In the meantime, it is attempting to paint a picture of stability across its existing portfolio, estimating that 94% of the companies across all funds currently have a cash runway of more than 12 months.

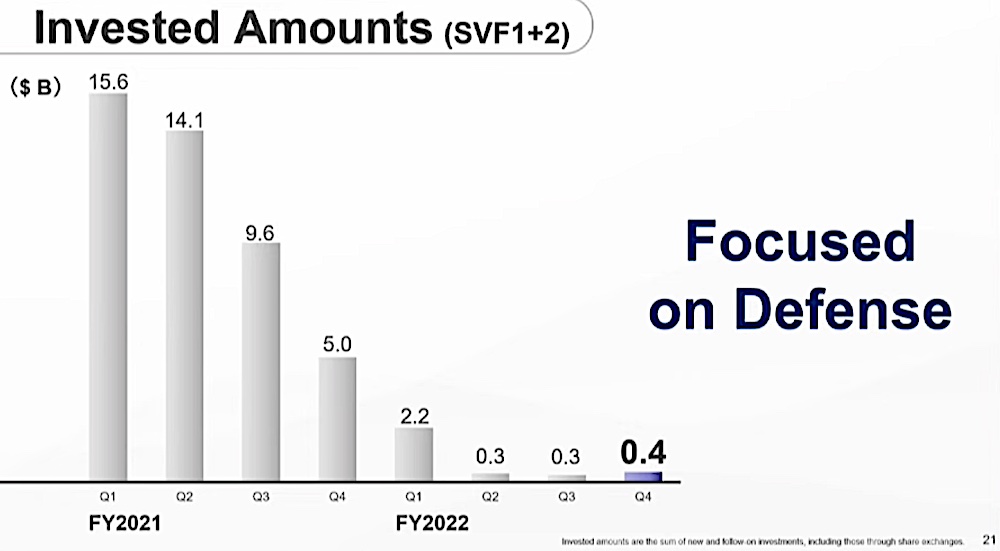

SoftBank Vision Fund and Tiger Global escalated the pace of their dealmaking in 2021 as many investors believed that the rally in public stock markets would continue for the foreseeable future. But a sharp decline in the markets — accentuated by the Fed increasing interest rates and the unfolding of geopolitical events such as Russia invading Ukraine — has left many tech companies exposed with drops in business and shadows over their earnings forecasts, devaluing the businesses themselves, and leaving many investors scrambling to find ways to cut losses.

More to follow.