Category: TECHNOLOGY

US App Store revenue from non-game apps just topped games for the first time

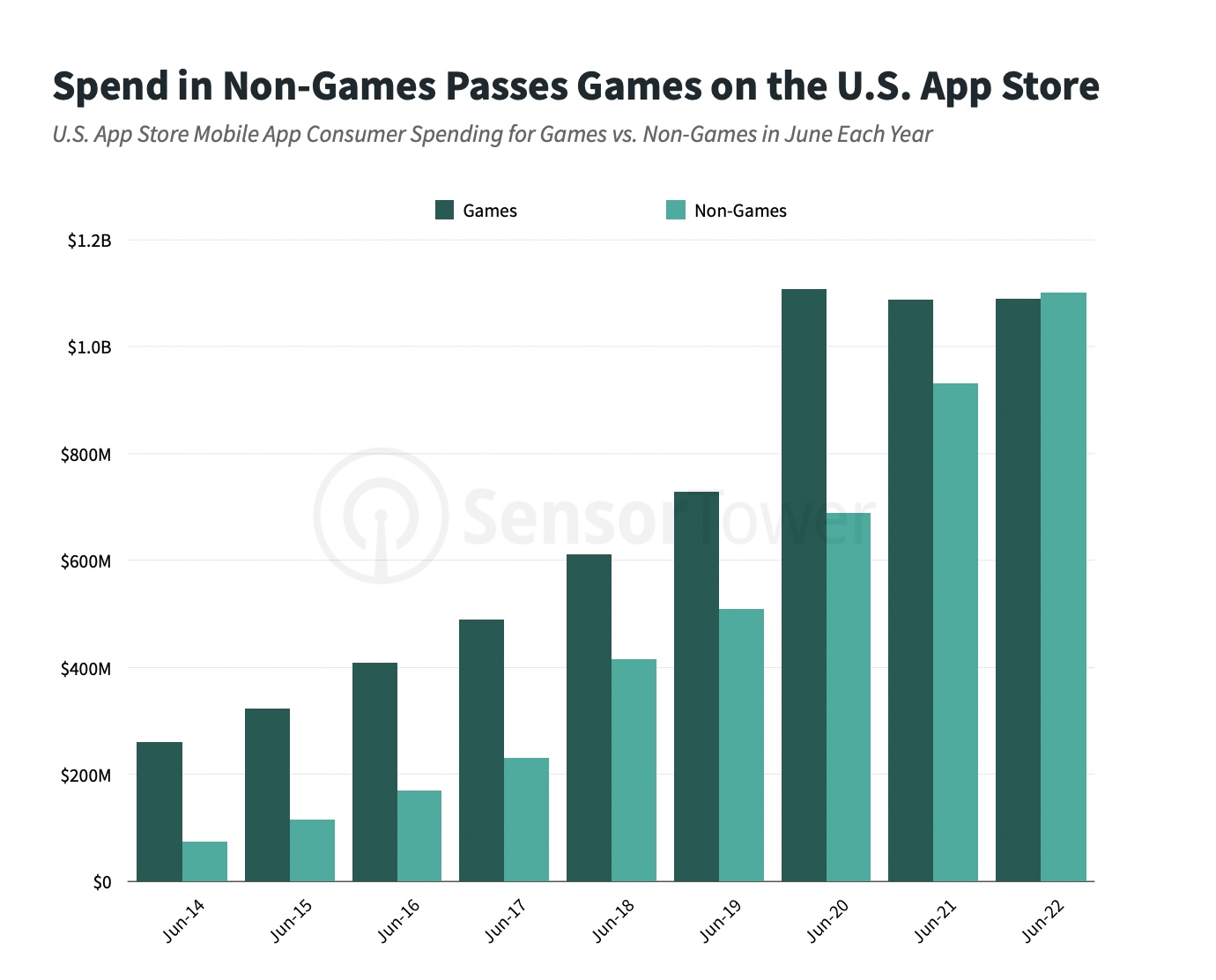

A major shift in the U.S. app economy has just taken place. In the second quarter of this year, U.S. consumer spending in non-game mobile apps surpassed spending in mobile games for the first time in May 2022 and the trend continued in June. This drove the total revenue generated by non-game apps higher for the quarter, reaching about $3.4 billion on the U.S. App Store, compared with $3.3 billion spent on mobile games.

After the shift in May, 50.3% of the spending was coming from non-game apps by June 2022, according to new findings in a report from app intelligence firm Sensor Tower. By comparison, games had accounted for more than two-thirds of total spending on the U.S. App Store just five years ago.

The trend was limited to the U.S. App Store and was not seen on Google Play, however. In Q2, games accounted for $2.3 billion in consumer spending on Google Play in the U.S., while non-game apps accounted for about $1 billion.

Image Credits: Sensor Tower

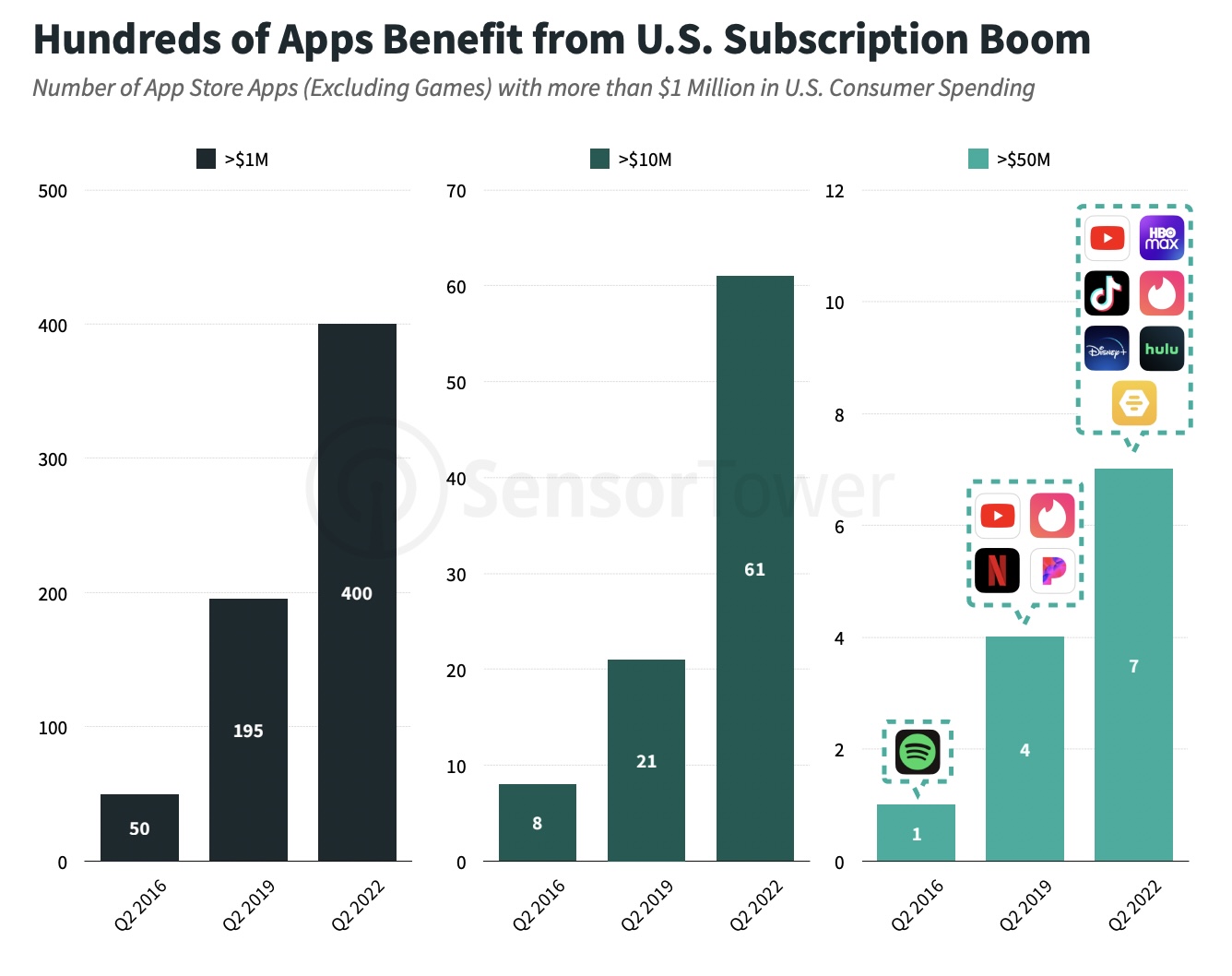

This shift in the U.S. app market is the most significant finding in the new report and demonstrates how successfully Apple has managed to create a subscription economy that allows a broader range of apps to generate sizable revenues.

The new data also supports this, as it shows it’s not only the biggest players that are benefiting from subscription revenue growth. In Q2 2022, 400 apps generated more than $1 million in consumer spending on the U.S. App Store, which is eight times the total from the same quarter in 2016. In addition, 61 U.S. App Store non-game apps generated at least $10 million in U.S. consumer spending in Q2 2022 — that’s more than the number of non-game apps that had generated $1 million+ in revenue in Q2 2016.

A handful of non-game apps also topped $50 million in U.S. consumer spending in the quarter, including YouTube, HBO Max, TikTok, Tinder, Disney+, Hulu and Bumble.

Image Credits: Sensor Tower

Subscriptions are the major revenue growth driver here, as non-game apps grew at nearly twice the rate — at a 40% compound annual growth rate — since June 2014 compared with less than 20% for games, the report found.

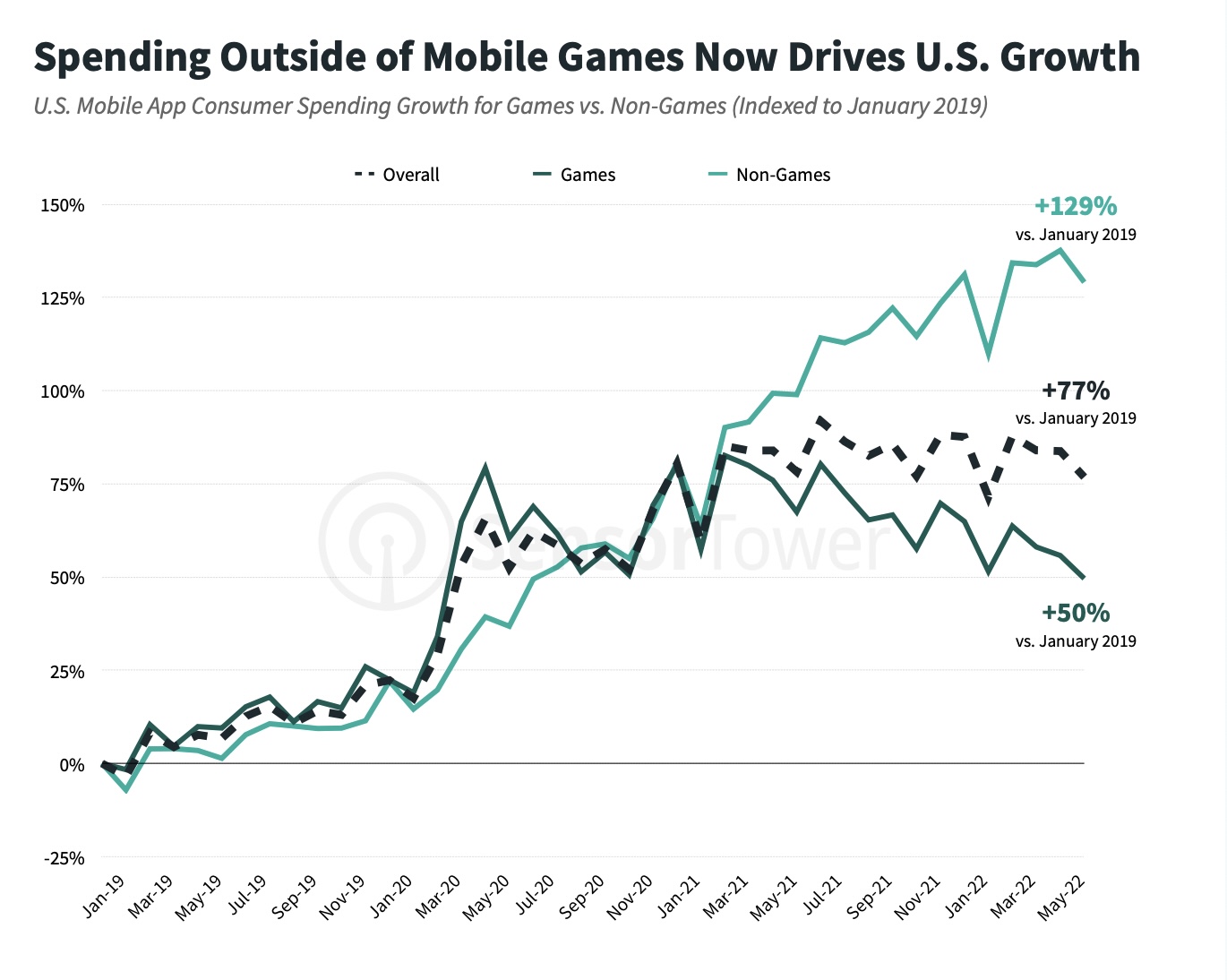

The trend is a significant reversal of what mobile app spending looked like just a few years ago.

In 2019 and early 2020, for instance, mobile game spending growth was consistently higher than non-game spending. Game spending then surged again at the start of the COVID-19 pandemic. But by late 2020, non-game growth had caught up and the gap widened in 2021.

Image Credits: Sensor Tower

While non-games are enjoying their new dominance, it’s not all great news for the app economy in …read more

As Coinbase falters, Binance.US is waiting in the wings

As the largest publicly traded crypto exchange in the United States, Coinbase has become something of a household name. But as the going gets tough in the crypto markets, the company seems to be fumbling the bag, leaving it vulnerable to competition.

Coinbase’s stock price is down nearly 80% from where it started the year and it recently made headlines for laying off one-fifth of its staff. The company posted a $430 million loss in the first quarter of 2022, underperforming Wall Street analysts’ expectations. Its trading volumes and number of monthly transacting users were both down from Q4 last year — bad news for a company that depends heavily on transaction fees for its revenue.

The exchange got over its skis quicker than even Coinbase itself probably imagined, a point evidenced by its decision to rescind job offers last month from candidates who had already accepted them. Its competitors, though, have been lying in wait for their moment to close in on the U.S. market. Now, sensing Coinbase’s moment of weakness, the two largest crypto exchanges in the world by volume (Coinbase is third globally) — Binance and FTX — are hoping to seize their opportunity stateside.

The three crypto giants all have different established customer bases and are trying to steal each other’s market share. Retail investors comprise around 95% of Coinbase’s transaction revenue, according to its latest quarterly filing. FTX, in contrast, already has a strong institutional trading business anchored in its founder and chief executive Sam Bankman-Fried’s background working at a quant hedge fund.

SBF, as he’s known in the crypto world, has been pulling out all the stops to gain retail customers, including introducing zero-fee U.S. stock trading in May, to try to turn FTX into a one-stop shop for the retail investor’s needs. After all, if Coinbase ascended to the No. 3 spot buoyed almost entirely by U.S. retail investors, its decline presents a valuable opportunity for global, institutionally focused exchanges to poach its users and boost their own trading volumes.

It makes sense, then, that Binance has its sights set on luring more retail investors, but the largest global exchange is still a bit of a dark horse in the race for the U.S. market as it battles against FTX for customers. Its Binance.US division saw spot trading volumes below $300 million as of July 12. That’s a drop in the bucket compared to its global business, which saw volumes of $10 billion for the same period — about seven times higher than volumes at both FTX and Coinbase.

Today, 70% of trading volume on Binance.US, the American offshoot of the global exchange, comes from institutional customers, its CEO Brian Shroder told TechCrunch in an interview. Still, retail investors bring in more revenue overall, in part because of the steep discounts Binance.US offers to its highest-volume customers, he added.

Binance is also taking a markedly different approach from FTX in luring U.S. retail investors, focusing on its core competency in crypto.

“Some exchanges …read more

Nintendo acquires CG animation studio and renames it Nintendo Pictures

Nintendo has entered an agreement to acquire CG animation company Dynamo Pictures in order to develop visual content using Nintendo IP. The gaming company is buying 100% of outstanding shares of Dynamo Pictures and rebranding it as Nintendo Pictures Co., Ltd. The deal is expected to close on October 3.

According to a regulatory filing, Nintendo stated:

Nintendo has decided to acquire 100% of the outstanding shares (excluding treasury shares) of Dynamo Pictures and make it a wholly owned subsidiary to strengthen the planning and production structure of visual content in the Nintendo Group.

The deal suggests that Nintendo is expanding further into the entertainment business. Having a studio gives Nintendo the freedom to produce its own content. While it is unsure whether the production company will develop full-length features, in-game cutscenes or short films, it is exciting to think about all the possibilities. Nintendo owns franchises like Mario, Kirby, The Legend of Zelda, Donkey Kong, Star Fox and Animal Crossing.

The company is already working with Universal’s Illumination studio to release an animated movie in April 2023 based on the Super Mario Bros. franchise.

This strategy of video game companies developing film and TV series content based on IP isn’t new. Sony, responsible for Playstation, is also set to develop titles with its large library of video game IP. Projects already in production include Twisted Metal, The Last of Us and Ghost of Tsushima. There are 10 others in development.

The visual production company Dynamo Pictures, Inc. was established in 2011 and is known for its work on the animated “Pikmin” short movies as well as “Ghost in the Shell SAC_2045” season 2, “Death Stranding,” “Monster Hunter: World,” “Final Fantasy XIII-2,” “Persona 5,” “Yuri on Ice,” “Earwig and the Witch” and more.

Facebook tests a way to add up to five profiles tied to a single account

Facebook is testing a way for users to have up to five separate profiles tied to a single account. The social media giant says the test allows users to dedicate different profiles to specific groups they want to connect with, such as one dedicated Facebook feed exclusive to their friends and another one just for their coworkers. Users who are part of the test will be able to switch between their different profiles in a few taps.

“To help people tailor their experience based on interests and relationships, we’re testing a way for people to have more than one profile tied to a single Facebook account,” Facebook spokesperson Leonard Lam told TechCrunch in an email. “Anyone who uses Facebook must continue to follow our rules.”

Additional profiles don’t need to include a person’s real name, as users will be able to choose any profile name and username, as long as it is unique and doesn’t use any numbers or special characters. People’s main profiles must still use the name they use in everyday life, Facebook says.

The company says additional profiles are still subject to its policies and that they can’t misrepresent your identity or impersonate others. If you receive a violation on an additional profile, it will impact your account as a whole. Facebook says this rule will help prevent people from abusing its platform across multiple profiles. If someone repeatedly violates the company’s policies using one of their additional profiles, Facebook’s systems will recognize which profile was violating and take appropriate action, such as removing the additional profile or all profiles, including the main account.

Facebook says there are some parts of the platform that are only available for people’s main profiles, such as creating and managing a Page or using Facebook Dating.

Considering that a user’s additional profiles are under one Facebook account, the company says the multiple-profile feature won’t change how it reports user metrics, such as monthly and daily active user totals.

Up until now, the company has barred regular users from having multiple Facebook accounts, so the introduction of additional profiles marks a change for the social media giant. The launch of the test indicates that Facebook is experimenting with ways to drive engagement on its platform, while also encouraging users to post and share more content with others.

The test also shows that Facebook is trying to move beyond just a platform to share updates with family and friends, as the company notes that additional profiles can be used to go deeper into topics you care about and want to learn more about. For example, Facebook says a user may want to create an additional profile focused on sustainable design, where they can follow their favorite brands and connect with others who share their passion. Facebook also suggests that additional profiles can be used to organize content about the things that matters to you. For instance, you can have one profile dedicated to foodie content where you can follow your favorite chefs and find local events and restaurants.

Facebook’s shift …read more

https://techcrunch.com/2022/07/14/facebook-tests-add-up-to-five-profiles-single-account/

Pivoting your startup in a bear market: Become undeniably fundable

Contributor

As a founder, it’s easy to say, “Of course, we’ll pivot!” But actually pulling a pivot off is no easy feat. How do you set yourself up for success in this new world? Which levers should you pull first? How do you ensure you can secure capital when needed or that your company is undeniably fundable?

Right now, becoming undeniably fundable should be every founder’s north star. It denotes that you’ve built an efficient company that will without a doubt garner venture capital attention and funding when the time is right.

Surface and scrutinize efficiency KPIs

As you begin the road to becoming undeniably fundable, you must prioritize KPIs that represent efficiency. Vanity metrics have taken the backseat in this new world, and there will be few paths forward for you if you don’t prove you’re efficient.

There are five key efficiency metrics that matter:

In this new chapter, CEOs must think like a CFO.

- Growth rate: The pace at which your annual recurring revenue (ARR) is scaling. Can you still grow 2x or 3x year over year right now? How does your product need to change?

- Customer acquisition cost (CAC): The amount of money you need to spend on sales and marketing to acquire one customer.

- CAC payback period: The time it takes to recoup the cost of acquiring a customer. Shoot for a time span that’s less than 20 months.

- Gross margins: The cost of servicing customers with both your technology and your people. The industry standard is about 75%.

- Burn multiple: The amount you are spending to generate incremental ARR. 1x is amazing but less than that is even better. Popularized by David Sacks, this metric has been a guiding light for my current company, as this metric doesn’t lie. You can’t hide spending or stash costs in other departments. It exposes the cold hard truth about your spending, growth and cash collection.

Examine your business and change your priorities

Once you have a strong grasp on your efficiency metrics, it’s time to take action. Regardless of your segment, industry or customer type, I believe you need to do the following.

Scrutinize your budget and shrink it to essentials

As a founder, you must dive deep into every department’s budget — don’t leave it to others. There’s no room for fluff.

Take stock of personnel costs

Dueling $2.5 million hypercar EVs arrive this summer

It’s shaping up to be the summer of dueling seven-figure electrified hypercars.

But perhaps it’s more of a sibling rivalry, as the Rimac Nevera and Pininfarina Battista share common DNA.

Rimac said Tuesday that its $2.5 million 1,914-horsepower Nevera has begun rolling off the assembly line. Pininfarina announced the following day that its own $2.5 million battery-electric hypercar, the 1,900-horsepower Battista, will start production in August.

If the cars sound similar, it’s because they areRimac supplies the Pininfarina Battista with the same 120-kilowatt battery pack and powertrain that the Nevera uses. Both accelerate from zero to 60 mph in 1.85 seconds and are capped at 150 units to maintain exclusivity. The Nevera is already sold out. Pininfarina has indicated strong interest in the Battista but said the company does not “discuss detailed sales figures, as our business is about the quality not quantity of clients.”

But how many $2.5 million hyper GTs can the EV market bear? Pagani said in June that it scrapped plans to build an electric car after a four-year study showed a lack of demand from supercar buyers.

“It’s unlikely that any one brand will be able to subsist on hypercar sales alone,” said Stephen Beck, founder and managing partner of management consultancy cg42. “It’s just not a practical business model.”

Instead, the success of a seven-figure EV depends upon its role in the automaker’s portfolio.

Supplier model

Image Credits: Rimac

For Rimac, the Nevera is a showpiece that will bolster its main business: supplying advanced battery technology to other carmakers. “Pairing a specific high-end niche with a strong B2B component, is the type of balance others should be looking to emulate to survive,” Beck said.

Analysts say Rimac has created a profitable long-term strategy providing EV components to other automakers, such as Porsche, Aston Martin and Pininfarina. It’s a business model that other suppliers are likely to replicate, given the relative simplicity of building a battery-electric powertrain.

“You can tweak the electric motor to your requirements, but at the end of the day 90% to 95% of the electric motor is going to be pretty much set,” said Arun Kumar, managing director of AlixPartners’ automotive and industrial practice.

Halo effect

The Battista fulfills a more traditional role for Pininfarina: a halo car to attract new well-healed clients to the brand and provide inspiration for a range of EVs Pininfarina plans to introduce. That will be the approach that most other heritage brands take toward building a hypercar EV, according to Kumar.

The Battista also serves as a “proof of concept” for Pininfarina’s network of technical partners, while announcing the arrival of a new luxury era, according to Automobili Pininfarina CEO Per Svantesson.

https://techcrunch.com/2022/07/14/dueling-2-5-million-hypercar-evs-arrive-this-summer/

SEC Questioned Elon Musk Tweet Over Twitter Deal

The billionaire is facing scrutiny from securities regulators over whether he promptly disclosed his intention to end his $44 billion deal to buy Twitter after a disagreement over spam-account data. …read more

US venture capitalists have never had so much spare cash

You might think given the chatter in the startup world that venture capitalists are short on funds — after all, we’re hearing about young tech companies finding themselves marooned between stages, hitting up investors with smaller capital pools than prior backers and turning to equity crowdfunding to keep their cash balances healthy.

And yet new data from PitchBook and the National Venture Capital Association indicate that while the pace of U.S. venture capital investment is slowing — more here on the global perspective — American venture capitalists are sitting atop more investable capital (dry powder) than ever before.

Even more, the pace at which venture investors are accreting funds is elevated compared to historical norms, meaning that private-market investors are in aggregate not struggling to raise, even if their portfolio companies may find themselves in a very different situation.

The question bouncing around our minds this morning is why — why are venture investments slowing when so much capital has been raised by VCs to invest?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

https://techcrunch.com/2022/07/14/us-venture-capitalists-have-never-had-so-much-spare-cash/

Wysa raises $20 million to expand its therapist chatbot into a wider set of mental health services

Wysa, a popular mental health app originally founded in India around an AI chatbot that helps users talk through their feelings, has raised $20 million in a Series B funding round to expand its business on the heels of hitting 4.5 million users in 65 countries.

The all-equity round is led by India’s digital health-focused venture capital fund HealthQuad, with participation also from British International Investment (BII), the U.K.’s development finance institution. The plan will be to use the money to double down on its home market as well as the U.S. and U.K, where it already has respectively had approvals from the FDA and the National Health Service (NHS) and is used by the latter as part of its online mental health services. Originally built to work in English, Wysa will use some of the investment also to widen multilingual support. The team currently has 100–150 people.

Previous backers have included both Amazon and Google (who invest by way of their digital assistant funds), and Wysa prior to this round had raised $9.4 million. It’s not disclosing valuation.

To date, Wysa has served over 400 million conversations to 4.5 million users in 65 countries, and its rise speaks not just to the stresses of life in the wake of the COVID-19 pandemic but to the lack of resources for many to deal with that.

“The demand for mental health, as you can imagine, is exploding,” said Ramakant Vempati, co-founder, Wysa, in an interview with TechCrunch. “The number of mental health professionals is just not enough to meet that demand.”

The executive added that in India, the country of 1.3 billion people where Wysa is based, less than 10,000 people are trained in the mental health profession. He also noted that the proportions are similar in other parts of the world. In the U.K., the NHS has a waitlist of six to 12 months, Vempati said.

“Typically, access to a mental health service is gated. It is restricted by some kind of diagnosis — saying only if you are severe enough you will be able to get to speak to a therapist because obviously therapy is expensive and somebody’s got to pay for it,” he said.

In contrast, he noted that the app offers “early engagement and a safe space where people can come in and anonymously just talk about what’s bothering them.”

“That encourages people to come forward,” the executive mentioned.

Wysa, which has operations in Bengaluru, Boston and London, is marketed as a solution to bridge that gap.

Conceptualized in 2016, after CEO and co-founder Jo Aggarwal fell into a deep depression, the app offers a range of therapeutic techniques to users.

Vempati underlined that Wysa works as a three-state solution. The first part of it is available to the masses as an AI chat offering, whereas its second piece is more structured help that is coming from human beings including coaches, counselors and therapists on staff. The third part, he said, is what the company calls clinical programs.

In simpler words, smartphone users can access Wysa as …read more

NFT marketplace OpenSea lays off 20% of its staff: ‘We have entered … crypto winter’

Despite a significant depression in crypto markets, plenty of top players have been hesitant to say that the good times are over for the time being, but as NFT marketplace OpenSea announces today that its laying off around 20% of the company’s employees, the top crypto startup’s CEO isn’t mincing words.

” … [T]he reality is that we have entered an unprecedented combination of crypto winter and broad macroeconomic instability, and we need to prepare the company for the possibility of a prolonged downturn,” OpenSea CEO Devin Finzer said in a message shared with staff that he posted publicly on Twitter as well.

Today is a hard day for OpenSea, as we’re letting go of ~20% of our team. Here’s the note I shared with our team earlier this morningpic.twitter.com/E5k6gIegH7

— Devin Finzer (dfinzer.eth) (@dfinzer) July 14, 2022

The company did not specify exactly how many employees were impacted by the decision, but the company’s LinkedIn page indicates the company has around 750+ employees currently. Finzer says that impacted employees will be receiving severance and health insurance “into 2023” as well as accelerated equity vesting.

The layoffs raise questions about the company’s aggressive growth tactics and how they approached the sustainability of the NFT sector’s breakneck growth. In his note to staff, Finzer says the company has years of runway ahead of it with these changes, assuming things don’t get even bleaker.

“The changes we’re making today put us in a position to maintain multiple years of runway under various crypto winter scenarios (5 years at the current volume), and give us high confidence that we will only have to go through this process once,” Finzer writes, later adding, “Winter is our time to build.”

OpenSea has been one of the top beneficiaries of crypto’s 2021-2022 bull run, raising hundreds of millions in investor dollars, most recently at a $13.3 billion valuation. That growth has not been without its drama; last month one of the company’s executive was arrested on charges of insider trading after an NFT trading scandal.

Crypto’s top venture capitalists have said that the talent entering the crypto space is one of the biggest reasons they’re bullish on the space, but as crypto giants continue to make huge layoffs, it’s unclear how much of that talent is being held onto.