Category: TECHNOLOGY

BetterHelp owes customers $7.8M after FTC alleges data mishandling

The Federal Trade Commission (FTC) is requiring online therapy company BetterHelp to pay $7.8 million to consumers in a settlement over alleged data mishandling between 2017 and 2020. This marks the first proposed FTC order that would compensate consumers whose health data was compromised.

According to the FTC, BetterHelp assured customers that it would not share their health data except for the purpose of providing counseling. But the FTC alleged that BetterHelp shared customer emails, IP addresses and health questionnaire responses with advertisers like Facebook, Snapchat and Pinterest.

“The FTC alleged we used limited, encrypted information to optimize the effectiveness of our advertising campaigns so we could deliver more relevant ads and reach people who may be interested in our services,” BetterHelp wrote in a statement. “This industry-standard practice is routinely used by some of the largest health providers, health systems, and healthcare brands.”

Customers who used BetterHelp between August 1, 2017 and December 31, 2020, when these advertising practices were in effect, will be eligible for partial refunds.

“When a person struggling with mental health issues reaches out for help, they do so in a moment of vulnerability and with an expectation that professional counseling services will protect their privacy,” said Samuel Levine, director of the FTC’s Bureau of Consumer Protection, in a statement. “Instead, BetterHelp betrayed consumers’ most personal health information for profit.”

BetterHelp said it has never received payment from any third parties for information about its customers.

The FTC’s proposed order also requires BetterHelp to limit how long it can retain customer data and ask third parties to delete consumer health data that they shared. BetterHelp is also ordered to obtain express consent before disclosing customer health information to third parties, and to develop a more comprehensive privacy program.

“This settlement, which is no admission of wrongdoing, allows us to continue to focus on our mission to help millions of people around the world get access to quality therapy,” BetterHelp wrote in its statement.

BetterHelp owes customers $7.8M after FTC alleges data mishandling by Amanda Silberling originally published on TechCrunch

https://techcrunch.com/2023/03/02/betterhelp-owes-customers-7-8m-after-ftc-alleges-data-mishandling/

Hackers steal gun owners’ data from firearm auction website

Hackers breached a website that allows people to buy and sell guns, exposing the identities of its users, TechCrunch has learned.

The breach exposed reams of sensitive personal data for more than 550,000 users, including customers’ full names, home addresses, email addresses, plaintext passwords and telephone numbers. Also, the stolen data allegedly makes it possible to link a particular person with the sale or purchase of a specific weapon.

“With this data, you can then take a public listing…and resolve it back to the [data in the stolen database] so you have the name, email and physical address and phone number of [the seller] and presumably, the location of the gun,” Troy Hunt, a cybersecurity expert who runs the popular data breach repository and alerting service Have I BeenPwned, told TechCrunch. (The researcher who found the breach shared the data with Hunt so he can upload it to Have I BeenPwned.)

At the end of last year, a security researcher — who asked to remain anonymous — discovered a server containing the data, which turned out to be used by a hacker (or group of hackers) who was using the server to store the stolen data. The server was not protected by any system to limit or control who could access it, so the researcher downloaded the data and analyzed it.

What he found was data taken from the website GunAuction.com, a site that since 1998 allows people to put guns for auction online.

A screenshot of GunAuction.com

TechCrunch analyzed a sample of the stolen data, and reached out to 100 people via email and 60 via phone call. Of those, 10 people confirmed that the data contained in the stolen database was accurate. It’s unclear, however, how recent the data is, given that for 25 email addresses our message bounced back or could not be delivered, and several phone numbers were also disconnected.

GunAuction.com CEO Manny DelaCruz confirmed the breach in an email.

“I can confirm that we were recently contacted by the FBI regarding the possibility of a data breach that has affected our company,” DelaCruz wrote in the statement. “The breach likely exposed personal customer information like names, addresses, and email addresses. However, we want to reassure our customers that we have no reason to believe that any financial information was accessed during the breach. We are advising our customers to remain vigilant and monitor their financial accounts and credit reports for any suspicious activity.”

DelaCruz added that “our intention is to inform affected users very soon.”

This is not the first time that sensitive data about gun owners has been exposed. Last year, California’s Department of Justice mistakenly leaked personal data, “including gun owners’ names, birthdays, addresses, ages, the purchase date and type of firearm permit they possessed, and their Criminal Identification Index numbers, which are used to track state and federal criminal records,” according to Gizmodo.

Do you have more information about this breach? Or similar breaches? We’d love to hear from you. From a non-work device, you can contact Lorenzo Franceschi-Bicchierai securely on Signal at +1 917 257 1382, or via Wickr, Telegram and Wire @lorenzofb, or email lorenzo@techcrunch.com. You can also contact TechCrunch via SecureDrop.

Hackers steal gun owners’ data from firearm auction website by Lorenzo Franceschi-Bicchierai originally published on TechCrunch

https://techcrunch.com/2023/03/02/hackers-steal-gun-owners-data-from-firearm-auction-website/

Neuralink human testing has reportedly received one FDA rejection already

Neuralink’s ambition to provide a brain-computer interface orders of magnitude better than what’s out there now has hit headwinds with the FDA, Reuters reports. The agency reportedly rejected the company’s application to begin human testing last year, a somewhat expected obstacle that seems nevertheless to have frustrated backer Elon Musk.

The well-sourced report explains that the company made its bid for human testing in 2022, but was rejected with numerous concerns cited. The “neural lace” that forms the implant could migrate through the brain’s soft tissue; the device could overheat; the implanted battery could fail; removal under any circumstances of failure, rejection or infection could damage the brain.

Such concerns are perfectly rational, and it’s commonplace for medical devices to be rejected for potential safety issues their creators either didn’t test properly or hoped the regulator wouldn’t notice. Generally one gets back to work and tries again a year later.

That may very well be what is happening at Neuralink; nothing Reuters’ sources said suggests that anyone is tearing their hair and bewailing their bad fortune. But some do report consternation from Musk at the slow pace of progress.

But the FDA is right to be wary: Not only is Neuralink proposing an entirely new in-body electronic system and even a new, robotic method of implantation, but the company has also been cited for cruelty in its animal testing. This part of the process is in a way unavoidably cruel, of course, but there are guardrails on what is ethical for testers to inflict on animals and Neuralink has reportedly exceeded those — possibly in pursuit of faster progress.

People in leadership have fled the company for one reason or another; one co-founder is leaving to form a new brain implant company, Precision Neuroscience, which just raised $41 million.

It’s difficult to gauge progress and setbacks because Neuralink is, like Musk’s other companies, very secretive, only sharing progress in the form of occasional, carefully curated events. But a working implant in a seemingly happy monkey on video, while promising, is hardly proof that the tech is ready for human testing. And when all we hear from the company is “soon, very soon” for years on end, despite apparently receiving a non-trivial rejection from regulators, we begin to doubt.

Most companies working in this space have been doing so for years, up to and including their FDA approval for human testing and use, without making the kind of promises Musk has on behalf of Neuralink. This technology in all its forms represents a potential breakthrough for people with debilitating conditions, but putting foreign matter, let alone a great deal of it, into the brain is fundamentally dangerous. A company that wants to pursue such lofty applications as restoring sight and mobility must first prove that the implants are safe at a basic level, and that is what the FDA is reportedly asking.

Neuralink human testing has reportedly received one FDA rejection already by Devin Coldewey originally published on TechCrunch

Hear why so many cybersecurity companies call Boston home

TechCrunch Live took a virtual visit to Boston this week at our special City Spotlight: Boston event. During the special, extended event, influential Boston founders and investors spoke including Boston Robotics founder Marc Raibert and MassChallenge CEO Cait Brumme. The event started with Greg Dracon, of .406 Ventures, and Matt Caulfield, founder and CEO of Oort, with a conversation around cybersecurity companies in Boston.

Caulfield started Oort in 2018, and to date, raised $18.05m to support the company including from Dracon at .406 Ventures.

But why Boston, I asked in the video embedded here.

“I live out in the boonies,” Caulfield said, laughing while adding, “In the town over, there’s a prototype fusion reactor from Commonwealth Fusion, which is out of MIT, and you’re not going to find that anywhere in the country.”

Both Caulfield and Dracon made Boston home and started companies in the area. To them, the area’s rich history in deep tech explains why high-tech startups, from biotech to cybersecurity companies, find success in the region.

And the Boston area keeps growing. As explained in this TechCrunch article on Boston, success begets success. In 2022, the area was the fourth most active venture capital market in the United States, trailing just California’s Bay Area, New York City, and Los Angeles.

Greg pointed to the flywheel effect to explain the scene: “We [Boston] have companies that are exiting for nice amounts, and spitting out entrepreneurs. We were early investors in Carbon Black, and we’ve backed two companies that spun out of Carbon Black… There are probably five or six companies that spun out of Carbon Black alone.” He explains that it’s important for a region when people feel success together and points to other large Boston companies like Hubspot, Wayfair, and Klaviyo that saw projects turn into spun-out startups.”

The Boston area requires a specific type of entrepreneur, the two say. “You have to be networked into the tech communities and a bit of a combination of an introvert and extrovert,” Dracon said. “We find good founders who are introverted enough, often have a technical background, but they can get out there, build up networks, and turn it on when when they have to sell.”

“If you’re solving a hard technical problem,” Caulfield said, “I can’t think of a better place than Boston to do it.”

Hear why so many cybersecurity companies call Boston home by Matt Burns originally published on TechCrunch

https://techcrunch.com/2023/03/02/hear-why-so-many-cybersecurity-companies-call-boston-home/

As tensions build, Silicon Valley’s Chinese affiliates invest in sensitive space tech

Chinese subsidiaries of American venture capital firms are investing money from U.S.-based funds into Chinese space startups, even as the Pentagon warns of Beijing’s growing activity in the space arena, according to data reviewed by TechCrunch.

The data, collected by PitchBook, includes information on past limited partners and investments of the Chinese units of Sequoia Capital, Matrix Partners and Lightspeed Venture Partners. Space industry investments represent a very small but notable portion of these firms’ portfolios, with Sequoia Capital China and Lightspeed China investing in two companies each and Matrix China investing in eight. Startups that have landed funding include companies working on launch, satellite manufacturing and Earth observation.

According to recent reporting from The Wall Street Journal and Politico, the White House is considering new screening requirements on U.S. investment flowing to foreign-based technologies that could be sensitive to national security, like semiconductors, though it’s unclear whether space technologies would be considered as part of a future order. But one investor, who asked to remain anonymous, citing co-investments with Sequoia Capital, told TechCrunch that the stakes are high.

As tensions build, Silicon Valley’s Chinese affiliates invest in sensitive space tech by Aria Alamalhodaei originally published on TechCrunch

https://techcrunch.com/2023/03/02/china-semiconductor-restrictions-investments/

How to turn an open source project into a profitable business

Contributor

Despite the premise of open source software distribution being “free,” multibillion dollar companies like RedHat, MongoDB, GitLab and Elastic have already broken ground building profitable businesses with open source at their core.

But is it possible for a smaller open source project to find its way into this land of commercial opportunity?

COSS is accelerating

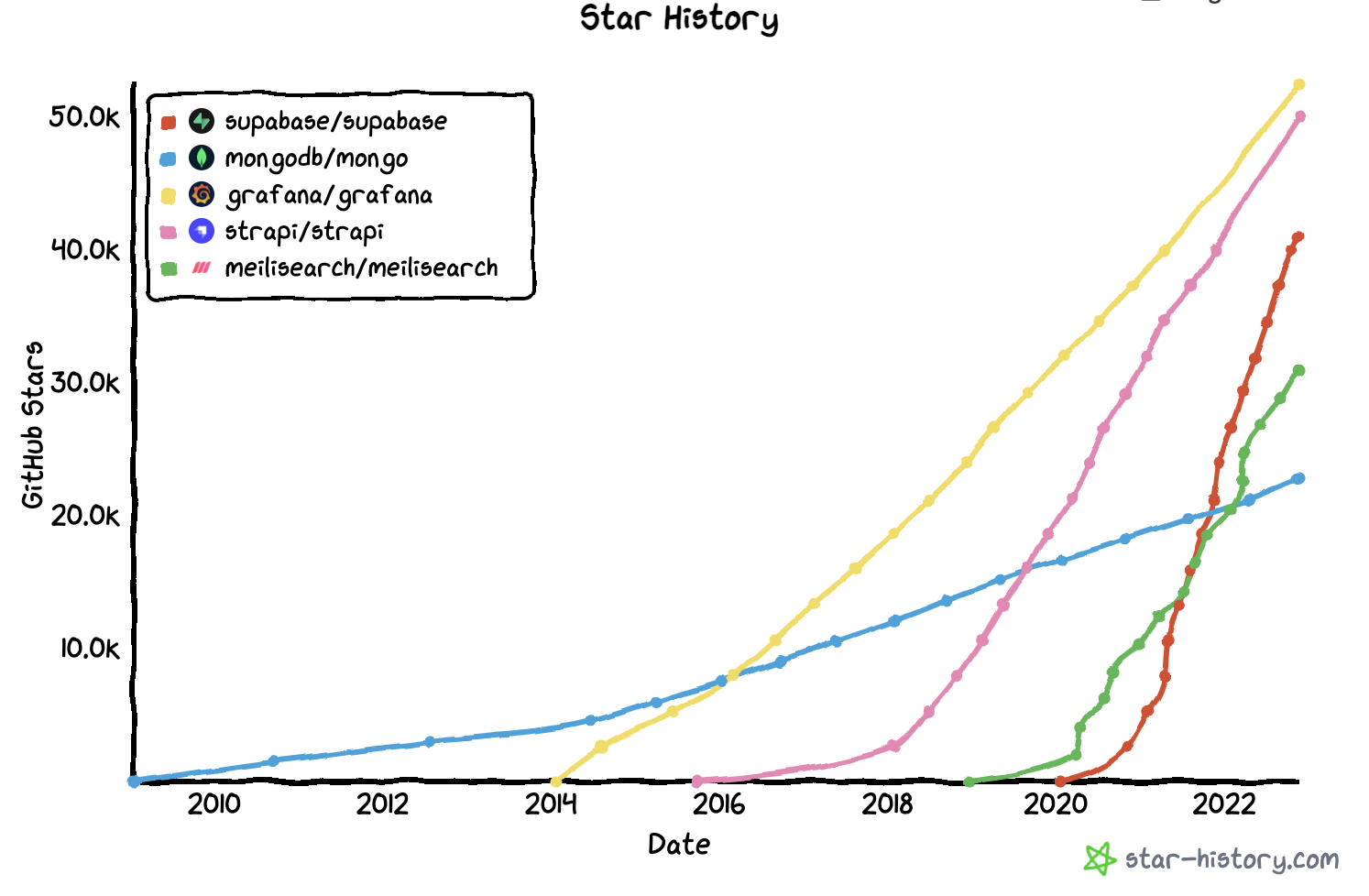

In general, the trends in commercial open source (COSS) are encouraging. New products like Meilisearch and Supabase are gaining traction exponentially faster than the legends of COSS like MongoDB, which were founded much earlier.

Image Credits: GitHub Star History (opens in a new window)

Let’s give some more context to the graph above. From 2010 to today, the number of GitHub users has exploded from 500,000 to 103 million. It might be tempting to suggest that this influx of new users into the community would be the driving force behind the increase in stars.

Your open source project can begin as a pet project but only if you can devote time to it.

But, at the same time, the number of projects (repositories) has grown at an even higher rate: from 600,000 to 359 million. And investments in open source products have almost tripled from 58 deals in 2015 to 144 deals in 2021.

Importantly, the average number of users per repository has shrunk from 0.8 to 0.3. This means the competition for GitHub stars is now higher than ever, which suggests the superstars above are indeed outliers and it’ll be difficult to replicate their success.

Judging from these numbers, investments and star dynamics, COSS is in a sweet spot at the moment.

That said, we must keep in mind that COSS and developer tools still only occupy a niche. After all, there are only 25 million to 30 million software developers in the world. Even though productivity in this industry is much higher than in many others, this number is only a fraction of other big markets like finance or retail.

Moreover, monetizing products built for developers is still, to a certain extent, an open question.

How to monetize open source

There are multiple strategies for earning money from open source.

Let’s start with a simple one: crowdfunding and donations. Grant money falls into the same category as donations, as the only difference is in how you raise the money. Foundations are a vehicle for collecting donations from large sponsors or from a great number of sponsors.

Sadly, such earnings are unlikely to cover the costs of a growing COSS. Take PostCSS, a widely popular CSS framework built by Andrey Sitnik. Through an Open Collective hub, with 27,000 stars on GitHub, he collects only about $12,000 per year despite the fact that massive companies like Meta or Google use PostCSS and could potentially support the product.

How to turn an open source project into a profitable business by Ram Iyer originally published on TechCrunch

https://techcrunch.com/2023/03/02/how-to-turn-an-open-source-project-into-a-profitable-business/

Naomi Osaka, Usher, Apolo Ohno back Immi’s next phase of instant ramen domination

Today, immi still has its three initial plant-based flavors of Spicy “Beef,” Tom Yum “Shrimp” and Black Garlic “Chicken.” However, a new round of $10 million in Series A funding puts the company on a path of unveiling nine additional flavors, rounding out its executive team and expanding its reach into nationwide retailers.

Touch Capital led the recently closed round and was joined by a bevy of celebrity investors, including Naomi Osaka, Usher, Apolo Ohno, David Grutman, Kygo’s Palm Tree Crew and Gryffin. Immi has now raised about $15 million in total funding, with Lee disclosing the valuation increased “by a good amount” over the seed round.

Other investors participating in the Series A include Siddhi Capital, Gold House Ventures, Anti VC, Harizury, Lab Capital Advisors, CAA’s Co-Head of Basketball, Lynja, Lauren Kleinman (Dreamday, The Quality Edit), Theresa Kang (Blue Marble Pictures), and the CEOs or co-founders of Fly By Jing, Bokksu, Boba Guys, LMNT, OWYN, Hero Cosmetics, Supply, Rumble Boxing, Worlds, Venice Music, Adgile Media Group and Hyphen Capital.

Immi grew over six times year over year in revenue and sold out seven times since 2021, and in 2022, the company launched in retailers, including Whole Foods, Wegmans and The Fresh Market. Additional locations are on tap to open this year, the founders said.

In 2021, the company had a private tasting community of about 4,000 people and that number has grown to 6,000. In addition to taste, the community gives the founders direct feedback on which retailers they would like to see immi launch in next. Lee said this was valuable information that often helps the company better market itself to retailers by being able to prove the size of a future customer base.

Following that rapid growth, the company began to get some inbound investor attention, from both existing and new investors, in the third quarter of 2022, Lee said.

“We wanted to raise this $10 million because there was just so much opportunity on the horizon with building out our team, improving the product and then launching in more retail, especially after seeing some of the early Whole Foods data,” Lee added. “We had excellent velocity right out the gate because of our direct-to-consumer audience, and the demand in retail of people coming across our bright yellow packaging.”

As mentioned, some of the new capital will be invested in product development research. Though Chanthasiriphan didn’t give a hint on what any of the nine new flavors would be — immi specializes in less commonly available flavors — he did say that it will be a combination of permanent, limited-time and co-branded partnership flavors with influencers, celebrities and movie studios.

On top of that are another 12 flavors that the company is just now “batting around” in efforts to see which ones immi should prioritize. It is also exploring other products outside of ramen.

“There are a lot of unique partnership opportunities to launch those,” Chanthasiriphan said in an interview. “We also have noodle improvements coming down the pipeline related to texture, cook times for the noodles and formats, like cups.”

Consumer tastes are ever changing, but one thing’s for sure: People are looking for healthier food options, including their favorite comfort foods.

Ramen is often a pantry staple, known jokingly for being the food of choice for college students and young entrepreneurs, but the market potential is huge: The market value of the global instant noodle sector in 2020 was nearly $46 billion and is projected to be about $66 billion by the end of 2027.

That’s where immi comes in. Two years ago, we profiled the company when it secured $3.8 million in seed funding. Kevin Lee and Kevin Chanthasiriphan started the company to carve out a niche in this big market and introduce a plant-based version of instant ramen that also has lower carbohydrates and increased protein.

“We’ve still been heads down, really focused on the ramen space,” Lee said in an interview. “We have seen some new folks entering the ramen space, but there still aren’t any competitors in that low-carb, high-protein, plant-based value prop area. We continue to maintain that lead and have an evergreen opportunity to tackle, especially in retail.”

Online demand of immi’s products hasn’t slowed down either, which is partly why Lee and Chanthasiriphan are eager to begin the next phase of their business.

Immi co-founders Kevin Lee and Kevin Chanthasiriphan Image Credits: Immi

Today, immi still has its three initial plant-based flavors of Spicy “Beef,” Tom Yum “Shrimp” and Black Garlic “Chicken.” However, a new round of $10 million in Series A funding puts the company on a path of unveiling nine additional flavors, rounding out its executive team and expanding its reach into nationwide retailers.

Touch Capital led the recently closed round and was joined by a bevy of celebrity investors, including Naomi Osaka, Usher, Apolo Ohno, David Grutman, Kygo’s Palm Tree Crew and Gryffin. Immi has now raised about $15 million in total funding, with Lee disclosing the valuation increased “by a good amount” over the seed round.

Other investors participating in the Series A include Siddhi Capital, Gold House Ventures, Anti VC, Harizury, Lab Capital Advisors, CAA’s Co-Head of Basketball, Lynja, Lauren Kleinman (Dreamday, The Quality Edit), Theresa Kang (Blue Marble Pictures), and the CEOs or co-founders of Fly By Jing, Bokksu, Boba Guys, LMNT, OWYN, Hero Cosmetics, Supply, Rumble Boxing, Worlds, Venice Music, Adgile Media Group and Hyphen Capital.

Immi grew over six times year over year in revenue and sold out seven times since 2021, and in 2022, the company launched in retailers, including Whole Foods, Wegmans and The Fresh Market. Additional locations are on tap to open this year, the founders said.

In 2021, the company had a private tasting community of about 4,000 people and that number has grown to 6,000. In addition to taste, the community gives the founders direct feedback on which retailers they would like to see immi launch in next. Lee said this was valuable information that often helps the company better market itself to retailers by being able to prove the size of a future customer base.

Following that rapid growth, the company began to get some inbound investor attention, from both existing and new investors, in the third quarter of 2022, Lee said.

“We wanted to raise this $10 million because there was just so much opportunity on the horizon with building out our team, improving the product and then launching in more retail, especially after seeing some of the early Whole Foods data,” Lee added. “We had excellent velocity right out the gate because of our direct-to-consumer audience, and the demand in retail of people coming across our bright yellow packaging.”

As mentioned, some of the new capital will be invested in product development research. Though Chanthasiriphan didn’t give a hint on what any of the nine new flavors would be — immi specializes in less commonly available flavors — he did say that it will be a combination of permanent, limited-time and co-branded partnership flavors with influencers, celebrities and movie studios.

On top of that are another 12 flavors that the company is just now “batting around” in efforts to see which ones immi should prioritize. It is also exploring other products outside of ramen.

“There are a lot of unique partnership opportunities to launch those,” Chanthasiriphan said in an interview. “We also have noodle improvements coming down the pipeline related to texture, cook times for the noodles and formats, like cups.”

Naomi Osaka, Usher, Apolo Ohno back Immi’s next phase of instant ramen domination by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/03/02/naomi-osaka-usher-immi-instant-ramen-food/

Behavioral marketing platform Wunderkind nabs $76M

Wunderkind, a platform that enables brands to target web visitors through emails, texts and other digital advertising formats, today announced that it raised $76 million in a Series C round led by Neuberger Berman, the financial services company.

Wunderkind’s newly appointed CEO, Bill Ingram, says that the tranche — which brings Wunderkind’s total raised to over $150 million — will be put toward investing in product development, hiring and ongoing market expansion.

“We see this as a real opportunity to expand our products outside of acquisition and conversion, and continue to increase the revenue growth of our customers while continuing to grow Wunderkind,” Ingram told TechCrunch in an email interview. “To do this, we’re investing heavily in AI and machine learning.”

Founded in 2010, Wunderkind aims to scale brands’ abilities to foster customer relationships through digital channels. How? By analyzing smartphone and desktop web visitors’ real-time and historical behaviors to match value to intent, Ingram says.

Wunderkind claims it can determine who visitors are based on the web page that referred them and the content that they’re interacting with. For example, the platform can figure out who’s most likely to purchase a paid subscription and sign up for a newsletter — or so Ingram claims.

The company also offers tools to launch “triggered” ad campaigns and create audience segments for those campaigns. It predictively models, seeking to take the guesswork out of determining the highest-intent audiences or any at-risk cohorts.

“We help drive better outcomes using a company’s existing technology investments and expertise,” Ingram said. “The technical decision maker is worried about not having their own customer relationship and data, not reaching their customers where they are, and being able to execute on smart digital marketing initiatives that their consumers expect. We help across all those fronts by providing access to data, user profiles and one-to-one marketing strategies that manufacture outcomes and truly deliver performance.”

From a user perspective, Wunderkind’s product sounds a bit…creepy, frankly. Indeed, the case against behavioral marketing is stacking up. But for many companies, the results are well worth the potential controversy. According to a survey by the Network Advertising Initiative conducted with a dozen different ad networks, targeted advertisements based on user behavior converted 6.8% compared with non-targeted ads at 2.8%.

Wunderkind’s found success without a doubt, boasting a customer base of more than 1,000 brands and publishers in the luxury, direct-to-consumer and tech spaces — including Rag & Bone, HelloFresh, Uniqlo, Sonos and See’s Candy. (In 2020, Wunderkind — then known as BounceX — reported $100 million in annual recurring revenue.) Last year, Wunderkind’s revenue grew 35% year over year, Ingram says, and the company’s poised to grow the top line again this year.

“We see the headwinds here as a combination of larger market economic trends, changes that rightfully align with consumer privacy and audience shifts in behavior. We’re also aware of the challenges in scaling first-party data assets and leveraging them in a meaningful way,” Ingram said. “But, look, Wunderkind is well-positioned here to help our clients and the industry as a whole. We’re sitting on over ten years of meaningful consumer data and insights that we collected voluntarily.”

That being said, 700-employee Wunderkind — no doubt with an eye toward a more regulated, privacy-conscious ad future — plans to expand and launch a one-to-one messaging offering for ads to enable “cookieless” retargeting. Also in the works is an improved “discovery” feature for e-commerce businesses that’ll serve product recommendations based on customer behaviors and interests.

“We firmly believe we can help our clients increase their customers’ lifetime value and ultimately grow better as a business with Wunderkind,” Ingram said.

Behavioral marketing platform Wunderkind nabs $76M by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2023/03/02/behavioral-marketing-platform-wunderkind-nabs-76m/

Figure emerges from stealth with the first images of its humanoid robot

For now, the system is focused on a wide range of manual labor tasks. It’s effectively the sorts of things you think of when you think about industrial robotics: warehouse/fulfillment/logistics, manufacturing and retail are all near the top. “General purpose” is the goal — but again, there are reasons robots have traditionally been built for single, repeatable tasks. It’s unclear whether the company plans to take a hardware as platform approach that’s driven products like Spot.

“Our vision is to build horizontal hardware that can scale to many applications,” Adcock adds. “We believe humanoids will revolutionize a variety of industries, from corporate labor roles, to assisting individuals in the home, to caring for the elderly, to building new worlds on other planets. However, our first-step applications will be in industries such as manufacturing, shipping and logistics, warehousing and retail, where labor shortages are the most severe. We believe it’s important to optimize our business model to get to revenue as quickly as possible.”

While he declined to comment on the progress of Tesla’s systems, it’s clear that emerging players will help demonstrate both the potential and difficulty of the form factor.

Humanoid robots are one of those ideas that never truly goes out of style — it does, however, tend to ebb and flow across the decades. Whatever you happen to think about the project or the company that built it, Tesla’s Optimus prototype has revived the conversation around the form factor and efficacy and viability of general-purpose robots. Boston Dynamics founder Marc Raibert told me in an interview this week, “I thought that they’d gotten a lot more done than I expected, and they still have a long way to go.”

It’s also reopened the debate. When I spoke to Playground Global partner Peter Barrett last week, he was quick to point out that our bodies aren’t exactly the hallmark of efficiency or product design, even if they made us sufficiently capable of outsmarting or out-running a wooly mammoth back in the day. The flip side of that conversation certainly makes sense however: We built our environment with us in mind, so it follows that we’d make robots in our image to perform our jobs.

Figure, which comes out of stealth this week, is very much in the second camp. Back in September, we broke the news of the startup’s existence. Founded by Archer co-founder Brett Adcock (who has also funded the company to the tune of $100 million), the startup is spending lot of time and money to build a general-purpose bipedal humanoid robot. It’s not an easy dream in any respect, of course. That no one has yet managed to crack the code certainly isn’t for lack of trying.

Among the things the new company brings to the table is a 40-person staff with excellent pedigrees.

“The team is ex-Boston Dynamics, Tesla, Apple SPG, IHMC, Cruise [and Alphabet X]. Collectively we align on building a better future for humanity through the intersection of AI and robotics,” Adcock tells TechCrunch. “We’ve been fortunate to hire the best in the world at specific skill sets in AI, Controls, Electrical, Integration, Software and Mechanical Systems. The team believes we’re at a point where we can commercialize robots that have primarily been R&D over the last two decades. This is something a lot of our team has dreamt about doing for a long time.”

The robot’s alpha build, which the company completed in December, is currently being tested in its Sunnyvale offices. The images of the Figure 01 offered by the company appear to be renders similar in nature to what Tesla released alongside its robot’s announcement.

Adcock explains, “We believe this to be at the forefront of any electromechanical humanoid in history. We are now working on our second-generation humanoid robot which will be feature-complete for commercial operations. In the near term, we believe it’s important to validate our humanoid in commercial operations as the critical milestone for the Figure team.”

Image Credits: Figure

For now, the system is focused on a wide range of manual labor tasks. It’s effectively the sorts of things you think of when you think about industrial robotics: warehouse/fulfillment/logistics, manufacturing and retail are all near the top. “General purpose” is the goal — but again, there are reasons robots have traditionally been built for single, repeatable tasks. It’s unclear whether the company plans to take a hardware as platform approach that’s driven products like Spot.

“Our vision is to build horizontal hardware that can scale to many applications,” Adcock adds. “We believe humanoids will revolutionize a variety of industries, from corporate labor roles, to assisting individuals in the home, to caring for the elderly, to building new worlds on other planets. However, our first-step applications will be in industries such as manufacturing, shipping and logistics, warehousing and retail, where labor shortages are the most severe. We believe it’s important to optimize our business model to get to revenue as quickly as possible.”

While he declined to comment on the progress of Tesla’s systems, it’s clear that emerging players will help demonstrate both the potential and difficulty of the form factor.

Figure emerges from stealth with the first images of its humanoid robot by Brian Heater originally published on TechCrunch

HR Signal helps companies figure out who is most likely to quit and why

High employee turnover is often a hint that a company’s human resources strategy isn’t working, but it’s also difficult for managers to identify who is thinking of leaving. HR Signal wants to make retention easier by using algorithms to predict which employees are most likely to seek another job. The worker analysis startup, which has benchmarked 50,000 job positions, announced today it has raised $1.6 million in pre-seed funding from Gammite Ventures and Aaron Grossman.

One of HR Signal’s algorithms, called the Employee Retention Engine, crunches billions of data points from public sources, market data and peer career path data, including a million anonymized resumes. The startup uses very little internal data from its clients in order to preserve employee privacy and make onboarding new clients faster, the founders say.

Co-founder Sagy Cohen came up with the idea for HR Signal while working as a senior data scientist for a venture-backed computer vision startup. Data scientists and computer vision AI specialists are in short supply and Cohen was constantly approached by recruiters, even though he was happy at his job. This prompted him to build an algorithm to help recruiters contact only people who are at a point in their careers where they are likely to leave their current positions.

Cohen and co-founders Andrew Spott, Daniel Gilon and Aaron Goodman began working on the algorithm in early 2020. At first, their goal was to direct recruiters toward people who are under-promoted or under-recognized. Then at the end of the year they had an internal case study predicting an abnormally high number of people were ready to move on from their jobs, and realized there was going to be large “turnover event” because many people felt stagnated as the result of the pandemic.

After that, HR Signal’s team decided to focus on boosting employee retention instead of recruitment. “There’s this narrative that people are less loyal to their jobs and are constantly quitting, but when we analyze the data in a large enough data set, the trend really is potentially different,” said Spott. “Employers seek leadership positions externally and are not promoting enough from within.”

To help clients retain employees, HR Signal’s algorithms consolidate data from external and public data sources. In addition to the million anonymized resumes, other examples of data include earnings reports, mandatory filings and IRS reports. To get more information about different job positions, HR Signal uses salary information and market data, like how many job ads are in each region for each type of position, how long have they been posted, how long they took to fill and whether that number is growing or falling. All data is GDPR and CCPA compliant.

“If we’re looking the resume of a person and comparing them to their peers in that position, with the same tenure and salary grade, we can create, even anonymously, a profile of a person and look at their career path and next position or salary trends,” said Spott. This helps companies figure out who in their workforce is most likely to want another job or get poached by a competitor.

An example of the insights produced by HR Signals include internal mobility, or the percentage of people who change positions, usually through a promotion, in a workforce. “Internal mobility is the thing that really explains business continuity and preservation of talent and tacit knowledge,” said Spott.

He added that if there are 10 companies of a similar size in the same industry, “we could just look at internal mobility and know which one’s going to have a better culture and more likely to have a better financial performance.”

Many companies already have “stay interviews” with employees to discuss what they like and don’t like about their jobs. What HR Signal can do is make the process more efficient by providing a suggested workflow for an employee’s stay interview. For example, it can help employers create a path towards promotion, including what projects or outside credentials someone should complete before moving on to a higher position.

HR Signal’s founders say thats algorithms can be used to help diversity, equity and inclusion initiatives. “Our customer agreement is very specific that this information is to be used for good,” said Spott. “We do not want to use it to exercise biases or inequity. In fact, all our information or analysis of career paths, is entirely devoid of any sort of demographics. It’s not based on trend reports and historical analysis, not based on gender, not based on age.”

The startup’s clients include HR consulting firm ERC, which is used by 1,500 companies that want to improve their workplace culture and promote from within. So far, HR Signals has been in prolonged soft beta mode to refine its algorithm’s output and it has worked with employers ranging from 30 people up to 3,600. The founders say their ideal client has least 100 clients because that gives HR Signal more data to use.

“We are tasked with being in the middle of the employee-employer mix, but we are really trying to be beneficial for both sides,” said Cohen. “And we think that this is a great role to have because there’s a lot of tension, but also a lot of good things that can come out of the length of a relationship and retention.”

HR Signal helps companies figure out who is most likely to quit and why by Catherine Shu originally published on TechCrunch