Category: TECHNOLOGY

L’Attitude Ventures closes on $100M fund to back Latino founders of early-stage startups

Latino founders of early-stage companies based in the U.S. just got a new potential source of capital.

L’Attitude Ventures announced today that it has closed on its first institutional fund, raising more than $100 million from several financial services heavyweights, including a “strategic anchor investment” from JPMorgan Chase.

The San Diego, California-based firm is looking to solely invest in Latina(o)-owned seed to Series A companies with “high growth potential.”

L’Attitude’s decision to only back Latina(o)-owned companies that are based in the U.S., and not those with headquarters in Latin America, stems from the fact that U.S.-based Latinos create 50% of all new employer-based businesses and wield $2.7 trillion in economic power, according to partner Laura Moreno Lucas.

“…And yet they are the most undercapitalized, with less than 2% of VC on early and 1% on late stage,” she added, citing the 2021 Bain Capital Study Report. “So we think that the opportunity is right here at home in the U.S., which we call the New Mainstream Economy.”

Notably, the firm’s partners come from varied — and impressive — backgrounds:

- Managing partner, co-founder and CEO Sol Trujillo is the former CEO of Telstra, Orange SA and US West. He also serves as chairman of L’Attitude LP Trujillo Group, the Latino Donor Collaborative and is a former board member of Bank of America, Pepsi and Target.

- Managing partner, co-founder and president Gary Acosta is co-founder and CEO of the National Association of Hispanic Real Estate Professionals, as well as the founder of several mortgage, real estate and technology companies.

- Managing partner, co-founder and CIO Kennie Blanco is a former portfolio manager at BlackRock and former president of Bay Area Latinos in Finance.

- Partner Oscar Munoz is the former chairman and CEO of United Airlines, and currently sits on the board of directors for CBRE Group Inc. and Univision Holdings Inc., as well as serves as an independent trustee on Fidelity’s Equity & High-Income Funds Board.

- Lucas is founder and CEO of Pandocap, a strategic advisory and media services firm as well as an advisor to 500 Startups. Lucas was previously a managing director at Nasdaq, where she led the IPOs of Beyond Meat, Lyft, The RealReal, Airbnb and other high-profile listings. She also founded and exited Ladada, a fashion subscription startup.

Both Munoz and Lucas joined the firm in early 2022.

In a prepared statement, JPMorgan Chase Chairman and CEO Jamie Dimon said: “Latino-led businesses are critical to the U.S. economy but often lack access to capital and resources for growth…Our investment in L’Attitude Ventures builds on our broader commitment to support U.S. Latino entrepreneurs and small businesses across the country.”

Bank of America and Trujillo Group, a private equity firm focused on real estate investing, were also early “key” investors, the fund said. Other LPs include UC Investments and MassMutual, Barclays, the Royal Bank of Canada, Polaris Limited Partners (Oscar Munoz), Cisco and Nuveen Investments.

L’Attitude’s raised its (drastically smaller) first fund in 2019, closing with $5 million in a capital raise led …read more

Thoma Bravo picks up Ping Identity for $2.8B in an all-cash deal

After a tough few months in the markets for Ping Identity, the enterprise identity management company today announced a big move: private equity firm Thoma Bravo is buying the company and taking it private for $2.8 billion.

The news was announced at the same time that Ping posted its Q2 earnings. The company said it made revenues of $72 million for the quarter, missing analysts’ expectations. (It has cancelled its earnings call in light of the acquisition news.)

Ping is traded on the NYSE (it went public pre-pandemic) and Thoma Bravo will be paying $28.50 per share in an all-cash transaction, which is 63% over Ping Identity’s closing share price on August 2, 2022, the company said.

“This compelling transaction is a testament to Ping Identity’s leading enterprise identity solutions, our talented team, and our outstanding customers and partners,” said Andre Durand, Ping Identity’s CEO, in a statement. “Identity security and frictionless user experiences have become essential in the digital-first economy and Ping Identity is better positioned than ever to capitalize on the growing demand from modern enterprises for robust security solutions. We are pleased to partner with Thoma Bravo, which has a strong track record of investing in high-growth cloud software security businesses and supporting companies with initiatives to turbocharge innovation and open new markets.”

This is actually the second time that Ping has bounced into the hands of a PE firm. Prior to going public, it was majority-owned by Vista Equity. Vista retained a share of the company, currently 9.7% of its outstanding shares.

Thoma Bravo has been one of the group of PE firms that has been aggressively scooping up tech companies in recent months capitalizing on the current climate. Companies that are targets have included those that have been struggling to perform well in the public markets; those finding it a challenge to scale and raise money in later-stage rounds; and those that had been planning to go public but have not been able to due to market conditions and the general cool state of the IPO market. Other major enterprise IT deals Thoma Bravo has been involved in have included buying SailPoint for $6.9 billion and Anaplan for $10.7 billion.

Identity management remains a very hot area in the world of enterprise IT, given the increasing number of cyber attacks and breaches that started by hackers maliciously entering networks through credential stuffing and other tactics that leverage weaknesses in log-in procedures.

Ping missed analysts’ estimates at a time when a lot of other technology companies are struggling to meet numbers — a collective sign of a wider downturn in the market, and of the pressure it is piling on software companies, with SaaS companies in particular facing particular volatility.

All the same, Ping is showing some growth. It noted that in the quarter that ended June 30, it had annual recurring revenues of $341 million, up 22% versus the same quarter a year ago, …read more

https://techcrunch.com/2022/08/03/thoma-bravo-picks-up-ping-identity-for-2-8b-in-an-all-cash-deal/

India withdraws personal data protection bill that alarmed tech giants

The Indian government is withdrawing its long-awaited Personal Data Protection Bill that drew scrutiny from several privacy advocates and tech giants who feared the legislation could restrict how they managed sensitive information while giving government broad powers to access it.

The move comes as a surprise as lawmakers had indicated recently that the bill, unveiled in 2019, could see the “light of the day” soon. New Delhi received dozen of amendments and recommendations from a Joint Committee of Parliament that “identified many issues that were relevant but beyond the scope of a modern digital privacy law,” said India’s Junior IT Minister Rajeev Chandrasekhar.

The government will now work on a “comprehensive legal framework” and present a new bill, he added.

The Personal Data Protection Bill sought to empower Indian citizens with rights relating to their data. India, the world’s second largest internet market, has seen an explosion of personal data in the past decade as hundreds of citizens came online for the first time and started consuming scores of apps. But there has been uncertainty on how much power the individuals, private companies and government agencies have over it.

“The Personal Data Protection Bill, 2019 was deliberated in great detail by the Joint Committee of Parliament 81 amendments were proposed and 12 recommendations were made towards comprehensive legal framework on digital ecosystem. Considering the report of the JCP, a comprehensive legal framework is being worked upon. Hence, in the circumstances, it is proposed to withdraw. The Personal Data Protection Bill, 2019′ and present a new bill that fits into the comprehensive legal framework,” India’s IT Minister Ashwini Vaishnaw said in a written statement Wednesday.

The bill drew criticism from many industry stakeholders. New Delhi-based privacy advocacy group Internet Freedom Foundation said the bill “provides large exemptions to government departments, prioritises the interests of big corporations, and does not adequately respect your fundamental right to privacy.”

Meta, Google and Amazon were some of the companies that had expressed concerns about some of the recommendations by the joint parliamentary committee on the proposed bill.

The bill also mandated that companies may only store certain categories of “sensitive” and “critical” data including financial, health and biometric information in India.

“I hope that the bill isn’t junked altogether, given all the work that went into it. Junking the bill altogether will create a limbo of sorts from a privacy protection standpoint. Nobody wants that,” said Nikhil Pahwa, the editor of MediaNama, which covers policy and media, in a series of posts on Twitter.

“The new bill should be put up for public consultation. Government should realise that civil society and wider industry participation helps improve laws and rules. The JPC didn’t involve many key civil society stakeholders. Govt has already made a mess with IT Rules 2021 and CERT-in directions. It needs to be reasonable with regulations else this will hurt India’s digital future.”

https://techcrunch.com/2022/08/03/india-government-to-withdraw-personal-data-protection-bill/

This is how edited tweets might look when embedded elsewhere

While Twitter hasn’t officially released its much-anticipated edit tweet feature yet, one lingering question has been how they would look as embeds on other sites. Would they dynamically change when edited on Twitter, or would they remain as they were when created? OR would Twitter introduce something radical alongside or instead of either of those options? Given how often tweets get embedded elsewhere, the answer to this question takes on nearly philosophical proportions.

Well, we now have an idea about how edited tweets might look like when a site embeds them, thanks to app researcher Jane Manchun Wong.

According to screenshots she posted this week, embedded tweets will have markers indicating if the author has edited the tweet after the site posted it, keeping the original text intact.

Wong presented a couple of scenarios about how embeds and the edit tweet function will work with each other. The first scenario shows a site embedding an already-edited tweet with the timestamp of the last edit. The second scenario shows a tweet that’s been edited after the site embedded it; the original version will show a “There’s a new version of the tweet” label under the edited tweet with a link to redirect readers to the latest version — on Twitter itself.

Embedded Tweets will show whether it’s been edited, or whether there’s a new version of the Tweet

When a site embeds a Tweet and it gets edited, the embed doesn’t just show the new version (replacing the old one). Instead, it shows an indicator there’s a new version pic.twitter.com/mAz5tOiyOl

— Jane Manchun Wong (@wongmjane) August 1, 2022

Embeds are important because they give users a chance to interact with Twitter even if they are not registered on the site. Plus, a lot of news reports rely on tweets, and if the content represented in a tweet changes, it might affect the whole story. Twitter has struggled with the formatting of embedded tweets that were removed after they were posted on a site. Earlier this year, it started showing a blank tweet embed box instead of blockquote when an embedded tweet was removed. The company said this change was to respect the author’s wish to remove, and it is working on showing a better message instead of a blank box for deleted tweets.

Hey Kevin! We’re doing this to better respect when people have chosen to delete their Tweets. Very soon it’ll have better messaging that explains why the content is no longer available 🙂 my DMs are open if you’d like to chat more about this

— Eleanor Harding (@tweetanor) March 29, 2022

This would be helpful for news sites, giving them a trail, and a record, of what an account or a person originally said even if the tweet is edited later.

Regardless of how embedded tweets might look, in another edit tweet-related find, reverse engineer Nima Owji discovered that Twitter appears to be working on limited functionality for …read more

https://techcrunch.com/2022/08/03/this-is-how-edited-tweets-might-look-when-embedded-elsewhere/

Braxia buys KetaMD to get into remote-delivered ketamine treatments

Braxia Scientific is a Toronto-based company that focuses on depression, suicidality and related mental health conditions. Today, the company announced it is buying KetaMD to extend its telehealth prowess and in particular to expand its tech-facilitated ketamine-based treatments from its current local market of Florida into the wider U.S. The deal is worth around $6 million, the company told TechCrunch.

KetaMD’s telemedicine platform provides access to affordable at-home ketamine treatments for people suffering from anxiety, depression and related mental health conditions. The company’s treatments are medically supervised, guided virtually by registered nurses with mental health expertise, and backed by psychiatrists and depression researchers. KetaMD’s integration of ketamine and telemedicine is guided by best practices and treatment guidance.

With the acquisition of KetaMD, Braxia provides a compelling and differentiated value proposition. KetaMD’s innovative technology capabilities provide Braxia the logistics and know-how to offer patient-centric treatments, both in-person and delivered through digital telehealth.

“Today marks a notable step forward in bringing awareness, accessibility and scalability of the benefits of ketamine and psychedelics generally for those suffering from depression and other mood disorders,” Dr. Roger McIntyre, CEO, Braxia Scientific said in a statement to TechCrunch. “We’ve seen improved outcomes firsthand from ketamine treatment in our clinics and in our clinical trials. Adding digital telehealth capabilities through KetaMD’s highly anticipated online and mobile platform strengthens our position to lead the medical use of evidence-based psychedelics, while accelerating our ability to get treatment to those in need, safely and quickly across the U.S. and Canada, and globally in the future.”

KetaMD is currently available in the state of Florida, but a roll-out to other key states is planned. Specifically, the company is gearing up to launch its offering in California, New York, Texas, Colorado and Washington this year, and plans to continue to expand throughout the United States. The KetaMD brand will remain as a standalone brand under the Braxia umbrella.

Under the terms of the share purchase agreement, Braxia acquired 100% of the common stock of KetaMD in exchange for 42 million Braxia common shares. After market close, Braxia shares were trading at around $0.049 per share, so the deal is worth around $2 million, plus an additional $1 million or so worth of “Earnout Shares” in five years based on certain performance targets. The somewhat complex deal is worth a max total of $6.3 million, the company notes.

Google now lets merchants add an ‘Asian-owned’ label to their profiles on Maps and Search

Google announced today that it’s adding a new label on Maps and Search that will allow people to identify their business as being Asian-owned. The new label is now available to merchants in the United States with a verified business profile on Google. Once a business adds the label on their Business Profile, users will be able to see the attribute on Search on Maps.

Today’s update builds on the Black-owned, Latino-owned, veteran-owned, women-owned and LGBTQ+ owned business attributes that Google already offers. The company says the new label is another way people can support a diversity of businesses across its products.

On a support page, Google notes that self-identification is optional and is currently only available to retailers based in the United States. Customers are able to filter for businesses using the identity attributes. Merchants can add labels to their business profile by logging into their Merchant Center and navigating to the “Business information” page. From there, you need to find the “About your business” tab and scroll down to the “Business identity attributes.” You can then click the toggle button next to the identity you want to add.

“It’s our hope the Asian-owned attribute brings people together and provides our communities with much-needed recognition: to help them be seen and thrive,” said Leanne Luce, a product manager at Google, in a blog post. “We are excited to spotlight Asian-owned businesses and highlight part of what makes our community unique and important.”

Google says it’s also committed to building up Asian-owned businesses’ digital skills. The company has partnered with the US Pan Asian American Chamber of Commerce (USPAACC) to help Asian-owned small businesses grow over the past few years and has helped more than 20,000 Asian-owned businesses. Today, Google is expanding this partnership to help an additional 10,000 Asian-owned small businesses gain digital skills to help them grow their businesses.

https://techcrunch.com/2022/08/03/google-asian-owned-label-profiles-maps-search/

ZayZoon charges employees $5 to get paid sooner

In spite of the so-called Great Resignation, wages haven’t risen as dramatically as some economists anticipated. About 41% of workers recently surveyed by Willis Towers Watson say that they’re living paycheck to paycheck, while the Bureau of Economic Advisers reports that personal savings rates reached a seven-year low in April — reflecting the dire financial situation many workers find themselves in.

Tate Hackert, the CEO of Calgary-based ZayZoon, asserts inflexible pay schedules are a major contributor to the inequity. That’s one of the reasons he founded ZayZoon, he says — so that workers can access pay when bills come due rather than on a fixed schedule.

To grow the business, ZayZoon today closed a $12.5 million funding round co-led by Carpe Diem Investments and Alpenglow Capital with participation from InterGen Capital, Prairie Merchant Corporation, and several angel investors. Alongside a $13 million loan from ATB Financial, the proceeds bring ZayZoon’s total raised capital to date to $25 million.

“Saving every penny I made, at the age of 16, I provided mortgage financing to a family friend in return for interest payments,” Hackert told TechCrunch in an email interview. “The same patterns emerged — people with relatively [good] incomes that needed a small amount of capital for a small amount of time just to get by … I sought out to create a product that could help employees in their most vulnerable moments, while staying socially responsible and true to a mission of improving their overall financial health.”

ZayZoon’s platform allows small- and medium-sized businesses to implement what’s known as an earned wage access (EWA) program. EWA gives employees access to some of their accrued wages before the end of their payroll cycle. Workers still receive the entirety of their paycheck at the end of each cycle. However, the advancements made are subtracted from the direct deposit account.

ZayZoon funds early wage requests itself to mitigate risk on the employer side. The service is free for companies to use, but ZayZoon charges workers a $5 fee to choose how much of their wages they’d like to access (up to $200). Companies can opt — but aren’t required — to subsidize the benefit.

Funding requests are disbursed “within minutes” to employees’ accounts, or workers can sign up for a ZayZoon-branded Visa card that acts like a prepaid debit card. Whether or not they decide to go the prepaid route, workers can link ZayZoon to their bank accounts for spending insights in addition to alerts of overdraft and minimum account balance fees.

“Employers assume implementing an EWA program takes immense effort, but ZayZoon can fully activate a business in less than 1 hour, with the majority taking less than a few minutes,” Hackert said. “Over 3,000 businesses offer ZayZoon to their staff today … Depending on the industry and employee demographics, it’s typical for a business that rolls out ZayZoon to have 25% to 45% of their workforce accessing ZayZoon regularly.”

ZayZoon claims that Sonic, McDonald’s, Domino’s, and Hilton franchisees are among its customers.

ZayZoon …read more

https://techcrunch.com/2022/08/03/zayzoon-charges-employees-5-to-get-paid-sooner/

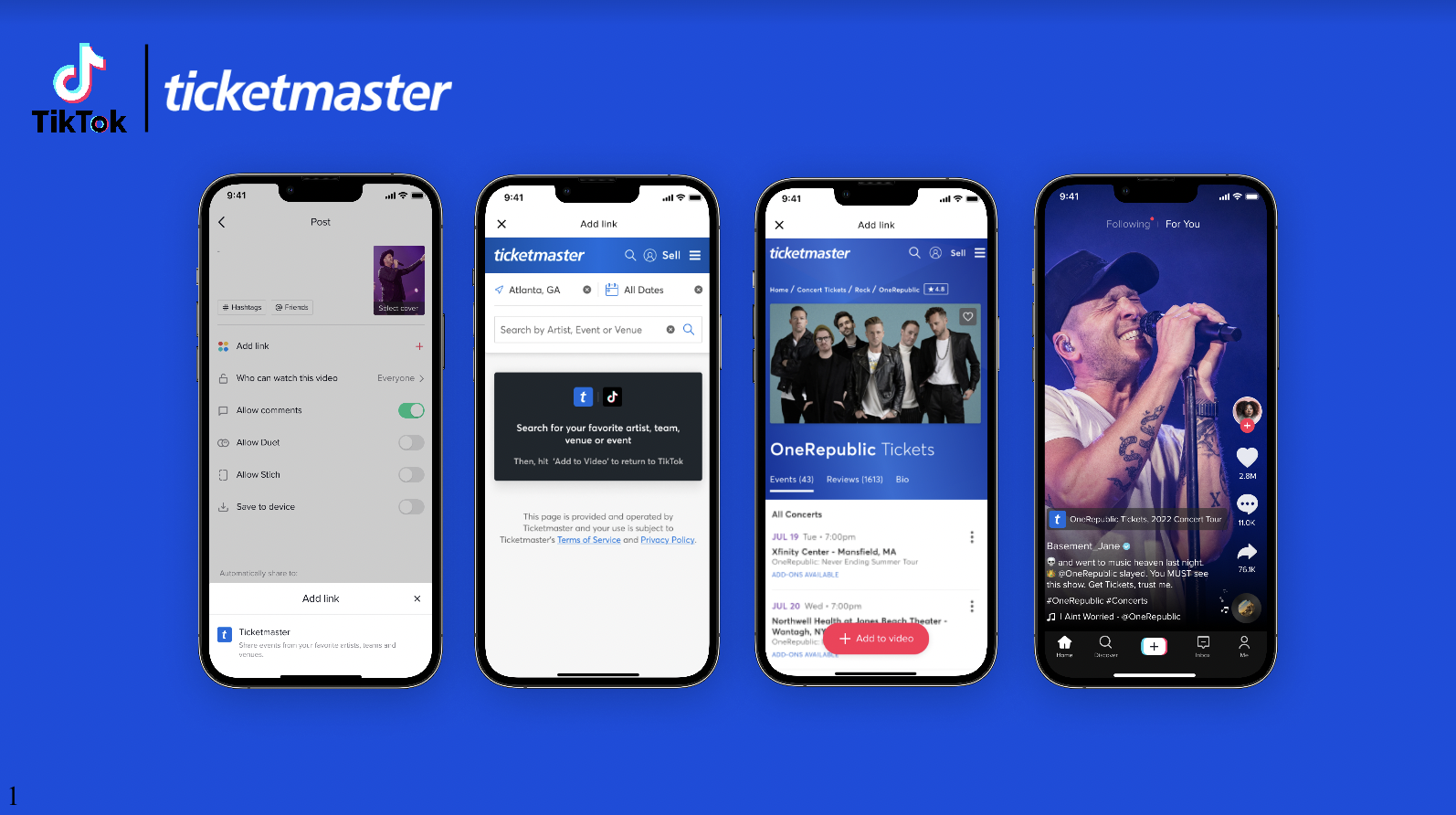

Ticketmaster, TikTok partner to give users a new way to discover and purchase event tickets

Ticketmaster and TikTok are partnering to launch an in-app feature that lets users discover events through the popular short-form video app. With this new partnership, TikTok users will be able to buy tickets for events they’re interested in directly through TikTok. Creators can now search for relevant Ticketmaster events and add destination links to their videos. Ticketmaster says the new feature will only be available to select creators at launch and will scale to more users over time.

Eligible creators can now select the “Add link” option after tapping and selecting the new Ticketmaster option before posting a video. Creators can then search for any event on Ticketmaster and then select “Add to video” to add the link. Once creators share their video, it will display the event link on the bottom-left to allow viewers to click and purchase tickets via an in-app browser.

Image Credits: Ticketmaster

Ticketmaster says it wants to reach fans on the platforms they use the most, which includes TikTok. The company also says the partnership will empower event organizers and creators to reach ticket buyers in a new way. Many artists and personalities have already signed on to begin using the ticketing mini app including Demi Lovato, OneRepublic, Usher, the Backstreet Boys, WWE and more, Ticketmaster says.

Ticketmaster’s partnership with TikTok comes five months after it launched a new way for users to discover live entertainment events on Snapchat. The feature matches users with events they might be interested in based on their preferences. If you find something you’re interested in, you can see if your friends have matched the same event. Once you’ve decided on an event, you’re redirected to Ticketmaster’s website to purchase tickets.

The company’s partnership with TikTok is part of its mission to continually improve how fans discover events on the platforms they interact with the most. Ticketmaster’s partnerships with TikTok and Snapchat show that it’s looking to find ways to reach younger users and get them interested in events they may have otherwise not known about.

https://techcrunch.com/2022/08/03/ticketmaster-tiktok-partnership/

Thousands of Solana wallets drained in multimillion dollar exploit

Solana, an increasingly popular blockchain known for its speedy transactions, has become the target of the crypto sphere’s latest hack after users reported that funds have been drained from internet-connected “hot” wallets.

An unknown actor drained funds from 7,767 wallets on the Solana network as of 5am UTC on Wednesday, Solana’s Status Twitter account said. However, blockchain security firm SlowMist’s crypto tracker identified that more than 8,000 wallets had been drained. It’s estimated the loss so far is around $8 million.

The attack – which has only affected only “hot” wallets or wallets that are always connected to the internet, allowing people to store and send tokens easily – does not appear to be limited to Solana. Justin Barlow, an investor at Solana Ventures, reported that his USDC balance was drained as well. Crypto analyst @0xfoobar confirmed that “the attacker is stealing both native tokens (SOL) and SPL tokens (USDC)… affecting wallets that have been inactive for less than 6 months.”

The attack has compromised other wallets including Phantom, Slope, Solflare, and TrustWallet. Wallets drained should be treated as compromised and abandoned, Solana warned as it encouraged users to switch to hardware or “cold” wallets.

Phantom, a fast-growing Solana-based wallet that hit $1.2 billion in valuation in January, said it’s “working closely with other teams to get to the bottom of a reported vulnerability in the Solana ecosystem.”

“At this time, the team does not believe this is a Phantom-specific issue,” the wallet developer says.

Slope added that it is “actively working to sort out the issue as rapidly as possible and rectify best we can”, while non-fungible token (NFT) marketplace Magic Eden called on users to revoke permissions for any suspicious links in their Phantom wallets.

The cause of the attack remains unclear, but industry leaders including Emin Gün Sirer, founder of another popular blockchain Avalanche, pointed out that the transactions were properly signed, which means the vulnerability could be a “supply chain attack” that manages to steal users’ private keys. @0xfoobar added that “it’s likely something has caused widespread private key compromise”, and warned that revoking wallet approvals will probably not help.

Solana spokesperson Chris Kraeuter declined to answer our questions but referred us to Solana’s Status Twitter account, which states that the company’s engineers “are currently working with multiple security researchers and ecosystem teams to identify the root cause of the exploit, which is unknown at this time.”

The Solana attack comes just hours after malicious actors abused a “chaotic” security exploit to steal almost $200 million in digital assets from cross-chain messaging protocol Nomad. The “free-for-all” attack, which saw more than 41 addresses drain $152 million — 80% of the stolen funds – was made possible by a recent update to one of Nomad’s smart contracts that made it easy for users to spoof transactions.

This is a developing story.

Ulta Beauty launches a fund, showcasing the resilience of corporate venture capital

Over the past few years, corporate venture capital investors have solidified their stature as a reliable source of VC funding. The number of companies launching investment arms has exploded, and the amount of new funds has continued to rise despite the current market volatility.

Ulta Beauty, the largest chain of beauty stores in the U.S., became the latest company to launch a venture arm this week. Prisma Ventures will tap a $20 million fund to back early-stage companies that have the potential to improve the online or in-store shopping experience for Ulta customers. Ulta chief digital officer Prama Bhatt said that after years of developing technology internally, a venture fund seemed like the next step to foster innovation at the company.

“If we think about our purpose, which is to shape the future of the beauty landscape, it seems appropriate to continue that vision by working with startups,” Bhatt told TechCrunch.

Ulta is just the latest corporate venture fund to launch this year. Consumer-focused companies including The Home Depot and Chipotle also announced funds this year, while corporations ranging from drug wholesaler AmerisourceBergen to defense consulting firm Booz Allen Hamilton also debuted funds. Just these four funds bring $450 million to the table.