Category: TECHNOLOGY

FTC slams Opendoor with $62M settlement over false advertising claims

Opendoor has agreed to pay $62 million to settle charges by the Federal Trade Commission, which says the company’s claims that it helps people make more money by selling their house to the company rather than listing it on the open market were deceptive.

For years, the real estate technology company has touted itself as using its pricing technology to provide “more accurate offers and lower costs,” said the FTC. Such “iBuyers” use this method to make quick offers on homes, with enthusiastic claims that sellers would make thousands of dollars more than they would on the open market.

But according to the FTC, that wasn’t true.

The commission alleges that not only were Opendoor’s offers lower than a home’s market value, but also that the company actually asked sellers to fork out more for home repair costs “that were higher than what people would typically spend on repairs in a market sale.”

The FTC says it will use the $62 million settlement to provide refunds to people who were affected.

Opendoor addressed the situation in a written statement:

While we strongly disagree with the FTC’s allegations, our decision to settle with the Commission will allow us to resolve the matter and focus on helping consumers buy, sell and move with simplicity, certainty and speed.

Importantly, the allegations raised by the FTC are related to activity that occurred between 2017 and 2019 and target marketing messages the company modified years ago. We are pleased to put this matter behind us and look forward to continuing to provide consumers with a modern real estate experience.

The agreement is a blow not only to Opendoor, but also to the whole iBuying industry, which for years has operated based on similar claims. There are a number of competitors to Opendoor — including incumbent channels that involve traditional agents, as well as others like Compass and Redfin (which, combined, laid off over 900 workers earlier this year) — that are also trying to change up the old way of doing things. Startups all over the world often promote themselves as the “Opendoor for ___.”

Whether or not the full settlement amount will be paid depends on the matter being enforced by the Department of Justice, which is responsible for collecting on behalf of the FTC in these matters — as sometimes penalties go unpaid or are vastly reduced.

For its part, Opendoor went public in late December 2020 after completing its planned merger with the SPAC Social Capital Hedosophia Holdings II, headed by investor Chamath Palihapitiya. The eight-year-old company first offered its stock to the public at $31.47 per share. Today, shares were trading at $4.78 after hours, only slightly higher than the company’s 52-week low of $4.30. This means that the company is valued at just under $3 billion, down from a valuation of $8 billion in 2021.

When it comes to venture capital, Opendoor last raised $300 million at …read more

Hackers stole passwords for accessing 140,000 payment terminals

Hackers had access to dashboards used to remotely manage and control thousands of credit card payment terminals manufactured by digital payments giant Wiseasy, a cybersecurity startup told TechCrunch.

Wiseasy is a brand you might not have heard of, but it’s a popular Android-based payment terminal maker used in restaurants, hotels, retail outlets and schools across the Asia-Pacific region. Through its Wisecloud cloud service, Wiseeasy can remotely manage, configure and update customer terminals over the internet.

But Wiseasy employee passwords used for accessing Wiseasy’s cloud dashboards — including an “admin” account — were found on a dark web marketplace actively used by cybercriminals, according to the startup.

Youssef Mohamed, chief technology officer at pen-testing and dark web monitoring startup Buguard, told TechCrunch that the passwords were stolen by malware on the employee’s computers. Mohamed said two cloud dashboards were exposed, but neither were protected with basic security features, like two-factor authentication, and allowed hackers to access nearly 140,000 Wiseasy payment terminals around the world.

Payment systems are frequently targeted by financially driven hackers with the aim of skimming credit card numbers for committing fraud.

Buguard said it first contacted Wiseasy about the compromised dashboards in early July, but efforts to disclose the compromise were met with meetings with executives that were later canceled without warning, and according to Mohamed, the company declined to say if or when the cloud dashboards would be secured.

Screenshots of the dashboards seen by TechCrunch show an “admin” user with remote access to Wiseasy payment terminals, including the ability to lock the device and remotely install and remove apps. The dashboard also allowed anyone to view names, phone numbers, email addresses and access permissions for Wiseasy dashboard users, including the ability to add new users.

Another dashboard view also shows the Wi-Fi name and plaintext password of the network that payment terminals are connected to.

Mohamed said anyone with access to the dashboards could control Wiseasy payment terminals and make configuration changes.

When reached by TechCrunch, Wiseasy chief executive Jason Wang would not comment. In a separate email from Wiseasy spokesperson Ocean An, the company confirmed that the issues were remediated and that it had added two-factor authentication to the dashboards.

It’s not clear if the company plans to notify its customers of the security lapse.

https://techcrunch.com/2022/08/01/wiseasy-android-payment-passwords/

Pinterest Reports Lowest Revenue Growth in Two Years

Pinterest joins the expanding ranks of tech companies that are trying to keep a tighter control on some spending and has moved to slow the pace of hiring significantly. …read more

Amazon Prime Video launches localized services for top three markets in Southeast Asia

Amazon Prime Video today launched localized versions of its streaming service in Southeast Asia’s biggest markets — Indonesia, Thailand and The Philippines. The company is attempting to boost its subscriber base in the three markets by increasing its investment in local production, releasing original slates for each territory and giving customers special offers like seven-day free trials and discounts.

“We’re delighted to be increasing our investment in Prime Video for customers in Southeast Asia, making it a truly localized experience — from local content specifically sourced for our customers to a localized user experience and the first full-scale local marketing campaign,” Josh McIvor, director of International Expansion, Prime Video, said in an official statement. “Our support of local production companies in Southeast Asia is a significant step toward our broader international expansion plans and our ambition to become the most local of global streaming services.”

Prime Video has been available in Southeast Asia since 2016, but until now it had never featured original content offerings, nor did it feature the local-language interfaces and subtitling that are typical in more developed markets.

To promote the new offerings, Amazon Prime Video is introducing free one-week trials and promotional subscription prices that last until December 2023 as part of its relaunch efforts in Indonesia, Thailand and The Philippines. The discounted subscriptions will cost 59,000 Indonesian rupiah ($3.98), 149 Thai baht ($4.10) and 149 Philippine pesos ($2.69).

“Southeast Asia is a tapestry of cultures, languages and histories, and there has truly never been a better time to be a content creator or a content consumer in this part of the world,” said Erika North, head of Asia-Pacific Originals, Prime Video. “We are committed to the local TV and film industry and believe in working with the most innovative creative talent in the region to bring the very best, most authentic and local storytelling to life for our customers not only in the region but also Prime Video members around the world. This is just the start.”

Originals coming to the platform include three versions of a new situational comedy improv show”Comedy Island.” The new local originals “Comedy Island: Indonesia,” “Comedy Island: Thailand” and “Comedy Island: Philippines” will each have eight comedians and celebrities taking part in comedic challenges and games. All three versions will be launching on Prime Video in over 240 countries and territories across the globe in 2023.

Indonesian content offerings include two films, “Siege At Thorn High” and “4 Seasons In Java,” plus other Indonesian titles like a local version of the Italian hit “Perfect Strangers,” “Ashiap Man” and horror film “Kuntilanak 3.”

Thai titles coming to the local service include “Three Idiots and a Ghost,” “Metal Casket,” “The 100,” “The Up Rank,” “My True Friends: The Beginning” and “How To Fake It In Bangkok.”

Filipino content ranges from comedy-drama “Big Night” to romance “How To Love Mr. Heartless” and “Whether The Weather Is Fine.”

Viewers will also get access to Korean offerings like “Nothing Serious,” “Toy Soldiers: Fake Men 2 The Complete,” along with popular …read more

Daily Crunch: Did Bolt Mobility bolt? The startup left equipment and confused customers in its wake

Board meetings are great for getting feedback on your progress and your plans for the future, but what’s the best way to tell them what’s going on?

According to Ridge Ventures partner Yousuf Khan, often the best and simplest way to “ensure you’re providing board members with the information they want to see is to just ask them.”

“Reaching out to your board not only helps provide a sense of direction, it also gives you the opportunity to build your relationship. People appreciate the opportunity to weigh in,” he says.

Khan also lays out seven tips for building a presentation to give your board updates on your progress, plans, the product and financials.

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Monday is here, and we are excited to throw ourselves into another week of summertime tech news. Apropos summer — as the VCs stop answering their phones in favor of drinking elderflower lime martinis, playing pickleball, spelunking in the Bitcoin mines, and kite surfing (I can only assume that’s what VCs do for their summer break), it gives us tech reporters a bit more time to go deeper on some of the stories and companies that have been itching our curiosity nerve.

In my distant past as a startup founder, long before I became a writer at TechCrunch, exhibiting at TechCrunch Disrupt turned out to be a huge moment for my first startup. As an early-stage startup founder, you know that the hustle is part of the game; if your company doesn’t have the budget to attend, you can apply to be a volunteer and attend that way. Don’t miss the volunteer FAQ to see if this is a good option for you! — Haje

The TechCrunch Top 3

- Did Bolt bolt?: It’s pretty rare that a startup just vanishes from the face of the planet, but that was the magic trick Bolt Mobility appears to have pulled off, leaving a bunch of e-bikes and confused customers behind, Rebecca reported.

- I am a passenger, and I ride and I ride: Swarm’s tiny satellites have been hitching a ride on SpaceX launches for other customers, where it’s easy for the company “to just pop them on” — here’s what Swarm has been up to since it was acquired by SpaceX, Darrell writes.

- The wheels on the bus go down and down: In the midst of an 88% stock nosedive, Swvl — who went public via a SPAC last year — is canceling its $100 million acquisition of Smart Bus startup Zeelo, Mike writes.

Startups and VC

The regulatory environment surrounding crypto is shifting in the US as the SEC takes aim at major players in the web3 world, promising to shake up business as usual with aggressive action. David Nage discusses how regulatory scrutiny is impacting venture investment in web3. It’s a great conversation with Lucas and Anita on this week’s episode of Chain Reaction, for you podcast fans!

Oui Capital, an Africa-focused VC firm based in Lagos and Massachusetts, announced today that it has completed the first closing of its $30 million second fund, Tage reports. The firm seeks to strengthen its presence on the continent.

More more more:

- Headline of the week: Ugh, why is Natasha M so good! Don’t miss her Startups Weekly, the succinct recap of what’s what in the land of startups this …read more

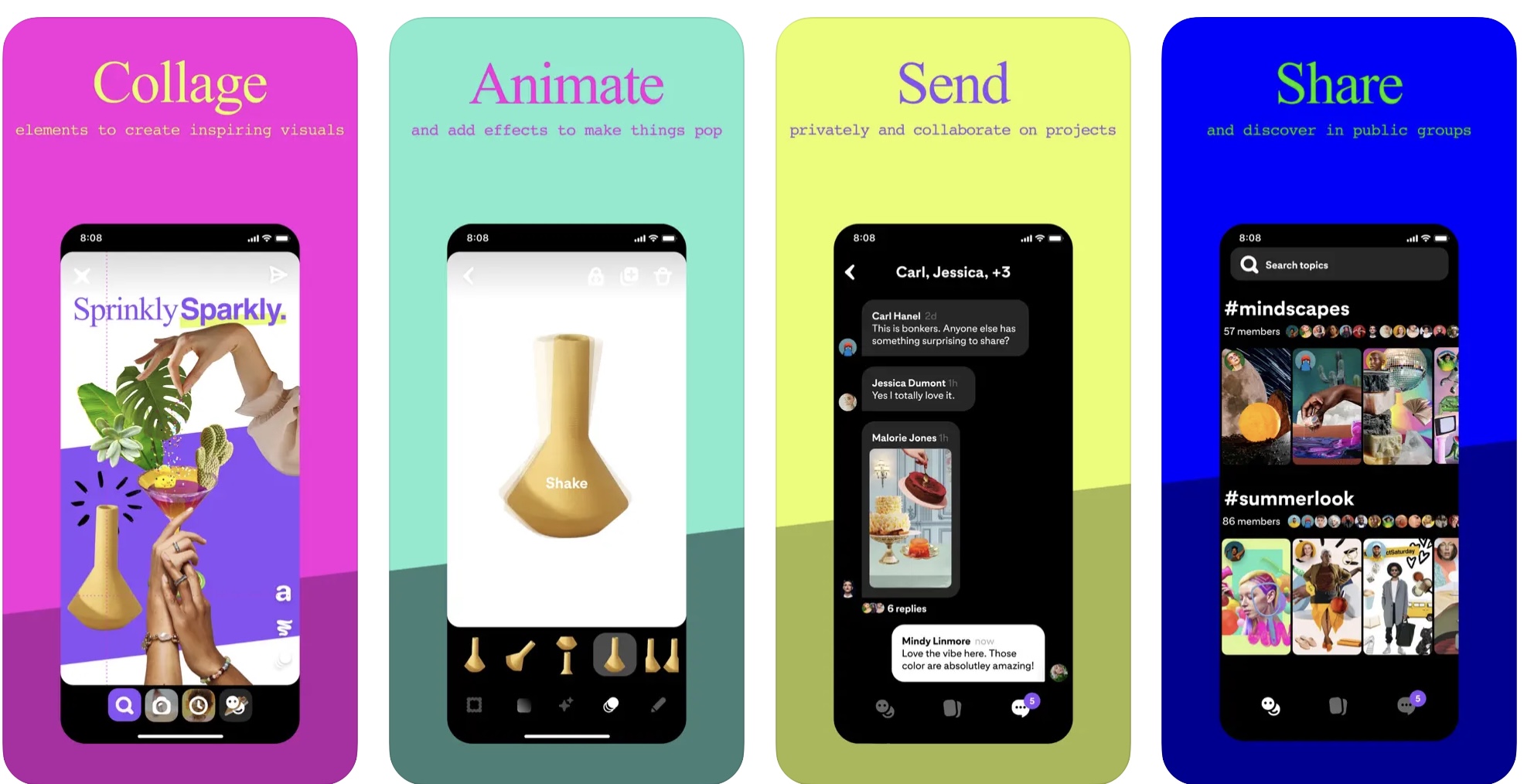

Pinterest debuts a new app, Shuffles, for collage-making and moodboards

Pinterest may be best known for shopping inspiration and design ideas, but the company’s newest product wants to inspire its users to tap into their own creativity. The company has quietly launched a new iOS app called Shuffles for putting together collages using photos, image cutouts and other animated effects. The app is currently in an invite-only status with the ability to join a waitlist from its home screen.

According to Shuffles’ description on the App Store, users can build their own collages using Pinterest’s photo library or snap photos of objects they want to include using the camera. They can also cut out individual objects from within an image using a tap — a feature that recalls iOS 16’s own clever image cutout ability. Images in Shuffles can then be rotated, layered and resized on the screen to create the collage, and animations and effects can optionally be added. The final project can be shared with friends for collaboration or posted to public groups where others can “remix” the original creation in their own way.

The app’s description suggests it could be used for visualizing a room makeover, fashion ideas, moodboards and more.

While the company hadn’t formally announced its plans around Shuffles, a Pinterest spokesperson confirmed the app hails from its new in-house incubator, TwoTwenty.

“Shuffles is a standalone app created by TwoTwenty, Pinterest’s innovative incubator team. Shuffles is an engaging way to create, publish, and share visual content,” the spokesperson said. “With more people coming to our platform for creative inspiration, we’re continuously experimenting with new ways to help Pinners and Creators bring their ideas to life.”

“As this app is in its initial test phase, we don’t have any additional details to share on the record at this moment,” they added, declining to share more about its future plans or monetization potential.

Image Credits: Pinterest

Launched last November and named after Pinterest’s first office, TwoTwenty’s goal has been to foster more internal experimentation at the social network and increase its pace of innovation. Other tech giants, including Meta, Microsoft and Google, have similar efforts with their own incubators — NPE, Microsoft Garage and Area 120, respectively.

In Pinterest’s case, the company has been working to make the transition from its past as an image pinboard and bookmarking site that helps drive e-commerce transactions to adapt to today’s creator-driven era where consumers are prompted to make purchases through video content. To address consumer demand for video, Pinterest released its TikTok-like Idea Pins and a live shopping feature, Pinterest TV. The latter was also launched by TwoTwenty’s team, in fact.

But TwoTwenty isn’t just meant to experiment with video. The organization consisting of engineers, designers and other product experts aims to research, prototype and test a variety of new ideas to see if any gain traction. Those that do will be handed off to other teams inside the company to scale.

The early-stage project Shuffles is …read more

Max Q: Off the bench

Hello and welcome back to Max Q. Last week was the week of ambitious timelines. In this issue:

- A modest profile of one of the foremost experts of space propulsion

- Deep dive into the history of NASA’s Landsat

- News from Masten Space, Swarm and more

P.S. Applications are closing soon for Startup Battlefield 200! Apply today to join Startup Battlefield 200 for the chance to exhibit your startup for free at TechCrunch Disrupt this October and win the $100,000 equity-free prize. Applications close August 5. Apply today.

On to the news.

SpaceX’s CTO of propulsion retired. Now he wants to go to Mars.

You may not have heard the name Tom Mueller, but if you’re a space fan, you’re likely acquainted with the technology he helped pioneer: the Merlin rocket engine, which powers SpaceX’s Falcon 9 rocket, and the Draco engines that power the SpaceX Dragon spacecraft.

Mueller spent 18 years at SpaceX before retiring. But as he told me, “I found when I stopped creating, I didn’t feel right.”

Mueller, who is widely considered one of the leading experts of propulsion alive today, started sketching up a small thruster. That thruster now has a name, “Rigel,” after the blue supergiant in the constellation Orion. It’s become a cornerstone of Mueller’s new startup, Impulse Space, which he founded in September 2021. With the new venture, Mueller wants Impulse to be the go-to option for cost-effective, efficient in-space transportation.

“It was going to be just for fun and not too serious, but then some ex-SpaceX people started talking [to me] and wanted to help and all of a sudden it became real,” he said. “Now it’s full on.”

Rigel thruster. Image Credits: Impulse Space

After 50 years pioneering satellite imagery, NASA’s Landsat is ready for 50 more

NASA’s Landsat satellite constellation has been making Earth observation history ever since the project launched way back in 1972, providing reams of EO data for the government, scientists and industry. TechCrunch’s Devin Coldewey caught up with Jim Irons, who retired at the beginning of this year as NASA’s director of the Earth Sciences Division, on the history of the project and why it is still relevant today.

Now, myriad constellations like that of Planet Labs are imaging the whole globe on a daily basis. Which begs the question: Why have Landsat at all?

“Those of us who work on Landsat are very impressed by what the commercial providers have achieved,” Irons said. “The message we want to get out is that Landsat is complementary to that data — they don’t replace Landsat data. One, it’s open and transparent access — that’s key, and it’s true of all the data collected by NASA satellites.

“Two, the USGS has maintained this 50-year archive of data. Is there a business case for companies to archive their data for decades, so we can observe the effects of climate change over the long term rather than just have short bursts of data? I don’t know …read more

What will it take to reignite the NFT market?

With July now behind us, we have a full month of trading data from the NFT market to digest. The numbers are mixed. While there are some positive signals from the non-fungible token market that matter, others are decidedly negative. Trading continues, but at what appears to be a far slower pace.

For companies in the NFT space, the news is likely unwelcome. The larger blockchain world is in a period of correction, but to see key NFT market metrics fall as quickly as we have makes us wonder what could reignite demand. It seemed doubtful that the period of hype that gave us endless Bored Ape derivatives would last forever. But what’s next?

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Let’s peek at the July data and then dive into what could return NFTs to prominence. After all, NFT trading has risen a few times during the first decade-plus of the blockchain era — such as it is — so surely it can rise again?

To start, we’ll check in on the market-leading OpenSea, and then we’ll add in other NFT marketplaces to get a good vibe for the non-fungible token market. After that, we’ll theorize some ideas that could make NFTs less uncool again. To work!

A lackluster July

The overall direction of NFT trading volume has been negative for some time, as the following chart from The Block and CryptoSlam makes clear:

https://techcrunch.com/2022/08/01/what-will-it-take-to-reignite-the-nft-market/

Tech’s riskiest founders are getting a $650 million bet from Redpoint Ventures

For venture investors, noise is ironically important. Wading through constant streams of capital-seeking founders and startup pitches may be the hardest part of the job, but it’s also imperative to the success of the same job.

So, what happens if energy around entrepreneurship slows? As the downturn looms, are fewer founders going to take risks? According to Redpoint managing director Annie Kadavy, there will be fewer total companies started in the next year than there were in the last two. And, somewhat counterintuitively, the investor thinks that the looming slowdown is “a great thing.”

“In an environment where it’s really easy to raise a seed round, it’s really easy to get your first product up as long as you can throw more money at the problem you’re trying to solve…that is a different profile of risk,” she said, “versus it’s really hard to raise money, and I have to build those products because I care so deeply about the problem.”

She added: “I think that the total number of founders we’re going to see will be fewer, but the quality bar is going up.”

Led by Kadavy and managing partner Erica Brescia, Redpoint Ventures’ early-stage team announced today that it has closed a $650 million fund to back startups. The investment vehicle is the firm’s ninth early-stage focused fund closed to date, which it will invest in companies from seed through Series B stages. The check size will range between $2 million to $15 million, depending on the company.

The firm is targeting the majority, around 70%, of its investments from this fund to be in the Series A space, with the remaining 30% dedicated to seed and Series B startups. It’s aiming for Series A ownership stakes of between 15% and 23%.

Brescia, who joined Redpoint last year after getting plucked from her role as GitHub’s COO, says that the firm hasn’t seen much activity lately from megafunds such as Tiger Global or SoftBank.

“The more players you have in the market, especially [last year] does tend to drive up prices…and now we’re seeing valuations come way back down,” she said. “I think that’s healthier for founders and for investors, and I’m sure that part of that is because we’re seeing fewer players actively pursuing the same company.”

It’s not just valuations that are changing due to a shift in sentiment; the investor said that competition is changing in startup land as well, thanks to the conservatism of megafunds. “One of the things that makes it much more challenging, much more expensive to build an early-stage company, is the number of well-funded early-stage competitors that you have to go down,” Kadavy said. “But if that can be two companies or three companies instead of 10 or 12 or 15, the likelihood of success, the ability of those companies to hire and retain great people, the ability for them to continue to fundraise, it all goes up.”

Brescia added that Redpoint’s product and a megafund’s product …read more

Pinterest popped 20% on earnings that weren’t as terrible as expected

If Pinterest is a bellwether of consumer spending, things are not looking up just yet. Still, investors in the social network rallied as Q2 revenue came in roughly in line with expectations and user declines were not as horrible as they thought. That’s not to say Pinterest’s earnings were good. Pinterest missed on earnings and delivered zero user growth in its most recent quarter, citing a combination of factors, such as the lingering impacts from the pandemic, reduced traffic from search engines, the rise of TikTok, and — like many companies reliant on digital advertising — the broader macroeconomic uncertainty that has pulled down other tech stocks, including Meta, Twitter and Snap.

Meta last week delivered its first quarterly revenue decline, while Snap missed analyst’s expectations and declined to forecast its future performance. Twitter, amid a contested acquisition by Elon Musk, has also been fending off an advertiser exit due to the uncertainty over the Musk sale.

Pinterest, meanwhile, posted its own fairly disappointing Q2 results with revenue up 9% year over year, reaching $665.9 million, which was below Wall Street estimates of $667 million. Or, as the Wall St. Journal put it, it was the lowest revenue growth in two years. The company also posted a new loss of $43.1 million and earnings of 11 cents adjusted per share, versus the 18 cents expected. More worryingly, it informed investors its third-quarter revenue growth would be in the “mid-single digits,” when analysts were predicting 12.7% revenue growth.

Users’ numbers stayed flat at 433 million monthly actives — the same number it reported in the prior quarter, and down 5% year over year. However, this was one of the few bright spots amid otherwise troubling news as analysts had been forecasting a bigger drop to 431 million users.

The stock popped on the news that the loss wasn’t as bad as expected, and because revenue was close to expectations. In after-hours trading, the stock was up over 20%, as Pinterest additionally benefited from praise by investor Elliott Investment Management, which recently took a more than 9% stake in the company. (Pinterest confirmed the investment on the earnings call.)

In its letter to shareholders, Pinterest admitted there was “work to be done to grow” users, particularly in its mature markets in the U.S., Canada and Europe.

This was also the first quarterly earnings under new Pinterest CEO Bill Ready, who joined the social image sharing service after leading payments and commerce at Google, and before that, serving as COO at PayPal.

Ready spoke to his plans for Pinterest’s future with a sense of both optimism and urgency, calling it a “very unique platform” but one that must be made more attractive to advertisers and content creators alike. His letter suggested, too, the threat from short-form video, like TikTok, which was listed …read more