Category: TECHNOLOGY

6 first-time funds see an advantage in entering a downturn without a large portfolio

Who will fare better in the current venture downturn?

Will it be the legacy investors with years of experience amassed through multiple market cycles — but who also have a sizable portfolio to worry about — or the emerging managers who are looking at the market with fresh eyes and a clean slate? We’re about to find out.

Last year saw a record 270 first-time funds close, according to PitchBook data, which means there are almost 300 emerging managers who raised their fund in a bull market and are now deploying it in very different market conditions.

We polled six first-time funds to better understand how this group of investors is navigating the downturn.

Several first-time fund managers, like Giuseppe Stuto, co-founder and managing partner of 186 Ventures, a Boston-based early-stage generalist fund, told TechCrunch that entering the downturn with a very small existing portfolio could serve as a big advantage.

“We don’t carry any of the baggage that may come with having previous funds or having a lot of capital tied up in what seems to be highly overpriced vintages,” Stuto said. “Just like a founder, who looks at the world differently than subject matter experts, we (first-time managers) bring a fresh outlook of how certain problems and industries are developing.”

Leslie Feinzaig, the founder and CEO at Graham & Walker, a fund that backs early-stage digital startups, added that even though she started investing her fund during the bull market last year, focusing on a company’s potential downstream risk was crucial — as a first-time fund manager, she couldn’t jeopardize her budding track record in any way.

“The big advantage is that we don’t have many prior investments that are now high risk, and we don’t need to focus as much of our time on triaging the portfolio,” Feinzaig said. “I can focus almost entirely on the path ahead.”

Because these investors have a smaller garden to tend, as they say, they can focus more on making sure the new companies they add to the portfolio are more resilient against current market trends.

One thing these managers are better equipped to help their portfolio plan for is runway. Stuto said that when 186 Ventures started investing in the fleeting days of the bull market, extension financing wasn’t a big part of the conversation, but now that it is clear that will be a challenge for startups, 186 Ventures plans to focus more on making sure its investments allow for a much longer runway.

“Bridge financing was readily available last year, so it was easy to hand-wave whether you’d be able to attract new investors at a ‘slight’ up round,” he said. “Part of our thesis now is that this bridge financing will likely not be as available, so depending on the industry and who the other financing partners are in the round, we have increased our ‘market readiness’ threshold.”

Ariana Thacker, the founder and solo GP at Conscience VC, agreed and said while she’s still looking for the same kinds of startups, she is definitely …read more

Elon Musk Suggests Big Tesla Factory Expansion Plans

The electric-vehicle maker is likely to need roughly a dozen factories to reach its goal of selling 20 million vehicles annually by 2030, its CEO says. …read more

6 first-time fund managers detail how they’re preparing to thrive during the downturn

Until a few months ago, the venture market was on a historic bull run that lasted for the better part of a decade. Many new investors and funds entered the fray, but the last few years also saw a proliferation of new venture firms. That trend came to a peak in 2021, when 270 first-time funds raised a collective $16.8 billion, according to PitchBook data.

That means there are now nearly 300 firms in the U.S. alone that raised their debut fund in the bull market and are finding themselves operating in very different market conditions today.

Over the past few months, many established investors have been quick to speculate that many of these new funds will struggle as markets worsen, even if they can survive. But these legacy VCs are forgetting that the new entrants don’t have to think about an existing portfolio with dozens of startups before making each decision.

We’re widening our lens, looking for more — and more diverse — investors to include in TechCrunch surveys where we poll top professionals about challenges in their industry.

If you’re an investor who’d like to participate in future surveys, fill out this form.

What’s keeping these first-time fund managers up at night isn’t their chances of survival or if they’ll raise a second fund, but rather how to best manage their time and assets in a seemingly volatile market. “The biggest challenge has been around scaling my team’s time, particularly around managing a growing portfolio at a time when founder support is critical,” said Ariana Thacker, founder of Conscience VC.

Several such investors, like Rex Salisbury, founding partner of Cambrian, said the downturn is actually a good thing for new funds given their long-term goals: “The current macro environment is causing the most pain at the Series B and beyond. But the exit environment that matters to a fund like ours, which is investing very early, is more than seven years in the future,” he said. “So, price compression in the short term, which is just starting to trickle down to the early stages of the venture market, is, if anything, a tailwind.”

That’s not to say these VCs aren’t being cautious about what they’re willing to bet on. “Our process for assessing companies has not changed, but we have certainly recalibrated our compass on assessing the current, instead of the future projected value of the companies we are considering investing in,” said Giuseppe Stuto, co-founder and managing partner, 186 Ventures.

“It makes sense for us to be more thoughtful than we already were with regard to portfolio construction and make sure we are not over-levered in any one vintage or ‘company stage’ pricing, e.g., 2021, pre-product, pre-revenue,” he said.

So how are these first-time fund managers going to fare? TechCrunch+ asked six of them to find out how they’re preparing to tackle this volatile market, how this environment has changed their approach to investments and raising Fund II, the best way to pitch them and more.

We spoke with:

The 5 biggest takeaways from Tesla’s Cyber Roundup

Tesla held its annual shareholder meeting, which the company now refers to as its Cyber Roundup, Thursday at the Tesla Gigafactory Texas.

The Cyber Roundup comes just a couple of weeks after Tesla reported its Q2 earnings, which showed quarterly revenue declines caused by production challenges, even as the company grew year-over-year.

The agenda had 13 shareholder proposals, including one for a three-for-one stock split that appears to have helped push Tesla’s shares up 0.40%.

There were also several proposals geared toward getting Tesla to be more ethically responsible, particularly after a series of lawsuits that have accused the company of sexual, racial and gender harassment in the workplace.

Here are the five key takeaways from the event.

Share split approved

Tesla shareholders approved the three-for-one stock split, which will bring the company’s shares down to the $300 range. It’s not clear when that will take effect, though.

Tesla, ever savvy in how it uses Twitter to affect its stock price, initially tweeted out the news of the shareholder proposal on March 28. Between then and now, Tesla’s stock saw a 20% rally from June lows when the drama of Musk’s proposed Twitter buy was at its peak. Shares rose Thursday in after-hours trading, to $928.55.

Ethical improvements unlikely to pass

Shareholders have called for better reporting and transparency on reporting sexual, racial and gender harassment, as well as on Tesla’s lobbying activities and usage of child labor to mine for battery materials. They have also asked for more diversity on the board to reflect Tesla’s workforce.

While the votes are not yet in, preliminary results suggest Tesla shareholders have voted against all such proposals.

IRL trolling

The 2022 shareholder meeting, the first one in a couple of years at which hundreds of people were able to gather in person, took on a boisterous tone from the outset.

Investors in attendance shouted out encouragement and questions to Musk. They also took their roles as Tesla boosters to a new level. At one point, the crowd laughed at Laura Campos, director of corporate and political accountability at the Nathan Cummings Foundation, as she spoke about her proposal to improve Tesla’s lobbying disclosures, and applauded Tesla’s investor relations head Martin Viecha when he cut her off as her time expired. Sister Dorothy of Sisters of the Good Shepherd was treated with similar derision — the audience laughed and applauded when she ran out of time as she asked the company to improve its reporting on child labor in its cobalt supply chain.

Musk welcomed the cheers, applause and standing ovation, playing up to his biggest supporters — retail investors. He worked the crowd as he usually does, telling the audience that he loved them and they were the “best crowd,” exclaiming statements of grandeur and cracking jokes about his failed Twitter buy.

More gigafactories

Musk teased the idea for another gigafactory location to be chosen later this year. …read more

https://techcrunch.com/2022/08/04/the-5-biggest-takeaways-from-teslas-cyber-roundup/

Beat tomorrow’s deadline and apply to the Startup Battlefield 200

Building a successful startup requires an enormous amount of talent, hard work, money and, frankly, a bit of luck. Translation: You need to grab hold of every opportunity you can to make it happen. Well, heads up, early-stage founders. Your opportunity to join our inaugural cohort — the Startup Battlefield 200 — ends tomorrow.

Don’t miss your chance for a 100% free VIP experience — at TechCrunch Disrupt on October 18–21 in San Francisco — which can help you build better or even launch your startup on a global stage.

Opt for opportunity: Apply to the Startup Battlefield 200 before the deadline expires tomorrow, August 5 at 11:59 p.m. PT.

Why apply? This is the only way early-stage companies can exhibit at TechCrunch Disrupt — a truly amazing experience. The expo floor is prime territory for building brand recognition, acquiring new customers, attracting investor interest and catching media coverage.

Applying is also the only way for any early-stage company to compete in the epic and historically life-altering pitch competition, Startup Battlefield. What could the $100,000 prize do for your startup?

Here’s the deal. TechCrunch is vetting thousands of applications, from which they will choose 200 outstanding early-stage startups to form the SUB 200. Founders of this elite cohort receive free of charge:

- Access to all the Disrupt presentations, breakouts and roundtables

- Exhibition space for all three days of Disrupt

- SBF 200-only masterclasses

- Pitch training with TC staff

- Pitch deck reviews with industry experts

- The opportunity to flash-pitch investors and TechCrunch editors

- Exclusive investor networking opportunities

- Media exposure

- One free year of TechCrunch+ membership

Now, about the pitch competition. TC editors will choose 20 startups from the SUB 200 as Startup Battlefield finalists, and those founders will throw down for a shot at $100,000. Finalist founders will receive private pitch coaching, be featured on TechCrunch and pitch on the Disrupt stage in front of the entire Disrupt audience. The ultimate winner takes home the $100,000 equity-free prize and all the glory.

To be eligible for consideration, your company should:

- Be an early-stage startup

- Have a minimally viable product

- Represent any vertical

- Represent any geography

- Have step-function innovation in your vertical

- Be bootstrapped or have prescale funding (variable by industry)

TechCrunch Disrupt takes place in San Francisco on October 18–20 with an online day on October 21. Grab hold of this awesome opportunity, and apply to TechCrunch Startup Battlefield 200 by tomorrow, August 5 at 11:59 p.m. PT!

Is your company interested in sponsoring or exhibiting at TechCrunch Disrupt 2022? Contact our sponsorship sales team by filling out this form.

https://techcrunch.com/2022/08/04/beat-tomorrows-deadline-and-apply-to-the-startup-battlefield-200/

Former Palantir engineers raise $20M to simplify web3 tooling

Kurtosis, a crypto-focused developer tool system, has raised $20 million in a Series A round led by tech-focused hedge fund Coatue.

Investors in the round include Coinbase Ventures, the Chainsmokers’ Mantis VC and angel investor Olivier Pomel, who is the CEO and founder of Datadog, among others. The round comes about two years after its $2.5 million seed round in August 2020, which was led by Signalfire with participation from Hustlefund, Alchemy Ventures, Figment, and NEAR protocol’s co-founder Ilia Polosukhin.

The two-year-old company was founded by former Palantir engineering leads Galen Marchetti and Kevin Today in hopes to simplify the tools for developers building on web3. It currently provides services for the Ethereum, Avalanche and NEAR ecosystems.

“We needed to raise capital because the company started as just me and my co-founder and the more we learned about the problems people are facing in these [blockchain] environments, the more we realized the software we would have to build as two developers would take us five years, which is way too long,” Marchetti said. “We developed enough conviction that this tool is genuinely useful for the people we’re working with and we want to go faster.”

The fresh capital will be used to hire new engineers and product experts in the developer tooling space so it can release a new product within the next six to 12 months, Marchetti said.

“The biggest demand circles around testing use cases,” Marchetti noted. “A lot of folks want to do more advanced testing that involves shadow forking different types of production systems.” (Shadow forking is having the data that a normal mainnet has, but being able to use it and mess around with the software tools without financial risk.)

A lot of developers today don’t have a private or secure test net environment to build on, Marchetti said. So as a result, many hacks and bugs in the web3 space occur because the production system is poorly put together due to lack of ability to build in an early-stage environment, Marchetti said.

“Developers need a place to play around and see whether their modifications to the system are safe or work,” Marchetti said. “It’s like building an airplane without using an air tunnel on the ground. There’s a bunch of instances where the airplane immediately crashes. It’s the same thing here.”

Long term, Kurtosis plans to continue building tools that simplify engineers’ ability to build on web3, Marchetti said. “I think we’re going to have every organization able to spin up their own test nets and dev nets that are private and they don’t want the outside world to see or a public one with many different forms of them so they can be configured for the exact use case they’re testing for.”

https://techcrunch.com/2022/08/04/former-palantir-engineers-raise-20m-to-simplify-web3-tooling/

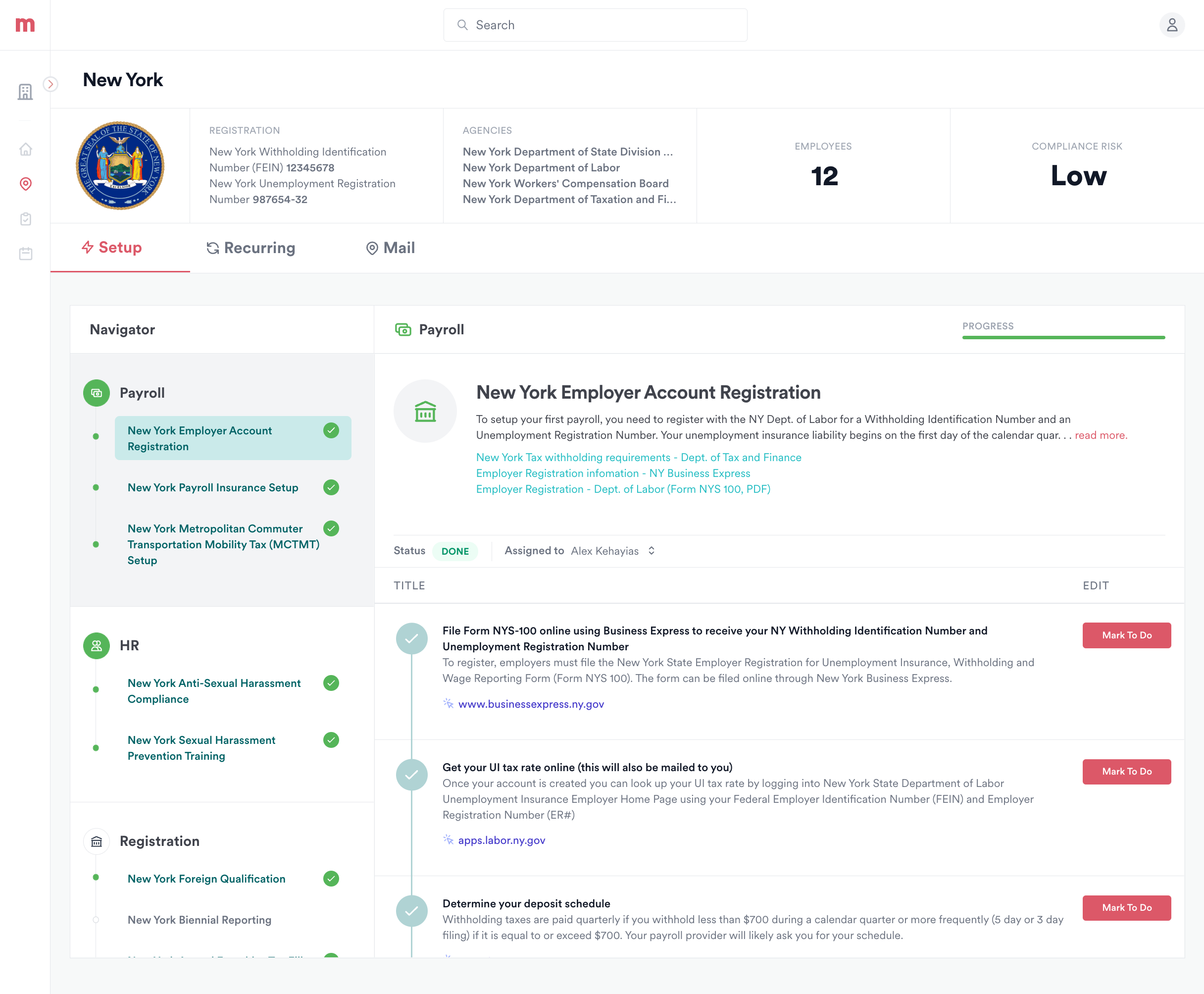

Mosey secures fresh capital to help companies comply with payroll rules

It’s clear that remote and hybrid work are here to stay — the pandemic forever changed the way many companies do business. But it’s introduced roadblocks from an HR perspective. For example, for payroll, businesses with employees in multiple states face barriers to opening the necessary accounts for disbursements. Others — fearful of the consequences from noncompliance — are letting vague regulations dictate day-to-day operations. A recent Deloitte report found that slightly over half of companies won’t permit employees to work in locations in which the company isn’t already established for tax purposes.

There’s no one solution to the perennial challenge of ensuring a company complies with multiple tax and employment laws. But Alex Kehayias makes the case that Mosey, the company he founded in 2021, comes close. Mosey offers customers automation tools designed to help U.S.-based companies hire workers remotely and stay compliant, leveraging a database of reporting requirements for all 50 states.

“Decoupling where we work from where we live is one of the most important problems to solve for the future of work. It has enormous potential to improve access to opportunity, but many businesses currently struggle because multi-state compliance is too difficult,” Kehayias told TechCrunch in an email interview. “Our customers are fast-growing businesses ranging from early-stage startups like Watershed, Mystery, Common Room all the way up to scaling companies such as Coda, ReCharge, Rallybio. Nearly every industry is being transformed by remote work, and our customers are retooling the back office.”

Setting the stage for future growth, Mosey today closed an $18 million Series A round led by Canaan with participation from Gusto, SemperVirens and Charge, bringing the startup’s total raised to $21 million. Kehayias says that the funding will be used to expand Mosey’s team, scale the platform, and establish new partnerships.

Compliance focus

Prior to founding Mosey, Kehayias was a product manager at Morgan Stanley and an engineering manager at Stripe, where he led the new user experience team. While at Stripe, Kehayias built and headed Stripe Atlas, a platform for early-stage startups that — for a fee — tackles bookkeeping blockers, including incorporation and tax filing.

Kehayias notes that most companies rely on a mix of legal, financial and HR consultants to figure out and manage their compliance requirements. This quickly becomes expensive, however, where multiple states are involved. Excepting states that have no income tax, each has its own rules for income tax withholding that companies must navigate. Things get more complicated if employees spend short periods in other states, or if the business is located in a state that implemented a temporary reprieve during the pandemic.

One source pegs the collective cost to corporations of complying with U.S. income taxes at $2 billion.

“The pandemic accelerated the move to remote work, and employee demand for location flexibility has never been higher. Out-of-state hiring increased from 35% before the pandemic to 62% in 2022, and office occupancy rates have stagnated,” Kehayias said. “Yet, the …read more

Kontempo lands fresh capital amid the boom for B2B BNPL

Kontempo, a startup offering buy now, pay later (BNPL) and interest-free installment plans to business-to-business (B2B) customers, today announced that it raised a $30 million seed round in a mix of equity ($6.5 million) and debt ($25 million). CEO and co-founder Matthew Meehan tells TechCrunch that the new cash will be used to hire staff, grow Kontempo’s merchant network and further develop the technology underlying its platform.

While BNPL has gotten a lot of play in the consumer market, with giants like Klarna, Afterpay and Affirm doing their best to corner it, alternative, installment-based payment plans have been slower to penetrate the traditionally conservative enterprise. While most B2B purchases and procurements are spread out over time (e.g, net 30-day terms), the deals aren’t structured in the way consumer-style BNPL plans typically are. High processing fees are frequently involved, with 35% of businesses in an Ardent Partners survey reporting that it costs $8 to process a single supplier payment. And delays are frequent. A separate report found that it takes an average of 30 days to complete a payment and that 47% of suppliers are paid late for their products or services.

Meehan says he and Kontempo’s other co-founders, Antonia Marino and Kwesi Steele, saw an opportunity to address these challenges in a single platform.

“Three important insights garnered from our prior work formed the basis of the rationale for starting Kontempo,” Meehan told TechCrunch in an email interview. “Most companies selling to small- and medium-sized businesses need to offer point of sale financing, or ‘net terms,’ to be competitive. Moreover, there are currently no viable options to outsource this function. Lastly, fast and flexible payment terms at the point of sale lead to higher average order values and higher overall sales — much like with BNPL in the consumer segment.”

Meehan was previously an analyst at Morgan Stanley and an associate at Lehman Brothers before becoming the VP of Latin America trading at Merrill Lynch. Marino was a senior regional operations manager at Uber in Mexico City, while Steele was a senior sales manager at Google.

Kontempo allows sales teams to approve credit for offline or online purchases with net terms of 30, 60, or 90 days. Alternatively or in addition, enterprises can use Kontempo’s API to deploy a BNPL option at checkout that doesn’t require a credit card or bank account information.

Meehan says that, to mitigate risk, Kontempo captures data from merchant partners to feed an algorithm that determines creditworthiness. The algorithm — which takes into account a range of factors that Meehan declined to reveal — allows Kontempo to reach a broader segment of small- and medium-sized enterprises (SMEs) that are typically rejected for credit.

“Kontempo sees an opportunity with its BNPL product to increase the use of digital payments in the B2B space, boost sales for both online and offline distributors and suppliers to SMEs, and be an early mover in building critical payments infrastructure for the still small but fast growing B2B …read more

https://techcrunch.com/2022/08/04/kontempo-lands-fresh-capital-amid-the-boom-for-b2b-bnpl/

European EV rental startup UFODrive launches in San Francisco

UFODrive, an Europe-based electric vehicle rental company, landed in San Francisco on Thursday, marking the startup’s expansion into the U.S.

The startup, which gives users an easy and contact-free way of renting and subscribing to EVs, comes to California at a time when gas prices are still incredibly high at $5.56. While that number has dropped in recent weeks, it’s still cresting the national average. Combine that with an ongoing rental car shortage and a cultural zeitgeist that’s embracing all things electric, and UFODrive has got itself a potentially winning product-market fit.

UFODrive’s U.S. launch follows the company’s rapid growth in 16 cities across Europe, including London, Paris, Berlin, Amsterdam and Dublin since its founding in 2018. The startup is also planning separate launches for New York and Austin in October.

Other companies have cropped up around the world to provide a similar service. For example, Onto and imove provide monthly EV subscriptions in the UK and Norway, respectively. Where UFODrive differs is it offers a combination of classic daily or weekly rentals and monthly subscriptions. That said, the San Francisco launch will initially offer pure rentals.

Bookings can be made on UFODrive’s app, where each customer is guided through the entire process – registration, identity verification, locating the vehicle, damage check, contract signature and driving away, according to Adain McLean, UFODrive’s CEO.

Customers in the Bay Area can visit one of two vehicle bays in downtown San Francisco on either side of Market Street where they can then use the app to be granted keyless access to their vehicle.

UFODrive worked with Inspiration, the EV asset financing firm that supplied New York-based Revel with its own set of Teslas for ride-hailing purposes, to get around 20 Tesla Model 3s and Model Ys on site for the launch. As the startup has done in Europe, UFODrive plans to lead with the dazzle of Tesla for the first locations and expand its range based on customer input and availability, according to McLean, who noted UFODrive is also looking forward to including Ford in that lineup.

In Europe, the fleet is predominantly made up of Tesla Model 3, Model S and Model Y with Volkswagen ID3, ID4, Hyundai Kona EV, Cupra Born, Polestar, and others, said McLean.

A software platform designed to minimize EV angst

Customers can unlock rented electric vehicles via the UFODrive app. Image Credit: UFODrive

“One of our biggest concerns when we started UFODrive was making people comfortable using an EV and minimizing or removing anxiety throughout the rental – not just at pick-up,” McLean told TechCrunch. “From Day 1, our platform was built to identify issues before they happen. The team is notified if a customer hasn’t completed any of the pick-up stages, fails to start the vehicle, is driving with a battery level below 30%, struggling to charge at a station, etc. In those cases, our team can proactively reach out to make sure the customer is ok if they haven’t already reached out to us. As a result we …read more

https://techcrunch.com/2022/08/04/european-ev-rental-startup-ufodrive-launches-in-san-francisco/

Kakao says emoji subscription purchases fell by a third due to Google’s new in-app policy

The number of emoji subscription purchases on the South Korean messaging app KakaoTalk has dropped by a third over the year, parent firm Kakao said in quarterly earnings call Thursday, blaming Google’s new in-app payment policy, which forces apps to use Android-maker’s own billing system.

KakaoTalk’s Emoticon Plus subscription service, which costs approximately $3.8 per month, allows users to access unlimited emojis. TechCrunch reported in June that South Korean app developers and content providers stand to see their paid subscription and service fees rise because of a recent change in Google’s Play marketplace that corners a 15-30% commission fee.

Kakao chief executive Whon Namkoong said that the negative impact of Google’s new billing policy is “inevitable,” adding that the number of KakaoTalk emoji purchases had dropped after Google introduced its new payment policy in June of this year.

“From the users’ perspective, because of Google’s new in-app payment policy, the [digital goods] price hurdle has gone up,” Namkoong said. “As a result, if you look at [KakoTalk’s] Emoticon Plus [subscription] service, the number of new users has gone down to one-third of what we had seen over the year.”

Kakao plans to work on countermeasures to respond to the change, Namkoong said. “We are planning on running a promotion for users, using Google’s in-app payment, and also for our subscribers in order to make sure we minimize the impact from the in-app payment in the second half of the year,” he said.

The U.S. tech giant enforced changes to its in-app payment system this June to charge transactions overflowing from non-game apps and other types of digital goods including over-the-top (OTT), music streaming, web cartoons, digital book apps and more. The non-games apps, prior to the change, were permitted to direct consumers to outside payment sources through in-app links.

Google said earlier this year in a blog post that “all developers selling digital goods and services in their apps are required to use Google Play’s billing system,” and clarified that apps using external payment links will be removed from Google Play Store starting in June to comply with Google’s new payment system.

Kakao runs two businesses: the platform business (Kakao Talk, Kakao Mobility, Kakao Pay) and the content business (Kakao games, Kakao Webtoons and Melon music streaming). The South Korean internet company posted its second-quarter revenue of $1.3 billion (1.82trillion WON), up 34.8% from the same period a year earlier, and a net income of $77.3 million (101.2 billion WON) for the quarter, down 68% from a year earlier.