Dovish Fed Sparks Bond & Stock Surge During Holiday Week

Amid a holiday-shortened week of low liquidity, bonds and stocks rallied as the dollar drifted lower on the heels of dovish Fed ‘pause’ hopes which sent terminal rate expectations slightly lower and subsequent rate-cut expectations higher…

Source: Bloomberg

Bonds were bid with the long-end of the curve outperforming significantly, inverting the yield curve even deeper…

Source: Bloomberg

While yields fell on the week, the longest-duration stocks actually underperformed thanks to selling pressure today with The Dow leading on the week..

The early weakness of the week gave way on Tuesday and Wednesday to a big short squeeze back to unchanged for the “most shorted” stocks

The dollar fell for the 5th week of the last 6 to its lowest weekly close in 3 months…

Source: Bloomberg

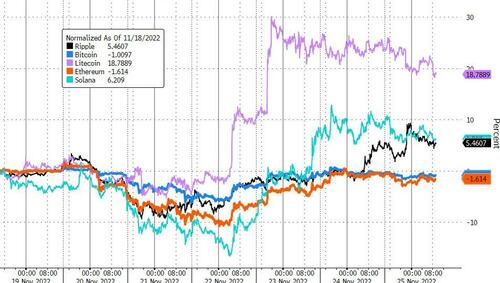

Cryptos were unusually quiet this week (relatively speaking) with Bitcoin and Ethereum ending the week down around 1-2%. Solana outperformed…

Source: Bloomberg

Commodities were mixed on the week with crude sliding amid Russian price cap scheme headlines and China COVID cases soaring. Silver outperformed (with gold flat) amid the dovish title to market expectations…

Source: Bloomberg

Finally, the Fed balance sheet contracted on a year-over-year basis last week for the first time since Dec 2019…

Source: Bloomberg

Worth considering since, as Goldman’s Tony P noted this week: “…for every one dollar of US GDP, there are still 34 cents on the Fed balance sheet… just before COVID hit, that number was 22 cents. in the third quarter of 2008, it was just 6 cents. even at the end of WWII, it was just 11 cents.”

In other words – there’s a lot more shrinkage to come…

Come on England!!!!

Tyler Durden

Fri, 11/25/2022 – 13:00

https://www.zerohedge.com/markets/dovish-fed-sparks-bond-stock-surge-during-holiday-week