Category: TECHNOLOGY

India pips North America to become the biggest smartwatch market

India surpassed North America to take the top global spot in the smartwatch market in the quarter that ended in September, according to a report from market research player Counterpoint. The festival sales and proliferation of affordable smartwatches helped grew the local market by 171% year-on-year.

The affordable smartwatch models getting bigger displays and adding features such as Bluetooth calling were key selling factors in India during the festival sales, Hong Kong-headquartered Counterpoint said.

“Indian brands expanding their product portfolios at affordable price points and emphasis on local manufacturing also contributed to the growth,” Counterpoint analyst Anshika Jain said in a statement.

“Bluetooth-calling emerged as an important feature, contributing a 58% share in total shipments, the highest ever share to date. Consumers are also preferring bigger display sizes, which is evident from the fact that over half of the total shipments in Q3 came from the 1.5”-1.69” display size.”

North America, which was the top market from Q4 2020 to Q2 2022, grew 21% year-on-year while China and Europe had a negative growth.

India’s growth meant that the country’s top brand Noise captured third place on overall shipment charts — thanks to a 218% year-on-year growth— only lagging Apple and Samsung.

The smartwatchmaker told TechCrunch that it aims to scale its local production from 50% to 80% by the end of the year. Local rival Fire-Boltt, which was only a percentage behind Noise in the market share, grabbed the fourth place in global rankings.

Apple grew 48% due to stellar sales of the new Apple Watch 8 series, which accounted for 56% of overall sales. Samsung grew 6% year-on-year despite registering a 62% shipping increase from the previous quarter.

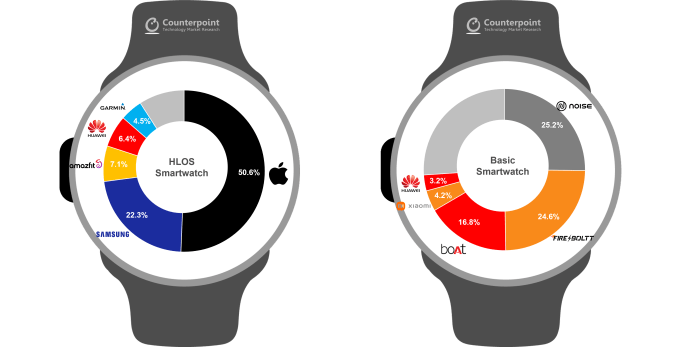

Counterpoint report segregates smartwatches into two categories: High-level operating system smartwatches (HLOS), which include devices from companies like Apple, Samsung, Huawei, Garmin, and Amazfit; and what it calls “basic” smartwatches that feature a lighter operating system and are more affordable. Noise, Fire-Bollt, and BoAT operate in the latter category.

The research shop said that the HLOS segment grew 23%, whereas basic smartwatches grew by more than a double — resulting in commanding a 35% of the market share. Apple currently dominates the HLOS market with about 50% market share whereas Samsung sits second in the chart.

Image Credits: Counterpoint

“This remarkable increase in basic smartwatch shipments shows us that the market base is rapidly expanding toward more accessible segments amid aggressive drives by the supply side. But still, in terms of revenue, the HLOS smartwatch overwhelms the basic smartwatch with a market size of almost 10 times due to its high average selling price (ASP),” Research Analyst Woojin Son said in a statement.

Earlier this month, analyst firm IDC published a report on India’s wearable market, noting that the smartwatch segment grew by 178% with more than 12 million units shipped in the quarter ending September. The report said that this growth could also be attributed to falling smartwatch prices in the region as the average selling price (ASP) dropped from $60 to $41.9 in a year. IDC says that the ASP of basic smartwatches is $27.5 as compared to the $330 ASP of advanced smartwatches. This is an indicator that Indian consumers are likely to go for cheaper alternatives than the Apple Watch or the Samsung Galaxy Watch.

All the India-based smartwatch manufacturers have committed to rapidly increasing their local manufacturing output in the coming months to increase the production rate. This could help them bring down the device prices further and increase shipments to catch up with Samsung and Apple in unit shipments.

India pips North America to become the biggest smartwatch market by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2022/11/30/india-pips-north-america-to-become-the-biggest-smartwatch-market/

Amazon Launches Supply-Chain Software Service

The cloud-based addition to Amazon Web Services aims to help businesses track and manage cargo flows.

China’s Latest Rocket Sends New Crew to Finish Tiangong Space Station

The crew of the Shenzhou-15 spacecraft will conduct scientific experiments and complete the station, marking a feat of China’s space program.

India’s Central Bank to Launch Retail Pilot of Digital Rupee

Digital rupee tokens will be issued in the same denominations as paper currency or coins and users can transact with merchants or other users through a digital wallet issued by participating banks.

Elon Musk’s Neuralink Set to ‘Show and Tell’ Latest Brain-Computer Advances at Event

Startup, which aims to help patients with neurological conditions or others by decoding brain activity with technology, is set to broadcast latest update.

U.S. Is Pushed to Revise EV Subsidy Program

Officials racing to set rules for electric-vehicle subsidies are caught between clean-energy goals and the demands of allies in Europe and Asia.

U.S.-Backed Researchers Use AI to Probe for Weaknesses in Drug Supply Chains

The U.S. Department of Homeland Security has approved research that will use artificial intelligence to delve into drug supply chains and probe for weaknesses, including foreign influence.

South Korean prosecutors seek arrest warrants for Terraform Labs co-founder, investors and engineers

South Korean prosecutors said Wednesday they have requested arrest warrants for eight people related to Terraform Labs for the alleged fraud as the local authorities widen their investigation into the collapse of the TerraUSD and Luna tokens that wiped tens of billions of dollars from the crypto market earlier this year.

The Seoul Southern District Prosecutors Office confirmed to TechCrunch that it is seeking arrest warrants for eight people including Terraform Labs co-founder Daniel Shin, three Terraform investors, and four engineers of the cryptocurrencies TerraUSD (UST) and Luna, but did not disclose the identities of most individuals.

The move comes two months after South Korea issued an arrest warrant for another co-founder, Do Kwon, whose whereabouts are currently unknown, and requested Interpol, the international law enforcement agency, to issue a red notice for Kwon.

The prosecutors suspect Shin of taking illegal profits worth approximately $105 million (140 billion won) by selling Luna at the peak without disclosing properly to investors ahead of the Terra-Luna collapse, according to a local media report Yonhap. Shin is also being charged with using customers’ data from his separate fintech startup Chai to promote Luna, violating the Electric Financial Transaction Act. Local authorities reportedly raided the Chai office in mid-November as part of UST-Luna’s fraud probe.

Shin has refuted the claims of trading Luna at a market high and violating the customers’ data. Shin’s lawyer said today Shin left Terraform two years ago before the Terra-Luna collapse, and that he has no ties with the failure, according to local media.

Terraform was founded in Singapore in 2018 by Do Kwon and Shin. Shin left Terraform in March 2020 to found Chai and stepped down as CEO of Chai earlier this year.

The Seoul Southern District Prosecution confirmed a court is set to hold a hearing to determine the validity of the warrants this Friday, December 2.

Terraform’s UST and Luna fell from grace in early May after the so-called stablecoin depegged from its $1 value, wiping out investors’ $40 billion and prompting an uproar. South Korean prosecutors began the investigation after the crash of the UST-Luna token.

South Korean prosecutors seek arrest warrants for Terraform Labs co-founder, investors and engineers by Kate Park originally published on TechCrunch

Pinterest shuts down its ‘Creator Rewards’ program

Pinterest has shut down its Creator Rewards program that allowed creators to earn money by creating content around monthly prompts and achieving certain engagement goals.

“The Creator Rewards program will end on November 30, 2022. To all the creators who participated, thank you for your partnership. We’re committed to exploring more ways to help you find success on Pinterest and we’re looking forward to finding more opportunities to work together in 2023,” Pinterest said in a note on its creator rewards help page.

The rewards program asked participants to create Idea Pins — a video format introduced by the company last year — based on a monthly theme to earn cash.

The announcement, first reported by The Information, also said that Pinterest will pay a one-time bonus to creators who participated in at least one reward goal for August, September, or October 2022. The company didn’t specify the bonus amount on the Creator Rewards page.

Pinterest said that it is closing this program “in order to focus on other creator programs and features.” Last year, when the company debuted Creator Rewards, it said it planned to invest $20 million in the program. Separately, the company launched a $500,000 Creator Fund last year and injected an additional $1.2 million this year into the project. The social network created this project to help creators from underrepresented communities through cash and ad rewards.

Pinterest is still continuing with programs like the Creator Fund, “shoppable” Idea Pins, and paid partnerships by converting Idea Pins into ads.

Social media companies have been constantly tweaking their creator payment programs in recent times. Last month, Snapchat reduced its payouts to creators from millions of dollars per week to millions of dollars per year. In September, Meta announced that it is closing its Live Shopping program to focus on reels. At the same time, the social media giant also closed its Instagram affiliate program, which allowed creators to get a commission if users purchased tagged products from their posts.

Pinterest shuts down its ‘Creator Rewards’ program by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2022/11/30/pinterest-shuts-down-its-creator-rewards-program/

Disney coughs up $900M to acquire MLB’s remaining stake in BAMTech streaming company

Disney paid $900 million to Major League Baseball (MLB) earlier this month to buy out the league’s remaining 15% stake in the streaming firm BAMTech, according to an SEC filing made public Tuesday.

The transaction makes Disney a 100% owner of the streaming company that powers Disney+ and the firm’s other consumer services.

The SEC filing noted that MLB’s interest in BAMTech was recorded in the entertainment company’s financial statements at $828 million, and in November Disney bought out MLB’s stake for $900 million. Last week, Disney announced that Bob Iger is returning to the company as a CEO to replace Bob Chapek. Since this transaction was undertaken earlier this month, it was probably one of the last big moves by Chapek.

In the filing, Disney said that Iger will “initiate organizational and operating changes within the Company to address the Board’s goals” in the coming months.

MLB founded MLB Advanced Media in 2000 to power its website and online streaming. It spun off the streaming division as BAMTech in 2015. A year later, Disney invested $1 billion for a 33% stake in BAMTech. In 2017, the entertainment conglomerate invested an additional $1.58 billion to acquire 42% more stake. In 2021, the National Hockey League (NHL) sold its 10% stake to Disney for $350 million— propelling Disney’s stake in BAMTech to 85%.

The move comes days before Disney+ is set to launch its ad-supported tier. In Q3 2022, the streaming service registered an increase of 12 million subscribers with a total of 164.2 million subscribers globally.

Disney coughs up $900M to acquire MLB’s remaining stake in BAMTech streaming company by Ivan Mehta originally published on TechCrunch