Category: TECHNOLOGY

Apple limits AirDrop ‘everyone’ option to 10 minutes in China

A change in the iOS 16.1.1 update for Chinese users is turning some heads. Apple is restricting the “Everyone” option in AirDrop to ten minutes on iPhones purchased in mainland China, according to online user reports. That means people can no longer keep their Airdrop on for an unlimited time, including for strangers and contacts.

Some argue that this feature should have long been an option for all Apple users — sometimes one just forgets to switch Airdrop off and end up with unsolicited content from unknown users — but others interpret the decision as Apple’s response to recent incidents in China.

Airdrop, which uses Bluetooth Low Energy and peer-to-peer wifi technology to enable instant file transferring, remains one of the few uncensored communication medium in China, which is why people were using the feature to share politically sensitive content with others in recent weeks as the country’s top leadership reshuffled.

Despite the rise of local rivals like Huawei and Oppo, Apple has managed to hold onto its dominance in China, especially among more affluent demographics. In the second quarter, iPhones accounted for 13% of handset shipments in China, according to Counterpoint’s research, down from 18% and 22% in Q1 and Q4 respectively.

It’s not unusual for Apple to introduce region-specific restrictions to abide by local regulations. In EU countries, for example, users can’t exceed the EU Volume Level as a result of hearing protection standards. In China, Apple has a history of applying more stringent rules on content-related services, including games and podcasts, a closely watched area by the local authorities.

Apple limits AirDrop ‘everyone’ option to 10 minutes in China by Rita Liao originally published on TechCrunch

https://techcrunch.com/2022/11/09/apple-limits-airdrop-everyone-option-to-10-minutes-in-china/

Waymo can now charge for fully driverless services in San Francisco

The California Department of Motor Vehicles approved an amendment to Waymo’s existing deployment permit Wednesday to include driverless, as well as drivered, operations. Now, Waymo will be able to charge for usage of its autonomous vehicles, which will operate without anyone in the driver’s seat, for services like food and grocery delivery.

The upgraded DMV permit is a prerequisite to launching a fully autonomous commercial ride-hail service in San Francisco, as its main competitor Cruise did this summer. All Waymo needs now is a driverless deployment permit from the California Public Utilities Commission (CPUC) to finally start charging for rider-only autonomous rides in the city. The company will be eligible to apply for that permit once it has operated its driverless cars on public roads for at least 30 days.

Waymo received its drivered deployment permit from the DMV last September, which allowed the company to begin a commercial autonomous delivery pilot in San Francisco with Albertsons earlier this year. Per the permit’s requirements, a human safety operator has to be in the front seat during operations.

Waymo’s service area in San Francisco. Image Credit: Waymo

Waymo then received a CPUC drivered deployment permit in February this year and began charging its “trusted testers” for robotaxi rides with a human safety operator in the front seat in May.

Between June and August, Waymo completed more than 709,000 miles with a safety driver in the state of California, according to the CPUC’s quarterly report.

The company recently expanded its service in downtown Phoenix to include trips, with a human safety operator, to Phoenix’s airport, and said it would launch a robotaxi service in Los Angeles.

Waymo can now charge for fully driverless services in San Francisco by Rebecca Bellan originally published on TechCrunch

Sequoia Capital marks its FTX investment down to zero dollars

Sequoia Capital just marked down to zero the value of its stake in the cryptocurrency exchange FTX — a stake that, as of last week, likely represented among the most sizable unrealized gains in the venture firm’s 50-year history.

It alerted its limited partners in a letter that it sent out to them this evening. (See below.)

No doubt those backers are collectively still processing the events of this week.

When Sequoia invested in the Series B round of FTX in July 2021, the high-flying, Bahamas-based outfit was valued at $18 billion. Two months later, the company was valued by investors at $25 billion. In January of this year, FTX raised a $400 million in Series C round that brought its total funding to $2 billion and its valuation to a breathtaking $32 billion.

Now, following a series of missteps — that’s the best-case scenario — FTX didn’t just lose its rich valuation. According to the WSJ, FTX founder and CEO Sam Bankman-Fried told investors today that he needed emergency funding to cover a shortfall of up to $8 billion due to withdrawal requests received in recent days. Reportedly, he has been seeking a mixture of debt and equity.

It’s not surprising that Sequoia decided instead to write off the investment and to write a letter to its limited partners toward that end (see below). Presumably, others of FTX’s investors — including SoftBank, BlackRock, Insight Partners, and Paradigm among them — are shooting out their own communications to limited partners today about making the same decision. (As an LP itself, the Ontario Teachers’ Pension Plan Board, which invested directly in FTX, has a much broader range of shareholders who may be learning that their retirement dollars just vanished into thin air.)

More uncharacteristic was Sequoia’s decision to tweet out the letter tonight after sending it directly to its investors. It’s hard to interpret the move as anything other than a clear signal that Sequoia wants to distance itself as far from FTX as it can, just as details of FTX’s abrupt unspooling continue to surface.

What is known already: Binance, an early investor in FTX turned into a fierce rival, announced on Sunday it was selling off its FTT holdings, the native token of FTX exchange, worth $529 million at the time, due to “recent revelations that came to light.”

Those revelations came courtesy of CoinDesk, which reported last week that Alameda Research, a trading house also owned by Bankman-Fried, had fully one-third of its assets in FTX’s own FTT token, raising questions about possible market manipulation as well as making it apparent that the two outfits were dangerously intertwined and thus vulnerable.

Binance promptly went for the jugular, tweeting about those “revelations” and dumping its FTT holdings and creating enough uncertainty that other FTT holders raced to unload their FTT tokens. By yesterday, a crippled FTX had collapsed at the doorstep of Binance and after Binance said it signed a letter of intent to acquire the outfit (presumably for a fire-sale price), the internet had its fun with the whole saga.

Except that the story is still unfolding, as it turns out. After conducting some due diligence, Binance said it was backing away from FTX. Specifically, it said in a statement: “In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help.” (Ouch.) Bankman-Fried has since been searching for funds elsewhere.

He’s clearly not getting any more money from Sequoia. The question is what happens in the very likely scenario that none of FTX’s backers want to throw FTX a lifeline, and why would they? On top of everything else, the SEC is now investigating whether FTX “mishandled customer funds, and they’re looking into the firm’s relationships with other parts” of Bankman-Fried’s crypto empire, Bloomberg reported earlier today.

Of course, if FTX isn’t rescued, its customers will be out billions of dollars, money they will be focused on getting some portion of which returned to them. Sequoia, for its, part, clearly wants nothing to do with that. Here is the letter it sent out a bit earlier:

Dear Limited Partner,

“We are reaching out to share an update on our investment in FTX. In recent days, a liquidity crunch has created solvency risk for FTX. The full nature and extent of this risk is not known at this time. Based on our current understanding, we are marking our investment down to $0.

Sequoia Capital’s exposure to FTX is limited. We own FTX.com and FTX US in one private fund, Global Growth Fund III. FTX is not a top ten position in the fund, and our $150 million cost basis accounts for less than 3% of the committed capital of the fund. The $150 million loss is offset by ~$7.5B in realized and unrealized gains in the same fund, so the fund remains in good shape.

Separately, SCGE Fund, L.P. invested $63.5M in FTX.com and FTX US, representing less than 1% of the SCGE Fund’s 9/30/2022 portfolio (at fair value).

We are in the business of taking risk. Some investments will surprise to the upside, and some will surprise to the downside. We do not take this responsibility lightly and do extensive research and thorough diligence on every investment we make. At the time of our investment in FTX, we ran a rigorous diligence process. In 2021, the year of our investment, FTX generated approximately $1B in revenue and more than $250M in operating income, as was made public in August 2022.

The current situation is developing quickly. We will communicate in a timely manner when more information is available. If you have any additional questions, please contact Andrew Reynolds, Marie Klemchuk and Kathleen Forte at: investorrelations@sequoiacap.com. For SCGE questions, please contact Kimberly Summe at summe@sequolacap.com.

Sincerely.

Team Sequoia

Footnotes:

Global Growth Fund III (GGFIlI) data is as of September 30, 2022 and is based on U.S. GAAP. The $7.5B is composed of $5.8B of unrealized gain and $1.7B of realized gain. which includes the General Partner distribution on May 27, 2021 pursuant to the 2021 Amendment. Past performance is not indicative of future results

Global Growth Fund III (GGFIII) refers to Sequoia Capital Global Growth Fund III – Endurance Partners, L.P. and does not include Sequoia Capital Global Growth Fund III – U.S./India Annex Fund, L.P., Sequoia Capital Global

Growth Fund III – China Annex Fund, L.P., and their parallel funds

Sequoia Capital marks its FTX investment down to zero dollars by Connie Loizos originally published on TechCrunch

https://techcrunch.com/2022/11/09/sequoia-capital-marks-its-ftx-investment-down-to-zero-dollars/

Lyft-backed plan to fund electric cars flops in California

California voters shot down a plan to make electric vehicles more affordable for some residents, dealing a blow to Lyft and the EV industry alike.

Proposition 30 would have taxed residents making more than $2 million a year to subsidize electric cars and public charging stations as well as funded wildfire prevention programs. Even with just 41% of the votes tallies so far, the defeat was clear. As of Wednesday afternoon, some 59% of voters rejected the proposition.

The measure’s defeat comes as several states ready bans on gas-powered vehicles in urgent efforts to cut climate pollution.

Prop 30’s primary backer was Lyft, which paid more than $48 million to support the would-be wealth tax. The measure’s opponents — which included Democratic Governor Gavin Newsom and venture capitalists Michael Moritz and Ron Conway — cast Prop 30 as a “Lyft grift,” calling it a “scheme to further line the pockets of Silicon Valley tech billionaires.”

Yet, Prop 30 did not include carve-outs for ride-share companies. It would have raised tens of billions of dollars to push down the price of electric cars for individuals, including drivers for ride apps like Lyft and Uber. Both companies have committed to going electric by 2030, and this measure could have helped them hit their targets.

Earlier this year, California mandated that nearly all ride-share vehicles go electric by 2030, as part of a broader effort to gradually push combustion engines off roads. Although the state already operates some programs to help cover the cost of going electric, Prop 30 could have provided further assistance. Without it, ride-app companies may be forced to fork up additional cash, one way or another, to incentivize their drivers to switch, so they’ll comply with the state’s mandate.

Though more affordable options are gradually coming to market, electric vehicles are generally still in short supply, and most are too pricey up front for most people. This is no good for the climate, because light-duty vehicles like cars and SUVs make up more than half of transportation-related emissions in the U.S., per the EPA.

On the NASDAQ, Lyft closed at $10.64, down by almost 2.4% from the prior day. The decline pales in comparison to the nosedive Lyft shareholders suffered on Monday, after disclosing hefty losses in its latest quarterly report. Earlier this month, Lyft laid off 683 employees, or about 13% of its workforce.

Lyft-backed plan to fund electric cars flops in California by Harri Weber originally published on TechCrunch

https://techcrunch.com/2022/11/09/lyft-prop-30-fund-electric-cars-flops-california/

Daily Crunch: Meta decimates its staff as the social media giant lays off 11,000

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Whooo-weee interesting times for crypto land, as Bitcoin crashes down to under $17,000 for the first time in a while. Wild, given that the cryptocurrency was trading at $65,000 or so a year ago. That’s a 74% decrease. What kind of winter is this — are we seeing a crypto cold snap or crypto permafrost? Answers on an immutable blockchain transaction, please.

If you’re excited to make sense of the crypto world, we’ve got an event in Miami coming up in a couple of weeks — details and tickets here! — Christine and Haje.

The TechCrunch Top 3

- More social media struggles: Though the subject matter was a downer, Paul wrote a great story about Meta’s confirmed layoffs of 11,000 employees, explaining what happened, why and what it means in the greater context of Meta’s future. More in Big Tech below.

- It was good while it lasted: For a few hours this morning, us TechCrunchers were elated to see our precious Twitter handle get the “Official Twitter Badge,” but as Amanda writes, what Twitter giveth, Twitter quickly taketh away.

- This is what really happened: It was Elon Musk, in the boardroom, with the badge code. As we just mentioned, Musk was killing spirit all over Twitter today, rolling out gray checkmarks for high-profile accounts and then deleting them. Kyle has more.

Startups and VC

Edge computing cloud and global data network Macrometa has raised $38 million led by Akamai Technologies, as the two announce a new partnership and product integrations, Catherine reports. The funding also included participation from Shasta Ventures and Sixty Degree Capital. Akamai Technologies CTO Andy Champagne will join Macrometa’s board.

Startups might be in a funding midwinter, but the ray of sun shining on some VCs speaks of a different trend, reports Ingrid. EQT Ventures, the venture fund arm of Sweden’s investment giant EQT making early-stage bets on startups primarily in Europe, has closed its latest fund and filled its coffers with €1 billion (and $1.1 billion in total commitments).

Like our headline stories, but more summarized:

- Like Excel, but more betterEquals secures $16 million investment to supercharge spreadsheets, reports Kyle.

- Like Made.com but less bankruptNext acquires Made.com’s brand and IP as the online furniture retailer enters administration, by Paul.

- Like app development, but more lucrativeAnna writes that Adapty is betting it can help app devs make more money after raising a round of funding.

- Like customer support, but more embeddablePlain is a new customer support tool with a focus on API integrations, Romain reports.

- Like notifications, but more distributedWeb3 messaging infrastructure Notifi raises $10 million seed round, reports Kate.

Three tips for managing a remote engineering team

Image Credits: Inok (opens in a new window) / Getty Images

Remote work is not for every business, and it may not be everyone’s cup of tea. When Greg Soh and his co-founder decided to build a distributed engineering team for their startup, numerous questions raced through their minds: Will the team be productive? How will decisions be made? How do they keep the culture alive? Today, the startup manages a remote team of about a dozen engineers, and they’ve learned quite a bit along the way.

On TechCrunch+, he shares some of the tips and advice the company has learned — most of the advice is best applicable to earlier-stage startups.

Three more from the TC+ team:

- No wave for youVC investors and startup founders see hope in the red wave that wasn’t, by Dominic-Madori.

- No crypto deals for youWill the FTX debacle scupper crypto venture deal-making? by Alex.

- No headwinds for youWhy mobile subscription management platforms are enjoying tailwinds, by Anna.

TechCrunch+ is our membership program that helps founders and startup teams get ahead of the pack. You can sign up here. Use code “DC” for a 15% discount on an annual subscription!

Big Tech Inc.

Following today’s Meta announcement regarding the layoff of 11,000 employees, Ingrid did a deep dive into the company’s 8-K and emerged with some fresh catch, including the predictable — that slashing expenses on hiring and capex investments will help the company’s 2023 bottom line.

Meanwhile, Frederic writes about IBM’s Osprey quantum processor, which isn’t exactly the 4,000 qubits the company wants to achieve by 2025, but at 433 qubits, it’s a good start.

And we have five more for you:

- More layoffs: You didn’t think you’d get off that easy, did you? Ron reports that Salesforce has laid off hundreds of employees, while Aria reports that Astra lays off 16% of its staff after nearly tripling it in the last year.

- Brrr, it’s cold in here — there must be some crypto in the atmosphere: It’s like Anita had some sixth sense or something. Earlier today, she wrote that the proposed Binance and FTX M&A deal looked unlikely to close. Lo and behold, just before this went out, Binance decided to walk away from the deal, Jacquelyn reports.

- Collaboration station: Ready to Freeform? Not sure it’s going to be a verb yet, but Apple hopes its collaborative whiteboard is something that sticks, Ivan reports.

- Sensors and software and EV, oh my!Volvo unveiled its first all-electric SUV today, and we are drooling. Jaclyn has more.

- We’re guessing he didn’t win the Powerball: Elon Musk sold more of his Tesla shares, Rebecca writes. The 19.5 million shares were worth almost $4 billion. Wonder what he’s using the money for…

Daily Crunch: Meta decimates its staff as the social media giant lays off 11,000 by Christine Hall originally published on TechCrunch

Canoo to buy vehicle manufacturing facility in Oklahoma City

Commercial electric vehicle company Canoo entered into an agreement to acquire a vehicle manufacturing facility in Oklahoma City, the company announced Wednesday along with its third-quarter earnings. The news comes a week after Canoo said it would build an EV battery module manufacturing facility in Pryor, Oklahoma.

The new facility will be dedicated to producing Canoo’s electric Lifestyle Delivery Vehicle (LDV) and Lifestyle Vehicle (LV), an electric SUV. Canoo is still working on its “megamicro factory” in Pryor, but until that comes online, this new facility will help Canoo ramp production and bring EVs to market in 2023.

Canoo CEO Tony Aquila said the company expects to start production for the LDV on November 17 and complete final certification in the first quarter of 2023. The goal is to build 15 production vehicles this year, which will go to committed order customers like NASA and Walmart.

The Oklahoma City 120+ acre facility has “production-ready infrastructure” and is “strategically located with easy access to road and rail,” according to Canoo Aquila. Canoo will adapt the facility to accommodate a full vehicle assembly line with robotics, a paint shop and upfitting center. Canoo said the facility will be powered by clean energy.

“Following these initial builds, we will then aggressively shift all our equipment and focus to our new facility during Q1 and Q2 of 2023,” Aquila said Wednesday. “As we start production, we expect the first sellable vehicle deliveries to occur in the back half of Q1 and we will ramp production in 2H 2023 to 20,000 units run rate by year end.”

Aquila said the megamicro factory in Pryor is “a bit delayed due to economic reasons,” but that when Canoo is able to shift resources there, the startup will be able to double its run rate to 40,000 units by the end of 2024.

Long term, the Oklahoma City facility announced Wednesday will focus on producing defence and specialty products, said Aquila. In April, NASA selected Canoo to provide crew transportation vehicles for the crewed Artemis lunar exploration launches, and in July, the U.S. Army selected Canoo to supply EVs for analysis and demonstration.

Canoo Q3 financials

Canoo closed out the quarter with cash and cash equivalents of $6.8 million. That’s down from last quarter’s $33.8 million, and $224.7 million from the fourth quarter of 2021. In less than a year, Canoo burned through $217.9 million, and it’s still not generating revenue.

Quarter-over-quarter, Aquila says Canoo’s cash burn is down 25% as the company continues to shift its expense mix, increasing the ratio of capital spend to operating spend.

The company’s loss from operating activities totaled $109.4 million this quarter, and its GAAP net loss and comprehensive loss hit $117.7 million.

Canoo says it has access to $200 million through an “at-the-market offering” program, as well, but access to capital isn’t the same thing as having cash on hand.

“On the financing front, we have secured an additional $30 million in a PIPE and a note to be converted to cash or stock,” said Aquila, noting the company is in the final phases of evaluating different financing options for the Oklahoma facility.

Canoo seems to be riding promises of future revenue to get access to more financing and stay afloat.

After reporting first-quarter earnings this year, Canoo issued a growing concern warning, saying that it may not have enough funds to make it stay in business. Things improved for the company in the second quarter, in part due to its agreement with Walmart to sell 4,500 electric delivery vehicles. This not only assured future revenue for Canoo, but also gave the company another opportunity to go after additional non-dilutive and lower-cost capital financing opportunities.

Since then, Canoo has also secured binding fleet orders from Kingbee and Zeeba to purchase 9,300 and 3,000 vehicles, respectively, with the option to increase to 18,600 and 5,450 vehicles, respectively. Today, Canoo has over $2 billion in total orders in its pipeline, according to Aquila.

“The last two quarters have been very tight,” said Aquila. “The macro economic has worsened, pushing the cost of capital higher and forcing us to accelerate our maturity and manage costs efficiently to achieve our goals. We have been doing our best to manage cash, continued access to liquidity and dilution.”

Aquila said that even though Canoo’s cash situation looks dire, he believes having less access to cash has led to more competitiveness and efficiencies.

“Being able to teach the crew here how to run a business on ‘just in time’ milestone capital is a very disciplined approach as an investor, not just as the chairman and CEO,” he said “I know it is painful. But, you know, would you rather give a young company a lot of money, or would you rather give it money based on milestones?”

Canoo revised its expenditure guidance for the remainder of the year, anticipating $70 million to $90 million in operating expenses, excluding stock-based compensation, and $30 million to $50 million of capital expenditures.

“We are now on track for a 40% reduction in operating expenses for the second half of the year, which is significant improvement compared to a previously disclosed projection of 20% reduction,” said Ramesh Murthy, Canoo’s senior vice president of finance.

Canoo’s stock, which closed at $1.17, is up 3.42% in after-hours trading.

Canoo to buy vehicle manufacturing facility in Oklahoma City by Rebecca Bellan originally published on TechCrunch

https://techcrunch.com/2022/11/09/canoo-to-buy-vehicle-manufacturing-facility-in-oklahoma-city/

Rivian upholds 2022 production targets as net loss widens

Electric vehicle maker Rivian affirmed Wednesday that the company is on track to hit its annual production target of 25,000 vehicles despite unpredictable supply chain crunches and component shortages.

The startup-turned-public company remained committed to its production goal even as industry-wide challenges, supply chain snarls and macroeconomic forces have conspired this year to keep automakers from satisfying a strong consumer appetite for cars, trucks and SUVs.

Rivian reported that its third-quarter production rose 67% over the same period a year ago, for a total count of 15,000 vehicles, including the automaker’s truck, SUV and Amazon delivery vans, through September 30. During the quarter, the company produced 7,363 vehicles, boosted by the addition of a second shift at its Normal, Illinois, factory. It delivered 6,584 of them — a significant jump from the 4,467 vehicles Rivian delivered in the second quarter of the year.

Like other automakers, and especially other startups, Rivian has struggled this year, with founder and CEO RJ Scaringe forced in July to lay off 6% of its workforce, or roughly 900 employees.

For the third quarter, Rivian reported a net loss of $1.72 billion on revenue of $536 million. That compares with a net loss of $1.23 billion on revenue of $1 million the same period a year ago.

In October, Rivian was forced to recall nearly all of its vehicles to fix a steering defect. Meanwhile, the company is gearing up for long-term supply chain constraints it foresees in the battery supply chain. The industry’s ongoing semiconductor chip shortage is “an appetizer to the degree of the sort of supply chain constraint we’re likely to see across the battery supply chain over the next 15 years,” Scaringe said from the TechCrunch Disrupt conference stage later in the month.

However, the demand for Rivian’s vehicles remains, with more than 114,000 preorders in the U.S. and Canada as of Monday. That’s on top of Amazon’s initial order of 100,000 electric vans.

Rivian pointed to several segments where it sees potential growth, including the 2026 launch of its next-generation R2 EV platform, a partnership with Mercedes-Benz to build electric vans at scale and the hiring of former Waymo and Zoox executive James Philbin to lead Rivian’s efforts in AI and automated driving technology.

The near-term economic challenges are putting pressue on EV makers of all sizes. British electric vehicle startup Arrival, which restructured its business amid a cash crunch and pivoted to develop commercial vans for the U.S. instead of Europe, said Tuesday it doesn’t expect to earn revenue until after 2023.

Also on Tuesday, Lucid Motors reported a net loss of $530 million for the third quarter, on $195.5 million in revenue. The startup confirmed it’s on track to build between 6,000 and 7,000 of its Lucid Air luxury sedans in 2022, down from an initial target of 20,000.

Tesla nearly doubled its third-quarter income, to $3.3 billion compared with the same year-ago period, but said production remains hamstrung by supply. The record-setting $21.45 billion revenue Tesla reported for the quarter still fell below analyst expectations.

Rivian, Tesla and the others also face competition from strong legacy automakers that continue to launch electric trucks and SUVs, such as the Volvo EX90 revealed Wednesday morning, on their quest to go fully electric by the end of the decade.

Rivian upholds 2022 production targets as net loss widens by Jaclyn Trop originally published on TechCrunch

https://techcrunch.com/2022/11/09/rivian-upholds-2022-production-targets-as-net-loss-widens/

Some crypto VCs see decentralization as the future following FTX collapse

As the crypto market digests the past few days of chaos, venture capitalists see the moment as a warning, but also as an opportunity for the growth of decentralization and maturation of the larger blockchain space.

“As venture investors, we take a long-term view on the industry; despite the current market turmoil. We are actively assessing and investing in the right opportunities,” Marc Weinstein, founding partner of Mechanism Capital, said to TechCrunch. “The premise of DeFi has, if anything, been strengthened by the collapse of centralized entities from opaque counterparty relationships.”

Decentralized finance (DeFi) is often associated with trusting blockchain technology to execute services through smart contracts, while centralized finance (CeFi) usually refers to more traditional business models and involves having people manage funds and manually execute services.

“Market sentiment is shaken, but committed VCs with experience from several crypto market cycles will continue to invest.” Marc Weinstein, founding partner, Mechanism Capital

Historically, the venture market doesn’t get “too offended” by what transpires in secondary markets, David Gan, general partner at OP Crypto, said to TechCrunch. Regardless, he said, the seeming death of FTX is saddening for everyone, “not just in the VC space, but across the board.”

When there are massive crashes and burns, it speaks to what we’ve been seeing over the past decade: It’s the Wild West out there, Samantha Lewis, principal at Mercury, said to TechCrunch.

“When summarizing it all, I see it as a continuation of the phase that started when winter hit and we saw Luna and all these crazy companies crash and burn like BlockFi, Celsius and now we have FTX,” Lewis said. “As an early-stage venture investor, it’s telling me the hype is now for sure gone. But that ushers in the maturation of the space that a lot of us have been craving for a really long time.”

Some crypto VCs see decentralization as the future following FTX collapse by Jacquelyn Melinek originally published on TechCrunch

Fake Twitter accounts flock to blue check mark chaos

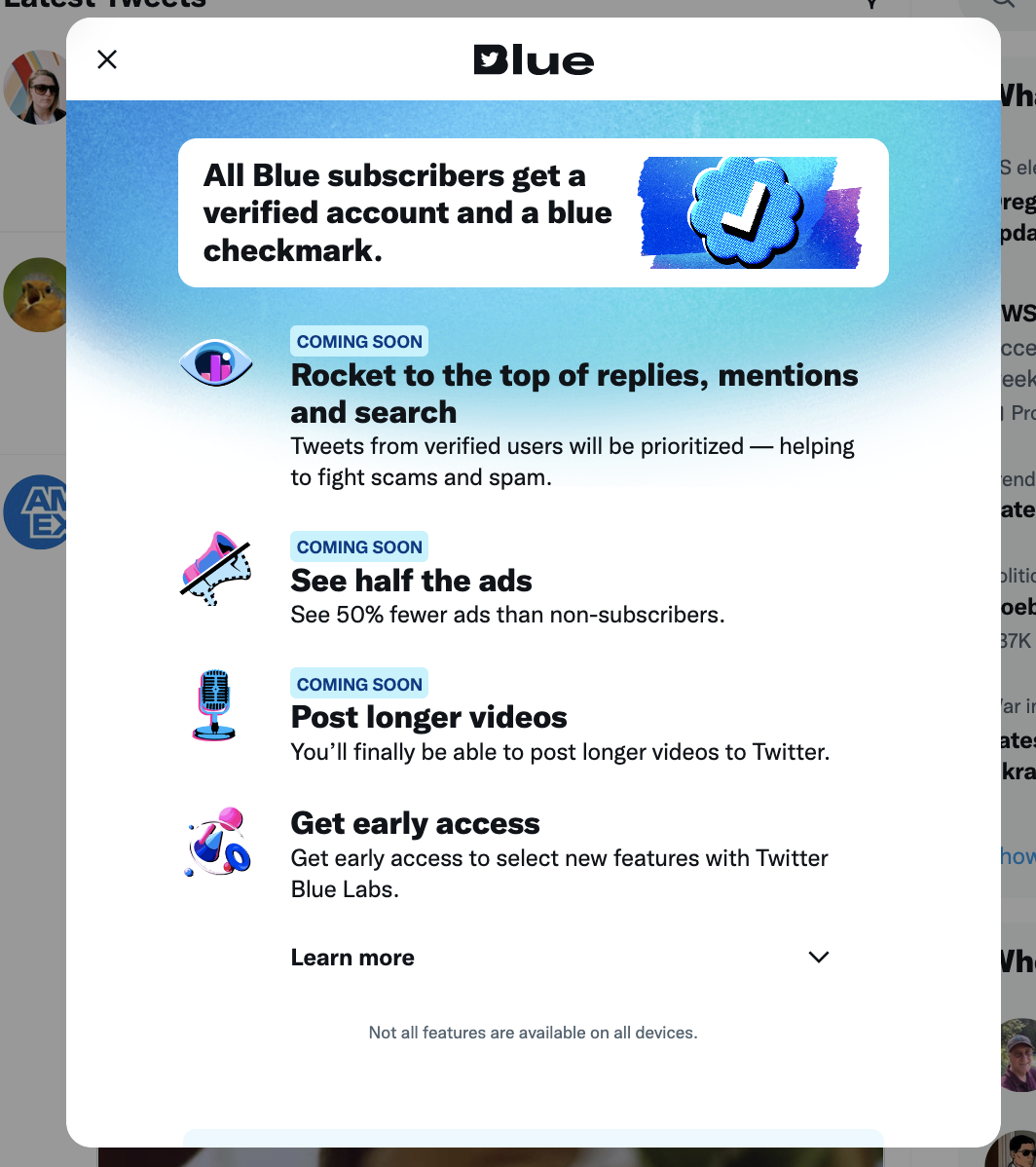

Elon Musk’s mercurial leadership and half-baked product plans are already creating fertile ground for confusion on Twitter.

We’ve lost count of how many times Musk has changed his mind or offered contradictory claims about what a new paid $8 verification badge would do, but after pushing the feature live, fake accounts are seizing on the chaos.

Twitter’s bought blue check marks are now available for some paying subscribers, injecting the timeline with tweets that appear to be from official accounts. And apparently Musk’s Twitter skeleton crew made no meaningful changes to the visual language of the blue check, so right now it signals that you’re either really who you say you are — @CocaCola, for instance — or you’re somebody random who just coughed up $8 and got a stamp of approval.

Now when tweets appear in Twitter’s timeline it’s impossible to visually distinguish the two categories of blue check accounts from one another. Doing so would require clicking through to examine a user’s follower count, which isn’t necessarily a reliable way to tell, or searching for whatever clues might be found in their other tweets. Clicking on the check mark itself from a profile page apparently displays different copy too, but like everything on Twitter right now, that is subject to change.

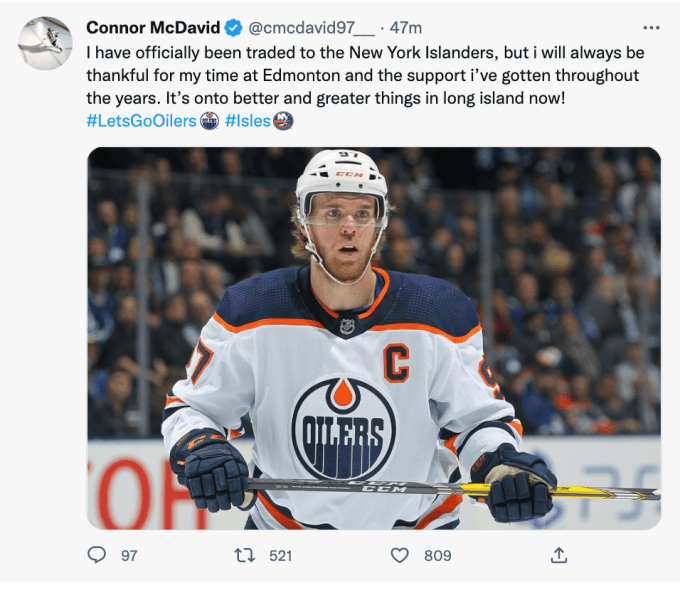

So far this has resulted in some quick attention for an account impersonating LeBron James, which announced that the basketball star was requesting a trade away from the Lakers. A few other athletes got the same treatment, including baseball pitcher Aroldis Chapman and NHL player Connor McDavid.

Following sports transactions and news could become a total mess with the new verification system

Already fake LeBron and Aroldis Chapman tweets going around pic.twitter.com/vQgMqws1W0

— Joon Lee (@joonlee) November 9, 2022

As we’ve reported, Musk has already changed his mind a number of times already on the scheme to get rid of bots and spam by making people pay $8 a month. But now that the feature is suddenly live, anyone can impersonate someone else for $8 a month and see their content boosted algorithmically without any vetting. (Though apparently that paid perk, like nearly all of the “new” Twitter Blue’s features beyond the blue check mark, is “coming soon.”)

All of those accounts are suspended now, but only after the tweets gained traction and caught the attention of Twitter moderators. With one half of the staff it was previously operating with, it’s impossible for Twitter to catch all of this stuff after the fact if it doesn’t have any interest in vetting at the time of payment, which Musk apparently doesn’t.

The implications for Twitter as a reliable news source and the potential for abuse here is massive. Musk held off on his haphazard plan until the day after the U.S. elections, but with many races not yet called we can definitely expect to see confusion that’s orders of magnitude more consequential than a fake basketball trade.

Misinformation potential aside, Musk’s plan also undermines the presence of celebrities — one of the things that makes Twitter interesting for the average user. If Twitter users can’t even reliably find prominent people like athletes, politicians and movie stars to follow, the platform’s value is going to fall off a cliff pretty fast, with its advertising revenue not far behind.

Fake Twitter accounts flock to blue check mark chaos by Taylor Hatmaker originally published on TechCrunch

https://techcrunch.com/2022/11/09/fake-twitter-blue-check-lebron-musk/

Elon Musk Says Twitter Is Ditching Gray ‘Official’ Check Mark Hours After Its Launch

The label was meant to indicate that the social-media company had verified an account’s authenticity.