Category: TECHNOLOGY

Former a16z partner starts solo fund to back early-stage fintech startups

With Salisbury serving as a solo GP, Cambrian plans to back 30 companies, with investments of up to $500,000. So far, the firm has made five investments over the last few months, including Keep Financial’s recent seed round. Salisbury expects the capital will be fully deployed over 24 months.

Generally, he plans to back U.S.based companies with U.S.-oriented go-to-markets.

“My key goal is, ‘how do I identify, and then also support, the next generation of fintech founders?” Salisbury said. “And at the earliest stage, you’re really investing in people.”

There were no hard feelings on the part of his former colleagues at a16z.

“Rex’s influence, reach, and ability to identify the next great entrepreneurs in fintech are impressive and made him a valuable asset at a16z,” said Acharya. “We are delighted to see how he and Cambrian will continue to support the fintech ecosystem with the launch of this fund.”

Carra, a SoFi co-founder who Salisbury worked with early in his career, recalls first meeting him after the engineer had completed a coding boot camp.

Although he was still early in his career, Carra describes Salisbury of being the person “who asked the incisive ‘hard’ questions in all-hands meetings,” to a point where other members of the management team thought Carra was feeding him queries.

“The case was simply that Rex is smart, understands both finance and tech, has a keen analytical mind, and is willing to ask the hard questions in good faith,” he said. “It was a running conversation among those of us who worked with him that we looked forward to investing in his startup — we assumed he’d be a founder next time around.”

It turns out that Salisbury’s “startup” was Cambrian, and Carra is now an LP in the new fund.

“I really like the community that he’s built and refer aspiring founders to it when I can,” he told TechCrunch via email. “I love that he’s taken time to understand the space as an operator in multiple roles, and I like Cambrian’s model and risk profile.”

Betterment Founder Jon Stein described Salisbury as a “great investor.”

“I invested with him because he’s among the best builders of network and community that I’ve ever seen,” he said via email.

Salisbury is not the only accidental VC in the fintech space. Earlier this year, Nik Milanovic — who had also started out with a newsletter and meetups —

In 2015, Rex Salisbury was working as a software engineer at now-defunct mortgage startup Sindeo where he built out the back end for fully automated online mortgage pre-approval.

At the time, he was working for Andy Carra, who served as that company’s CTO before going on to co-found SoFi.

It was Salisbury’s first foray into fintech, and high on the excitement of getting a new product live in a highly regulated industry, he admittedly got bit by the fintech bug. At that time, the sector was nowhere near the force that it is today, just “emerging as a meaningful and sizable category,” Salisbury recalls.

“This meant there were many other software engineers, product managers and founders doing what I was – bringing new technologies to bear on an industry that was painfully out of date,” he said. “I wanted to meet these people.”

After a number of coffee dates and meetups, Salisbury determined that something more formal was required. So in 2016, he started his own community, Cambrian. His goal with Cambrian was to cultivate a community focused on founders and builders in fintech.

Soon after the organization was born, Salisbury began holding monthly events in San Francisco and New York, hosting an annual product summit and inclusion summit, along with quarterly job fairs. Speakers included the likes of Credit Karma’s Ken Lin, Deel’s Shuo Wang, Betterment’s Jon Stein and Plaid’s William Hockey & Zach Perret, among others. His work caught the attention of venture firm Andreessen Horowitz.

“When they reached out, it became apparent that it could be a very interesting opportunity – many of the things I had been thinking about scaling with regards to Cambrian were similar to the work at a16z,” Salisbury recalls.

His community building had accidentally led him into the world of venture, as Salisbury ultimately became a founding member of a16z’s fintech practice alongside general partners Anish Acharya and Angela Strong before becoming a partner in 2019.

During his two years at the firm, Salisbury went on to back the likes of now-decacorn Deel and Tally, two companies he had gotten to know through the Cambrian community. While at a16z, he started the firm’s newsletter, which still publishes today.

Meanwhile, Cambrian had surged to 15,000 newsletter subscribers and an 1,100+-member Slack community exclusively for founders.

In 2021, Salisbury came to the conclusion that layering on a fund was a natural extension of the community he’d grown. So he began the process of raising capital for his own venture firm, Cambrian Ventures.

“The venture landscape shifted dramatically during my time at a16z and fintech was no exception,” Salisbury said. “Fintech had exploded, which is both daunting and exciting for prospective entrepreneurs. I realized that the networks I’d built through Cambrian could help the next generation of entrepreneurs navigate the ever-expanding ecosystem.”

He managed to attract a who’s who in fintech group of LPs that includes founders from companies such as NerdWallet, Plaid, Simple, Alloy, Modus, SentiLink, Jeeves, Betterment, Blend, Routable, Trim, LendUp, One, SoFi, Moonpay, LoanPro, Altruist, Melio, and …read more

Neon nabs $30M to build a scalable cloud service for Postgres databases

Neon implements what Shamgunov calls a “copy-on-write” technique to deliver checkpointing, branching and “point-in-time” restore. Using this, developers can create branches of databases for test environments every time new code is deployed, he said.

“Most cloud database platforms charge based on availability. But you only have about five hours a day of developers working on the codebase and about 22 business days in a month, so you only use the compute capabilities about 15% of the time when the database actually needs to run,” Shamgunov continued. “With Neon, the entire system is designed with costs in mind. It integrates a cloud object store to push cold data to the cheapest storage medium and automatically scales down to zero on inactivity.”

Shamgunov sees Neon’s main competitors as database vendors that separate storage and compute but aren’t open source, like Aurora and Google Cloud’s

Neon, a startup providing developers with a serverless option for Postgres databases, today announced that it raised $30 million in a Series A-1 round led by GGV with participation from Khosla Ventures, General Catalyst, Founders Fund and angel investors. In an email interview with TechCrunch, CEO Nikita Shamgunov, who described the tranche as “oversubscribed,” said it would be put toward growing Neon’s engineering team, bootstrapping its go-to-market team and building developer relations with new partnerships and integrations.

Postgres, also known as PostgreSQL, is an open source database management system launched in 1996 as the successor to a database developed at UC Berkeley called Ingres. Postgres has grown in popularity over the years, with a survey from Timescale finding that over half of developers report using Postgres more in 2021 than they did in 2020. Many developers opt for a fully managed platform. But according to Shamgunov, they’re often compromising, because the bulk of the available serverless Postgres database platforms — platforms that abstract away server management — are lacking in key capabilities.

“I noticed just how much Postgres is out there in the world, and my initial idea for Neon was to build an open source alternative to [Amazon] Aurora and provide developers with the best way to run Postgres in the cloud,” Shamgunov said. “As we started to build, we discovered how important serverless is, and now we emphasize the serverless Postgres when talking about Neon.”

Shamgunov, a former software engineer at Microsoft and Meta, founded SingleStore before incubating Neon at Khosla Ventures with Heikki Linnakangas and Stas Kelvich in 2021. Kelvich studied physics before joining embattled tech giant Yandex as a software engineer on the database team.

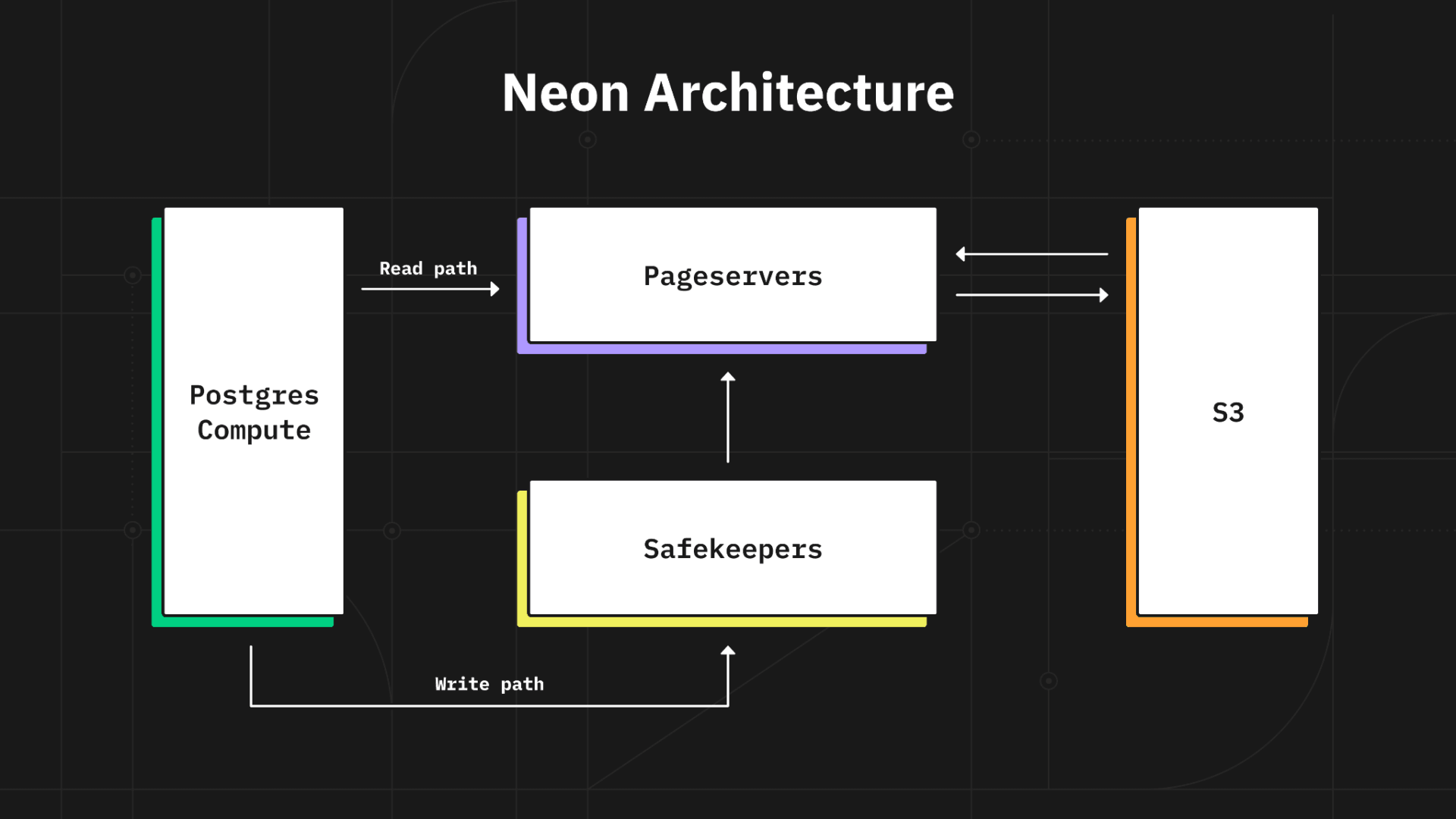

Neon provides a cloud serverless Postgres service, including a free tier, with compute and storage that scale dynamically. Compute activates on incoming connections and shuts down during periods of inactivity, while on the storage side, “cold” data (i.e., data that’s rarely accessed) can be offloaded to third-party services such as Amazon S3 for cost savings.

Image Credits: Neon

Neon implements what Shamgunov calls a “copy-on-write” technique to deliver checkpointing, branching and “point-in-time” restore. Using this, developers can create branches of databases for test environments every time new code is deployed, he said.

“Most cloud database platforms charge based on availability. But you only have about five hours a day of developers working on the codebase and about 22 business days in a month, so you only use the compute capabilities about 15% of the time when the database actually needs to run,” Shamgunov continued. “With Neon, the entire system is designed with costs in mind. It integrates a cloud object store to push cold data to the cheapest storage medium and automatically scales down to zero on inactivity.”

Shamgunov sees Neon’s main competitors as database vendors that separate storage and compute but aren’t open source, like Aurora and Google Cloud’s AlloyDB, and those that don’t separate storage and compute (e.g., Supabase, PlanetScale, …read more

Pogo lands millions to become the ‘Honey for the real world’

If Pogo had its way, you’d get paid every time you stroll down Market Street in San Francisco. Or check your e-mail. Or open its app. The only catch is that you give your personal data to the consumer-focused fintech in return.

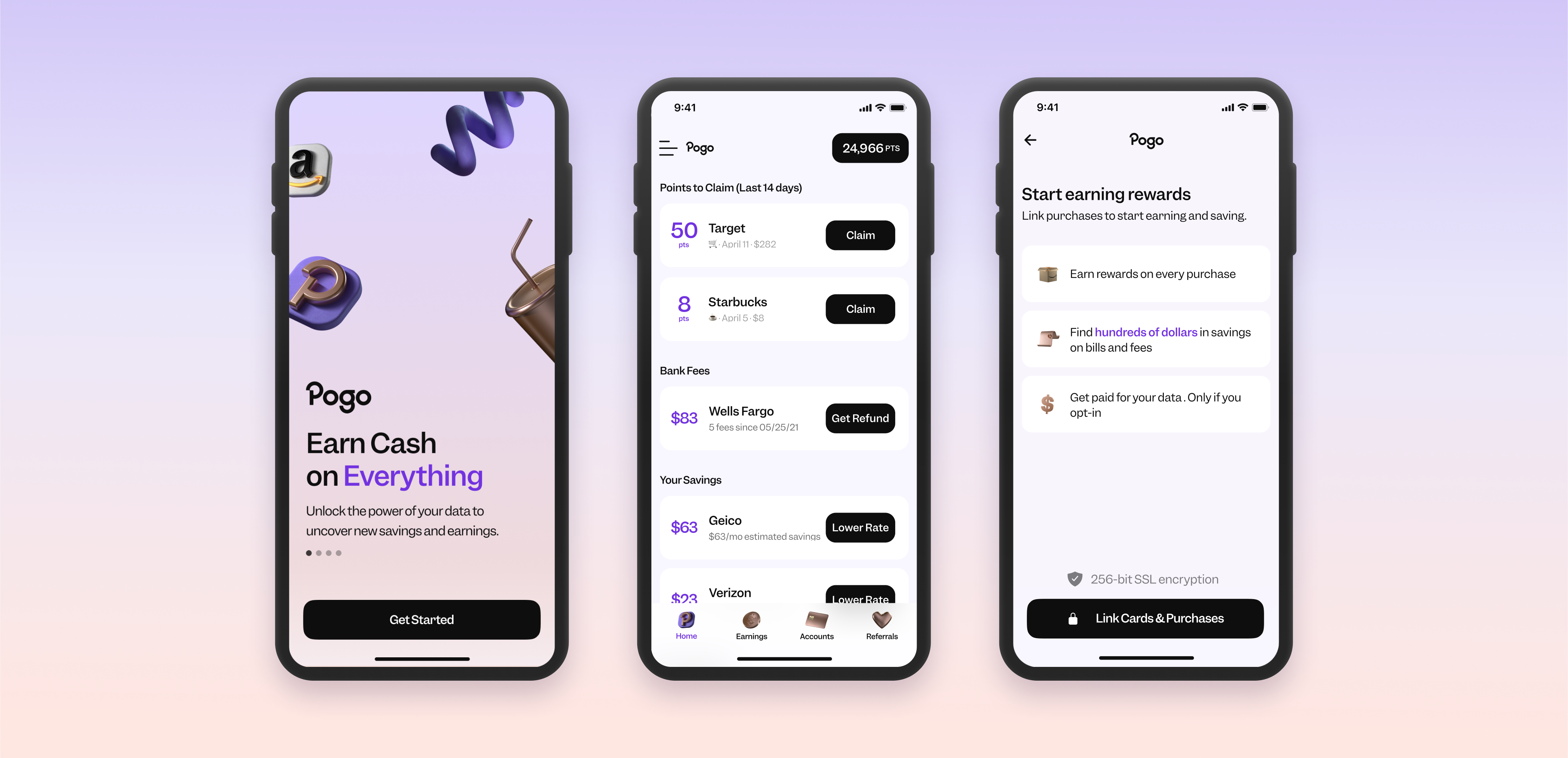

“We can almost create Honey for the real world,” said Pogo co-founder and chief executive Dom Wong, who is building the company alongside founders Oskar Melking and Shikhar Mohan. The startup seeks to use a few tech trends to its advantage. First, as data privacy becomes more of a concern, users are able to choose whether or not to share their information with companies. Pogo’s argument is that if they do share – why not get a benefit out of it?

Second, Pogo is a play on the rise of ecommerce tools such as Rakuten and Honey, browser extensions that automatically find cash, coupons and deals in return for your shopping history. And third, it is using a slew of APIs to plug into everywhere consumers exist, from their inbox, to their transaction history to, if they so choose, their location data.

To scale data in exchange for cash, the startup raised $14.8 million in venture capital in the form of a $12.3 million seed round led by Josh Buckley and a previously unannounced $2.5 million pre-seed round. Other investors in the startup include Slow Ventures, Village Global, Harry Stebbing’s 20VC, MrBeast’s Night Ventures, Hyper, Shrug, and creators including The Chainsmokers, Sophia Amoruso, Ryan Tedder and Lenny Rachitsky. Additionally the startup has money from the founders of Front, Rent the Runway, and, quite fittingly, Honey.

Here’s how it works: when a user joins the app, they are invited to send their data to the company. Once Pogo is connected with different sources of information, it begins to show rewards for purchases, or recommendations to “act on ” to save money.

Part of the app is helping people, who opt in, get paid for their data: “Pogo makes it easy for you to aggregate your data in one place, giving you the controls to get paid for use cases that you’re comfortable with, whether that’s anonymous market research or personalized marketing from trusted brands.” The other part of the app is similar to Honey, in that it works as a type of financial agent that sees your spending and makes suggestions, both for better deals or promotions you may not know about.

This isn’t entirely unheard of. Dosh, for example, is …read more

https://techcrunch.com/2022/07/26/pogo-lands-millions-to-become-the-honey-for-the-real-world/

Shopify lays off 10% of its workforce as rapid pandemic growth slows

Shopify is laying off around 10% of its workforce, or about 1,000 employees, the Wall Street Journal has reported. The Ottawa, Canada-based company told staff in a memo sent on Tuesday that the layoffs are necessary as users are pulling back on online orders and returning to old shopping habits.

“Shopify has to go through a reduction in workforce that will see about 10% leave by the end of the day,” Shopify CEO and founder Tobi Lütke write in a blog post about the layoffs. “Most of the impacted roles are in recruiting, support, and sales, and across the company we’re also eliminating over-specialized and duplicate roles, as well as some groups that were convenient to have but too far removed from building products. Emails will go out in the next few minutes that will clarify if your role was affected; those impacted will then have a meeting with a lead in their team.”

Lütke noted that when the COVID-19 pandemic hit, almost all retail shifted online, which led to demand for Shopify to skyrocket. The company had believed that surging e-commerce sales growth would last past the COVID-19 pandemic and that it had to expand the company to match demand.

“It’s now clear that bet didn’t pay off,” Lütke writes. “Ultimately, placing this bet was my call to make and I got this wrong. Now, we have to adjust.”

The job cuts the company announced today are the first big layoffs Shopify has undergone since the company was founded in 2006. Shopify is offering 16 weeks of severance to the laid-off employees, plus an additional week for every year of tenure at Shopify.

Lütke went on to note that it’s still early days for Shopify and that every team at the company is now either focused on building products or directly supporting those who do. He also noted that although the company has had to adapt to changes in the past, most of those adaptations have been about growing into something bigger, Now, the company has to grow into something “more focused, more driven, and more singular in mission.”

The company is scheduled to release it second-quarter financial results on Wednesday.

Shopify’s layoffs are among a wave of cuts and hiring freezes in the technology sector. An increase in interest rates, supply-chain issues and the reversal of pandemic trends have led to a number of companies reeling in their employee numbers.

Shopify to Lay Off 10% of Workers in Broad Shake-Up

Chief Executive Tobi Lütke says the company made a wrong bet on the pandemic-fueled boom in e-commerce growth lasting. …read more

Messaging app Viber launches Payments, a new digital wallet for paying bills, money transfers and buying goods

Viber, the messaging app owned by Japanese e-commerce giant Rakuten, has long been dancing around the area of fintech, launching services like money transfer and chatbot payments in various countries over the years. Now, it is making a move to double down on that strategy: it’s launching Payments on Viber — a new service that will let users set up digital wallets tied to their Viber accounts.

Linked to other bank accounts as well as Visa and Mastercard, Payments wallets can in turn be used to make bill payments and buy goods, as well as transfer money to other individuals. Peer-to-peer transfers will be the first of these services to launch, and these will be free. Services like payments to businesses like will have some fees attached.

The service is being launched first in two markets — Germany and Greece — with the plan being to extend that to the rest of Europe, and then Viber’s wider global footprint of 180 countries, this year and next.

Viber CEO Ofir Eyal said the reasons for starting with these two countries first were strategic.

Greece is what he described as a “purple country”, where Viber is installed on the phones of some 91% of smartphone users in the country, working out to 7 million Viber users in a population of 10.7 million, and making P2P transfer more viable (there is an option to transfer money to non-Viber users, but it is less seamless, he said).

Germany, meanwhile has just 3 million Viber users, but Eyal described it as a “strong corridor” for transfers to Greece. Viber also happened to win a security award there recently, he said, “so brand perception is strong.”

For now, Viber’s pre-existing payment services — such as chatbot payments — will continue to stay in place where they are live — mainly Ukraine, Bulgaria and Hungary, Eyal said. These have to date facilitated “millions” of transfers, but as Payments expands, they will gradually be wound down with Payments functionality replacing them.

Viber has a large team of engineers working on its app — in addition to voice and video calls and text messaging, it provides a complement of other media and third-party integrations for users. But interestingly, this turn to fintech is being done in partnership with an outside partner.

Rapyd, the “fintech-as-a-service” startup that provides a wide variety of embedded financial services by way of APIs to a host of other companies, is powering Payments in the two initial launch countries. Eyal noted that Viber might work with Rapyd in other markets, too, or it might opt for other partners. He also noted that Rakuten is not investing in Rapyd, nor does it have plans to. Viber might also incorporate services from Rakuten itself or companies that Rakuten does invest in as Payments and Viber’s fintech ambitions overall expand, he added. Viber is not handing the whole operation to Rapyd: it will be providing tech and data to fill out “KYC” aspects …read more

Butlr lands new cash to put people-detecting sensors in the office

One key advantage of Butlr’s sensors is that they preserves privacy, claims Deng. The palm-sized hardware captures only “temperature pixels” and nothing else, unlike, say, cameras.

“There are various sensing modalities to understand space occupancy and utilization, ranging from the old-school time and utilization studies (i.e., consultants with clipboards and clickers) to using Wi-Fi access points to cameras and more exotic lidar solutions,” Deng continued. “Each sensing modality has its advantages and limitations due to physics. The reason customers are choosing Butlr has to do with privacy, cost of ownership, time to value and flexibility.”

It’s worth noting that Butlr isn’t totally unique in its privacy-preserving approach.

Butlr, an MIT Media Lab spinout developing sensors that use body heat to estimate office occupancy, today announced that it raised $20 million in a Series A round with participation from Carrier Global Corporation (a strategic investor), Tiger Global, Primetime Partners, E14, Unionlabs, Hyperplane and Tectonic Ventures. Co-founder and CEO Honghao Deng said that the proceeds will support product development and expanding Butlr’s 50-person workforce, specifically its go-to-market team.

Deng asserts that many companies are flying blind when it comes to real estate. While they added heads during the pandemic, they now face economic headwinds that could — or already have — prompted hiring freezes and layoffs. With the lack of clarity on whether they should lease more space, reduce their footprint, use co-working spaces or all of the above, Deng said, it’s resulting in paused construction and office redesigns as companies figure how to accommodate employees’ needs while cutting costs.

According to a March AT&T poll, 72% of businesses lack clear hybrid work strategy.

“The pandemic brought home the need to understand occupancy and utilization data for real estate executives,” Deng told TechCrunch in an email interview. “Whereas pre-pandemic, they could assume everyone would be in every day of the week, that’s no longer the case. Real estate and workplace executives need to establish a new baseline and make data-driven decisions given the dollars at risk with regard to office space and employee productivity.”

He points to Butlr’s technology as the solution, which uses thermal sensing and AI to provide data on space occupancy and historical activity. The company’s sensors — which Deng and Butlr’s other co-founder, Jiani Zeng, developed while at MIT — don’t require networking equipment other than a Wi-Fi connection and hub and have a claimed “multiyear” battery life. Via a cloud dashboard and API, Butlr displays information like which areas of an office are the busiest and how many people have entered and exited a space.

One of Butlr’s temperature sensors. Image Credits: Butlr

One key advantage of Butlr’s sensors is that they preserves privacy, claims Deng. The palm-sized hardware captures only “temperature pixels” and nothing else, unlike, say, cameras.

“There are various sensing modalities to understand space occupancy and utilization, ranging from the old-school time and utilization studies (i.e., consultants with clipboards and clickers) to using Wi-Fi access points to cameras and more exotic lidar solutions,” Deng continued. “Each sensing modality has its advantages and limitations due to physics. The reason customers are choosing Butlr has to do with privacy, cost of ownership, time to value and flexibility.”

It’s worth noting that Butlr isn’t totally unique in its privacy-preserving approach. Density, a competitor, has long claimed that its sensors can only capture occupancy data and not information that might be used to identify a person.

Still, Deng says that Butlr’s hardware design and space-designing software was what won over many of its early customers.

“Commercial real estate and senior living are the first two industries to embrace Butlr’s technology, and the company …read more

Cordial, which personalizes and automates cross-channel messaging campaigns, raises $50M

Cordial supports A/B experiments, automatically updating messages to include better-performing content aligned with KPIs like revenue, gross margin and clicks. Out-of-the-box models attempt to predict everything from churn propensity (i.e., the likelihood of a customer to leave) to product affinity (i.e., a customer’s liking for a product), or users can build custom models and automation triggers based on their business needs, rules and inputs.

“Cordial has extensively emphasized and invested in machine learning throughout the platform, using customizable models for each client,” Swift said. “Clients can view or set the top predictors in each model to ensure they have a clear understanding of how Cordial’s machine learning is working … We believe that clients should have full access and be able to easily understand how our models work to ensure a trusting relationship and to avoid the “black-box” approach of most broad-based, generic AI.”

When asked who he sees as Cordial’s closest rivals, Swift named Braze and

Cordial, a cross-channel marketing and data management platform, today announced that it closed a $50 million Series C funding round led by NewSpring, with participation from new investor ABS Capital. Jeremy Swift, Cordial’s CEO and co-founder, said that the fresh capital will be used to expand the company’s global footprint, launch new platform features and nearly double headcount by the end of the year.

In Swift’s view, customers today expect highly personalized messaging in exchange for the first-party data they share. McKinsey agrees — according to a 2021 survey by the firm, 71% of consumers expect companies to deliver personalized interactions and 76% get frustrated when this doesn’t happen. To meet expectations, marketers must be able to go beyond simply aggregating data to power messaging that wins and keeps customers, Swift says.

Another challenge is striking the right balance between thorough outreach and giving customers some breathing room. It’s not easy. In a 2017 survey from Campaigner, nearly half (49%) of consumers said they receive too many emails from business owners and marketers and three in 10 said they wanted to hear from a brand once a month or less.

“Consumers aren’t tuning into the same old, cyclical outbound messages from brands, nor are they buying in the same way they used to … Having all of your customer data available in real-time when sending a message — via email, SMS, mobile, social, and more — has never been more important,” Swift told TechCrunch in an email interview. “Legacy email service providers (ESPs) are trying to acquire businesses to shore up their lack of messaging and data capabilities, but they’re just accumulating point solutions that end up providing a clunky user experience without the capability of truly real-time marketing execution.”

Seeing an opportunity to “inspire more thoughtful communication” between brands and consumers, Swift co-founded Cordial in 2014 with Adam Gillespie, Chris McGreal and David Baker. Gillespie and McGreal had previously worked together with Swift to build BlueHornet, an ESP that was later acquired by Digital River.

“Our hindsight within the ESP market has paid huge dividends to anticipate what marketers would need and want for the future, far ahead of the competition,” Swift said. “We believed that there had to be a better solution for marketers to engage their customers in personal, relevant ways.”

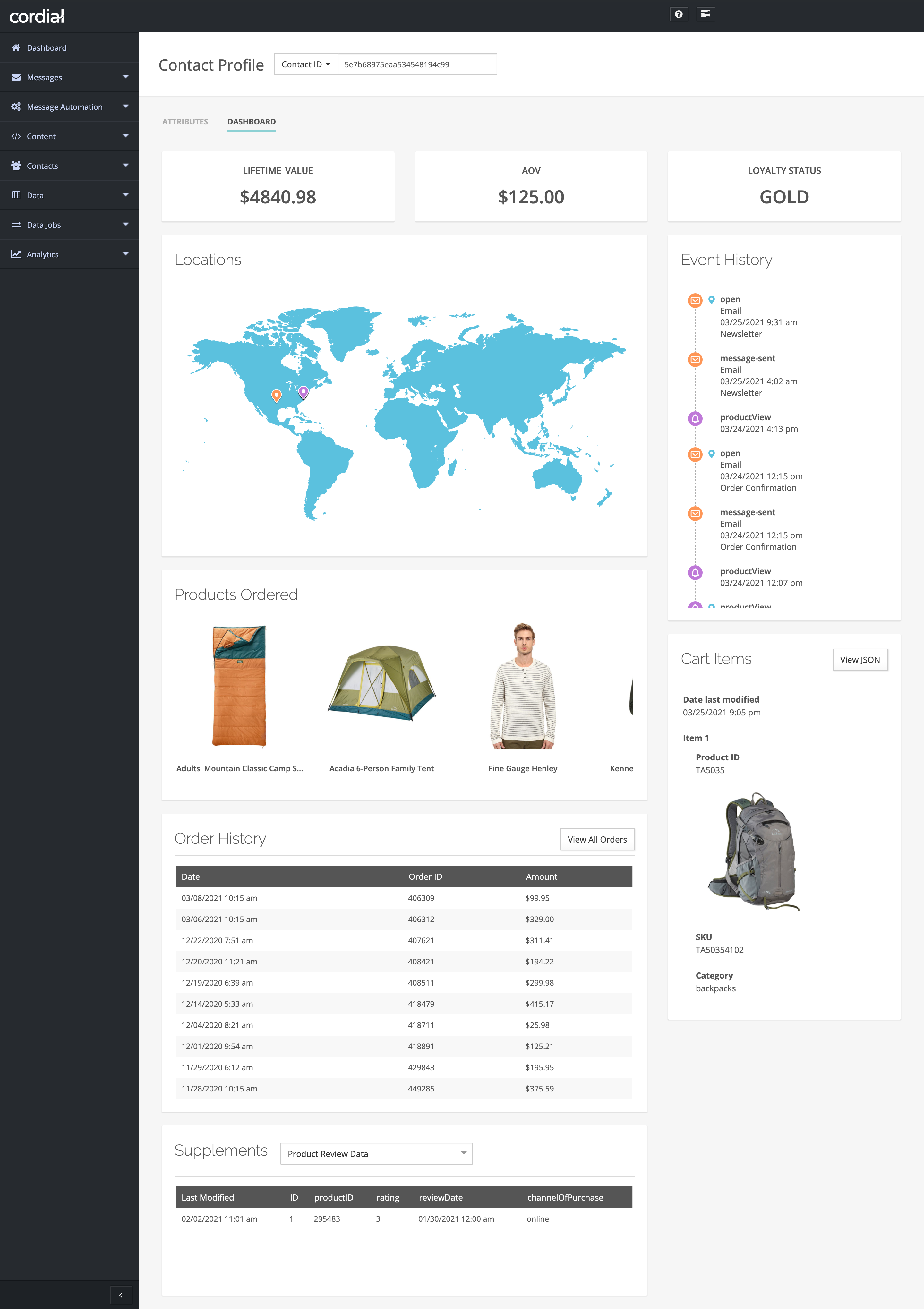

Cordial is the fruit of their labor, offering tools for orchestrating marketing across channels, including email, SMS and mobile apps. The platform brings together data from multiple sources (e.g., cloud storage, rest APIs) to create AI models that automate campaigns, letting marketers connect customers to known profiles for an improved customer experience.

The Cordial central dashboard. Image Credits: Cordial

Cordial supports A/B experiments, automatically updating messages to include better-performing content aligned with KPIs like revenue, gross margin and clicks. Out-of-the-box models attempt to predict everything from churn propensity (i.e., the likelihood of a customer to leave) to product affinity (i.e., a customer’s liking for a product), or users can build custom …read more

Snyk adds policy-based code security to its arsenal

Last year was a pretty good one for Snyk, a Boston-based security company. It raised a hefty $530 million on a $8.5 billion valuation, and with that kind of money in the bank, it’s probably not surprising that it went shopping. In February, it bought developer-focused cloud security company Fugue for an undisclosed amount.

Today, Snyk announced a new developer-centered cloud security product at AWS re:Inforce in Boston. The product’s policy engine enables security teams to hard code complex rules into the system to fix problems before they become an issue, and it’s based on the technology that Fugue brought to the company.

Former Fugue CEO and co-founder Josh Stella, who is now chief architect at Snyk, says when Snyk’s co-founder Guy Podjarny approached him last year, they bonded over the idea of putting developers at the center of the security solution. “We got into a conversation about how in both of our views the future of security would be focused on developers, the builders of systems,” he said.

He says when you look at some of the major breaches in recent years, they typically have involved system-level security issues that the solution his company brought to Snyk is designed to prevent. “Our unified policy engine will allow both developers and security practitioners to share an understanding through policy code of what is safe and secure. And that allows us at Snyk to share with all of our customers what we know is safe or unsafe,” he said.

He says this goes beyond the protoypical kind of use case of an Amazon S3 bucket being left exposed, which he says is rarely as simply as a misconfiguration. “Very often it’s a little more nuanced than that and it’s some combination of how the application works in the application code, how the IAM (identity and access management) privileges are configured, and how the S3 bucket is configured,” he said.

“And our approach to our policy engine allows us to look across those things, which is where the real vulnerabilities tend to lie, and where they get exploited.”

He said that from the beginning the idea was to integrate this solution into the Snyk platform. Snyk CEO Peter McKay says that Fugue’s technology really enhances the company’s product set, and adds a critical component.

“We needed to become more developer centric, and we looked at that market. We saw really one company that we thought was the most developer centric, which was Fugue, and [acquiring them] allowed us to bring their capabilities into our platform, which allowed us to offer the fifth product [in our product portfolio],” he said.

The product is available to a limited group of customers starting today with general availability expected later this year. And even though they are announcing it at an Amazon security event, it will work on all major cloud platforms.

https://techcrunch.com/2022/07/26/snyk-adds-policy-based-code-security-to-its-arsenal/

Corporate travel tech platform Spotnana nabs $75M

Corporate travel bounces back

The global business travel market was a $700 billion industry in 2020,

Spotnana, a self-proclaimed “travel-as-a-service” platform that targets corporations, travel management firms, and other technology companies with a cloud-based toolset for booking and managing travel, has raised $75 million in a series B round of funding.

The raise comes less than a year after Spotnana exited stealth with $41 million in funding, and the latest cash injection is perhaps indicative of the world slowly returning to normal as businesses resume at least some degree of travel.

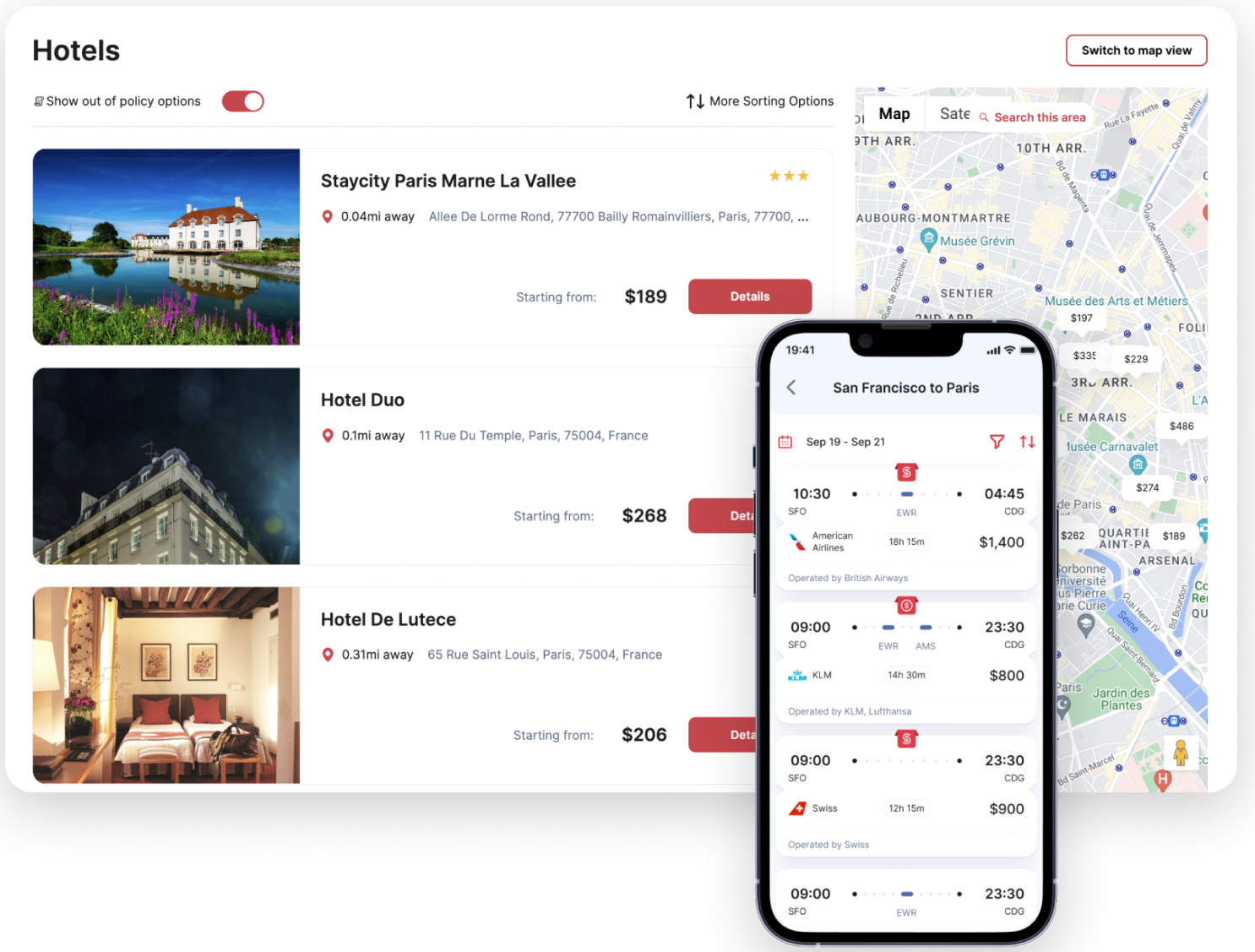

Founded out of New York in 2019, Spotnana touts itself as a “unified cloud-based platform,” one that gives a consistent interface and booking experience to each user — it serves as a single platform for both travelers and agents, who can see the same travel inventory, profiles, policies, and rates, all at the same time.

But Spotnana can be used in different ways, either as a full standalone product replete with interface, or as an API that allows third-parties to take Spotnana’s infrastructure and build their own products. At its core, Spotnana is about bringing “consumer-grade” booking technologies into the enterprise, while simultaneously allowing anyone to leverage its booking engine and data integrations.

“It’s our mission to rebuild the infrastructure of the travel industry in order to bring freedom, simplicity, and trust to travelers everywhere,” Spotnana cofounder and CEO Sarosh Waghmar said in a press release. “The infrastructure that has been in place for decades puts huge barriers between suppliers and travelers.”

Spotnana interface

Corporate travel bounces back

The global business travel market was a $700 billion industry in 2020, according to data from Allied Market Research, a figure that was surprisingly high given that the world was in a pandemic-driven lockdown. But as corporate travel begins to crank back into gear, the sector is expected to hit the giddy heights of $2 trillion within six years.

Elsewhere, there is evidence that investors are starting to view travel tech companies favorably again. Just last year, corporate travel company TripActions hit a $7.25 billion valuation, though this was in part due to its expansion into broader corporate expenses — even work-at-home employees need to buy things.

Spotnana, meanwhile, has a fairly impressive team of people at the helm. Waghmar previously started another digital travel management company called WTMC, while CTO Shikhar Agarwal formerly worked at Google Brain. And then there’s executive chairman Steve Singh, who founded travel expense management company Concur before selling to SAP for more than $8 billion in 2014. In 2020, Singh joined Madrona Venture Group as managing director, and co-led Spotnana’s series A round of funding.

Spotnana’s series B round of funding was led by Durable Capital Partners LP, with participation from Madrona Venture Group, Iconiq Growth, Mubadala Capital, and Blank Ventures.

https://techcrunch.com/2022/07/26/corporate-travel-tech-company-spotnana-nabs-75m/