Category: TECHNOLOGY

SureImpact wins the TC City Spotlight Columbus: Pitch-Off

I’m excited to announce SureImpact won today’s City Spotlight: Columbus pitch-off! Winning a free exhibition space and a spot in TechCrunch Startup Battlefield 200, the Ohio-based company pitched alongside Skuld and Healia Health on TechCrunch Live earlier today.

Founder and CEO Sheri Chaney Jones, pitched to two fantastic judges – Anna Mason (Managing Partner, Rise of the Rest Seed Fund at Revolution) and Parul Singh (General Partner, Initialized Capital).

In four-minutes, Sheri explained how SureImpact modernizes the social service and social impact sectors. With a case-management based integrated platform, SureImpact SaaS platform allows both the organization and its funders to clearly understand key impact metrics and ROI – real time and with less demand on the non-profit.

Historically, organizations relied on top level impact metrics to share with those that contribute into the organization. With the increasing demand in real-time social impact data, non-profits are required to elevate their tracking and reporting capacities. SureImpact solves the technology gap with automated data collection and impact evaluation capacity, that connects all players in the social impact ecosystem.

Sheri says, non-profits no longer need to “waste time manipulating reports for their funders, and wasting funders time by having to wade through grant narratives and aggregated data to understand their collective impact.”

The company says it developed the product with 10 paid beta customers, paying $15,000 annually. After launching in February 2020, the company touts a whopping 220 organizations on its platform, across 50 US markets. SureImpact has raised approximately $1.6 M in funding from a variety of angels and VCs.

An expert in her own right, Sheri has over 20 years of experience in the non-profit sector, as a serial social impact founder and working directly with mission driven organizations.

Special thanks to the wonderful judges and the founders who took the stage with fire and pitch mastery.

https://techcrunch.com/2022/06/01/sureimpaact-wins-the-tc-city-spotlight-columbus-pitch-off/

Daily Crunch: Buick unveils Wildcat concept car as company shifts to EV-only lineup

Dear Sophie,

Our startup will be sponsoring my co-founders and me for O-1A visas.

How do we qualify for each of the O-1A criteria?

— Extraordinary Entrepreneur

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Extra, extra, read all about it — Sheryl Sandberg surprised us this afternoon and said she was stepping down as Meta COO. We’re still figuring out the details, so stay tuned for more. And oh Hai! Or rather, Ohio — more specifically, Columbus, Ohio. Today, we’re doing our City Spotlight, and we’ve been exploring who’s building in Columbus, and how it became the tech hub of the Midwest. We also dove into why Intel chose the city to build its $20 billion manufacturing facilities. — Haje and Christine

The TechCrunch Top 3

- Buick going full EV: If you are into electric vehicles, you will love today’s Daily Crunch. First up is Buick, which is full of surprises today — not only did the company say it is transitioning to electric vehicles only, but after a few years of focusing on SUVs, Buick is going back to its coupe and sedan roots. The Wildcat looks like a sweet ride. If it wasn’t already evident, the U.S. is getting more serious about EVs, per Tim. Speaking of a sweet ride, the 1980s are indeed back in style. Jaclyn also wrote about the new DeLorean, which is being reimagined as an electric vehicle. Sorry, no flux capacitor on this one, but thankfully you won’t need the plutonium or the 1.21 gigawatts.

- Tiger gets its claws into Slice: Getting a bank account can be easy; getting credit, not so much. Slice is an Indian fintech company working to change that and is now buoyed by a new Tiger Global–led $50 million round that Manish reports has the company in unicorn territory. Slice is bringing credit to the masses in that country by bringing technology to the underwriting process and is issuing hundreds of thousands of cards per month, putting it at the top of its game in the South Asian market.

- A “Netflix for education”: Spain-based Odilo has a catalog of nearly 4 million educational items and today brought in $64 million to keep hidden. No, really, as Ingrid writes, the “white-labelness” of the company means businesses can build their own customized e-learning offerings, but customers may only see the education portal it’s powering as the front-facing brand, like, ahem, Google, which we talk about a lot today in the Big Tech Inc. section.

Startups and VC

Every time I explain what a SPAC is to someone, they go, “Wait, how is that legal?” It seems like some folks in government agree, Connie reports, with Sen. Elizabeth Warren planning a new bill to tame the wild, wild west a little. The law may be a little late — interest was on the wane already, when the SEC warned in March …read more

This is the beginning of the unbundled database era

Contributor

Thanks to the cloud, the amount of data being generated and stored has exploded in scale and volume.

Every aspect of the enterprise is being instrumented for data, so new operations are built based on that data, pushing every company into becoming a data company.

One of the most profound and maybe non-obvious shifts driving this is the emergence of the cloud database. Services such as Amazon S3, Google BigQuery, Snowflake and Databricks have solved computing on large volumes of data and have made it easy to store data from every available source.

The enterprise wants to store everything they can in the hopes of being able to deliver improved customer experiences and new market capabilities.

It’s a good time to be a database company

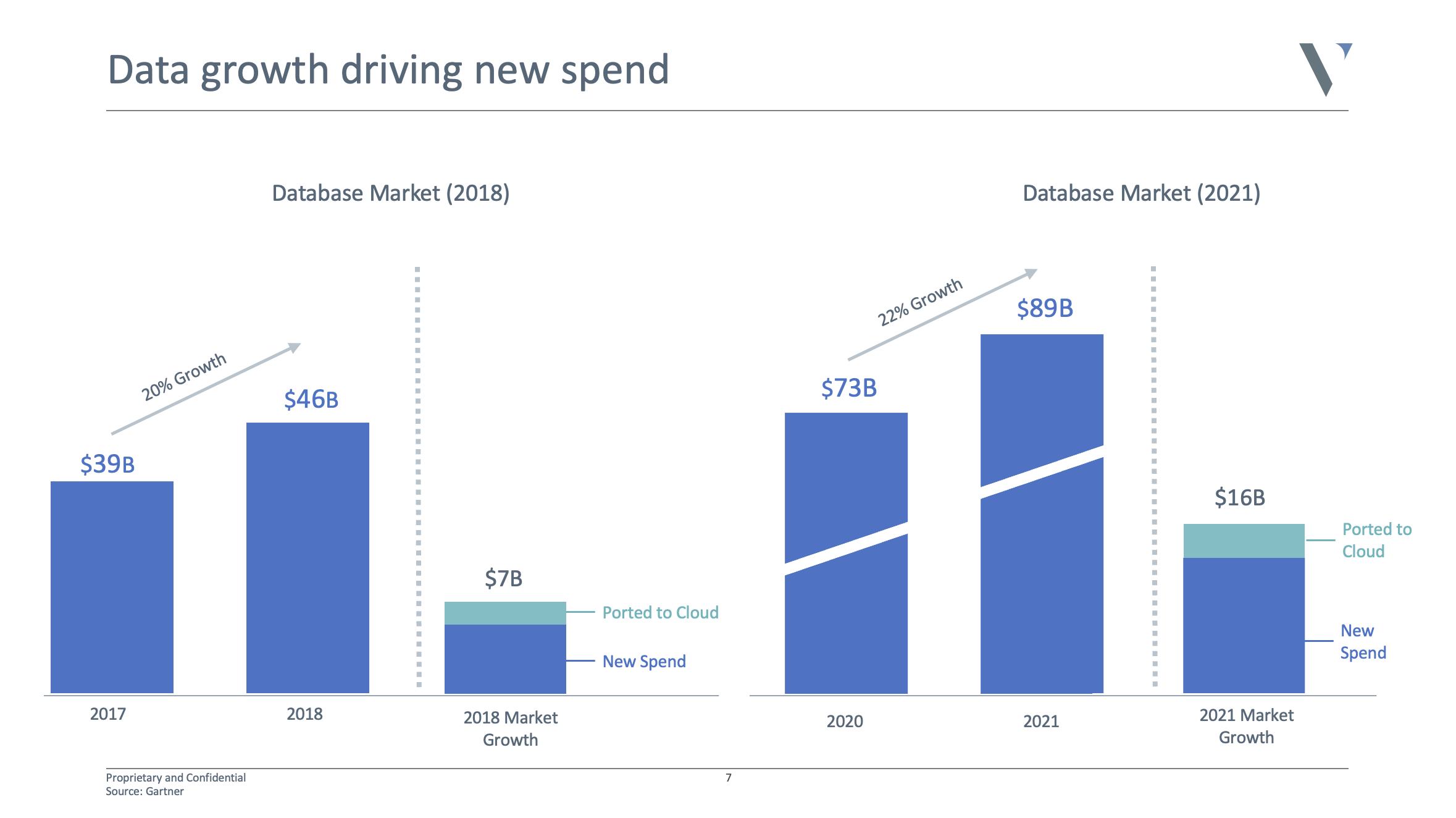

Database companies have raised over $8.7 billion over the last 10 years, with almost half of that, $4.1 billion, just in the last 24 months, according to CB Insights.

It’s not surprising given the sky-high valuations of Snowflake and Databricks. The market doubled in the last four years to almost $90 billion, and is expected to double again over the next four years. It’s safe to say there is a huge opportunity to go after.

See here for a solid list of database financings in 2021.

Database growth is driving spend in the enterprise. Image Credits: Venrock

20 years ago, you had one option: A relational database

Today, thanks to the cloud, microservices, distributed applications, global scale, real-time data and deep learning, new database architectures have emerged to solve for new performance requirements.

We now have different systems for fast reads and fast writes. There are also systems specifically to power ad-hoc analytics or for data that is unstructured, semi-structured, transactional, relational, graph or time-series, as well as for data used for cache, search, based on indexes, events and more.

It may come as a surprise, but there are still billions of dollars in Oracle instances still powering critical apps today, and they likely aren’t going anywhere.

Each system comes with different performance needs, including high availability, horizontal scale, distributed consistency, failover protection, partition tolerance and being serverless and fully managed.

As a result, enterprises, on average, store data across seven or more different databases. For example, you may have Snowflake as your data warehouse, Clickhouse for ad-hoc analytics, Timescale for time-series data, Elastic for their search data, S3 for logs, Postgres for transactions, Redis for caching or application data, Cassandra for complex workloads and Dgraph* for relationship data or dynamic schemas.

That’s all assuming you are collocated to a single cloud and you’ve built a modern data stack from scratch.

The level of performance and guarantees …read more

https://techcrunch.com/2022/06/01/this-is-the-beginning-of-the-unbundled-database-era/

GameStop Sales Climb as Loss Widens

More people returned to the videogame retailer’s stores, but investors’ hopes for signs of a turnaround were damped by a widening loss. …read more

https://www.wsj.com/articles/gamestop-sales-climb-as-loss-widens-11654117160?mod=rss_Technology

Elon Musk Tells Tesla Employees to Return to the Office

The electric-vehicle maker’s employees are required to spend at least 40 hours a week in the office, the Tesla boss said in an email to staff. …read more

Google bans deepfake-generating AI from Colab

Google has banned the training of AI systems that can be used to generate deepfakes on its Google Colaboratory platform. The updated terms of use, spotted over the weekend by BleepingComputer, includes deepfakes-related work in the list of disallowed projects.

Colaboratory, or Colab for short, spun out from an internal Google Research project in late 2017. It’s designed to allow anyone to write and execute arbitrary Python code through a web browser, particularly code for machine learning, education and data analysis. For the purpose, Google provides both free and paying Colab users access to hardware including GPUs and Google’s custom-designed, AI-accelerating tensor processing units (TPUs).

In recent years, Colab has become the de facto platform for demos within the AI research community. It’s not uncommon for researchers who’ve written code to include links to Colab pages on or alongside the GitHub repositories hosting the code. But Google hasn’t historically been very restrictive when it comes to Colab content, potentially opening the door for actors who wish to use the service for less scrupulous purposes.

Users of the open source deepfake generator DeepFaceLab became aware of the terms of use change last week, when several received an error message after attempting to run DeepFaceLab in Colab. The warning read: “You may be executing code that is disallowed, and this may restrict your ability to use Colab in the future. Please note the prohibited actions specified in our FAQ.”

Not all code triggers the warning. This reporter was able to run one of the more popular deepfake Colab projects without issue, and Reddit users report that another leading project, FaceSwap, remains fully functional. This suggests enforcement is blacklist — rather than keyword —based, and that the onus will be on the Colab community to report code that runs afoul of the new rule.

Archive.org data shows that Google quietly updated the Colab terms sometime in mid-May. The previous restrictions on things like running denial-of-service attacks, password cracking and downloading torrents were left unchanged.

Deepfakes come in many forms, but one of the most common are videos where a person’s face has been convincingly pasted on top of another face. Unlike the crude Photoshop jobs of yesteryear, AI-generated deepfakes can match a person’s body movements, microexpressions and skin tones better than Hollywood-produced CGI in some cases.

Deepfakes can be harmless — even entertaining — as countless viral videos have shown. But they’re increasingly being used by hackers to target social media users in extortion and fraud schemes. More nefariously, they’ve been leveraged in political propaganda, for example to create videos of Ukrainian President Volodymyr Zelenskyy giving a speech about the war in Ukraine that he never actually gave.

From 2019 to 2021, the number of deepfakes online grew from roughly 14,000 to 145,000, according to one source. Forrester Research estimated in October 2019 that deepfake fraud scams would cost $250 million by the end of 2020.

Os Keyes, an adjunct professor at Seattle University, applauded Google’s move to ban deepfake projects …read more

Sheryl Sandberg Stepping Down as COO of Facebook Parent Meta

During her tenure, Facebook became one of the world’s most profitable companies and she became one of the most prominent women in business. …read more

Garmin pops solar power onto its fancy Forerunner running watch

Garmin just brought solar power to its Forerunner line, a cult-favorite among runners.

Along with some other devices, the company took the wraps off its new Forerunner 995 Solar today. The $600 running watch packs a new touchscreen display (as well as physical buttons), up to 20 days between charges (thanks in part to its charging lens), multi-band GPS, and a new heart rate variability feature, among other things. Garmin is also selling a standard 955, which shaves $100 off of the price and five days off of the effective battery life.

Towards lower end, Garmin also announced the Forerunner 255, which (as the Verge pointed out) isn’t too different from the earlier Forerunner 245. The $350 device adds multi-band GPS, contactless payments and some new software features. It comes in two sizes, with optional music features that’ll set you back another fifty bucks. All of the new watches are available as of June 1.

Garmin’s Forerunner 995 Solar

Solar-powered digital watches date back to at least the early 70s, so this isn’t what you’d call a groundbreaking launch. Garmin released its first GPS watch with solar power back in 2019, and expanded its solar lineup a year later. But it’s still a pretty exciting to see solar on new feature-packed watches, in part because keeping them charged is still a pain.

Though specialized watches like Garmin’s can go a lot longer than generalist smartwatches between charges, never having to plug one in again is the dream. Plus, wearables often require proprietary cables to juice up—the sort that can easily get buried in a drawer somewhere. It’d be nice to lose those, too.

Sadly, you’ll still need a cable if you decide to snag a 955 Solar. In Garmin land, solar power simply stretches out each charge by a few days. For the 955 Solar, Garmin says the extra $100 for the charging lens can boost its life by as much as five days, with caveats: It assumes the wearer will spend three hours in 50,000 lux conditions per day—that’s about three hours spent outside in indirect sunlight. Office-bound city dwellers won’t hit those numbers year round, at least not in places like New York.

https://techcrunch.com/2022/06/01/garmin-pops-solar-power-onto-its-fancy-forerunner-running-watch/

Sheryl Sandberg will step down as Meta COO

Sheryl Sandberg announced today on Facebook that she is leaving Meta after more than a decade as the company’s chief operating officer.

Sandberg joined Meta, then Facebook, as COO in 2008. Over the course of 14 years, Sandberg steered the company through an IPO, an unprecedented period of explosive industry growth and its at-times rocky path to becoming one of the most socially impactful and valuable tech companies in the world.

Meta’s Chief Growth Officer Javier Olivan will step into the COO role as Sandberg departs. According to a Facebook post on the news from Meta Founder and CEO Mark Zuckerberg, Olivan will be in charge of Meta’s ads and business products while overseeing its teams dedicated to “infrastructure, integrity, analytics, marketing, corporate development and growth.”

Zuckerberg noted that Olivan’s role as COO will be “different from what Sheryl has done,” a commentary on just how much influence and power Sandberg exercised during her years with the company. “It will be a more traditional COO role where Javi will be focused internally and operationally, building on his strong track record of making our execution more efficient and rigorous,” Zuckerberg wrote, adding that he didn’t plan to replace her role directly.

“I think Meta has reached the point where it makes sense for our product and business groups to be more closely integrated, rather than having all the business and operations functions organized separately from our products,” he said. While Sandberg was an outsized presence at the company, Meta has always been synonymous with Zuckerberg and it’s possible that he will have even more direct control of decisions at the company as it reorganizes.

In the post, Zuckerberg also took the time to reflect on just how much Sandberg shaped the company into the social media and advertising giant it is today:

“When Sheryl joined me in 2008, I was only 23 years old and I barely knew anything about running a company. We’d built a great product — the Facebook website — but we didn’t yet have a profitable business and we were struggling to transition from a small startup to a real organization. Sheryl architected our ads business, hired great people, forged our management culture, and taught me how to run a company. She created opportunities for millions of people around the world, and she deserves the credit for so much of what Meta is today.”

While she will exit the c-suite, Sandberg will stay on in her role on Meta’s board of directors. She became the board’s first female member when she joined it in 2012.

In a Facebook post, Sandberg opined about her long tenure at the company and the personal challenges she endured over that time, including the death of her husband, Dave Goldberg, in 2015.

“When I was considering joining Facebook, my late husband, Dave, counseled me not to jump in and immediately try to resolve every substantive issue with Mark, as we would face so many over time,” Sandberg wrote.

Reports in recent years suggested that Facebook’s missteps during the Trump …read more

https://techcrunch.com/2022/06/01/sheryl-sandberg-steps-down-facebook/

Boldstart Ventures has two new funds to plug into teams with an idea and little else

Boldstart Ventures, a seed- and early-stage venture firm that markets itself as a “Day One partner for developer-first, crypto-infrastructure and SaaS founders,” has closed on two new funds roughly 14 months after announcing its last two funds.

The firm — which began in New York with a $1 million proof-of-concept fund in 2010 — has closed its sixth flagship fund with $192.2 million, it is announcing today; it also closed its third opportunity-style fund to back its breakaway companies with $175 million in capital commitments.

Early last year, Boldstart closed on $155 million in capital commitments for its fifth flagship fund and $75 million for its second opportunity fund, so its newest later-stage vehicle is a big step up in particular. It also comes at an auspicious time, given that some of the industry’s most active late-stage investors, including SoftBank and Tiger Global, are writing fewer and smaller checks at the moment. (The less competition for late-stage deals, the less frothy the deal terms and the more time for due diligence, and so on.)

Not much has changed otherwise, unless you count the move of firm co-founder Ed Sim to Miami, which is notable given that Boldstart’s early focus was largely regional, including a focus on New York, as well as on underfunded Canadian talent. (The firm remains active up north.) The firm will still writes checks as small as $250,000, it says; it is also willing to invest up to $30 million in a single portfolio company.

Some of its best-known deals to date include Snyk, a company that helps developers use open source code and stay secure and whose valuation, as of last fall, was $8.5 billon; Blockdaemon, a blockchain infrastructure company valued at $3.25 billion earlier this year; and the data intelligence platform BigID, valued at $1.25 billion by its investors last year. Boldstart was also among the first investors in Kustomer, a startup that specializes in customer-service platforms and chatbots and which Facebook acquired in November 2020 for a reported $1 billion.

We talked with Sim last week about the markets, which he noted “suck” right now. At the same time, he’added, “I do think that things [had grown] a bit too frothy.”

Among the newer developments he has observed are pulled term sheets, he told us, particularly on the later-stage side. He said he also saw terms for a 2x liquidation preference inserted into a sizable round, meaning investors demanded that in exchange for their funding, they be guaranteed twice the amount of their invested capital in an exit scenario — before anyone else gets paid.

Like a lot of VCs right now, Boldstart is also actively counseling its startups to conserve cash so that they aren’t in the position of having to accept terms that can hurt them down the road. “Founders can get shocked when they see that because on the one hand [they’re thinking], ‘I’ve raised money. I maintained my valuation,” said Sims. “The reality is maintaining your valuation is not great if you …read more