Category: TECHNOLOGY

Pear VC’s Anand Iyer goes solo with new $200M fund for crypto developer tools

Engineers are the bedrock of any tech product, and blockchains are no exception. As the race between different chains heats up, communities of loyalists are duking it out to attract developers to their blockchain of choice in hopes that doing so will turbocharge growth. And competition aside, without adequate infrastructure and tooling, the big ideas and promises of web3 don’t have any shot of seeing the light of day.

That’s why Anand Iyer, who has worked at Microsoft as a “developer evangelist” trying to incentivize engineers to build on the company’s stack, is looking to do the same in crypto — this time, as an investor. Iyer, a serial entrepreneur with two successful exits, spent the majority of last year honing in on his interest in web3 as a visiting partner at Pear VC and an instructor teaching a DeFi masterclass to over 2,000 students.

Now, the blockchain aficionado who got his start in trading Bitcoin in 2013 is joining the ranks of a growing group of solo GPs raising venture funds built on their own name and reputation. Iyer has raised $20 million in what he says was an oversubscribed round for his inaugural fund, Canonical Capital, he told TechCrunch. Participants in the fundraise include a number of family offices and individuals from the VC and tech communities, including Coinbase Ventures’ Shan Aggarwal, a16z’s Marc Andreessen and Chris Dixon, Judith Elsea, Lux Capital, Mar Hershenson, Haseeb Qureshi from Dragonfly Capital, Dan Romero, Semil Shah, Amy Wu from FTX Ventures and Bilal Zuberi, among others, the firm says.

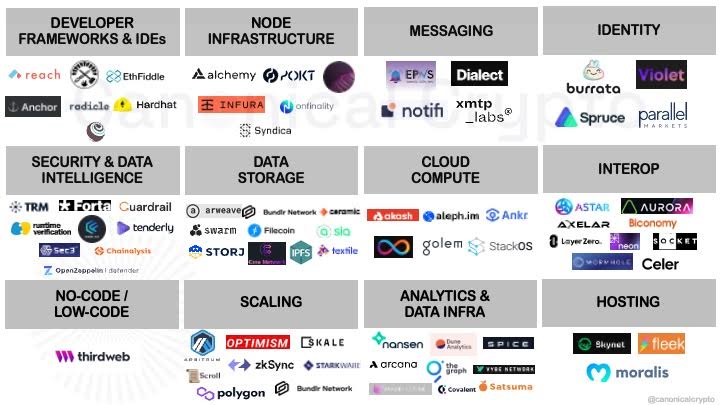

Canonical has already made 16 investments in seed and pre-seed startups spanning the developer infrastructure landscape, Iyer said. Its portfolio includes Solana-based NFT marketplace FormFunction, low-code multi-chain dApp tool Thirdweb, and web3 messaging startup Notifi. The firm expects to make 40 to 50 investments in its first fund, writing checks between $250,000 to $500,000, it says.

Canonical Crypto’s market map of various segments within the web3 developer infrastructure landscape Image Credits: Canonical Crypto

Iyer sees his fund’s relatively small size as a key differentiator in a competitive space. Traditional venture firms such as Sequoia, a16z, and Silver Lake have all made recent forays into web3 developer infrastructure startups.

“I didn’t want this to be a fund that was too big, or greater than 20 million, because I can participate in many rounds. I can also invest in the very, very early stages, so I’m not trying to compete necessarily for a certain percentage of ownership. I can write relatively small checks and still be a meaningful part of the startup journey very early on,” Iyer said.

Despite that developer infrastructure is a hot space for venture investors of late, Iyer says he still sees it as an untapped area within crypto.

“If you look at DeFi apps, or dApps today, I feel like they’re built by early adopters for early adopters,” Iyer said, adding that in order to expand its reach, crypto needs more …read more

JupiterOne raises $70M at a $1B+ valuation to help track, manage and secure complex cyber assets

One of the by-products of today’s IT environments — which can involve multiple clouds and data warehouses, on-premise servers, thousands or even millions of connected devices and users, a multitude of apps and more — is that this size and complexity is a minefield when it comes to security. Malicious hackers have a lot of potential points of entry to exploit, so the aim for security specialists is to have a complete picture of how things are looking across the whole of the network — regardless of how fragmented those operations might actually be.

Today a company called JupiterOne that’s built a platform that aims to do just this is announcing $70 million in funding at a valuation it says is over $1 billion — a sign not just of its own success but also of the opportunity investors see for growth.

Tribe Capital is leading the round, with participation from a number of others, including new backers Intel Capital and Alpha Square Group, and existing investors Sapphire, Bain Capital Ventures, Cisco Investments, and Splunk Ventures.

You’ll notice a number of tech companies in that list. Part of JupiterOne’s special sauce is how it integrates leverages data effectively from the many tools and vendors an organization might work with, and so all of these are strategic. Case in point: just yesterday the company announced a deep integration with Splunk to provide better data visibility for Splunk users. Another example of that is a recent launch with Cisco for a new product, Cisco Secure Cloud Insights with JupiterOne.

“JupiterOne directly complements our cloud-first portfolio and our Splunk Ventures investment, coupled with a new integration partnership, will make it easier for organizations to analyze security insights,” said Varoon Bhagat, vice president of corporate development for Splunk Ventures, in a statement. “Splunk and JupiterOne share a commitment to offering our customers deep visibility to stay ahead of the threat landscape, the ability to safely scale, and use data to help power digital transformation opportunities.”

Erkang Zheng, JupiterOne’s founder and chief executive, launched the company initially as a spinout of LifeOmic, with Zheng himself having a long history of working in security for a number of major enterprises, including also Fidelity and IBM. His thesis, which continues to today, is that you cannot conceive of “assets” simply as infrastructure, but that data and really anything and everything on the network (or existing in any way to connect to it) has to be considered part of that bigger picture of “cyber asset attack surface management”, as the bigger space that JupiterOne is in is called.

“JupiterOne was created from my own pain points and my own digital transformation journey,” he said. “How do we transform security organizations into more than just engineering? That is what digital transformation is about, helping use data to run more efficiency, so that for example remote work is not so painful, and so on. The only way to do that is to have …read more

Visa and Kenya’s Safaricom launch virtual card to support global digital payments via M-Pesa

Global digital payments giant, Visa, and East Africa’s biggest telecom Safaricom, the operator of the M-Pesa mobile money product, have today launched a virtual card, enabling millions of M-Pesa users to make digital payments globally, and giving Visa extended reach across Africa.

The launch of the M-Pesa GlobalPay Visa virtual card follows a partnership between the two companies forged in 2020 to develop “products that will support digital payments for M-Pesa customers.”

The virtual card will enable 30 million M-Pesa users to make cashless payments at Visa’s global network of more than 100 million merchants spread across 200 countries. Users can activate the virtual card through the M-Pesa mobile app or by USSD. Previously, M-Pesa users could only make mobile money payments within M-Pesa’s network of nearly 400,000 merchants.

“Safaricom has changed how money moves in Kenya. We are pleased to be working together to build new and innovative payments products and services that will help merchants and customers in Sub-Saharan Africa overcome hurdles to global trade,” said Visa vice president and general manager for East Africa, Corine Mbiaketcha, during the launch of the new service.

“We are thrilled to be collaborating with Safaricom, especially given the current environment where we are seeing a hastened shift away from cash and toward digital payments. We are forging a new path for local payments by combining our large global network and experience with Safaricom’s local know-how and subscriber base,” said Mbiaketcha.

Launched in March 2007, M-Pesa remains one of the most powerful mobile money payment networks across the globe, with a user-base of 51 million (30 million in Kenya alone). It is also arguably the most recognized fintech product across Africa through its multiple integrations including with financial firms to provide digital banking services, and other partners in promoting cashless transactions.

Kenya remains the most vibrant mobile money market in Africa and across the globe, with almost every adult using M-Pesa frequently to send, receive, withdraw or save money, or to pay bills to merchants. This popularity has made it Safaricom’s biggest revenue earner. The telco’s latest financial announcement indicates that M-Pesa revenue grew by 38.3% to $927 million in the year ended March 2022.

Safaricom operates M-Pesa in Kenya, while South Africa’s Vodacom runs the service through its subsidiaries in Tanzania, the Democratic Republic of Congo, Mozambique, Lesotho, Ghana and Egypt. Safaricom and Vodacom operate M-Pesa Africa as a joint venture after acquiring the M-Pesa brand and platform from their UK parent firm Vodafone Plc in April 2020.

Following the Kenya launch, Visa hinted that it will forge similar partnerships across Africa, opening up a huge market for merchants tapping Africa for growth.

“Visa is committed to expanding the payments ecosystem across Africa by opening up the global marketplace for every single consumer. This partnership with Safaricom is an important step in helping to achieve this,” said Mbiaketcha.

Other Safaricom global partnerships include with PayPal, AliExpress and Western Union, that enable customers to receive and …read more

Yummy’s super-sized round helps grow its delivery, ride-sharing super app in LatAm

Less than a year after taking its first funding, Latin American local on-demand delivery and transportation super app Yummy is back with an upsized round of $47 million.

The round was led by Anthos Capital, with the participation of JAM Fund, Soma Capital, WIND Ventures, Ethos Capital and YC Continuity. The new investment gives Yummy a total of $69 million in funding to date.

Yummy was founded in 2020 by CEO Vicente Zavarce, a Venezuelan native and former Postmates and Getaround director of user acquisition. It started out as a food-delivery app and was part of Y Combinator’s summer 2021 cohort.

Today, the free super app provides delivery of items — from food to medicine to clothing — ride-sharing, grocery delivery in under 20 minutes and the purchase of experiences like concerts and sporting events. The company has also moved on from its initial markets of Venezuela and Bolivia and into Peru and Panama, Zavarce told TechCrunch. In addition, it partnered with quick-serve restaurants, including KFC, Arturo’s and Burger Shack to provide exclusive offerings for customers.

This latest investment is nearly three times higher than the amount Yummy announced last October. Around this time last year, the company had about 200,000 registered super app users, and that now sits at 2.5 million users, Zavarce said. It is also providing thousands of gig worker jobs in the region.

Yummy app Image Credits: Yummy

For its grocery business, Zavarce’s goal last year was to have 50 active dark stores by the end of 2022. It has 21 of its own microfulfillment centers and also works with partner-owned facilities. Meanwhile, Zavarce tells me the ride-sharing business, which includes both motorcycle and car options, became the first of Yummy’s business units to achieve profitability.

Altogether, Yummy is working with over 8,000 merchants, processing 800,000 monthly transactions across its markets and growing over 40% quarter over quarter. The average cart size varies per category, but on the prepared food side, it is $14, while groceries are $30.

With the new capital, Yummy plans to invest in product development, increasing density within its current categories and expanding coverage in its more mature markets, including Venezuela and Bolivia.

The company initially started in Panama and Peru with groceries, but now that it has had some success there, Zavarce expects to expand more categories.

“This round is going to focus on going deeper where we already are,” he added. “We realize that e-commerce penetration in Latin America is still low, and we have also identified access to modern financial services as a need and opportunity for us.”

Zavarce noted that he didn’t want to speak too early on what plans for the financial services would look like, but he did reveal that with consumers using the Yummy app to purchase food and groceries, “there is no reason why we couldn’t add a fintech layer to make everyday life in Yummy easier.”

https://techcrunch.com/2022/06/02/yummy-delivery-ridesharing-superapp-latam/

Sanlo, a startup that offers app and game developers access to financial tools and capital, raises $10M

As for the new funding, Caliujnaia said Sanlo will use the money to create more products for developers and to bring on more people to grow its 15-person team.

“The plan is to build out more products and to build out the team,” Caliujnaia said. “We’re looking for passionate people to help us build better and faster. We’re working with people primary in North America at this point, but we’re open to talented people in other places around the world.”

The funding round included participation from existing investors, including Initial Capital, Portag3 Ventures, XYZ Venture Capital, London Venture Partners and Index Ventures. The funding round also included participation from new investors, including Fin Capital, GFR Fund and a number of angel investors. Sanlo’s Series A funding comes a year after it

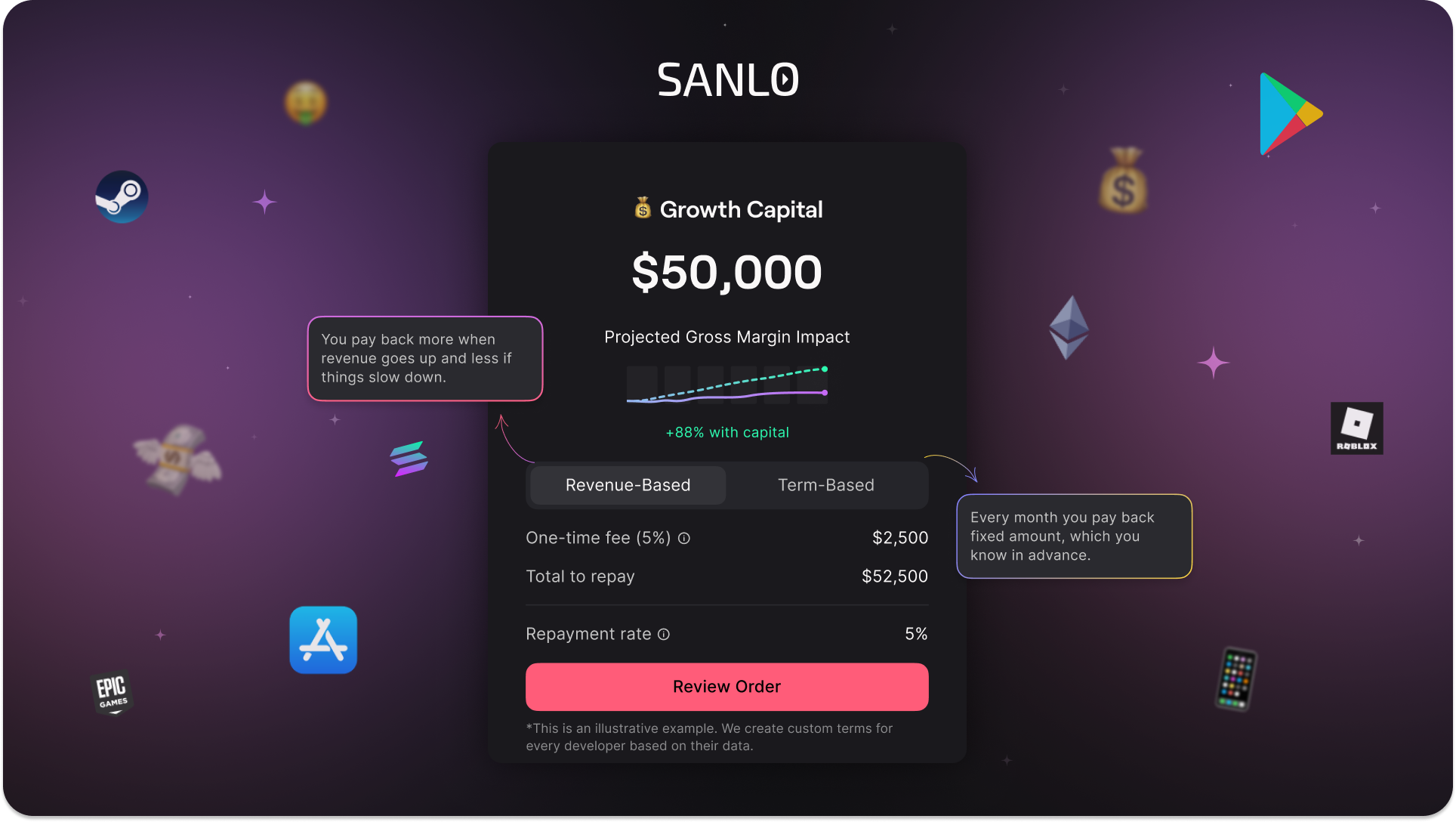

Sanlo, a San Francisco-based fintech startup that offers small to medium-sized game and app companies access to tools to manage their finances and capital to fuel their growth, has raised $10 million in Series A funding led by Konvoy.

The startup was founded in 2020 by CEO Olya Caliujnaia and CTO William Liu, who both have backgrounds in fintech and gaming. Sanlo offers businesses access to technology, tools and insights that aim to help them achieve scalable growth. When Sanlo determines that the business could benefit from the deployment of capital, the startup assists by offering financing. Sanlo notes that it’s not a VC fund that takes equity in exchange for funding or a lender that charges compounding interest. The amount of financing provided varies, but it’s non-dilutive capital, which means that Sanlo takes no ownership stake in the companies it finances.

Caliujnaia told TechCrunch in an interview that one of the ways that Sanlo differs from other fintech companies is its focus on gaming and app developers. She noted that although there are other companies that are focusing on other verticals in ecommerce or SAAS, Sanlo is focused on gaming and consumer apps.

“We’re a technology company, not a fund,” Caliujnaia said. “That allows us to move quickly and be transparent about how we work and how we arrive at the products that we build and offer to customers. We’re also building a full stack of products, it’s not just about growth capital. Developers have other options via publishers, VCs and banks, but those usually involve complex and lengthy processes.”

To get started, Sanlo asks companies for certain types of data, including product data about how well the app or game monetizes. Sanlo also gets information about customer acquisition and retention, as well as marketing data and a subset of financial data. Its predictive algorithms then continually monitor the company’s growth trajectory to surface insights to identify where and how the business can grow. Sanlo then provide companies with access to capital.

Image Credits: Sanlo

As for the new funding, Caliujnaia said Sanlo will use the money to create more products for developers and to bring on more people to grow its 15-person team.

“The plan is to build out more products and to build out the team,” Caliujnaia said. “We’re looking for passionate people to help us build better and faster. We’re working with people primary in North America at this point, but we’re open to talented people in other places around the world.”

The funding round included participation from existing investors, including Initial Capital, Portag3 Ventures, XYZ Venture Capital, London Venture Partners and Index Ventures. The funding round also included participation from new investors, including Fin Capital, GFR Fund and a number of angel investors. Sanlo’s Series A funding comes a year after it announced $3.5 million in seed funding co-led by Index Ventures and Initial Capital.

As part of the funding announcement, Sanlo also revealed that it has partnered with HCGFunds to expand its pool of capital …read more

Tech Valuations Tumble, but Business Software Stocks Are Cushioned by the Cloud

Enterprise software companies have shown relative resilience in the recent tech rout, and fevered demand for their cloud-computing services explains it, analysts say. …read more

Nabla is now offering a health tech stack for patient engagement

After setting out to examine digital healthcare from the inside by launching its own women’s health clinic as an app last year, French startup Nabla is executing the next step in a planned pivot to b2b — announcing today that it’s opened its machine learning tech stack to other digital health businesses and healthcare providers so they can offer what it bills as “personalized medicine”.

Nabla’s AI-powered patient communications and engagement/retention platform is designed to support clinicians to deliver a more continuous, data-driven service, whether the client is offering real-time telehealth consultations or delivering a service to patients via asynchronous, text-based messaging.

Nabla’s messaging and teleconsultation communication modules sit as a layer atop the customer healthcare service, ingesting and structuring patient data — with its machine learning software supporting clinicians with real-time prompts and visualizations, as well as offering ongoing patient outreach features to extend service provision.

The startup argues its approach can improve medical outcomes by supporting healthcare professionals to be able to ask relevant questions during a consultation, based on the AI’s ability to aggregate patient activity and surface contextually relevant data — and afterwards, with features like automated transcription and by suggesting updates a clinician could make to a patient’s medical file.

It likens the platform’s capabilities to having a really attentive family doctor who knows their patient’s full medical history and situation — and has a fault-less memory for all that detail. But the tech can go beyond what even a great doctor can offer as it enables healthcare providers to supplement in person consultations with ongoing, asynchronous outreach to provide a layer of continuous care — such as via follow on scheduled messaging (e.g to offer treatment reminders or ask patients about their progress etc). And, of course, even the best human doctor isn’t going to be able to provide patients with that level of check-in and attention in between visits.

Nabla’s premise is therefore that blending digitally delivered, synchronous (human) care with data-driven (AI-powered) support and asynchronous follow ups can offer a win-win: For patients, who get more ongoing (and potentially holistic) care than they could expect from traditional healthcare service delivery; and for digital health businesses which get to drive customer engagement and retention thanks to the smart, personalized assistance and outreach enabled by its platform.

Customer retention has become a pressing problem for digital healthcare providers, Nabla argues — pointing out that after the flood of interest in the space during the pandemic many of these businesses are likely coming back down to Earth with a bump as patient attention disperses, and as the wider global downturn complicates the task of scaling by raising funding.

“Health tech of course is affected a lot by the economic downturn,” says co-founder and CEO Alexandre Lebrun. “Around us we see lots of health tech startups that… owing to the COVID-19 crisis they automatically had lots of patients… It was very easy …read more

https://techcrunch.com/2022/06/02/nabla-health-tech-stack-api/

Indonesian hyperlocal social commerce app Super gets $70M led by NEA

Super, the Indonesian social commerce startup focused on small towns and rural areas, announced today it has raised an oversubscribed $70 million Series C. The round was led by NEA with participation from Insignia Ventures Partners, SoftBank Ventures Asia, DST Global Partners, Amasia, B Capital, TNB Aura, Bain Capital chairman Stephen Pagliuca, Goldhouse, and Xendit CEO Moses Lo.

This brings Super’s total raised so far to $106 million since it was founded in 2018. TechCrunch last covered the startup at the time of its $28 million Series B in April 2021.

Steven Wongsoredjo, the co-founder and CEO of Super, says that Indonesia’s Tier 2, Tier 3 and rural area’s gross domestic product is three to five times lower than Jakarta, yet the cost of consumer goods there is higher by 20% to 200% thanks to supply chain issues. Not only that, but more than 30% of Indonesia’s GDP comes from East Java, Kalimantan and East Indonesia, making those places a valuable source of potential revenue for fast-moving consumer goods. By streamlining the supply chain and giving FMCG brands an easier way to reach consumers in rural areas, Super is also able to lower the costs of goods.

The startup plans to use its funding to expand into Kalimantan, Bali, West Nusa Tenggara, East Nusa Tenggara, Maluka and Papua over the next few years.

Super currently works with third-party logistics providers to create a hyperlocal logistics platform that it says can deliver consumer goods to thousands of agents within 24 hours of an order. The company’s agents, or resellers, can either be individuals or local shops called warungs.

Super says it currently has thousands of community agents, and aggregates and distributes millions of U.S. dollars worth of goods to communities each month. It now operates in 30 cities in East Java and South Sulawesi, primarily targeting areas that have a GDP per capital of $5,000 USD or lower.

Part of the funding will also be used to apply machine learning to the SKU’s in Super’s warehouse, to help the startup understand what sells best and where, so it can better determine the kind of inventory it holds. It is launching two private-label brands, including in cosmetics, and will create an app feature for agents that will let them track end-consumer transactions.

a16z-backed Loom lays off 14% of staff, one year after becoming a unicorn

Loom, an enterprise collaboration video messaging service, has laid off 34 employees, or 14% of its total staff, sources say. Employees across product and people operations were impacted.

The venture-backed company confirmed the layoff and number of people impacted, and provided the following statement from founder and CEO Joe Thomas:

We’ve had to make the extremely difficult decision to move forward with a reduction in force across our team. Each person impacted was not only a talented employee, but also a valued individual and teammate. We’re committed to supporting these employees through this transition both in their offered severance as well as career support. We’re confident in the path ahead for Loom. This decision was ultimately made to ensure we’re able to move forward sustainably, especially in light of increased economic uncertainty, and continue to deliver on our vision for years to come.

The company was founded by Thomas and Vinay Hiremath in 2015, hitting 1.8 million users across 50,000 businesses just three years later. Per its website, Loom currently boasts 14 million users across 200,000 companies — including Netflix, Atlassian, HubSpot and Juniper Networks.

Similar to Hopin, Loom benefited from a surge of people working from home in response to the COVID-19 pandemic; the product was positioned to help remote workers find better ways to connect with colleagues in a virtual-first world, and help hybrid workforces find a lightweight way to skip some meetings. Then, again similar to Hopin, the startup conducted layoffs to help it build in what it describes as a more sustainable way moving forward.

That growth has attracted $203 million in known venture capital funding, with the company most recently announcing a Series C led by Andreessen Horowitz. The same round valued the company at $1.53 billion, making it hit unicorn status for the first time. Kleiner Perkins, Sequoia, Coatue and General Catalyst are also investors in the company.

Over a year has gone by since the startup landed the new financing and valuation, and per today’s news, Loom joins the club of unicorns that have had to scale back workforces after landing the coveted milestone.

Less than a year ago, visual creator tools startup Picsart raised $130 million from SoftBank, landing a valuation of over $1 billion. The company laid off 8% of its staff last month, affecting 90 people. Cameo, which also became a …read more

https://techcrunch.com/2022/06/01/a16z-backed-loom-video-layoffs/

Poparazzi hits 5M+ downloads a year after launch, confirms its $15M Series A

Though Poparazzi appears to be an overnight viral sensation, it’s actually taken three years to get to this point, explains co-founder and CEO

Poparazzi, the anti-Instagram social app that hit the top of the App Store last year, is today, for the first time, detailing the growth stats for its business, future plans, as well as its previously unconfirmed Benchmark-led Series A round. The L.A.-area startup now reports its iOS-only has seen over 5 million installs in its first year, with users primarily in the Gen Z demographic.

The startup says that 75% of its users are between the ages of 14 and 18 and 95% of users are between 14 and 21. Most of its users are U.S.-based and, to date, they’ve shared over 100 million photos and videos on the app.

While the startup positioned itself as an Instagram alternative where friends create your profile, the app’s competition today is not really the established tech giants. Instead, it’s the newer set of “alternative” social media apps that are targeting a younger crowd, like Yubo, Locket, LiveIn, HalloApp, and BeReal, among others. In general, this group of apps shares a thesis around how big tech is no longer the best place to connect with your real-life friends. With differentiated angles, they all claim to offer that opportunity.

Some of these are already outpacing Poparazzi. Yubo says it’s seen 60 million sign-ups to date. BeReal, which has declined press, has an estimated 12.3 million global downloads, according to app intelligence firm Sensor Tower. The firm also reports that Locket has seen about 18.7 million worldwide installs to date, while LiveIn has hit a little more than 8 million installs. (Sensor Tower also sees 4.6 million downloads for Poparazzi, which is largely in line with the startup’s claims as these estimates aren’t an exact science.)

This heated competition among alternative social apps could explain why Poparazzi is taking to its blog today to share its metrics and confirm its financing after a year of silence. (Or it could be that it’s hiring.)

Image Credits: Poparazzi

Though Poparazzi appears to be an overnight viral sensation, it’s actually taken three years to get to this point, explains co-founder and CEO Alex Ma. He along with his brother, co-founder Austen Ma, went through several pivots to get to Poparazzi, he told TechCrunch.

“Poparazzi was maybe the 11th or 12th app that we built,” Alex says. Among those was the audio social network TTYL, a sort of “Clubhouse for friends.” But, says Alex, nine months into TTYL the team realized that things weren’t working and they made the decision to wind it down.

The co-founders understood that most social apps fail, and had decided the best thing to do was to keep building and experimenting until one hit. At other points, they tested a live texting app called Typo and many other social experiences. But when they built Poparazzi, they knew from day one it was something special. The app blew up, primarily among high schoolers, who were testing the app via TestFlight.

The app’s idea was, effectively, to turn …read more