Category: TECHNOLOGY

Meta Fined $276 Million in Europe for Data-Scraping Leak

The fine issued by Ireland’s Data Protection Commission, Meta’s main privacy regulator in the European Union, is the latest sign of how authorities in the region are becoming more aggressive in applying the bloc’s privacy law to big technology companies.

BlockFi files for Chapter 11 bankruptcy

This past year has been hectic for the crypto lending platform BlockFi and today is no different as the company shared an announcement that it filed for voluntary Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of New Jersey.

On November 10 the crypto platform shared in a tweet that it paused activity, including withdraws, and stated on Monday that “activity continues to be paused at this time.”

The bankruptcy was commenced to “stabilize its business and provide the company with the opportunity to consummate a comprehensive restructuring transaction” for all its clients and other stakeholders.

BlockFi says it has $256.9 million in cash, which will be used to provide “sufficient liquidity to support certain operations during the restructuring process.”

The company said it will focus on recovering all obligations owed to BlockFi and counterparties like FTX.

In July, FTX signed a deal with the option to buy BlockFi for up to $240 million, the CEO of BlockFi Zac Prince tweeted. Since then, things have tumbled as FTX collapsed and also filed for Chapter 11 bankruptcy, weeks before BlockFi. With that said, “the company expects that recoveries from FTX will be delayed.”

The company stated that it has a consolidated amount of over 100,000 creditors across a massive range of $1 billion to $10 billion in liabilities and assets, according to a court filing.

This news follows a number of crypto-focused companies, like Voyager and Celsius, which are also currently going through bankruptcy proceedings.

Earlier this year, the U.S. Securities and Exchange Commission (SEC) charged BlockFi for failing to register its retail crypto lending product and violating the registration provisions of the Investment Company Act of 1940, according to a press release in February. To settle the charges, BlockFi agreed to pay a $50 million penalty to the SEC and an additional $50 million in fines to 32 U.S. states to settle similar charges.

BlockFi files for Chapter 11 bankruptcy by Jacquelyn Melinek originally published on TechCrunch

https://techcrunch.com/2022/11/28/blockfi-files-for-chapter-11-bankruptcy/

Cameroonian crypto and savings platform Ejara raises $8M, led by Anthemis and Dragonfly

Ejara, a Cameroonian fintech offering an investment app that allows users to buy crypto and save through decentralized wallets, has raised $8 million in Series A investment.

London-based venture capital firm Anthemis co-led the growth round alongside crypto-focused fund Dragonfly Capital. Anthemis is a follow-on investor in Ejara, having also led the fintech’s $2 million seed round announced last October.

Participating VC firms in this new financing include other follow-on investors Mercy Corps Ventures, Coinshares Ventures and Lateral Capital–and new investors such as Circle Ventures, Moonstake, Emurgo, Hashkey Group and BPI France. Jason Yanowitz, co-founder of Blockwoks is one of the angels in the round.

Ejara wants to “democratize access to investment and savings products across the region, using blockchain technology.” While its recently launched savings product where it tokenizes government bonds is one of the ways it uses blockchain, so is its crypto product which was pivotal to the two-year-old startup raising $10 million in less than 18 months.

By providing users in Francophone Africa with an option to buy, sell, exchange and store their crypto investments, CEO Nelly Chatue-Diop and her co-founder Baptiste Andrieux saw an opportunity to increase crypto activity in the region. However, unlike most crypto platforms in Africa that provide custodial wallets to users, Ejara offered customers the option of non-custodial wallets so they could own and store their keys. That decision paid off, especially during this period when the collapse of FTX and other crypto organizations continue to underscore the need for customers to prioritize privacy and ownership when dealing with crypto and tokenized assets.

“When everyone was taking the other route and building centralized exchanges, we always thought that, if you want to own crypto, you need to own your keys. And that’s pretty much what’s saved us in turbulent times,” Chatue-Diop said to TechCrunch over a call.

Ejara’s crypto product has caught on fast with users in a region where access to financial products is limited to the most informed and wealthy. In addition to connecting their mobile money accounts and accessing crypto, users could also make cross-border transactions via stablecoins. As a result, users on the platform have grown in multiples over the last 14 months. Last October, it had 8,000 users from Cameroon, its first market and others including Ivory Coast, Burkina Faso, Mali, Guinea, and Senegal. Now, it counts over 70,000 users across nine Francophone African countries.

Chatue-Diop – who noted that Ejara has seen revenue growth 10x and achieved a 15% month-on-month transaction volume growth since last October despite crypto’s meltdown – expects users on the platform to reach 100,000 by the end of the year. Its savings product, which Ejara described, in a statement, as the first of its kind in the crypto world, was launched to get it there. “In an ecosystem where many people around the world are trying to find use cases for blockchain technology, Ejara has demonstrated that startups in emerging markets are likely to pioneer many such innovations in web3,” the company added.

With this product, the Cameroonian fintech asserts that users do not need to set up a bank account to access savings products but can instead start that journey with Ejara by downloading its app and depositing a minimum of 1,000 CFA franc (~$1.5). Users can earn up to 10% interest on their two-year deposits on the platform, said Chatue-Diop, while adding that Ejara is going up against traditional financial institutions with this product.

“The competition for treasury bonds is with the traditional asset managers and banks. And given the way they are structured, they mainly target high-net-worth individuals and institutions like other banks or insurance companies,” she commented. “Nobody is targeting the woman selling the markets or the man driving a motorbike for a living. And because we structure the product the way we do, we have many people come to our platform because they can save up to 1000 CFA franc daily.”

Both lead investors in this round recognize Ejara’s ambition to be a financial super app of some sort for users in French-speaking Africa and even those in the diaspora who send and invest money back home. Mia Deng, a partner at Dragonfly said Ejara is well-positioned to imitate the growth of China’s Alipay and WeChat Pay, two prominent web2 super apps based, in the early 2010s and help the Francophone region achieve a web3 financial leap in the coming years.

“Conscious of the challenges across the zone, Ejara does not intend to limit itself to being a crypto app, but rather to become a one-stop-shop for products tailored to the needs of Africans: a shop where a suite of financial products will be accessible at their fingertips, without the need for any crypto knowledge,” stated Ruth Foxe Blader, partner at Anthemis, on Ejara’s potential.

Ejara’s journey to a million users is somewhat dependent on how fast its target audience catches on to the nuances associated with crypto, savings and investments. It’s one reason why the fintech is championing a couple of non-profit initiatives to teach the public, particularly women, girls and orphans about crypto, savings, investments (it is yet to launch its fractional investing product) and financial education while prepping the market for its growth.

“The initiative we launched for women and orphans and girls is to improve their financial literacy and computer skills. When I think about Ejara, I think about an ecosystem and as a leveler to bring the community together, whether they are in Africa or the diaspora, whether they belong to the elites, or they are in the poorer layers of the community,” said the chief executive who also mentioned that Ejara recently obtained a license to extend its offerings to the French-speaking diaspora in Europe.

Last week, Djamo, an Ivorian fintech announced what seems to be the largest equity round in the country. At $10 million, Ejara is one of Cameroon’s most-funded companies (if not the most funded). That’s two similar events across different Francophone markets in quick succession. Though it’s too early to say, it appears the market is rapidly embracing innovation, and its ecosystem — which for the most part, embodies a strict regulatory landscape — is becoming more attractive to foreign venture capital despite the current global downturn.

Cameroonian crypto and savings platform Ejara raises $8M, led by Anthemis and Dragonfly by Tage Kene-Okafor originally published on TechCrunch

Google, Microsoft-backed VerSe Innovation cuts 5% of workforce, reduces salaries

India’s VerSe Innovation — the $5 billion Indian startup behind news aggregator Dailyhunt, short-video platform Josh, and hyperlocal video app PublicVibe — has cut 150 employees, or 5% of its workforce of 3,000, TechCrunch has learned and confirmed.

The Bengaluru-based startup informed impacted employees on Friday and separately held a town hall meeting on Monday where it announced pay cuts to its remaining staff, people familiar with the matter told TechCrunch.

It’s a major turn for VerSe Innovation, which is backed by the likes of Google and Microsoft and raised more than $800 million in fresh funding as recently as April of this year. The change speaks to just how much the bottom has fallen out from under the advertising market, how that’s impacting high-profile consumer businesses reliant on it, and how that’s stretching to even some of the fastest-growing digital markets like India.

“Given the current economic climate, like other businesses, we’ve evaluated our strategic priorities. Considering the long-term viability of the business and our people, we have taken steps to implement our regular bi-annual performance management cycle and made performance and business considerations to streamline our costs and our teams,” said Umang Bedi, co-founder of VerSe Innovation, in a prepared statement responding to queries originally sent on Saturday.

He also confirmed that the startup implemented an 11% salary cut for all remaining employees with salaries above $12,200 (10 lakh Indian rupees) per annum.

“We remain extremely committed and bullish across our entire family of apps — Josh, Dailyhunt and PublicVibe — to drive profitable growth,” he said.

In April, VerSe Innovation raised $805 million at a nearly $5 billion valuation in a Series J round led by Canada Pension Plan Investment Board (CPP Investments). Ontario Teachers’ Pension Plan Board (Ontario Teachers’), Luxor Capital, Sumeru Ventures, Sofina Group and Baillie Gifford.

The startup at the time said that its Josh app — one of the local alternatives to TikTok, which India banned in mid-2020 — had climbed to over 150 million users, including 50 million creators. Similarly, Dailyhunt grew its creator ecosystem to over 100,000 content partners and crossed the mark of 350 million users, while PublicVibe expanded its user base to over 5 million monthly active users.

Nonetheless, that growth did not help VerSe Innovation offset its losses.

In its regulatory filings, which Entrackr reported, the startup noted that its losses in the financial year 2021-22 grew over 217% to $314 million (2,563 crores Indian rupees) from $99 million (808 crores Indian rupees) in the previous year. However, its operating revenue reportedly increased about 45% to $118 million (965 crores Indian rupees) from $82 million (666 crores Indian rupees).

VerSe Innovation has become the latest Indian startup to cut its workforce due to ongoing economic uncertainties. In the last couple of months, Byju’s, Unacademy and Chargebee, among others, have laid off hundreds of employees.

Google, Microsoft-backed VerSe Innovation cuts 5% of workforce, reduces salaries by Jagmeet Singh originally published on TechCrunch

https://techcrunch.com/2022/11/28/verse-innovation-layoff-salary-cut/

Cyber Insurers Turn Attention to Catastrophic Hacks

While cyber insurance has evolved significantly in recent years, insurers say they might still be unprepared for the fallout from a catastrophic cyberattack.

BlockFi Files for Bankruptcy as Latest Crypto Casualty

Cryptocurrency lender BlockFi filed for bankruptcy, making it the latest major digital assets company to fail since FTX, with which BlockFi is financially intertwined.

JPMorgan, Others in Talks to Reimburse Zelle Customers

U.S. banks including JPMorgan Chase and Wells Fargo are devising a plan to compensate victims of scams on the Zelle payment network.

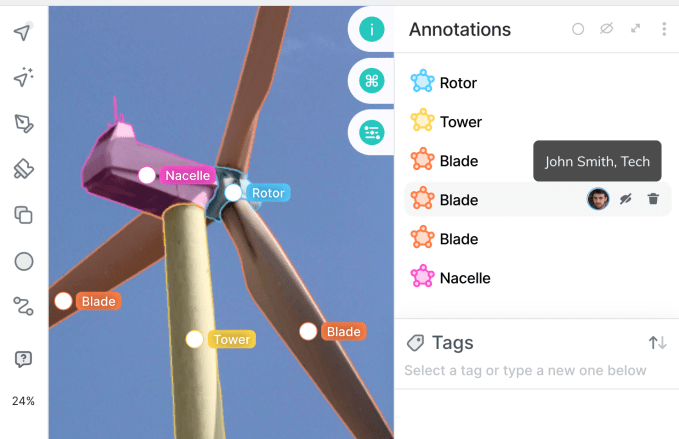

V7 snaps up $33M to automate training data for computer vision AI models

Artificial intelligence promises to help, and maybe even replace, humans to carry out everyday tasks and solve problems that humans have been unable to tackle, yet ironically, building that AI faces a major scaling problem. It’s only as good as the models and data used to train it, so there is a need for sourcing and ingesting ever-larger data troves. But annotating and manipulating that training data takes a lot of time and money, slowing down the work or overall effectiveness, and maybe both.

A startup called V7 Labs believes it’s had a breakthrough in how this is approached. It’s effectively built training models to automate the training of those models. Today it’s announcing $33 million in funding to fuel its growth after seeing a lot of demand for its services.

V7’s focus today is on computer vision and helping identify objects. It says it can learn what to do from just 100 human-annotated examples.

It currently has strong traction in the fields of medicine and science, where its platform is being used to help train AI models to speed up, for example, how cancers and other issues are identified on scans. V7 is also starting to see activity with tech and tech-savvy companies looking at how to apply its tech in a wide variety of other applications, including companies building engines to create images out of natural language commands and industrial applications. It’s not disclosing a full list of customers and those evaluating its tech but the list numbers over 300 clients and includes GE Healthcare, Paige AI, and Siemens, alongside other Fortune 500 companies and larger privately-held businesses.

Radical Ventures and Temasek are co-leading this round, with Air Street Capital, Amadeus Capital Partners, and Partech (three previous backers) also participating, along with a number of individuals prominent in the world of machine learning and AI. They include Francois Chollet (the creator of Keras, the open-source Python neural network library), Oriol Vinyals (a principal research scientist at DeepMind), Jose Valim (creator of the Elixir programming language), Ashish Vaswani (a co-founder of Adept AI who had previously been at Google Brain, where he invented Transformers) and unnamed others from OpenAI, Twitter, and Amazon.

CEO Alberto Rizzoli said in an interview that this is the largest Series A funding round in this category to date, and it will be used both to hire more engineers as well as to build out its business operations to take on a new wave of customer interest with an emphasis on the U.S. He declined to comment on valuation, but the startup has now raised around $36 million, and from what I understand the valuation is now around $200 million.

Rizzoli also declined to talk about revenue figures but said that ARR grew three-fold in 2022

There have been a number of other startups that have emerged to help improve the efficiency of training AI data and to address the wider area of AI modeling. SuperAnnotate, which has raised about $18 million per PitchBook, is one of V7’s closer competitors. (V7 even lays out how the two services compare.) Others include Scale AI, which initially focused on the automotive sector but has since branched into a number of other areas and is now valued at around $7 billion; Labelbox, which works with companies like Google and others on AI labelling; and Hive, which is now valued at around $2 billion.

V7 — named in reference to AI being the “seventh” area for processing images after the six areas in the human brain that form its visual cortex (V1 through V6) — and the others are banking on the fact that the training model is inefficient and can be improved.

V7’s specific USP is automation. It estimates that around 80% of an engineering team’s time is spent on managing that training data: labelling, identifying when something is incorrectly labelled, rethinking categorizations and so on, and so it has built a model to automate that process.

It calls the process it’s come up with “programmatic labelling”: using general-purpose AI and its own algorithms to segment and label images, Rizzoli (who co-founded the company with its CTO Simon Edwardsson) says that it takes just 100 “human-guided” examples for its automated labelling to kick into action.

Investors are betting that shortening the time between AI models being devised and applied will drive more business for the company. “Computer vision is being deployed at scale across industries, delivering innovation and breakthroughs, and a fast growing $50 billion market. Our thesis for V7 is that the breadth of applications, and the speed at which new products are expected to be launched in the market, call for a centralised platform that connects AI models, code, and humans in a looped ecosystem,” said Pierre Socha, a partner at Amadeus Capital Partners, in a statement.

V7 describes the process as “autopilot” but co-pilot might be more accurate: the idea is that anything flagged as unclear is routed back to humans to evaluate and review. It doesn’t so much replace those humans as makes it easier for them to get through workloads more efficiently. (It can also work better than the humans at times, so the two used in tandem could be helpful to double check each other’s work.) Below is an example of how the image training is working on a scan to detect pneumonia.

Image Credits: v7 labs

Considering the many areas where AI is being applied to improve how images are processed and used, Rizzoli said the decision to double down on the field of medicine initially was partly to keep the startup’s feet on the ground, and to focus on a market that might not have never built this kind of technology in-house, but would definitely want to use it.

“We decided to focus on verticals that are already commercializing AI-based applications, or where a lot of work on visual processing is being done, but by humans,” he said. “We didn’t want to be tied to moonshots or projects that are being run out of big R&D budgets because that means someone is looking to fully solve the problem themselves, and they are doing something more specialized, and they may want to have their own technology, not that of a third party like us.”

And in addition to companies’ search for “their own secret sauce”, sometimes projects might never see the light of day outside of the lab, Rizzoli added. “We are instead working for actual applications,” he said.

Image Credits: V7 Labs (opens in a new window)

In another regard, the startup represents a shift we’re seeing in how information is being sourced and adopted among enterprises. Investors think that the framework that V7 is building might potentially change how data is ingested by those enterprises in the future.

“V7 is well-positioned to become the industry-standard for managing data in modern AI workflows,” said Parasvil Patel, a partner with Radical Ventures, in a statement. Patel is joining V7’s board with this round.

“The number of problems that are now solvable with AI is vast and growing quickly. As businesses of all sizes race to capture these opportunities, they need best-in-class data and model infrastructure to deliver outstanding products that continuously improve and adapt to real-world needs,” added Nathan Benaich of Air Street Capital, in a statement. “This is where V7’s AI Data Engine shines. No matter the sector or application, customers rely on V7 to ship robust AI-first products faster than ever before. V7 packages the industry’s rapidly evolving best practices into multiplayer workflows from data to model to product”.

V7 snaps up $33M to automate training data for computer vision AI models by Ingrid Lunden originally published on TechCrunch

https://techcrunch.com/2022/11/28/v7-labs-computer-vision-ai/

Bahamian Attorney General Defends Handling of FTX Collapse

Island nation’s leaders are under pressure after encouraging cryptocurrency companies to do business there in recent years.

3 mistakes to avoid as an emerging manager

Contributor

By all accounts, I was a successful emerging manager. I raised $65 million with fewer than 25 LPs, including an institutional fund of funds and a sovereign wealth fund. I was not a spin-out manager from a name brand fund. Hell, I didn’t even have a VC or tech background.

Still, I spent a good chunk of my fundraising period wrestling an unrelenting sense of self-criticism I couldn’t ignore. Fortunately, listening to that critical inner voice instead of ignoring it led to my success.

While there’s no one right way to go about fundraising, there are a few wrong ways — and failure is a wonderful teacher. Here’s how I learned from my failures in order to succeed as an emerging manager:

LPs don’t care about the same things you do

As a systematic fund that spent thousands of hours unearthing unique insights through deep research, I assumed that my LPs would care to know exactly what that research process looked like, what insights were uncovered and how they applied to our investments.

Instead of holding a rolling close, let the momentum build up and use that to create FOMO to force a formal closing.

To my surprise, they really didn’t care about any of that. At least not to the extent I thought they would.

By over-explaining how I was going to make them money, I committed the same mistake I’ve seen many technical founders make: talking incessantly about perceived superiority without gauging my listener’s actual interest in the topic.

3 mistakes to avoid as an emerging manager by Ram Iyer originally published on TechCrunch

https://techcrunch.com/2022/11/28/3-mistakes-to-avoid-as-an-emerging-manager/