Category: TECHNOLOGY

Finance YouTubers sued over promotion of FTX

A new class action lawsuit alleges that several well-known finance YouTubers, including Graham Stephan, Andrei Jikh, Jaspreet Singh and others, should be held responsible for promoting now-disgraced cryptocurrency exchange FTX.

The lawsuit’s plaintiff is Edwin Garrison, a private investor who also filed a lawsuit against former FTX CEO Sam Bankman-Fried, plus celebrity promoters like Tom Brady, Stephen Curry, Shaquille O’Neal, Larry David, Kevin O’Leary and others. Bankman-Fried is also facing numerous criminal fraud charges from multiple U.S. government bodies, including the U.S. Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

According to Federal Trade Commission (FTC) guidelines for social media influencers, creators must clearly disclose when they are being paid to promote a product. Kim Kardashian, for example, settled with the FTC for $1.26 million last year for not properly disclosing that she was paid $250,000 to promote EthereumMax’s EMAX token.

“Though FTX paid Defendants handsomely to push its brand and encourage their followers to invest, Defendants did not disclose the nature and scope of their sponsorships and/or endorsement deals, payments and compensation, nor conduct adequate (if any) due diligence,” the lawsuit reads.

One of the influencers implicated in the lawsuit, Kevin Paffrath, told TechCrunch that this allegation is false.

“It’s pretty obvious that when we say regularly, ‘Hey, we’re sponsored by…’ on our videos, or ‘Brought to you by…’, you know, this is an ad,” he told TechCrunch. “We even have to check a little box on our videos that say, ‘Hey, this video includes a paid promotion,’ and every one of our FTX ones has a little disclaimer that says this is paid.”

The lawsuit also alleges that the YouTubers took part in a civil conspiracy with FTX and misled customers “with the false impression that any cryptocurrency assets held on the FTX Platform were safe and were not being invested in unregistered securities.”

SEC chair Gary Gensler has asserted that existing securities laws apply to cryptocurrencies, while many in the crypto industry have argued otherwise. This lack of clarity makes it more challenging for crypto companies and influencers alike to know when to abide by more intense standards for the advertisement of securities.

“Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities,” Gensler said when Kardashian settled with the SEC.

If FTX accounts are considered securities, then these YouTubers could be held liable for not sharing exactly how much FTX paid them.

Finance YouTubers sued over promotion of FTX by Amanda Silberling originally published on TechCrunch

https://techcrunch.com/2023/03/16/finance-youtubers-sued-over-promotion-of-ftx/

Goodbye Google Glass, we knew you well

Update: Google tells TechCrunch that it remains committed to augmented reality, stating, “For years, we’ve been building AR into many Google products and we’ll continue to look at ways to bring new, innovative AR experiences across our product portfolio.”

I know at least one TC staffer who is gutted by the inevitable second death of Google Glass. I won’t call them out by name, but will say that I empathize with seeing a tech giant reverse the truck to drive over a beloved piece of technology once again. Is it possible to be ahead of your time twice? Or do you have to admit at a certain point that yours is an alternate timeline?

Here’s what we know for sure: The world still wasn’t ready for Glass, even after a product makeover and shift in focus. Google confirmed plans to once again end support for its misunderstood bit of AR tech, writing:

Thank you for over a decade of innovation and partnership. As of March 15, 2023, we will no longer sell Glass Enterprise Edition. We will continue supporting Glass Enterprise Edition until September 15, 2023.

Not an entirely interrupted decade, of course. Glass celebrated its 10th anniversary last month. The original developer version of the head-worn display launched in February 2013, beginning its Glass Explorers program two months later and finally opening things up to the public in May 2014. Parodies ensued. Less than a year later, it announced that former Apple designer and Nest co-founder Tony Fadell was working on a follow-up.

Google Glass disappeared for a bit in 2015, thanking Explorers for playing along. Rumors of its death had apparently been a bit exaggerated — or at least premature. Specifically, Google Glass was shifting its focus to the enterprise. Really, that’s another way the product line was ahead of its time. HoloLens launched a year later from Microsoft, with business as its central thesis. And these days, folks like Meta, HTC and Magic Leap see the category as a saving grace on the way to mainstreaming AR/VR/MR.

Makes sense. You stand to make a lot of money selling these products to businesses in bulk. And IT departments are often willing to shell out more for products than your average consumer. A second enterprise edition arrived in 2019 with some modest upgrades.

The timing and the seeming finality of this announcement are interesting. Much of the industry is waiting to see what Apple delivers later this year with its rumored mixed reality headset. Of course, Google has been rumored to be working on a new AR product under the codename Project Iris. According to a report from early last year:

Early prototypes being developed at a facility in the San Francisco Bay Area resemble a pair of ski goggles and don’t require a tethered connection to an external power source.

The product would presumably be a more direct competitor to the current crop of XR products, including Apple. Google has also had its own checkered past with VR products, including Cardboard and Daydream. The latter was discontinued in 2019, the former finally end of lifing in 2021.

Goodbye Google Glass, we knew you well by Brian Heater originally published on TechCrunch

https://techcrunch.com/2023/03/16/goodbye-google-glass-we-knew-you-well/

Everything you need to get caught up on the SVB crisis

On Friday, the Federal Deposit Insurance Corporation announced that it had taken over Silicon Valley Bank, and as we rushed to plan coverage, one of my colleagues succinctly described the situation: “This is historic shit.”

A week later, we can all agree they were right. But a lot has happened, and unless it’s your job to edit the news, it’s possible you missed a slice of the saga, if not the entire story.

Here’s what went down:

How it started

The drama kicked into high gear in the middle of last week: SVB’s shares fell over 60% on Wednesday evening, when the bank said that it planned to sell shares to raise capital after taking a $1.8 billion charge from the sale of some assets. The bank also indicated that it would boost its borrowing, reinvest capital into higher yielding assets and take on more funding from an external entity.

Given the recent failure of crypto bank Silvergate and SVB’s own troubles due to its exposure to the venture capital and startup ecosystem (which hasn’t been doing well), investors understandably got jittery and started selling SVB stock.

Famously, on Thursday evening, SVB CEO Greg Becker said on a call with customers that the bank had “ample liquidity” to support its clients “with one exception: If everybody is telling each other that SVB is in trouble, that will be a challenge.”

The executive asked VC clients to “stay calm.” He said, “That’s my ask. We’ve been there for 40 years, supporting you, supporting the portfolio companies, supporting venture capitalists.”

We all know how that went.

Around the same time, several sources told TechCrunch+ that VCs were advising their portfolio companies to pull their money out of SVB, fearing a bank run.

In case you aren’t too familiar with how banks can quickly fail thanks to a loss of depositor confidence, here’s how Alex and Natasha explained it in the case of SVB:

A number of investors fear a bank turn — meaning that enough startups will withdraw their capital at SVB, a situation in which the financial institution could wind up upside-down in terms of deposits versus demand for those funds. (Bank runs are often ironic in that they can become self-fulfilling prophecies.)

One investor even told TechCrunch that many VCs are advising startups to decentralize their assets across multiple banks and generally keep no more than $250,000 in SVB checking accounts. (NB: $250,000 is the maximum that is insured by the FDIC, meaning that those funds would have solid external protection.)

SVB’s stock started Friday in the basement as fears of a bank run congealed into reality. Trading of the bank’s shares was halted, reportedly because SVB was frantically trying to sell its assets so it wouldn’t shut down.

SVB also asked its employees to work from home until it figured out the next steps.

What really happened?

To better understand how things had played out, Alex dove deep into what led to the bank going from a relatively stable business to a going concern risk in just five days:

- The COVID-19 venture boom was partially predicated on money being incredibly cheap: Global interest rates were low to negative, so there were few places to put capital to work. This led to larger venture capital funds investing mountains of money into startups, which deposited said money into SVB, as it was, until recently, the premier destination for startups’ banking needs.

- However, as the FT notes, the massive rise in deposits at SVB — never a bad thing at a bank — eclipsed the bank’s ability to loan capital. This meant it had a lot of cash lying around at a time when holding cash was useless for seeing returns.

- The bank invested all that money, at low rates, into things like U.S. Treasuries (page 6 of its mid-March update presentation).

- Later, in an effort to quell inflation, the U.S. Federal Reserve raised interest rates, venture capital investment slowed and the value of low-yield assets fell as the cost of money rose (bond yield trades inversely to price, so as rates went up, the value of SVB-held assets went down).

- The bank decided to sell its available-for-sale (AFS) portfolio at a loss (rates up, value down) so that it could reinvest that capital into higher-yielding assets. SVB wrote to investors that it was “taking these actions because we expect continued higher interest rates, pressured public and private markets, and elevated cash burn levels from our clients as they invest in their businesses.”

- What did SVB expect after all was said and done? An estimated $450 million boost to its annualized net interest income (NII).

- Initially, TechCrunch+ thought that the bank’s shares were selling off due to investors being unhappy with the $1.8 billion charge it suffered when selling its AFS portfolio, as well as SVB’s plan to sell a few billion shares, which would dilute existing shareholder ownership.

- Instead, the venture and startup market fretted. Why was SVB selling so much stock? Taking such a huge charge? Making such drastic moves? Concern led to fear, which led to panic. Basically everyone was worried that everyone else would panic and take out their capital, so they wanted to do it first. Any risk of capital loss was unacceptable, so folks raced to not be last.

- It later became clear that SVB had greater unrealized losses on its balance sheet compared to peers, which formed a crack in its foundation that would ultimately crater the bank when it attempted to spackle over the matter with the actions it took prior to the bank run.

We were gobsmacked at SVB’s rapid demise: “Why did the bank go from saying it was well capitalized yesterday to what appears to be a fire sale so soon? Our guess at this point, pending other information, is that the panic over the bank’s health led to such an outflow of deposits that it actually did get into trouble. Banking depends on trust, and suddenly SVB didn’t have the market’s.”

A couple of hours later, the other shoe dropped: The FDIC announced that it had taken over SVB, that the bank had failed and it would resume operations on Monday, March 13, with regulators in charge.

“Of the many moves that FDIC is making, the top priority appears to be giving customers access to their deposits,” Natasha wrote. “The same memo says that all insured depositors will have ‘full access’ to insured deposits no later than Monday morning, March 13, and that official checks ‘will continue to clear.’ Uninsured depositors will get paid an advanced dividend within the next week, the memo says, and future dividends could be made as FDIC sells assets of SVB.”

The news that SVB had failed, becoming the second-largest U.S. bank to do so, ruined the weekend for many startup founders and venture capitalists. How were startups going to pay for stuff while the mess was being sorted out?

It’s important to remember that at this time, no one actually knew how things would play out. Startups and investors had little visibility into the FDIC’s plans for SVB, and there was no telling how long companies with funds locked up at the bank would have to go without cash.

Alex explored what was at stake:

A good number of startups have been sitting on huge sums of money raised late in the last startup boom. They were depending on that money to get them through the current downturn. What happens to those companies if they banked at SVB and don’t have that capital available to them? The later stage the startup, the greater its cash needs likely are, and the harder they will be to bridge with straight-up cash.

Some of these cash-rich unicorns are also very upside-down when it comes to their valuations. Precisely who is going to offer them cash at a price on par with their prior round? Probably no one.

It’s a mess right now. This crisis is going to kill a host of startups, either quickly or by simply adding enough operational friction to bring them to their knees.

The (un)stablecoin situation

As if the crypto industry already hadn’t had a bad enough week with Silvergate Bank shutting down, on Friday it became known that one stablecoin in particular, USDC, had held some of its backing capital at SVB, funds that were likely now illiquid for several days at least. USDC is the second-largest stablecoin by market capitalization.

USDC’s issuer, Circle, said the next day that “3.3 billion of the ~$40 billion of USDC reserves remain at SVB,” or about a third of the cash the company said it held in January. Following that announcement, USDC depegged from its $1 target to trade as low as 88 cents.

Meanwhile, Signature Bank, a significant lender for the crypto ecosystem, became the second casualty of the banking crisis on Monday when regulators shuttered the bank, saying “it had caused a systemic risk and could threaten the U.S. banking system.” Around 30% of the bank’s deposits came from the crypto industry.

“Signature Bank’s closure serves as a one-two punch as worries mount over the vulnerability of any bank with exposure to the crypto industry,” Francesco Melpignano, CEO of Kadena Eco, told TechCrunch+. “With only a small number of publicly traded banks having ties to the crypto space, many investors are scrambling to place bets against them.”

Everything you need to get caught up on the SVB crisis by Ram Iyer originally published on TechCrunch

Technical interview platform Karat snaps up Triplebyte to add adaptive quizzes for engineers

The technology industry continues to rack up an ever-longer list of layoffs — which now stand at nearly 139,000 according to Layoffs.fyi — but taking the wider job market, the overall pace of recruiting engineers and other technical talent has not let up. Now, one of the bigger players in the area of technical recruitment is making an acquisition in a consolidation play to better tackle the opportunity. Karat, a technical interview platform used in the recruiting process that was last valued (in 2021) at over $1 billion, is acquiring Triplebyte, a smaller, but well-connected, player in the same space that built and ran adaptable technical skills quizzes for engineers, and then helped get them on the radar for jobs that matched their skills.

Financial terms of the deal are not being disclosed, but from what we understand, Triplebyte appears to have gotten to the end of its funding runway, a story that is not uncommon in the current market. The deal includes Triplebyte’s core assessment products and content library but its “Magnet” talent network will be wound down at the end of this month. (Any underlying data that gets used for analytics will get anonymized, Karat said.)

Triplebyte — founded by Harj Taggar, Guillaume Luccisano and Ammon Bartram (who is the current CEO) — raised just under $50 million. It never disclosed its valuation, but in 2019, when the company raised $35 million, Taggar (who was still with the company and CEO) told me it was “hundred million multiples towards being a unicorn.” Pitchbook puts it at a more modest-sounding $135 million.

Karat itself is backed by the likes of Tiger Global, Norwest Venture Partners, 8VC, Exor, Base Partners and Sempervirens Fund. Mohit Bhende, the founder and CEO of Karat, said that it did not need to raise extra funding for this acquisition — nor, in this current market, does it have plans to raise more.

Karat and Triplebyte may both be addressing the world of technical recruitment, but they have been doing it from different directions.

Karat has built what it describes as an “Interviewing Cloud” — a suite of tools and services for recruiters to use to run technical interviews. It says that “hundreds” of interviews are run daily on its platform, with customers including big global brands like Walmart, Roblox, and Indeed.

Triplebyte, meanwhile, has built a platform for engineers to take adaptive tests, with the results being used to get on the radar of recruiters based on their respective skills. It is a very tech-first startup: the “adaptive” part of the platform is a reference to Triplebyte having been built around machine learning that tailors the tests as they are taken to highlight and drill into specific skills. There are tens of thousands of engineers on the platform today, the company says.

The idea will be to bring those two businesses closer together in an end-to-end strategy: recruiters will have a set of tools they can use to help screen candidates as part of the Karat platform.

“Our goal at Triplebyte was to make real-world engineering skills the most important requirement for getting a shot at a job in tech,” said Bartram in a statement. “By combining our adaptive assessment technology with the Interviewing Cloud, Karat is creating a unique solution that eliminates pedigree bias, delights candidates and delivers an unparalleled amount of hiring signal.”

Bhende also noted that longer term, there might be ways of using the technology that Triplebyte has built and is building to bring more automation into the currently very human-centric process that Karat has built. Although plans there are still very early, that could include adaptive prompts and help for recruiters in terms of the kinds of questions they could ask and have answered in interviews.

There are still a lot of areas to tackle to turn digital platforms into more suitable partners for improving inclusion in the job market.

Bhende noted that one of the strongest points of the Triplebyte platform was the potential for using it to help remove bias in the wider recruitment process, since its automated approach gives it the ability to take on a large volume of applications — and in theory anyone who wants to apply — meaning the initial default for any job can be no screening at all. (This is still of course a work in progress, since bias and accessibility can come in many forms.) Triplebyte for its part has made its own efforts to promotive inclusivity in its platform and among other startups the computer science community.

All of this talk of more opportunities for everyone is a little ironic considering Triplebyte’s own beginnings, with a lot of advantages that other startups lack when breaking into the world of tech, acquiring customers, and raising money.

Before co-founding the startup, Taggar was (and still is) a longtime partner at Y Combinator, and before all that he’d co-founded and sold a company with Patrick Collison (who himself went on to found Stripe after). Triplebyte was incubated at the famous accelerator and counted a number of YC startups among its earliest customers and the engineers at those startups among the 300,000 that took tests to build its machine learning algorithms. It also became a part of YC’s later-stage Continuity investment portfolio, a business that YC announced this month it would be winding down. Other big-name investors included Initialized Capital (co-founded by Garry Tan, who is now YC’s CEO), Founders Fund, Caffeinated Capital, and dozens of high-profile angels.

Of course, all of that will get you far, but not always to the finish line. And in the current market, that end point might look very different than it did a few years ago.

The market today definitely seems like it’s a harder one for jobs in the technology industry, but Bhende says that demand has remained high among Karat’s customers because the need for tech talent has spilled further out into other industries.

“If Karat is a barometer of the technology industry, our business with companies undergoing digital transformation has really boomed, and India has boomed,” he said. That means that even with the layoffs and hiring freezes, which have had their own impact, “the puck of hiring has shifted. The shortage of engineers is still very much a thing. There are not enough of them given the demand.

On the India booming note, he said that Karat is planning to do a lot more in there, with a lot of demand both to recruit engineers and to source technical talent from India to fill opportunities around the world.

“The distribution of engineers looks very different, and it will look different again in two years,” he added.

Updated to make clear that Karat is an interview platform used in the process of hiring.

Technical interview platform Karat snaps up Triplebyte to add adaptive quizzes for engineers by Ingrid Lunden originally published on TechCrunch

Virgin Orbit pauses operations for a week to conduct a search for cash

Virgin Orbit is halting all operations for a week to save money while it “conducts discussions with potential funding sources and explores strategic opportunities,” the company announced in an SEC filing. The company has been struggling financially and a recent launch failure clearly exacerbated those issues.

The January launch was accompanied by much fanfare, as it was very possibly the start of a new British space economy with Virgin Orbit in pole position. But the rocket, launched via the company’s signature custom plane method, failed to reach orbit, as we now know due to a single faulty fuel filter the effects of which cascaded through the system and caused the abort.

This high-profile failure came at a time when the company was already on shaky ground financially. It has largely been funded by its parent company Virgin for the long and expensive development and testing period, and more recently by private capital and Virgin’s billionaire founder Richard Branson. The big British launch was to be the beginning of something new for the company.

But it’s expensive to run a full-service orbital launch company, and when an anomaly occurs it leads to costly refits and testing, and the delay of profitable operations.

Virgin Orbit has said that it hoped to reach more than $2 billion in revenue by 2026, which at current costs would necessitate about 175 successful launches per year. Although its air launch method has some advantages in cost and flexibility, it’s hard to imagine the company scaling to that level even before the disaster in January.

Today’s week-long pause of operations will save a little cash, and perhaps give everyone the time they need (away from all the pressing rocket-building work) to take stock of the company and its prospects, and then convince either investors or a buyer that Virgin Orbit is worth launching itself.

The company said it expects to get back to work on the 21st.

“[Virgin Orbit] anticipates providing an update on go-forward operations in the coming weeks. On the ops side our investigation is nearly complete and our next production rocket with the needed modification incorporated is in final stages of integration and test.”

Virgin Orbit pauses operations for a week to conduct a search for cash by Devin Coldewey originally published on TechCrunch

Anonymous app Sidechat picks up rival Yik Yak…and users aren’t happy

Sidechat, the anonymous posting platform that began blowing up last year on college campuses, appears to have acquired a rival anonymous social platform, Yik Yak. While you may recall Yik Yak’s troubles from earlier years, where bullying and harassment ultimately led to an ignominious exit in the form of an acquihire by Square, the gossip app relaunched under new Nashville-based ownership in 2021, promising improved moderation.

But now, Yik Yak’s app has been republished under the same App Store developer account as Sidechat — Flower Ave. It had originally been published under its own name, Yik Yak, Inc. (The first version under the original founders was Yik Yak LLC).

In addition, Sidechat’s users are complaining in App Store reviews about the forced migration from one app to the other.

“Bring back Yikyak,” one review is titled, noting they received an update that warned them that their “herd is moving,” which pointed them to Sidechat’s app. Several reviews also complain that Yik Yak had been anonymous, but Sidechat was asking for students’ school emails in order to participate.

“Yikyak merging with sidechat is the worst decision,” another reviewer lamented, adding that Yik Yak had been available to everyone, not just college students. Plus, the reviewer said, everyone is worried about the merger because their account info is now being associated with their school.

Oddly, not all Yik Yak users have gotten the push to migrate. As other App Store reviews noted, Yik Yak is still operating in some markets but not others. In fact, we were able to log in to Yik Yak in our local community when testing the app today — and have not yet received a push to move to Sidechat.

It could be that Sidechat is selectively pushing users located on or near universities and college campuses to migrate, as that’s its core demographic.

What’s interesting about this M&A event — which we’re hearing is more akin to an acqui-hire than some sort of big exit — is that both companies’ founders have tried to stay anonymous. Yik Yak earlier refused to respond to questions about its relaunch. And, even when being profiled by The New York Times, Sidechat only responded to press inquiries from a generic email. Dozens of student ambassadors for the app had also declined to respond to or ignored the paper’s inquiries.

However, an SEC filing for Sidechat’s parent company, Flower Ave., points to involvement from ex-Snap engineer Sebastian Gil and ex-Snap product designer Chamal Samaranayake. Per the filing, the company raised north of $10 million last summer, shortly after getting written up by various university press, like The Harvard Crimson and The Tufts Daily. More recently, Sidechat was covered by Annenberg Media, a paper funded by USC Annenberg School for Communication and Journalism. Some of the papers highlighted students’ misgivings over Sidechat’s moderation capabilities and overall influence on campus.

When asked, Sidechat’s founders declined to be interviewed for those articles, as well.

Our phone calls, emails, and other outreach to Yik Yak, Sidechat, and its founders have not been returned.

But there are plenty of social media complaints about the merger from less-than-satisfied users.

WHY CANT I USE YIKYAK, I DONT WANT TO USE SIDECHAT

— Ur mom (@firemedaddy123) February 5, 2023

@YikYakApp y’all should bring back yikyak and get rid of sidechat

— SlothsForDays (@flaminghydra0) February 14, 2023

@YikYakApp literally returned only to merge into another app that isnt near as good. Sidechat is stupid #bringyikyakback #yikyak

— who am I really (@mediocrem0ments) February 3, 2023

The timing of the complaints and App Store reviews point to a deal that went through sometime last month. For what it’s worth, Yik Yak Inc. updated its privacy policy in January, but it has not disclosed any change in ownership.

According to app store intelligence firm data.ai, Yik Yak’s app changed the name of its publisher from Yik Yak Inc. to Flower Avenue Inc. on February 28, 2023.

The firm tells us the new Yik Yak has seen approximately 3.5 million installs since its August 2021 relaunch. The highest ranking it ever received was the day after its relaunch when it briefly became the No. 1 Overall app on the U.S. App Store. Today, it no longer ranks in the Overall listings but is No. 89 in Social Networking.

Sidechat, meanwhile, had just slightly north of 180,000 lifetime installs, making it the smaller of the two apps. (But perhaps the one with more runway!). Its highest rank was No. 30 in the U.S. Social Networking category, which was achieved in November 2022.

The merger makes sense given that both Sidechat and Yik Yak share a similar purpose of connecting people anonymously, though Sidechat has more squarely focused on college student gossip.

But staying anonymous when asking others to trust your platform is an odd choice for these companies — and one which seems to be backfiring. Because the users don’t know who is running Sidechat or what their values are, they’re hesitant to even provide the company with their email, it seems.

Sarah Perez is available via email sarahp@techcrunch.com and Signal (415) 234-3994.

Anonymous app Sidechat picks up rival Yik Yak…and users aren’t happy by Sarah Perez originally published on TechCrunch

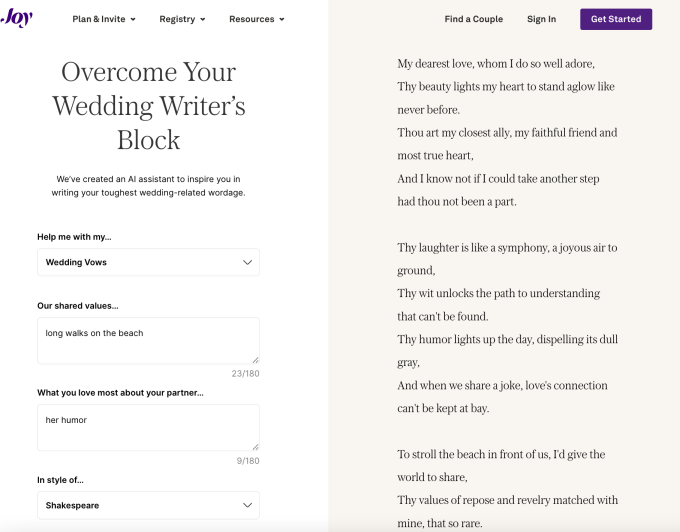

Wedding platform Joy will let you outsource your vows to OpenAI

There’s nothing more romantic than having an AI-powered bot write your vows for you. Earlier this month, wedding planning platform Joy launched a new OpenAI-powered “Wedding Writer’s Block” tool that uses AI technology to generate a draft for one of the most important speeches of your life.

The AI assistant is designed to help write vows and wedding toast speeches, among other “wedding-related wordage,” the company claims, like a love story for your wedding website, thank you notes, or if you’re stuck on how to politely decline a wedding invite.

There are also several different tones that the draft can be written in. For instance, if you want to sound like William Shakespeare or maybe a pirate for some reason. The AI assistant can even write in the style of a therapist, TikToker, astrologist or pessimistic ex.

Image Credits: Joy

“Weddings are unique because they are a time to celebrate and honor relationships while bringing friends and family closer. At Joy, we always look for a way by which smart technology can eliminate roadblocks and make couples focus on what’s really important: each other,” Vishal Joshi, Co-Founder and CEO of Joy said in a statement.

In a recent survey, Joshi claims that 89% of users found it “somewhat overwhelming” to begin writing their wedding materials. Twenty-eight percent considered using AI to jumpstart the process, he added.

While Joy’s Writer’s Block Assistant is only meant to be an inspiration tool, it’s wild to think about the people out there who might use the feature to possibly copy the AI-generated draft word-for-word. So, keep an eye out for anyone that sounds a little more robotic than usual. (Just kidding.)

Jokes aside, Joy’s new AI assistant is a sign that companies are integrating OpenAI’s ChatGPT into literally anything. Even dating app users are using the chatbot tech for messaging their matches—which we’d argue is a little much. Let’s just stick to using it for silly things, shall we?

Wedding platform Joy will let you outsource your vows to OpenAI by Lauren Forristal originally published on TechCrunch

https://techcrunch.com/2023/03/16/wedding-platform-joy-will-let-you-outsource-your-vows-to-openai/

Course Hero, edtech unicorn last valued at $3.6 billion, conducts layoffs

Course Hero, a tutoring business last valued by investors at $3.6 billion, has cut 15% of staff, or 42 people – its first round of layoffs in 17 years, TechCrunch has learned from numerous sources.

A spokesperson confirmed the layoffs, saying that “the layoffs are happening as a part of a strategic effort to set Course Hero business line up for future growth.” The company says it does not anticipate future layoffs.

“Part of this transition support includes providing several months of severance, health care benefits through the end of June, outplacement and immigration support services, and we are working with individuals with special circumstances to make sure we do everything we can to ease their transition,” a spokesperson said.

The workforce reduction comes after Course Hero itself, a rare edtech unicorn, saw co-founder Andrew Grauer leave his post as chief executive four months ago. He was succeeded by John Peacock, who was formerly the VP of product at the company. The layoff appears to be one of the new CEO’s first significant changes to the business since taking over. Peacock sent an email to staff this week explaining the changes.

“This is the first time in Course Hero’s 17 years that we have done a layoff of this size, and it’s not a decision we made lightly,” the email, obtained by TechCrunch, reads. “It follows careful deliberation with the leadership team about the moment we’re in.” He went on to say that the layoff was done to meet the needs of the “rapidly evolving” sector and that it was “absolutely necessary” for the future of the company.

Launched in 2006, Course Hero was somewhat allergic to venture capital until recent. After launching, the company waited eight years to raise a $15 million Series A. Then, after going another nearly six years without raising venture capital, Course Hero closed two financings in 2020.

Then in 2021, the edtech company announced yet another tranche of capital: a $380 million Series C at a $3.6 billion valuation. It brought a 227.3% increase to Course Hero’s valuation in a little over a year. With fresh capitalization and a broader vision of its total addressable market, the company began scooping up businesses, including Scribbr and LitCharts, a Sparknotes spin off. It’s unclear how the acquisition cadence will change given today’s scale back, if at all.

Grauer once expressed concerns on the risks and reward of rapid capitalization to TechCrunch. Since leaving the company, he became CEO of Course Hero’s parent company, Learneo.

The business tells TechCrunch that Course Hero and Learneo are cash flow positive and profitable on an adjusted EBITDA basis.

If you have a juicy tip or lead about happenings in the venture and startup world, you can reach Natasha Mascarenhas on Twitter @nmasc_ or on Signal at +1 925 271 0912. Anonymity requests will be respected.

Course Hero, edtech unicorn last valued at $3.6 billion, conducts layoffs by Natasha Mascarenhas originally published on TechCrunch

China’s ChatGPT rival Baidu Ernie is off to a rough start

Following on the heels of GPT-4’s buzzy debut and the announcement of Microsoft 365’s AI makeover, Baidu, China’s search engine giant, introduced its Ernie Bot.

Since ChatGPT blew the world away, Baidu has been widely considered the closest Chinee candidate to build an equivalent to the OpenAI chatbot. Naturally, Ernie’s launch was much anticipated. On Thursday, Baidu CEO Robin Li gave a one-hour presentation on Ernie that only offered a small glimpse into the chatbot. The jury is still out on what Ernie can do and how it actually works.

For now, Ernie is only available for testing through invitation and others need to get on a waitlist. TechCrunch hasn’t tried it yet, so it’s unfair to draw any conclusions about Ernie’s capability.

But the public was clearly underwhelmed. Industry observers inside and outside China pointed to the fact that rather than showcasing Ernie through a live demo, Baidu opted for a lengthy presentation with pre-recordings of Ernie’s answers. The company’s shares slumped as much as 10% in Hong Kong following Li’s presentation.

In slides, Li presented the prompts for Ernie and its answers in five functional areas:

- Literature writing: The user asked Ernie for advice on writing a sequel to the celebrated sci-fi novel The Three-Body Problem.

- Business writing: The user asked Ernie to suggest names for a large-language model company that helps small-and-medium enterprises digitize.

- Logic and reasoning: Ernie was asked to solve the famous “chickens and rabbits” math puzzle.

- Chinese interpretation: Ernie was asked to define a traditional Chinese idiom and write a poem based on the phrase.

- Multi-modal generation: Ernie was given a question (“Which city is most suited for implementing smart transport?”) and asked to perform “multi-modal” tasks based on the initial prompt, such as reading the answer out in a Chinese dialect and generating an image based on the text.

Baidu evidently did try to demonstrate what Ernie could achieve, and the answers were satisfactory; but still, investors weren’t impressed by the carefully orchestrated reveal. One can’t help but wonder if Baidu avoided a live demo due to its lack of confidence, and whether it had rushed the launch because of OpenAI’s impressive advancement. After all, even AI titan Google made a mistake in the demo of its conversational AI Bard.

Fangbo Tao, CEO and founder of AI startup Mindverse and a former AI scientist at Alibaba and Facebook, echoed the sentiment.

“Under the pressure of models like ChatGPT, domestic large language model companies in China have indeed launched similar products much faster than expected. Baidu only took just under two months to release their product, and has shown to be the one closest in performance to ChatGPT among the Chinese ‘ChatGPTs’.”

“However, to truly leverage Ernie Bot to build an application ecosystem, it may be necessary to demonstrate stronger performance in abilities like reasoning and following instructions,” he continued. “But the first step is always the hardest, and Baidu is very courageous.”

China’s ChatGPT rival Baidu Ernie is off to a rough start by Rita Liao originally published on TechCrunch

https://techcrunch.com/2023/03/16/baidu-chatgpt-launch-china/

Bitcoin rises about 14% in 7-day span as US banking system wobbles

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Welcome back to Chain Reaction.

It’s been an insanely busy and chaotic past seven days. Unless you live under a rock, you probably know what I’m talking about. But for those who don’t (or just want a recap), let’s get into it.

Last week, a few massive U.S. banks made headlines. Signature Bank, a crypto-friendly New York regional bank, was closed by regulators due to systemic risk that could threaten the U.S. banking system. This closure came just days after Silicon Valley Bank crashed and Silvergate Capital wound down its operations.

Signature, known as one of the largest crypto lenders, was the second casualty from the ongoing banking crisis in the U.S., but regulators said that its customers will be made whole, meaning the government is stepping in to protect the economy from further damage.

For reference, Signature Bank had 40 branches across New York, California, Connecticut, North Carolina and Nevada. As of December 31, 2022, the bank had $110.4 billion in total assets and total deposits of $82.6 billion. Around 30% of the bank’s deposits came from the crypto industry.

Going forward, the crypto industry needs to watch closely for deposit flight from regional banks over the next week, Tegan Kline, chief business officer and co-founder of Edge & Node, said. “If it gets worse, the regulators have a tremendous problem on their hands. Many regional banks may have to close.”

In the wake of all the banking chaos, bitcoin and ether, the biggest cryptocurrencies by market cap, had a seven-day increase of about 15% and 8%, respectively, at the time of publication, according to CoinMarketCap data. The global market cap for all cryptocurrencies also increased 8.3% during the same time period to about $1.1 trillion, slightly down from a weekly high of $1.14 trillion on Tuesday, the data showed.

The overall market turmoil has seemingly created a bullish sentiment in the crypto economy, however, as traders responded positively to the news and the overall market cap rose on the week.

This week in web3

Chaos in US banks could push crypto industry toward decentralization (TC+)

The crypto industry lost a number of banking on- and off-ramps due to recent collapses in the U.S. banking industry, signaling that there may be a shift in the space toward decentralization and a need for regulation going forward. With these banks’ closure, it will become difficult for cryptocurrency businesses to move money between entities and access banking services, Mina Tadrus, CEO of quant investment management firm Tadrus Capital LLC and general partner of Tadrus Capital Fund, said. “Furthermore, such closures could mean reduced trust from investors who may no longer be aware of the necessary safeguards involved in their bank transactions.”

SVB’s mess could become stablecoins’ problem (TC+)

After USDC depegged from $1 last week, many in the crypto industry are questioning whether Silicon Valley Bank’s collapse will have bigger implications on the stablecoin ecosystem. If anything, this latest market event “will trigger more interest in the stablecoin sector among global regulators,” said Lucas Kiely, chief investment officer of digital wealth platform Yield App. “This can only be a good thing for the industry, which needs much clearer guidelines for more institutions to enter.”

Meta winds down support for NFTs on Instagram and Facebook

Looks like Meta is NGMI, as some might put it. Meta’s head of commerce and financial technologies, Stephane Kasriel, posted on Twitter that the company will sunset its NFT and digital collectibles features on Instagram and Facebook. This short-lived product only began testing with select Instagram creators last May, plus some Facebook users in June. By July, Meta expanded NFT support on Instagram for creators in 100 countries. Less than a year later, Meta is moving on from NFTs…RIP.

Hackers steal around $200 million from crypto lender Euler Finance

Euler Finance, a non-custodial DeFi protocol, was exploited of about $197 million in crypto on Monday. While this sounds like a lot of money — and it is — it’s only the 26th largest crypto theft ever, according to the Rekt Database, which tracks DeFi scams, hacks and exploits. Since then, the team behind the protocol has launched a $1 million reward for information leading to the attacker’s arrest and return of the funds.

India probing ‘several’ crypto cases for money laundering, seizes over $115 million

India’s Enforcement Directorate is investigating “several” crypto cases for money-laundering schemes and has seized $115.5 million to date in such crimes, the Ministry of Finance said, the latest in a series of crackdown by the authorities on the nascent space. The disclosure comes at a time when India is pushing ahead with rules to better scrutinize the activities of cryptocurrency firms, even as until now New Delhi has resisted formulating a blanket law to regulate the virtual digital assets.

The latest pod

For last week’s episode, Jacquelyn interviewed Jack Mallers, the founder and CEO of Strike, a bitcoin-based payment network and financial app that is trying to grow cross-border payments and remittance markets. Last year, Mallers’ company raised $80 million in a Series B round to grow into that space and also has partnered with major companies like Visa, Clover and Fiserv.

Mallers is also the CEO of Zap, a bitcoin investment and payments company that transacts on the Lightning Network, which is a second layer on Bitcoin’s blockchain that allows for off-chain transactions between parties.

We discussed Mallers’ backstory, how he got into the Bitcoin scene in his late teenage years, whether the lightning network could be better than the payment networks that exist today and how big players could get into the space. This episode was heavily focused on Bitcoin, so buckle up.

We also dove into:

- Lightning Network’s global potential

- El Salvador’s adoption of Bitcoin

- Creating new infrastructure to make Bitcoin more accessible

- Future of Strike and the Bitcoin ecosystem

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- Backed with $3 million, Soul Wallet aims to bring self-hosted crypto wallets to the next billion

- KuCoin and Circle back Chinese yuan-pegged stablecoin CNHC in $10 million round

- Virtual fashion platform DressX raises $15 million

- DWF Labs invests $10 million in blockchain infra provider Orbs Network

- NFT social platform Metalink raises $6 million in a seed round

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Bitcoin rises about 14% in 7-day span as US banking system wobbles by Jacquelyn Melinek originally published on TechCrunch