Global ESG Bond Issuance Records First-Ever Annual Decline

Global sales of environmental, social, and governance (ESG) linked corporate bonds declined for the first time ever as interest rates soared, market turmoil persisted, and economic uncertainty turned borrowers away from debt markets.

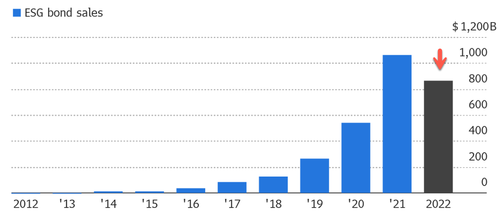

Bloomberg data shows companies and governments worldwide raised $863 billion in ESG bonds in 2022, a 19% drop compared to a year earlier of a record $1.1 trillion. This is the first decline in ESG bonds since green bonds first emerged on Wall Street in 2007.

Total issuance is down, much of that has to do with soaring borrowing costs amid central banks racing to tame the highest inflation in a generation. Bloomberg sheds more color on souring ESG space:

Social bond issuance dropped 34% to about $141 billion last year, the biggest decline across all the labels, as government agencies and corporations dialed back spending on eligible projects. Big borrowers including sovereigns have pivoted to long-term climate goals, following a rush to raise funds for pandemic relief that boosted social issuance.

Sales of sustainability bonds, whose proceeds can be used for both social and green projects, fell by 22% to $154 billion, the second biggest drop. By country, the UK and the US fell most, with 52% and 39% declines, respectively. The most scrutinized segment of the market for environmental, social and governance-related debt — sustainability-linked bonds — plunged 21% to $86 billion.

Green bonds, meanwhile saw the smallest year-on-year decline, dropping 11% to about $480 billion, propped up by a surge in sales from China. BNP Paribas SA, the biggest underwriter of green bonds in 2022, expects sales of green debt to recover to 2021 levels this year, driven largely by Europe and China. The biggest boost will come from China, thanks to supportive local policy and a recent alignment of its local taxonomy, according to a BNP outlook report published in November.

Besides soaring borrowing costs, perhaps many issuers shored up their balance sheets earlier last year before rates soared. Also, securities regulators from Europe to the US have increasingly focused on the ESG space from scams and misleading info by issuers or asset managers who package up ‘green’ funds.

Deutsche Bank AG and its asset management arm, DWS Group, were one such group that came under fire by regulators for exaggerating green investments in ESG products. DWS recently said it would dial back hype in ESG sales pitches to wealthy clients.

And all of this comes as global bond markets have been in turmoil for more than a year.

For the ESG space to thrive once more, it all depends on when global central banks halt aggressive rate hikes and pivot back to rate cuts. IMF head warned earlier this week of an impending global recession.

Tyler Durden

Sun, 01/08/2023 – 09:55

https://www.zerohedge.com/markets/global-esg-bond-issuance-records-first-ever-annual-decline