Category: TECHNOLOGY

FTX Tapped Into Customer Accounts to Fund Risky Bets

Crypto exchange FTX lent billions of dollars worth of customer assets to fund bets by its affiliated trading firm, Alameda Research, setting the stage for the exchange’s implosion, a person familiar with the matter said.

Colorado-based SpringTime Ventures pivots its focus for new $25 million fund

There are a lot of changes afoot for SpringTime Ventures as it looks to deploy its freshly closed second fund.

For one, the Denver-based firm is pivoting away from its original focus on its home state of Colorado, despite being the only local fund in two of the state’s 10 unicorn companies. It’s also now able to expand its team thanks to raising three times as much money for Fund II, giving SpringTime enough cash on hand to allow its partners to finally pay themselves a real salary.

So far, these changes have proved positive. SpringTime is announcing a $25 million second fund to cut checks ranging from $400,000 to $600,000 into U.S.-based seed-stage software companies. The fund was raised from an LP base of 120 entities that largely consisted of high-net-worth individuals.

This latest fund allows SpringTime managing partners Matt Blomstedt and Rich Maloy to ditch their consulting work to focus on investing full-time, and actually get paid for doing so, overcoming a financial hurdle that plagues many first-time fund managers but isn’t spoken about often. The firm was also able to add a principal and two additional partners.

The new pool of capital will be invested across startups in sectors including fintech, insurtech, healthcare, logistics and supply chain. While Fund I largely was deployed into companies across these same sectors, Fund II’s thesis represents a deviation from where the firm first focused: filling a funding void for startups in Colorado.

Blomstedt told TechCrunch that he originally got the idea for SpringTime after moving to Colorado in 2015 after a career in the energy business in Texas. He started attending happy hours to get to know people in his new community and met a bunch of startup founders who all shared the same problem. Blomstedt saw an opportunity.

“At the time, there just wasn’t a dedicated seed fund really in Colorado and the consistent theme was [local founders] were having to go to the coast or maybe to Austin, Texas, or Chicago to raise seed capital,” Blomstedt said. “I started to become pretty convicted in kind of an opportunity and the need for a seed fund in Colorado.”

He decided to raise a proof-of-concept fund to back these startups. The first fund was a slog to raise, he said. He garnered $8 million, which the firm invested in 35 companies including future Colorado unicorns SonderMind (telehealth) and Veho (logistics).

While the fund isn’t sticking to its original thesis of backing companies in the Centennial State, Blomstedt said that most of their existing portfolio company would fall under this new strategy anyway. The above two examples back that up. Plus, he thinks this distinction will help them better leverage their LP network — 77% of Fund I’s LPs reupped for the new approach.

“They send deal flow or they help us evaluate deals, so we started just kind of gravitating toward those industries,” Blomstedt said. “It also just made us better; we can make quicker, sound decisions in a much shorter period of time by having this focus and this network around us.”

He added that they can be a value add later to the firm’s portfolio companies. SpringTime also brought on a handful of operating partners for Fund II for the same reason. Now, after raising across two very different market conditions — Blomstedt said it took about the same time to raise the first $22 million and the final couple million — it’s time to deploy.

Colorado-based SpringTime Ventures pivots its focus for new $25 million fund by Rebecca Szkutak originally published on TechCrunch

With $7M raised, Keyo launches a biometric palm verification network

Maybe you’ve heard of Keyo. Perhaps you saw the initial round of press the firm did in 2017 — roughly two years after its founding. Or maybe you saw it pop back in 2020, riding the wave of news around Amazon’s lukewarmly received hand-scanner tech. You may have wondered precisely what’s been going on with the Chicago-based firm in the interim.

“I think we were probably a bit naïve in the beginning to underestimate the true complexity of this undertaking,” admits co-founder/CEO Jaxon Klein. “There’s a lot involved in building a global scale identity solution. We’ve been in deep engineering mode for several years now. We’ve put the last five years and millions of dollars into building what we really view as the first global scale biometric identity ecosystem.”

It’s not a unique case, in that respect. And may well mean that your organization is on the right track, if members of the press are willing to discuss your technologies at such an early stage. But the kind of technology Keyo has been working on is the sort of thing it’s important to get exactly right, given the security, privacy and financial implications of its biometrics.

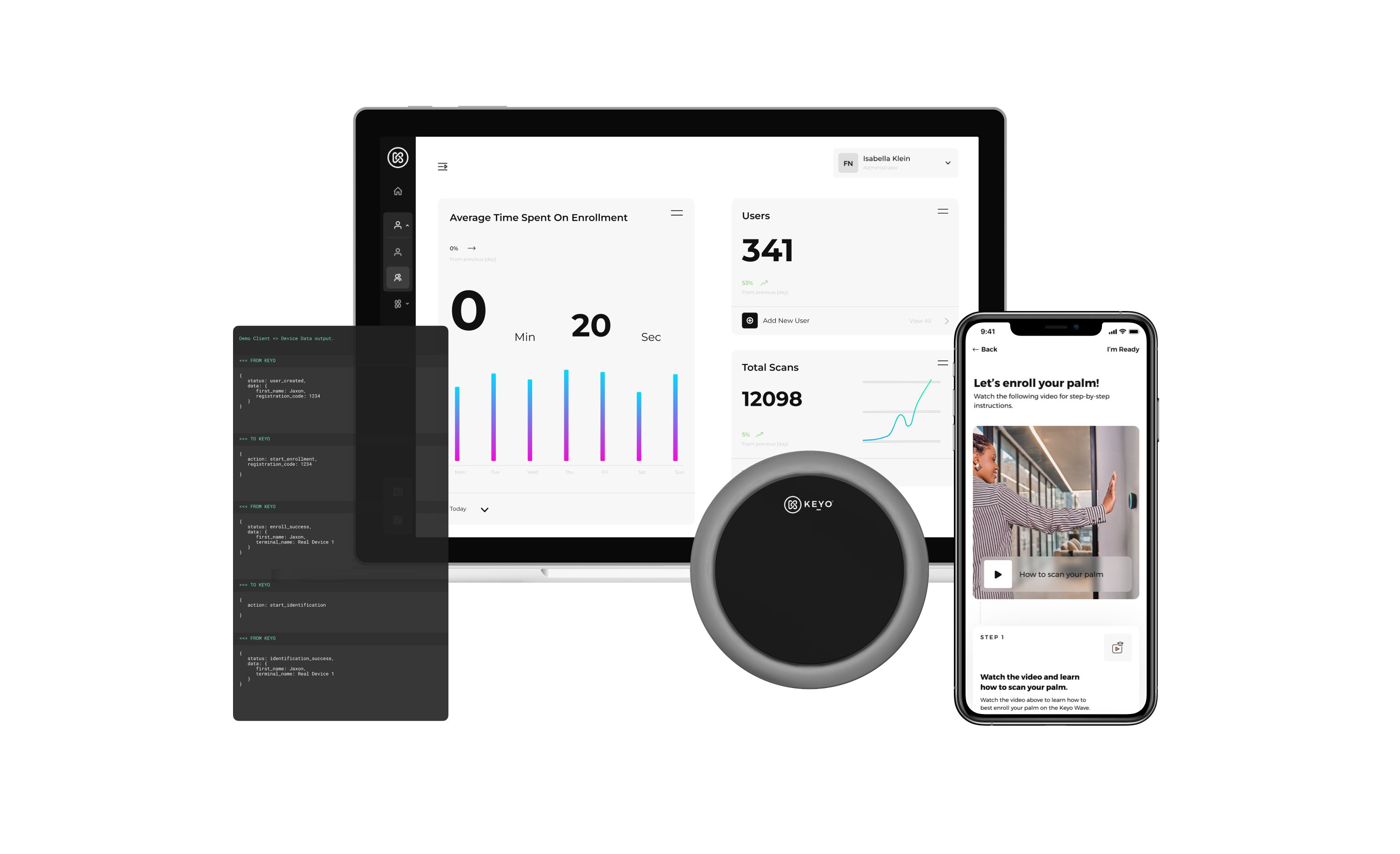

Image Credits: Keyo

“That early press coverage was us prematurely saying ‘hey, look what we’re doing,’” Klein adds. “It settled in what we were really doing and the reasons that no other companies were competing for the space and how just how long and hard the road were heading down. We then retreated from that and said, ‘okay, we have a lot to build and we need to go actually deploy this into the real world, work with real customers work with real users and make sure we’re doing it right.”

This week, the company’s got something to show for that work. Fueled by an aggregate $7 million in seed funding, the Keyo Network had previously been in beta. It’s a combination of hardware and software designed to bring palm scanning to a broad range of different markets and services. Today it’s announcing the Keyo Wave hand-scanner hardware, Keyo mobile app, third-party partner program and the Keyo Identify Cloud, which “enables users to instantly and privately identify themselves based on a simple scan of their hand at any business participating in the Keyo network.”

The Keyo team remains small, with 33 remote employees, though Klein says the firm has been hiring around an employee a week. Not huge growth, though he winkingly notes that at least the startup is bucking the current brutal trend in startup land.

Image Credits: Keyo

“One of the things we’ve gotten really good at is scalable supply chain deployment. We’ve deployed 15,000 devices just recently, and we manage our supply chain internally. Even pre-pandemic, we’ve been building out our supply chain in North America — largely in the U.S. We’ve built a lot of institutional knowledge and capabilities around operating and expanding supply chains. We are really unique in the hardware space — or part of a very small cohort — that designs and builds their own devices, that’s entirely distributed.”

The notion of replacing more traditional payment methods like cards — or even phones — with hand scanning will continue to attract its share of critics. That will only increase as massive corporations like Amazon adopt such technologies, but there’s little doubt the interest is there, at least with the corporations fueling such change.

With $7M raised, Keyo launches a biometric palm verification network by Brian Heater originally published on TechCrunch

SoundHound, the voice AI platform, lays off 10% of staff citing ‘challenging market conditions’

SoundHound — maker of the voice AI technology used by Mercedes-Benz, Deutsche Telecom, Snap and Mastercard and more — has laid off about 10% of its workforce amid ongoing economic turmoil across global markets.

The Santa Clara-headquartered company — which went public via a SPAC in April of this year — announced the decision to its employees on Wednesday. Alongside that, it also imposed salary cuts for some of those not laid off. The company did not specify the details of the salary cuts, nor how many were affected.

“Yesterday, we announced to our SoundHounders that we are taking actions to streamline our company, including an approximate 10% reduction in workforce. We don’t take this lightly, but in the face of challenging market conditions, we must channel our investments into the areas that continue to drive growth and allow us to best serve our customers. We’re extremely grateful to the departing colleagues that have contributed to our success as a leading voice AI platform,” a SoundHound spokesperson said in a statement emailed to TechCrunch.

SoundHound has a total headcount of 450 employees — meaning that the layoff has impacted around 45 people. The company will likely share more details during its Q3 earnings call later today.

Founded in 2005, SoundHound offers its voice AI platform in 25 languages. It powers voice-enabled experiences in a number of the cars provided by Hyundai, Mercedes-Benz and Honda. Earlier this month, the company also tied up with Samsung’s Harman International to offer fully OEM-owned and branded in-vehicle voice experience to several vehicles.

Alongside offering its standalone platform to companies, SoundHound has two mobile apps, namely SoundHound Music that works similar to Apple’s Shazam and lets users discover music playing around them and Hound that offers voice-based search and assistance.

In November last year, SoundHound announced it would go public via a SPAC transaction with blank check company Archimedes Tech SPAC Partners at a nearly $2.1 billion valuation. It was over 5x what Apple paid for its competitor Shazam, a $400 million announced in December 2017 and closed in September 2018.

But its fortunes as a public company have been mixed. In its last quarterly results for the second quarter that ended on June 30, SoundHound reported a 26% year-on-year revenue drop to $6.2 million, while Q2 net loss spiked to nearly $31 million, compared to $15 million in the same quarter a year before.

And its market cap, like that of many tech companies at the moment, is not doing very well. It’s currently trading at around $2/share with a market cap of $406 million.

SoundHound has become another tech company to take the layoff route during this economic slowdown. In addition to recent layoffs announced by Facebook owner Meta and Twitter, others including Netflix, Salesforce, Spotify and Tencent and many others have cut collectively tens of thousands of jobs in the last several months. Indian startups such as Byju’s, Ola and Unacademy have also laid off hundreds of employees to reduce their operating expenses amid dip in funding and investments.

SoundHound, the voice AI platform, lays off 10% of staff citing ‘challenging market conditions’ by Jagmeet Singh originally published on TechCrunch

Perfekto bags $1.1M to find homes for imperfect produce in Mexico

The company is among a group of startups that want to save produce and other food from ending up in landfills. Today, it announces $1.1 million in pre-seed funding to expand its program across Mexico City. Over the past year we’ve seen a number of them also get venture capital backing for their approaches. For example,

Over a third of food ends up wasted across the globe, with 6% of that occurring in the Latin America and Caribbean regions. Among that waste, the majority of it, around 70%, occurs prior to the consumer stage.

This is where Perfekto believes its subscription box of imperfect food can help. Launched in 2021, the Mexico-based company works with over 70 producers to “rescue” food and delivers it to consumers. Subscribers used to get a “surprise box,” but can now personalize their box and choose how much of each type of produce they want. On the backend, the company developed software that automates routing and logistics.

In the past year, the company was part of Y Combinator’s summer 2021 batch, grew to over 3,000 active monthly subscribers and reached $1 million in annual run rate, Jan Heinvirta, co-founder and CEO, told TechCrunch. Subscribers average two boxes per month.

“We saw an expensive problem that needed urgent solution,” he added. “We felt like it’s time to do this because no more time should be wasted. We also saw a trend going in the direction of consumers being more responsible.”

It’s an expensive problem indeed, with the cost of food waste estimated to be around $940 billion each year. And that’s while 9.7 million people across Latin America have food insecurity. Add to that, grocery delivery businesses in the business-to-consumer space are traditionally a capital-intensive business. Even highly venture-backed companies find it difficult to reach profitability.

Heinvirta said it is possible to build a grocery delivery business with positive unit economics. Since December, Perfekto also grew over 10x across all key performance indicators and rescued 1 million pounds of produce.

“We have been very capital efficient, reaching $1 million in ARR having spent less than $1 million,” he added. “This is possible thanks to our subscription model, efficient logistics model and strong organic growth.”

Heinvirta, who grew up in a Swiss farmer village and has a background in financial services, moved to Mexico and met Anahí Sosa, the daughter of a citrus producer who told TechCrunch that she saw how imperfections affected her father’s business. She went on to lead Uber’s grocery initiative in Latin America and later helped launch Cornershop in Costa Rica.

Together Heinvirta and Sosa, chief operating officer, started Perfekto. They recently brought on Juan Andrade as the third co-founder and chief supply chain officer. Andrade was a logistics advisor to the company since it started and previously led Walmart’s e-commerce logistics operations in Mexico.

Perfekto co-founders Jan Heinvirta, Anahí Sosa, and Juan Andrade (Image credit: Perfekto)

The company is among a group of startups that want to save produce and other food from ending up in landfills. Today, it announces $1.1 million in pre-seed funding to expand its program across Mexico City. Over the past year we’ve seen a number of them also get venture capital backing for their approaches. For example, Full Harvest raised $23 million in Series B funding at the end of 2021 for its business-to-business marketplace that connects produce buyers and sellers so they can quickly close deals on surplus or imperfect crops.

“We have a lot of interest from other cities, and I can certainly plan our international expansion, but we’re focused on Mexico City right now because it is so big,” Heinvirta said. “We plan to reach $2 million in annual run rate within the next six to eight months, and there is an opportunity to grow as much as we can.”

Perfekto is also looking at some new opportunities beyond fruits and vegetables and is working with large consumer packaged goods companies that are interested in partnering to reduce food waste for other items that have a short shelf life or damaged packaging. There is also increased interest coming from businesses that are subscribing to a box of fruit each week, he added.

The company just launched a crowdfunding campaign, but in the meantime, Heinvirta intends to plug the new capital into three areas: improve operations and technology, expand its catalog of products to offer customers more variety and growth in the B2B space.

Perfekto bags $1.1M to find homes for imperfect produce in Mexico by Christine Hall originally published on TechCrunch

https://techcrunch.com/2022/11/10/perfekto-imperfect-produce-mexico/

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading

Sam Bankman-Fried said on Thursday that he will be winding down the trading firm Alameda Research and is attempting to raise liquidity for the troubled FTX International, as he scrambles to keep the world’s second largest crypto exchange alive after a bailout deal with Binance failed earlier this week.

Bankman-Fried said in a series of tweets that he is engaging with a “number of players” to raise capital for FTX’s international business and those discussions are at various stages including letter of intents and term sheets deliberations.

FTX’s U.S. business is “fine” and “100% liquid,” he said.

He did not disclose the names of the firms or individuals he is engaging, but one of them appears to be Justin Sun, the founder of Tron blockchain. Axios reported on Thursday that Bankman-Fried is also in talks with Kraken, another large crypto exchange.

The 30-year-old entrepreneur, hailed as wunderkind, said he assumes all responsibility for the mess FTX’s at and any capital he raises for FTX International unit will be first used to do right by the customers. “I’m sorry. That’s the biggest thing. I fucked up, and should have done better,” he said.

“Every penny of [any fundraise] that–and of the existing collateral–will go straight to users, unless or until we’ve done right by them. After that, investors–old and new–and employees who have fought for what’s right for their career, and who weren’t responsible for any of the fuck ups,” he said.

FTX International faced liquidity crunch earlier this month when it saw withdrawals worth $5 billion on Sunday, he said.

Binance founder Changpeng Zhao said last week that Binance, the world’s largest exchange and an early backer of FTX, was selling its holdings of FTT, the native token of FTX exchange, that it had received as part of an exit from the firm last year.

Zhao said the firm was liquidating its FTT holdings as a “post-exit risk management,” giving some credence to a widely circulated rumor about Alameda Research’s concerning financial health. The comment contributed to a bank run on FTX and resulted in voluminous withdrawals. Binance earlier this week signed a letter of intent to acquire FTX, but backed out a day later after reviewing the younger firm’s finances.

“At some point I might have more to say about a particular sparring partner, so to speak. But you know, glass houses. So for now, all I’ll say is: well played; you won,” Bankman-Fried tweeted Thursday.

Troubles are mounting for FTX. The exchange’s sudden collapse has attracted scrutiny from regulators and many players are beginning to cut ties. Tether, the issuer of the world’s most used stable crypto coin, has frozen $46 million of USDT on the Tron blockchain in compliance with a request from law enforcement, it said Thursday.

FTX was valued at $32 billion in its most recent funding round (a Series C) in January this year. The firm counts Sequoia, BlackRock, Tiger Global, Paradigm, SoftBank, Ribbit Capital, Insight Partners, Lightspeed Venture Partners, Bond and Iconiq Growth among its long list of backers.

Sequoia Capital, one of the largest backers of FTX, marked down its investment in the crypto exchange to zero on Wednesday.

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading by Manish Singh originally published on TechCrunch

Apple pledges $450M toward expanding the satellite infrastructure powering Emergency SOS

As a part of its Advanced Manufacturing Fund, Apple will invest $450 million in satellite network and ground stations to power Emergency SOS, its service for the iPhone 14 and iPhone 14 Pro lineups that uses satellite to route emergency calls, the company announced today. The majority of the funding will go to Globalstar, the satellite provider with which Apple has an existing partnership to deliver Emergency SOS when it launches later this month.

In part, Apple’s capital infusion will fund the installation of new custom-designed antennas manufactured by California-based company Cobham Satcom. Designed to receive signals transmitted by Globalstar’s satellite constellation, the antennas have already be installed in the satellite provider’s existing ground stations including facilities in Nevada, Hawaii, Texas, Alaska, Florida and Puerto Rico.

“The launch of Emergency SOS via satellite direct to iPhone is a generational advancement in satellite communications, and we are proud that Globalstar’s satellites and spectrum assets will play a central role in saving lives,” Globalstart executive chairman Jay Monroe said in a statement. “With Apple’s infrastructure investment, we’ve grown our teams in California and elsewhere to construct, expand, and upgrade our ground stations, and we look forward to the next chapter in Globalstar’s lifesaving technology.”

As CNBC notes, Apple’s investment — one of the largest to date out of its Advanced Manufacturing Fund, through which the company has furnished U.S.-based suppliers including Corning, Finisar, XPO Logistics and Copan Diagnostics with over $1.4 billion dollars combined — underscores the costly nature of satellite-based communications. In addition to substantial technical and communications infrastructure, Emergency SOS requires human-staffed call centers. Apple says that over 300 Globalstar employees will work on the service.

Emergency SOS doesn’t support ordinary data, voice or text. But it alerts emergency services with a location and other key information. Once users point their phone at a satellite using an orientation guide in iOS, they can choose between preset messages to be sent along with the phone’s battery level and medical info to local EMS. If supported in the region where the emergency call is placed, iPhone users can have a two-way conversation with first responders. If not, Emergency SOS will route communications through Apple-operated local relay stations that act as intermediaries with emergency services.

Emergency SOS will remain free for two years to Phone 14 and iPhone 14 Pro owners when it goes live in late November in the U.S. and Canada. But Apple has left open the possibility of charging for it after that.

Apple pledges $450M toward expanding the satellite infrastructure powering Emergency SOS by Kyle Wiggers originally published on TechCrunch

a16z-backed Tellus wants to help people use their savings to become real estate investors

Crypto is not having a good week, as Bitcoin crashed to under $17,000 — its lowest level in two years. The stock market continues to post declines as layoffs abound. Meanwhile, inflation recently reached a 40-year high.

For those looking for a safe place to park their cash and actually earn a decent amount of interest on their savings above the national average APY of just 0.20%, the options are not exactly plentiful.

Enter Tellus. The six-year-old fintech startup claims it can offer people yields of 3.85% to 4.5% on their savings balances by using the money to fund certain U.S. single-family-home loans.

With mortgage interest rates having more than doubled since a year ago, one might think that this is not the best time to be a digital mortgage lender.

But co-founder Rocky Lee believes his company’s unique business model sets it apart from other such lenders in the space.

For one, the company has a very niche offering. It targets existing home owners who wish to upgrade to larger homes without selling the homes they live in, which makes it difficult for them to get approved for loans by traditional mortgage lenders.

If it sounds complicated, well, it is.

Lee breaks it down as such: “The home they [Tellus’ borrowers] buy typically is not the starter home. What they are seeking is called a super jumbo loan, which is designed for people that actually don’t have a ready to use mortgage solution. And we provide that solution for those categories of people.”

So where does the savings part come in?

Tellus’ interest rates are typically 200 bps higher than the standard conforming mortgage. For example, in today’s market if a loan’s rate is 7%, Tellus will charge 9% — a premium because it claims it’s offering to lend money to American single-family-home borrowers “in prime cities” who would otherwise not be able to get such loans. Because it is using its retail customers’ savings deposits to fund these loans at a 3.85% to 4.5% yield, Tellus makes its money on the spread of what it’s paying out in interest versus what it’s charging its borrowers.

Its retail customers are able to earn interest on a daily basis, while getting help with things such as budgeting funds and setting financial goals. Tellus says it promotes financial literacy by quizzing users on financial terms, for example, and then rewarding them with higher interest rates. At the same time, the company touts that it is enabling these consumers to invest in real estate in a way they would not have otherwise been able to while having the ability to withdraw their money at any time.

While its strategy might sound risky, Lee told TechCrunch that Tellus utilizes “very strict underwriting criteria” and has not yet seen any defaults because the majority of its borrowers go on to soon after refinance their loans at more favorable terms.

Since its 2016 inception, Tellus has lent out more than $80 million with an average loan size of $2 million. It partners with mortgage brokers to find borrowers. And it finds its retail clients via channels such as Instagram, TikTok and Google. Since the company is mobile-first, it focuses on people using a smartphone. Tellus allows anyone in the U.S. to use its savings software. It only lends in California because that’s where it has a lending license and partnerships.

Despite a challenging real estate market, the company says it grew its revenue by 55% in the third quarter compared to the second quarter of 2022, according to co-founder T Zhu. And earlier this year, it raised $16 million in a seed round of funding led by Andreessen Horowitz (a16z) and with participation from All-Stars Investments, Alumni Ventures, Decent Capital, Vectr Ventures, West Arrow and Westwood Ventures. Co-founders of YouTube, Lime and Sereno Group Real Estate also participated in the financing, which followed a $10 million SAFE.

The remote-first, Cupertino, California-based startup is emerging from stealth as it seeks to build out its engineering, marketing and product teams, adding to its headcount of 50. It also plans to build upon its recently launched new offering aimed at SMBs.

My weekly fintech newsletter, The Interchange, launched on May 1! Sign up here to get it in your inbox.

a16z-backed Tellus wants to help people use their savings to become real estate investors by Mary Ann Azevedo originally published on TechCrunch

Amazon debuts Sparrow, a new bin picking robot arm

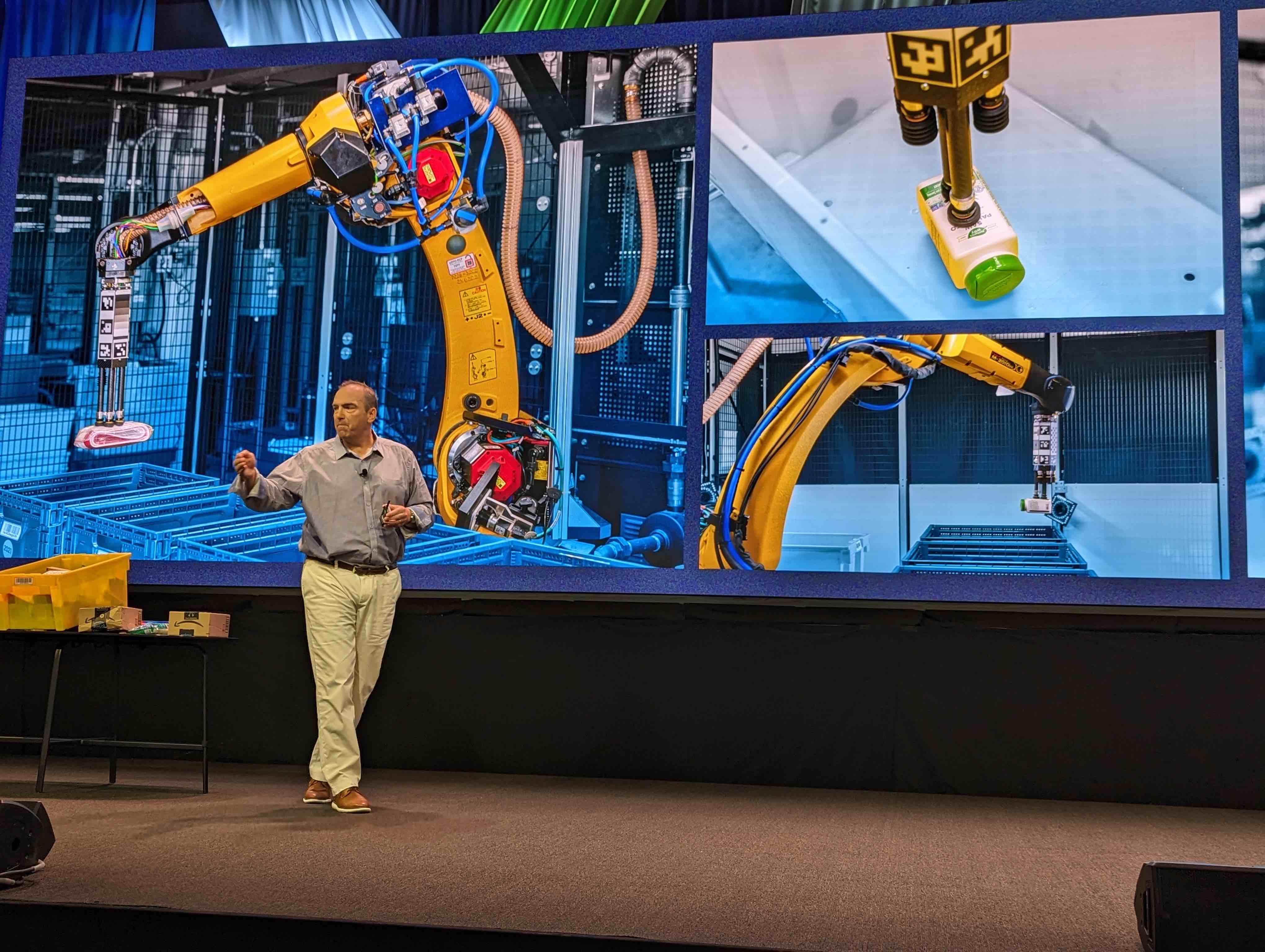

The bin moving robots designed by Kiva Systems still form the foundation of Amazon’s warehouse robotics play a decade after it acquired the startup. There’s a reason — for example — that the recently announced fully autonomous Proteus robot effectively looks like a green (“Seahawks green,” per robotics VP, Joseph Quinlivan) version of one of those systems. Over the years, the retail giant has broadened the scope of its warehouse ‘bots – hundreds of thousands of them now occupy fulfillment centers across the U.S.

Image Credits: Brian Heater

As one might imagine, robot arms are a big piece of that puzzle. Robin (which debuted 18 months ago) and Cardinal (which rolls out this year) are the two most prominent examples, both designed to move packages and send them on their way inside the warehouse. Cardinal is effectively an update to Robin that’s able to pack boxes full of packages. There are currently around 1,000 Robin units deployed in Amazon warehouses.

At an event held in its Westborough, Massachusetts robotics center (about 40 minutes from downtown Boston), the company added a third bird into the mixSparrow.

Image Credits: Amazon

The new arm is a more sophisticated take on the company’s existing robotic arms, adding the ability to pick and place specific objects in bins. The arm’s computer vision and AI are capable of identifying and move “millions” of items, according to the company.

Amazon writes,

Working with our employees, Sparrow will take on repetitive tasks, enabling our employees to focus their time and energy on other things, while also advancing safety. At the same time, Sparrow will help us drive efficiency by automating a critical part of our fulfillment process so we can continue to deliver for customers.

The company is, of course, quick to point out that Sparrow (along with its other robots) is designed to replace repetitive tasks – and, perhaps, save a few human backs in the process. It’s understandably become common practice to get out ahead of the standard criticism of companies automating away jobs, but pointing out that these systems,

1. Have the ability to actually create more jobs in the long run and

2. Those are “better” jobs than the standard warehouse fare.

Image Credits: Amazon

Per the second, Amazon attached a note about its employee education programs in the Sparrow blog post, noting,

An example of our commitment to advancing employee careers is our Amazon Mechatronic and Robotics Apprenticeship. A 12-week classroom apprentice program covered by Amazon that is followed by 2,000 hours of on-the-job training and industry-recognized certifications, helping our employees learn new skills and pursue in-demand, technical maintenance roles. Following completion of the apprenticeship, employee pay increases by approximately 40% for program participants.

Amazon debuts Sparrow, a new bin picking robot arm by Brian Heater originally published on TechCrunch

https://techcrunch.com/2022/11/10/amazon-debuts-sparrow-a-new-bin-picking-robot-arm/

Coefficient wants to bring live data into your existing spreadsheets

With the explosive adoption of software-as-a-service (SaaS) apps, the average company now has more than 100 SaaS apps to manage — leading to data being siloed across countless different systems. That makes analysis challenging. To wit, according to Forrester, between 60% and 73% of all data within an enterprise goes unused for analytics.

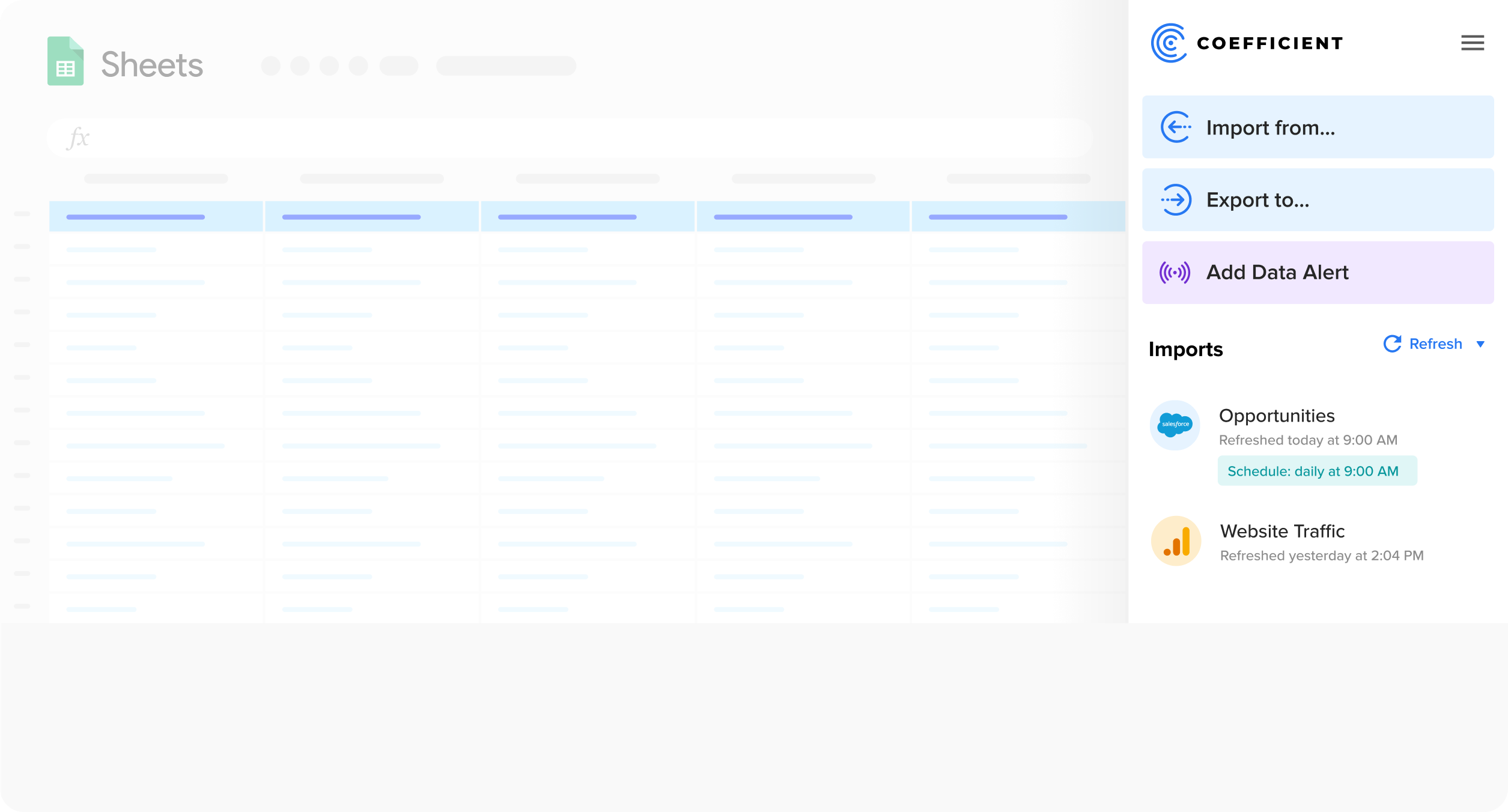

Ideally, analysts need something that connects disparate enterprise systems, like business intelligence and analytics tools. But these tools are often complex and unintuitive, leading employees to spend hours each day searching and gathering information. In search of an answer, Navneet Loiwal teamed up with Tommy Tsai, with whom he’d previously founded an e-commerce app, to build Coefficient, an app that brings live data into Google Sheets and other existing spreadsheet platforms.

“Tsai and I had worked on consumer technologies for many years, and we saw a big opportunity to bring consumer-grade experiences to companies,” Loiwal told TechCrunch in an email interview. Loiwal was previously a software developer at Google working on AdWords, while Tsai was an early engineer at location-sharing smartphone app Loopt. “Most data products are designed for the technical user, which results in a poor user experience and low adoption for business users. We wanted to bring the power of technical products to the business user with the simplicity that they expect in their consumer lives.”

To this end, Coefficient — which today closed an $18 million Series A funding round — is designed to cut down on the number of manual and repetitive tasks business users have to complete daily to cross-reference data across systems. The platform lays on top of Google Sheets (with support for Excel forthcoming), bringing in data from customer relationship management (CRMs) systems, SQL databases and other SaaS tools.

Using Coefficient, users can create, share and automate live reports, set up alerts and write data back to connected SaaS tools. A template gallery provides pre-made spreadsheet dashboards for common reports used by business operations teams (think team KPIs, leadership dashboards and decks and revenue analyses), which users can integrate with existing data systems to enable live data to power all charts within their spreadsheets.

Coefficient’s spreadsheet add-on. Image Credits: Coefficient

“Business users are more technical in the spreadsheet than anywhere else, yet business teams are often forced to resort to archaic methods of managing data — requesting frequent updates from technical teams with data expertise or exporting raw data from dashboards or CRMs to report repeat, manual analysis, reducing team efficiency and productivity,” Loiwal said. “Coefficient’s products extend the reach of advanced, connected data and analytics to business users, enabling the business to become more self-sufficient through real-time connectivity to the data in their source systems from where they’re working: in spreadsheets.”

That’s a lot to promise. And to be sure, Coefficient isn’t the first to attempt this sort of thing. Startups like Airtable and Smartsheet already offer spreadsheet-like UIs to organize business data. Others have tried to put their own spins on the formula, like spreadsheets with apps and spreadsheets with granular access controls.

Indeed, at first glance, Coefficient sounds a lot like Actiondesk, which similarly connects with databases, CRMs and SaaS tools to feed live data into Excel and Google Sheets spreadsheets. Like Coefficient, Actiondesk supports common formulas and offers templates for getting started.

But to its credit, Coefficient got off to an auspicious start — Loiwal claims that Zendesk, Spotify, Foursquare, Contentful and Miro are among its customers. Combined, tens of thousands of people are currently using the platform.

“We are seeing our customers grow their contracts with us despite undergoing layoffs — a testament to the value proposition of making business teams more efficient,” Loiwal said. “Additionally, with increased remote work and complex economic headwinds, companies need their employees to become more self-sufficient.”

Loiwal says that the proceeds from the Series A will be put toward expanding Coefficient’s product offerings and “scaling global operations.” In the coming months, the startup plans to add new SaaS system integrations and expand the scope of its reporting automation tools.

Battery Ventures led Coefficient’s Series A with participation from Foundation Capital and S28 Capital. To date, the company has raised $24.7 million in capital.

Neeraj Agrawal, a general partner at Battery Ventures, added: “It is a testament to the Coefficient team’s product craftsmanship that users become evangelists, promoting use of the product throughout the organization … Coefficient products equip business users with the tools and automation needed to reach peak performance, a critical advantage amid an unpredictable macroeconomic environment.”

Coefficient wants to bring live data into your existing spreadsheets by Kyle Wiggers originally published on TechCrunch

https://techcrunch.com/2022/11/10/coefficient-live-data-excel-google-sheets-spreadsheets/