Category: TECHNOLOGY

BlockFi Files for Bankruptcy as Latest Crypto Casualty

Cryptocurrency lender BlockFi filed for bankruptcy, making it the latest major digital assets company to fail since FTX, with which BlockFi is financially intertwined.

JPMorgan, Others in Talks to Reimburse Zelle Customers

U.S. banks including JPMorgan Chase and Wells Fargo are devising a plan to compensate victims of scams on the Zelle payment network.

V7 snaps up $33M to automate training data for computer vision AI models

Artificial intelligence promises to help, and maybe even replace, humans to carry out everyday tasks and solve problems that humans have been unable to tackle, yet ironically, building that AI faces a major scaling problem. It’s only as good as the models and data used to train it, so there is a need for sourcing and ingesting ever-larger data troves. But annotating and manipulating that training data takes a lot of time and money, slowing down the work or overall effectiveness, and maybe both.

A startup called V7 Labs believes it’s had a breakthrough in how this is approached. It’s effectively built training models to automate the training of those models. Today it’s announcing $33 million in funding to fuel its growth after seeing a lot of demand for its services.

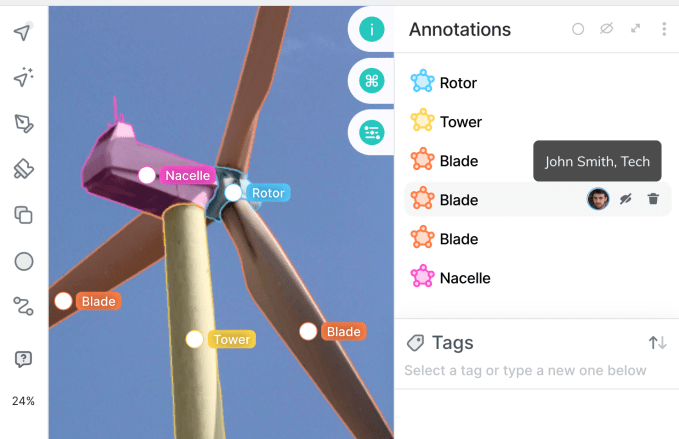

V7’s focus today is on computer vision and helping identify objects. It says it can learn what to do from just 100 human-annotated examples.

It currently has strong traction in the fields of medicine and science, where its platform is being used to help train AI models to speed up, for example, how cancers and other issues are identified on scans. V7 is also starting to see activity with tech and tech-savvy companies looking at how to apply its tech in a wide variety of other applications, including companies building engines to create images out of natural language commands and industrial applications. It’s not disclosing a full list of customers and those evaluating its tech but the list numbers over 300 clients and includes GE Healthcare, Paige AI, and Siemens, alongside other Fortune 500 companies and larger privately-held businesses.

Radical Ventures and Temasek are co-leading this round, with Air Street Capital, Amadeus Capital Partners, and Partech (three previous backers) also participating, along with a number of individuals prominent in the world of machine learning and AI. They include Francois Chollet (the creator of Keras, the open-source Python neural network library), Oriol Vinyals (a principal research scientist at DeepMind), Jose Valim (creator of the Elixir programming language), Ashish Vaswani (a co-founder of Adept AI who had previously been at Google Brain, where he invented Transformers) and unnamed others from OpenAI, Twitter, and Amazon.

CEO Alberto Rizzoli said in an interview that this is the largest Series A funding round in this category to date, and it will be used both to hire more engineers as well as to build out its business operations to take on a new wave of customer interest with an emphasis on the U.S. He declined to comment on valuation, but the startup has now raised around $36 million, and from what I understand the valuation is now around $200 million.

Rizzoli also declined to talk about revenue figures but said that ARR grew three-fold in 2022

There have been a number of other startups that have emerged to help improve the efficiency of training AI data and to address the wider area of AI modeling. SuperAnnotate, which has raised about $18 million per PitchBook, is one of V7’s closer competitors. (V7 even lays out how the two services compare.) Others include Scale AI, which initially focused on the automotive sector but has since branched into a number of other areas and is now valued at around $7 billion; Labelbox, which works with companies like Google and others on AI labelling; and Hive, which is now valued at around $2 billion.

V7 — named in reference to AI being the “seventh” area for processing images after the six areas in the human brain that form its visual cortex (V1 through V6) — and the others are banking on the fact that the training model is inefficient and can be improved.

V7’s specific USP is automation. It estimates that around 80% of an engineering team’s time is spent on managing that training data: labelling, identifying when something is incorrectly labelled, rethinking categorizations and so on, and so it has built a model to automate that process.

It calls the process it’s come up with “programmatic labelling”: using general-purpose AI and its own algorithms to segment and label images, Rizzoli (who co-founded the company with its CTO Simon Edwardsson) says that it takes just 100 “human-guided” examples for its automated labelling to kick into action.

Investors are betting that shortening the time between AI models being devised and applied will drive more business for the company. “Computer vision is being deployed at scale across industries, delivering innovation and breakthroughs, and a fast growing $50 billion market. Our thesis for V7 is that the breadth of applications, and the speed at which new products are expected to be launched in the market, call for a centralised platform that connects AI models, code, and humans in a looped ecosystem,” said Pierre Socha, a partner at Amadeus Capital Partners, in a statement.

V7 describes the process as “autopilot” but co-pilot might be more accurate: the idea is that anything flagged as unclear is routed back to humans to evaluate and review. It doesn’t so much replace those humans as makes it easier for them to get through workloads more efficiently. (It can also work better than the humans at times, so the two used in tandem could be helpful to double check each other’s work.) Below is an example of how the image training is working on a scan to detect pneumonia.

Image Credits: v7 labs

Considering the many areas where AI is being applied to improve how images are processed and used, Rizzoli said the decision to double down on the field of medicine initially was partly to keep the startup’s feet on the ground, and to focus on a market that might not have never built this kind of technology in-house, but would definitely want to use it.

“We decided to focus on verticals that are already commercializing AI-based applications, or where a lot of work on visual processing is being done, but by humans,” he said. “We didn’t want to be tied to moonshots or projects that are being run out of big R&D budgets because that means someone is looking to fully solve the problem themselves, and they are doing something more specialized, and they may want to have their own technology, not that of a third party like us.”

And in addition to companies’ search for “their own secret sauce”, sometimes projects might never see the light of day outside of the lab, Rizzoli added. “We are instead working for actual applications,” he said.

Image Credits: V7 Labs (opens in a new window)

In another regard, the startup represents a shift we’re seeing in how information is being sourced and adopted among enterprises. Investors think that the framework that V7 is building might potentially change how data is ingested by those enterprises in the future.

“V7 is well-positioned to become the industry-standard for managing data in modern AI workflows,” said Parasvil Patel, a partner with Radical Ventures, in a statement. Patel is joining V7’s board with this round.

“The number of problems that are now solvable with AI is vast and growing quickly. As businesses of all sizes race to capture these opportunities, they need best-in-class data and model infrastructure to deliver outstanding products that continuously improve and adapt to real-world needs,” added Nathan Benaich of Air Street Capital, in a statement. “This is where V7’s AI Data Engine shines. No matter the sector or application, customers rely on V7 to ship robust AI-first products faster than ever before. V7 packages the industry’s rapidly evolving best practices into multiplayer workflows from data to model to product”.

V7 snaps up $33M to automate training data for computer vision AI models by Ingrid Lunden originally published on TechCrunch

https://techcrunch.com/2022/11/28/v7-labs-computer-vision-ai/

Bahamian Attorney General Defends Handling of FTX Collapse

Island nation’s leaders are under pressure after encouraging cryptocurrency companies to do business there in recent years.

3 mistakes to avoid as an emerging manager

Contributor

By all accounts, I was a successful emerging manager. I raised $65 million with fewer than 25 LPs, including an institutional fund of funds and a sovereign wealth fund. I was not a spin-out manager from a name brand fund. Hell, I didn’t even have a VC or tech background.

Still, I spent a good chunk of my fundraising period wrestling an unrelenting sense of self-criticism I couldn’t ignore. Fortunately, listening to that critical inner voice instead of ignoring it led to my success.

While there’s no one right way to go about fundraising, there are a few wrong ways — and failure is a wonderful teacher. Here’s how I learned from my failures in order to succeed as an emerging manager:

LPs don’t care about the same things you do

As a systematic fund that spent thousands of hours unearthing unique insights through deep research, I assumed that my LPs would care to know exactly what that research process looked like, what insights were uncovered and how they applied to our investments.

Instead of holding a rolling close, let the momentum build up and use that to create FOMO to force a formal closing.

To my surprise, they really didn’t care about any of that. At least not to the extent I thought they would.

By over-explaining how I was going to make them money, I committed the same mistake I’ve seen many technical founders make: talking incessantly about perceived superiority without gauging my listener’s actual interest in the topic.

3 mistakes to avoid as an emerging manager by Ram Iyer originally published on TechCrunch

https://techcrunch.com/2022/11/28/3-mistakes-to-avoid-as-an-emerging-manager/

Yahoo gets 25% stake in Taboola as part of long-term advertising deal

Yahoo is taking a nearly 25% stake in advertising network Taboola. In exchange for this move, Taboola is becoming Yahoo’s native advertising partner through a 30-year commercial agreement.

If you’re not familiar with Taboola, you may have seen its content recommendation widgets on popular news websites, such as USA Today, Insider and The Weather Channel. They mostly feature sponsored links that lead to third-party websites. Those links appear in recommendation widgets at the end of news articles or in the middle of a content newsfeed.

Yahoo is a name that you may already know quite well. It is now a private company owned by investment firm Apollo Global Management. It owns many popular media properties, such as Yahoo Finance, Yahoo Sports, Yahoo News, AOL and Engadget. Yahoo’s homepage and Yahoo Mail are also important products for the company as they attract large audiences. Yahoo is TechCrunch’s parent company as well.

This isn’t the first time Taboola is signing a strategic partnership that covers some of these properties. In 2015, Verizon acquired AOL. The next year, Taboola and AOL signed a strategic partnership that led to integrations of Taboola’s ads on AOL properties. Shortly after, Verizon also acquired Yahoo and merged AOL with Yahoo.

And now, the second incarnation of Yahoo, which includes AOL’s activities and operates separately from Verizon, is doubling down on digital advertising. With this new deal, Taboola becomes the exclusive partner for native advertising across all of Yahoo’s digital properties.

It means that you’ll soon scroll through news articles on Yahoo Finance and see an item that looks just like a normal article. But it will be a Taboola-powered advertising unit instead. Or at least, that’s the idea. Advertisers will be able to buy Taboola through the Yahoo DSP.

“Partnering with Taboola enables Yahoo to further enhance the contextual and native offerings within our unified advertising stack. The partnership also allows Yahoo and Taboola to continue to differentiate in market, improving user, advertiser and publisher experiences across properties, while benefiting from the long-term tailwinds in digital native advertising,” Yahoo CEO Jim Lanzone said in a statement.

As Yahoo currently reaches nearly 900 million monthly active users, it represents a significant deal for Taboola. Right now, Taboola partners with 9,000 publishers and reaches 500 million users every day.

This deal isn’t just a way to display Taboola ads in front of more eyeballs. As technology companies and regulators are cracking down on privacy-invasive targeting methods, adtech companies like Taboola need to find new ways to target audiences in an effective way.

“Our collaboration with Yahoo will give advertisers access to what I believe is the most sophisticated contextual dataset online. Together, we’re going to build a ‘Contextual Powerhouse’, enabling advertisers to target relevant audiences without relying on third-party cookies and while maintaining complete user privacy,” Taboola founder and CEO Adam Singolda writes in a blog post.

Taboola went public last year by merging with a special purpose acquisition company, also known as a SPAC. Taboola shares (NASDAQ:TBLA) are currently up 70% in pre-market trading compared to yesterday’s closing price — but Taboola shares have been steadily going down over the past twelve months. Shares should open at around $3.14.

As part of the deal, Yahoo is becoming Taboola’s largest shareholder with a 24.99% stake in the advertising network company. Yahoo will also get a seat on Taboola’s board of directors. Both companies expect to generate $1 billion in annual revenue from this newly formed partnership if integrations go well.

Yahoo gets 25% stake in Taboola as part of long-term advertising deal by Romain Dillet originally published on TechCrunch

SWVL reduces its headcount by 50% six months after axing 400+ staff

Cairo-born and Dubai-based mass transit and shared mobility services provider SWVL has carried out its second round of layoffs affecting 50% of its remaining headcount, according to a statement shared by the company.

The news is coming six months after SWVL laid off 32% of its workforce in a “portfolio optimization program” effort geared towards achieving positive cash flow next year. Over 400 employees were affected at the time, leaving more than 900 behind at the mobility company, based on data from its LinkedIn profile. But with the second round of layoffs, the number of employees at SWVL would have reduced to a little over 450.

Reports about a second round of layoffs at SWVL had been circulating for over two weeks as axed employees took to LinkedIn to share that they were open to new job opportunities. Local media said the layoffs affected teams across multiple departments including tech and HR in Dubai and Pakistan. Another report has it that SWVL completely shuttered its Pakistan operations entirely two weeks ago

Although SWVL, in its statement, didn’t confirm these reports, it did not that it was evaluating a “potential sale, scale back or discontinuation of operations” of its smaller markets. It’s unclear what markets the Dubai-based mobility company is referring to but several sources have referred to Pakistan as one of its larger markets. As of June, SWVL, in its financial statement to investors, said it was present in 20 markets across 4 continents: the UAE, Egypt, Kenya, Germany, Spain, Italy, Switzerland, Turkey, Japan, Argentina, Saudi Arabia, Mexico, Jordan, Kuwait, Pakistan, Chile, France, the U.K., Portugal and Brazil.

SWVL went into some of these markets via acquisitions: Germany’s door2door, Turkey’s Voltlines, Mexico’s Urbvan, Spain’s Shotl and Argentina’s Viapool (its planned acquisition of U.K.-based Zeelo was called off in July). When SWVL conducted its first round of layoffs, it said that though the acquisitions contributed to its overall growth, it needed to make reductions on roles automated by investments in its engineering, product and support functions teams. However, the second round of layoffs reveals a different story: the current economic downturn has exposed that SWVL scaled too fast and didn’t have the necessary systems in place to make the acquisitions work.

SWVL’s sloppy operations – despite claiming that it turned EBITDA positive or break even in half of its markets as of August – are also evident in its stock market performance so far. In March, the mobility company went public via a SPAC merger with U.S. women-led blank check company Queen’s Gambit Growth Capital. It listed at $9.95 per share on Nasdaq and targeted a $1.5 billion valuation. Several months later, SWVL has seen its valuation tank to $53 million and its share price drop by over 90% to $0.40 (price before the market opening). As a result, SWVL received a letter from Nasdaq this month saying it was not in compliance with a listing rule (its shares traded below $1 for 30 consecutive business days) and it had until May 1, 2023 (180 days) to regain compliance and avoid delisting (get its shares above $1).

Cutting costs is one way SWVL believes will, in some way, affect its share price. The Dubai-based company stated it is taking these measures amid the continuing uncertainty in the global economic environment as the volatility in capital markets “potentially impact SWVL’s ability to generate sufficient cash from operating activities and external financings to fund working capital and service its commitments.” The company, in the statement, said it is also reducing operating expenses including discretionary spending such as marketing expenses and other third-party services. Going forward, SWVL’s broader optimization plan is to sharpen its focus on its largest markets which contribute the most to its revenues including Egypt and Mexico.

For the first half of the year, SWVL made $40.7 million in revenue, a 3.2x growth from H1 2021; however, its losses (including operating loss and recapitalization costs) during this same time amounted to over $161.6 million.

SWVL reduces its headcount by 50% six months after axing 400+ staff by Tage Kene-Okafor originally published on TechCrunch

https://techcrunch.com/2022/11/28/swvl-reduces-its-headcount-by-50-six-months-after-axing-400-staff/

BackingMinds raises new €50 million fund to fund normally overlooked entrepreneurs

Denmark-based venture fund BackingMinds, founded in 2016, likes to think it takes a different approach to venture in Europe. Its new €50 million fund will aim to take a road less travelled by most VCs, looking “for the blind spots” traditional venture capital can often miss because of typical VC herd behaviour (such as investing in white men in major capital cities).

Instead, the new fund will look for companies with high potential outside of Europe’s capital cities and entrepreneurs often overlooked by traditional investors.

The investment range of the fund will be €500,000 to €3,000,000 on initial investments, and across the whole of entire Europe, except the UK, due to it being outside the EU.

“Sweden is far ahead in terms of demographic and digital transformation and we can apply many insights when looking for overlooked opportunities in Denmark and the Nordics,” said Susanne Najafi, founder of BackingMinds, in a statement.

The fund’s geographical focus is northern Europe, and includes LPs from Spotify, King, Supercell, and the H&M family office, but so far no institutional investors.

Those LPs include Supercell’s chief executive Ilkka Paananen, the Persson family that owns retailer H&M, and co-founder of Spotify, Martin Lorentzon. Other investors in the new fund include the founders of private equity firms EQT and Nordic Capital, Thomas Hartwig, who is co-founder of King — the company behind Candy Crush Saga. Also the founders of software company Sinch Robert Gerstmann and Kristian Mannik, and the Olsson family behind the Stena group of companies, including the ferry operator.

After launching in 2016 with an undisclosed fund size, BackingMinds says it has since invested in 13 companies which are either led by women, immigrants, or lie outside the Stockholm region.

“It’s not about charity or diversity investing, it’s about driving societal change and even out injustices by making good returns. We go straight to the solution, challenging bias and put focus on blind spots by delivering returns in companies where traditional investors see nothing but risks,” added Sara Wimmercranz.

Najafi, was previously the founder of more than ten companies, several of which she exited, including Eleven, one of the largest beauty e-tailers in the Nordics. Wimmercranz previously co-founded the e-commerce company Footway, listed at First North Stockholm with a market cap of SEK 2 bn. They are joined by partners Sara Resvik and Niklas Thörnestad.

BackingMinds claims that evidence of these homogeneous networks and herd behaviour is showing up in the VC data which shows most Danish VCs only investing in Danish startups, not further afield, while immigrant founders are often ignored.

Investments to date:

● Brain Stimulation: Precision diagnostics and individualised digital rehabilitation.

● Cemvision: Re-inventing cement with a product that is economical, environmental friendly and technically superior.

● Combify: Construction tech specialised in digitalisation and visualisation of data related to construction projects.

● Lingio: Industry-validated language learning to improve operational efficiency in the labour market.

● Serviceform: Makes complex technologies simple and bring them all under one service – for all businesses.

● Skrym: A headless solution for optimising logistics with built-in emissions tracking.

BackingMinds raises new €50 million fund to fund normally overlooked entrepreneurs by Mike Butcher originally published on TechCrunch

Meta hit with ~$275M GDPR penalty for Facebook data-scraping breach

Facebook’s parent, Meta, has been hit with another hefty penalty for breaching European data protection law.

The €265 million (~$275M) fine was announced today by the Irish Data Protection Commission (DPC), the tech giant’s lead regulator for the European Union’s General Data Protection Regulation (GDPR).

The DPC confirmed that the decision, which was adopted on Friday, records findings of infringement of Articles 25(1) and 25(2) GDPR — which are focused on data protection by design and default.

The DPC said it is also imposing a range of corrective measures, writing: “The decision imposed a reprimand and an order requiring MPIL [Meta Platforms Ireland Limited] to bring its processing into compliance by taking a range of specified remedial actions within a particular timeframe.”

The penalty relates to an inquiry which was opened by the DPC on April 14, 2021, following media reports of more than 530M Facebook users’ personal data — including email addresses and mobile phone numbers — being exposed online.

At the time, Facebook tried to play down the breach — claiming the data that had been found floating around online was “old data” and that it had fixed the issue that led to the personal data being exposed.

The company followed that by saying it believed the data had been scraped from Facebook profiles by “malicious actors” using a contact importer feature it offered up to September 2019, before it tweaked it to prevent data abuse by blocking the ability to upload a large set of phone numbers to find ones that matched Facebook profiles.

The DPC confirmed its inquiry looked at a variety of contact search and importer tools the company offers on its platforms between the date the GDPR came into application and the date of changes to the contact importer tool Facebook made in fall 2019.

“The scope of the inquiry concerned an examination and assessment of Facebook Search, Facebook Messenger Contact Importer and Instagram Contact Importer tools in relation to processing carried out by Meta Platforms Ireland Limited (‘MPIL’) during the period between 25 May 2018 and September 2019,” the DPC wrote.

“The material issues in this inquiry concerned questions of compliance with the GDPR obligation for Data Protection by Design and Default,” it added, specifying that it had examined the implementation of “technical and organisational” measures relevant to Article 25 GDPR (which deals with data protection by design and default).

“There was a comprehensive inquiry process, including cooperation with all of the other data protection supervisory authorities within the EU. Those supervisory authorities agreed with the decision of the DPC,” the regulator also said — putting a spotlight on the lack of disagreement over this particular decision, which is often not the case with cross-border GDPR enforcements (while disputes between EU regulators can often substantially increase the time it takes to enforce the GDPR — hence this final decision has landed relatively quickly).

DPC deputy commissioner, Graham Doyle, told TechCrunch that the corrective measures it has applied to Meta as part of this decision are “an order pursuant to Article 58(2)(d) GDPR… to bring its processing into compliance with the GDPR in the manner specified in this Decision” — with the company getting a deadline of three months from the date of the final decision to comply with that.

“Specifically, to the extent that MPIL is engaged in ongoing processing of personal data which includes a default searchability setting of ‘Everyone’, this order requires… MPIL to implement appropriate technical and organisational measures regarding the Relevant Features in respect of any ongoing processing of personal data, for ensuring that, by default, only personal data which are necessary for each specific purpose of the processing are processed, and that by default personal data are not made accessible without the individual’s intervention to an indefinite number of natural persons,” he added, emphasizing: “This order is made to ensure compliance with Article 25(2) GDPR.”

“Relevant Features” in this context are Facebook Contact Importer; Messenger Contact Importer; Instagram Contact Importer; and Messenger Search; and its variant Messenger Contact Creator features.

Meta was contacted for a response. A spokesman did not confirm whether or not it will seek to appeal — but the tech giant said it is “reviewing” the decision “carefully”.

Here’s Meta’s statement:

“Protecting the privacy and security of people’s data is fundamental to how our business works. That’s why we have cooperated fully with the Irish Data Protection Commission on this important issue. We made changes to our systems during the time in question, including removing the ability to scrape our features in this way using phone numbers. Unauthorised data scraping is unacceptable and against our rules and we will continue working with our peers on this industry challenge. We are reviewing this decision carefully.”

The company added that it has put in place a range of measures to combat data scraping since this breach — including applying rate limits and deploying technical tools to combat suspicious automated activity, as well as providing users with controls to limit the public visibility of their information.

The GDPR penalty is not the first for Meta — and it may not be its last.

Just over a year ago, Meta-owned WhatsApp was fined €225M (~$267M) for transparency breaches. While, back in March, the company was also fined around $18.6M over a string of historical Facebook data breaches.

The DPC also has a number of ongoing enquiries into other aspects of Meta’s business — not least a major probe of the legal basis Meta claims to be able to process people’s data which dates back around 4.5 years.

Meta hit with ~$275M GDPR penalty for Facebook data-scraping breach by Natasha Lomas originally published on TechCrunch

Apple and Huish devise clever pricing model for divers with Oceanic+ app

The Oceanic+ app has a number of features available for free:

- Snorkeling

- Gauges

- Depth meter

- Max depth tracking

- Last dive time

- Maximum elapsed time

- Total activity time

- GPS location for an actiity

- Logbook

- Cumulative lifetime dive time

- Total number of dives

- Deepest dive

- Longest dive

- Dive ratings (you can rate your dive and specifics about the dive)

- Sharing activities to social networks

- Storing pictures

To get its advanced features, however, you have to pony up for a subscription. This is where things get clever. Renting a dive computer from a dive shop can cost anywhere from $5-$30 per day, and very few divers would choose to go without these days.

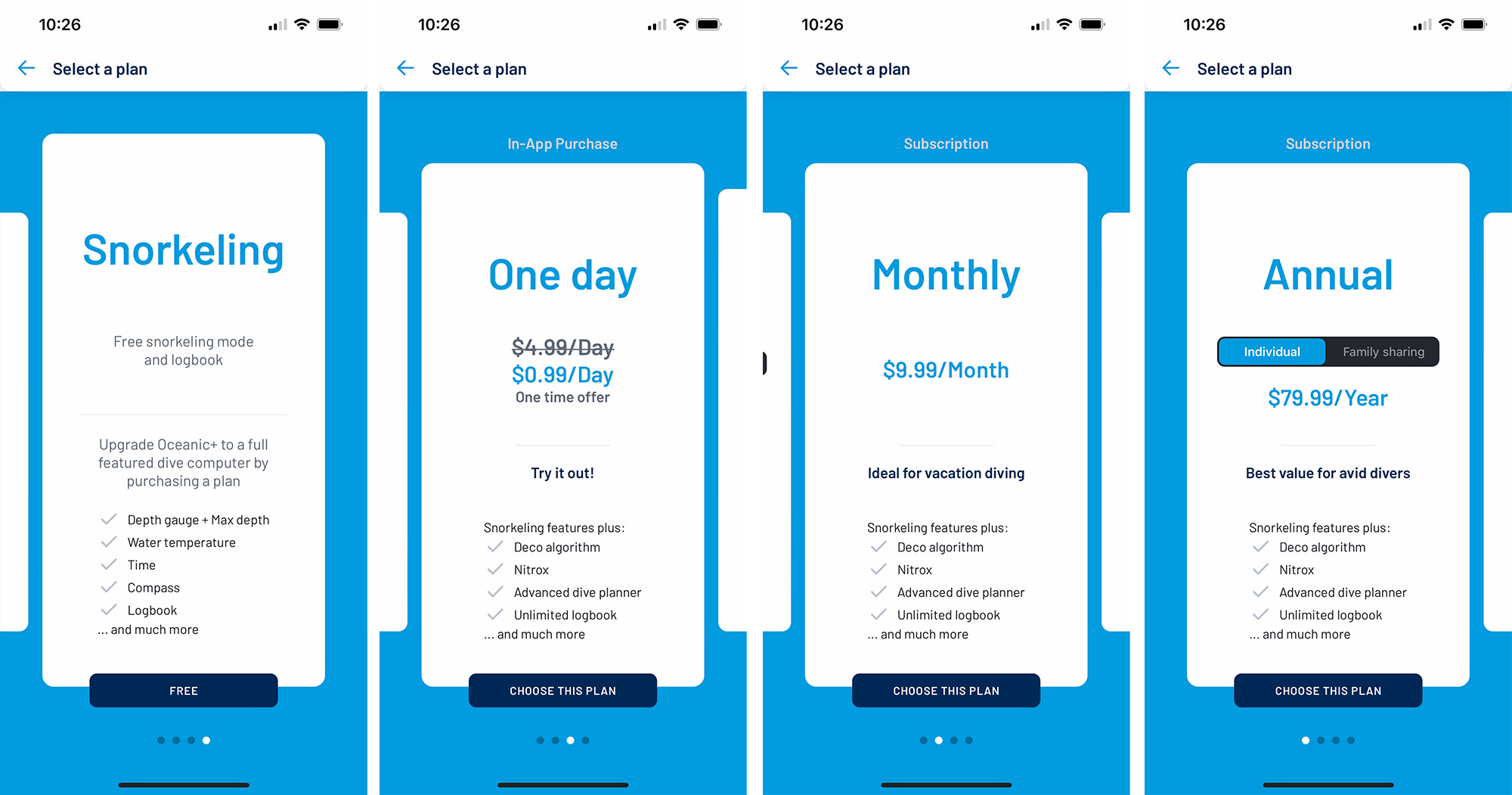

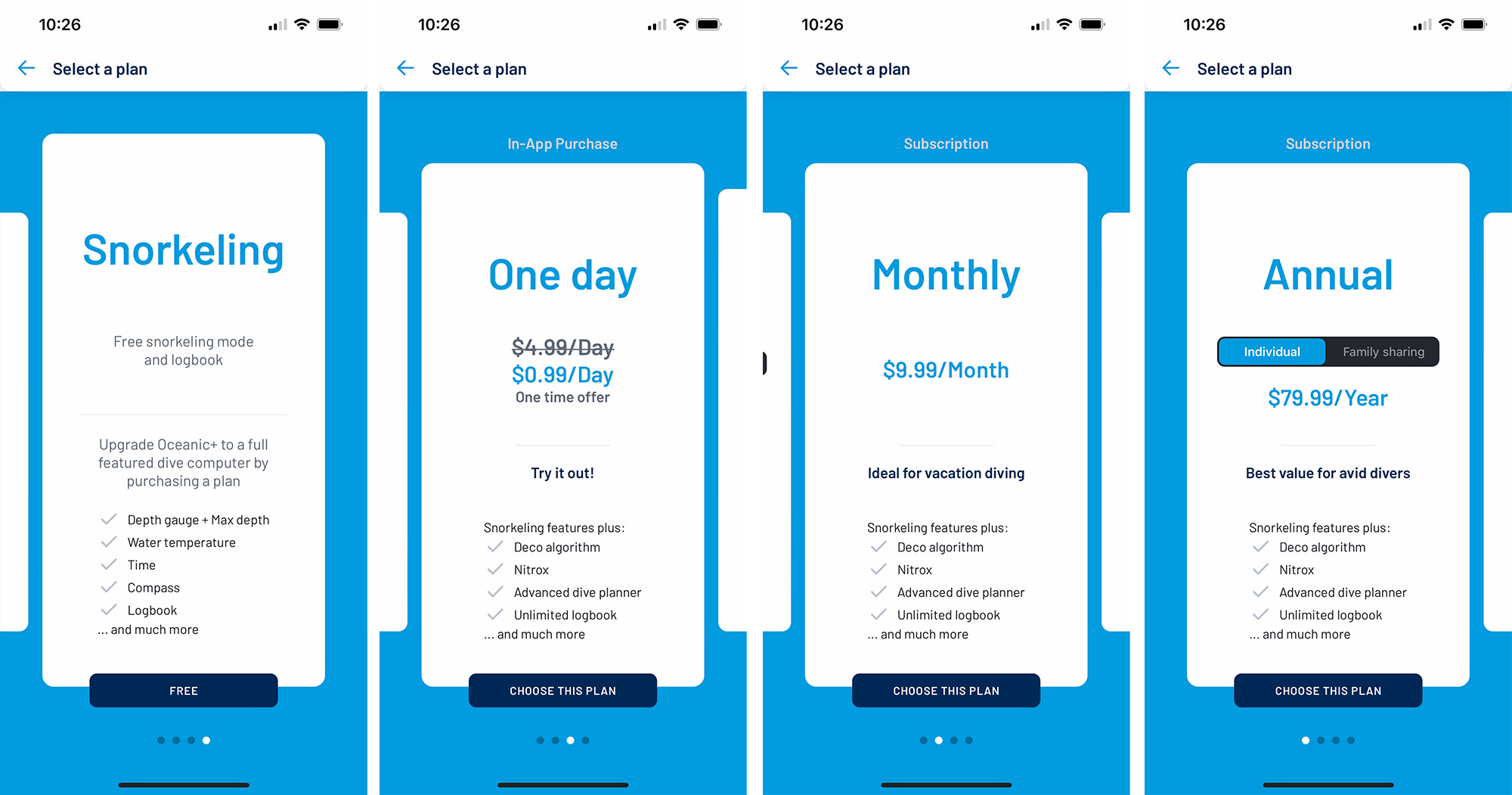

This is where the Oceanic+ makers did something clever. Instead of only having very long-term subscription plans (such as $80 per year, for example), the app makers devised shorter plans that suit divers extremely well:

- $4.99 per day

- $9.99 per month

- $79.99 per year

- $129 per year for “family share” up to five people.

You subscribe to the app for a day, month, or year via the Oceanic+ iPhone app. Image Credit: Huish Outdoors

Assuming you already have an Apple Watch Ultra, the above becomes a no-brainer. For the same price as the cheapest dive computer rental I could find, you can use your existing Apple Watch as a dive computer. Most dive trips last less than a month, so for $10, you’re covered for as much diving as you can stomach. And if you’re planning more than one dive trip in a year, you can shell out a bit extra.

The cool thing about the features that are added when you subscribe is that they are only strictly needed when you are actively diving. If you just want to refer back to your past dives once you’re safely back at home, that’s made possible by the free app.

The paid app adds the following features:

- Tissue loading – the bit you need to avoid decompression sickness

- Decompression info – that’s the part you need to stay safe as you are in the water, and calculates the surface intervals, and the time it takes before you can safely fly in an airplane after you’ve been diving

- Community dive conditions – water temperature, visibility, and currents, etc.

- Local 3-day weather forecast for your dive sites

- Local 3-day temperature forecast for your dive sites

- UV index

Of course, not everybody will be falling over themselves to spend $800 on the Apple Watch Ultra, but for those who did for the diving feature, the days of having to use a rented dive computer may be counted. If you can afford to buy the watch, the pricing plans mean that you’d be crazy to spend more than you have to in order to go meet some fish.

Oceanic+, developed by Huish Outdoors, made a splash at this year’s Apple Fall Event in September, when Apple pulled a surprise new watch out of its proverbial hat, the Apple Watch Ultra. One of the surprises was that the $800 watch is rated for recreational scuba diving, enabling owners to take it underwater to 40 meters or 130-ish feet.

Pre-installed on the watch is a Depth app, which shows depth, water temperature and a few other things. As a scuba diver, however, you need more than that. To avoid decompression sickness (the bends), you need a dive computer that logs how long you stay at certain depths. The precise instruments measuring and logging depth and time, paired with an algorithm, makes up a dive computer. This is pretty specialized stuff, and it makes sense that Apple decided to partner with an external supplier — in this case the scuba veterans at Huish Outdoors.

I reviewed the app and watch combo, but I wanted to talk about the pricing model and how it, in itself, is a game changer for scuba divers.

You can rent a dive computer from most dive shops, of course, but this comes with some (very slight) risk: If the computer was used by another diver the day before, their dive profile might influence yours. The worst that can happen is that the computer believes that you have less no decompression time than you really do. In other words: You may have to do shorter, shallower dives.

Because of this, and a few other reasons, serious divers usually have their own dive computers. The issue is that these often lay around for long stretches of time. Turning up to go diving, only to discover that the battery in my dive computer is low, is frighteningly common both for many of my fellow divers and for myself. When that happens, you end up scrambling to get a replacement battery (not trivial, as the dive computer needs to be re-sealed properly afterwards, and not everyone has the right tools to do that), or rent a dive computer and bring that with you as a backup.

A Scuba diver observes that the target 30 minute dive time alarm has been reached. Image Credit: Bang Bang Studios

The Oceanic+ app has a number of features available for free:

- Snorkeling

- Gauges

- Depth meter

- Max depth tracking

- Last dive time

- Maximum elapsed time

- Total activity time

- GPS location for an actiity

- Logbook

- Cumulative lifetime dive time

- Total number of dives

- Deepest dive

- Longest dive

- Dive ratings (you can rate your dive and specifics about the dive)

- Sharing activities to social networks

- Storing pictures

To get its advanced features, however, you have to pony up for a subscription. This is where things get clever. Renting a dive computer from a dive shop can cost anywhere from $5-$30 per day, and very few divers would choose to go without these days.

This is where the Oceanic+ makers did something clever. Instead of only having very long-term subscription plans (such as $80 per year, for example), the app makers devised shorter plans that suit divers extremely well:

- $4.99 per day

- $9.99 per month

- $79.99 per year

- $129 per year for “family share” up to five people.

You subscribe to the app for a day, month, or year via the Oceanic+ iPhone app. Image Credit: Huish Outdoors

Assuming you already have an Apple Watch Ultra, the above becomes a no-brainer. For the same price as the cheapest dive computer rental I could find, you can use your existing Apple Watch as a dive computer. Most dive trips last less than a month, so for $10, you’re covered for as much diving as you can stomach. And if you’re planning more than one dive trip in a year, you can shell out a bit extra.

The cool thing about the features that are added when you subscribe is that they are only strictly needed when you are actively diving. If you just want to refer back to your past dives once you’re safely back at home, that’s made possible by the free app.

The paid app adds the following features:

- Tissue loading – the bit you need to avoid decompression sickness

- Decompression info – that’s the part you need to stay safe as you are in the water, and calculates the surface intervals, and the time it takes before you can safely fly in an airplane after you’ve been diving

- Community dive conditions – water temperature, visibility, and currents, etc.

- Local 3-day weather forecast for your dive sites

- Local 3-day temperature forecast for your dive sites

- UV index

Of course, not everybody will be falling over themselves to spend $800 on the Apple Watch Ultra, but for those who did for the diving feature, the days of having to use a rented dive computer may be counted. If you can afford to buy the watch, the pricing plans mean that you’d be crazy to spend more than you have to in order to go meet some fish.

Apple and Huish devise clever pricing model for divers with Oceanic+ app by Haje Jan Kamps originally published on TechCrunch

https://techcrunch.com/2022/11/28/oceanic-plus-pricing-model/