Category: TECHNOLOGY

Ford to restart F-150 Lightning production on March 13

Ford today provided a statement to TechCrunch detailing its plan to restart F-150 Lightning production. The manufacturing lines will start rolling again on March 13. The automaker says that will allow for the EV’s battery pack to be reworked to include SK On’s battery cells. Ford also says it will continue to hold already produced vehicles as it works “through engineering and parts updates.”

This comes weeks after Ford paused the production and shipment of F-150 Lightning for an unspecified battery concern. On February 14 Ford said the initial stoppage occurred after a vehicle failed a post-production quality control test at the Rouge Electric Vehicle Center. The company tells TechCrunch it is unaware of any incidences of this issue in the field. As a result, dealers can still sell Lightning models on the lot.

Since launching the vehicle less than a year ago, Ford has only issued one recall for the vehicle, and it was related to a tire pressure sensor. Ford has yet to issue a recall or dealer notice associated with this instance.

Ford paused production of the vehicle as it was beginning to scale production numbers. It said previously it intended to make 150,000 Lightning models by the end of 2023. Ford reported it shipped 13,258 Lightning models in 2022.

Ford to restart F-150 Lightning production on March 13 by Matt Burns originally published on TechCrunch

https://techcrunch.com/2023/03/02/ford-to-restart-f-150-lightning-production-on-march-13/

HBO’s ‘Succession’ releases the official trailer for its final season

The official trailer for the final season of “Succession” premiered today, and it appears the series is ending with an epic mic drop. Season 4 makes its debut on March 26, giving fans 10 more episodes before we bid farewell to the Roy family.

The new trailer gives viewers a closer look at the feud between the Roy kids and their father, Logan (Brian Cox), who put Waystar Royco up for sale without their knowledge. Kendall (Jeremy Strong), Siobhan (Sarah Snook), Roman (Kieran Culkin) and Connor (Alan Ruck) try to stop the family company’s deal with GoJo, a streaming company founded by Lukas Matsson (Alexander Skarsgård).

While many viewers will likely be disappointed to see “Succession” come to an end, the show has sadly run its course.

“I’ve never thought this could go on forever. The end has always been kind of present in my mind,” creator and showrunner Jesse Armstrong told The New Yorker. “We could go on for ages and turn the show into something rather different and be a more rangy, freewheeling kind of fun show, where there would be good weeks and bad weeks. Or we could do something a bit more muscular and complete and go out sort of strong.”

The HBO series was not only hugely successful, with its 13 Emmy wins and five Golden Globe awards, but it was also an interesting commentary on the media industry. It’s not at all difficult to see the parallels between fiction and reality. A media conglomerate trying to appeal to cord-cutters? Surprise, surprise. Many people have even compared it to Disney’s $71.3 billion deal with Rupert Murdoch and the majority of 21st Century Fox assets. Armstrong has admitted to taking inspiration from lots of places, including the Murdoch playbook.

Season 1 of “Succession” premiered on June 3, 2018. The third season finale reached 1.7 million viewers, the highest viewership for the satirical comedy-drama.

HBO’s ‘Succession’ releases the official trailer for its final season by Lauren Forristal originally published on TechCrunch

Ford forms automated driving subsidiary from Argo AI’s remains

Ford has launched a wholly owned subsidiary — staffed by hundreds of former employees of Argo AI — that will initially focus on commercializing a hands-free, eyes-off driver assistance system.

The new 550-person company, called Latitude AI, will be dedicated to improving Ford’s existing advanced driver assistance system known as Blue Cruise and developing new automated driving technology for its next-generation of vehicles. Most of the company is comprised of machine learning and robotics, cloud platform, mapping, sensors, test operations and systems and safety engineers who worked at Argo AI, the autonomous vehicle startup that folded last year after Ford and VW pulled their backing.

Latitude is headquartered in Pittsburgh, where Argo was also based, and will have additional engineering hubs in Dearborn, Mich. and Palo Alto, Calif. The company also will operate a highway-speed test track facility in Greenville, South Carolina. Sammy Omari, executive director of ADAS Technologies at Ford, also will serve as the CEO of Latitude. Ford named Peter Carr has Latitude’s CTO, who will oversee product and technical development, and David Gollob as president, who will be responsible for business operations.

“We see automated driving technology as an opportunity to redefine the relationship between people and their vehicles,” Doug Field, Ford’s chief advanced product development and technology officer, said in a statement. “Customers using BlueCruise are already experiencing the benefits of hands-off driving. The deep experience and talent in our Latitude team will help us accelerate the development of all-new automated driving technology — with the goal of not only making travel safer, less stressful and more enjoyable, but ultimately over time giving our customers some of their day back.”

Argo AI burst on the scene in 2017 stacked with a $1 billion investment from Ford — and Iater an investment from VW. The startup shuttered suddenly in October 2022 after Ford and VW determined they would no longer pursue AV technology, at least not under the Argo umbrella. Ford said, at the time, it was making a strategic decision to shift its resources to developing advanced driver assistance systems, and not autonomous vehicle technology that can be applied to robotaxis. The company said it recorded a $2.7 billion non-cash, pretax impairment on its investment in Argo AI.

Ford forms automated driving subsidiary from Argo AI’s remains by Kirsten Korosec originally published on TechCrunch

https://techcrunch.com/2023/03/02/ford-forms-automated-driving-subsidiary/

Brinc’s Lemur 2 straps on blue strobes and is ready for action

The company says it is heavily focused on manufacturing and sourcing within the U.S., with R&D and a lot of its manufacturing happening at its Seattle headquarters. This has given Brinc a competitive edge: It says it is National Defense Authorization Act (NDAA) compliant and approved by the U.S. government for its products to be used by federal agencies and contractors.

Drone developer Brinc today showed off its newest drone, designed to help cops and others who care about public safety do their jobs from a safe distance. The new quadcopter is called Lemur 2 and is tooled up and ready to go into areas that otherwise would be too dangerous for humans.

The new drone builds on the learnings from the previous version and adds a stack of new features. The new drone has increased autonomous abilities, with onboard lidar sensors that can help create 3D maps, and a handy standby mode where the drone just sort of hangs out, ready to take action when the drone operator wants to take over. The autonomous hover feature doesn’t need GPS systems to hang out and can evade obstacles and objects.

The drone relies on a broad sensor array, including cameras, night-vision, thermal imaging, lidar sensors, a spotlight, night-vision lights, and microphones and speakers that afford operators the ability to do two-way comms. The data is transmitted to a custom controller using heavy encryption, and the new drone can use mesh networking between drones, effectively extending the range of each drone. The company claims that this extends the product’s ability to operate over larger areas, indoors, and underground.

“Today marks the next step on BRINC’s journey to advance drone technology in the service of public safety. Our mission at Brinc is to revolutionize public safety by leveraging technology to de-escalate dangerous situations,” Blake Resnick, CEO of Brinc, said in a statement to TechCrunch. “Each drone deployed to a dangerous situation is one less individual in harm’s way, and a potential life saved. The LEMUR 2 is the next era of first response technology that will undoubtedly make law enforcement and emergency services in our country more efficient and safer for all involved.”

Why, hello, Mr. Drone. Yes, you look very, very scary. Who’s a good drone? Who’s a good drone? Image Credits: Brinc

The company says it is heavily focused on manufacturing and sourcing within the U.S., with R&D and a lot of its manufacturing happening at its Seattle headquarters. This has given Brinc a competitive edge: It says it is National Defense Authorization Act (NDAA) compliant and approved by the U.S. government for its products to be used by federal agencies and contractors.

“Throughout our journey, we have worked with past and present law enforcement and emergency services professionals to understand their unique challenges and enhance their ability to do difficult jobs safely with best-in-class technology,” Resnick says. “We look forward to building upon our success and continually pushing the boundaries of what BRINC can offer to benefit public safety.”

The company produced a “Cops”-style dramatization video that, among other things, shows it smashing its way through windows and open doors to illustrate its vision for how it hopes law enforcement will take the new drone to heart:

Brinc’s Lemur 2 straps on blue strobes and is ready for action by Haje Jan Kamps originally published on TechCrunch

Brave Search launches an AI-powered summarization feature

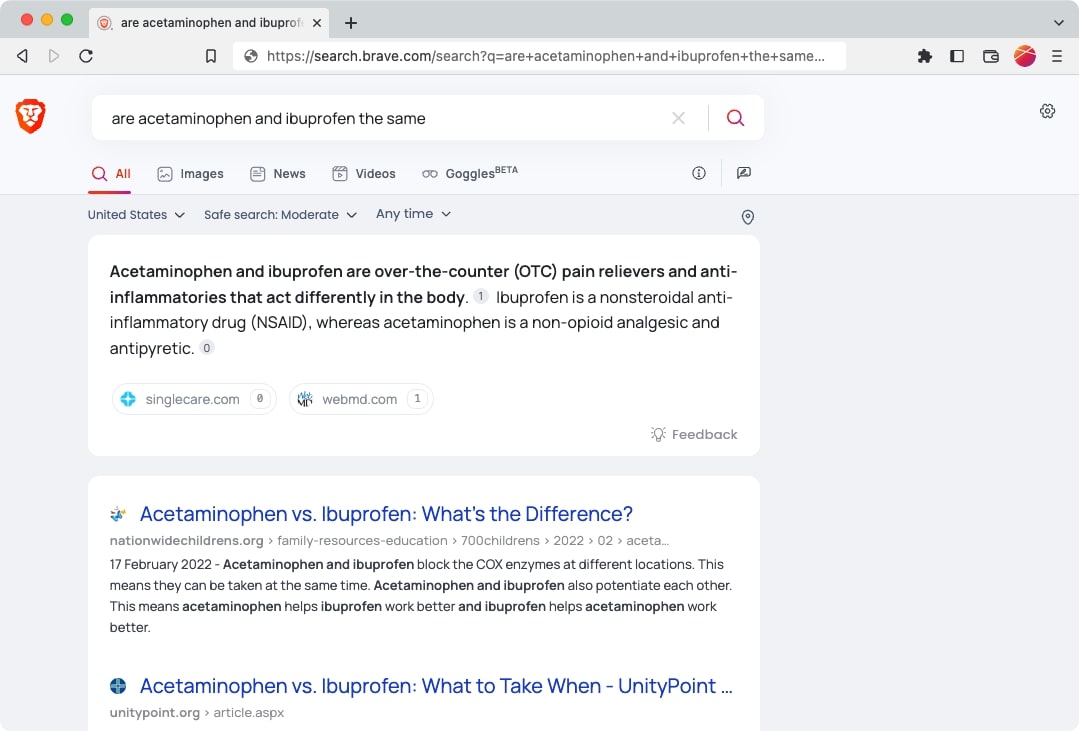

It is raining AI-powered features all across search engines. Today, Brave Search launched a new “Summarizer” feature, which is powered by different large langue models (LLMs) — OpenAI’s GPT tech isn’t one of them. Just like the name suggests, its job is to provide a synopsis of a search query using different sources.

The summary feature is available to all Brave Search users on desktop and mobile. In the examples given by the company, it can summarize results for queries like “are acetaminophen and ibuprofen the same” through medical resources or “what happened in East Palestine Ohio” through news links.

Image Credits: Brave

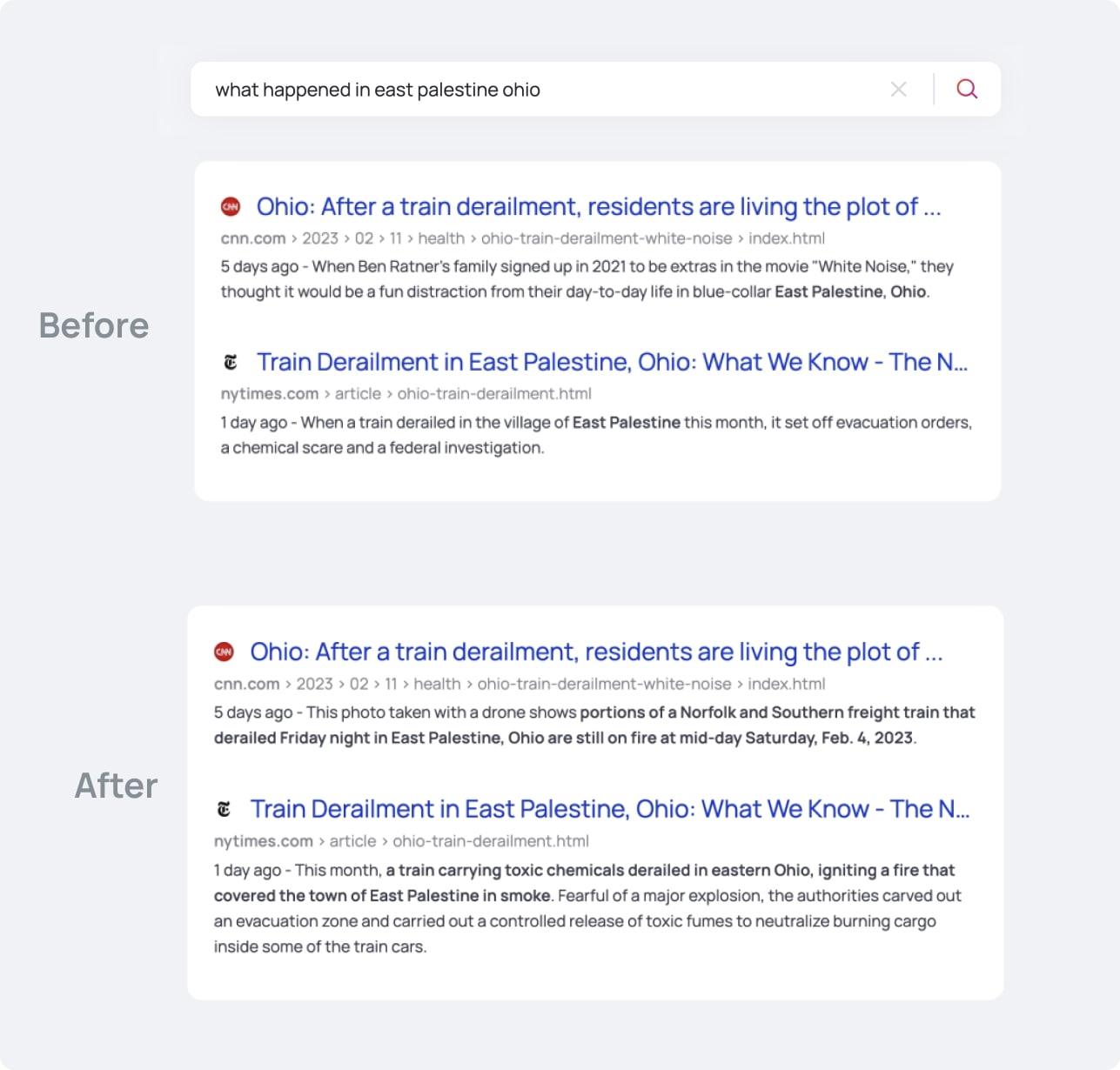

Besides the summary, the improved Brave Search will also highlight relevant sentences in listed results as news articles. Previously, it just highlighted search keywords from the page description.

Image Credits: Brave

“With 22 million queries per day, Brave Search is the fastest-growing search engine since Bing. Unlike AI chat tools which can provide fabricated responses, the Summarizer generates a plain-written summary at the top of the search results page, aggregating the latest sources on the Web and providing source attribution for transparency and accountability. This open system is available to all Brave Search users today to help them better navigate search results,” said Josep M. Pujol, chief of Search at Brave.

The company said that its LLM is trained to fight “unsubstantiated assertions,” referring to AI chat of other search engines like Bing going awry and sprouting out misinformation because of prompt engineering. Just like other offerings, Brave Search offers citations and links so that people can look at sources to double-check the information. So people have to decide for themselves if the mentioned sources are reliable — but there is a chance that people won’t even look at these links.

Brave warns users that they should not trust everything produced by AI-powered search results in its announcement. But it’s not clear if a similar warning will be shown in search results when people try out this feature.

“Given the current advancements in AI, it’s crucial to remind users that one should not believe everything an AI system produces, in much the same way one should not believe everything that is published on the Web. At the risk of stating the obvious, we should not suspend critical thinking for anything we consume, no matter how impressive the results of AI models can be,” the company said.

In the announcement, Brave noted that this new release won’t generate a summary for all queries. Currently, it is applicable for only 17% of the queries on the search engine, but the company expects this percentage to increase over time.

The company explained that the Summarizer feature is reliant on its own LLMs, instead of the popular GPT tech by OpenAI. It said that it uses a mix of three models: the first one is a question-answering model to get answers from text across pages; the second model is a classifier to weed out hate speech and spam; the final model rewrites the sentences to present a concise result.

Brave is competing with a lot of search engines going into AI-powered search. Last month, Bing made headlines with the announcement of a GPT-powered search where you can chat with a bot. In response, Google announced Bard in a closed beta. Relatively smaller players in the space like Neeva and You.com have also announced AI-aided search features. Given a lot of them are making errors in the early versions of these features, the search engine with the least glitches will have an advantage in AI-powered search.

Brave Search launches an AI-powered summarization feature by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/03/02/brave-search-launches-an-ai-powered-summarization-feature/

Instacart’s Q4 results impressed. Are they good enough to push it toward an IPO?

The best-known unicorns in the world are getting fit, showing that it is possible to trim losses while still posting growth. They are living experiments when it comes to corporations looking to get lean without cutting muscle.

European fintech giant Klarna is working through a valuation reset and a change in investor priority ahead of an eventual public offering. It’s not the only private tech company adjusting its valuation and working to scale its revenue and profitability to meet the new valuation reality the startup world is still digesting.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Here in the United States, Instacart is undergoing a similar reforging. Much like Klarna, Instacart soared amid the pandemic, watching its valuation explode as it caught a business updraft during COVID-triggered economic upheaval. And, like Klarna, it has had to slash its valuation and clip staffing so that it can, at last, go public.

Earlier this week, we dug into Klarna’s 2022 results, paying special attention to its Q4 data; the company’s full-year results obfuscated the fact that Klarna made material progress toward profitability as the end of the year neared. That mattered more than its historical losses from earlier in the year.

Instacart’s Q4 results impressed. Are they good enough to push it toward an IPO? by Alex Wilhelm originally published on TechCrunch

Are NFT marketplaces becoming an open sea for creator royalties?

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Welcome back to Chain Reaction.

PSA: I’ll be at ETH Denver this week, so if you see me, say hi! I’ll have a few Chain Reaction pins on me and the first few people to find me will get one. Think of it like a free NFT, but instead of it going in your crypto wallet, it’ll go in your wallet, wallet. Woah!

Anyways, let’s get into the news; oh, and Happy March!

February wrapped up as a big month for the NFT market as non-fungible tokens on the Ethereum blockchain surpassed $1.5 billion in volume for the first time since May 2022.

NFT marketplace Blur hit an all-time high for monthly volume at $1.12 billion for February, making up 74.6% of the total volume across all Ethereum NFT marketplaces, according to data from The Block. (The Block’s data aggregation filters out wash trading — when traders buy and sell items between themselves to artificially raise volumes and prices.)

By comparison, OpenSea, now the second-largest Ethereum NFT marketplace, had $270.11 million in volume for February, the data showed. At its peak, OpenSea had about $4.8 billion in monthly volume in January 2022 but has since seen its overall transaction volume deflate.

Amid the recent rebound, Blur has bested the once-largest NFT marketplace OpenSea in monthly volume for the third month in a row as the crypto market debates the issue of NFT creator royalties.

“If you look at what’s been happening recently with OpenSea and Blur, obviously that’s a concern broadly speaking in terms of the market and royalty fights,” Yat Siu, chairman of Animoca Brands, said to TechCrunch. “However, the volume as a result of that has increased tremendously, which means it has brought back another kind of excitement into the space.”

More below.

This week in web3

As mentioned above, the NFT market is getting hot again and the rise of Blur in the NFT market has helped reignite a debate concerning royalties. In previous quarters, OpenSea tried to balance creator royalties as it held the top position for NFT marketplaces, but Blur’s aggressive stance is causing OpenSea to change its tack. But as massive NFT marketplaces drop fees, this could be a “slippery slope” that hurts creators in the long term, Siu said.

Does web3 need a venture bailout now that AI has all the hype? (TC+)

Shifting investor priorities, more expensive cash and a dearth of the large deals that were so common during the last startup boom could leave many late-stage web3 companies short on cash. And the clock is ticking. For startups stuck in a now passé category, watching venture dollars flow elsewhere cannot feel great, even if such evolutions in capital flows are normal.

Chainlink’s new platform lets web3 projects connect to Web 2.0 systems like AWS and Meta

Chainlink, a web3 services platform, is launching a self-service, serverless platform to help developers connect their decentralized applications (dApps) or smart contracts to any Web 2.0 API, the company exclusively told TechCrunch. This new platform also supports more widely used programming languages like JavaScript so that developers who are new to web3 can get into the space. It will also provide integrations to Amazon Web Services (AWS), Meta and others.

The latest pod

For last week’s episode, Jacquelyn interviewed Alex Adelman, the co-founder and CEO of Lolli. Founded in 2018, Lolli is a bitcoin rewards app that lets people earn bitcoin or cash back when they shop online or in-person at over 10,000 stores like McDonald’s, Starbucks, Dunkin’, CVS, Costco and so on.

Adelman previously was on the team that built a commerce gateway, Cosmic, that was acquired by PopSugar in 2015 then Ebates and Rakuten in 2017. And similar to Jacquelyn, Adelman also went to UNC-Chapel Hill — go Tar Heels!

Lolli has grown significantly over the past few years, from partnering with less than 1,000 stores to over 10,000 stores, to date. Adelman dived into the rewards system in the crypto ecosystem and how it has evolved over the years — and what the future holds for Lolli.

We also dived deep into the topic of Bitcoin NFTs and Ordinals, which is the latest craze for the community. We discussed whether Bitcoin NFTs are good for the ecosystem, how the technology can grow long term and possibilities for these digital inscriptions to potentially fit into Lolli’s business model.

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- China’s regulatory compliant blockchain Conflux raised $10 million in a private token sale

- Decentralized crypto exchange Mangrove raised $7.4 million in a Series A round

- Singapore-based digital asset exchange DigiFT raised $10.5 million in a pre-Series A round

- Institutional DeFi-focused asset management platform Hashnote raised $5 million

- Term Labs raised $2.5 million in a seed round to build safer crypto lending for institutions

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Are NFT marketplaces becoming an open sea for creator royalties? by Jacquelyn Melinek originally published on TechCrunch

https://techcrunch.com/2023/03/02/are-nft-marketplaces-becoming-an-open-sea-for-creator-royalties/

Felicis funded 50% more deals last year than in 2021, some as prices were still rising — and it says it has no regrets

Felicis, a now 17-year-old, San Francisco- and Menlo Park-based venture firm, is announcing today that it has closed its ninth flagship fund with $825 million, compared with the $600 million core fund that it announced in the summer of 2021. The vehicle brings the firm’s total assets under management to exactly $3 billion, and it took just three months to raise, it says.

It’s a feat in the current market, but Joanna Rupp, managing director of private equity at the University of Chicago — which is among Felicis’ limited partners — suggests is boils it down to the numbers, saying in a statement to TechCrunch that Felicis has “delivered strong results for the endowment.” (Some of Felicis’ exits include the IPOs of Shopify, Adyen, Recursion and Matterport, along with acquisitions, like Credit Karma’s sale to Intuit and Fitbit’s 2021 sale to Google after first going public back in 2015.)

The question is whether the returns of Felicis will look as strong in the coming years. Its most recent fund was aggressively invested into the frothiest market on record in terms of dollars invested and startup valuations. Investor Chamath Palihapitiya summed up the fears of many institutional investors at a recent investing conference, saying despite the “successive amounts of capital” that startups raised during the pandemic and the ensuing “valuation creep” they enjoyed, it “won’t translate into what the actual money is that [VCs] are going to get back.”

In an interview this week, firm founder Aydin Senkut said he’s not concerned and suggested the best returns for Felicis may be yet to come, primarily for two reasons.

First, though the firm’s partners plowed a lot of money into the market in a short span of time, they invested much of it in earlier-stage companies. One of these is Prenuvo, a startup based in Redwood City, California, that created an alternative to traditional magnetic resonance imaging that can be used to screen and diagnose more than 500 medical conditions, including most solid tumors at Stage 1, and that last fall raised a $70 million Series A round that Felicis led.

Another is Meilisearch, the four-year-old Paris-based creator behind an open source search engine project of the same name and which closed a $15 million Series A round last fall led by Felicis.

“When you skew a bit earlier, the check sizes go down a bit more on average and you’re [getting more of the company] in the deal,” says Senkut.

Felicis also bets on winners, he insists, and in his experience, it doesn’t matter what the “entry” price is if you’re betting on the right horses. “People looking only at valuations are missing a big piece of the equation,” Senkut says. “Entry point is important, but it’s the companies you choose and whether they exit or not,” he adds.

He notes that when Felicis invested in a deal at 100 times revenue multiples in 2014, “everyone thought we were insane,” but the company, he continues, “grew 1,000 times revenue from there.” That deal was an investment in what has become Australia’s most valuable privately held company, Canva, which was valued at $40 billion by investors in the fall of 2021, though another of Canva’s biggest investors, Blackbird, marked down its own valuation of the company to $25.6 billion last summer.

Other companies that attracted big checks more recently from Felicis — and that the firm would write again, Senkut suggests — include Supabase, a two-year-old, Pleasanton, California-based open source database-as-a-service (DBaaS) company that raised $80 million in Series B funding led by Felicis in May of last year; Weights & Biases, a 4.5-year-old, San Francisco-based machine learning operations company that raised $135 million in Series C funding led by Felicis in the fall of 2021; and Runway ML, a four-year-old, New York-based maker of video editing software that is one of the two startups behind the popular AI text-to-image model Stable Diffusion and which raised $50 million in Series C funding led by Felicis in December.

Indeed, in conversation, Senkut talks proudly of the merits of each, saying of Runway, for example, that it’s precisely the kind of investment Felicis likes because it is the “original creator of the IP” on which it is built, and it has a big and growing base of customers, including a variety of Fortune 500 companies already using its tech such as CBS’s “Late Show with Stephen Colbert” and New Balance.

Whether the companies produce the returns Felicis is expecting will take years to know, presumably. In the meantime, expect more of the same from the team, whose most recent addition is Javier Soltero, a senior venture partner who previously sold companies to both VMware and Microsoft and most recently ran Google’s collaboration businesses as VP & GM of Google Workspace.

Saying you are cost conscious “sounds smart and, to some LPs, makes them feel better,” says Senkut. “But you can’t worry about valuations when you’re investing in a company that’s one in 10,000” in terms of its potential.

Felicis funded 50% more deals last year than in 2021, some as prices were still rising — and it says it has no regrets by Connie Loizos originally published on TechCrunch

To fix the climate, these 10 investors are betting the house on the ocean

Climate change is a problem important and pressing enough that investors have begun to grasp the opportunities that arise when trying to solve it. Now, they’ve started to cast their nets wider for other, adjacent opportunities.

Tech that serves to conserve the oceans while using it to replace older, more harmful means of generating energy and food seems to be one such opportunity. In fact, when we asked 10 investors in the sector to share their thoughts on the space, we quickly learned that ocean conservation tech startups are seeing more and more interest from generalist investors now that climate change is hot and people are seeking more ways to mitigate its effects.

“Climate change used to be more focused on terrestrial operations. It is now ‘warming’ up to ocean conservation,” Daniela Fernandez, managing partner of Seabird Ventures, told TechCrunch.

The world’s oceans and its climate have always been tightly coupled. Winds generate ocean currents, which in turn influence weather patterns both over the open water and deep into the continents.

“Our planet is 70% ocean, so the urgency of facing and solving climate change can only be properly addressed if we include the ocean in the equation,” said Rita Sousa, partner at Faber Ventures.

The open ocean also contains tremendous amounts of energy. Previously, accessing it meant drilling into the ocean floor to tap hard-to-reach deposits of oil and gas. But today, it increasingly means tapping the enormous energy represented by the ocean’s winds and waves. Just offshore wind alone has the potential to meet global electricity demand by 2040, according to the IEA, which is well in excess of all offshore oil and gas production today.

Stephan Feilhauer, managing director of clean energy at S2G Ventures stressed the viability of technologies like offshore wind as commercial alternatives to fossil fuels: “Offshore wind has established supply chains across the globe. It is possible today to manufacture, install and operate gigawatts of offshore wind energy using technology and equipment that is well-established and has years of operational data to help us understand its performance. Offshore wind is the only ocean-based renewable technology that meets these criteria today.”

The oceans are constantly exchanging gases with the atmosphere, too, most importantly withdrawing and storing about 30% of all carbon dioxide pollution. The ocean’s capacity as a carbon sink has created problems for myriad marine life, which have depended on historically stable acidity levels that are now creeping higher. However, this very capacity also creates opportunities to put key nutrient cycles to work and capture humanity’s excess emissions.

“A healthy ocean will continue to provide crucial opportunities for carbon sequestration,” said Peter Bryant, program director (oceans) at Builders Initiative. “There are a number of opportunities for increasing the ocean’s ability to store carbon. We have biological approaches that include ecosystem restoration, seaweed cultivation and iron fertilization; chemical solutions where you use minerals to lock dissolved carbon dioxide into bicarbonates; and electromagnetic approaches that store carbon by running electric currents through seawater.”

Founders and investors have a growing appreciation for the ocean’s potential as a resource for renewable energy and its capacity to buffer and even solve some of the climate problem. “We’re confident in the ocean’s resilience here. It’s simply one of the best resources we have in the fight against climate, and that means opportunity,” said Reece Pacheco, partner at Propeller. “We won’t achieve our climate goals without the ocean. Full stop.”

Christian Lim, managing director at SWEN Capital Partners, agreed: “It took too much time, but finally the ocean is being recognized as a critical piece of our fight against climate change.”

We spoke with:

- Daniela V. Fernandez, founder and CEO of Sustainable Ocean Alliance, and managing partner at Seabird Ventures

- Tim Agnew, general partner, Bold Ocean Ventures

- Peter Bryant, program director (oceans), Builders Initiative

- Kate Danaher, managing director (oceans and seafood), S2G Ventures

- Francis O’Sullivan, managing director (oceans and seafood), S2G Ventures

- Stephan Feilhauer, managing director (clean energy), S2G Ventures

- Sanjeev Krishnan, senior managing director and chief investment officer, S2G Ventures

- Rita Sousa, partner, Faber Ventures

- Christian Lim, managing director, SWEN Blue Ocean Partners

- Reece Pacheco, partner, Propeller

Daniela V. Fernandez, founder and CEO, Sustainable Ocean Alliance (Seabird Ventures)

Climate change is the elephant in the room. Has the issue’s rising profile sucked the air out of the room or is it bringing attention to ocean conservation that otherwise wouldn’t be there? How have things changed in the past five years?

Climate change has been a topic for decades. It used to be a “nice to have” about a decade ago: “If you have the extra funds to perform climate risk assessment, then we will dedicate it to climate change.”

Now, it’s more of a “must have.” If we don’t address climate change, we’ll see more extreme weather events. Over the past five years, we’ve seen more focus on ocean conservation, but there is still a $149 billion annual ocean funding gap. Climate change used to be more focused on terrestrial operations. It is now “warming” up to ocean conservation.

We are just now beginning to see a distinct shift in tone. The thinking used to be that “the ocean is a victim of climate change,” but now the thought is more “the ocean can become a climate hero” and play a huge role in reducing our carbon footprint. Yet, this shift is still very much in its infancy. In particular, the philanthropic community is just starting to recognize that there is an urgent need to support efforts to develop ocean-based climate solutions.

Until now, most climate funders focused on terrestrial or atmospheric issues, and ocean funders focused on important, but only tangentially climate-related ocean issues such as ending unsustainable fishing practices and establishing marine protected areas. The ocean is already the biggest carbon sink on the planet, and we need to better understand both what absorption of all that carbon is doing to ocean ecosystems, and how much more it can potentially contribute without disrupting its other critical ecosystem functions.

It’s also been encouraging to see governments taking action to truly prioritize and create financial incentives for investing in climate/ocean innovations, such as the bipartisan Infrastructure Law passed in the U.S. in 2022. There is also an upswell of talent realizing that working a “typical” job is no longer an option if we won’t have a liveable planet in the next seven years. We are seeing society reset its priorities and climate is one of the highest ones at the moment.

Climate change has been called “recession-proof” because governments and investors have come to recognize the scope, scale and urgency of the issue. Do you think that’s true of ocean conservation tech as well?

Yes. Climate change and ocean restoration are inherently linked. The ocean is humanity’s biggest protection against climate change, as it produces more than half the air we breathe and absorbs 93% of excess heat from global warming.

Ocean tech and climate change companies and investors all have the same goal. The urgency of the climate crisis has kept passionate funders and entrepreneurs engaged in the development of solutions regardless of the state of the economy.

Climate change has affected the oceans greatly, causing everything from rising water temperatures to more acidification. How are you approaching the question of climate change in your investments?

Seabird Ventures is internally tracking impact and reporting on social and/or environmental factors in our investments. We have externally reported on the following key ocean impact areas:

- Blue carbon & CO2e removal or avoidance: Initiatives in this category are incredibly important for capturing and avoiding harmful GHG emissions, which contribute to climate change and ocean acidification. The impact of these companies is measured by the weight of CO2e emissions reduced or sequestered as a result of the solution.

-

Waste reduction and circular use: We focus on companies that reduce the amount of solid waste and plastic polluting our ocean. Two approaches commonly used are preventing plastics from leaking into waterways, and plastic cleanup solutions. Plastic pollutants are responsible for choking marine life and destroying both marine and coastal ecosystems. Tracking impact in this category is done by measuring the mass of plastic reduced, avoided or recycled. Companies offering fully biodegradable plastic alternatives are also considered in this area for their ability to displace the use of traditional plastics.

To fix the climate, these 10 investors are betting the house on the ocean by Tim De Chant originally published on TechCrunch

Barcelona nights

I’ve yet to walk the entire floor at Mobile World Congress in Barcelona this year (that’s the goal for this afternoon), but my sense is the majority of the robots present fit into one of two categories: robot vacuums or greeter robots. With Pepper out of commission, maybe there’s a wide-open market there. Who knows?

The two Xiaomi robots — CyberOne and CyberDog — may well have been the most prominent of the show, and neither were especially inspiring. It was fun finally seeing the Cyber One in person after writing about it seven months ago. The humanoid robot’s stilted locomotion screamed “research prototype” in the first demo, and I’m plenty wary about phone makers getting “serious” about robotics. There was no demo in the booth this year, rendering it more of an expensive mechanical mannequin.

Xiaomi’s humanoid CyberOne robot at MWC 2023. Image Credits: Brian Heater

CyberDog was moving, at least. The system was significantly smaller than I’d anticipated, standing at only 1.3 feet. The demo largely consisted of some pacing and sitting up and begging. If it’s a toy, it’s an expensive one, at $1,600. It also has some fairly sophisticated hardware on board. It’s powered by Nvidia Jetson and sports an Intel RealSense depth sensor on the front. The quadrupedal dog robotic form factor is a familiar one by now, thanks in no small part to Boston Dynamics’ Spot.

I recently spoke to Boston Dynamics’ founder, Marc Raibert, as part of the TC City Spotlight: Boston event. Since I last had the opportunity to sit down with him, Raibert’s job has changed fairly dramatically. He stepped down from the CEO role a couple of years back, as Boston Dynamics has become much more aggressive about monetizing their products, Spot and Stretch.

Image Credits: TechCrunch

In August, Boston Dynamics’ parent company, Hyundai, announced the launch of the Boston Dynamics AI Institute, with Raibert at the helm. While acting as a corporate research wing, the institute’s research is not currently driven by the same need to productize as Boston Dynamics, the company. For those who missed the live conversation, here’s a transcript of our chat:

TC: The obviously geographical limitations of the name aside, was it clear from the earliest days that Boston Dynamics was always going to stay in the Boston area?

MR: I’m kind of a lifelong Boston person.

I grew up in New Jersey, but my mother grew up here, so I had a connection to Boston from a very early age. I love Boston. I went to school here, left for 10 years, and eventually was faculty at MIT. I was a professor there for 10 years before starting Boston Dynamics. When we started, it was half-time Boston Dynamics, half-time MIT. It wasn’t really motivated by Boston being a hub of robotics. It was just where I was comfortable. We did open a California office.

That was the result of an acquisition?

It was a result of our acquisition of Kinema, which was in Palo Alto when we first got them. And then we opened an office in Mountain View, which is still there.

I didn’t know you’d left Boston for 10 years. What did you do in the meantime?

Three years at the Jet Propulsion Lab, back in the 1970s. And then six years at Carnegie Mellon, on the faculty in both the Robotics Institute and the computer science department.

Were there a lot of robotic applications for JPL in the ’70s?

It was fledgling, but they had a mockup of a Mars rover back in the ’70s. It looked like a car, and it had the old Stanford arms that had a sliding joint. It had some cameras, and there were a couple of different groups working on it.

Image Credits: Boston Dynamics

People talk a lot about brain drain. How large of a problem was the exodus to places like San Francisco and New York in the early days?

I don’t think we’ve lost too many people to the West Coast. Sometimes that happens. When we were part of Google, there was a group of us from Boston Dynamics who moved out to the West Coast, and I think those people mostly stayed. When we got out of Google, they didn’t come back with us. But Boston has its own charms and attraction, and there’s lots of tech here. Lots of schools doing good stuff.

How dramatically has Boston and the Boston ecosystem changed in the 30-plus years since the company was founded?

I don’t know how many startups there are in the area. There’s all the logistics companies — there must be a dozen of them — which all have robotics talent at them. There’s the social robot activity — Cynthia Breazeal’s company [Jibo], and others like that. New things are springing up all the time. To be honest, I think more globally. I’m always thinking of us being an international company, now that Boston Dynamics has Spot robots all around the world. There’s about 1,000 of them out there now.

Obviously, there are certain benefits in terms of infrastructure when it comes to running an institute full of roboticists and AI researchers.

The recruiting here is great. Amazon’s got robotics people. Google is right across the street; they don’t exactly have robotics in Boston, but obviously, they have a lot of talent in AI and software. So those are potential employees. There’s a lot of technical people, but we recruit all across the country, and somewhat from Europe. We’ve been seeing applicants from all over.

How has your day to day changed since stepping down from the CEO role?

There was a point at Boston Dynamics where we were clearly turning more commercial. I decided that I wasn’t the right guy to do that. I had also heard a talk by [Lloyd Blankfein], who was the chairman of [Goldman Sachs], and he gave a talk about his decision to step down. He said, you really need to step down when things are going great. If you step down when things are in trouble, then they think you’re a bum and they kicked you out. But if you do it when it’s going great, it’s hard, because things are so much fun. But that’s when you have to do it.

I listened to that and decided he was right. That, plus the fact that we turning to commercialization. I became the chairman and appointed Rob Playter, who had been my right-hand man. He’d been my graduate student at MIT and been with me for 27 years at that point. He became CEO, and I didn’t have enough to do, to be honest. I thought about retiring. I’m old enough to retire.

When Hyundai agreed to fund the institute, I decided I needed to be here every day to work and inspire the others. And it’s been great. It’s just like being back in it, full-bore.

How much of that push toward commercialization or push toward products activation was a result of the Hyundai acquisition?

It really started when we were still at Google. Then we were with SoftBank for four years, and it was just all about the future. It got to be more about what the products were and tightening up the bottom line. I think another force is that Robert Playter has always wanted to commercialize. I’m a research guy. I really want to work on the long-term and make the next generation or the generation after that happen for robots.

Was the AI Institute part of the Hyundai deal from the beginning?

No. After I became chairman and started to get bored, I wrote a proposal that I actually shopped around to a few billionaires, and got someone to agree at a level that wasn’t enough, in my opinion. Then COVID happened, so I slowed down. But after the Hyundai deal was all done, I pitched it internally, and they went for it.

Beyond the obvious $400 million contribution, what is Hyundai’s relationship to the institute?

They’re the only stockholder in the current arrangement. It’s been very collaborative. I talked to some managers involved, and also to [Hyundai’s] chairman on a regular [basis]. He’s a real enthusiast. He’s really leaning into the future [of] software, AI and other high-tech things. EVs are central to Hyundai to HMG.

Is pure research a hard thing to pitch to a multinational automaker?

The institute has only been around since last summer. You never know until later what the staying power is. Right now, my pitch is to avoid products, because products force you into quarterly and annual work. Products force you into all the various needs of all the various customers. They have a lot of good information, but they also take you in lots of directions. If you want to do the vision of what’s going to come next, it has to come from the technical people who are developing it. I proudly say we’re not doing products. No one’s trying to steer me at the moment.

Was the philosophy of avoiding product part of Boston Dynamics’ mission statement at the beginning?

No. We had some software products in the very early days that we actually made money on. In the early days, we were always in the black, because we didn’t have any investors up until Google acquired us 20-something years in. We always had to be making money. A lot of it was contract work, but we also had some software products.

If productization and commercialization aren’t the focus for the institute, what happens to IP and patents that are developed?

We have a multiprong plan. We can do spinouts. For some, spinouts are seen as a way to commercialize. For me, it’s a way to protect the institute from products.

What research opportunities are afforded the institute that you wouldn’t necessarily have in a university setting?

You have a university, which is full of smart people with blue-sky ambitious goals to do new, novel things. And then you have a corporate lab, which has teamwork. They have support from hardware, software, sensor and electronic engineering, and they have schedule and budget discipline. I think of the institute as being right in the middle, having larger scale. We plan to have about 50 people in engineering that support the work of the researchers, in addition to other engineering people in the research groups. We’re trying to make the future happen and solve really the fundamental problems in robotics, not just the features that are needed right now.

Image Credits: Boston Dynamics (Image has been modified)

The concept of a multipurpose humanoid robot comes around every few years. You’ve been involved in one of the more notable examples, the Atlas robot. Does that bipedal form factor ultimately make a lot of sense?

I don’t know. Elon thinks so. That’s interesting. I would rather point at Spot as a general-purpose robot, because we designed it without a particular application in mind. It’s a platform where you can customize it for your use. We have 1,000 of them out there, which are being used in a reasonably diverse set of environments. We’re finding out how well that works. You can amortize the technical investment in the platform and have it really pay off for a wide variety of use cases. At the institute, we’re in a planning phase where we have a list of projects that we’re contemplating doing. We’re getting all our talented people to say things about what they’d like to do. Getting the balance between trying to have robots that do everything and robots that do one thing is a hot topic for us. We’re probably going to pick a couple of activities that span that space and see how it works out.

What were your thoughts on the Tesla Optimus demo?

I thought that they’d gotten a lot more done than I expected, and they still have a long way to go. I thought that their design of the second, nonworking robot was cosmetically very interesting. I’m a Tesla driver. I’ve had a couple of them. I really admire Elon, despite the recent Twitter activity. I think he’s a brilliant guy, and I absolutely wouldn’t count him out.

Why was it important that the company sign a weaponized robotics pledge?

There was a lot of sentiment among the employees that the robots aren’t suitable for weaponizing. There’s so many additional concerns, if a robot were to be weaponized, and we just wanted to say that we shouldn’t be doing it with these. I think there was some unhappiness that it looked like some of the other companies had just kind of flung a weapon on there without maybe necessarily considering all the safety. As much as anything, it’s a friendly fire–type worry.

Robotics companies that are hiring

Boston Dynamics AI Institute (11 roles listed, more on the way)

News

Image Credits: Figure

All right, let’s talk news. First up is Figure. The Sunnyvale-based startup emerged out of stealth this week, six months after we initially reported on its existence. I’m frankly enjoying the reinvigorated debate around general-purpose robots and humanoid form factors reignited by the early Tesla Optimus demo, and the company is aiming to be right in the eye of that storm with the Figure 01.

“The team is ex-Boston Dynamics, Tesla, Apple SPG, IHMC, Cruise [and Alphabet X]. Collectively we align on building a better future for humanity through the intersection of AI and robotics,” Figure founder Brett Adcock tells TechCrunch. “We’ve been fortunate to hire the best in the world at specific skill sets in AI, controls, electrical, integration, software, and mechanical systems. The team believes we’re at a point where we can commercialize robots that have primarily been R&D over the last two decades. This is something a lot of our team has dreamt about doing for a long time.”

Image Credits: Renovate Robotics

Another interesting startup is emerging on the scene. Renovate Robotics is building systems to automate the shingle installation process. Roofing is both dangerous and extremely widespread, making it a prime candidate for these sorts of technologies.

“I’ve seen a lot of hard tech startups go through steep inflection points from the inside during my time at SOSV, and the ones that I was always the most drawn towards were climate focused,” co-founder Dylan Crow told TechCrunch. “All of these companies have a vision that was fundamentally disruptive, and I see the same in where we’re headed at Renovate Robotics. I have huge conviction in my co-founder Andy, as an engineer and a leader who can get us to market. There’s such a fantastic fit between the two of us, and I have a deep gut feel about the jump.”

That’s about all I’ve got in me this week. See you back in the States. Adieu.

Image Credits: Bryce Durbin/TechCrunch

Subscribe to Actuator here.

Barcelona nights by Brian Heater originally published on TechCrunch