Category: TECHNOLOGY

Coralogix streams $142M into its coffers to expand its production analytics into a full-stack observability platform

We’ve long documented the challenges that DevOps and operations teams in specific areas like security face these days when it comes to data observability: a wide range of services across the landscape of an organization’s network translates into many streams of data that they need to track for performance, security and other reasons. That’s leading to the rise of a wave of startups building tools to improve how to manage this. In one of the latest developments, Coralogix, which has built a platform to harness those data streams into one mighty river is announcing a mighty round of funding to expand its business.

The Israeli startup, which also has an HQ in San Francisco, has raised $142 million, funding that it will be using to continue investing in its R&D as well as in building out more of its sales and business development globally.

This is a Series D round, and it is being co-led by Advent International and Brighton Park Capital, with participation also from Revaia Ventures and previous backers Greenfield Partners, Red Dot Capital Partners, Eyal Ofer’s O.G. Tech, StageOne Ventures, Joule Capital Partners, and Maor Investments.

The company is not disclosing its valuation — specifically, CEO and co-founder Ariel Assaraf told me that it would not be disclosing this figure because of the current climate around fundraising (very tough) and the fact that he and the rest of the team are humbled by that. But he did acknowledge it was definitely an up-round that came on the back of very strong numbers since its $50 million round less than a year ago (when it was valued at between $300 million and $400 million), with revenue in the last year growing threefold, positive ROI on its R&D spend and 50% growth in headcount. It has raised $238 million to date and says its 2,000+ customers.

When we covered Coralogix’s funding round last July, the company’s unique selling point was providing a particular approach to stateful streaming services — specifically providing tools to amass log analytics and metrics to platform engineers, with emerging pockets of opportunity also in security services (which also need data observability, and in which the company recently launched a dedicated service called Snowbit) and business intelligence, based around its flagship Streama product.

Essentially, Coralogix allows DevOps and other engineering teams a way to observe and analyze data streams before they get indexed and/or sent to storage, giving them more flexibility to query the data in different ways and glean more insights faster (and more cheaply because doing this pre-indexing results in less latency).

Added to this, the company is now going to be adding in a fourth area: now it will also offer a distributed query engine for fast queries on mapped data from a customer’s own archives in remote storage. As with the other tools, part of the aim is speed but the other (related to it) is cost savings, some 40-70% less compared to other tools used to query data in storage, …read more

Car-sharing startup Turo expands to New York and France

Peer-to-peer car sharing company Turo is expanding to New York State and France in June, the company said on Wednesday. The expansion comes at a time when post/mid-Covid tourism is beginning to heat up, but renting a car will be difficult and expensive due to ongoing semiconductor shortages and supply chain issues.

Turo’s launch in New York follows the state legislature’s passing of SB 6715 in December 2021, a law that provides a regulatory framework for peer-to-peer car sharing operations in the state. NY was the only state in the country where such a service was unavailable, so the signing of the bill means Turo is now in all 50 states.

Prospective hosts can start pre-listing cars on Wednesday, and guests who want to book on Turo can start June 27, the company said.

Meanwhile in France, Turo has acquired French competitor OuiCar, effectively opening up the French market and supporting broader expansion plans in Europe, the company says. Turo did not share the terms of the deal, but it’s an acquihire that will involve initially maintaining the OuiCar brand before assimilating OuiCar under the Turo umbrella in the future.

Aside from the U.S., and now France, Turo’s service is available in the UK and Canada. The company says it spans 8,000 cities with over 2 million active guests and 217,000 active vehicles on the platform as of March 31.

Turo previously also offered its service in Germany, after an investment from Daimler allowed the company to take over the automaker’s car-sharing subsidiary Croove. However, at the start of the pandemic, Turo decided to sunset its German operations to maintain the “long-term health of the global business.”

Turo filed to go public earlier this year under somewhat mysterious terms. Turo, then and now, has not shared information on the number of shares to be offered in the IPO or the price range. The company also wouldn’t share any updates on its IPO process, but a spokesperson for the company told TechCrunch Turo was monitoring stock market conditions to ensure a successful public debut.

https://techcrunch.com/2022/06/01/car-sharing-startup-turo-expands-to-new-york-and-france/

Social media giants are failing women, finds Ofcom

Ofcom, the UK’s soon-to-be social media harms watchdog under incoming Online Safety legislation, has warned tech platforms that they are failing to take women’s safety seriously.

Publishing new research (PDF) into the nation’s online habits today, Ofcom said it has found that female Internet users in the UK are less confident about their online safety than men, as well as being more affected by discriminatory, hateful and trolling content.

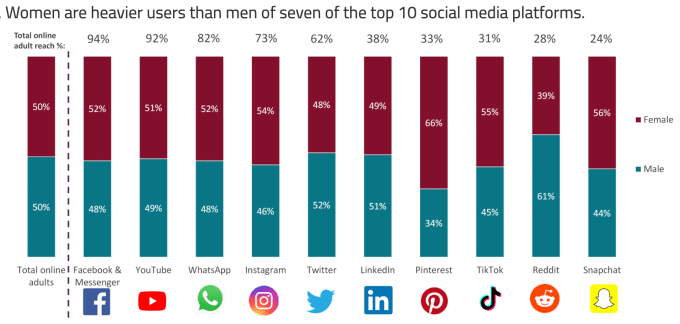

Its study, which involved the regulator polling some 6,000 Brits to understand their online experiences and habits, also indicates that women feel less able to have a voice and share their opinions on the web than male counterparts — and that’s despite another finding from the study that women tend to be more avid users of the Internet and major social media services.

Ofcom found women spend more than a quarter of their waking hours online — around half-an-hour each day more than men (4hrs 11min vs. 3hrs 46min).

Image credits: Ofcom’s Online Nation 2022 report

The regulator is urging tech companies to listen to its findings and take action now to make their platforms more welcoming and safe for women and girls.

While the regulator doesn’t yet have formal powers to force platforms to change how they operate, under the Online Safety Bill that’s currently before parliament — which is set to introduce a duty of care on platforms to protect users from a range of illegal and other types of harms — it will be able to fine rule-breakers up to 10% of their global annual turnover. So Ofcom’s remarks can be seen as a warning shot across the bows of social media giants like Facebook and Instagram owner, Meta, which will face close operational scrutiny from the regulator once the law is passed and comes into effect — likely next year.

In a statement accompanying the research, Ofcom’s CEO, Melanie Dawes, said:

“The message from women who go online is loud and clear. They are less confident about their personal online safety, and feel the negative effects of harmful content like trolling more deeply.

“We urge tech companies to take women’s online safety concerns seriously and place people’s safety at the heart of their services. That includes listening to feedback from users when they design their services and the algorithms that serve up content.”

Discussing the findings with BBC Radio 4’s Today program this morning, Dawes further emphasized that the research shows — “on every measure” — that women feel less positive about being online than men do. “They simply feel less safe and they’re more deeply affected by hate speech and trolling,” she added. “As a result there’s a chilling effect, to be honest — women feel less able to share their opinions online and less able to have their voices heard.”

Another finding from the research highlights the greater impact negative online experiences can have on women’s mental health, especially for younger women and black women — with Ofcom finding that women aged 18-34 were more likely …read more

https://techcrunch.com/2022/06/01/ofcom-women-online-nation-2022-report/

Smiler comes up with a different kind of gig economy for event and venue photographers

Traditional venue photography providers like DEI Global, MagicMemories, Picsolve and Sharingbox are reliant on fixed equipment, permanent staffing costs, and on-site printed products. So Amsterdam, Netherlands-based Smiler came up with a different approach. Freelance photographers can simply use the platform to roam around events, selling event photography formally attached to the venue and allowing customers to buy photos there or later online.

It’s now raised a $8 million seed round led by Mosaic Ventures, with participation from Speedinvest, Dutch Founders Fund, PROfounders Capital, and angel investors including Greg Marsh, who sold his startup onefinestay to AccorHotels for £117m.

The new funds will be used to expand across the UK, The Netherlands, France, Spain, and Italy.

Launched in May 2021, Smiler is an on-the-spot photography marketplace used by freelance, professional and enthusiast photographers. They show the customer a QR code to connect them to the photos. Customers are then matched with their photoshoot, which they can then review and purchase.

It means any photographer can then trade at a large number of public locations around the world, or at one of Smiler’s partner venues. It now has more than 9,000 photographers on its books.

“It’s not only professional photographers who become Smilers,” said Smiler CEO and co-founder Kasper Middelkoop, in a statement. “Many are young, talented photography enthusiasts who are looking to make money with their skills and passion. The earning potential is substantially higher than through a traditional gig economy platform via a generous commission split, scalable control over how much and often they want to work.”

Smiler venues now include Manchester City Football Club, Paris’s Montparnasse Tower, and ARTIS Amsterdam Royal Zoo, and the Tower of London.

“At Mosaic we look for exchange platforms that delight customers and create new economic opportunities for suppliers,” said Bart Dessaint, partner at Mosaic Ventures. “In the case of Smiler, creating strong memories with loved ones for tourists and a new creator gig role for photographers is a perfect example of technology unlocking an interaction that was previously in-accessible.”

Baby-Formula Shipments Come With High Security to Deter Cargo Thieves

Logistics companies are using tracking technology and special locks to protect deliveries of infant formula, which has become even more attractive to criminals due to the shortage. …read more

Odilo raises $64M as its white-label e-learning library passes 8,500 customers and 170M users

E-learning — whether it’s in the form of a supplement to physical materials or live lessons; or the primary or even only medium being used — is now an indelible part of the educational experience; and now a startup out of Spain that’s built a platform to help deliver e-learning in more places is announcing a growth round of funding to expand its business further.

Odilo, a Madrid-based startup that has built a white-label platform used by businesses or organizations to build their own customized e-learning offerings in a B2B2C model, has picked up €60 million ($64 million). London investor Bregal Milestone led the round with participation from previous backers Swanlaab and CDTI. Odilo is not disclosing its valuation, but it’s been around since 2012 and had raised less than $30 million before now.

You may not be familiar with the name “Odilo.” Rodrigo Rodriguez, the founder and CEO, described Odilo to me as a “Netflix” for education because of its large catalogue — the company has so far amassed a catalogue of 3.9 million items, including some 3 million books but also podcasts, full courses and other materials, from 6,300 publishers in 43 languages — and the fact that people dip into that content on an on-demand, use-whatever-you-want basis.

Unlike Netflix, however, it operates as a while-label service, so you may never actually see the Odilo brand. Yet there is a chance you may have used one of the education portals that it powers. Odilo has so far racked up 8,500 customers in 52 countries, covering some 170 million users in all, with the list including government bodies, libraries and education organizations like MIT, but also big corporate customers such as Google and Vodafone.

Rodriguez said that the new funding will be used to continue growing that catalogue as well as to expand deeper into more markets, specifically North America and the African continent.

The company has grown out of two significant trends in tech.

The first is the rise of e-learning, which in its widest view — which can include both school learning as well as professional training and everything in between — was estimated to be worth some $315 billion in 2021 and will grow at a CAGR of 20% for the next six years according to researchers. That whole trend, of course, was accelerated by Covid-19, when schools and other in-person learning experiences were shut down, but it was already big even before the pandemic, and given the economics of virtual experiences is likely to remain in place.

The second is the rise of “headless” systems: services that are built as extensible platforms, where customers are given the option of using a variety of APIs and other tools to build out their own customized experiences on top of them. These are very common in other areas of tech that are otherwise very complex to build from the ground up — e-commerce backends (Shopify or Commercetools for example), content management systems (eg Contentful) — and now …read more

Indian fintech Slice tops $1.5 billion valuation in new funding to scale UPI payments

Slice, a fintech startup that is bringing credit card features to millions of Indians, has raised $50 million in a new financing round as it looks to scale its recently launched UPI payments product and push to make its core credit business profitable.

Tiger Global led the Bengaluru-headquartered startup’s Series C financing round, which according to a source familiar with the matter, values Slice between $1.5 billion to $1.8 billion. Slice entered the unicorn club in a round in November last year.

The new round also saw participation from GMO Venture Partners and existing backers Insight Partners and Moore Strategic Ventures. Slice is engaging with additional investors to raise another $100 million, the source said, requesting anonymity as the details are private.

TechCrunch reported earlier this year that Slice was in talks to raise a new financing round. The startup declined to comment Thursday on its valuation and talks for additional top up in the current round.

Launched in 2019, Slice offers credit card features including rewards with various popular merchants and flexible payment options to over 12 million Indians.

Nearly 1 billion Indians have bank accounts but most of them are not eligible for several basic services such as credit. Credit bureaus in India have data of only a fraction of the nation’s 1.4 billion population.

Slice is among a group of startups that is increasingly broadening the market for who all can get a card by using modern underwriting systems. It is issuing between 300,000 to 400,000 cards a month, according to a source familiar with the matter, a figure that makes it one of the top card firms in the South Asian market.

“Slice is leading the way for innovation, customer experience, and growth in India’s rapidly developing payments market. We are delighted to continue our partnership with Rajan and his team as they improve and expand payment products with the goal of making money more relatable for the consumer,” said Alex Cook, Partner at Tiger Global, in a statement.

Some of Slice’s marquee features are a 2% cashback on card spendings and a buy now, pay later offering with merchants such as Amazon and MakeMyTrip, where customers get the ability to pay for their purchases over a course of a few months at no additional charge.

“We have really struck a chord culturally with millennials and Gen Zs nationwide in the last couple of years,” said Rajan Bajaj, founder and chief executive of Slice, in a statement.

The startup is now broadening its offerings. Last month it launched support for UPI, a payments railroad that has become the most popular way Indians transact online. By adding UPI, Slice is looking to drive engagement by giving users more reasons to use its eponymous app for their daily spendings.

Bajaj (pictured above) said the UPI product is already “gaining strong early traction.”

“With the significant growth in wallet share of Slice card, it became increasingly clear that our customers would love to use Slice for all their payment needs. Driving on that, we made our …read more

Egyptian q-commerce platform Appetito bags Lamma for over $10M

Appetito, the Egyptian platform that delivers groceries and household products to customers from 11 dark stores across three cities in the North African country, is acquiring Lamma, an identical startup with operations in the Maghreb regions of Tunisia and Morocco.

Appetito didn’t disclose the size of the deal in its statement, and neither did CEO Shehab Mokhtar when quizzed about it via email. But sources familiar with the matter said the deal size was between $10 million to $15 million. Mokhtar declined to comment on the speculated price. The deal is expected to close by the end of Q3 2022.

“We’ve been very cost-efficient with solid unit economics from day one. The fact that we were able to do so much with so little is great evidence,” replied Mokhtar when asked how Appetito financed the acquisition, having raised just $2.5 million. “Moreover, we’ll be closing an eight-figure round soon to foster our expansion even further.”

The acquiree, Lamma, launched in Tunisia as a carpooling service two years ago. It pivoted to a quick commerce platform delivering groceries, personal care and fashion items to users in Tunisia and Morocco (launched this year) in less than 45 minutes. Lamma was founded by CEO Yassir El Ismaili El Idrissi, ex-GM at Careem, Hamza Guesmi and Koussi Aymen — and is backed by Orange Ventures.

The Lamma team, its three dark stores and a distribution centre will be integrated into Appetito as both teams “explore lots of synergies.” El Idrissi will join Appetito as its chief expansion and growth officer.

Appetito said the deal makes it the largest q-commerce player in Africa. Its claim is based on the number of markets it currently operates in: Egypt, Morocco and Tunisia. “No other q-commerce player in Africa operates in such big markets,” Mokhtar told TechCrunch.

The company said it plans to become the largest q-commerce player in frontier and emerging markets. Similar upstarts such as Rabbit have operations in Egypt and Saudi Arabia, while older players like Breadfast, though only operational in Egypt, runs more than 50 dark stores.

Since the pandemic hit, q-commerce platforms have been subject to a lot of VC interest — and cash — as consumer habits changed and people shopped for groceries online with the expectation to get them in minutes, as promised by these platforms.

But as the number of platforms offering grocery and household items delivery under 20 minutes grew, it became apparent that most wouldn’t survive with their little margins and questionable unit economics. A consolidation began late last year. Big players such as Getir, Flink, Gorillas and Gopuff have since acquired smaller platforms like Weezy, Cajoo, Frichti and Dija.

Appetito’s acquisition of Lamma is a first in the African market, albeit among small players. They operate similar models, particularly with the timing of their deliveries ranging between 45 minutes to two hours; Appetito also allows scheduled daily or weekly deliveries. This timing model differs from the “under 20-minute” pitch from the likes of Breadfast and …read more

https://techcrunch.com/2022/05/31/egyptian-q-commerce-platform-appetito-bags-lamma-for-over-10m/

France’s Alven VC launches 6th fund with a hard cap of €350M

With a heritage that goes back to the fabled times of 2000 A.D. (since when it has backed 160 European teams) Paris-based early stage fund Alven, has something of a reputation to keep up. After investing in unicorns such as Qonto, Dataiku, Algolia, Stripe and Ankorstore, it now has €2B in assets under management.

But that was yesterday. And today it’s coming out with its sixth fund, having hit a hard cap of €350M after exceeding the initial target of €300M, making it one of the largest early stage funds operating out of France. The fund will write cheques from 100k€ to 15M€ and has plenty of reserves for follow on investments.

After more than 70 exits, those recent ones include the sale of Sqreen to Datadog, Cardiologs to Philips and Frichti to Gorillas.

While Alven is known mainly as being a Franco-hile fund, it also now has a London office which it plans to expand. Part of the fund will be deployed across Europe, as well as to back European founders in the US in relevant sectors.

Charles Letourneur, co-founders of Alven said: “We pride ourselves in building long term relationships with entrepreneurs, and this also applies to investors in Alven. Not only our existing LPs have continually invested in us, but we’ve also welcomed a number of new investors that want to be part of the French Tech success story.”

Alven recently launched Operation3, a talent program aimed at web3 entrepreneurs.

The fund will also now put an emphasis on new growth areas in crypto (it has invested in Kaiko, a market data provider for digital assets), developer and data tooling (it invested in Mindee, a document parsing tool for developers), climate tech, MyTraffic (physical location data analytics), Carbonfact (a carbon footprint API) and Stoik (data-driven cyber insurance).

Over a call Partner François Meteyer told me: “We’ve been consistently hiring, what we think is the next generation of successful VCs, first in France, and then and then in Europe. So our LPs trust us and every backer from our previous fund invested again in this new fund. And then we decided to extend the LP bases and bring more global institutions in as LPs.

I asked him, given they exited Frichti to Gorillas, and given the potential recession looming, if just-in time groceries have a future. He said: “We have seen many M&A in the past and we’ll seen more and more. We think just-in time groceries is going to continue to matter – it will be about price.”

https://techcrunch.com/2022/05/31/frances-alven-vc-launches-6th-fund-with-a-hard-cap-of-e350m/

Rimac raises more than $500M from Porsche, Softbank and Goldman Sachs

Rimac Group said Tuesday it has raised 500 million euro ($536 million), funds that will help the Croatian startup expand beyond its electric hypercar roots and grow into a global EV components supplier — and eventually a publicly traded company.

Softbank Vision Fund 2 and Goldman Sachs led the Series D investment round in a deal that valued the manufacturer at 2 billion euro ($2.2 billion). The round includes an “eight-figure sum” from Porsche, which now owns 20% of the company. Founder and CEO Mate Rimac will remain the largest shareholder of Rimac Group, the majority shareholder of the recently merged Bugatti Rimac and the sole shareholder of Rimac Technology.

“SoftBank is the biggest tech investor in the world, and Goldman is a very big financial investor,” Mate Rimac said Tuesday on a call with media. He added that, while the company’s hypercar business is sustainable, the investment is crucial to both the development of the company’s Rimac Technology subsidiary and Rimac’s prospects for going public in the future.

The funding will be used to hire talent, build a $200 million campus for Rimac’s Zagreb, Croatia headquarters and to develop and produce batteries, software and other components for electric cars.

Above all, the money will also help Rimac stay independent from larger automakers, the CEO said. “It’s very good for us to have Porsche and Hyundai onboard as shareholders, but we don’t want to be fully dependent on them.”

Rimac merged its hypercar division with French supercar maker Bugatti in November. The resulting company, called Bugatti Rimac, is developing the $2.5 million Rimac Nevera hypercar, a 1,914-horsepower EV that it claims can accelerate from 0 to 60 mph in 1.85 seconds, faster than any other production car. That car, which made its debut last year, will come to market this summer.

Developing and building the Nevera in house has helped the company develop a range of technologies that it can supply to other automakers. In addition to Porsche and Hyundai, the company has also partnered with Automobili Pininfarina, Koenigsegg and Aston Martin to design, engineer and manufacture batteries and other parts for high-performance EVs.

Construction on the nearly 25-acre campus in Zagreb began in August. Rimac said Tuesday that the project is on schedule to open in 2023.

“Despite all the material shortages and all the challenges that are now in the supply chain, we are progressing with that quite well,” Rimac said.

The headquarters will house research and development for Rimac and Bugatti, as well as the production for electric cars – including the Nevera – and a variety of components including battery systems and chassis. The company said that the site will be able to produce tens of thousands of components annually once it ramps up to full capacity.

The new funding will also help Rimac hire 700 employees in 2022, nearly doubling its current workforce, and open new offices and factories across Europe, including in Germany and England, and possibly Italy, according to the company.

“Croatia has two unicorns, us and another company,” Rimac …read more