Kremlin responds after Germans announce tanks for Ukraine

Germany has confirmed that it will send Leopard 2 tanks to Ukraine following weeks of diplomatic pressure. Chancellor Olaf Scholz announced the move in a cabinet meeting, according to federal government spokesman Steffen Hebestreit. CNN’s Fred Pleitgen has more on Russia’s response.

US Stocks Face 25% More Downside In Deep Recession

US Stocks Face 25% More Downside In Deep Recession

Authored by Simon White, Bloomberg macro strategist,

US stocks are vulnerable to a further decline of as much as 25% from a deeper-than-anticipated US recession.

Ebullient markets are marking down the odds of a recession.

“Immaculate disinflation” is the current zeitgeist, where inflation continues to slow and the US experiences only a mild recession, or avoids one altogether.

But markets are not economies. While there are feedback loops between the two, just because the market is gunning for a softer outcome will not necessarily make it so.

The data show:

-

A recession this year is highly likely.

-

It would be deeper than anticipated.

-

Stocks still face quite significant downside, but to be limited by a potentially steep Fed-cutting cycle.

Recession prediction is not easy. Many indicators are useful for gauging recession risk, but they can be inconsistent and give false signals. However, combining indicators together and noting when many of them expect a recession at the same time gives a much stronger signal. Today multiple indicators are flashing recession (the latest being Monday’s release of the Conference Board’s Leading Index), giving a high degree of confidence the US will enter one this year.

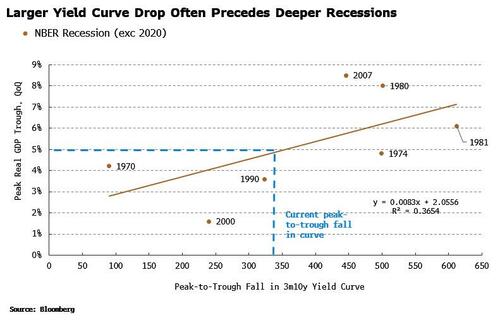

It is likely to be a worse recession than currently expected. The steep inversion of the yield curve has been used to posit the recession will be severe. However, there is not a particularly strong relationship between the yield curve and recession depth. What does have a more significant relationship is the peak-to-trough decline in the 3m-10y yield curve. The current fall in the curve would put the maximum trough in real GDP at 5%, which is the average drop for recessions over the last 50 years.

This is still larger than economists’ expectations, which currently foresee about a 1.5% trough in GDP.

Indeed, economists typically overestimate GDP in recessions. The larger blue bars to the left-hand side of the chart below show that economists more frequently believe GDP will be higher than it turns out to be in recessions, versus when there is no recession.

The data also show the economists’ overestimates are larger in downturns.

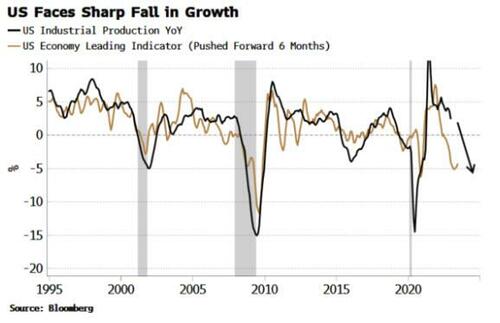

A fairly deep recession can also be inferred by cyclical leading indicators.

The chart below shows my leading indicator for the US, based on leading inputs such as ISM data, housing data, and credit spreads. It aims to give a 6-month lead on US growth, and shows a steep fall in the coming months.

Stocks are currently pricing only about a 60% chance of a recession, and this continues to moderate as stocks rally.

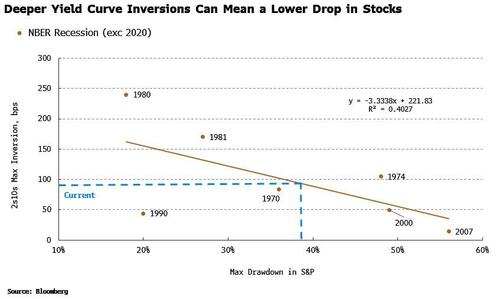

However, equities face quite significant further downside if we get a recession. There is a good relationship between the peak size of the yield-curve’s inversion (2s10s) prior to a recession and the maximum drawdown in the S&P. The current peak inversion of the curve infers a maximum drawdown for the S&P of ~38%, which is up to another ~25% fall from today’s price (i.e. as low as 3000).

That’s not pretty, but as the chart above shows, the depth of the yield curve’s inversion has typically meant a less severe equity drawdown. Greater yield-curve inversions have historically led to more Fed cuts, mitigating the fall in stocks. Today’s deepish curve inversion therefore indicates equities should be “cushioned” from even greater declines.

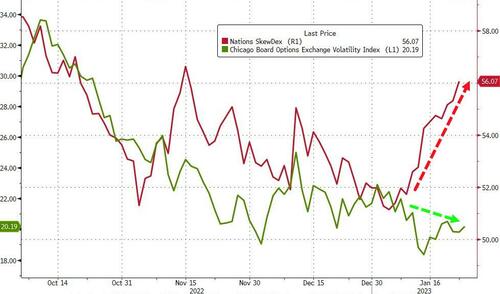

S&P put skew has been rising, but still remains historically very low, meaning downside protection through put spreads, perhaps financed with selling calls or call spreads, continue to look attractive recession hedges.

[ZH: Although we note that skew has started to rise recently…]

As with any data analysis, caveats should be noted around sample size (especially when dealing with recessions), and the in-sample/out-of-sample historical record. Nonetheless, it is still preferable to making inferences based on the current state of play without regard to the past – history should be used as an anchor for today’s forecasts about the future.

And history shows that immaculate disinflation, like its biblical parallel, is highly unlikely.

Tyler Durden

Wed, 01/25/2023 – 07:20

https://www.zerohedge.com/markets/us-stocks-face-25-more-downside-deep-recession

The seven teams with a real chance to win the NBA title

Here is our late-January snapshot of NBA teams that look as if they can win the title as presently constructed.

https://nypost.com/2023/01/25/the-seven-teams-with-a-real-chance-to-win-the-nba-title/

Russia slams ‘blatant provocation’ as Germany promises to send tanks to Ukraine

Russia rips “blatant provocation” as Germany confirms it is sending battle tanks to help Ukraine in the war.

https://nypost.com/2023/01/25/russia-sending-tanks-to-ukraine-is-blatant-provocation/

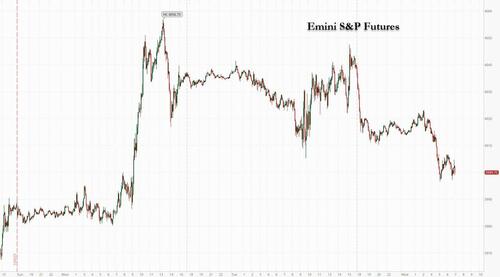

Futures Slide On Ugly Microsoft Outlook, Renewed War Escalation Fears

Futures Slide On Ugly Microsoft Outlook, Renewed War Escalation Fears

US equity futures slumped on Wednesday after Microsoft started off the tech giants’ earnings parade by pulling off the old pump and dump, first jumping on Azure/Cloud results which beat estimates, but then erasing all gains and slumping during the company’s conference call after the company’s guidance disappointed, forecasting slower earnings and weaker demand (separately, hours later customers reported difficulties across multiple regions in accessing Microsoft 365 services, which the company attributed to networking issues). Earnings reports from companies such 3M, Boeing and chipmaker Texas Instruments also reinforced concerns about the health of corporate America and added to investors’ jitters as they await updates from the likes of Tesla and IBM. Fears also grew that a decision to send German and US tanks to Ukraine would provoke an escalation in the war.

As a result, contracts on the tech-heavy Nasdaq fell 1.3% at 7:15 a.m. ET while S&P 500 futures dropped 0.8%, and traded right around 4,000. The Bloomberg Dollar Spot Index was little changed, leading to mixed trading in Group-of-10 currencies. Treasuries edged higher, mirroring gains in most UK and German government bonds. Brent crude was little changed, while gold and Bitcoin fell.

In premarket trading, all eyes were on Microsoft which fell after saying revenue growth in its Azure cloud-computing business will decelerate in the current period and warned of a further slowdown in corporate software sales. Amazon and Alphabet also fell in sympathy, dragging other cloud stocks lower (Amazon.com -1.6% and Alphabet -1.1%; Snowflake -3.1%, Datadog -4.0%, Adobe -1.4). Texas Instruments suffered its first sales decline since 2020 and gave a tepid forecast for the current quarter. Microsoft comprises about 12% of the Nasdaq 100, while Texas Instruments has a weighting of 1.4%. Here are other notable premarket movers:

- Enphase Energy (ENPH US) declines 4% after it was cut to neutral from overweight at Piper Sandler as demand for residential solar loans dipped more than the broker expected.

- Precigen (PGEN US) drops 16% after an offering of shares priced at $1.75 apiece, representing a 20% discount to the last close. Proceeds to be used to fund the development of product candidates and for other general corporate purposes.

- Block (SQ US) declines 4% as Oppenheimer cuts the stock to market perform from outperform, saying the firm looks less defensively-positioned than other payments names.

- Intuitive Surgical’s (ISRG US) falls 8.9% as the medical tech firm’s quarterly results are overshadowed by the company saying it won’t launch a new multiport robotic system in FY23, which analysts say removes a positive catalyst for the stock.

- Capital One’s (COF US) slumps 3.3% following the release of results. Its earnings slightly missed expectations and analysts flag a quicker-than-expected acceleration in net charge-offs for the company.

- Keep an eye on Stryker (SYK US) as it was initiated by KeyBanc at sector weight, which says the US med-tech firm’s valuation “reflects an above-average growth rate with some risk of mean reversion over time.”

A weak earnings outlook, fears of US recession as well as the potential escalation in the Ukraine-Russia war were all contributing to the market pullback, according to Kenneth Broux, a strategist at Societe Generale. “The market is definitely worried about slowing earnings growth especially on tech, so there has been a sense the market wants to keep selling tech and the dollar,” Broux said. “But a huge tail risk now is what happens in Ukraine, if there is an escalation in the conflict and Europe gets drawn into the conflict.”

While today’s drop will hurt, the Nasdaq 100 Index has surged 8.3% this year, on track for the best January since 2019. Expectations that the Federal Reserve will soon pivot away from its hawkish policy have aided the rally, though strategists are increasingly preferring non-US equities this year as they hunt for cheaper valuations and grow concerned about a US recession. Investors are now parsing earnings statements for the impact of the economic slowdown on results.

“The main focus is clearly on US big tech,” said Fabio Caldato, a partner at Olympia Wealth Management. “How can those bulls in a China shop reassure the financial community? Just showing growth. We remain very cautious on this aspect and prefer to underweight the whole sector.”

Next, all eyes will be on Tesla when the electric-car maker reports results after the market closes on Wednesday. Investors will focus on demand, profitability and 2023’s expected pace of deliveries. They are also keen to learn whether Chief Executive Officer Elon Musk will name a new CEO of Twitter.

In Europe, the Stoxx 600 was down 0.6% and on course for its first back-to-back declines of the year. Shares in major European software firms such as SAP SE and Sage Group Plc. feeling the heat from Microsoft and Dutch chip-tool maker ASML Holding NV falling after posting a profit miss. Here are the most notable European movers:

- EasyJet shares rise as much as 12% after the budget carrier reported 1Q revenue that was 8% ahead of consensus and projected strong trends will continue into the second quarter

- Aviva shares gain as much as 3.5%, the most since October, with JPMorgan saying the general insurance underwriting update from the group will provide some reassurance

- Caverion shares rise as much as 4.1% after the Bain-led consortium increased its offer for the Finnish building-maintenance-services firm following a rival bid from private equity firm Triton

- Hill & Smith rises as much as 2.2% after delivering an unscheduled trading update guiding to operating profit above expectations, which Jefferies describes as “pleasing to read”

- ASML shares fall as much as 2.3%, trimming a recent rally, after the Dutch chip-tool giant’s profitability target missed higher Street expectations despite its bullish sales growth forecast for 2023

- Netcompany shares plunge as much as 23%, the most on record, after the Danish IT consultant’s Ebitda margin guidance for 2023 missed expectations

- Aroundtown shares dropped as much as 7.4% after Societe Generale cut its recommendation to sell from buy as part of a more cautious view on REITs

- Gjensidige shares fall as much as 9.9% with analysts saying the Norwegian insurer’s results were weak across the board and that the lack of a special dividend will disappoint

Earlier in the session, Asian stocks headed for a fourth straight daily gain as tech stocks rose amid lighter trading volumes and holidays in China and Hong Kong. The MSCI Asia Pacific Index advanced as much as 0.4% to its highest since early June. Samsung Electronics and SK Hynix were among the biggest contributors to the gauge’s advance as Korea traders returned from the Lunar New Year holidays. “With the global growth outlook narrative shifting more toward a soft landing rather than recession, we are seeing the tech sector come back in favor for now,” said Charu Chanana, strategist at Saxo Capital Markets. “But caution is warranted as inflation risks are back on the horizon with China’s reopening.”

Tech investors also assessed Microsoft’s second-quarter earnings release, which showed profit beat estimates although the company gave a downbeat revenue forecast. Traders are now turning their attention to Tesla’s result announcement later Wednesday. Singapore stocks led gains in Asia Pacific alongside their South Korean peers.

Japanese stocks rose as investors continued to assess the overall economy and shifted their focus to upcoming earnings. The Topix rose 0.4% to 1,980.69 at the close in Tokyo, while the Nikkei advanced 0.4% to 27,395.01. The yen weakened 0.2% to 130.44 per dollar. Keyence contributed the most to the Topix’s gain, increasing 1.7%. Out of 2,161 stocks in the index, 1,342 rose and 699 fell, while 120 were unchanged. “Global economic recession risk has declined sharply as China and Europe demand is expected to improve this year,” said Daniel Yoo, head of global asset allocation at Yuanta Securities Korea. “Overall tech demand including capex investments of global corporations isn’t slowing down much.”

Stocks in India fell ahead of the expiry of monthly derivative contracts on Wednesday. Adani Group shares were among major decliners after activist investor Hindenburg Research shorted the group. The S&P BSE Sensex slid 0.9% to 60,404.47, as of 11:09 a.m. in Mumbai, while the NSE Nifty 50 Index declined 1%. All but one of BSE Ltd.’s 20 sector sub-indexes declined, led by a gauge of service industry stocks. HDFC Bank contributed the most to the Sensex’s decline, decreasing 1.8%. All but three of 30 shares in the Sensex dropped. All stocks controlled by Adani Group fell after Hindenburg Research accused firms owned by Asia’s richest man of “brazen” market manipulation and accounting fraud. Representatives for the Adani Group didn’t immediately respond to calls and emails seeking comment, saying the company would issue a statement in response later.

Meanwhile, Australian stocks dropped after data showed that domestic inflation accelerated to the fastest pace in 32 years in the final three months of 2022. Trading volumes have been light in Asia this week as markets in China, Hong Kong, Taiwan and Vietnam remain closed for the new-year break. A blackout period on communications ahead of the Federal Open Market Committee’s policy meeting next week has supported risk appetite, with the MSCI Asia gauge up about 25% from an October low

In FX, the Bloomberg Dollar Index was little changed even as the greenback advanced against most of its Group-of-10 peers, with notable outperformance in the Aussie dollar after CPI surprised to the upside. Kiwi dollar is the weakest among the G-10’s.

- The pound fell for a third day and gilts rose, led by the belly, after data showed UK factories’ fuel and raw material costs rose at the slowest pace in almost a year. Input prices rose 16.5% in December from a year ago, down from a peak of 24.6% in June. Money markets went to fully price in a 25-basis point rate cut by the Bank of England before the end of the year

- The euro fell a first day in six against the US dollar, though moves were limited to a narrow range. Bunds advanced, outperforming Italian notes.

- The Canadian dollar was little changed while overnight volatility in dollar- loonie rose to its highest level since Jan. 12 as traders position for the Bank of Canada policy decision. The implied breakeven of around 84 pips may be understating the possibility of outsized swings in the pair.

- Australian dollar rose against all of its G-10 peers, to trade at the highest level since August versus the greenback, and the nation’s bonds tumbled after 4Q inflation accelerated to the fastest pace in 32 years in the final three months of 2022. The outcome of 7.8% from a year earlier exceeded forecasts of 7.6% and prompted money markets to price in an interest-rate hike at next month’s central bank meeting.

- Kiwi dollar was the worst G-10 performer as New Zealand inflation held near three-decade high at 7.2% but undershoot RBNZ’s forecast.

In rates, the risk-averse tone benefited bonds, with UK and German 10-year yields falling by 8bps and 6bps respectively. Treasuries also rose as the Treasury curve bull-flattened modestly and as futures extending through Tuesday’s highs, following wider gains across gilts after soft UK factory price inflation data. Treasury yields richer by around 2bp from belly out to long-end with 10-year at 3.42%, lagging gilts by almost 4bp in the sector after sharp rally across UK bonds. The US auction cycle resumes at 1pm with $43b 5-year sale, before Thursday’s $35b 7-year notes; strong 2- year auction Tuesday traded through the WI by 1.3bp.

In commodities, oil prices are little changed with WTI hovering around $80.10. Spot gold falls roughly 0.6% to trade near $1,926/oz

Bitcoin is back below the USD 23k mark, though remains just above the WTD trough set on Monday at USD 22.3k.

On today’s calendar, we get data on US mortgage application (up 7.0%, vs up 27.9% last week). The EIA will release figures on oil inventories at 10:30 a.m. The US will sell $24 billion of two-year floating-rate notes and $36 billion of 17-week bills at 11:30 a.m., followed by $43 billion of five-year notes at 1 p.m. From central banks, the main highlight will be the Bank of Canada’s latest policy decision. Finally, earnings releases include Tesla, Boeing, IBM, AT&T and Abbott Laboratories.

Market Snapshot

- S&P 500 futures down 0.5% to 4,011.25

- MXAP up 0.3% to 169.09

- MXAPJ up 0.2% to 553.07

- Nikkei up 0.4% to 27,395.01

- Topix up 0.4% to 1,980.69

- Hang Seng Index up 1.8% to 22,044.65

- Shanghai Composite up 0.8% to 3,264.81

- Sensex down 1.3% to 60,174.06

- Australia S&P/ASX 200 down 0.3% to 7,468.30

- Kospi up 1.4% to 2,428.57

- STOXX Europe 600 down 0.3% to 451.94

- German 10Y yield little changed at 2.11%

- Euro little changed at $1.0884

- Brent Futures up 0.5% to $86.56/bbl

- Gold spot down 0.3% to $1,930.94

- U.S. Dollar Index little changed at 101.93

Top Overnight News from Bloomberg

- A gauge of German business expectations by the Ifo institute rose to 86.4 in January from 83.2 the previous month. That’s the fourth consecutive improvement and a bigger increase than economists had anticipated. A measure of current conditions slipped, however

- European natural gas headed for a third day of declines as ample supplies and reserves, along with the return of milder weather, help to ease the region’s energy crisis

- With the Federal Reserve’s Feb. 1 interest-rate decision a week away, traders in the options market are contemplating a scenario in which the rate hike it’s expected to deliver ends up being the last one of the tightening cycle

- Japan’s broken bond market continued to throw up anomalies with central bank ownership of some government debt exceeding the amount outstanding, according to its latest data

- Japan’s government cut its monthly view of the economy for the first time since February 2022, reflecting gathering concerns over the outlook for the global economy

A More detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed after the indecisive performance stateside owing to the varied data releases and geopolitical tensions, while the region also digested firmer-than-expected inflation data from Australia and New Zealand. ASX 200 failed to sustain an initial foray above 7,500 with the index subdued by hot CPI data which printed its highest since 1990 and boosted the market pricing for the RBA to continue with its hiking cycle next month. Nikkei 225 gradually edged higher with trade uneventful in the absence of any pertinent drivers although Dai Nippon Printing outperformed after Elliot Management built a stake in the Co. of slightly under 5%. KOSPI was among the biggest gainers on return from the Lunar New Year holiday with the index also driven by strength in top-weighted stock Samsung Electronics.

Top Asian News

- US Secretary of State Blinken is likely to warn China against aiding Russia when visiting Beijing, according to SCMP.

- Australian PM Albanese said there is increased engagement at different levels between Australian and Chinese agencies, according to Reuters.

- North Korea ordered a 5-day lockdown of its capital Pyongyang due to increasing cases of an unspecified respiratory illness, according to South Korean-based NK News.

- Japan lowers its overall economic view in January; first time in 11 months.

- Japanese Gov’t official, citing BoJ’s Kuroda, says the BoJ will resolutely keep monetary environment easy; BoJ aims to regain market functionality by tweaking YCC operations and maintaining an easy monetary environment.

European bourses are pressured across the board, Euro Stoxx 50 -0.6%, after a sluggish post-MSFT start to the session and thereafter a further waning in the general risk tone. Within Europe, a strong update from ASML has been overshadowed by the MSFT pressure, while the likes of Ryanair and IAG are buoyed by easyJet. Stateside, futures are all in the red with the NQ -1.2% lagging and the ES Mar’23 below 4k and its 200-DMA at 3999, to a 3996.5 session trough. NYSE said it is thoroughly examining the glitch and that the exchange ended Tuesday with a normal close, while a regular open is expected on Wednesday, according to Reuters.

Top European News

- German Economy Minister sees 2023 German GDP at 0.2% (vs -0.4% in Autumn forecast); 2023 inflation seen at 6% (vs prev. 7%); “we do not see signs of marked recession as feared by many observers”. In-fitting with earlier reports via the likes of Bloomberg and Reuters in recent sessions.

- French Regulator Set to Provisionally Close Government EDF Offer

- Traders Reverse Course to Bet BOE Will Cut Rates Before Year-End

- UK’s Growth Potential Falls, Reducing Hunt’s Room for Tax Cuts

- Renault Gets Two Upgrades, Shares Rise as Nissan Deal Nears

- Ukraine Latest: Allies to Send Tanks; Kishida Pressed to Visit

- UK Parliament Seeks Power to Scrutinize Finance Regulators

Notable US Headlines

- US House Speaker McCarthy said they need to have a responsible debt ceiling and called for eliminating wasteful spending, while he added debt is the greatest threat to the nation and that President Biden needs to stop playing politics on the debt ceiling.

- US President Biden is close to naming the next National Economic Council head, Fed Vice Chair Brainard has emerged as the top contender, according to Washington Post sources; current NEC Director Deese is expected to leave soon, no decision made yet.

- US Senator Manchin is to reportedly introduce a bill to delay EV tax credit due to disagreements over how to implement the programme, according to WSJ.

FX

- The DXY has spent the morning in close proximity to the 102.00 mark and has most recently extended to fresh session highs of 102.12 amid a general decline in the risk tone.

- AUD is the standout outperformer after much hotter-than-expected CPI while the NZD was only able to derive fleeting support from its own inflation data, at best AUD/USD and NZD/USD above 0.71 and 0.65 respectively.

- JPY has settled down somewhat after Tuesday’s pronounced action and was relatively resilient to Japan downgrading its economic assessment for the first time in almost a year.

- The aforementioned decline in sentiment that bolstered the USD did so at the expense of Cable and EUR/USD which moved below and further below 1.23 and 1.09 respectively.

Fixed Income

- Core EGBs have continued to extend with the Bund comfortably above 139.00, though the upside seemingly stalled after a brief breach of Fib resistance.

- An easing/pullback that was perhaps spurred by mixed German auction results; though, benchmarks remain elevated overall with Gilts once again outperforming and closer to 106.00 vs 105.08 low (current high 105.79).

- Stateside, USTs are firmer though lagging their EZ peers a touch ahead of a USD 43bln 5yr outing.

Commodities

- WTI and Brent front-month futures trade with no firm direction in early European hours, similar to yesterday’s price action, as market participants await the next catalyst for the complex.

- US Energy Inventory Data (bbls): Crude +3.4mln (exp. +1.0mln), Cushing +3.9mln, Gasoline +0.6mln (exp. +1.8mln), Distillate -1.9mln (exp. -1.1mln)

- US Treasury issued a license allowing Trinidad and Tobago to develop Venezuela’s Dragon offshore gas field.

- Spot gold and base metals have been impacted by the general risk tone with the yellow metal unable to glean any haven support as the USD remains firm.

Geopolitics

- Ukrainian President Zelensky said Russia is readying for new aggression and that Ukraine will prevent further Russian actions, while he added Russia is intensifying its offensive towards Ukraine’s Bakhmut.

- Russian Ambassador to the US said Washington’s possible deliveries of tanks to Ukraine would be a blatant provocation and it is clear Washington is trying to inflict a strategic defeat on us, according to Reuters.

- EU ambassadors have now formally given green light to roll over all the EU’s economic sanctions on Russia for an additional six months, via Radio Free Europe’s Jozwiak.

- German government is to send Leopard 2 tanks to Ukraine, Germany is to approve re-export of Leopard 2 tanks.

US Event Calendar

- 7am: U.S. MBA Mortgage Applications, 7.0%, prior 27.9%

DB’s Jim Reid concludes the overnight wrap

There’s been a little bit of a bias towards risk-off sentiment over the last 24 hours, thanks partly to some weaker-than-expected earnings releases that added to growing concerns about a potential US recession. The S&P 500 (-0.07%) came off its 7-week high from the previous day, oil prices took a sharp turn lower, and sovereign bonds rallied on both sides of the Atlantic. After the close, Microsoft did report better-than-expected earnings due to strength from their cloud-services business (Azure) even as their consumer businesses faltered. Their shares initially traded 4.5% higher before reverting late last night and are now down -1% in after-market trading after news came out during the earnings call that Azure sales could slow in Q1. S&P and NASDAQ futures are -0.46% and -0.78% down respectively as I type.

Those small equity losses in the normal trading session came as the flash PMIs for the US showed the economy still in contractionary territory at the start of the year. To be fair, the numbers were a bit better than expected, but even with the upside surprise the composite PMI was only at 46.6 (vs. 46.4 expected), which is its 7th consecutive month beneath the expansionary 50-mark. Looking at the details, the US PMIs also showed that input price rises had increased in January after 7 months of moderating, so that adds to some other indicators so far this quarter suggesting price pressures might be a bit more resilient than thought. The more negative tone from the data was then cemented by the Richmond Fed’s manufacturing index, which came in at a post-Covid low of -11 (vs. -5 expected).

Although the US numbers continued to point towards contraction, there was some better news from the Euro Area as the flash composite PMI came in at 50.2 (vs. 49.8 expected). That’s the first time it’s been above 50 since June, and came amidst upside surprises in both the services (50.7 vs. 50.1 expected) and manufacturing PMIs (48.8 vs. 48.5 expected) as well. The readings offer yet more evidence that the European economy has been faring better over recent months, echoing the rise in consumer confidence we saw the previous day.

With all this positive news out of Europe lately, our economists updated their forecasts yesterday (link here) and are no longer expecting a recession in 2023 as flagged in our German upgrade two weeks ago. That comes amidst falling gas prices, lower inflation, and declining uncertainty, which means our economists now expect the Euro Area to grow by +0.5% in 2023. They’ve also lowered their headline inflation outlook for 2023 to 5.8%, and now see 2024 at just 1.8%. Nevertheless, they don’t think the ECB can take their foot off the hawkish pedal just yet, since an improved growth outlook and stronger domestic demand raises the threat of more persistent underlying inflation.

Speaking of the ECB, yesterday saw a fresh round of commentary as the Governing Council debate how long to keep hiking rates by 50bps. On the one hand, Lithuania’s Simkus said that “there’s a strong case for staying on the course that’s been set for the coming meetings of 50 basis-point increases.” However the Executive Board’s Pannetta, one of the biggest doves on the council, said that beyond the next meeting in February “any unconditional guidance … would depart from our data-driven approach”. For now, investors are continuing to price in two 50bp moves as the most likely outcome, with +92.1bps worth of hikes priced over the next couple of meetings.

As this debate was ongoing, sovereign bonds rallied strongly on both sides of the Atlantic, with yields on 10yr Treasuries down -5.7bps to 3.45%. That was led by a sharp decline in real yields, which fell -7.6bps on the day. However, near-term policy expectations from the Fed were little changed ahead of their meeting a week from today, and the terminal rate priced for June was down just -0.1bps, whilst the 2yr Treasury yield fell -1.7bps to 4.21%. In Asia 10yr Treasury yields have moved back +1.29bps higher as we go to press. Back to yesterday, and there was a stronger rally in Europe, with yields on 10yr bunds (-5.1bps), OATs (-6.9bps) and BTPs (-11.1bps) all seeing a sharp decline.

As mentioned at the top, it was a bit of a battle for equities, with the major indices struggling to gain much traction after their recent rally. That left both the S&P 500 (-0.07%) and Europe’s STOXX 600 (-0.24%) with modest declines, although that was partly down to a drag from energy stocks after prices took a significant hit yesterday. For instance, Brent crude oil prices (-2.34%) had their worst day in nearly three weeks, falling to $86.13/bbl, whilst natural gas prices in Europe fell -11.71% to €58.27 per megawatt-hour as they closed in on the lows from last week. In the US, one of the worst performing industries for the S&P was Media & Entertainment (-1.02%), whose losses were partially due to the -2.09% pullback by Alphabet as the US Department of Justice did indeed sue the ad-giant under US anti-trust laws. This is the second such suit and a resolution could take years according to legal experts cited by Bloomberg.

Asian equity markets are continuing with their winning streak even with US futures lower. As I type, the KOSPI (+1.27%) is surging as trading has resumed after the Lunar New year holiday while the Nikkei (+0.43%) has rebounded after opening lower in morning trade. Markets in China and Hong Kong remain closed for the holidays. Elsewhere, the S&P/ASX 200 (-0.12%) is in negative territory following disappointing inflation data out from Australia.

Australian inflation rose to +8.4% y/y in December from +7.3% in November while surpassing market expectations for a rise of 7.7%. With inflation pressures broadening, its implication for policy rates pushed 10yr bond yields sharply higher (+5.2 bps) to settle at 3.52%, as we go to print. Meanwhile, the Australian dollar (+0.75%) is trading higher, hitting a 5-month high against the US dollar to trade at $0.7099.

Back to yesterday’s data, and the flash PMI releases were the main data highlight, but we did also get the UK’s public finance statistics for December. That showed public sector net borrowing (ex-banking groups) at £27.4bn (vs. £17.3bn expected), which was driven by more spending on energy support along with higher debt interest. Meanwhile, the latest flash PMIs from the UK weren’t as optimistic as their counterparts in the Euro Area, with the composite PMI falling to 47.8 (vs. 48.8 expected). That’s the lowest reading on that measure in two years, back when the economy went into lockdown again at the start of 2021.

To the day ahead now, and data releases include the Ifo’s business climate indicator for January from Germany. From central banks, the main highlight will be the Bank of Canada’s latest policy decision. Finally, earnings releases include Tesla, Boeing, IBM, AT&T and Abbott Laboratories.

Tyler Durden

Wed, 01/25/2023 – 07:55

https://www.zerohedge.com/markets/futures-slide-ugly-microsoft-outlook-renewed-war-escalation-fears

After inking its OpenAI deal, Shutterstock rolls out a generative AI toolkit to create images based on text prompts

When Shutterstock and OpenAI announced a partnership to help develop OpenAI’s Dall-E 2 artificial intelligence image-generating platform with Shutterstock libraries to train and feed the algorithm, the stock photo and media giant also hinted that it would soon be bringing its own generative AI tools to users. Today the company took the wraps off that product. Customers of Shutterstock’s Creative Flow online design platform will now be able to create images based on text prompts, powered by OpenAI and Dall-E 2.

Key to the feature — which does not appear to have a brand name as such — is that Shutterstock says the images are “ready for licensing” right after they’re made.

This is significant given that one of Shutterstock’s big competitors, Getty Images, is currently embroiled in a lawsuit against Stability AI — maker of another generative AI service called Stable Diffusion — over using its images to train its AI without permission from Getty or rightsholders.

In other words, Shutterstock’s service is not only embracing the ability to use AI, rather than the skills of a human photographer, to build the image you want to discover, but it’s setting the company up in opposition to Getty in terms of how it is embracing the brave new world of artificial intelligence.

Stability AI has been backed with significant funding, but as of yesterday, not as much as OpenAI, which closed a massive, $10 billion round and extended partnership with Microsoft.

In addition to Shutterstock’s work with OpenAI, the company earlier this month also announced an expanded deal with Facebook, Instagram and WhatsApp parent Meta, which will be (similar to OpenAI) using Shutterstock’s photo and other media libraries (it also has video and music) to build its AI datasets and to train its algorithms. You can expect more generative AI tools to be rolling out as a result.

What’s interesting is that while we don’t know the financial terms of those deals with OpenAI, Meta or another partner, LG, there is a clear commercial end point with these services. Shutterstock’s bet seems to be that it’s worth jumping in and getting involved with these new technologies, and try to build a business around them, rather than stand by and let itself get cannibalized by those tools.

The big question will be whether what Shutterstock offers will have a clear enough differentiation, and unique selling point, from others offering generative AI tools for making images. Yes the licensing is currently one aspect that will be compelling, but longer term, if all are built on the same platform, what will set one apart from the other? In image libraries the idea is that one might simply have a better selection, better pricing, better discovery, and overall better experience, for the paying customer (and for the photographer uploading images). Will those parameters remain the same in the AI world or be obliterated?

To be fair, Shutterstock is pitching itself as an “ethical” partner here, with promises of paying out to artists whose images have been used to feed these new services. Again, though, the issue will be whether these payouts be anywhere near the compensation those artists and photographers might have gotten for supplying the images themselves.

“Shutterstock has developed strategic partnerships over the past two years with key industry players like OpenAI, Meta, and LG AI Research to fuel their generative AI research efforts, and we are now able to uniquely bring responsibly-produced generative AI capabilities to our own customers,” said Paul Hennessy, Chief Executive Officer at Shutterstock, in a statement today. “Our easy-to-use generative platform will transform the way people tell their stories — you no longer have to be a design expert or have access to a creative team to create exceptional work. Our tools are built on an ethical approach and on a library of assets that represents the diverse world we live in, and we ensure that the artists whose works contributed to the development of these models are recognized and rewarded.”

After inking its OpenAI deal, Shutterstock rolls out a generative AI toolkit to create images based on text prompts by Ingrid Lunden originally published on TechCrunch

Jeremy Renner was trying to save nephew when he was run over by snowplow

Jeremy Renner was attempting to stop a snowplow from sliding and hitting his nephew when the accident that left him in critical condition occurred, according to a Nevada sheriff’s office incident report.

https://nypost.com/2023/01/25/jeremy-renner-crushed-by-snowplow-when-trying-to-save-nephew-report/

Jeremy Renner was trying to save nephew when he was run over by snowplow

Jeremy Renner was attempting to stop a snowplow from sliding and hitting his nephew when the accident that left him in critical condition occurred, according to a Nevada sheriff’s office incident report.

https://nypost.com/2023/01/25/jeremy-renner-crushed-by-snowplow-when-trying-to-save-nephew-report/

When it comes to large language models, should you build or buy?

Contributor

Last summer could only be described as an “AI summer,” especially with large language models making an explosive entrance. We saw huge neural networks trained on a massive corpora of data that can accomplish exceedingly impressive tasks, none more famous than OpenAI’s GPT-3 and its newer, hyped offspring, ChatGPT.

Companies of all shapes and sizes across industries are rushing to figure out how to incorporate and extract value from this new technology. But OpenAI’s business model has been no less transformative than its contributions to natural language processing. Unlike almost every previous release of a flagship model, this one does not come with open-source pretrained weights — that is, machine learning teams cannot simply download the models and fine-tune them for their own use cases.

Instead, they must either pay to use them as-is, or pay to fine-tune the models and then pay four times the as-is usage rate to employ it. Of course, companies can still choose other peer open-sourced models.

This has given rise to an age-old corporate — but entirely new to ML — question: Would it be better to buy or build this technology?

It’s important to note that there is no one-size-fits-all answer to this question; I’m not trying to provide a catch-all answer. I mean to highlight pros and cons of both routes and offer a framework that might help companies evaluate what works for them while also providing some middle paths that attempt to include components of both worlds.

Buying: Fast, but with clear pitfalls

While building looks attractive in the long run, it requires leadership with a strong appetite for risk, as well as deep coffers to back said appetite.

Let’s start with buying. There are a whole host of model-as-a-service providers that offer custom models as APIs, charging per request. This approach is fast, reliable and requires little to no upfront capital expenditure. Effectively, this approach de-risks machine learning projects, especially for companies entering the domain, and requires limited in-house expertise beyond software engineers.

Projects can be kicked off without requiring experienced machine learning personnel, and the model outcomes can be reasonably predictable, given that the ML component is being purchased with a set of guarantees around the output.

Unfortunately, this approach comes with very clear pitfalls, primary among which is limited product defensibility. If you’re buying a model anyone can purchase and integrate it into your systems, it’s not too far-fetched to assume your competitors can achieve product parity just as quickly and reliably. That will be true unless you can create an upstream moat through non-replicable data-gathering techniques or a downstream moat through integrations.

What’s more, for high-throughput solutions, this approach can prove exceedingly expensive at scale. For context, OpenAI’s DaVinci costs $0.02 per thousand tokens. Conservatively assuming 250 tokens per request and similar-sized responses, you’re paying $0.01 per request. For a product with 100,000 requests per day, you’d pay more than $300,000 a year. Obviously, text-heavy applications (attempting to generate an article or engage in chat) would lead to even higher costs.

You must also account for the limited flexibility tied to this approach: You either use models as-is or pay significantly more to fine-tune them. It is worth remembering that the latter approach would involve an unspoken “lock-in” period with the provider, as fine-tuned models will be held in their digital custody, not yours.

Building: Flexible and defensible, but expensive and risky

On the other hand, building your own tech allows you to circumvent some of these challenges.

When it comes to large language models, should you build or buy? by Ram Iyer originally published on TechCrunch

https://techcrunch.com/2023/01/25/when-it-comes-to-large-language-models-should-you-build-or-buy/

Two mass shootings in three days. Are these copycat crimes?

Suicides tend to occur in clusters that suggest contagion, but there is little evidence that murders or mass shootings follow the same pattern, experts say.