Coronation fashion: Kate Middleton honors Princess Diana, twins with Princess Charlotte

As millions gathered worldwide to witness His Majesty, King Charles III officially being crowned the King of England, the women of the royal family dressed in high regal fashion for the momentous occasion.

While King Charles was crowned with St. Edward’s Crown – which was created in 1661 and only worn by the king during the ceremony – his wife Queen Camilla was crowned beside him, with her head held high wearing Queen Mary’s Crown.

“Queen Camilla looked utterly statuesque in her long white Bruce Oldfield Coronation gown, emblazoned with silver and gold embroidery,” royal fashion expert Miranda Holder told Fox News Digital.

CORONATION OF KING CHARLES III: THE HISTORIC DAY IN PHOTOS

“The silhouette was typical of the Queen’s signature style, the elongated waist balancing out her shorter torso, the bracelet sleeves the perfect backdrop to the exquisite embroidery featuring the national emblems of the U.K.; shamrock, daffodil, a thistle and rose.”

“The gentle V-neck was the perfect frame to the magnificent Coronation necklace and the silver embroidery in the body of the dress featured British wildflowers intertwined with bunting in celebration of the couple’s passion for nature combined with this historic day.”

KING CHARLES AND CAMILLA’S LOVE STORY: HOW SHE WENT FROM MISTRESS TO QUEEN

Queen Camilla’s Robe of State is made of crimson velvet and was originally made for Queen Elizabeth’s coronation in 1953.

All eyes were on Princess Kate Middleton as she shined in full regalia during the historic coronation ceremony at Westminster Abbey.

The Princess of Wales’ striking ensemble featured an exquisite custom gown by Alexander McQueen – the same designer who made her breathtaking bridal gown for her royal wedding to Prince William.

Middleton looked elegant and regal in her robes, as she proudly wore the beautifully decorated garter paraphernalia.

“The outfit was perfect, subtle enough to not steal focus from the Sovereign and his Queen but quietly beautiful, fitting for a woman of Kate’s beauty and position,” royal fashion expert Holder added.

The Princess of Wales kept the memory of Princess Diana close to her heart as she honored her late mother-in-law with a touching accessory to complete her regal ensemble.

“The earrings, known as the ‘diamond and south sea pearl earrings’ feature a circular design of diamonds, a single diamond-encrusted pear and a large dangling pearl drop. Diana loved the jewels, and wore them repeatedly throughout the ’90s,” Holder noted to Fox News Digital.

As Middleton stood proudly next to her husband Prince William and their three children – Prince George, Princess Charlotte and Prince Louis – she had a precious mother-daughter matching moment at the celebratory event.

The Princess of Wales and Princess Charlotte wore similar glittering leaf tiaras, as Middleton’s daughter stole the show in her stunning Alexander McQueen headpiece.

“Princess Charlotte coordinated with her mother in a typical Wales show of family unity in a similar glittering botanical hairband and sweet McQueen cape dress in court dress white,” Holder detailed.

KING CHARLES OFFICIALLY CROWNED BRITISH MONARCH

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

King Charles III and Queen Camilla later appeared on the balcony of Buckingham Palace in their elegant royal ensembles for a fly-past to conclude the coronation ceremony.

Thirteen other members of the royal family, including Prince William, Kate Middleton and their children along with Prince Edward and Princess Anne joined them as they waved to a crowd of onlookers.

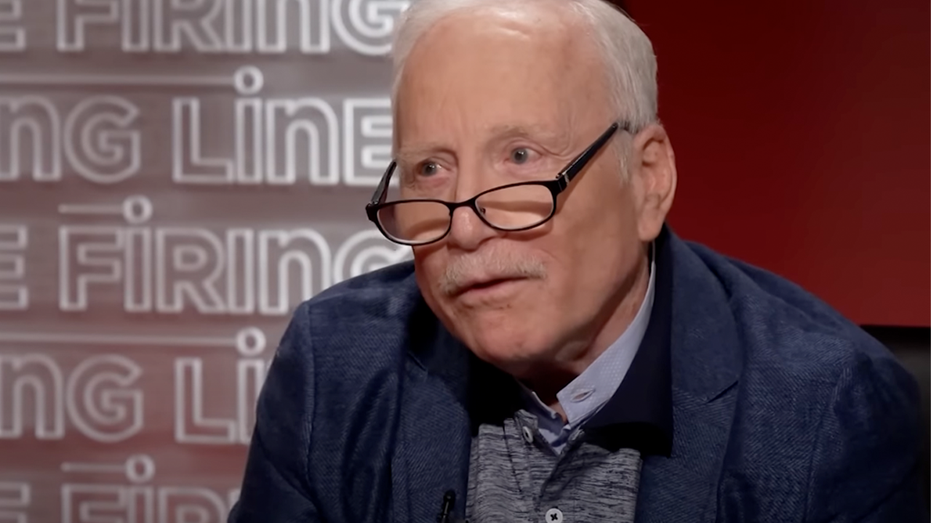

‘Jaws’ star Richard Dreyfuss blasts Hollywood inclusion standards: ‘They make me vomit’

Legendary actor Richard Dreyfuss condemned Hollywood’s new inclusivity standards in strong terms during a recent interview, claiming they make him “vomit.”

Dreyfuss, who’s starred in “Jaws,” “Close Encounters of the Third Kind,” and many other classic Hollywood films, blistered the new diversity and inclusion guidelines that will be implemented at the Academy Awards starting next year.

The guidelines must be adhered to by any film in the running for a “Best Picture” Oscar.

RICHARD DREYFUSS CLAIMS BILL MURRAY WAS A ‘DRUNKEN BULLY’ ON ‘WHAT ABOUT BOB?’ SET

As first noted on Hollywood in Toto, PBS anchor Margaret Hoover brought up the new guidelines during her interview with the actor on PBS’ “Firing Line” Friday.

The anchor stated, “Starting in 2024, films will be required to meet new inclusion standards to be eligible for the Academy Awards for ‘Best Picture.’ They’ll have to have a certain percentage of actors or crew from underrepresented racial or ethnic groups.”

She asked, “What do you think of these new inclusion standards for films?”

Not holding back, Dreyfuss declared, “They make me vomit.”

Defending his total rejection of the concept, he said, “Because this is an art form, it’s also a form of commerce and it makes money, but it’s an art. And no one should be telling me, as an artist, that I have to give in to the latest most current idea of what morality is.”

The actor continued, claiming that such guidelines stifle creativity and risk. “And what are we risking? Are we really risking hurting people’s feelings? You can’t legislate that? And you have to let life be life.”

Dreyfuss further claimed he doesn’t believe any group in society today that should be given special treatment. He said, “And I’m sorry, I don’t think there’s a minority or a majority in the country that has to be catered to like that.”

The actor then defended Hollywood legend Lawrence Olivier’s “Blackface” rendition of Shakespeare’s “Othello” in 1968.

He stated, “Lawrence Olivier was the last White actor to play ‘Othello,’ and he did it in 1965. And he did it in ‘Blackface.’ And he played a Black man brilliantly.”

He conveyed his point with a few rhetorical questions, asking , “Am I being told that I will never have a chance to play a Black man? Is someone else being told that if they’re not Jewish, they shouldn’t play the ‘Merchant of Venice?’ Are we crazy? Do we not know that art is art?”

Dreyfuss wasn’t done condemning the inclusion guidelines, saying, “This is so patronizing. It’s so thoughtless and treating people like children.”

Hoover asked the actor if the history of slavery and racism in America might justify making “Blackface” a taboo, though Dreyfuss claimed he didn’t think so.

Again, he said, “Because it’s patronizing. Because it says we’re so fragile that we can’t have our feelings hurt. We have to anticipate having our feelings hurt, our children’s feelings hurt. We don’t know how to stand up and bop the bully in the face.”

Pro-Kremlin novelist Zakhar Prilepin injured in car bombing in Russia

A prominent pro-Kremlin novelist was injured and his driver killed Saturday during a car bombing in Russia, according to media reports.

https://nypost.com/2023/05/06/pro-kremlin-novelist-injured-in-car-bombing-in-russia/

Older Americans are being targeted in a Malvertising campaign

We can’t deny that many scammers are clever in how they choose their victims. They consistently go for those who are the most vulnerable, which is why we hear so many stories of older Americans who are not as skilled in the world of technology being scammed.

One way that these scammers have been tricking people lately is with malvertising campaigns executed through fake Google ads.

Malvertising is a form of fake online advertising that uses ads that look real to spread malware to people’s devices. Malvertisements can be placed on legitimate websites, and they can use a variety of tactics to trick you into clicking on them, such as promising free software downloads or falsely claiming that your device is infected with a virus.

When you search for something on a search engine like Google, for example, you will often notice that your search results will give you a few sponsored ads at the very top of your results. Here is an example of what this looks like.

NEW MALWARE IS TARGETING MACOS AND CAN STEAL SENSITIVE INFORMATION FROM YOUR DEVICES

With malvertising, you might perform a search and see sponsored ads pop up for you that look just like the ones above. However, these links are riddled with malware and will likely lead you to fake websites that will release viruses to your device or try to take your personal information.

MORE: TOP BROWSERS TARGETED BY NEW MALWARE TO STEAL YOUR SENSITIVE DATA

According to Malwarebytes, the malvertising campaign that has been growing in popularity among scammers creates hundreds of fake websites via the web hosting platform Weebly. The scammers use Weebly to host fake content that looks real so that the ads they place on Google can be validated and approved.

Once the ads are approved this campaign can potentially be harmful in at least two ways.

Clicking on an ad can potentially install malware onto your device

Clicking on an ad can lead you to a fake website where you can be forced into a fullscreen page that you’d be unable to exit (tip: you can actually exit this screen by clicking and pressing the escape key). On the screen is a phone number to call “For help”. That phone number leads to a scammer who will con you out of money and potentially your personal information.

And many of these malicious ads are being pushed onto older Americans.

The scammers keep an eye out for things that older Americans might search for the most. Some of these terms might include “chicken recipe” or “solitaire,” and once those terms are searched, the scammers will push those ads so that they pop up in the search results and hope that the victim will click the first one they see.

MORE: TROUBLING MALWARE THREAT SPREADING ON FACEBOOK AND TWITTER

This is where the cleverness of the scammer comes in. These criminals know their way around cybersecurity and are constantly coming up with new ways to slip through the cracks.

The main way they do this is by making their websites look as legitimate as possible. Only the intended target will see the malicious content that the site has, which therefore means that quality checkers will miss what the website is being used for and allow it to be revealed to a larger demographic.

This is possible because of a technique they use that is known as cloaking, which is a way of hiding malicious content from viewers who do not fall within the intended audience.

FOR MORE OF MY SECURITY ALERTS, SUBSCRIBE TO MY FREE CYBERGUY REPORT NEWSLETTER BY HEADING TO CYBERGUY.COM/NEWSLETTER.

Have good antivirus software on all your devices

Having antivirus software running on your devices will make sure you are stopped from clicking on any malicious links or from downloading any files that will release malware into your device and potentially have your private information stolen.

See my expert review of the best antivirus protection for your Windows, Mac, Android, and iOS devices by visiting CyberGuy.com/LockUpYourTech.

FREE ANTIVIRUS: SHOULD YOU USE IT?

For more of my tips, subscribe to my free CyberGuy Report Newsletter by heading to CyberGuy.com/Newsletter.

Copyright 2023 CyberGuy.com. All rights reserved.

https://www.foxnews.com/tech/older-americans-being-targeted-malvertising-campaign

Coronation in the city — Big Apple eateries give guests the royal treatment

Big Apple bars are ringing in King Charles III’s coronation on Saturday with festivities across the pond.

https://nypost.com/2023/05/06/big-apple-eateries-give-the-royal-treatment-for-coronation/

Coronation in the city — Big Apple eateries give guests the royal treatment

Big Apple bars are ringing in King Charles III’s coronation on Saturday with festivities across the pond.

https://nypost.com/2023/05/06/big-apple-eateries-give-the-royal-treatment-for-coronation/

King Charles, royal family (not Harry) together on Buckingham Palace balcony: See the photos

Prince Harry was absent from the Buckingham Palace balcony after the coronation, where his father, King Charles III, and other family greeted crowds.

USA TODAY’s true-crime podcast, Unsolved, covers the cold case of Alexis Patterson

Season 4 of USA TODAY’s true crime podcast, Unsolved, covers the cold case of missing child Alexis Patterson.

Who Benefits From The New York Times’ Attacks On Bitcoin?

Who Benefits From The New York Times’ Attacks On Bitcoin?

Authored by Level39 via Bitcoin Magazine,

Does one of the largest individual shareholders of The New York Times benefit from the publication’s recent hit piece on Bitcoin mining?

The article, “The Real-World Costs Of The Digital Race For Bitcoin,” attacked the role of Bitcoin miners who participate in sanctioned demand-response programs within the Electricity Reliability Council Of Texas (ERCOT), the state’s energy grid. These programs provide ancillary and demand-response services that enable variable renewable power to be profitable and readily available when consumer demand rises. They also allow for grids to remain reliable during extreme weather events, such as Winter Storm Uri in February 2021.

In its haste to attack Bitcoin mining, The New York Times appears to have reversed more than a decade of support for pro-renewable, demand-response programs and has potentially handed the Texas legislature fodder to limit competition on the Texas grid, in favor of policies that promote natural gas peaker plants and pipelines.

Who Is Carlos Slim?

Carlos Slim Helú, a Mexican business magnate who provided the newspaper with a $250 million loan in 2009, currently owns roughly 8% of The New York Times Company’s class A shares. He is the eighth-richest person in the world with a net worth of $96 billion, making him the richest person in Latin America. Slim’s fortune largely derives from telecommunications networks, such as América Móvil — Latin America’s largest mobile phone company that dominates Mexico’s telecommunications industry. The company has kept the nation’s phone rates among the highest in the world and is thought to be a key factor restraining Mexico’s economic development.

Slim has investments in the Texas energy market, through oil and gas companies. His corporate conglomerate, Carso Grupo, owns Carso Energy, which transports and sells Texas natural gas to Mexico’s state-run power companies through pipelines. By attacking Bitcoin mining, The New York Times indirectly helps midstream companies such as Carso Energy, which increase its profits from transporting and selling natural gas to Mexico.

Carlos Slim’s second eldest son, Marco Antonio Slim Domit, manages the financial side of their family’s business empire and is a member of the board of directors of Grupo Carso and an independent director at BlackRock, in addition to being a member of its board of directors. BlackRock is the second-largest investor of the New York Times Company, holding 8.67% of class A shares.

Slim’s Connection To Texas Oil And Gas

The Wahalajara system is a new network of pipelines that transports natural gas from the Permian Basin to population centers in Guadalajara and western-central Mexico. The network originates from the Waha hub in western Texas, a critical supply hub for Permian Basin natural gas producers.

A joint venture between Carso Energy and Energy Transfer Partners operates two critical pipelines to Mexico that originate from the Waha hub — the Waha-Presidio “Trans-Picos” pipeline and Waha-San Elizario “Comanche Trail” pipeline, entering service in 2017. Carso Energy has a 51% stake in the joint venture. Carso Energy has a 100% stake in the Sásabe-Samalayuc pipeline, in Mexico, which is fed from Waha via San Elizario and entered service in 2021. With the help of additional Carso Energy pipelines and other sources of natural gas, the Secretaría de Energía (SENER), Mexico’s ministry of energy, expects to add 30,000 megawatts of combined-cycle, gas-fired power generation capacity to the country’s electric grid over the next decade.

Natural Gas Prices At The Waha Hub

Approximately 70% of Mexico’s natural gas imports are supplied by U.S. pipelines. Therefore, it is common for natural gas contracts in Mexico to be linked to locations in the U.S. where pricing is determined, such as the Waha hub, Henry hub and Houston Ship Channel.

The Waha hub is one of the most important pricing point for natural gas in Mexico, in part because each of the Wahalajara pipelines jointly operated by Carso Energy and Energy Transfer are designed to transport and sell over 1 billion of cubic feet of natural gas per day to Mexico’s state-owned Comisión Federal de Electricidad (CFE) power plants.

The natural gas price index for the Mexican market, known as the IPGN, is calculated with the Waha benchmark price by the Comisión Reguladora de Energía (CRE), a government energy regulatory commission. Carso Energy’s transport income generally benefits from higher prices at the Waha hub. The CRE uses the Waha benchmark to calculate a daily reference price for natural gas used by CFE, which helps determine the price of natural gas sold to the CFE by Carso Energy, including the midstream costs of transportation and other fees associated with importing natural gas. The CFE is one of the largest customers of natural gas in Mexico and by the end of next year, the CFE is expected to generate 65% of Mexico’s power. Selling natural gas to the CFE can become extremely profitable during severe weather events in Texas, due to heavily-inflated spikes in the Waha benchmark price.

Severe weather events aside, the Waha hub has been plagued with takeaway capacity constraints, causing record low prices in the Waha benchmark of natural gas that have consistently fallen below the Henry hub in Erath, Louisiana. The New York Mercantile Exchange (NYMEX) primarily uses the Henry hub price for natural gas futures contracts. Physical supply and demand dynamics at the Waha hub can have effects that influence the Henry hub and NYMEX natural gas futures. The Wahalajara pipelines had been expected to help narrow the steep Waha hub discount to the Henry hub, however, the Waha benchmark still went negative 20 times in the last three years due to other factors that remain an issue.

Negative pricing at the Waha hub can occur when there is an oversupply of natural gas and not enough pipeline capacity to transport the gas. When this happens, producers may be forced to pay buyers to take their natural gas in order to avoid having to entirely shut down production. This can lead to negative pricing, which can present a number of challenges for Waha pipelines.

“Waha is in the Permian basin, and is characterized as a market that is perpetually long supply, and needs to trade at a discount to its marginal demand market. That demand market is almost always outside of the Permian basin. Therefore, basis is determined by the amount of excess gas that needs to be moved to another location. The relative abundance or scarcity of this egress capacity influences Waha basis greatly…

“On a daily basis, wind generation directly competes with natural gas. As new wind (and solar) farms are constructed, renewable energy sources are taking a larger share of total generation. If renewables generation grows faster than load (demand for power), then gas demand generally suffers.”

Bitcoin Mining Competes With Natural Gas Pipelines

Low prices reduce the incentive for producers to sell natural gas in the Waha market, which in turn can lead to lower throughput volumes for the Wahalajara pipelines. Shale oil wells in the Permian Basin have become extremely gassy — producing more associated natural gas as they age and oil production falls. This results in increased exploration for shale oil, which results in more gassy wells and an oversupply of natural gas. As prices stay low, or go negative, it becomes more profitable to waste natural gas by either venting it or flaring it.

Venting methane is harmful for the environment as it is a potent greenhouse gas that traps 80 times more heat than carbon dioxide (CO2) over a 20-year period. Flaring is better than venting, but is only 92% efficient, meaning that 8% of all flared methane still escapes into the atmosphere.

Bitcoin mining is nearly 100% efficient at mitigating methane emissions, so it’s more ecologically sound and profitable to mine Bitcoin with methane from stranded Permian Basin wells than it is to waste it. Bitcoin miners can even be used to reduce fugitive emissions from abandoned oil wells once the wells are no longer productive. Ultimately, this all means there is less incentive to build expensive infrastructure to transport Permian natural gas to the Waha hub where it may sell for practically nothing.

This is a major problem for operators of the Wahalajara pipeline system. Midstream companies such as Carso Energy and Energy Transport grow profits by increasing the volume and value of transported natural gas. The oil and gas industry has concluded that costs have to rise because the current cost structure is unsustainable as losses for natural gas explorers continue to mount.

Bitcoin Mining Competes With Natural Gas Peaker Plants

To make matters more challenging for the oil and gas industry, research indicates that using large, flexible loads, such as Bitcoin mining operations, can have a net decarbonizing effect on grids over the long term. This is believed to happen when loads balance fluctuations in variable renewable generation, which in turn facilitates higher penetrations of renewable resources when those power sources are available.

Brad Jones, the former interim CEO of ERCOT, has publicly affirmed that Bitcoin mining has already played a major role in bringing renewables into the Texas grid, by supporting the financials of solar and wind facilities, and providing a balancing effect between consumers and excess generation that would otherwise be negatively priced or curtailed.

“For many years, ERCOT had been looking for loads of scale that could respond in a demand responsive way that can help us balance our grid… It’s here now. And it’s a great thing for helping us to manage the grid. Helping us to manage our resources. Bitcoin has the nature of really turning down when prices begin to rise, in a way that we can give that power back to other consumers. And at the same time, as we bring more and more renewables into the state, it becomes a driver of more renewables. Because right now if we bring in all the renewables that are signed up to want to come to our state, there will be a significant depression of pricing during the day. By having Bitcoin there to assist, to stabilize those prices throughout the day, it’s going to drive more renewables into our system. And that’s good for Texas.”

–Brad Jones, former Interim CEO of ERCOT

Moreover, research suggests that demand-response programs are competitors to traditional, flexible-generation plants and, by proxy, the natural gas companies that provide fuel to those plants.

“Widespread adoption of demand response may not be viewed favourably by all participants in the power market. In particular, if the capacity value, or the availability in times of need, of demand response is significant, owners of peaking plants will likely see their capacity factors decrease as demand response takes over some or all of the responsibility for regulation, load following and ramping… This will have a significant impact on the potential for generator owners to recover their investment, possibly leading to the decommissioning of otherwise operational plants. Such a scenario would clearly be greatly opposed by operators of flexible generators, even though it may present an efficient solution for the system as a whole.”

–“Benefits And Challenges Of Electrical Demand Response: A Critical Review”

If flexible demand response can lead to the decommissioning of flexible generation, there would obviously be fewer potential buyers of natural gas during periods of peak demand. As variable renewables continue to increase market share within ERCOT, Carso Energy and Energy Transfer would have good reason to view demand-response programs that Bitcoin mining operations participate in as competitors to peaker plants that reliably buy and consume natural gas.

Of course, natural gas peaker plants are necessary when solar and wind aren’t available, enabling miners to continue mining during those hours. On the surface, this would appear to make Bitcoin miners and natural gas companies close allies. However, if oil and gas executives concur with Jones and the research above, there would be a motive for oil and gas companies to negatively color the public’s perception of Bitcoin’s participation in ERCOT demand-response programs. Natural gas may be maintaining its market share within ERCOT as renewables grow, but the industry would rather increase its market share and eliminate competition to secure its long-term future.

Oil And Gas Lobbies The Texas Legislature

Warren Buffett also has a motive to view Bitcoin mining’s role in demand response as competition. Buffett owns Berkshire Hathaway Energy, a subsidiary of Berkshire Hathaway, which is currently lobbying the Texas legislature to build 10 new peaker plants totaling 10 gigawatts of generation capacity by November 2023 — paid for by an additional charge on Texans’ power bills. Peaker plants are typically natural gas power plants that only run when there is a high demand for energy. New peaker plants would replace the need for demand-response customers.

It’s no wonder Buffett has described Bitcoin as “rat poison squared.” Despite what Elizabeth Warren says, attacking Bitcoin mining’s role in demand response results in higher electricity bills for Texans, to pay fees for peaker plants.

The Texas Senate recently passed Senate Bill 6, which would funnel at least $10 billion to build those natural gas peaker plants, and possibly up to $18 billion, for them to sit idle until high demand and extreme weather events. In testimony at a committee meeting in March, Berkshire Hathaway was the lone supporter of the bill. Energy analysts and The Wall Street Journal have criticized the plan as being bad for Texas, due to it being costly and undermining competition from solar and wind. Senate Bill 7 adds oversight requirements to ERCOT for peaker plants and provides allowances for plants that will operate at a loss when severe weather isn’t observed. This is a sophisticated way of saying the industry is requiring the state to provide the oil and gas industry with a subsidy, for which the people of Texas will be on the hook.

Meanwhile, the Texas Senate passed Senate Bill 1751 unanimously out of committee and with only one “no” vote from the senate floor, which unfairly prohibits bitcoin miners from competing to receive commonly used tax incentives. Worse, it stymies miners in their efforts to make the Texas electrical grid more resilient in emergency situations by arbitrarily limiting Bitcoin mining’s participation in ancillary and demand-response services to 10%, which the industry likely already exceeds. Another bill, Senate Bill 2015 would establish a goal for 50% of new generating capacity installed in ERCOT by 2024, to come from dispatchable generation, which is primarily natural gas.

It’s well known that the oil and gas industry showers Texas Governor Greg Abbott and other politicians with money. After Winter Storm Uri, Energy Transfer’s CEO donated $1 million to Governor Abbott after the company pocketed billions of dollars from the deadly storm.

Atmos Pipeline-Texas and NuStar Energy are operators of some of the largest pipelines and natural gas storage networks in Texas and aim to increase takeaway capacity from the Permian Basin where the Waha hub is located. In 2022, both Atmos and NuStar donated, in total, $40,500 to the campaigns of co-sponsors of the anti-Bitcoin-mining Senate Bill 1751. These four state senators received $163,500 from the oil and gas industry as a whole.

If Bitcoin really were to promote the use of fossil fuels over the long run, why are Texas senators — who significantly benefit from the oil and gas industry — introducing legislation that unfairly targets Bitcoin miners?

Bitcoin Mining Relocates To Texas And Balances Its Grid

Prior to China’s ban on Bitcoin mining enacted in June 2021, severe weather events in Texas resulted in windfall profits for natural gas companies. For example, Energy Transfer raked in $2.4 billion during the February 2021 blackout of Winter Storm Uri, by using natural gas as a peaking asset — storing it when the price is low, and selling when demand skyrocketed.

Exporting natural gas to Mexico during a severe weather event in Texas can be even more profitable for the Wahalajara pipeline operators, since the Mexican price might be even higher — especially If ERCOT were more reliant on natural gas peakers. During the 2021 Texas winter blackouts, the price of natural gas in Mexico skyrocketed to 100 times normal prices. Natural gas peaker plants struggled during Uri, as natural gas was freezing in pipes.

After an influx of mining rigs from China relocated to Texas in late 2021, many became sanctioned as large flexible loads (LFLs) within ERCOT. Today, LFLs are providing and profiting from ancillary services that natural gas peaker plants would have previously dominated. And they are doing so at a lower price point that peaker plants struggle to compete with — saving Texans money on their electric bills by getting more for less. In fact, LFLs helped balance the grid and avoid blackouts during the summer heat wave of 2022 and during Winter Storm Elliot, over Christmas of 2022 — freeing up over 3,000 megawatts of spare capacity on the grid. This success was forecasted by ERCOT a few weeks prior to Winter Storm Elliot, in a report that heralded Bitcoin miners as beneficial to balancing the grid during extreme weather events.

The Gray Lady Attacks Bitcoin

In November 2022, five months before his anti-Bitcoin mining article was published, Gabriel Dance — deputy investigations editor at The New York Times — attended the Texas Blockchain Summit, in Austin, as part of his investigative research. A few weeks later, he began emailing participants from the conference, promising to include their nuanced perspectives in his upcoming article.

Dance ultimately proved this was all a ruse. When his article was finally published, it became evident that he chose to omit all of the pro-Bitcoin mining arguments and only included unbecoming quotes from its proponents.

The substance of Dance’s article deserves harsh criticism. It was filled with disinformation and fallacious reporting about the role of demand response that has since been thoroughly debunked by the Bitcoin Policy Institute. Dance’s reporting contradicted the U.S. Department of Energy, which views demand response favorably. It also conflicted with earlier endorsements of demand response from The New York Times, going back at least to 2007.

Here is a selection of previous endorsements from the Times:

“Across the United States, several thousand businesses and residential customers are ceding control of their electrical systems during moments of unusually high demand. And they are getting paid to do it. The system, based on a concept called ‘demand response,’ is one of the latest ways that Internet technology is being applied to manage over-stretched U.S. power supplies better.”

–“Demand Response Technology Shaves Peak Energy Consumption By Remote Control,” The New York Times, November 7, 2007

In 2009, The New York Times reported that demand response had been endorsed by the Obama administration’s Federal Energy Regulatory Commission chairman, Jon Wellinghoff.

“The Obama administration, Congress and the new Federal Energy Regulatory Commission chairman, Jon Wellinghoff, have all focused on reducing peak demand. Mr. Wellinghoff has called demand response the ‘killer application’ of the smart grid.”

–“Dimming The Lights To Meet Demand,” The New York Times, April 17, 2009

In 2010, in its “Energy And Environment” section of the paper, the Times continued to extol the benefits of demand response to its readers.

“This concept, called demand response, has gained traction in utility circles. In essence, it involves paying users to make small sacrifices when there is an urgent need for extra power (the ‘peak’). The utility can then rely on cutting some demand on its system at crucial times and, in theory, avoid the cost of building a new plant just to meet those peak needs… For farmers, however, this process isn’t easy. Workers must be dispatched to turn the pumps on and off, and there is a risk of crop damage.”

–“Why Is A Utility Paying Customers?,” The New York Times, January 23, 2010

Again, later in 2010, the Times reiterated the Obama administration’s positive view of demand response.

“…[Wellinghoff] sees consumers as active parts of the grid … stabilizing the grid by adjusting demand through intelligent appliances or behavior modification, known as demand response; and storing energy for various grid tasks. He thinks consumers should get paid to provide these services.”

–“Making The Consumer An Active Participant In The Grid,” The New York Times, November 29, 2010

The newspaper even quoted environmentalists who wanted Texas to adopt more demand response.

“Environmentalists argue that the strains on the grid should spur Texas to work on energy-saving strategies. In particular, they are pushing a program called demand response, in which businesses and consumers are paid to reduce power at times of high demand, like late summer afternoons. Colin Meehan, a clean energy analyst with the Environmental Defense Fund in Texas, said in an e-mail that Texas had ‘so far only taken very small steps’ on demand response.”

–“Electric Grid In Texas Faces Multiple Challenges,” The New York Times, December 22, 2011

The Times continued to praise demand response throughout the Obama administration, almost as if it was doing the administration’s job to promote the technology.

“But balancing the grid involves more than just increasing capacity. Perhaps the state’s most promising conservation tool is ‘demand response,’ … The programs, which are voluntary in Texas, can take many forms… Demand response ‘probably deserves more focus and attention,’ said Doyle Beneby, the president of C.P.S. Energy, a municipally owned utility that has not taken a position in the capacity market debate. ‘In Texas, it could be a big part of the solution.’”

–“With Strain On Electric Grid, A Push To Prioritize Conservation,” The New York Times, January 23, 2014

And yet, Dance’s hit piece against Bitcoin mining single-handedly reversed the Times’ position on demand response. Dance wrote the following passage, which makes demand response sound like an evil scheme for flexible customers to defraud retail customers:

“Their massive energy consumption combined with their ability to shut off almost instantly allows some companies to save money and make money by deftly pulling the levers of U.S. power markets. They can avoid fees charged during peak demand, resell their electricity at a premium when prices spike and even be paid for offering to turn off. Other major energy users, like factories and hospitals, cannot reduce their power use as routinely or dramatically without severe consequences.”

–“The Real-World Costs Of The Digital Race For Bitcoin,” The New York Times, April 9, 2023

It all begs a long list of questions: Why did The New York Times spend months researching an article that distracts readers from serious environmental issues, only to focus on a technology that is only responsible for an infinitesimal 0.14% of global emissions? Why did it ignore a December 2022 ERCOT study that showed large flexible loads, such as Bitcoin mining operations, were beneficial to the Texas grid? Why did The New York Times ignore the fact that Bitcoin mining played a significant role in avoiding blackouts during Winter Storm Elliot, over Christmas and during the 2022 summer heat wave? Why did it ignore that Bitcoin mining reliably provides a price floor for overbuilding renewable generation on the ERCOT grid? Why single out a sanctioned demand-response customer that was, according to ERCOT’s former interim CEO, largely responsible for bringing in large-scale, variable renewable projects into Texas? Why did The New York Times reverse more than a decade of support for pro-renewable demand response programs that were championed by the U.S. Department of Energy and Obama’s Federal Energy Regulatory Commission chairman? Why, after months of research, did The New York Times publish its anti-Bitcoin mining story precisely when the Texas legislature was voting on bills that attack Bitcoin mining demand-response programs and replace them with natural gas peaker plants? Why did the Times’ editors use allegedly-manipulated footage that made it appear as if there was smog in Rockdale, Texas?

Very little about the hit piece makes any sense. Is it a coincidence that The New York Times attacked Texas Bitcoin mining at just the right time that it could benefit one of its largest shareholders?

“The point is, Slim doesn’t have to interfere at all. I know from experience that publishers do intervene in the editorial process, as is their prerogative. And I can assure you that Slim’s investment will be a factor, even if unspoken, in editorial decision-making henceforth at the Times. Perhaps Mexico’s crony capitalism will remain a mostly neglected topic — but now conspiracies will be read into the neglect.”

–Andreas Martinez, former columnist for The New York Times

We may never know if Slim influenced the editorial process in the newspaper’s latest hit piece attacking Bitcoin mining. However, it would fit an ongoing pattern of The New York Times protecting Slim’s business interests in addition to patterns of alleged, calculated, systemic bias and distortions. Whether these are all coincidences, or something more, may be up for debate. However, editors of the Times seem more than willing to sacrifice the newspaper’s remaining shreds of journalistic integrity for whatever motivates them to run such hit pieces.

More and more readers, on the other hand, are beginning to distrust mainstream media and it doesn’t help when the largest shareholders of media companies are positioned to reap profits from the reporting. There is little recourse in such matters, however, bringing attention to potential conflicts of interest may at least provide some context to otherwise inexplicable editorial decisions.

Thanks to Justin Orkney for assistance with this article.

This is a guest post by Level39. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Tyler Durden

Sat, 05/06/2023 – 11:30

https://www.zerohedge.com/crypto/who-benefits-new-york-times-attacks-bitcoin

Bill Barr warns of ‘chaos’ and ‘horror show’ if Donald Trump is re-elected

Former Attorney General Bill Barr issued a stern warning Friday about the possibility of former President Trump — his ex-boss — returning to the White House.

https://nypost.com/2023/05/06/bill-barr-warns-chaos-if-donald-trump-re-elected-president/