FTX’s Collapse Takes Heavy Toll on an Island Nation

The Bahamas encouraged crypto companies such as FTX to set up shop. The firm’s collapse has left many islanders feeling frustrated.

Hiking trip turns fatal in Utah national park as woman dies and her husband is rescued with symptoms of hypothermia, officials say

A married couple’s hiking trip in a Utah national park turned deadly when they started experiencing symptoms of hypothermia, leading to the wife’s death, officials said.

https://www.cnn.com/2022/11/25/us/utah-zion-national-park-couple-deadly-hike-trip/index.html

Recreational Laughing-Gas Use Mounts In Europe… Along With Casualties

Recreational Laughing-Gas Use Mounts In Europe… Along With Casualties

A European Union drug monitoring agency is sounding alarms over rising recreational use of nitrous oxide, also known as “laughing gas.”

“There is a general perception among users that inhalation of nitrous oxide is safe,” says the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA). “Yet we see that more frequent or heavier use of the gas increases the risk of serious harms.”

In addition to industrial uses, the gas is used as a sedative in medical and dental procedures, and as a propellant in whipped cream canisters. Classified as a depressant, it’s typically consumed by inhaling it from party balloons, and is frequently used in tandem with drugs like ketamine or MDMA.

Inhaling it can foster a sense of euphoria, relaxation and dissociation from reality. In most places, anyone can legally buy it at a convenience store, supermarket or online — and cheaply.

“A profitable and expanding supply chain has developed, with specialised internet stores directly promoting the gas for its recreational use or offering it under the guise of its use to make whipped cream,” says the EMCDDA.

Listen up, going extra large with laughing gas can KILL you. #balloons #nitrousoxide #NHS @djnicholl pic.twitter.com/Yd8FfFF8TR

— SWB NHS Trust (@SWBHnhs) November 18, 2022

Commonly called “hippy crack” or “nos,” it’s become a common fixture at music festivals. According to Reuters, concerns started mounting in 2017 with the introduction of larger canisters that deliberately targeted recreational users. In the UK, nitrous oxide is now the second-most-used drug among 16- to 24-year-olds.

The popularity of the gas is elevated by the ease with which it’s consumed and shared — usually by filling party balloons with the gas. Some users cut out that middle step, and suck it straight from the canister — risking lung injuries and cold burns.

That’s just the start of the dangers. According to WebMD, the gas can cause lower blood pressure, fainting, heart attacks, suffocation, irreversible vitamin B12 inactivation, anemia, nerve damage, memory loss, incontinence, depression, weakened immunity, numbness of hands and feet, limb spasms and ringing ears.

“This stuff is dangerous. Seven years ago, this was a neurological rarity, even a couple of years ago I was seeing cases maybe once a month, now I’m seeing them every week,” said Dr David Nicholl, a UK neurologist.

The EMCDDA says the number of poisonings is still “relatively small in number,” but increasing sharply:

“In Denmark, cases rose from 16 in 2015 to 73 in 2021. In France, 134 cases were reported in 2020 — up from 10 in 2017. Meanwhile, in the Netherlands, cases rose from 13 in 2015 to 144 in 2020.”

The UK Daily Mail this week shared some laughing gas horror stories: A teen with a ruptured lung, a woman with a damaged spinal cord now partially paralyzed and forced into a wheelchair.

A road safety group says the gas contributed to 1,800 vehicle accidents in the Netherlands alone in the past three years. In January, the Dutch government will institute a ban on the purchase, sale or possession of the gas, with exceptions for its continued use in medicine and in food packaging.

Bans and limitations are under consideration in the UK and elsewhere. The EMCDDA cautions that “any response measure needs to consider the widespread legitimate uses of nitrous oxide by industry, healthcare and consumers.”

Tyler Durden

Fri, 11/25/2022 – 05:45

https://www.zerohedge.com/political/recreational-laughing-gas-use-mounts-europe-along-casualties

Egypt struggles to combat scourge of violence against women

In 2017, a report from the Thomson Foundation named the Egyptian capital Cairo as the world’s most dangerous city for women. Some 99 percent of female residents there report having been sexually harassed. Egyptian women also struggle to access healthcare, education and the labour market. For a long time, it was taboo to even discuss these topics. But that was until the rise of a new generation of feminist activists, who are using the internet and social media to denounce sexual violence and support victims. Our correspondents report.

Shipping: Freight rates slowly getting back to normal

For more than two years the only way for container shipping prices was up. That trend is now reversing as backlogs at ports dissolve and supply chain snarls ease.

Daylight Saving Time sheds light on lack of sleep’s disproportionate impact in communities of color

As the United States rolled back the clocks one hour this month to observe the end of Daylight Saving Time, many people got a bit more sleep than usual — but some not as much as others.

https://www.cnn.com/2022/11/25/health/racial-inequities-sleep/index.html

Gold’s Climb Amidst Wisdom’s Decline

Gold’s Climb Amidst Wisdom’s Decline

Authored by Matthew Piepenburg via GoldSwitzerland.com,

As the latest headlines from the FTX implosion remind us yet again of a politicized and rigged market riddled with deception, gold’s climb becomes easier to foresee.

But first, a little philosophical musing…

Modern Policy: High Office, Low Wisdom

I have often referred to La Rochefoucauld’s maxim asserting the highest offices are rarely, if ever, held by the highest minds.

Nowhere has this been more apparent than among the halls of the physically impressive yet intellectually vacant Eccles Building on Constitution Ave in Washington DC, where a long string of Fed Chairs have been un-constitutionally distorting free market price discovery for over a century.

The media-ignored levels of open fraud and inflationary currency debasement which passes daily for monetary policy (namely monetizing trillions of sovereign debt with trillions of mouse-clicked Dollars) within the FOMC would be comical if not otherwise so tragic in its crippling ripple effect to the Main Street citizen.

From Greenspan to Powell, we have witnessed example after example of error after error and gaffe after gaffeon everything from mis-defining inflation narratives as “transitory” to re-defining a “recession” as non-recessionary.

And all this while the Fed (and its creative writing team at the BLS) simultaneously and deliberately fudges the math on everything from misreported CPI data to artificial U6 employment statistics.

Pondering the Philosophically Nobel Amidst the Administratively Dishonest

To any who have pondered the philosophical pathways (as well as elusive definition) of wisdom (from the ancient Greeks to the pre- and post-modern Europeans, romantic Emersonians, tortured Russians or enlightened Confucians), one common trait of wisdom through time, culture and language is the ability to admit, and then learn from, error–as any man’s journey is one riddled with countless opportunities for teachable error.

Yet when it comes to public mea-culpas and the grand teaching moments of “I was wrong,” it seems our central and commercial bankers have failed miserably.

Infallible Bankers or Exceptional Finger Pointers?

Not only have bank leaders taken little to no responsibility for (or contrition of) their many financial, political and moral sins (think billion-dollar bailouts, a 0 in 10 record for recession forecasting or the creation of the greatest and levered asset bubble and wealth transfer in history), they have a remarkable talent for blaming anyone (Putin et al) or anything (COVID or coal) but themselves or the derivative toxins and unpayable debt piles they alone created…

In summary, it seems we are living in era of great change, great turmoil and great risk, yet also one of very little accountability, transparency and hence: wisdom.

Sustained Levels of Mediocrity

Instead, from DC to Wall Street, Tokyo to Brussels, Canada to Australia, and Brainard to Draghi, the world is increasingly led by figures (left, right and center) who are capable, at best, of little more than a sustained level of mediocrity and an over-paid repertoire of canned phrases and prompt-read platitudes rather than actual, economic savvy, candor or personal wisdom.

Such high-office mediocrity and lack of wisdom, of course, spills well beyond the centers of political power and office; in fact, it thrives with equal force in the private sector and public markets, as any who have tracked and pre and post Enron world will and do know…

Modern Dystopia: High Tech, Low Wisdom

As to more recent scandals and headlines related to the staggering blowout at FTX, enough has already been written/said of its impressive mix of fraud, leverage and corrupt (paid-for) politics for me to add more mathematical detail here.

Unfortunately, FTX’s scandalous scheming with investor money (ala Madoff) and bank leverage (ala Bear Sterns) is nothing new.

The broader sins of fractional reserve banking, historical debt levels and trillions in mouse-click monetary policies have effectively murdered honest capitalism within a rigged-to-fail financial system whose destructive consequences far outpace the FTX headlines of late.

I am thinking of 1) the leverage-poisoned MERK, compliments of Leo Melamed and Alan Greenspan in the 80’s, 2) a completely fixed paper gold pricing exchange, 3) the post Glass-Steagall (nod to Larry Summers) banking era which turned depositor accounts into levered ammunition for banks speculating like hedge-funds or 4) the open fraud (legalized counterfeiting) which daily passes for monetary policy at a central bank near you.

As Henry Ford warned, if more folks actually understood banking practices and the false idols hiding behind expert masks, the net result would be chaos.

Patterns of Fake Genuis

As for the recent chaos in the C-suites of our tech leadership, an equally clear, and all too familiar pattern of under-30 millionaire/billionaires (from WeWork’s Adam Newman to Facebook’s Mark Zuckerberg or FTX’s Sam Bankman-Fried) is the now obvious as well as inverse correlation between so-called “technological genius” and basic human wisdom.

In short, we would be right to ask if our modern technological progress and high-office prestige has far outpaced our human wisdom.

All Piano, No Music

As Antoine de St. Exupery warned (as far back as 1944), the world is capable of producing 1000 pianos per hour but unable to produce enough worthy pianists to play them.

In short, the speed of our so-called “progress” (from computer chips, social media, Fauci-science and digital money to de-regulated margin accounts) seems to have tragically outpaced the philosophical measure of our wisdom.

Despite some wonderful exceptions from Wall St to Pal Aalto, many of our best and brightest are driven by the timeless and “human all too human” impulses of greed, FOMO, and telegraphed/photographed virtue-signaling rather anonymous good work or honest commerce.

Sam Bankman-Fried (SBF), for example, was a master at appearing like a Robin Hood despite having the instincts of a robber baron.

Self-Service Masquerading as Virtue Signaling

The end result is a literal “selfie culture” which, fractured by identity politics, victim narratives and resentment on the fly, has morphed into a priority of the “I” over the good of (or genuine concern for) the many.

This trend is equally true of our public and private markets.

Moral, legal and economic laws have become more and more, shall we say… “elastic” as the sins and consequences (from currency debasement to anti-trust/monopolies and cancerous debt levels) of one generation are happily billed to the next.

Such patterns of ignored decencies/rules in which a Madoff sits comically on the NASDAQ board or an SBF ironically teaches a paid-for Congress about crypto safety, are common.

Equally disconcerting is a celebrity-mad population who trusts its mandate science to Spike Lee or its crypto advice from Matt Damon. If one is financially “successful” it is assumed he is wise; that is a dangerous assumption…

Meanwhile, headline spin and financial lobbying has replaced the ideal of genuine capitalism with a kind of neo feudalism in which figures like Bezos (with easier access to capital after years of violating anti-trust principles and CEO-to-employee salary ratios) have become part of a new aristocracy rather than exemplars of democratic meritocracy or fair-priced capitalism.

Back to the Markets: What FTX Portends

Given the foregoing cynicism/realism emanating from our modern markets, there is still much we can glean about the direction of, and risks to, our current markets.

For example, it will come as no surprise that the FTX fiasco has already been spun into a positive rather than negative narrative for the BTC camp.

As to cryptos in general and BTC in particular, I have already written and spoken at length of my views.

Toward this end, and to the understandable chagrin of the crypto camp, I (rightly or wrongly) view BTC more as a speculative growth/tech stock than as a viable alternative currency or long-term store of value.

Nothing about the recent FTX blowup has altered this view.

Again (and I could very easily be wrong), I don’t see BTC as money, a view which seems to be shared by a large number of emerging markets and central banks who are loading up on record amounts of physical gold rather than invisible cryptos.

Just saying…

And to re-heat a tired yet accurate quote by JP Morgan, I (we) still fully embrace the “barbarous” notion that gold is money, the rest is credit/debt.

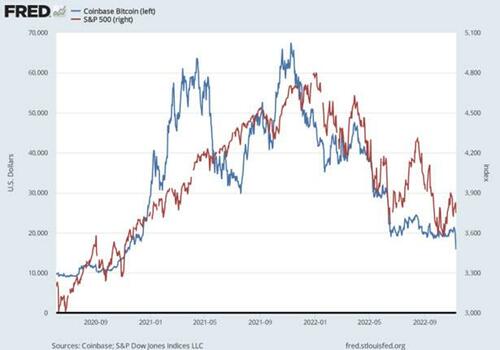

BTC As Market Indicator

Regardless, however, of one’s views, biases or take on cryptos, Bitcoin’s pricing still has immense relevance to modern markets, including gold markets.

In terms of US stocks, for example, BTC has been an exceptional leading liquidity metric outside of the derivatives markets or Fed-manipulated bond markets.

In other words, stock, bond and even property markets tend to behave and move a lot like BTC behaved just a short period before.

In short, and regardless of one’s pro or con take on BTC, as an asset class and market indicator, this “coin” still clearly matters.

BTC: Local to Systemic Sickness?

And perhaps more to the point: As a tanking asset class with trillions in losses, BTC, like any bleeding asset in a grotesquely over-levered system, really matters.

Why?

Because BTC’s local sickness can easily become systemic.

The risk of this systemic spread, for example, will increase if there are less and less “dip buyers” for BTC, especially when inflation factors should otherwise favor the asset.

The potential for such a low-bid trend for BTC (based on FTX-like fears of broken exchanges and hence broken TRUST) could easily and accurately portend a low-bid contagion effect in the broader equity markets in general and the already bleeding tech sector in particular.

That said, an increasingly cynical as well inflation-ravaged generation of jaded outsiders are feeling increasingly cornered, which means they have less and less to lose.

This desperation may lead to more distrust in the system and hence more buying of BTC as a modern 9and fully understandable) middle-finger to that system.

For now, let’s wait and see what the post-FTX trend will be for BTC; I personally foresee an eventual (though not immediate) rip in its price.

The Bond Market Matters

Equally, if not more importantly, the current and declining liquidity canary in the BTC coalmine, as stated above, has been a leading indicator for equal liquidity risks (and hence declining behavior) in the bond and property sectors as well.

With US debt to GDP levels above the precarious 120% level and US deficits spiking, Uncle Sam is going to need to need to find liquidity somewhere to cover its bond obligations.

One can not emphasize enough how much this bond market matters.

Hawk to Dove—A Brewing & Golden Tailwind

And as I’ve been arguing ever since Powell went Hawkish, it is my conviction that such liquidity will ultimately (and only) be found when that hawk becomes a doveand the Fed reverts to the desperate mean of relying (tragically/addictively) on the only consistent income source it has, namely: A mouse clicker at the Eccles Building.

Such mouse-clicked “magical money,” of course, has immediate as well as immense inflationary and currency (USD) ramifications, which means the pivot will have immediate as well as immense ramifications on the price of gold in USD.

Expanding Deficits: More Tailwinds for Gold

Equally bullish for gold yet equally tragic for the US are the recent (and doubling) deficit forecasts coming out of DC.

That is, the US Treasury has already announced its borrowing amounts for the next 6 months ($1.3T), which is an indirect way of revealing a federal deficit doubling (on an annualized basis) for the same period.

For me, the implications of such added debt levels are mathematicalrather than just cynical or political.

That is, Uncle Sam simply can’t afford to pay ever-increasing debt piles of this embarrassing magnitude unless interest rates are decidedly negative rather than painfully positive.

Stated even more plainly, all debtors love (and hence eventually engineer) inflation rates to be higher than interest rates.

And since Uncle Sam (and the Fed) are not only powerfully distorted, but powerfully in control, one can easily predict what any all-powerful but debt-cornered policy hack would and will do as we stumble into 2023, namely: Seek more inflation and lower rates while simultaneously under-reporting inflation by at least 50%.

How’s that for trust building, wisdom and central bank accountability?

In the end, as wisdom dies from above, and hence trust rots from within as inflation rises and real rates go increasingly negative, Gold will do what it always does in such man-made settings—namely surge north as the USD, now artificially supported by rising rates, sinks dramatically south once those rates go dovishly in the same direction.

Defaulting Bonds, Tanking Treasuries, Rising Gold

Of course, as soon as the market collectively realizes that negative yielding bonds (the historical instrument of all debt-soaked and hence failing regimes) are effectively defaulting bonds, investor interest in US Treasuries will fall while interest in gold will rise, as is already the case:

Cynics, of course, might say that $260B in gold is a trifle amount compared to other asset classes.

Fair point.

Gold: Repressed Today, Fairly Priced Tomorrow

But here’s the rub: The central banks are (and have been) intentionally suppressing paper gold in order to take more physical delivery today before they inevitably reprice gold higher tomorrow to recapitalize their horrific balance sheets.

This trend is easy to see simply because the rigged game played by the broken actors described above is as easy to predict as their lack of wisdom is easy to measure.

As Egon and I have often remarked, the central banks are unwittingly gold’s best friend, for the bankers’ lack of wisdom and abundance of self-interest in otherwise desperate times makes them easy to track.

Or stated more simply: As the system gets more corrupt (as it always does when backed against a debt wall and a moral vacuum), gold gets more loyal.

Tyler Durden

Fri, 11/25/2022 – 06:30

https://www.zerohedge.com/markets/golds-climb-amidst-wisdoms-decline

How two strangers on opposite sides of an airport counter made an unlikely connection

It had been seven days since she landed in New York City, and Hana Sofia Lopes’ luggage was still lost.

https://www.cnn.com/travel/article/chance-encounters-lost-luggage-friendship/index.html

Berlin Airport Closed By Climate Activists Glued To Runway

Berlin Airport Closed By Climate Activists Glued To Runway

European climate cultists upped the ante in their increasingly deranged war on fossil fuels on Thursday, bringing flight operations at Berlin Brandenburg Airport to a complete standstill for an hour and a half.

Reuters reports that activists from the Letzte Generation (Last Generation) group entered the airport from both the north and south ends, with some glueing themselves to the tarmac. According to the group, others rode bikes around the taxiways. The trespass began just after 4 pm local time.

“The plane is not a means of transport for ordinary people,” tweeted the group. “Most people – around 80% – have never flown. One affluent percent of the population is responsible for about half of all flight-related emissions.”

Letzte Generation demanded that the public stop using airplanes to travel, and tweeted video of its members entering the airport through a hole cut in a chain-link fence:

+++ Flugverkehr am BER eingestellt +++

Das Flugzeug ist kein Verkehrsmittel für Normalbürger:innen. Die meisten Menschen – etwa 80% – sind noch nie geflogen.

Ein wohlhabendes Prozent der Bevölkerung verursacht allein etwa die Hälfte der flugbedingten Emissionen. pic.twitter.com/Avfg5tDeqw— Letzte Generation (@AufstandLastGen) November 24, 2022

Police detained the trespassers, but not before they caused misery for an estimated 3,000 to 4,000 travelers to and from Berlin’s primary commercial airport. In addition to those stuck in the airport or on airplanes awaiting takeoff 15 flights to Berlin were diverted to Düsseldorf, Leipzig/Halle and Dresden.

The same group is behind many attention-seeking stunts across Europe in recent months, such as throwing food on famed works of art, disrupting a Hamburg orchestra concert by gluing themselves to the conductor’s podium, blocking road traffic, and vandalizing businesses and government buildings with orange paint.

Letzte Generation activists have covered Monet’s Les Meules in mash potato.

The protestors then glued themselves to the floor at the Barberini Museum in Potsdam. It is unclear if the painting was damaged. https://t.co/Av2TSbR4iI pic.twitter.com/myup95RBtm

— Sky News (@SkyNews) October 23, 2022

Local authorities condemned the latest stunt:

Brandenburg Interior Minister Michael Stübgen (CDU) described the action as a “dangerous intervention in air traffic.” It was “a serious crime” that “in the worst case even endangers human life. There’s no justification for that.” He called the activists criminals. — German broadcaster RBB

Berlin police said protestors showed “they are ready to commit crimes and that the democratic framework is of no importance to this organization.”

At least one passenger stuck on an airplane maintained his sense of humor:

Ryanair have also kindly portrayed the harrowing effects of climate change by ensuring the heat on the plane resembles a Mediterranean summer in the year 2050.

— Neil Delaney (@neilpdelaney) November 24, 2022

Tyler Durden

Fri, 11/25/2022 – 06:55

https://www.zerohedge.com/political/berlin-airport-closed-climate-activists-glued-runway

How redistricting shaped the midterms

Both parties entered the latest redistricting cycle seeking to press their advantages where they could.

The first election held under the new lines showed both succeeded — though Democrats had their most ruthless gerrymanders thrown out in the courts and the GOP did not, giving Republicans an edge that just might have carried them to a narrow House majority.

“The Democrats’ redistricting strategy was right. I think it worked,” said Kelly Ward Burton, the president of the National Democratic Redistricting Committee, which oversaw the party’s 2022 mapmaking.

Democrats’ excesses in New York and Maryland — where they drew maps to excise the few Republican seats remaining — were checked by the courts, even though similarly gerrymandered GOP maps were allowed to stand by conservative jurists. But independent commissions and strategic Democratic maneuvering did help blunt larger Republican gains.

“If they would have been able to do everywhere what they did in Florida,” Ward Burton said of Republicans, who netted four districts in the state, “we would be having a totally different conversation about the House right now.”

Now that the 2022 midterms are in the books, here are five takeaways about how the map lines drove the results — and what comes next.

Redistricting probably did give Republicans control of the House

After a shockingly disappointing election night, Republicans will have a razor-thin majority of no more than five seats (and maybe as small as four). A margin that small means that the GOP could not have reclaimed control without their redistricting advantage.

Republicans drew several red districts in states where they controlled the redistricting process: one each in Tennessee, Texas and Georgia, and three in Florida. Without them there would be no GOP majority. Their machinations forced Reps. Jim Cooper (D-Tenn.); Carolyn Bourdeaux (D-Ga.); Stephanie Murphy (D-Fla.) and Charlie Crist (D-Fla.) into early retirements. Rep. Al Lawson (D-Fla.) ran in a new GOP-leaning district and lost to Rep. Neal Dunn (R-Fla.) by 20 points.

In blue states, Democrats netted themselves a seat each in New Mexico and Illinois — not enough to offset GOP gains.

The GOP also gained new safe districts through reapportionment in three states that added congressional seats: Texas, Montana and Florida. But Democrats largely matched them with gains in new seats in Colorado, Oregon and North Carolina — though some of those maps were drawn by courts or commissions.

Republicans notably declined to aggressively redistrict in several other states where they had total control to take out Reps. Frank Mrvan (D-Ind.), Emanuel Cleaver (D-Mo.) and John Yarmuth (D-Ky.). Those decisions, which irked some national strategists, could have given the GOP more of a cushion but also potentially provoke more lawsuits.

Democrats didn’t create dummymanders

Blue-state Democrats headed into election night with a persistent concern: Did they stretch their voters too thin? Would a bad environment gut their delegations in Oregon, Nevada, Illinois and New Mexico?

The answer was a resounding no.

Democrats didn’t accidentally create any “dummymanders” — a term used to describe maps that end up harming the party that drew them. In contrast, Democratic-drawn maps performed remarkably well. Next year Republicans will hold just six of the 43 districts that were drawn by Democrats.

For example, in Nevada, Democrats pulled friendly voters from Rep. Dina Titus’ Las Vegas-centered district to shore up fellow Democratic Reps. Susie Lee and Steven Horsford in a move that prompted a foul-mouthed rebuke from Titus. Former President Joe Biden would have carried the districts by high single-digit margins. All three members survived.

In New Mexico, some operatives feared that Democrats may have endangered Democratic Rep. Teresa Leger Fernandez when they reshuffled the state’s lines to target GOP Rep. Yvette Herrell’s southern district. But Herrell narrowly lost to challenger Gabriel Vasquez as both Democratic incumbents won by double-digit margins, giving Democrats all three seats in the state.

Illinois was perhaps the biggest redistricting coup for Democrats. They reduced the GOP footprint to just three districts, shored up retiring Democratic Rep. Cheri Bustos’ district and netted a new seat anchored in Springfield. In anticipation of a possible Republican wave, Democratic groups threw some last-minute money to protect Reps. Sean Casten and Lauren Underwood, but both ended up winning by 8 points.

Democrats flirted with disaster the most in Oregon, which hosted three battleground races. Republicans did flip a Portland-area district that was open after moderate Rep. Kurt Schrader fell to a progressive primary challenger. But Democrats held onto retiring Rep. Peter DeFazio’s district and captured a new district created in apportionment. Rep.-elect Lori Chavez-DeRemer (R-Ore.), who will succeed Schrader, will be a top 2024 in a seat that Biden won by nearly 9 points.

The courts hurt Democrats but boosted the GOP

New York was Democrats’ biggest disaster on Election Day. They won only 15 congressional districts compared to 11 for Republicans — an increase of three seats for the GOP, even though the state lost a seat in reapportionment. A slew of statewide races were also closer than Democrats had anticipated.

But the party’s challenges in congressional races started much earlier when the state’s highest court struck down new maps in April that were drawn to favor Democrats. The new maps established the following month forced incumbents to scramble, most notably DCCC Chair Sean Patrick Maloney, who opted to run in the new 17th District, where more than 70 percent of voters were new to him. Maloney ultimately narrowly lost to Republican Michael Lawler in November.

Redistricting is not solely responsible for Democrats’ losses in New York, but the episode is one example of how courts in blue states declined to allow Democratic gerrymanders to stand. In Maryland, courts similarly threw out a Democratic gerrymander to force a more neutral map, although the ultimate electoral impact was less there as Rep. David Trone (D-Md.) held on in a competitive seat that his party had unsuccessfully sought to make safer.

Democrats’ inability to gerrymander Maryland and New York stands in stark contrast with states such as Florida, where courts declined to block Gov. Ron DeSantis’ aggressive redistricting plan that allowed Republicans to pick up four seats despite an anti-gerrymandering amendment to the state’s constitution passed by voters a decade ago that states districts should not be drawn to advantage a political party, along with lawsuits that dismantling Lawson’s North Florida seat stripped away a district where Black voters could elect a candidate of their choice.

The 2024 map

Democrats have a relatively easy task in drawing up targets for 2024. Although court fights could shift the maps in a few states, more than a dozen Republican incumbents will be running in districts Biden won with the Democratic president himself likely to be on the ballot.

Some of those Republicans are incumbents who survived this cycle despite being top Democratic targets — including Reps. Mike Garcia (R-Calif.) and Don Bacon (R-Neb.) — and battle-tested incumbents such as Rep. Brian Fitzpatrick (R-Pa.) who will be tough to oust. But the group also includes newly elected members who took advantage of poor Democratic performances in states such as New York, where six Republicans will represent districts won by Biden.

By contrast, only five Democrats — Reps. Jared Golden of Maine, Matt Cartwright of Pennsylvania, Mary Peltola of Alaska, Marie Gluesenkamp Pérez of Washington and Marcy Kaptur of Ohio — represent districts won by then-President Donald Trump in 2020.

House Majority PAC, Democrats’ top congressional outside group, released a preliminary 19-district list of districts it would try to flip in 2024 full of Republicans in Biden-won districts. Among its targets: Garcia, Bacon, Fitzpatrick, Lawler, Chavez-DeRemer, along with Reps. David Schweikert (R-Ariz.), Young Kim (R-Calif.), Michelle Steel (R-Calif.) and Reps.-elect Juan Ciscomani (R-Ariz.), Tom Kean Jr. (R-N.J.), George Santos (R-N.Y.), Anthony D’Esposito (R-N.Y.), Marc Molinaro (R-N.Y.) and Jen Kiggans (R-Va.).

The next redistricting battlefields

Several states could see another round of redistricting before 2024 as their current maps face legal challenges that were not resolved this year — although some states will depend on future court rulings.

In Ohio, the midterm elections were carried out under Republican-drawn maps that the state Supreme Court had deemed an illegal gerrymander — although Democrats actually managed to gain a seat anyway. The state’s redistricting commission is tasked with drawing new maps ahead of 2024. If it ends up in front of the state Supreme Court again, it might be handled differently, as the Republican justice who had sided with Democrats against the original maps retired this year.

Earlier this year, a divided U.S. Supreme Court blocked a district court’s ruling that Alabama should be forced to draw a new map with a second majority-black district, deeming such a move would come too close to the primary election. When the court heard the full case on its merits in October, the justices seemed skeptical of Alabama’s race-neutral interpretation of the Voting Rights Act. But several conservative justices also seemed wary of the claims from civil rights groups, and the high court has generally not been friendly to challenges based on the VRA in recent years.

Maps in Texas and Florida have also faced challenges on the basis of racial gerrymandering, although it’s unclear whether either state will be forced to redraw its maps.

But a second case before the U.S. Supreme Court could have broad implications for redistricting. The high court next month will hear oral arguments in Moore v. Harper, which argues that North Carolina’s maps — created by a court-appointed special master after the state Supreme Court ruled the maps drawn by the Republican-led legislature were an extreme gerrymander — are unconstitutional on the basis that only state legislatures, not state courts, can decide district lines.

A ruling in favor of the Republican legislators who challenged North Carolina’s special maste- drawn-map could potentially open up avenues for legal challenges to maps in a range of other states where courts were involved. But the high court could also rule against them and let North Carolina’s maps stand.

https://www.politico.com/news/2022/11/25/redistricting-midterms-00070810