Category: TECHNOLOGY

Amazon launches ‘Sports Talk’ on Prime Video to give sports fans 12 hours of live daily content

Today, Amazon Prime Video announced the launch of “Amp.

Amazon partnered with production company Embassy Row to bring a programming block that can be an “‘always on’ sports destination for customers,” the company wrote in its announcement.

The new shows include “Bonjour Sports Talk,” which is hosted by sports broadcasters Madelyn Burke and Ben Lyons, plus a guest host that rotates weekly; “The Cari Champion Show,” with former ESPN anchor Cari Champion; “Game Breakers,” with writers and comedians Eitan Levine and Drexton Clemons; “From the Desk of Master T,” with Bleacher Report’s Master Tesfatsion; and “The Power Hour,” with commentator and former tennis player Rennae Stubbs.

There will also be “The Greatest Hour of All Time,” a re-airing of the best hour of the programming from the day, and “The Backup Plan,” with hosts Hana Ostapchuk and Jason Spells catching viewers up to speed with the highlights.

The entire 12-hour programming block will re-air every day from 8 p.m. to 8 a.m. ET. Episodes from the previous week will air throughout the weekend.

As Amazon tries to position itself as the go-to source for streaming live sports, the new shows will join the thousands of live sports events that air annually on Prime Video, including “Thursday Night Football,” which premiered its first exclusive game in September with 15.3 million viewers.

The streaming service also introduced a new interface in July that included a dedicated sports tab for live sports, replays and highlights.

Amazon launches ‘Sports Talk’ on Prime Video to give sports fans 12 hours of live daily content by Lauren Forristal originally published on TechCrunch

Meeting camera startup Owl Labs lands $25M and partnership with HP

Owl Labs, a startup developing a linuep AI-powered meeting hardware, today announced that it raised $25 million in a Series C round led by HP Tech Ventures (HP’s venture capital arm) with participation from Sourcenext, Matrix Partners, Spark Capital and Playground Global. The closing of the tranche marks the start of a strategic partnership with HP, Owl Labs CEO Frank Weishaupt says, which will see HP invest in Owl Labs’ various product offerings while providing sales coverage and outreach with enterprise customers.

HP, notably, recently acquired Poly, which developed a range of video and voice devices and software for virtual conferencing. Weishaupt sees no conflict, arguing that Poly’s products are complementary with Owl Labs’ and show “HP’s commitment to transforming the workplace to a hybrid model.”

“The funding will allow Owl Labs to continue its accelerated growth … Owl Labs will use the investment to support product development and increase global adoption of the company’s products, including the [Owl Labs’] product line,” Weishaupt told TechCrunch in an email interview. “The funding will also be used to expand Owl Labs’ global footprint and deepen go-to-market partnerships starting with a commercial agreement between Owl Labs and HP France, where HP will sell Owl Labs’ products through their local sales team.”

Owl Labs was founded by Mark Schnittman and Max Makeev in 2014, who sought to develop a better videoconferencing experience than cameras at the time could achieve. (Weishaupt, a former CarGurus exec, joined Owl Labs as CEO in early 2019.) Drawing on their work at iRobot, the Schnittman and Schnittman created Owl Labs’ first product, the auto-swiveling Meeting Owl Pro, after testing the concept by putting a laptop on a spinning stool.

Today, Owl Labs sells several products, including a dedicated whiteboard camera, meeting room control console and its latest-generation meeting camera, the Meeting Owl 3. The Meeting Owl 3 features a mic and speaker array paired with a 360-degree camera, which zooms in on whoever’s speaking.

There’s countless “intelligent” meeting cameras on the market, including from heavy hitters like Microsoft and Google. But Weishaupt makes the case that Owl Labs’ software is a differentiator. Called the Owl Intelligence System, it allows customers to connect up to two Meeting Owls to expand their video and audio range and add facial recognition including for masked faces.

“Meeting Owl 3 is the only 360-degree videoconferencing device on the market that can be connected to others to expand reach in larger spaces,” Weishaupt said. ” Owl Labs’ technology learns the space to create a more seamless experience, getting smarter over time.”

Owl Labs got caught in a negative press cycle earlier this year when a security firm, Modzero, uncovered vulnerabilities in several models of the Meeting Owl and whiteboard camera that attackers could’ve exploit to obtain sensitive data. Owl Labs patched the exploit, which doesn’t appear to have majorly dented sales — Weishaupt says that over 130,000 organizations are using Owl Labs products including 84 Fortune 100 companies.

“We can share that we’ve had a solid growth trajectory with more than 3x revenue growth year-over-year and 7x revenue growth since the pandemic began,” Weishaupt said, declining to share more precise revenue figures. “Owl Labs became the first company to build AI-powered, 360-degree video conferencing solutions for hybrid organizations. Owl Labs as a company was hybrid pre-pandemic and are experts at using technology to bridge the gap between remote and in-person work environments.”

To date, Boston-based, over-100-employee Owl Labs has raised $47 million in funding.

Meeting camera startup Owl Labs lands $25M and partnership with HP by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2022/11/14/meeting-camera-startup-owl-labs-lands-25m-and-partnership-with-hp/

Binance’s CEO isn’t sweating the FTX implosion

The crypto market is trying to pick up the pieces after it was thrown into massive disarray last week when the previously third-largest crypto exchange, FTX, imploded and filed for bankruptcy.

“It’s obvious that people are jittery, interested and somewhat nervous about what’s happening in the industry,” Changpeng ‘CZ’ Zhao, CEO of the largest crypto exchange Binance, said during a Twitter Space on Monday. “I want to say, short-term it is painful. But, I think this is good for the industry long-term.”

Zhao acknowledged that a lot of people lost money recently and many still have money stuck with FTX, so “there will be pain.” But he hinted that market conditions should improve down the line.

“The industry is not going away and the other strong industry players are now even stronger,” he said.

Last week, a number of crypto exchanges, including Binance, Crypto.com, KuCoin and OKX said they would begin publishing proof-of-reserves in an effort to reassure customers and investors that their funds are safe in the wake of the FTX debacle. Last week, Zhao emphasized the importance of transparency, tweeting, “All crypto exchanges should do merkle-tree proof-of-reserves.”

Proof-of-reserves (PoR) are independent audits by third parties that aim to provide transparency and evidence that a custodian holds the assets it claims to own on behalf of its clients.

These exchanges join other crypto businesses like Gemini, BitGo, and Paxos, to name a few, which have used PoR for many years to prove billions of dollars in value, Sergey Nazarov, co-founder of Chainlink, told TechCrunch on Friday.

“Now we’re increasing transparency in the industry, we’re increasing security in the industry, and we’re increasing communications with regulators all around the world,” Zhao said today. “I think five years later, when we look back at this, the industry will be stronger.”

Binance’s CEO isn’t sweating the FTX implosion by Jacquelyn Melinek originally published on TechCrunch

https://techcrunch.com/2022/11/14/binances-ceo-isnt-sweating-the-ftx-implosion/

SoftBank writes down nearly $100 million investment in FTX

TechCrunch has reached out to SoftBank for comment on its investment in FTX.

On November 12, Nikkei Asia reported that SoftBank Group had “

As more details emerge regarding the events that led to FTX’s bankruptcy and stunning collapse, the cryptocurrency exchange’s investors are also being scrutinized.

Namely, many people are asking just how could so many high-profile investment firms pour a collective $2 billion with apparently so little due diligence.

The notorious Japanese investment conglomerate SoftBank, for example, is just one of many such firms that backed FTX after the startup raised a $400 million funding round in January, valuing the company at a staggering $32 billion. SoftBank, which invested as part of its Vision Fund 2, revealed days ago that it sunk just under $100 million into the company. That investment is now marked down to zero with SoftBank saying “it would not face a material markdown in the value of its stake,” according to MarketWatch.

Of course it’s not the first time SoftBank has made an, er, error in judgment when it comes to its investment. It (in)famously poured at least $18.5 billion into WeWork, which along with its co-founder Adam Neumann, spectacularly fell from grace.

SoftBank also put money in Katerra, a construction tech startup that also burned through more than $2 billion in funding before shutting down in June 2021. The firm also loaned $100 million to blood testing company Theranos in 2017 through a private equity arm. And it also pumped $500 million into digital mortgage lender Better.com before signing up to co-lead its never materialized SPAC. That company has been the subject of various scandals over the past year and has been struggling in the face of rising mortgage interest rates, a slowed housing market and volatile CEO.

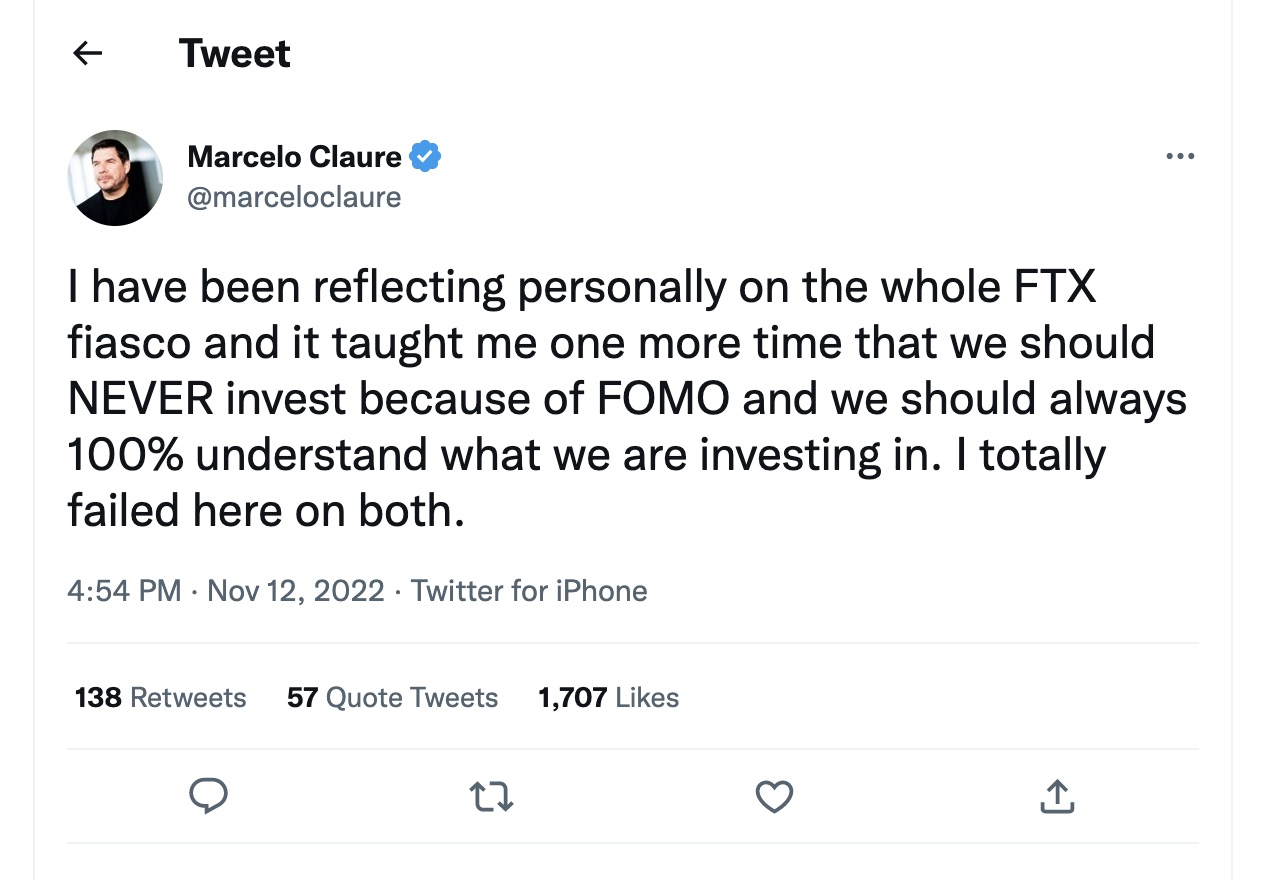

Notably, former SoftBank COO Marcelo Claure, who stepped down in late January after a reported battle over pay, had this to say about the FTX fiasco:

Image Credits: Twitter

TechCrunch has reached out to SoftBank for comment on its investment in FTX.

On November 12, Nikkei Asia reported that SoftBank Group had “lost all the cumulative investment gains it had made through its Vision Fund business as global rate rises and a weakening economic outlook hammered the valuations of portfolio companies.”

The publication went on to add that the “Vision Funds’ unrealized gains since the start of investment in 2017 fell to negative $1.46 billion in the July-September period, down from positive $8.49 billion three months ago, according to its quarterly earnings presentation.”

SoftBank’s disclosure regarding its FTX investment came soon after Sequoia Capital also marked down to zero the value of its stake in FTX — “a stake that accounted for a minor percentage of Sequoia’s capital but as of last week likely represented among the most sizable unrealized gains* in the venture firm’s 50-year history,” as reported by TC’s Connie Loizos on November 9.

But Sequoia had egg on its face for more than just putting capital into FTX. It also very recently (in late September) published on its website what Bloomberg described as a “ long, meandering profile of Sam Bankman-Fried, a.k.a. SBF, the now-disgraced founder of the bankrupt cryptocurrency exchange FTX.” Ironically entitled “Sam Bankman-Fried Has a Savior Complex — And Maybe You Should Too,” the 14,000 (yes, you read that right) piece was apparently “prominently displayed on the Sequoia website, right underneath the dictum, ‘We help the daring build legendary companies,’ ” as reported by Bloomberg. Unsurprisingly, as more details came out around the goings-on within FTX, that piece was taken down. Bankman-Fried stepped down from his role as CEO of FTX on November 10.

The New York Times reported earlier today that “Pantera Capital and Galois became the latest hedge funds to announce losses tied to FTX, $130 million and $40 million, respectively.”

Also among FTX’s long roster of investors are: NEA, IVP, Iconiq Capital, Third Point Ventures, Tiger Global, Altimeter Capital Management, Lux Capital, Mayfield, Insight Partners, Lightspeed Venture Partners, Ribbit Capital, Temasek Holdings, BlackRock and Thoma Bravo.

Got a news tip or inside information about a topic we covered? We’d love to hear from you. You can reach me via Signal or messages at 408.204.3036. Or you can drop us a note at tips@techcrunch.com. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.

SoftBank writes down nearly $100 million investment in FTX by Mary Ann Azevedo originally published on TechCrunch

Disney+ has a new adorable short film for ‘The Mandalorian’ and ‘Spirited Away’ fans

Disney+’s adorable new short film, “Zen – Grogu and Dust Bunnies,” premiered on Saturday, November 12. From Lucasfilm and Japanese animation house Studio Ghibli, the hand-drawn short film will excite many fans as it features Grogu–a.k.a Baby Yoda or The Child–from the “Star Wars” series “The Mandalorian” and the coal dust bunnies from “Spirited Away.”

The streamer released the three-minute movie to celebrate the streaming service’s third birthday and the debut of “The Mandalorian” in 2019.

When “The Mandalorian” first premiered, it quickly became a signature series for Disney+– mostly because viewers were entranced by the cuteness of Grogu. Its second season drew in 14.5 billion minutes of viewership for the year 2020, per Nielsen. The third season of “The Mandalorian” has a February 2023 release date.

In addition to the success of “The Mandalorian,” Miyazaki’s award-winning “Spirited Away” continues to resonate with audiences worldwide.

“Zen – Grogu and Dust Bunnies” is a delightful blend of two titles that many viewers will enjoy.

Zen – Grogu and Dust Bunnies, an Original short, is now streaming on #DisneyPlus. pic.twitter.com/m5SUzxeYuS

— Disney+ (@DisneyPlus) November 12, 2022

Last week, Disney+ reported a total of 164.2 million global subscribers in Q4, an increase of 12 million subscribers from 152.1 million in the third quarter. The company’s large subscriber base is in part due to its many “Star Wars” series like “Andor,” “Obi-Wan Kenobi,” and “The Book of Boba Fett,” among others.

Disney+ recently became the exclusive international home for new episodes of the popular British show “Doctor Who” in 150+ markets, including the U.S.

Disney+ has a new adorable short film for ‘The Mandalorian’ and ‘Spirited Away’ fans by Lauren Forristal originally published on TechCrunch

https://techcrunch.com/2022/11/14/disney-plus-short-film-for-the-mandalorian-and-spirited-away-fans/

The startup and venture markets are coming back to square one

What goes up must come down” is a cliche that is also a bastardization of Newton’s third law. It’s also a good reminder that when it looks like the business market has changed fundamentally, we’re often really just seeing a temporary aberration.

This idiom rings true when we consider the cycle of tech valuations (up and then down), venture capital (up and then down), and the pace at which new unicorns are being minted (also up and then down). These three trends are linked, obviously, but what gave us pause recently was the realization that we haven’t merely seen declines in recent quarters: instead, there’s been a whole-cloth return to pre-COVID norms.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

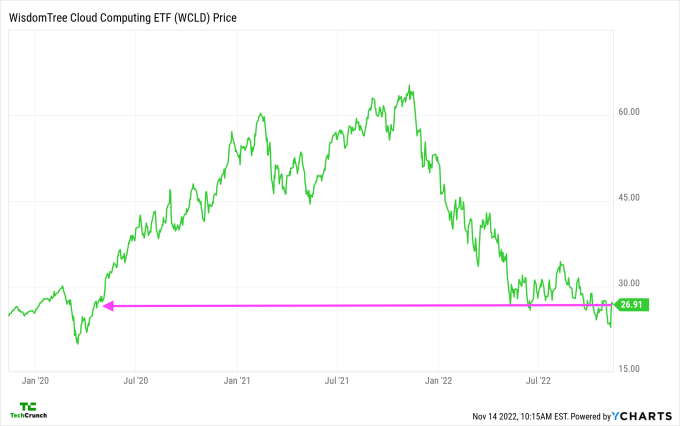

Take tech valuations, for example: It struck us this morning while drafting the weekly kick-off Equity episode that the value of tech stocks — measured through our favorite software-company tracking index — is today trading around the value it had in early 2020, just before and after the massive COVID-induced sell-off hit American stocks:

Please excuse our annotation method — it’s Monday.

It’s clear that the 2020-2021 boom in software valuations was more of an anomaly than a new-normal. Besides, the fact that the companies in the index grew over the last few years but are worth less today implies that they might have been overvalued even pre-COVID. If today’s prices hold up, they will indict not only the excess of the recent past, but the overvaluations of the 2010s as well.

The startup and venture markets are coming back to square one by Alex Wilhelm originally published on TechCrunch

https://techcrunch.com/2022/11/14/the-startup-and-venture-markets-are-coming-back-to-square-one/

Apple faces new lawsuit over its data collection practices in first-party apps, like the App Store

A new lawsuit is taking on Apple’s data collection practices in the wake of a recent report by independent researchers who found Apple was continuing to track consumers in its mobile apps, even when they had explicitly configured their iPhone privacy settings to turn tracking off. In a proposed class action lawsuit, plaintiff Elliot Libman is suing on behalf of himself and other impacted consumers, alleging that Apple’s privacy assurances are in violation of the California Invasion of Privacy Act.

As reported last week by Gizmodo, app developers and independent researchers Tommy Mysk and Talal Haj Bakry discovered that Apple was still collecting data about its users across a number of first-party apps even when users had turned off an iPhone Analytics setting that promises to “disable the sharing of Device Analytics altogether.” In their tests, the researchers examined Apple’s own apps including the App Store, Apple Music, Apple TV, Books and Stocks and found that disabling this setting as well as other privacy controls didn’t impact Apple’s data collection.

The App Store, for example, was continuing to track information like what app users tapped on, what they searched, what ads they saw, how long they looked at a given app’s page, and how the app was discovered, among other things. The app also then sent details that included ID numbers, type of phone, screen resolution, keyboard languages and more — information that could be used in device fingerprinting.

According to Apple’s device settings, if a user turns off either iPhone or iPad Analytics, a message informs the user that Apple will “disable [the sharing of] Device Analytics altogether.” In addition, users are left to believe that Apple would stop collecting their data if they turn off other settings, like “Allow Apps to Request to Track” or “Share [Device] Analtyics.” Despite configuring these privacy controls, the lawsuit states that Apple “continues to record consumers’ app usage, app browsing communications, and personal information in its proprietary Apple apps,” specifically the App Store, Apple Music, Apple TV, Books and Stocks.

The complaint goes on to detail the researchers’ findings, specifying what data was being collected. Stocks, for instance, was tracking users’ watchlists, the names of stocks they viewed and searched for, and news articles they saw in the app and more. And most of the apps shared consistent ID numbers, the suit states, which would allow Apple to track users across its apps.

In light of these new findings, the lawsuit alleges that Apple’s assurances and promises regarding privacy are “utterly false.” It also pointed out that this level of data collection was out of line with standard industry practices as both Google Chrome and Microsoft Edge browser could not collect the same sort of data if their own analytics settings were turned off.

“The data Apple surreptitiously collects is precisely the type of private, personal information consumers wish and expect to protect when they take the steps Apple sets out for users to control the private information Apple collects,” the complaint states. “…There is no justification for Apple’s secret, misleading, and unauthorized recording and collection of consumers’ private communications and app activity.”

The plaintiff is looking to have the lawsuit certified as a class action and is seeking compensatory, statutory, and punitive damages in addition to other equitable monetary relief.

Apple has not responded to a request for comment.

If accurate, this sort of data collection would raise questions about Apple’s implementation of Apple Tracking Transparency (ATT) which Apple said would give users more control over how their app data was used in personalized advertising. As critics have noted, ATT hurt the advertising businesses of major tech companies, like Meta and Snapchat, while Apple’s own advertising market share increased.

A September 2022 report by InMobi’s Appsumer found that Apple’s advertising business had benefitted from the launch of ATT, allowing the Cupertino tech giant to join the Facebook (now Meta)-Google advertising duopoly by growing its adoption by 4 percentage points to reach 94.8% year-over-year, while Facebook’s adoption dropped 3% to 82.8%. Meta, of course, has long argued that Apple’s ATT would cut into its ad revenues, forecasting it would have a $10 billion impact in 2022.

In addition, Apple recently rolled out new ad slots on the App Store to capitalize on its improved stance in the ad industry. Soon, many developers became distressed to find that those ad slots were being sold to gambling app makers and others they felt unsuitable to be marketed alongside their own.

Apple has also been facing increased scrutiny over its practices, following the launch of ATT and the growth of its App Store business, which has given Apple significant power in the app market overall. The company is currently battling Epic Games in a lawsuit over App Store fees and Apple’s alleged antitrust behavior, which has now headed to an appeals court. Plus, the U.S. Department of Justice is said to be in the early stages of drafting an antitrust lawsuit against Apple.

This latest lawsuit, though currently smaller in scope than others, has the potential for larger implications if the researchers’ findings turn out to be correct and are held up in court.

Case 5:22-cv-07069 by TechCrunch on Scribd

Apple faces new lawsuit over its data collection practices in first-party apps, like the App Store by Sarah Perez originally published on TechCrunch

A simple Android lock screen bypass bug landed a researcher $70,000

Google has paid out $70,000 to a security researcher for privately reporting an “accidental” security bug that allowed anyone to unlock Google Pixel phones without knowing its passcode.

The lock screen bypass bug, tracked as CVE-2022-20465, is described as a local escalation of privilege bug because it allows someone, with the device in their hand, to access the device’s data without having to enter the lock screen’s passcode.

Hungary-based researcher David Schütz said the bug was remarkably simple to exploit but took Google about five months to fix.

Schütz discovered anyone with physical access to a Google Pixel phone could swap in their own SIM card and enter its preset recovery code to bypass the Android’s operating system’s lock screen protections. In a blog post about the bug, published now that the bug is fixed, Schütz described how he found the bug accidentally, and reported it to Google’s Android team.

Android lock screens let users set a numerical passcode, password, or a pattern to protect their phone’s data, or these days a fingerprint or face print. Your phone’s SIM card might also have a separate PIN code set to block a thief from ejecting and physically stealing your phone number. But SIM cards have an additional personal unlocking code, or PUK, to reset the SIM card if the user incorrectly enters the PIN code more than three times. PUK codes are fairly easy for device owners to obtain, often printed on the SIM card packaging or directly from the cell carrier’s customer service.

Schütz found that the bug meant that entering a SIM card’s PUK code was enough to trick his fully-patched Pixel 6 phone, and his older Pixel 5, into unlocking his phone and data, without ever visually displaying the lock screen. He warned that other Android devices might also be vulnerable.

Since a malicious actor could bring their own SIM card and its corresponding PUK code, only physical access to the phone is required, he said. “The attacker could just swap the SIM in the victim’s device, and perform the exploit with a SIM card that had a PIN lock and for which the attacker knew the correct PUK code,” said Schütz.

Google can pay security researchers up to $100,000 for privately reporting bugs that could allow someone to bypass the lock screen, since a successful exploit would allow access to a device’s data. The bug bounty rewards are high in part to compete with efforts by companies like Cellebrite and Grayshift, which rely on software exploits to build and sell phone cracking technology to law enforcement agencies. In this case, Google paid Schütz a lesser $70,000 bug bounty reward because while his bug was marked as a duplicate, Google was unable to reproduce — or fix — the bug reported before him.

Google fixed the Android bug in a security update released on November 5, 2022 for devices running Android 10 through Android 13. You can see Schütz exploiting the bug in his video below.

A simple Android lock screen bypass bug landed a researcher $70,000 by Zack Whittaker originally published on TechCrunch

https://techcrunch.com/2022/11/14/android-lock-screen-bypass-google-pixel/

Google’s Health Connect app is now available in beta

Google announced today that its Health Connect app is now available in beta on the Play Store. Health Connect is designed to centralize access to health and fitness data from various eligible apps. Today, more than 10 health and fitness apps are launching integrations with Health Connect, including MyFitnessPal, Oura and Peloton.

The app syncs health and fitness data from eligible platforms and allows other apps to gain access to this data with their consent, while providing centralized privacy controls for users. Developers have previously had to establish multiple API connections to share data between different apps, which limited developers’ data sharing capabilities and made it hard for users to unlock this data for use in different apps.

With Health Connect, developers no longer have to build a whole new integration. Google says building an integration with a new app is as simple as reading in new data from Health Connect.

“For example, Android users will now be able to sync and get credit for their Peloton workouts in apps like Oura, MyFitnessPal, WeightWatchers and Lifesum,” Google said in a blog post. “Now, through a single integration with Health Connect, Peloton Members will have the option to share their workout stats across the ecosystem of apps they use to support their overall wellness.”

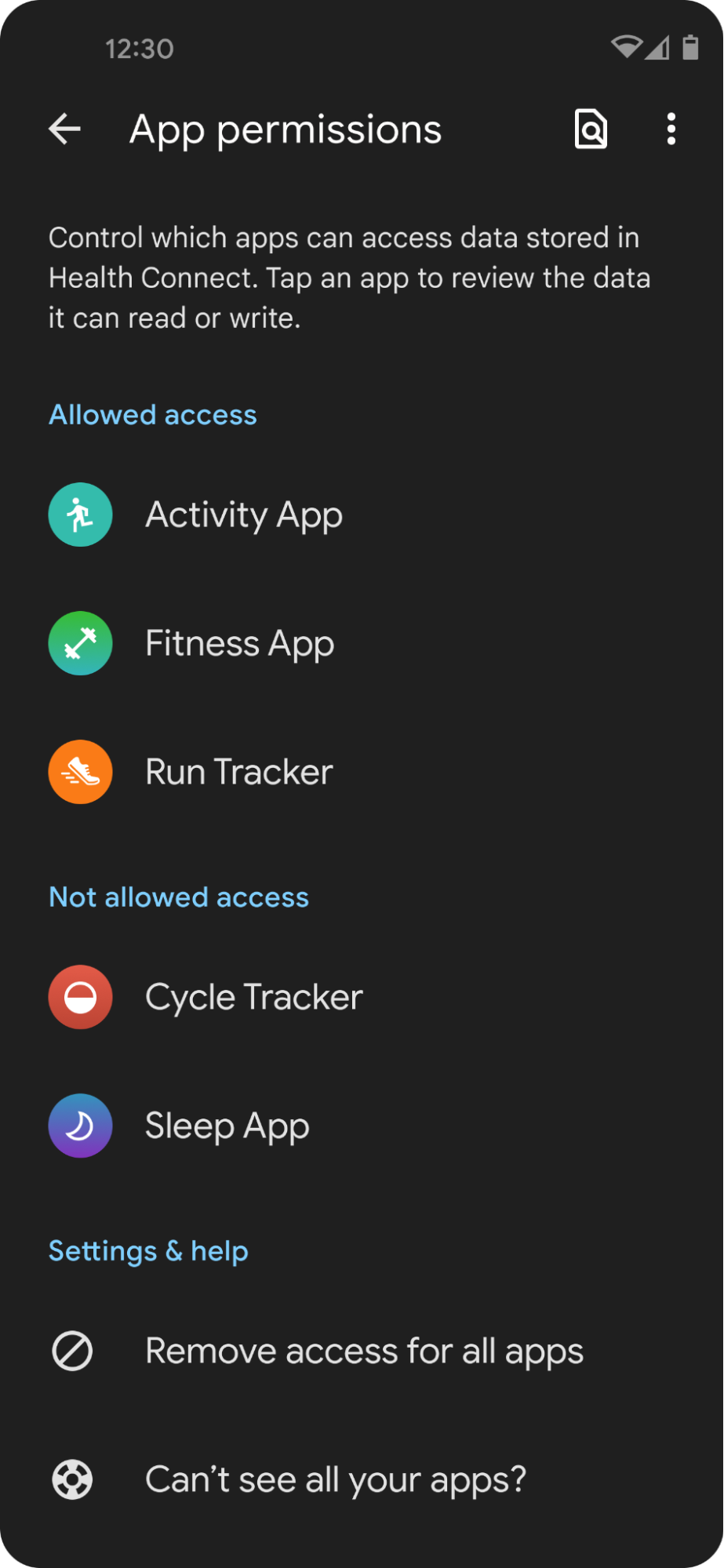

Image Credits: Google

Google says Health Connect provides a standardized data schema that supports 40+ data types across six categories. The schema covers a wide range of use cases, from exercises to sleep tracking to vital signs.

The app not only simplifies app connectivity, but also give users more privacy controls by allowing them to monitor which apps have access to data. In the past, users have had to navigate to multiple apps to manage data permissions and developers had to build out permissions management UIs themselves. Health Connect allows users to manage permissions in a single place. As for developers, Health Connect provides the permissions management hub and granular permissions UIs out of the box.

Google collaborated with Samsung to build Health Connect with the goal of simplifying the connectivity between health and fitness apps. The company first unveiled the initiative earlier this year at its I/O developer conference.

Health Connect is available to download as a public beta via the Google Play Store starting today. Google hasn’t detailed its plans regarding a full public release. At launch, the app has integrations with Fitbit, Samsung Health, Google Fit, MyFitnessPal, Peloton, Oura, WeightWatchers, Flo, Lifesum, Signos, Tonal, Outdooractive and Proov Insight.

Google’s Health Connect app is now available in beta by Aisha Malik originally published on TechCrunch

https://techcrunch.com/2022/11/14/googles-health-connect-app-is-now-available-in-beta/

Faraday Future gets a lifeline to raise up to $350 million

Moribund EV startup Faraday Future could receive up to a $350 million lifeline to help launch its first vehicle, according to a regulatory filing.

The company said Monday it has signed a deal with an affiliate of Yorkville Advisors Global for an equity line of credit up to $350 million. The financing, which entails an initial commitment of $200 million from the New Jersey-based investment firm, will be “key” to producing the company’s long-awaited first model, the FF 91 sports car. As of Monday, Faraday Future had a market cap of $234 million.

“This new financing facility is a key part of our strategy to raise the funds we need to get the FF 91 on the road and in the hands of users as quickly as possible,” Faraday Future CEO Carsten Breitfeld said in a statement.

Faraday has faced numerous challenges in delivering the car to customers, including the removal of founder and former CEO Yueting Jia as an executive officer and investigation by the U.S. Securities and Exchange Commission into charges that Faraday misled investors.

Yorkville has also provided financing for EV startups Canoo and Lordstown Motors.

Faraday Future said the 1,050-horsepower car has a battery range of 350 miles and can accelerate from 0 to 60 mph in less than 2.4 seconds — impressive figures comparable to supercars such as the Rimac Nevera — if the company can deliver on its goal.

“Our FF 91 vehicle program is advancing, and recent testing and validation results have exceeded our targets,” Breitfeld said Monday.

Faraday Future gets a lifeline to raise up to $350 million by Jaclyn Trop originally published on TechCrunch

https://techcrunch.com/2022/11/14/faraday-future-gets-a-lifeline-to-raise-up-to-350-million/