’s raging around the rights of content owners (among other affected stakeholders), and countless nagging issues have yet to be settled in the courts.

To allay concerns, the OLMo team plans to work with AI2’s legal department and to-be-determined outside experts, stopping at “checkpoints” in the model-building process to reassess privacy and intellectual property rights issues.

What about the potential for misuse? Models, which are often toxic and biased to begin with, are ripe for bad actors intent on spreading disinformation and generating malicious code.

Hajishirzi said that AI2 will use a combination of licensing, model design and selective access to the underlying components to “maximize the scientific benefits while reducing the risk of harmful use.” To guide policy, OLMo has an ethics review committee with internal and external advisors (AI2 wouldn’t say who, exactly) that’ll provide feedback throughout the model creation process.

We’ll see to what extent that makes a difference. For now, a lot’s up in the air — including most of the model’s technical specs. (AI2 did reveal that it’ll have around 70 billion parameters, parameters being the parts of the model learned from historical training data.) Training’s set to begin on LUMI’s supercomputer in Finland — the fastest supercomputer in Europe, as of January — in the coming months.

AI2 is inviting collaborators to help contribute to — and critique — the model development process. Those interested can contact the OLMo project organizers here.

AI2 is developing a large language model optimized for science by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/05/11/ai2-is-developing-a-large-language-model-optimized-for-science/

Australian software giant won’t say if customers affected by hack

Australian enterprise software company TechnologyOne has halted trading after confirming it was hit by a cyberattack.

In a stock exchange filing on Wednesday, the Brisbane-based software maker said it had detected that “an unauthorized third-party acted illegally to access its internal Microsoft 365 back-office system.”

TechnologyOne said the company’s customer-facing platform is not connected to the affected Microsoft 365 system and “therefore has not been impacted,” but when reached, the company would not say if any customer or employee data had been accessed as a result of the wider incident.

Brendan Altadonna, who represents TechnologyOne on behalf of a third-party public relations agency, declined to answer TechCrunch’s other questions. Altadonna said that the company will only be able to provide further details once its investigation has progressed.

The nature of the incident remains unknown.

Brett Callow, threat analyst at Emsisoft, told TechCrunch that while details about the incident are vague, TechnologyOne may have fallen victim to ransomware. “Statistically speaking, the most likely explanations are either a ransomware attack or the systems being proactively taken offline to prevent a ransomware attack after the detection of an intrusion,” Callow said.

The cyberattack has not yet been claimed by any of the major ransomware groups. It’s not uncommon for ransomware actors to publish stolen information as part of efforts to extort victims.

TechnologyOne claims to be Australia’s largest software company, and says its “deeply integrated” technology is used by more than 1,300 organizations, including government agencies, local councils and universities. The company’s flagship cloud-based enterprise resource planning (ERP) product helps its corporate customers manage their business operations.

TechnologyOne is the latest Australian technology company to confirm a breach in recent months, following a spate of high-profile cyberattacks that compromised millions of citizens’ personal information.

In September, Australia telecoms giant Optus said that current and former customer data — including driver’s license and passport numbers — was accessed following a cyberattack on its systems. By November, Australian health insurance giant Medibank confirmed hackers stole 9.7 million customers’ personal details and health claims data for almost 500,000 people.

Australian software giant won’t say if customers affected by hack by Carly Page originally published on TechCrunch

https://techcrunch.com/2023/05/11/australia-technologyone-cyberattack/

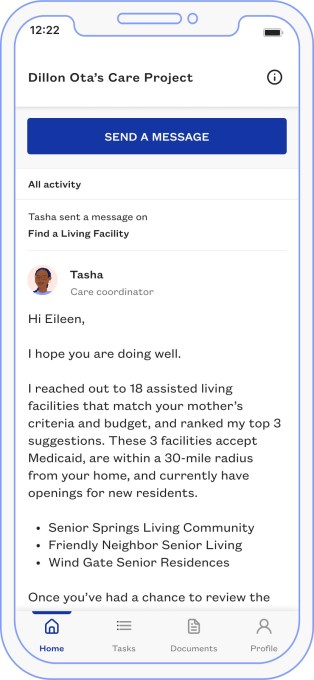

Wellthy lands $25M to help caregivers feel less overwhelmed

Jurist-Rosner founded Wellthy in 2015 (the startup actually launched as a Battlefield contestant at TechCrunch Disrupt that year) to help others like herself who were juggling work and caregiving. At first, the company offered its services direct to consumer but by 2017, it had started working with employers so businesses could cover the cost of Wellthy as an employee benefit. Companies like Salesforce and Snap signed up immediately.

Wellthy works by hiring “skilled” individuals, many of whom are social workers, and matches them up with families to help them with things like making follow-up doctor appointments, providing transportation to those appointments and acquiring needed equipment and supplies.

“The goal is to make their lives better and easier, but also to help save money,” Jurist-Rosner said. “Care is so massively expensive and opaque — and access is an issue.”

Employers have an interest in helping their employees with caregiving, considering one of the reasons people leave the workforce is because of struggling with caring for loved ones.

“It’s not an uncommon issue and yet it’s so under-discussed,” Jurist-Rosner said. “It feels like mental health and women’s health have started to get some well-deserved attention but caregiving is still really under the radar.”

Wellthy saw its business “explode” in 2020 after the COVID-19 pandemic hit as care became even more challenging “and employers were figuring out how they could best support employees,” said Jurist-Rosner. From 2019 to 2022 the number of lives covered with Wellthy benefits grew from about 100,000 to 2 million. And while the company declined to reveal hard revenue figures, Jurist-Rosner says it saw 17x growth in revenue from 2019 to 2022.

Today, Wellthy works with health plans and hundreds of companies, including 30 of the Fortune 500 employers, six of the top 10, and businesses such as Best Buy, Cisco and Hilton. To support its continued growth, Wellthy just raised $25.5 million in funding. In an effort to expand its offerings, the startup has acquired Lantern, a public benefit corporation founded in 2018 that provides guidance for individuals and families on navigating life before and after a death.

Wellthy still does have a private pay business but doesn’t promote it. It mainly exists so that if an employee leaves a company that paid for access to Wellthy’s services, they can still get help.

In total since inception, Wellthy has raised just over $77 million. Its latest financing was an up round, but Jurist-Rosner said that was not something the company was focused on.

Founder and CEO Lindsay Jurist-Rosner with her parents. Image Credits: Wellthy

“This was an opportunistic raise for us,” she said. “We have a lot to do on the tech side to support our growth, and we’re launching with some health insurance companies. So, there’s just a lot of momentum that we wanted to be able to continue to support with some real investment.”

Previous backers Hearst and Eldridge co-led the financing (both are also Wellthy clients), which included participation from new backers Citi Impact Fund, Cercano Management (Paul Allen’s family fund) and Stardust Equity, and existing backers such as ReThink Impact.

Presently, New York City-based Wellthy has about 350 employers, 90% of which are full-time.

Todd Boehly, chairman and CEO of Eldridge, believes Wellthy has helped to both define and drive innovation in the caregiving market.

Ryan Alam, senior vice president of the Citi Impact Fund, notes that one in five adults in America is a caregiver.

“That’s a big number that will only grow over the next few decades,” he added. “Anyone who has been a caregiver for a loved one will likely tell you it’s one of the toughest jobs they’ve ever had. In fact, people are dropping out of the workforce at alarming rates because they struggle with the challenges of caregiving at home. Wellthy is the market leader in solving that and it’s a privilege to support their mission.”

It’s called the sandwich generation for a reason.

Millions of people in the U.S. are taking care of parents as they age or deal with illnesses. The constant demands of caregiving, often while working and raising children at the same time, can take a huge toll.

It’s not uncommon for caregivers to feel overwhelmed as they navigate the administrative and logistical complexities of caring for a parent. Wellthy is a startup aimed at helping caregivers be more equipped to deal with all aspects of their various responsibilities by serving as a self-described “tech-enabled care concierge.” Its founder, Lindsay Jurist-Rosner, knows firsthand how challenging caregiving can be. She spent 28 years as the primary caregiver for her mother, who had multiple sclerosis. During that time, she also held a full-time job as a marketing manager at Microsoft.

Image Credits: Wellthy

Jurist-Rosner founded Wellthy in 2015 (the startup actually launched as a Battlefield contestant at TechCrunch Disrupt that year) to help others like herself who were juggling work and caregiving. At first, the company offered its services direct to consumer but by 2017, it had started working with employers so businesses could cover the cost of Wellthy as an employee benefit. Companies like Salesforce and Snap signed up immediately.

Wellthy works by hiring “skilled” individuals, many of whom are social workers, and matches them up with families to help them with things like making follow-up doctor appointments, providing transportation to those appointments and acquiring needed equipment and supplies.

“The goal is to make their lives better and easier, but also to help save money,” Jurist-Rosner said. “Care is so massively expensive and opaque — and access is an issue.”

Employers have an interest in helping their employees with caregiving, considering one of the reasons people leave the workforce is because of struggling with caring for loved ones.

“It’s not an uncommon issue and yet it’s so under-discussed,” Jurist-Rosner said. “It feels like mental health and women’s health have started to get some well-deserved attention but caregiving is still really under the radar.”

Wellthy saw its business “explode” in 2020 after the COVID-19 pandemic hit as care became even more challenging “and employers were figuring out how they could best support employees,” said Jurist-Rosner. From 2019 to 2022 the number of lives covered with Wellthy benefits grew from about 100,000 to 2 million. And while the company declined to reveal hard revenue figures, Jurist-Rosner says it saw 17x growth in revenue from 2019 to 2022.

Today, Wellthy works with health plans and hundreds of companies, including 30 of the Fortune 500 employers, six of the top 10, and businesses such as Best Buy, Cisco and Hilton. To support its continued growth, Wellthy just raised $25.5 million in funding. In an effort to expand its offerings, the startup has acquired Lantern, a public benefit corporation founded in 2018 that provides guidance for individuals and families on navigating life before and after a death.

Wellthy still does have a private pay business but doesn’t promote it. It mainly exists so that if an employee leaves a company that paid for access to Wellthy’s services, they can still get help.

In total since inception, Wellthy has raised just over $77 million. Its latest financing was an up round, but Jurist-Rosner said that was not something the company was focused on.

Founder and CEO Lindsay Jurist-Rosner with her parents. Image Credits: Wellthy

“This was an opportunistic raise for us,” she said. “We have a lot to do on the tech side to support our growth, and we’re launching with some health insurance companies. So, there’s just a lot of momentum that we wanted to be able to continue to support with some real investment.”

Previous backers Hearst and Eldridge co-led the financing (both are also Wellthy clients), which included participation from new backers Citi Impact Fund, Cercano Management (Paul Allen’s family fund) and Stardust Equity, and existing backers such as ReThink Impact.

Presently, New York City-based Wellthy has about 350 employers, 90% of which are full-time.

Todd Boehly, chairman and CEO of Eldridge, believes Wellthy has helped to both define and drive innovation in the caregiving market.

Ryan Alam, senior vice president of the Citi Impact Fund, notes that one in five adults in America is a caregiver.

“That’s a big number that will only grow over the next few decades,” he added. “Anyone who has been a caregiver for a loved one will likely tell you it’s one of the toughest jobs they’ve ever had. In fact, people are dropping out of the workforce at alarming rates because they struggle with the challenges of caregiving at home. Wellthy is the market leader in solving that and it’s a privilege to support their mission.”

Wellthy lands $25M to help caregivers feel less overwhelmed by Mary Ann Azevedo originally published on TechCrunch

Higher interest rates are fostering a fintech comeback story

While rapidly rising interest rates in the United States have caused more than a few financial institutions to topple, a group of well-known fintech companies are posting signs of a comeback.

Both Coinbase and Robinhood reported better-than-anticipated revenue in the first quarter. This is welcome news for the backers and employees of both companies, which saw their shares skyrocket during COVID and tank after those pandemic tailwinds tapered away.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

No comeback story is built on a single factor, though; there’s always more at play. But the changing revenue mix at both Coinbase and Robinhood makes it clear that their ability to generate material amounts of revenue off cash balances (and the crypto equivalent) is changing the game in their favor.

Studying public company performance is a great way to better understand what’s happening in that segment of the market, so that’s what we’re doing today with Coinbase and Robinhood. As always, we’ll relate what we’ve learned back to startups. Consider today’s column a rejoinder to the persistent doom and gloom around fintech these days.

The power of costlier cash

As you know, when interest rates rise, money is more expensive to borrow, and vice versa. For banks and credit unions, then, interest-rate hikes are more than welcome. For perspective, consider that net interest income at Wells Fargo in the first quarter amounted to $13.3 billion, up 45% from a year earlier. That’s a lot of money the bank can spend, save or invest.

The situation is a little different for fintech startups that went public in recent years. They make money off cash, but are less focused on loans, meaning that they have a chance to make lots of net interest income.

Let’s observe how that plays out for Robinhood. In the first quarter, Robinhood’s transaction-based revenue — the revenue stream it rode to the public markets — came to $207 million, while net interest revenue came in slightly higher at $208 million.

Higher interest rates are fostering a fintech comeback story by Alex Wilhelm originally published on TechCrunch

https://techcrunch.com/2023/05/11/fintech-interest-rate-benefits/