Equity drops every Monday at 7 a.m. PDT and Wednesday and Friday at 6 a.m. PDT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Category: TECHNOLOGY

Affirm teams up with Stripe as the BNPL wars intensify

Two fintech giants are partnering up.

Affirm is making its buy now, pay later technology available to businesses that use Stripe’s payments tech. This means that a whole slew of companies that were not previously able to offer their customers the option to pay in installments, now can.

The deal is significant for Affirm because Stripe, which was valued at $95 billion last year, has “millions” of customers. It processes hundreds of billions of dollars each year for “every size of business – from startups to Fortune 500s.” And this gives Affirm an opportunity to generate more revenue as it makes money in part on interest fees. For its part, Stripe is able to offer prospective, and current, customers more payment flexibility.

Affirm — which was founded by PayPal co-founder Max Levchin — has built technology that can underwrite individual transactions, and once determining a customer is eligible offer them the option to pay on a biweekly or monthly basis. Those that qualify have the option to use Affirm to break up the cost of purchases ranging from as little as $50 all the way up to $30,000. The maximum credit limit is $17,500.

A common misconception about BNPL is that customers don’t have to pay interest. Some customers are in fact charged interest but Affirm says it doesn’t charge late fees and that there are no surprises with the amount of interest it charges. For example, it presents the exact fixed amount a customer will pay in interest upfront.

In an interview earlier this year, Libor Michalek, Affirm’s president of technology emphasized the company’s efforts to be transparent.

“We’ll communicate it to them obviously, as an interest rate as we’re legally required to, but also in dollars and cents,” he said. “A lot of times people get surprised when I tell them that a $1,000 purchase at 15% for a year actually translates to $83 because of the amortization schedules. A calculator on our website lets you play with all of those numbers.”

Affirm’s stock has taken a huge hit in the last year – along with most other tech companies – and as of today, was trading at just under $30. That’s significantly lower than its 52-week-high of $176.65 and means that the company is now valued at about $8.5 billion. Still, the company’s last earnings report beat expectations, with Affirm noting that its active merchants in its fiscal third quarter grew by more than 16x year-over-year to 207,000 and that active consumers grew by 137% year-over-year to 12.7 million. It also reported that its revenue was up 54% to $355 million. Meanwhile, its operating loss widened to $226.6 million compared to $209.3 million in the same period last year – which it says was driven by “continued investment in sales and marketing,” including $102.4 million of expense related to warrants granted to Amazon in November 2021.

The company has also recently announced partnerships with Fiserv, Shopify, WooCommerce and Verifone.

Meanwhile, competitor Klarna has hit some …read more

https://techcrunch.com/2022/05/31/affirm-stripe-partner-buy-now-pay-later-fintech/

Last chance: Our bring a friend for free promotion on TechCrunch events ends tonight

Savings-savvy startuppers take note. Your chance to buy two attendee passes for the price of one — for three TechCrunch events — disappears tonight, May 31 at precisely 11:59 pm (PT).

Whether you buy a single pass, split the cost and go with a friend, or buy in bulk to take your entire team, this is the time to do it — and save a tidy bundle. Heck, at this price, you can attend all three events and really expand your startup skills, knowledge and network.

Here’s the scoop on the three qualifying events, their dates and the links to go purchase your pass(es).

- TC Sessions: Climate (featuring the Extreme Tech Challenge 2022 Global Finals); June 14 in Berkeley, California; Buy your 2-4-1 Climate pass here.

- TechCrunch’s Annual Summer Party 2022; June 23 in Menlo Park, California; Buy your 2-4-1 Party pass here.

- TechCrunch Disrupt 2022; October 18-20 in San Francisco, California; Buy your 2-4-1 Disrupt pass here.

Note: The 2-for-1 pricing applies only to attendee tickets; it does not apply to demo or exhibiting packages.

Why should you go to TechCrunch events? Two of your peers shared their reasons with us.

“I’m never disappointed when I attend TechCrunch events. Whether from the smallest startup all the way up to a Google, I always find someone or something surprising that makes me say, “Oh, I didn’t know about that.” — Rachael Wilcox, creative producer, Volvo Cars.

“TechCrunch does this thing of connecting total strangers to create a genuinely supportive community. We’re all trying to do the same thing, which is bring our idea to life and make it a reality. I loved that unexpected benefit.” — Jessica McLean, director of marketing and communications, Infinite-Compute.

Here’s just a sample of what we have planned at these three events.

TC Sessions: Climate

- Speakers including Bill Gates and Impossible Foods’ Pat Brown

- The exhibition floor featuring these innovative early-stage startups

The TC Summer Party

- Enjoy a relaxed evening of cocktails, canapés and conversation and celebrate the spirit of entrepreneurship with your peers. It’s the perfect atmosphere for networking magic, because you just never know when you’ll meet your next investor, co-founder or even a future unicorn. Why not over drinks and nibbles in Menlo Park?

TechCrunch Disrupt 2022

- Learn about the all-new Startup Battlefield 200. Apply, and you might be chosen as one of only 200 early-stage startups allowed to exhibit at the show — for free. And it’s the only way you can be selected to compete for the $100,000 Startup Battlefield prize.

Time is running out on this 2-for-1 promotion. Don’t miss your chance for serious savings. Click on the links above and get ready to mine for opportunities at three TechCrunch events. Remember, the sale ends tonight, May 31 at 11:59 pm (PT). Go, click, save!

Is your company interested in sponsoring or exhibiting at TC Sessions: Climate, TC’s Annual Summer Party or TechCrunch Disrupt? Contact our sponsorship sales team by filling out this form.

U.S. Energy Secretary Jennifer Granholm will speak at TC Sessions: Climate

It’s hard to believe that, despite a scientific consensus and mountains of verified evidence, climate change has become a global political football. And yet here we are.

All the innovative climate tech in the world — both current and emerging — is not enough to turn the rising climate-crisis tide without one key ingredient: political will. Yet, the increasingly gridlocked nature of U.S. politics is holding back progress on emissions mitigation. It begs the question: How can we, as a nation, meaningfully move forward here at home — much less influence other major carbon polluters across the globe?

This vital question is just one reason why we’re excited to announce that the Secretary of the U.S. Department of Energy (DOE) Jennifer Granholm will join us on June 16 for our Online Day at TC Sessions: Climate & The Extreme Tech Challenge 2022 Global Finals.

Granholm leads the DOE’s effort to help achieve President Biden’s goal of net-zero carbon emissions by 2050, which would, Granholm said in the Secretary’s Message to America, mean “cheap, abundant, clean power — made right here in the U.S.”

It’s unlikely that Granholm, or any of our current politicians, will be in office come 2050. But, given the likelihood of yet another contentious presidential election in 2024, we’re curious about what concrete measures Granholm plans to take over the next two — or possibly six — years to move us closer to that distant goal.

In 2021, the DOE announced $2.1 million in public-private partnership awards related to advancing fusion energy. We’d like to hear more about the DOE’s funding of public-private partnerships and what other projects may be in the pipeline.

These are just some of the topics we’ll discuss with Granholm, who became the second woman to lead the DOE on February 25, 2021. She was also the first woman elected Governor of Michigan, serving two terms from 2003 to 2011.

Granholm led efforts to diversify Michigan’s economy, strengthen its auto industry, preserve manufacturing and add emerging sectors — such as clean energy — to the state’s economic portfolio.

After serving as governor, Granholm joined the faculty of the University of California, Berkeley as a Distinguished Professor of Practice in the Goldman School of Public Policy, focusing on the intersection of law, clean energy, manufacturing, policy and industry. She also served as an advisor to the Clean Energy Program of the Pew Charitable Trusts.

Don’t miss this online fireside chat and the opportunity to hear directly from the Secretary of the U.S. Department of Energy, Jennifer Granholm, about the ongoing efforts to move the U.S closer to net-zero carbon emissions.

TC Sessions: Climate takes place in person on June 14 at UC Berkley’s Zellerbach Hall, and this fireside chat takes place during our online day on June 16. Buy your ticket today.

Amazon is killing its Alexa-connected Cloud Cam, will replace customers’ dead devices with a Blink Mini

Amazon is shutting down its smart home camera, the Cloud Cam, and its companion apps, the company informed customers via a recent email. Launched in 2017, the nearly five-year-old Cloud Cam was one of Amazon’s first entries into the area of Alexa-connected home security devices, arriving just ahead of the retailer’s acquisition of connected camera and doorbell maker, Blink, and soon thereafter, smart doorbell maker Ring. Now, Amazon says it’s now focusing its efforts on Ring and Blink, which is why it no longer intends to support Cloud Cam.

“With your help over the last five years, Cloud Cam has served as a reliable indoor security camera and a hub for Amazon Key-compatible smart locks that work with Alexa,” the email to existing customers states. “As the number of Alexa smart home devices continues to grow, we are focusing efforts on Ring, Blink, and other technologies that make your home smarter and simplify your everyday routines.”

The email goes on to inform customers that, starting on Dec. 2, 2022, they’ll no longer be able to use Cloud Cam or its associated apps. Until then, users will still be able to download their video recordings. But as of the shutdown date, all video history will be deleted and the service will no longer function.

Fortunately for impacted customers, they won’t just be left with a useless device as a result of the shutdown, after having paid over $100 to purchase their Cloud Cam smart camera. Instead, Amazon is doing the right thing in this case by offering a replacement device for free. The company says it will provide Cloud Cam users with a complimentary Blink Mini and one-year Blink Subscription Plus Plan. The Blink Mini is an indoor security camera with 1080p HD video, 2.4 GHz Wifi connectivity, night vision, motion detection, two-way audio, and, like Cloud Cam, it works with Alexa devices.

These specs are similar to Cloud Cam, which had also offered 1080p HD video, night vision, and two-way audio. However, Cloud Cam’s subscription plan differs from Blink’s. Today, Cloud Cam users can choose from three priced tiers of $6.99, $9.99, or $19.99 per month, based on how many cameras they have (3, 5, or 10) and how long they want to store video clips — either a week, two weeks or a month, respectively. Blink’s subscriptions, meanwhile, include a free tier without video history, or a $3/mo or $10/mo paid plan — Basic or Plus — each of which offers a 60-day unlimited video history. But only the Plus subscription allows for more than one camera.

Amazon said it will send out a separate email ahead of Cloud Cam’s shutdown to inform customers how to claim their complimentary replacement device.

In the meantime, Cloud Cam users can back up their videos from the “Recorded Clips” section in the app’s top-right menu. They’ll need to click on each video and then click the Download icon to save the video. They can also delete recordings from here or from Amazon’s “Manage Your …read more

Faster ML models, crypto M&A, and what’s ahead for on-demand pricing

Hello and welcome back to Equity, a podcast about the business of startups, where we unpack the numbers and nuance behind the headlines.

It’s Monday, which means that Alex and Grace were back as a team to cover the biggest, boldest and baddest technology news. We are once again back with your weekly kickoff! Here’s what we got into:

- More on the potential M&A boom this week, in light of this recent CNBC piece that got my mind turning. Sure, this is kinda like the CVC story we’ve been tracking but a bit more focused.

- China’s venture capital market is taking body-blows, albeit from recent highs. Still, it is more than easy to track the country’s regulatory crackdown to falling venture capital activity.

- Strong Compute raised money, highlighting the fact that early-stage companies can still raise, and that there could be huge unlocks coming in ML model training. Which would be good for all of us.

- And is on-demand pricing on the way out? Things aren’t looking good for the model that once challenged the incumbency of SaaS.

Woo! Equity is live this Thursday, so come hang with us on Twitter Spaces or Hopin, yeah? Chat then!

https://techcrunch.com/2022/05/31/faster-ml-models-crypto-ma-and-whats-ahead-for-on-demand-pricing/

Hannah Grey launches its $52M inaugural fund

Focusing on “Customer-centric founders redefining everyday experiences,” venture firm Hannah Grey told me it just closed its oversubscribed $51.6 million fund. The company’s thesis focuses on “studying macro-societal forcing functions and evolving human behavior to identify areas of opportunities.”

The team told me it was planning to raise $25 million but found a lot more interest for its thesis, eventually closing more than twice that. The firm is backed by LPs such as Screendoor Partners, JPMorgan, Twitter, Carta, Stagwell Group, Insight Partners, Equity Alliance, and other foundations, fund of funds, family offices and strategic industry veterans.

The firm is the brainchild of Kate Beardsley and Jessica Peltz-Zatulove. Beardsley was founding member of Lerer Hippeau and Upslope Ventures. Before that, she was an early Huffington Post employee and chief of staff to Martha Stewart. She’s been in VC since 2009. Peltz-Zatulove formerly ran the CVC of Stagwell Group and spent 10-plus years working with Fortune 500+ brands commercializing emerging technology. She’s been investing since 2014, and co-founded Women in VC, which has since scaled to over 4,000 women across 65 countries.

The firm invests at the pre-seed and seed stage, writing checks ranging from $400,000 to $1 million. It leads a lot of the rounds it invests in. Hannah Grey is named for the firm’s partners’ oldest daughters — Raya Hannah and Gunnison Grey, now 4.5 and 5 years old, respectively. The firm uses its name as a touchstone.

“[The name] is a constant reminder that we are investing in companies building for generational change,” Peltz-Zatulove told me. “The firm’s name is also a tribute to the human side of venture capital — which can be overlooked. We feel privileged to be long-term partners with our portfolio founders, empathizing and empowering them through the highs and lows of both everyday life and building businesses in the decades ahead.”

The firm has hired its first full-time employee. To my surprise, that person wasn’t an associate or an admin person, but a marketing and branding expert in the form of Michael Miraflor:

“The assumption is we probably hire an associate first. Jess and I have been doing the work, and are used to doing the work. We expect to continue to do all of the work in that capacity,” says Beardsley. “Tech talent is more available than it was in the early days, but there’s not an understanding of brand in the same way. That’s where we found a huge opportunity. Founders tell us that ‘we don’t care about technical talent: we have our team from this previous company. We care much more about this area; we don’t come from a marketing background, and we need to lean on your expertise to find the right hire.”

With its focus on brand and marketing, Hannah Grey is positioning itself as a catalyst and amplifier for companies that need to make a big splash. It offers assistance with go-to-market and acquisition strategies, brand voice, visual identity, content strategy and the full gamut of brand guidance …read more

TechCrunch Live is going to Columbus, OH — June 1st!

On June 1, 2022, the TechCrunch Live crew is hosting an extended TechCrunch Live episode with Columbus investors, founders and business leaders. There’s even a pitch-off with Columbus-area startups.

Register for the virtual event here for free!

Why Columbus? Because it’s quickly becoming a major startup scene in the Midwest, especially in the areas of healthcare and insurance. More than $3 billion has been injected into the city over the past 20 years, according to Crunchbase data. Investment into the city startups started picking up around 2017 and really peaked in 2021. That’s when investment essentially doubled, going from $583 million in 2020 to just over $1 billion, with half of those dollars going into two companies: healthcare technology company Olive and autonomous robotics company Path Robotics. So far in 2022, $110 million has gone into Columbus startups.

Olive is now valued at over $4 billion and is among other Columbus success stories like CoverMyMeds, a healthcare software company that was acquired by the McKesson Corp. in 2017 for $1.4 billion, which represents Central Ohio’s first $1 billion exit. Root Insurance, which raised over $800 million since 2015, went public in 2020. Other notable raises include Forge Biologics’ $120 million Series B round, which was thought to be Ohio’s largest Series B to date. Forge plans to add 200 new jobs by 2023.

We hope you can attend this event! Like every TechCrunch Live event, it’s free to participate and attend. And like every TechCrunch Live event, it kicks off at 2:30 p.m. EDT/11:30 a.m. PDT, and this one happens on June 1, 2022.

TechCrunch Live in Columbus!

Columbus Unicorns with Olive and Drive Capital (3:00 p.m. EDT)

Olive is a homegrown Columbus unicorn; hear from the CEO and lead investor how the company was built and raised $850+ million since its founding in 2012.

- Sean Lane, Olive CEO

- Chris Olsen, Drive Capital Founding Partner

Raising startup capital (3:30 p.m. EDT)

Ohio isn’t Silicon Valley, and yet there are numerous venture capital funds eager to write checks to early-stage founders. Join this session and hear from two investors on which industries are thriving in Columbus, and which sort of founders fit best in this scene.

- Janine Sickmeyer, Overlooked Ventures

- Wolf Starr, CEO, Atlas Partners

Work for a startup in Columbus (4:00 p.m. EDT)

Columbus, like many major American cities, is home to industry giants with hundreds of workers toiling away in cubicles. But startups are hiring! Hear from two local leaders on who’s hiring and what startups look for in new employees.

- Erika Pryor, Denison University

- Alex “Fro” Frommeyer, CEO Beam Dental

- Ryan Landau, CEO Purpose Jobs

Pitch Competition (4:20 p.m. EDT)

Judges

- Anna Mason, managing partner, Rise of the Rest Seed Fund at Revolution

- Parul Singh, partner, Initialized Capital

Found Live with Claire Coder, CEO of Aunt Flow (5:00 p.m. EDT)

Aunt Flow is an innovative startup from Columbus, Ohio that supplies 23,000 bathrooms with essential feminine …read more

Bonfire Ventures secures $230M for two new funds targeting B2B software startups

Bonfire Ventures, a Los Angeles venture capital firm, invests in seed-stage business-to-business software companies and aims to change the odds so that more than the average 33% of companies in this sector make it to Series A.

The firm seems to have some good traction so far. It says over 85% of its portfolio companies raise follow-on funding — a collective $1.15 billion — and its first fund is “ranked as one of the top 5% of VC funds globally,” while the second fund is in “the top 10% of their respective vintage years.”

Some of the companies getting follow-on funding include digital adoption company Spekit, led by CEO Melanie Fellay, which announced a $45 million Series B in January, consumer goods app company Aforza and e-commerce company Swell.

Both managing directors Jim Andelman and Mark Mullen were leading their own venture capital firms in the early 2000s and often co-invested on startups and decided to combine forces as Bonfire Ventures. The third managing director, Brett Queener, joined in 2018 after a career at Salesforce and Siebel Systems.

They secured $230 million in capital commitments for their two new funds, which include a third core seed fund of $168 million and a second opportunity fund flush with $63 million. The firm’s leaders tell me they are “intentionally selective” in the number of startups they invest in under each fund, around 25 to 30, so they can give more specialized support to founders.

Andelman and Queener spoke to me about the new funds, how the firm is working with startups and what they are telling their portfolio companies during this challenging investment environment. The following conversation was lightly edited for length and clarity.

TechCrunch: How did you and Mark Mullen start working together?

Andelman: The L.A. venture community was small for a long time, still relatively pretty small, and we all had small funds. We bumped into each other all the time and collaborated a lot more because we had independently developed the same investment focus in the same geography, same sector, same stage. We joined forces for a couple of reasons: One, we knew there was a great opportunity here for a bigger firm to play a bigger role in the ecosystem. We knew with a bigger team we could better support founders and the community. Two, we wanted to build something that outlasted us. It started as the two of us and now there are seven of us.

What’s your approach in investing in companies?

Queener: We’re going to spend the next 10 years of our lives together with the people that we invest in, so we have to like them and they have to like us because the journey or any software company is long and has lots of ups and downs. Our approach is pretty hands-on, like a two-way partnership. We are looking for software companies with a strong narrative that we think can become iconic brands with products that buyers cannot live without. We also want a strong …read more

Onramp Funds accelerates e-commerce financing platform with $42M in equity, credit

Providing working capital to small businesses is somewhat of a personal mission for Youngstrom, who grew up around business owners in a small town and related to the need to support local businesses. He also notes e-commerce sales in the U.S. are still under 20% of all retail sales, so there is over 80% of retail still ripe for e-commerce to grab more market share.

“If we can help the small business owner, we can make the world a better place,” he added. “If we get to help people succeed at their jobs, I think that’s wonderful.”

Meanwhile, Youngstrom declined to provide the breakdown on the $42 million equity versus credit line ratio. Luther King Capital Headwater Investments led the funding, which also included a group of high-net-worth individuals.

Since officially launching the working capital offering nine months ago, Onramp is now working with hundreds of customers, some of whom have used the service multiple times. Revenue is growing 30% month over month.

While the credit line will be used for financing small businesses, the equity portion will go to build out Onramp’s customer acquisition engine and bring in additional staff in the areas of engineering, product, sales, marketing and client success. The company currently has 27 employees.

The company is also providing more guidance to merchants when it comes to navigating the supply chain bottleneck that got worse during the global pandemic.

“We’re building a really cool business that’s finding great success and very early standards, and we plan to be here for the long haul to help these guys,” Youngstrom added.

Onramp Funds, an Austin-based company providing financing to e-commerce sellers, secured $42 million in equity and credit to expand its working capital offering.

CEO Eric Youngstrom founded the company in 2020 after a career at multicarrier shipping software company ShippingEasy. One of the problems with shipping at that time, back in 2012, was that you would have to log into each individual marketplace. For example, Amazon, eBay or Shopify, to see orders and figure out how to process them. What ShippingEasy did was bring that all together under one data management platform.

When ShippingEasy was acquired by Stamps.com in 2016, Youngstrom shifted over to the new company and saw a new problem emerge — that smaller e-commerce merchants couldn’t afford to ship an order because their credit cards were maxed out.

“People just didn’t have the money necessary to complete the order,” he told TechCrunch. “The money’s there — in three days it’ll be deposited into your account, but if you don’t get it going today, you’re going to lose the order. Amazon set the standard there.”

Youngstrom and his team tried solving the problem inside of Stamps.com, but couldn’t find a good solution, so he decided to leave in 2020 and launch a product that could help merchants.

The solution Onramp Funds came up with was a data-driven technology. The company doesn’t just look at top-line sales, which Youngstrom believes differentiates his company from competitors but takes in historical sales data to build a sales forecast.

Onramp then provides working capital from that data to resolve the shipping, fulfillment, advertising and inventory cost of goods so that merchants can take their own capital and redeploy it into their growing business. The company makes its revenue by charging a percentage of the sales, typically around 1%.

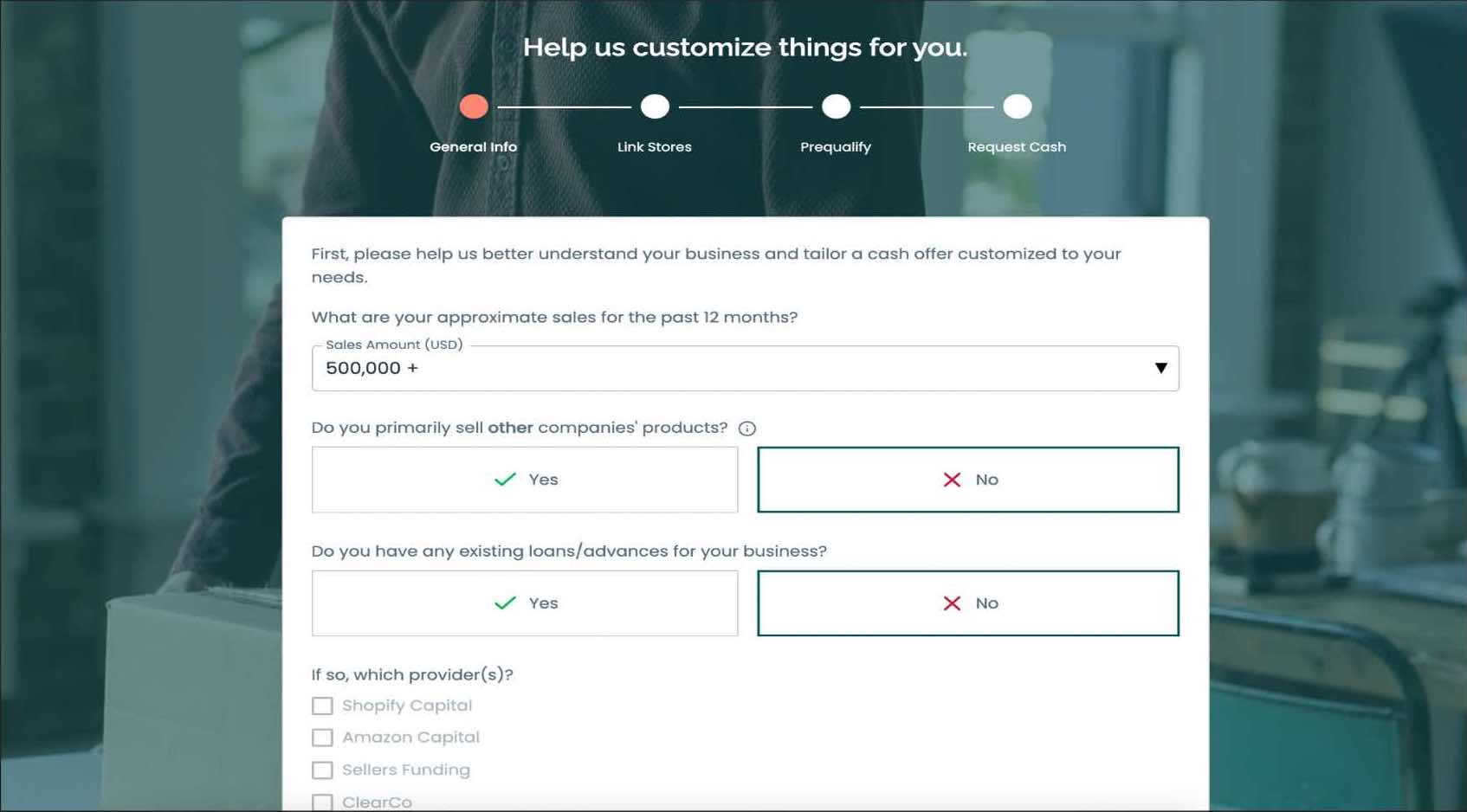

Onramp Funds web platform. Image Credits: Onramp Funds

Providing working capital to small businesses is somewhat of a personal mission for Youngstrom, who grew up around business owners in a small town and related to the need to support local businesses. He also notes e-commerce sales in the U.S. are still under 20% of all retail sales, so there is over 80% of retail still ripe for e-commerce to grab more market share.

“If we can help the small business owner, we can make the world a better place,” he added. “If we get to help people succeed at their jobs, I think that’s wonderful.”

Meanwhile, Youngstrom declined to provide the breakdown on the $42 million equity versus credit line ratio. Luther King Capital Headwater Investments led the funding, which also included a group of high-net-worth individuals.

Since officially launching the working capital offering nine months ago, Onramp is now working with hundreds of customers, some of whom have used the service multiple times. Revenue is growing 30% month over month.

While the credit line will be used for financing small businesses, the equity portion will go to build out Onramp’s customer acquisition engine and bring in additional staff in the areas of engineering, product, sales, …read more

Fidelity’s Crypto-Focused Business Plans Tech Hiring Spree

Fidelity Digital Assets aims to add 110 technology workers by year-end as it branches out to digital currencies beyond bitcoin. …read more