Category: TECHNOLOGY

Savana raises a fresh round of capital to digitize banks’ services

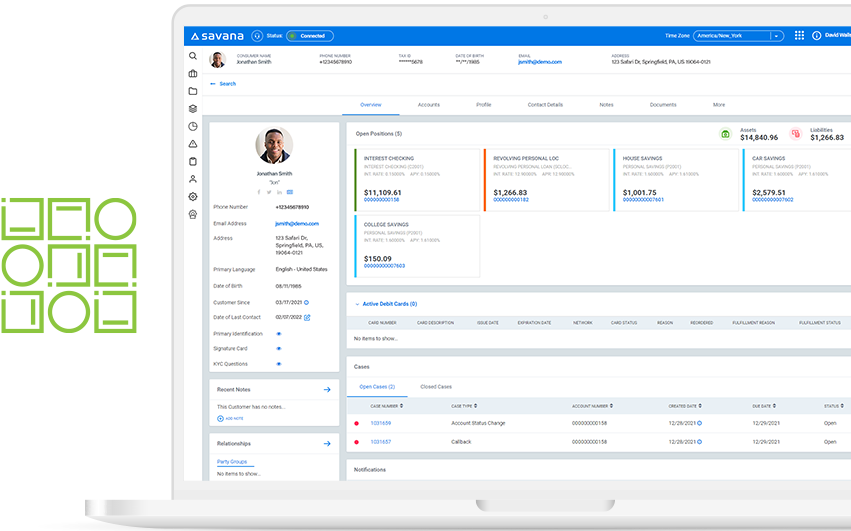

More specifically, Savana attempts to decouple third-party components of banking systems and abstract them into APIs that encapsulate not only the components, but also the rules, workflows, automations and integrations required to perform business tasks. The APIs serve as a library of customer and account servicing functions that are reusable and complementary to Savana’s enterprise content management system, a repository of a bank’s content related to customers and accounts. Beyond this, Savana offers a low-code UI framework to build internal and customer-facing apps that interface with the aforementioned APIs.

“Through pre-configured processes and integrations, [bankers using Savana] gain a real-time, holistic view of all customer accounts, cards, communications, and more, while customers benefit from better, more personalized service,” Sanchez continued. “It eliminates process silos by automating processes between systems and people and eliminates the need for multiple, siloed vendors. [The] turnkey, end-to-end platform is pre-configured with hundreds of APIs enabled.”

Of course, Savana doesn’t stand alone in the market for banking modernization tools.

Malvern, Pennsylvania–based Savana, a company building financial software products for legacy banks, today announced that it raised $45 million. A portion of the capital — $10 million — was debt, while the rest was a Series A equity tranche led by Georgian Capital Partners.

CEO Michael Sanchez told TechCrunch that the proceeds will be put toward general growth and supporting Savana’s go-to-market and product development projects.

Savana was founded in 2009 by Sanchez, who previously served as the president of the international division of FIS. Prior to FIS, he launched Sanchez Computer Associates, a supplier of core banking systems.

The problem Savana solves pertains to architecture, Sanchez tells TechCrunch. Despite banks’ digital transformation efforts, many haven’t made the switch successfully, he ardently claims.

To his point, a 2022 survey found that — among banks and credit unions who believe they’re at least three-quarters through a transition to digital — less than 25% have seen a meaningful increase in revenue. Moreover, only 11% of finance executives say their organization has modernized systems to the point where they can easily incorporate new digital technologies, according to Deloitte.

“Today’s consumers prefer digital-only banking. This change in consumer behavior has been underway for a number of years and accelerated by COVID-19 shutdowns, which led consumers to complete everyday tasks, such as shopping for groceries, depositing their checks, or managing their bills, all online,” Sanchez said in an email interview. “Despite appearances that banks have all made the transformation to digital, the majority of banks are not ready for this major change in consumer behavior … This is a major problem for banks trying to stay competitive in an environment with tons of fintech pressure.”

Savana purports to solve this problem through a combination of templates, APIs and integrations engineered to automate back-office and core banking processes. The company’s platform provides a “process architecture” for service spanning various banking and customer channels, ostensibly speeding the time to market for products and ensuring service requests get addressed quickly.

A glimpse at Savana’s service management dashboard. Image Credits: Savana

More specifically, Savana attempts to decouple third-party components of banking systems and abstract them into APIs that encapsulate not only the components, but also the rules, workflows, automations and integrations required to perform business tasks. The APIs serve as a library of customer and account servicing functions that are reusable and complementary to Savana’s enterprise content management system, a repository of a bank’s content related to customers and accounts. Beyond this, Savana offers a low-code UI framework to build internal and customer-facing apps that interface with the aforementioned APIs.

“Through pre-configured processes and integrations, [bankers using Savana] gain a real-time, holistic view of all customer accounts, cards, communications, and more, while customers benefit from better, more personalized service,” Sanchez continued. “It eliminates process silos by automating processes between systems and people and eliminates the need for multiple, siloed vendors. [The] turnkey, end-to-end platform is pre-configured with hundreds of APIs enabled.”

Of course, Savana doesn’t …read more

Instagram is being MySpaced by TikTok and other TC news

This week on the TechCrunch Podcast, Becca Szkutak comes on to talk about the fraught state of extension rounds for many early-stage startups and Devin Coldewey about upcoming changes to Instagram that a lot of users agree will make the app much worse. And as always, Darrell will catch you up on the tech news you may have missed this week.

Articles from the episode:

- Instagram to walk back full-screen home feed and temporarily reduce recommended posts

- Instagram gets worse with dark patterns lifted from TikTok

- Every startup wants an extension round, but there aren’t enough to go around

Other news from the week:

- Meta posts its first ever quarterly revenue decline

- Amazon’s shares rise on earnings beat, despite $2B loss

- iPhone revenue up slightly for Q3, as other hardware categories lose steam

- Rivian begins laying off 6% of workforce

- T-Mobile will pay out $350M to customers in data breach settlement

https://techcrunch.com/2022/08/02/instagram-is-being-myspaced-by-tiktok-and-other-tc-news/

Innoviz lidar will be on all VW vehicles with automated driving capabilities

Israeli lidar startup Innoviz will supply its lidar sensors and perception software to all vehicles with automated driving capabilities within Volkswagen group brands, the company said Tuesday.

Innoviz will work directly with Cariad SE, VW’s automotive software company, to integrate its technology into upcoming VW vehicles.

The partnership with VW is Innoviz’s third design win with a Tier 1 supplier. In April, BMW revealed that Innoviz’s lidar would be on the 2023 BMW i7 electric vehicles, and in May last year, Innoviz was selected by another unnamed Tier 1 automotive supplier for its autonomous shuttle program.

VW hasn’t yet revealed which models will first be built with Innoviz’s tech, but the automaker has been making several moves towards boosting its advanced driver assistance systems (ADAS) and autonomous driving capabilities. Earlier this year, Cariad and Bosch teamed up to develop software for automated driving for use in VW’s cars, and in May, VW chose Qualcomm’s Snapdragon Ride platform to power its ADAS and automated driving.

Innoviz says the VW program, which brings with it a forward-looking order book of $4 billion, takes the startup’s total estimated sales up to $6.6 billion.

Innoviz says it is able to achieve a high level of performance, up to 300 meters of visual range, at a low cost using a 905 nanometer (nm) laser. Velodyne, a lidar rival, also uses a 905 nm laser and claims to be able to reach up to 300 meters of range. However, Velodyne’s highest performance lidar is 128 lines at up to 20 frames per second. To compare, Innoviz has 600 lines at up to 20 frames per second, the company says.

Keilaf claims Velodyne’s products are priced in the thousands of dollars, whereas Innoviz’s is priced in the hundreds. TechCrunch was unable to confirm costs with Velodyne.

“What really sets Innoviz, and this deal, apart is that we won the deal as a Tier 1 supplier,” Keilaf told TechCrunch. “Innoviz is the only lidar manufacturer to have achieved this designation. This signals a major shift—not just for Innoviz, but for the entire automotive industry—in the way that carmakers partner with their tech providers. As a Tier 1 supplier, we benefit from direct access to OEMs, as well as increased margins and profits.”

Cybrary secures $25M to grow its platform for cybersecurity training

The cybersecurity industry has taken a hit recently, with economic headwinds prompting layoffs and a broad investor pullback. But some firms have escaped unscathed, like cybersecurity training platform Cybrary, which today announced that it raised $25 million in a Series C funding round. CEO Kevin Hanes conveyed to TechCrunch that the round, which brings Cybrary’s total raised to $48 million, was led by BuildGroup and Gula Tech Adventure and will be put toward developing “content and capabilities” on the company’s platform.

Cybrary was launched in 2015 by co-founders Ralph Sita and Ryan Corey (Hanes joined as CEO a year ago). As Hanes tells it, their mission was to break down barriers to the cybersecurity industry by creating a way for aspiring professionals to enter the field — no matter their background or experience.

“There are an estimated 3.5 million unfilled cybersecurity roles today. Studies suggest the global cybersecurity workforce needs to grow 65% to effectively defend organizations’ critical assets. Introducing more products and technology will not help organizations solve this fundamental issue,” Hanes told TechCrunch via email. “Investing in people is key to narrowing the cybersecurity skills gap and helping to combat increasing burnout and human error. Cybersecurity professionals at every stage of their careers need an affordable and accessible training platform to arm them with the skills and confidence to respond to threats.”

Cybrary’s e-learning portal offers access to training content, including online courses and tools, built around adversary techniques and vulnerabilities. Contained within the catalog are activities led by cybersecurity experts, covering topics like ethical hacking, digital forensics, web app security and networking and operating systems.

Hanes makes the case that Cybrary is a more affordable alternative to in-person bootcamps and other cybersecurity e-learning platforms on the market. A Pro plan, which includes certification prep, labs, and practice assessments, starts at $59. While some might argue that Cybrary isn’t as comprehensive as an intensive, weeks-long bootcamp, it’s indeed a fraction of the cost — most cybersecurity bootcamps average in the thousands of dollars.

“Decision makers should assess the most risk they can reduce with the next dollars they spend and consider the case for training their team,” Hanes said. “Worldwide, 80% of organizations suffered one or more breaches that they could attribute to a lack of cybersecurity skills and awareness. So leaders need to invest in their people, not only to reduce organizational risk, but also to build a cybersecurity talent pipeline across their organizations.”

Eighty-employee Cybrary has reasonably strong traction in the market, with more than 3.7 million users and 742 companies enrolled in its Cybrary for Teams product. The startup also has a budding defense business, involving what Hanes vaguely described as “many” different government groups and military branches.

“Ramping up our in-house cybersecurity expertise has enabled us to create a new style of training that is focused on hands-on skills and understanding real-world threats and vulnerabilities, and how to ensure …read more

Identity verification company Youverify extends seed funding to $2.5M as it expands across Africa

This past month has seen several African fintechs such as Flutterwave and Union54 make headlines for compliance checks and fraud issues. Both unlinked events re-emphasize the importance of know your customer (KYC) and anti-money laundering (AML) checks and why regulators enforce strict policies that financial institutions need to be held accountable to while operating across the continent and globally.

For the many startups whose services help keep the operations of financial institutions such as banks and fintechs in check, this period highlights their relevance more than ever. In the latest development, Youverify, a Lagos and San Francisco–based identity verification company helping African banks and startups automate KYC and other compliance procedures, is announcing that it has secured a $1 million seed round extension. The startup raised a $1.5 million round in 2020, bringing its total seed raise to $2.5 million.

Africa-focused VCs Orange Ventures and LoftyInc Capital, the two investors who co-led its initial seed round, also led the extension. Additional investment came from Octerra Capital, Plug & Play Venture, Syntax Ventures, HTTP Investors, Afer Group and Fronesyz Capital.

The proliferation of financial services in Africa is beginning to attract more scrutiny from regulators. According to reports, transactions worth $116 billion will be made through digital payment channels this year, requiring stringent measures to prevent identity theft and fraud. Therefore, the rise in focus on maintaining transparency in financial regulations and improving strategies for KYC and AML by implementing regulatory technologies has become a significant growth factor for the market. And as regtech demand globally increases, so will Africa’s, with reports saying it will reach about $1.2 billion in the next five years.

Youverify came into Africa’s regtech scene when founder and CEO Gbenga Odegbami founded the company in 2018. Launched in the Nigerian market, Youverify first provided API for address and identity verification to several financial institutions. Now it has added more KYC products and expanded into new markets such as Ghana, Côte d’Ivoire, South Africa, Kenya and Uganda.

“The way our customers see us is that we help them automate their KYC and compliance issues,” said Odegbami on a call with TechCrunch.

In addition to verifying identities beyond Nigeria’s bank verification number (BVN) and addresses, Odegbami says Youverify layers KYC and compliance products such as transaction monitoring. He further explained that these offerings cater to issues some fintech platforms have faced recently: alleged AML issues in the case of Flutterwave in Kenya and Ping Express in the U.S. and fraud in the case of Union54’s chargebacks. In the latter, Youverify claims it could’ve prevented large-scale chargeback fraud by identifying the pattern of transactions to flag fraud, blocking the virtual cards and tying them back to fraudsters committing the multiple fake chargebacks.

“They [Union54] grew faster than they could put in place the proper transaction monitoring and fraud detection systems that will identify transactions happening from their customers,” the CEO said of the …read more

Amazon launches AWS ‘skill builder’ training subscriptions starting at $29 per month

Skilling up

It’s worth noting that each of the so-called “big three” cloud companies have introduced all manner of training courses through the years as they try to sway developers and companies over to their respective ecosystems. For the most part,

Amazon’s AWS is introducing premium paid subscriptions for individuals and teams looking to bolster their cloud computing skills.

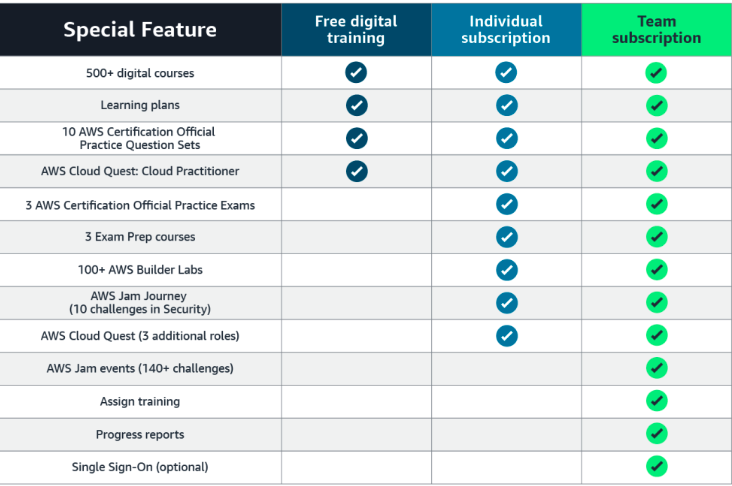

Amazon announced a bunch of free cloud skills training products last November, one of which was AWS skill builder, an online learning center featuring hundreds of free cloud computing courses. With AWS skill builder subscriptions, the tech giant is now looking to monetize the offering through monthly subscriptions that usher in a bunch of extra features and services on top of the basic free training plan.

Individual subscriptions are priced at $29 per month or $299 for the year, and they offer three practice exams for those looking to pass an official AWS Certification program, which the company has offered for the past decade. On top of that, subscribers are offered tools such as “builder labs,” which are basically practical guided exercises spanning some of the more common cloud situations — users are given a sandboxed AWS account for the exercise.

Team subscriptions, meanwhile, weigh in at $449 per learner each year, though high-volume discounts are available. This plan includes a bunch of enterprise-focused features such as the ability to assign training exercises, progress reports, and integration with a company’s single sign-on (SSO) provider.

AWS Skill Builder Subscriptions

Skilling up

It’s worth noting that each of the so-called “big three” cloud companies have introduced all manner of training courses through the years as they try to sway developers and companies over to their respective ecosystems. For the most part, they’ve largely been free (though there are many premium courses available through third-party partnerships), but we are starting to see a push toward cloud companies charging their existing customers for skilling up, which is what Amazon’s latest program is all about. By charging a recurring fee, this may encourage users to place a greater value on the courses, and ensure that they keep up with their learning — while simultaneously giving AWS a small revenue boost.

Last year Google introduced Google Cloud Skills Boost with the goal of training 40 million people how to use various facets of its cloud platform. This was powered by its 2016 acquisition of Qwiklabs, and similar to Amazon’s new effort, it charges $29 or $299 depending on whether the user wants to commit to a monthly or annual subscription. There is also a team subscription option that’s apparently available upon request.

If nothing else, all this helps to highlight how pivotal the cloud has become in the fortunes of Big Tech. Despite the global economic climate and a $2 billion loss, Amazon last week reported continued strong cloud growth, with AWS revenues jumping 33% year-on-year to $19.74 billion in Q2.

But while cloud spending is clearly going up, IT skills gap aren’t necessarily keeping apace, and addressing this disparity is something that Amazon hopes its customers will be willing to pay for.

Sheryl Sandberg officially stepped down as Meta COO on August 1, filing shows

We knew it was happening, but Meta has confirmed that its long-standing chief operating officer (COO) Sheryl Sandberg has departed from her role as of yesterday (August 1).

News emerged on June 1 that Sandberg would be stepping down after more than 14 years in position and would be replaced by chief growth officer Javier Olivan, though no specific date was given. But in a SEC filing yesterday, Meta revealed the transition is now complete. Moving forward, Sandberg will remain a Meta employee through September 30, 2022, after which she will continue purely as a board member.

Meta struggles

The switch comes at a turgid time for Meta, having just reported its first ever quarterly revenue decline, while the FTC also confirmed that it was suing Meta to block its acquisition of VR fitness studio Within. On top of that, Meta just can’t seem to shake off the Cambridge Analytica data scandal, an episode that involved a U.K. political consulting firm siphoning Facebook data as a means to predict and influence voters’ behavior through targeted ads. After nearly four years of legal wrangles, a class-action lawsuit moved a step closer last month when it was confirmed that cofounder and CEO Mark Zuckerberg and Sandberg would both be deposed, in an upcoming hearing that could see both executives testify for up to 11 hours in total. Court documents also revealed that new COO Olivan will testify for up to 3 hours.

Sandberg’s departure represents part of a broader restructuring at Meta, with chief financial officer (CFO) David Wehner scheduled to step into the role of chief strategy officer (CSO) on November 1, a move that some may interpret as intended to give investors’ confidence that it’s making moves to steady ye olde Meta ship. Elsewhere, current VP of finance, Susan Li, will step into the CFO role.

Sandberg’s departure represents a milestone moment in the Meta / Facebook story, given how instrumental she was in the company’s evolution into the major moneymaking machine it is today. In a post back in June, Zuckerberg noted that Olivan wouldn’t be a direct replacement for Sandberg in terms of the role he will play, even if the job title will remain the same — Olivan will head up Meta’s ads and business products, and oversee the teams focused on “infrastructure, integrity, analytics, marketing, corporate development and growth,” he wrote.

“Looking forward, I don’t plan to replace Sheryl’s role in our existing structure,” Zuckerberg noted. “I’m not sure that would be possible since she’s a superstar who defined the COO role in her own unique way. But even if it were possible, I think Meta has reached the point where it makes sense for our product and business groups to be more closely integrated, rather than having all the business and operations functions organized separately from our products.”

Arena raises money from Peter Thiel and David Petraeus for its decision-making AI

Can AI automate enterprise decision-making? It’s an exceptionally broad and challenging task — assuming it’s within the realm of possibility. But that’s what startup Arena claims to do, fueled by a round of funding ($32 million) led by Initialized Capital and Goldcrest Capital along with Founders Fund, Flexport and a colorful cast of characters, including retired general David Petraeus, Peter Thiel, and Y Combinator CEO Michael Seibel.

New York–based Arena is the brainchild of Pratap Ranade and Engin Ural, who co-founded the company in 2020. The two were inspired to build a platform that could, leveraging predictive algorithms, help businesses formulate strategies to navigate “uncertain” environments — like a global pandemic.

Ranade, who attended Stanford and Columbia, was previously an associate partner at McKinsey and co-founded web-scraping startup Kimono Labs, which was acquired by Palantir in 2016. Ural was an app developer at Goldman Sachs before joining Palantir as an engineer, where he met Ranade.

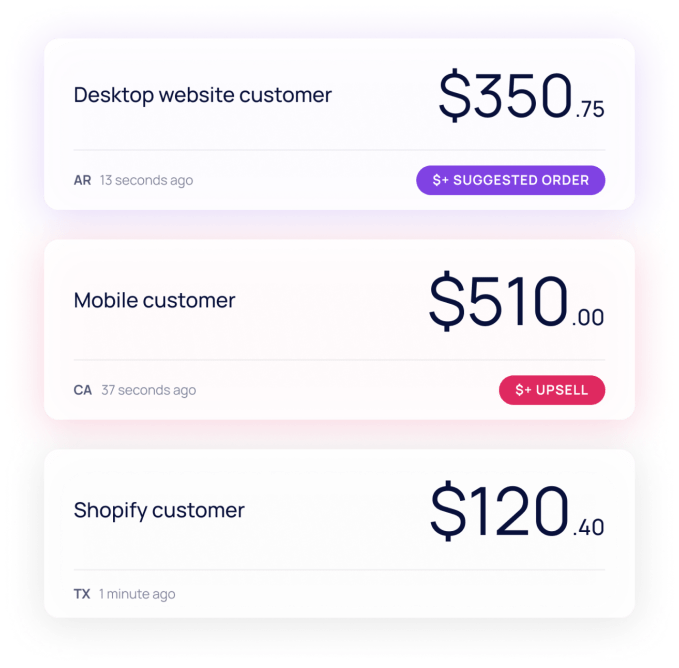

Arena’s services are wrapped up in a lot of hyperbolic language, but they’re relatively straightforward in execution. One of the startup’s tools uses AI techniques to simulate an economy, testing out millions of product pricing configurations to arrive at an optimal model for a company. It brings to mind the AI Economist, a Salesforce-developed research environment that similarly runs millions of simulations to come up with plausible fiscal policy.

Beyond pricing, Arena can ostensibly simulate things like inventory management. Ranade also claims it can account for “deviations” in the economic environment, like headwinds stemming from snarled supply chains, in making recommendations to customers (i.e., execs).

Image Credits: Arena

“Without Arena, enterprises traditionally approach such decisions in a few ways: Hiring large teams of people to make these decisions, buying decision assistance software to help people in operational roles make data-driven decisions, or do nothing and continue pushing through with traditional processes,” Ranade told TechCrunch via email. “Each of these approaches has merit, but they are a far cry from the full promise of AI: truly intelligent machines that operate autonomously, on our behalf, to elevate human potential.”

Arena clients feed the platform data like SKU-level sales, pricing, inventory at the location level and shopper behavior during e-commerce sales. Arena augments that data with context from what Ranade calls the “demand graph,” which provides broader, real-time market signals. Together, these inputs are used to create the aforementioned simulations, which in turn produce models for pricing, inventory and marketing that are then fine-tuned world data.

“Today, when the most sophisticated, data-centric business-to-business companies run a promotion, data scientists analyze past data to determine the best type of promotion to run for a specific product in a specific market. They then load the promotion into their enterprise resource planning system, and weeks after, will analyze its performance,” Ranade said. “With Arena, this entire process is autonomous … Under the hood, Arena’s AI actively adapts to changing price elasticity and personalizes to customer behavior, making adjustments as it learns in real-time to drive bottom …read more

A16z-backed Shein challenger Cider is growing rapidly

Shein has shown the world how combining social media marketing, data analytics, and China’s well-oiled supply chain has created a $100 billion fast fashion behemoth.

Its success naturally spawns imitators and challengers. Among its fastest-growing challengers is Cider, which, like Shein, relies on China’s responsive clothing manufacturers to sell affordable, trend-led pieces to customers around the world.

Cider has racked up roughly 7.4 million installs across the world to date, according to data provided by market intelligence firm Sensor Tower. That number is dwarfed by Shein, which gained over 170 million downloads worldwide in 2021 and surpassed Amazon as the top shopping app in the U.S. last year.

But keep in mind Cider was only founded in 2020 while Shein started out over a decade ago. And Cider has broken into the crowded U.S. market, which accounts for 43% of its total downloads. In the first half of 2022, it recorded 2 million downloads in the U.S., marking a staggering 1,686% year-over-year growth.

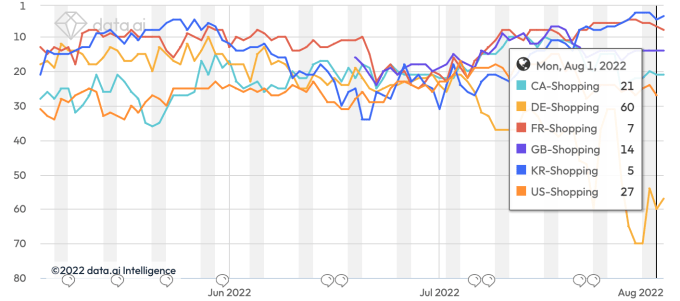

Cider’s other major markets are the U.K., Germany, France, Canada, and South Korea, Sensor Tower finds. It currently ranks among the top 10 shopping apps in the App Stores of France and South Korea, app analytics firm Data.ai shows.

Cider’s App Store rankings over the past 90 days. Data: Data.ai

Shein has grown to be too big to be easily toppled, so startups like Cider are targeting the giant’s untapped niches instead. A browse around Shein today shows the company is increasingly coming after Amazon and is unbounded by its origin in fashion. From pet toys to air purifiers, Shein keeps on widening its product offerings.

Cider, in comparison, is more focused. It clearly wants to be the go-to shop for Gen Z consumers with its array of Y2K looks of crop tops and vibrantly colored tees.

The startup’s traction is by no means a shock given the list of resourceful investors that it has attracted: a16z, of which partner Connie Chan personally explained how Cider’s demand-driven marketplace works; DST Global, ByteDance’s early investor; IDG Capital, one of China’s most prominent VC firms; and MSA Capital, which bets on global startups inspired by China’s tech business models.

As of last September, Cider had raised $130 million in funding and crossed the $1 billion valuation point.

The company is vague about its physical base, saying only it “has offices in Los Angeles” and employs between 200-500 employees, according to its website. It won’t be surprising if the firm announces one day that its headquarters is outside China. Over the past few months, Shein, which has for years clung to the narrative that its inception was inspired by its founder’s trip to LA, has been shifting its key assets to Singapore.

As China tightens control over how tech firms move data across borders and Chinese firms become increasingly ensnarled in geopolitical complications, Chinese-founded startups will look to position themselves as “global” companies, …read more

https://techcrunch.com/2022/08/02/shein-a16z-challenger-cider-growth/

Locket, the popular app that lets you post photos to your loved ones’ homescreens, raises $12.5M

Moss says Locket plans to launch new features in the coming months that will stick to the core idea of sharing little moments of your day with your favorite people. Among the new features will be new ways to respond to photos. Overall, Moss says the new features will be focused on making users’ homescreens feel more dynamic and personal. The company is also in the early days of launching a subscription model, but is currently focused on building out new features for the time being.

The company’s $12.5 million investment consists of two funding rounds. The company raised $2.5 million when Locket was first gearing up to launch in January 2022 after conducting a small round consisting of friends and close contacts. Locket then raised $10 million in seed funding in late April in a round led by OpenAI CEO Sam Altman. The round included participation from existing investors Sugar Capital and Costanoa Ventures, along with Instagram co-founder Mike Krieger and Quora CEO Adam D’Angelo.

When asked if Locket plans to add filters or effects to its camera, Moss said he doesn’t have any immediate plans to do so. He believes that it’s important for people to feel free to capture their true selves and that the best way to do that is with a simple camera experience.

He also believes Locket can help make phones feel more personal to users by ensuring that their favorite people are at the center and focus of their devices.

“I think phones have felt pretty impersonal for a long time now, as everyone opens up their phone to the same kinds of generic apps. I think we have an opportunity to flip that so the phone feels like a place where your favorite people are at the center. That’s the long-term vision that’s guiding us, particularly at a time when a lot of social media is shying away from content from your friends and keeping up with people you really care about. But, there’s always going to be a natural need for people to feel closer with their favorite people.”

Moss’s comments about social media platforms shying away from content from friends comes at a time when

Locket, a popular app for sharing photos straight to your family and friends’ homescreens, has raised $12.5 million in funding. The app rose to the top of the App Store charts after launching on New Year’s Day this year and has since amassed more than 20 million downloads. Locket’s simple premise of putting photos from your friends and family onto your homescreen embodies a private social networking platform that aims to make you feel closer to your loved ones. Since its launch, Locket has seen over 1 billion photos shared.

The app was founded by Matt Moss, a former Apple Worldwide Developer Conference student scholarship winner and recent UC Santa Barbara grad. Moss initially created Locket as a personal side project for his girlfriend as a way to capture and share a genuine moment of his day with her. Moss’s friends had asked if they could use the app with their own friends and family, after which Moss made Locket publicly available on the Apple App Store and on the Google Play Store shortly after.

Moss told TechCrunch in an interview that he believes traditional social media platforms are designed to share content with hundreds of your closest friends and can also introduce challenges, such as being overly focused on like counts or continuously scrolling through endless feeds. Locket, on the other hand, is designed to make people feel closer to the 10-15 people in their lives that matter the most, while providing a simple release from doomscrolling and algorithmic feeds. The widget allows you to add up to 20 people to your homescreen, and Moss says this number is the natural limit for Locket’s core premise of focusing on your closest connections.

As for the new funding, Moss says Locket plans to use the money to hire more people and roll out new features while staying true to its core premise of helping users feel closer to their significant others, best friends and family.

“It’s been exciting to see the product resonate with people, but going forward, we have an even bigger opportunity to become the best way for people to stay in contact with those 10 to 15 people that matter the most,” Moss said. “The main impetus behind the funding is really just to accelerate; it’s just going to let us hire more people and continue to ship new features and become the product that is the best way to stay in contact with your close friends and family.”

Image Credits: Locket

Moss says Locket plans to launch new features in the coming months that will stick to the core idea of sharing little moments of your day with your favorite people. Among the new features will be new ways to respond to photos. Overall, Moss says the new features will be focused on making users’ homescreens feel more dynamic and personal. The company is also in the early …read more