Category: TECHNOLOGY

Cast AI raises $20M to help companies reduce cloud spend

Cloud costs remain a top concern for organizations. According to a recent Anodot survey, 50% of businesses are struggling to control them, in part because they lack visibility into their cloud usage. Unsurprisingly, reducing those costs has become a top priority. A report from Wanclouds finds that 81% of IT leaders have been directed by their C-suite to reduce or take on no additional cloud spending.

Surely that’s music to the ears of startups whose tech is designed to reduce cost spend. There’s several out there. But one of the more successful vendors is Cast AI, which today announced that it raised $20 million in an investment led by Creandum with participation from unnamed existing investors.

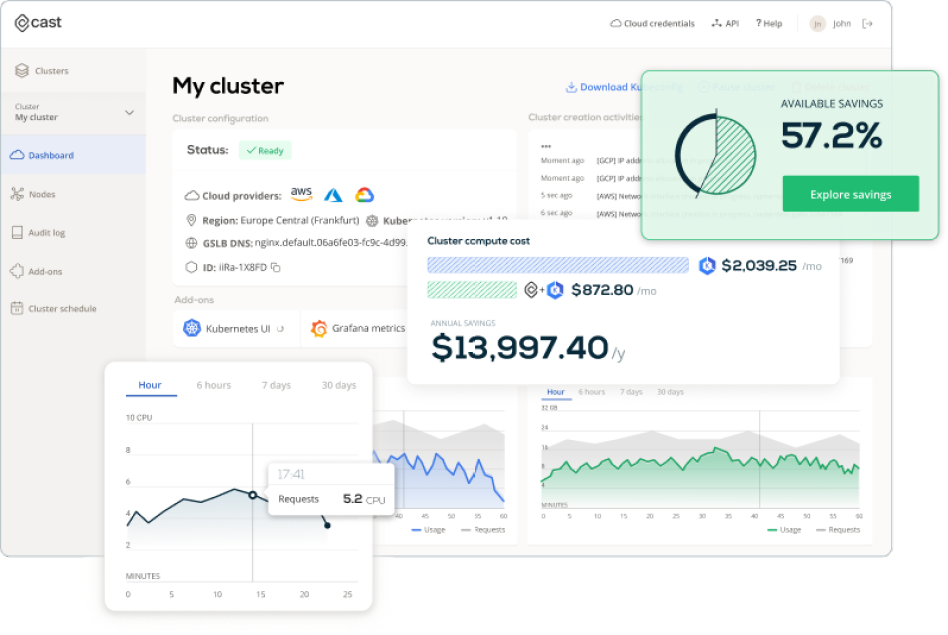

Founded by Yuri Frayman, Leon Kuperman and Laurent Gil in 2019, Cast AI — powered by AI, as the name implies — analyzes a company’s cloud usage to attempt to find the optimal cost-performance ratio. Cast AI customers can connect their cloud plans across AWS, Google Cloud and Azure to see recommendations and have the system implement them automatically.

“We decided to build a platform that would help companies automatically optimize and reduce their cloud costs — without manual intervention,” Frayman, who serves as Cast AI’s CEO, told TechCrunch in an email interview. “The need for such a platform became clear after we co-founded Zenedge, a cloud-based cybersecurity platform that was ultimately acquired by Oracle. As our application scaled up, we watched our cloud bill exponentially increase from thousands of dollars to millions of dollars … Our goal [with Cast AI] was to build the product we wished we had at Zenedge.”

According to Frayman, Cast leverages “many models” to drive its cloud usage optimization automation engine, which scales cloud resources up and down in real time while optimizing for cost. The models are trained on usage metadata from customers, public cloud pricing and inventory information, and undisclosed “other signals” that cloud providers make available. (Frayman notes that customers who don’t wish to submit their data for training can request that it be deleted.)

Cast AI’s optimization dashboard, showing real-time data across public cloud instances. Image Credits: Cast AI

Some of Cast’s models are responsible for determining how often public cloud jobs might be interrupted, while others predict spare compute capacity availability. Still others are trained to anticipate seasonal changes in workload requirements, like decreases in cloud usage during the winter months.

“We’re able to predict lower future compute prices to impact future batch workload scheduling, kind of like searching for a cheaper flight on Kayak and booking a future date that’s cheaper,” Frayman explained.

As we’ve written about before, several years ago, the market for cloud optimization software, while nascent, was consolidating as incumbents in adjacent sectors saw an opportunity to make a mark. In 2017, Microsoft acquired Cloudyn, which provided tools to analyze and forecast cloud spending. VMware and NetApp bought CloudHealth and Spot (formerly Spotinst), respectively, within the span of a few years. Somewhere in the midst of all that, Apptio snatched up cloud spending management vendor Cloudability, while Intel purchased Granulate for $650 million.

The consolidation isn’t necessarily over. But some vendors are prospering, judging by their successful fundraises. For example, ProsperOps, a Cast rival, landed $72 million in a venture round that closed in February.

To stay competitive, Cast recently launched a “zero-cost,” trial-like cloud cost monitoring and reporting product and its first cybersecurity offering: a tool that shows users security best practice violations as measured by the Center for Internet Security benchmarks and shows ways to fix those violations.

“Our goal is to have fewer people doing higher-order, more interesting work in cloud operations,” Frayman said. “The industry is faced with a challenged customer that needs to save cloud costs immediately and cannot afford to parse through reports and assign people to solve the problem manually.”

Frayman declined to disclose Cast’s revenue numbers. But he did say that Cast’s quarter-by-quarter revenue has grown by over 220% since the platform launched. Thousands of customers’ apps are being optimized by the platform, he claims, and Cast is actively managing over a million public cloud CPUs.

He thinks the Silicon Valley Bank scare could spur business, too, given the newfound tightness of capital. To that end — in light of the bank failures — Cast is offering onboarding services for free for a limited time. Customers will pay only once they start saving money.

Frayman says that Cast will put the newly secured funds, which bring the startup’s total raised to more than $38 million, toward growing its team and “working toward being cash-flow positive.”

“We currently have 75 employees and expect to grow the team as the business scales, and as we continue to hit our metrics driven milestones,” he added. “We will add automated security capabilities into the Cast AI platform. We will also invest in other features to help our customers with ‘day-two’ operations, like monitoring, testing and alerting. That way, we can help maintain the performance and reliability of our customers’ clusters with the ultimate goal of minimizing or completely eliminating human intervention.”

Cast AI raises $20M to help companies reduce cloud spend by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/03/16/cast-ai-raises-20m-to-help-companies-reduce-cloud-spend/

The UK joins other countries in banning TikTok from government devices

The U.K. has become the latest jurisdiction to ban social video app TikTok from government devices, confirming reports that surfaced earlier this week.

The ban follows a security review ordered by U.K. ministers looking to establish whether government data could be compromised from social networks installed on work devices. Indeed, the review did include other social media apps, but the government has decided on a “precautionary ban” for TikTok only — likely because its use is limited in governmental roles, compared to something like Twitter. There is nothing to indicate that the Government has found any specific security concerns unique to TikTok.

However, the government has said that employees can still use TikTok on personal devices, while it will consider exemptions for work devices on a case-by-case basis.

“The security of sensitive Government information must come first, so today we are banning this app on Government devices,” Oliver Dowden, secretary of state and chancellor of the Duchy of Lancaster, said in a statement. “The use of other data-extracting apps will be kept under review. Restricting the use of TikTok on Government devices is a prudent and proportionate step following advice from our cyber security experts.”

TikTok has emerged as a hugely popular social network, claiming well over 1 billion users. Moreover, TikTok has overtaken the mighty YouTube as the preeminent social video app among teens, making it a hot medium for governments looking to tap into younger demographics.

The U.K.’s ban was mostly expected, and it comes less than a year after the U.K. Parliament closed its official TikTok account a few days after launch when politicians raised concerns that sensitive data could be passed to TikTok’s parent company ByteDance, which is headquartered in China. As with similar social apps, TikTok requires device owners to give permission to access data from the device, including contacts, content and location data.

TikTok in the spotlight

Today’s announcement comes amid a swath of similar bans elsewhere in the world, including the U.S. House of Representatives back in December, while the European Union and Canada issued blanket delete notices for TikTok on government devices last month. Belgium also announced a ban last week, while the Netherlands is considering a similar path.

Although TikTok isn’t facing any immediate threats in terms of nationwide bans, this rising tide of political discontent has led the company to embark on a major charm offensive, particularly in Europe. The company recently announced Project Clover, a program incorporating various privacy and security efforts including commitments around local data storage, sovereignty, and independent auditing processes.

“We are disappointed with this decision — we believe these bans have been based on fundamental misconceptions and driven by wider geopolitics, in which TikTok, and our millions of users in the U.K., play no part,” a TikTok spokesperson said in a statement issued to TechCrunch. “We remain committed to working with the government to address any concerns but should be judged on facts and treated equally to our competitors. We have begun implementing a comprehensive plan to further protect our European user data, which includes storing U.K. user data in our European data centres and tightening data access controls, including third-party independent oversight of our approach.”

The UK joins other countries in banning TikTok from government devices by Paul Sawers originally published on TechCrunch

Ember is in the baby bottle business now

Ember has been a fascinating company to watch. The Los Angeles-based startup entered the scene with a self-heating mug, only to leverage its temperature tech learnings to enter the cold chain space, where it has developed containers for medical supply shipping.

I suppose you could say that the firm has returned to its roots with the launch of its latest product. And frankly, baby bottles actually make sense here. I might even go so far as arguing that keeping milk at body temperature is a bigger need than making sure your coffee doesn’t go lukewarm when you forget to drink it.

The Baby Bottle works similarly to Ember’s various mugs. Place the bottle on the “Smart Warming Puck” and it will raise the temperature to a balmy 98.6. There’s a connected app, as well, because it’s 2023 and you gotta. That allows for remote warming, and also tracks feedings over time.

Ember Baby app. Image Credits: Ember

CEO Clay Alexander cites his own parenthood as the product’s genesis, noting, “I knew there had to be a better solution to this, so I began to draw up ideas which eventually led to the Ember Baby Bottle System. It was designed to give back time to parents, so they can spend less time worrying and more time being present to enjoy those precious moments with their baby.”

The bottle is bundled as a “system” that includes two bottles/nipples, the warming puck and a “thermal dome” for taking it on the go. It’s currently shipping and predictably doesn’t come cheap, running $400 when you buy it through Ember’s site.

Ember is in the baby bottle business now by Brian Heater originally published on TechCrunch

https://techcrunch.com/2023/03/16/ember-is-in-the-baby-bottle-business-now/

Camo 2 launches with support for any camera, new tools and more

Reincubate’s Camo launched in 2020 with the aim of fixing webcam quality for all users and offered an efficient way for iPhone users to access the advanced cameras on their device. The company is now launching Camo 2 to bring even more capability to its offering.

Most notably, Camo 2 supports any webcam, built-in, connected pro camera, Continuity Camera device or action cam. The company notes that if you can connect a camera to your PC or Mac, Camo supports it. This includes regular webcams as well as built-in devices, monitors with built-in cameras, DSLR and mirrorless cameras, inputs from capture cards and HDMI dongles, action cameras and other software virtual cameras. Camo also supports iPhones connected with Continuity Camera.

Camo 2 brings additional features including a bokeh depth effect, light correction, a blur effect, greenscreen and auto framing. There’s also hardware acceleration on AMD, Apple Silicon, Intel and Nvidia hardware, for better looking and 3-5x greater efficiency than other effects. Camo 2 also brings a new Fluent Design interface on Windows, and 4K output from capable webcams and connected pro cameras. The update also adds Native LUT support. For context, LUT are color mapping and lookup tables that professionals use to grade and color correct film in post production.

As before, Camo 2 comes with full compatibility with Zoom, Teams, OBS, Chrome, Discord, Safari, FaceTime and others, and no ads or tracking.

“While today’s release is a big one, we have more in store,” said Reincubate CEO and founder Aidan Fitzpatrick in a blog post. “Our vision is to help people stand out on video in any medium, and that means opening Camo to multiple video sources and streaming services, deepening our integrations with platforms, chipsets and cameras to ensure those with unique capabilities really shine, and allowing others to extend and build on top of Camo.”

Camo 2 is a free upgrade for existing users. If you haven’t tried Camo before, you can try out Camo 2 for free. You can unlock advanced features with Camo Pro, which costs $4.99 per month or $39.99 per year. You can also get a lifetime license for $79.99.

Camo 2 launches with support for any camera, new tools and more by Aisha Malik originally published on TechCrunch

https://techcrunch.com/2023/03/16/camo-2-launches-with-support-for-any-camera-new-effects-and-more/

Here’s a new corporate card startup, backed by $157M in equity, debt, going after Brex, Ramp

Parker’s revenue comes from interchange and transaction fees, and since its launch, has surpassed $300 million in transaction volume. It also has a run rate of close to half a billion dollars, Sibous said. Customers include Amour Vert, Italic, SpikeBall, Canopy and Caraway.

The company started raising venture capital after graduating from Y Combinator and is now announcing all of its previously unannounced funding, most recently $31.1 million in Series A venture funding led by Valar Ventures that followed $5.9 million in seed funding. In addition is $70 million in debt, comprised of venture debt from Triple Point Capital and warehouse debt from Jefferies. The warehouse debt facility also includes an uncommitted option to upsize by $50 million.

“Parker has identified an opportunity as a massive segment of e-commerce has been underserved by traditional banks, startup cards and merchant cash advance companies,” said Andrew McCormack of Valar Ventures, in a written statement. “The company has seen great product market fit among companies that require flexible financing terms and innovative underwriting to be successful and unlock growth.”

Sibous said Parker has maintained a solid runway through the global pandemic, which enabled it to not need as much additional funding over the years. The funding will deploy into research and development across product, engineering and go-to-market as it readies to expand across the country this year.

Parker is also working toward profitability, and the company is working on scaling to access the cheaper cost of capital and upsell other products, though there is a path to profitability on just the card business, Sibous said.

“We want to become the de facto card for profitable e-commerce brands looking to scale,” Sibous added. “We want to build the best-in-class card experience and solve the problem space of cash flow, management and profitability. Once we’ve met that goal, we’ll look into expanding our product lines, including other financial products these brands might need.”

Parker, a startup offering a corporate credit card for e-commerce businesses, emerged from stealth Thursday with $157 million in equity and debt funding, much of which closed in 2022.

The company touts itself as “the first charge card for e-commerce” with raised limits that are on average 10 to 20 times higher than traditional business credit cards, like CapitalOne, American Express and Brex.

Co-founders Yacine Sibous and Milan Ray were more into computing before they kind of fell into the world of e-commerce. They were building internet-based businesses to help people build passive income when they came across the problem around financials in e-commerce.

“We imagined building better financial products for e-commerce founders with the mission of increasing the number of financially independent people,” CEO Sibous told TechCrunch.

Sibous and Ray founded Parker in 2019 and were part of the Y Combinator winter 2019 cohort. The company focuses on the middle market — companies doing $3 million to $100 million in annual sales.

Parker’s “secret sauce” is its underwriting process, which assesses cash flow so that e-commerce brands can have credit limits that make sense for their business; for example, up to $10 million in credit, Sibous said.

In addition, the company offers payment terms that Sibous said make sense in the context of e-commerce — think net terms on every transaction. For example, if you buy something on March 1 and then on March 3, you can have net 30 or 60 days on each of those and not pay on that transaction until May 1 and May 3, respectively.

“We’ve essentially changed the way statements work for credit cards, so instead of operating on a monthly statement, we have the option to work on daily or weekly statements,” Sibous added. “That helps these brands a ton with cash flow.”

Sibous believes Parker has a good opportunity to compete in the crowded credit card space that includes other venture-backed companies like Moss and Emburse. Sibous also pointed out that corporate card companies like Brex, American Express and Ramp do a broad reach to startups and don’t niche down to a certain industry to focus on custom needs like Parker does.

“We tried to use those cards for our own business and the cards just kept breaking,” Sibous added. “We realized no one’s really solved the problem in a way that makes sense. Because we had been working in fintech and e-commerce startups for so long, we knew all the vendors in the landscape pretty well and were very well-positioned to actually tackle this problem.”

Parker co-founders Yacine Sibous and Milan Ray. Image Credits: Parker

Parker’s revenue comes from interchange and transaction fees, and since its launch, has surpassed $300 million in transaction volume. It also has a run rate of close to half a billion dollars, Sibous said. Customers include Amour Vert, Italic, SpikeBall, Canopy and Caraway.

The company started raising venture capital after graduating from Y Combinator and is now announcing all of its previously unannounced funding, most recently $31.1 million in Series A venture funding led by Valar Ventures that followed $5.9 million in seed funding. In addition is $70 million in debt, comprised of venture debt from Triple Point Capital and warehouse debt from Jefferies. The warehouse debt facility also includes an uncommitted option to upsize by $50 million.

“Parker has identified an opportunity as a massive segment of e-commerce has been underserved by traditional banks, startup cards and merchant cash advance companies,” said Andrew McCormack of Valar Ventures, in a written statement. “The company has seen great product market fit among companies that require flexible financing terms and innovative underwriting to be successful and unlock growth.”

Sibous said Parker has maintained a solid runway through the global pandemic, which enabled it to not need as much additional funding over the years. The funding will deploy into research and development across product, engineering and go-to-market as it readies to expand across the country this year.

Parker is also working toward profitability, and the company is working on scaling to access the cheaper cost of capital and upsell other products, though there is a path to profitability on just the card business, Sibous said.

“We want to become the de facto card for profitable e-commerce brands looking to scale,” Sibous added. “We want to build the best-in-class card experience and solve the problem space of cash flow, management and profitability. Once we’ve met that goal, we’ll look into expanding our product lines, including other financial products these brands might need.”

Here’s a new corporate card startup, backed by $157M in equity, debt, going after Brex, Ramp by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/03/16/parker-ecommerce-corporate-card-fintech/

Warp brings an AI bot to its terminal

Warp, a fast-growing startup that is working on building a better terminal, today announced that it has added a new chat feature (unsurprisingly based on ChatGPT) that will help its users with using the command line and troubleshooting errors.

We’ve obviously seen a flood of ChatGPT-enabled services lately, with some more interesting than others, but this feels like a legitimately useful application of the technology. The command line, after all, isn’t necessarily the most user-friendly of interfaces — and that means that even experienced users often have to resort to troubleshooting by searching for answers on Stack Overflow.

“The terminal is a notoriously difficult tool. It’s difficult to know how to do workflows. It’s difficult to understand errors. It’s difficult to write scripts,” Warp co-founder and CEO Zach Lloyd explained. “We think that there’s a pretty significant opportunity to put AI in the core of the app in a way that makes it so that it can do most of these things for you.” He also noted that this is a good way for new users to learn how to use the terminal.

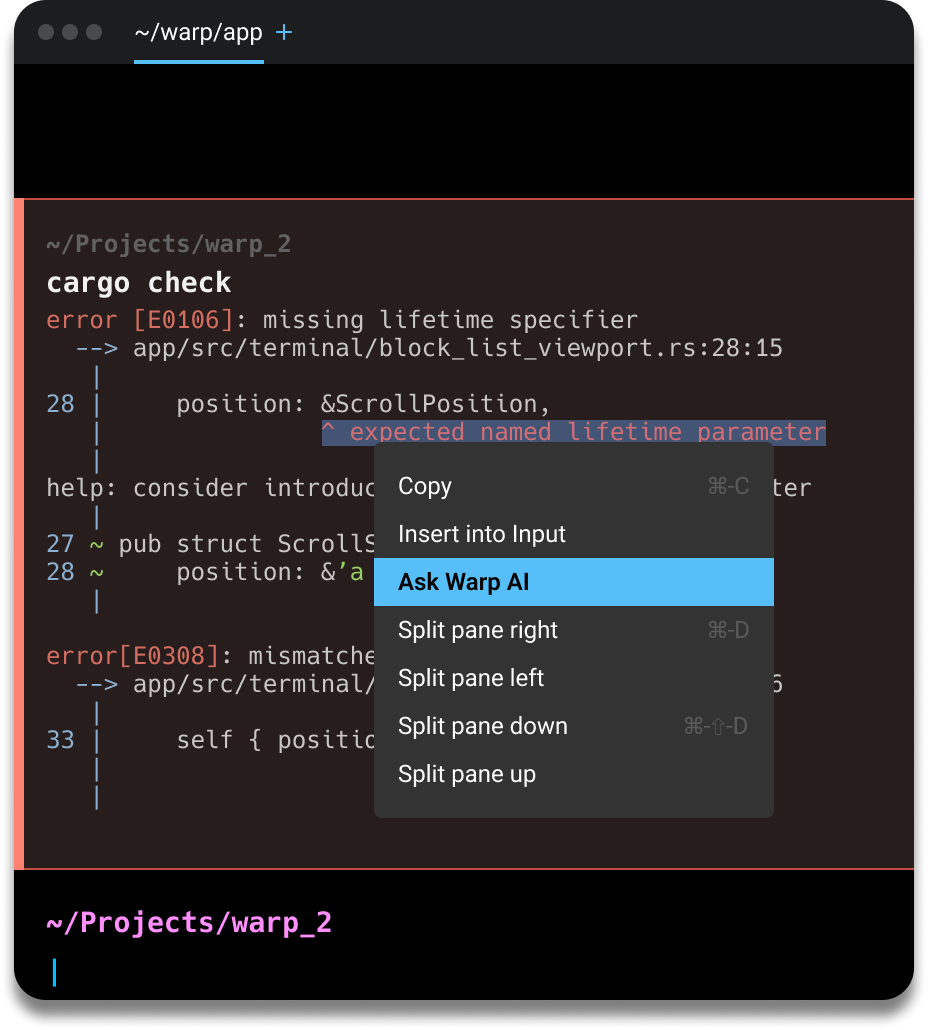

Image Credits: Warp

As you would expect, Warp is exposing the chat interface, dubbed Warp AI, as a sidebar in the terminal, but the team did some nifty things here that make it easy to copy and paste commands back and forth. “What wouldn’t make sense to me is if we just had a bolted-on ChatGPT in a way that didn’t integrate with the terminal,” said Lloyd.

At any point during a terminal session, users can bring up the new Warp AI features and start chatting away. And while the team tuned the bot so you won’t be able to talk about anything that ChatGPT knows about, it will happily talk about Bash scripts, Python errors and more.

As Lloyd noted, one of the issues with ChatGPT is that its information isn’t always the freshest. That’s less of a problem here, given that most of these command line tools don’t change all that quickly, but it’s something the team hopes to change over time.

For now, Warp AI is available free of charge, with a limit of 100 requests per day. Over time, it will become a paid feature. Warp does have to pay for access to the OpenAI API, after all.

Interestingly, this is actually Warp’s second AI integration. The company previously launched a “natural language to command” feature that — no surprise — translates a user’s query in natural language to a terminal command.

Warp brings an AI bot to its terminal by Frederic Lardinois originally published on TechCrunch

https://techcrunch.com/2023/03/16/warp-brings-an-ai-bot-to-its-terminal/

Backed with $3M, Soul Wallet aims to bring self-hosted crypto wallets to the next billion

If you own a non-custodial crypto wallet like MetaMask, you know the headache of keeping your 16-word seed phrase safe. That’s the responsibility that comes with having full control over one’s digital assets.

A third-party wallet, like one hosted by an exchange, on the other hand, stores private keys on users’ behalf and provides a better user experience. The risk is the lack of transparency over how user funds are managed, which could lead to incidents like the FTX meltdown.

Some believe a new technical change in the Ethereum ecosystem is about to solve the dilemma between asset control and user experience. At the center of the movement is the ERC-4337 standard introduced by the Ethereum Foundation, the non-profit research affiliate of Ethereum, the world’s second-largest cryptocurrency that boasts a vibrant developer community.

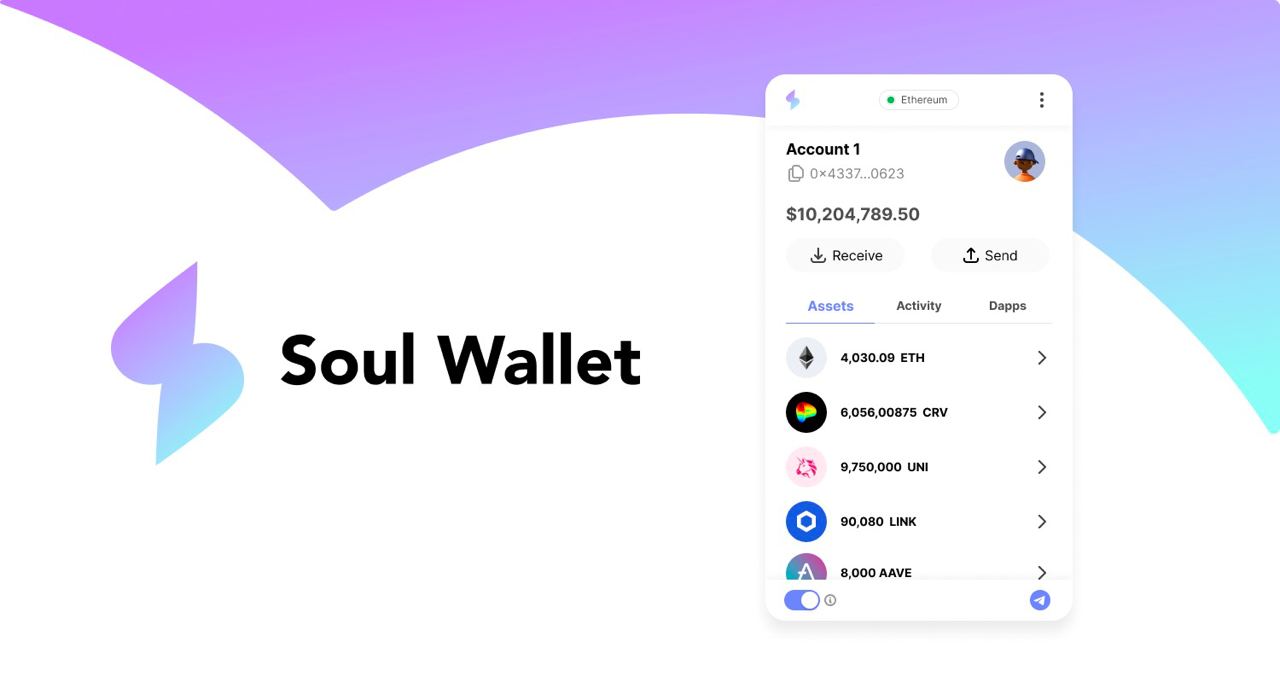

Jiajun Zeng, a former product manager at TikTok’s parent firm ByteDance and Chinese on-demand services giant Meituan, was amongst the first to leverage the new standard. His startup Soul Wallet just raised $3 million in a seed funding round to offer an online, self-custodial Ethereum wallet built on top of ERC-4337.

Comparing existing crypto wallets and wallets powered by the new technical upgrade is akin to “comparing Nokia to iPhones,” said Zeng in an interview with TechCrunch.

“After the FTX implosion, people are refocusing on how to achieve a better user experience on a self-host wallet,” observed Zeng.

At EthDenver, a major Ethereum developer conference that attracted over 30,000 attendees in the Colorado capital in early March, the new standard was generating plenty of buzz amongst blockchain application builders.

Through ERC-4337, Ethereum plans to bring smart contract capabilities to wallets (through what’s called “account abstraction”, but let’s not get into the nitty-gritty). In short, developers can program smart contracts, or lines of codes that execute predefined agreements, into wallets.

Image: Soul Wallet

Being smart means doing away with some of the legacy issues of crypto wallets, such as the reliance on seed phrases. Instead, smart contract-enabled wallets make it possible for users to recover their accounts via social recovery, such as using one’s trusted contacts, another wallet, or even a third-party service. For those who use WeChat, it’s a similar account recovery process.

Developers can also code other customized functions into wallets, such as letting users pay gas fees using stablecoins rather than limiting payments to Ethereum.

MetaMask, a popular self-custodial Ethereum wallet, uses an old cryptographic method called EOA, or externally owned accounts, where if a user loses their private keys, their funds are forever lost. Early mover Argent has incorporated some smart functions into its wallets but the features are still limited, said Zeng.

The challenge of introducing any new technological standard is scaling. MetaMask has sticky users because it’s compatible with many popular decentralized apps. The question is how Soul Wallet and other similar startups can compete to build a significant pool of partners.

Ethereum is promoting smart contract wallets as the future of Ethereum, so dApp developers will feel incentivized to make the switch, reckoned Zeng, an active member of the Ethereum community.

“We are targeting the next billion crypto adopters rather than trying to win users away” from the likes of MetaMask, said Zeng.

“In developing countries like South America and Africa, people are using cryptocurrencies to hedge against currency inflation, so it’s down to how crypto adoption can spread in these regions,” he continued.

“As for developed countries, adoption hinges on how dApps and NFTs are evolving.”

Soul Wallet is currently undergoing internal testing and is scheduled to launch in Q3 or Q4 after a series of stringent audits, according to Zeng. The team has a dozen people spanning the U.S., Japan, Thailand, and China.

Backed with $3M, Soul Wallet aims to bring self-hosted crypto wallets to the next billion by Rita Liao originally published on TechCrunch

https://techcrunch.com/2023/03/16/soul-wallet-crypto-wallet/

Fairmatic raises $46M to bring AI to commercial auto insurance

With inflation sparking an increase in the cost of repairs, labor and claims, fees for insurance are similarly spiking across the board. Car insurance premiums rose 13.7% nationally over the past year, according to a study from Bankrate.com. Home insurance, meanwhile, climbed 12.1% year-on-year, Policygenius found.

But Jonathan Matus argues that it doesn’t have to be that way. He’s the founder of Fairmatic, a company that’s applying AI to — at least according to him — reduce risk in the car insurance industry.

Matus previously founded Zendrive, a platform that provides insights to enterprises for car insurance underwriting and claims as well as roadside assistance. While Zendrive is focused on insurance for individuals and families, Fairmatic has a more commercial bent — a customer base made up primarily of businesses.

“Having spent about a decade of my career at Google and Facebook, I quickly noticed the negative externalities of the technology I actively helped become widespread,” Matus told TechCrunch in an email interview. “The path to Fairmatic’s inception was created out of a need to de-risk one of the worst externalities of this powerful technology: the increase in distracted phone use while driving and subsequent loss of lives on the road.”

Matus might speak in grandiose terms, but Fairmatic’s business proposition is simple: analyzing and pricing a vehicle fleet’s risk profile. The company uses AI models trained on driving data to attempt to mitigate risk and assist with various policy management and claims processes.

Customers get access to an app that they can use to monitor “driving events” — e.g. erratic driving — and “identify actionable improvement opportunities.” The app also offers what Fairmatic calls a “fully digital mobile claims experience” that can automatically detect crashes (hopefully better than Apple) and analyze incident data.

Here’s Matus: “With Fairmatic, small, medium and large enterprise fleets are empowered with actionable insights that improve safety and have a direct impact on insurance savings.”

But there’s reasons to be skeptical. Fairmatic isn’t the first to bring AI to car insurance decisioning — Jerry, Just, Root and Tractable offer similar technologies, albeit targeted at consumers — and AI has a spotty track record in the insurance industry.

Last year, the Casualty Actuarial Society (CAS), the professional society of actuaries specializing in property and casualty insurance, acknowledged the prejudicial effects AI might have when used by financial institutions in determining insurance and mortgage lending. In a series of papers, the CAS concluded that biased data — data on which insurers train their algorithms — could perpetuate the discrimination that already exists in the insurance industry. (See: Allstate’s pricing algorithm that disproportionately negatively impacted nonwhite customers.)

Fairmatic applies AI to commercial auto insurance. Here, its app detects a crash automatically. Image Credits: Fairmatic

A subsequent report from the California Department of Insurance called out especially problematic recent applications of AI by insurers, including flagging claims from inner-city ZIP codes and using personal information unrelated to risk in marketing and underwriting insurance policies. “Conscious and unconscious bias or discrimination … can and often does result from the use of AI, as well as other forms of ‘big data’,” the authors of the report wrote.

Washington and Oregon have sought to ban the use of credit-based scoring algorithms to set auto insurance premiums. Separately, Colorado has introduced legislation requiring insurers to test their algorithms and scoring models to uncover biases.

Matus is adamant that Fairmatic takes care to reduce the potential for bias in its AI. In fact, he argues, Fairmatic’s reliance on AI generally leads to better outcomes for customers, who’ve historically been stuck with insurers using antiquated data and pricing models.

“Fairmatic’s AI predictive risk model has been trained using over 200 billion miles of driving data,” he said. “This allows us to develop a deeper and more comprehensive understanding of each fleet’s and each driver’s unique risk profile, and then distill that data into insights and coaching that improve driving behavior and reduce risk.”

But even if it’s true that Fairmatic’s approach is better than most, the platform’s driver monitoring capabilities are concerning in their own right. They bring to mind algorithms Amazon has used to monitor delivery drivers’ behaviors during the workday. According to Vice, the algorithms incorrectly penalized drivers whenever cars cut them off — data that Amazon used to evaluate driving performance and determine individual bonus payouts.

In response to a question about monitoring and data privacy, Matus said that Fairmatic “only actively monitors data relevant to the insurance policy,” including information needed for risk and claims management. “Fairmatic’s technology layer uses anonymous data and doesn’t retain driver information without fleet permission,” he added.

Whatever the case, Fairmatic hasn’t had trouble attracting investors — or customers, for that matter. The startup raised $46 million in a funding round led by Battery Ventures with participation from current investors and Bridge Bank that closed this week, bringing its total funding to $88 million at double its previous valuation (Matus wouldn’t give a figure). On the client front, Matus says that it’s onboarded “hundreds of thousands” of drivers.

That’s not terribly surprising. Commercial auto insurance is a massive market, with Allied Market Research estimating that it’ll be worth $307.10 billion by 2030 — up from $128.44 billion in 2020. Bias risk aside, money talks — even at a time when global insurtech VC funding continues to cool.

Fairmatic’s near-term plan is to bring on 30 employees for its R&D hub in Israel and more in Bangalore, India, Matus said. The company’s current workforce — distributed across offices in the U.S., Israel and India — stands at 85 people.

“Fairmatic has seen outsized traction since our Series A and this new capital will be used to accelerate our lead in bringing the full power of AI to commercial auto insurance. Fairmatic is making strategic hires across the globe and we are accelerating the growth of our R&D hubs in Israel and in India,” Matus said. “Our vision is to build a tech-powered insurance platform that’s not only fully digital but also comprehensively improved and powered by AI, across every product and business function.”

Fairmatic raises $46M to bring AI to commercial auto insurance by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/03/16/fairmatic-raises-46m-to-bring-ai-to-commercial-auto-insurance/

Nimble makes the leap to fully automated third-party logistics warehouses

There’s a long-standing debate in the world of logistics robotics. On one side stand the greenfield folk, who insist that the best possible experience is one built from the ground up, with these automated systems at its core. Brownfield proponents, on the other hand, point to the time and money required for a full rebuild. Many firms looking to automate their warehouses simply don’t have the resources to effectively start from scratch.

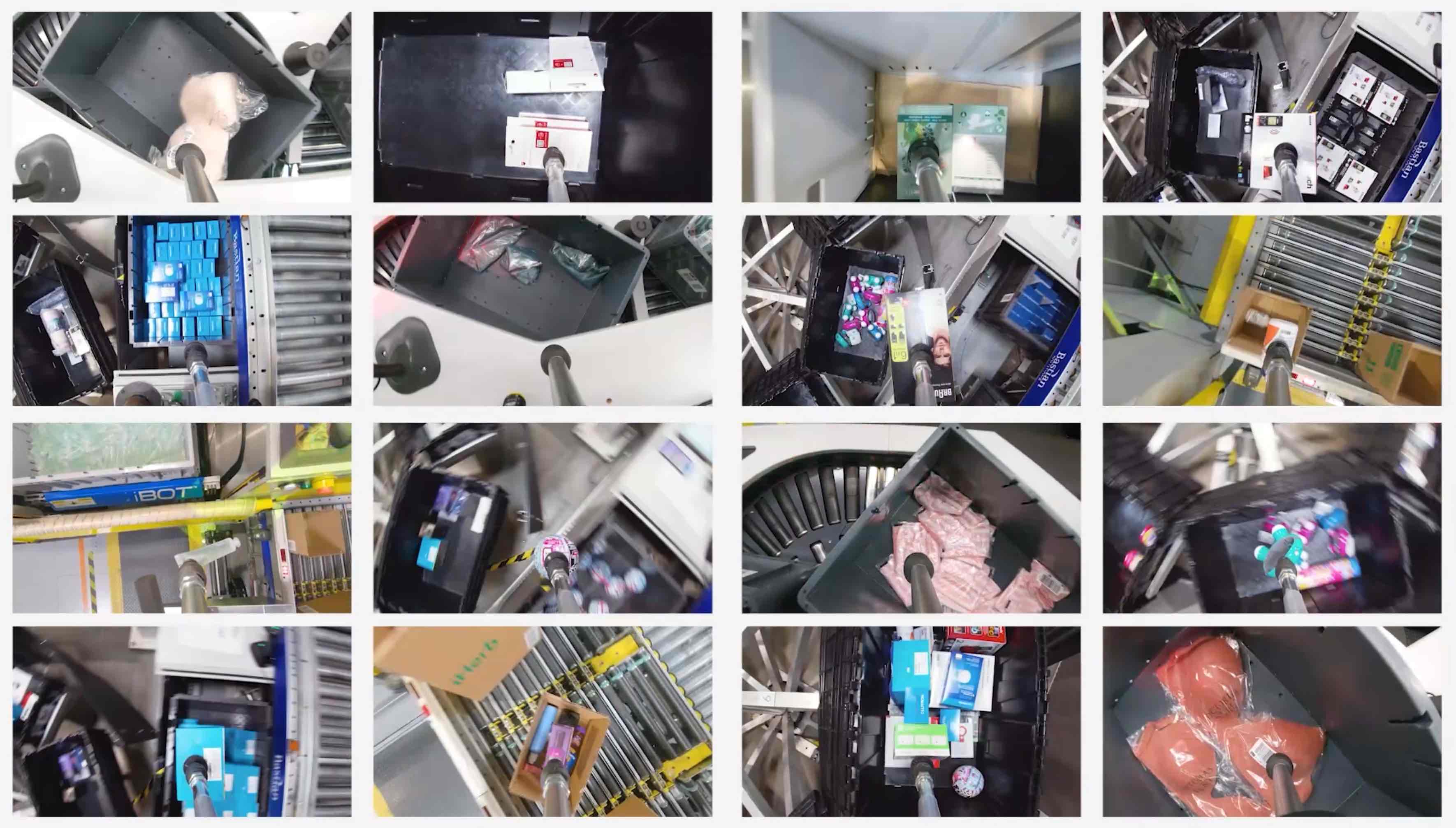

Most people ultimately land on some combination of these approaches. After all, no one size fits all. This morning, Nimble is announcing plans its own third-way compromise. It’s a method that lets companies effectively outsource their warehousing needs through fully automated third-party logistics (3PL) factories.

Founder and CEO Simon Kalouche says that Nimble’s new model wasn’t the goal when the pick and pack robotic automation firm launched in 2017. “It evolved as we learned about the industry,” he tells TechCrunch. “I’ve been in hundreds of warehouses now, and as I went to more and more, I learned that everyone’s automating almost all the pieces of the warehouse, but picking is still the hardest part. Until you automate picking, you need people in the warehouse. You need to make warehouses ergonomic, safe and OSHA compliant for people. When you automate the picking step, you remove all of those constraints.”

Image Credits: Nimble

Kalouche says the company has already begun operating its own third-party fulfillment centers, quietly opening the first roughly a year ago. He won’t disclose how many are currently online, only that the figure is “between one and 10” and the locations are geographically dispersed across the U.S. I its press material, the company explains that its “intelligent robotic fulfillment systems will autonomously pick, pack and ship e-commerce orders while reducing warehouse size by up to 75%. Nimble’s network of robotic warehouses will provide brands 96%+ U.S. population coverage in one-two days and click-to-collect savings of up to 40% compared to legacy 3PL providers.”

While it’s not same-day, it takes online retailers a step closer to the thing they most want these days — something that can help somewhat level the playing field against Amazon’s 800-pound gorilla. That’s the promise of third-party warehouse automation writ large — though Amazon has its own growing army of robots.

Nimble’s advantage is the prevalence of autonomous systems. Kalouche notes that it hasn’t yet achieved a fully lights out factory just yet. “There are still manual operations,” he says. “Our goal is to work toward the dark warehouse. We’re still working toward that, but we’re not there yet. But the picking is an automated function.”

There are, of course, broader implications of moving America’s factories further in the direction of top to bottom automation. Kalouche cites Amazon’s recent report that its pool of human workers is running out, and plenty of warehouse managers have similarly complained of hiring difficulties in the shadow of the pandemic. But there’s a real difference between partial and full automation when it comes to the job market.

Image Credits: Nimble

The decentralized nature of the fulfillment center goes a long way toward speeding up delivery by bringing products close to customers. Kalouche says the company is taking a controlled, deliberate approach to the number of warehouses. The eventual goal is to work with a wide range of different company sizes, from enterprise to Etsy seller (his own hypothetical was Shopify merchants, but I prefer the alliteration), and the ability to serve multiple clients in a single factory should help.

In the meantime, Nimble is focusing on mid-market retailers — though it won’t disclose the names of any of those clients. Again, let’s say somewhere between Walmart and your cousin’s eBay store. Nimble will continue to support existing clients, but the launch of these robotic fulfillment finds it largely moving away from its previous model of retrofitting existing warehouses.

The startup’s growth is being fueled, in part by a $65 million Series B led by Cedar Pine that also features DNS Capital, GSR Ventures and Breyer Capital. That follows a $50 million Series A almost exactly too years ago, bringing its total funding up to around $110 million. Nimble isn’t quite ready to talk valuation just yet.

“With E-commerce and warehouse automation continuing to exhibit incredible growth, we were attracted to Nimble’s industry leading AI robotic technology and 3PL fulfillment capabilities,” Cedar Pines’ Stephen Weiss said in a release tied to the news. “Our robust due diligence process showed that Nimble has a clear technology lead on the incumbents and has an extraordinary opportunity to be the next generation leader in the industry.”

As with the growth of its warehouses, Nimble is taking a measured approach toward adding to its 100 or so person headcount. “We’re being cautious,” says Kalouche. “We’re not trying to triple headcount in the next year, but we are hiring.”

Nimble makes the leap to fully automated third-party logistics warehouses by Brian Heater originally published on TechCrunch

5 strategies for biotech startups to outlast a market downturn

Contributor

Founders in the biotech industry are no strangers to challenges. Success is impossible to come by without substantial investment, time, and technical expertise. Although life science startups managed to come out relatively unscathed last year, the enduring economic climate is turning fundraising into a never-ending marathon. Inflationary market dynamics and ongoing fiscal tightening continue to pose significant risks to capital commitments. A successful raise in 2021 feels like ancient history.

As a venture capitalist specializing in early-stage life science companies, I work with startups that have the potential to revolutionize the world against biothreats, pandemics and more. Every day I see new biotechnology that inspires my team and our investors to put capital to work. Many of these startups were well-capitalized last year but are now facing difficulties as they look to raise.

To ensure survival, it’s essential to explore alternative funding methods rather than relying solely on classic fundraising. This is especially true for biotech startups, where investment needs are higher and success timelines can be much longer.

If you’re an entrepreneur in the biotech industry, it could be time to make practical pivots to ensure your company can thrive. Here are five strategies that could help your biotech startup navigate a cooling fundraising environment:

To ensure survival, it’s essential to explore alternative funding methods rather than relying solely on classic fundraising.

1. Set lower fundraising goals

During an economic downturn, trying to raise a large sum might not be feasible, and the time and resources you invest in fundraising could be better used on key business initiatives. By raising less, you can prioritize your survival, conserve your most valuable resource (time), and keep your focus on meeting near-term inflection points. With a smaller pool of investors, you can also maintain a stronger influence over your company’s strategy.

2. Target experienced investors

When raising, it’s crucial to focus on building relationships with investors who share your vision and can offer more than just capital. Investors who have experience in your industry can provide valuable guidance and connections that can help you navigate challenges and take advantage of opportunities — this type of investor is valuable in a downturn since they can advise you on technology-specific strategies.

5 strategies for biotech startups to outlast a market downturn by Jenna Routenberg originally published on TechCrunch

https://techcrunch.com/2023/03/16/5-strategies-biotech-startups-outlast-market-downturn/