Category: TECHNOLOGY

Writer introduces product that could help reduce hallucinated content in its LLMs

As companies explore generative AI more deeply, one of the more confounding issues is the hallucination problem, where if the model doesn’t know the answer, it simply makes one up, whether it makes sense or not. To work in business, finding a way to mitigate this problem is paramount.

Today, Writer, the generative AI writing platform, announced Knowledge Graph in public beta, a tool which enables companies to collect all of the current source content across an organization in a graph database. Company CEO May Habib says that by making use of the customer’s own content, Knowledge Graph can act as a kind of content validator, checking it against the generated content

“The great thing about an LLM is that if it has actual information about what you’re trying to do, it will use that information,” she said. “Knowledge Graph provides the ability to easily get the information that matters — databases, knowledge bases, shared drives, chats — into embeddings so that it can be used by the LLM in service of the very specific use cases our customers build around.”

It will automatically highlight content that needs to be fact-checked, while suggesting a replacement statement based on the most relevant content in the Knowledge Graph when appropriate. And Writer will show its work, displaying the source of the content where the replacement material came from, giving the human employee the ability to accept or reject the suggestion.

The company defines Knowledge Graph as “a structured representation of information stored in graph format, which allows for fast retrieval of specific pieces of information.” It can connect directly to the company’s content sources or customers can manually move content by dragging it dropping it into the Knowledge Graph interface.

It’s a separate repository, so it’s not actually part of the content systems that contribute to the graph. What’s more, companies can host the Knowledge Graph themselves if they wish, or they can let Writer manage it for them.

It’s by no means fool proof because nothing is, but it is a step towards trying to help companies reduce the impact of a known problem. Customers can choose how often they update Knowledge Graph, typically it’s weekly, but it could be more or less often if the customer wants to configure it that way, Habib said. The longer you take between updates, the more content that is not included in the accuracy check.

The company also announced the availability of the ability to bring your own LLM to the Writer platform if you choose to do so. This would replace the Writer LLM. Some large organizations may want to maintain complete control over the content inside their organization and not use an external model. The Knowledge Graph can connect to these externally created LLMs, as well.

Both the ability to use an external LLM and the Knowledge Graph are available in open beta starting today. The two products had been in a closed beta prior to this. Writer was founded in 2020, and has raised $26 million to date, per Crunchbase.

Writer introduces product that could help reduce hallucinated content in its LLMs by Ron Miller originally published on TechCrunch

Cable wants to help banks cut financial crime through automated assurance

This makes Cable’s platform, which provides automated assurance and risk assessment, complementary to many of the financial crime vendors. It enables banks and fintechs to monitor all of their accounts — not just a fraction as before — to know, in real time, if they are compliant with regulations and if their failure controls are working as expected to combat breaches.

Cable also gives Banking-as-a-Service organizations oversight on the fintech partners they work with — remember, most fintechs don’t have banking licenses and therefore work with banks to offer financial services.

In the past year, the company increased its revenue five times, and since 2021, attracted customers, including Axiom Bank, Quaint Oak Bank and Griffin on the banking side, and fintech and crypto companies, including Tide and Ramp.

“Fintechs have to work with banks to, in essence, borrow their license,” Vernier said. “That’s where we’re finding real traction and one of the areas that the OCC (Office of the Comptroller of the Currency) is particularly focused on right now: banks that are lending their license to fintechs. They need to understand the effectiveness of the controls at those fintechs, and our product is perfectly suited for that use case.”

Today, Cable announced an $11 million Series A, led by Stage 2 Capital and Jump Capital, with participation from existing investor CRV. The new investment gives the company just over $16 million in total funding.

The capital enables the company to hire across product, engineering, data and go-to-market teams and also accelerate its product development. Vernier said that the company has only built out 1% of the products and features on its two-year roadmap.

Meanwhile, Vernier said as the banking industry moves forward, it will continue to add more ways for consumers to deal with their finances rather than just traditional banks. And with that will be more scrutiny from regulators for improved oversight, which is why she said it is the “perfect time for Cable to raise more money and accelerate.”

“Regulators are particularly interested in effectiveness testing, but also, just the volatility in the banking industry right now, with COVID and if we are in a recession or not, there is increased financial crime,” Vernier said. “We’ve certainly seen, globally, an increase in fraud and other types of financial crime over the last few years. And, as real-time payments get rolled out in the U.S., we’ll see more financial crime.”

People in the U.S. reported $8.8 billion of financial fraud in 2022 to the Federal Trade Commission, and while the FTC received fewer reports, 2.4 million versus 2.9 million in 2021, the overall monetary figure is 30% higher than 2021. Bank transfer or payment fraud amounted to $1.6 billion in 2022.

When you expand this globally, Cable’s co-founder Natasha Vernier told TechCrunch that financial crime becomes a $4 trillion problem. And one Vernier, co-founder Katie Savitz and the Cable team have been working on it since 2021.

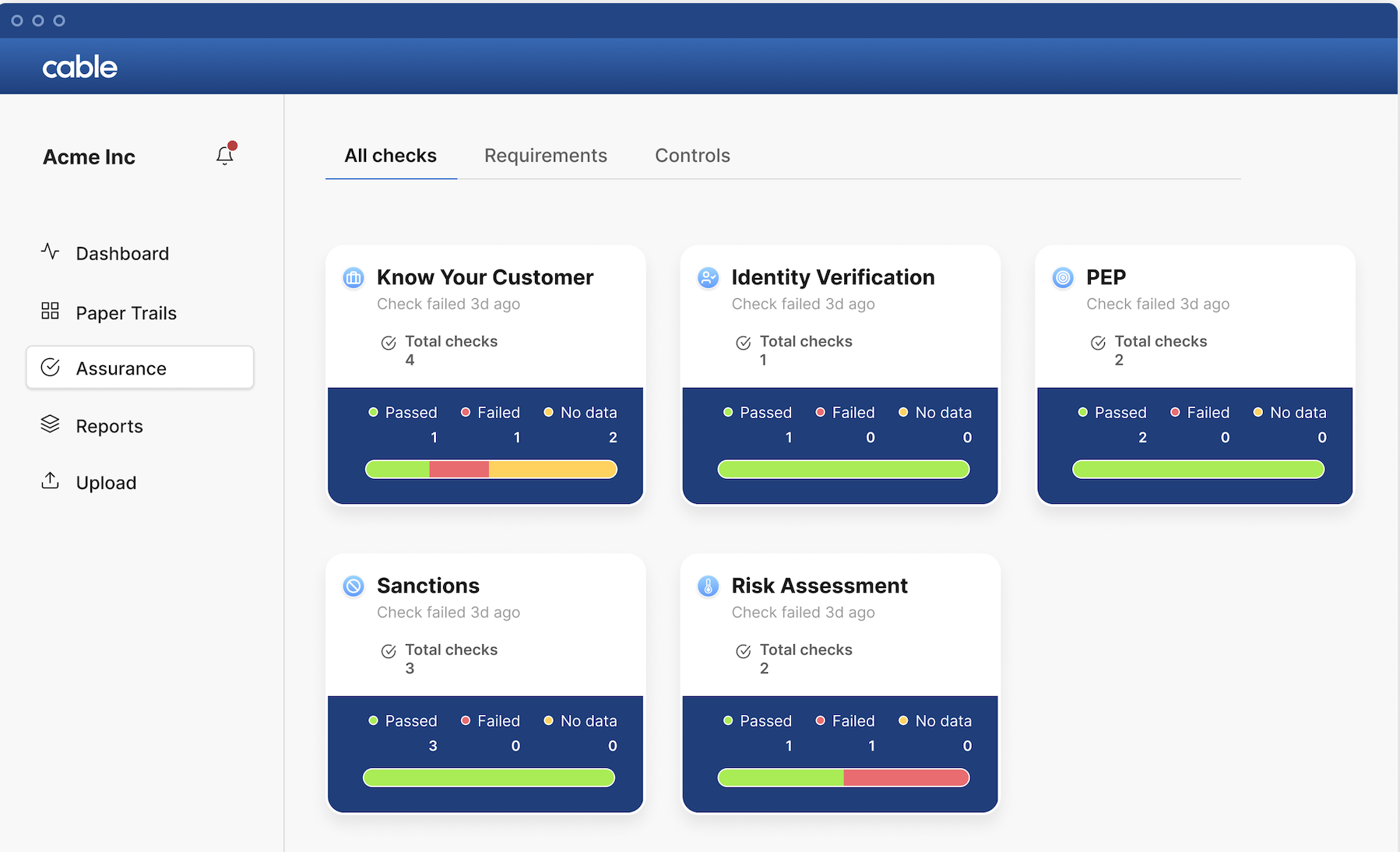

Vernier explained that banks and fintechs need to first have controls in place to mitigate risk, Controls can include Know Your Customer checks, sanctions, screenings, transactions and monitoring, all of the offerings that vendors like Unit21 and Alloy do.

About a decade ago, banks were receiving fines by regulators for having “inadequate financial crime controls,” and while the number of those fines dropped off as monitoring vendors came in, some banks are still receiving fines for having “ineffective controls,” Vernier said. That’s because there is a second requirement that regulated financial institutions have to meet, which is to independently test if their controls actually work.

“So far this has been done entirely manually,” she said. “Banks and fintechs manually sample a tiny percentage of accounts to try and see if those controls are working. That’s what we’ve automated, and we believe we’re the first and only automated solution available at the moment.”

Cable’s financial crime risk assessment dashboard (Image credit: Cable)

This makes Cable’s platform, which provides automated assurance and risk assessment, complementary to many of the financial crime vendors. It enables banks and fintechs to monitor all of their accounts — not just a fraction as before — to know, in real time, if they are compliant with regulations and if their failure controls are working as expected to combat breaches.

Cable also gives Banking-as-a-Service organizations oversight on the fintech partners they work with — remember, most fintechs don’t have banking licenses and therefore work with banks to offer financial services.

In the past year, the company increased its revenue five times, and since 2021, attracted customers, including Axiom Bank, Quaint Oak Bank and Griffin on the banking side, and fintech and crypto companies, including Tide and Ramp.

“Fintechs have to work with banks to, in essence, borrow their license,” Vernier said. “That’s where we’re finding real traction and one of the areas that the OCC (Office of the Comptroller of the Currency) is particularly focused on right now: banks that are lending their license to fintechs. They need to understand the effectiveness of the controls at those fintechs, and our product is perfectly suited for that use case.”

Today, Cable announced an $11 million Series A, led by Stage 2 Capital and Jump Capital, with participation from existing investor CRV. The new investment gives the company just over $16 million in total funding.

The capital enables the company to hire across product, engineering, data and go-to-market teams and also accelerate its product development. Vernier said that the company has only built out 1% of the products and features on its two-year roadmap.

Meanwhile, Vernier said as the banking industry moves forward, it will continue to add more ways for consumers to deal with their finances rather than just traditional banks. And with that will be more scrutiny from regulators for improved oversight, which is why she said it is the “perfect time for Cable to raise more money and accelerate.”

“Regulators are particularly interested in effectiveness testing, but also, just the volatility in the banking industry right now, with COVID and if we are in a recession or not, there is increased financial crime,” Vernier said. “We’ve certainly seen, globally, an increase in fraud and other types of financial crime over the last few years. And, as real-time payments get rolled out in the U.S., we’ll see more financial crime.”

Cable wants to help banks cut financial crime through automated assurance by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/05/11/cable-bank-financial-crime-fintech/

Apple’s ATT faces competition probe in Italy

Apple is facing another antitrust investigation in Europe over privacy rules it applies to third party apps running on its mobile platform which affect their ability to track iOS users in order to target them with advertising.

Italy’s competition watchdog said today it’s concerned Apple may be creating an unfair advantage for its own ‘personalized’ ads which are not subject to the same permission pop-up it requires for third parties to track iOS users.

Apple launched the App Tracking Transparency (ATT) feature just over two years ago, requiring third party apps obtain opt-in consent from users to be tracked for ads. The move was decried by the ad industry — and quickly led to a number of complaints being filed with competition authorities. So Italy is by no means the first to probe Apple’s privacy measure.

In a press release today the Italian AGCM announced the launch of an investigation into Apple for alleged abuse of a dominant position in the app market — saying it suspects the company of applying a more “restrictive” privacy policy to app developers than the one it applies to itself. This in turn means third parties are likely to be at a disadvantage when it comes to the “quality and detail” of data made available to them by Apple, it suggested, including relating to the effectiveness of their ad campaigns on iOS.

“This happens due to the technical characteristics of the programming interface they can access — SkAdNetwork — which appears much less effective than Apple Ads Attribution, the tool that Apple adopts for itself,” the AGCM wrote in a statement [NB: this is a machine translation of the original Italian text].

“The availability of data relating to both user profiling and the measurement of the effectiveness of advertising campaigns — while in compliance with privacy protection regulations — are essential elements for the attractiveness of the advertising spaces sold by app developers and purchased by advertisers. For this reason, according to the Authority, Apple’s alleged discriminatory conduct may cause a drop in advertising revenue from third-party advertisers, to the benefit of its commercial division; reduce entry and/or prevent competitors from remaining in the app development and distribution market; benefit their own apps and, consequently, mobile devices and the Apple iOS operating system.”

The AGCM added that it’s concerned Apple’s behavior could reduce incentives to develop innovative apps and create barriers for consumers to switch mobile ecosystems.

Apple was contacted for comment on the AGCM’s investigation.

Since the Apple-imposed iOS limit on third party tracking rolled out a number of studies have also suggested the move lifted Apple’s own ad business and boosted its market power. While ATT has also been credited with blasting a $10BN hole in Facebook-owner Meta’s revenue.

Back in March 2021, soon after launching ATT, Apple was accused of privacy hypocrisy by a French startup lobby group which filed data protection and competition complaints but failed to get the country’s antitrust watchdog to block the feature at that time. Although the French competition authority said it would continue to investigate.

Antitrust watchdogs in Germany and Poland have also announced probes of Apple’s approach since ATT launched. While the UK’s Competition and Markets Authority raised substantial concerns about Apple’s market power generally, in a wide-ranging mobile market ecosystem review towards the end of 2021 (and again in a final report in June 2022). And it has an open investigation into Apple’s App Store following complaints of unfairness by developers.

Back in the EU, antitrust action by the bloc’s competition commission against Apple in recent years has focused on the music streaming market, Apple Pay and in-app payments-related conditions. But one thing to note is that self-preferencing is set to be banned in the region for tech giants designated as so-called Internet “gatekeepers” under a major ex ante competition reform that’s aimed at curbing Big Tech’s market power.

The pan-EU Digital Markets Act (DMA) applies to “core platform services” operated by gatekeepers.

Apple’s App Store is a likely candidate for falling under the DMA regime. If that happens, requirements against self-preferencing and fair dealing with third parties will apply — and could, potentially, affect how it can operate ATT (which is a feature of the App Store).

That said, the bloc’s data protection rulebook (GDPR) also applies so any moves to impose conditions on Apple with the goal of enhancing competition would need to avoid causing privacy harms for consumers in the process, requiring a balance of considerations.

Apple’s ATT faces competition probe in Italy by Natasha Lomas originally published on TechCrunch

https://techcrunch.com/2023/05/11/apple-att-italy-antitrust/

Unlocking the M&A code: 5 factors that can make (or break) a deal

Contributor

Mergers and acquisitions (M&A) have long been a driving force for companies seeking exponential growth, gaining market share and creating shareholder value. History has shown that well-executed M&A strategies can be transformative and yield impressive results.

For instance, Disney’s acquisition of Pixar in 2006 revitalized the animation giant’s fortunes, though market analysts were skeptical of this move when it was announced. In a conversation with CNBC 15 years later, Bob Iger stated it was perhaps the best acquisition decision during his time at Disney. “It put us on the path to achieving what I wanted to achieve, which is scale when it comes to storytelling,” were his exact words.

But the Disney-Pixar marriage isn’t the only one that proved to be a massive growth engine. Facebook’s purchase of Instagram in 2012 allowed the social media behemoth to dominate the photo-sharing space. There are many such examples in the history of businesses around the world.

But all’s not rosy in the world of M&A. It is a complex and substantially risky decision, not for the faint-hearted. It is essential to approach the decision and process with diligence and forethought.

Over the years, with experience navigating the complicated world of M&A, including eight acquisitions in just the past few years, I have built five indispensable elements to consider for a successful mergers and acquisitions journey.

Be watchful of revenue synergies

One of the critical drivers of a successful acquisition is the ability to achieve revenue synergies. However, what’s more important is not to assume this synergy will automatically occur just because it seems feasible.

Making a decision about consolidated revenue potential after the M&A involves carefully analyzing the potential for growth and gaining clear visibility into how to maximize synergy. Consider acquiring companies with high sales velocity and exponential growth potential to maximize success. Analyze the target’s product offerings, customer base and sales channels to identify cross-selling, upselling and market expansion opportunities.

For instance, in 2015, PayPal acquired Braintree, a payments company that owned the mobile payment service, Venmo. It was a strategic and wise move at a time when digital payments were just taking off across the globe. Now in 2023, PayPal is relying on Venmo to drive the adoption and usage of the company’s digital payments services. The two operations are expected to converge by next year. This acquisition has enabled PayPal to tap into the growing peer-to-peer payments market and strengthen its revenue streams.

Don’t let refactoring throw cold water on your go-to-market strategy

Tech CEOs often make the mistake of assuming that a product will seamlessly integrate into their existing tech stack, especially in a tuck-in acquisition. However, this may not always be the case.

Before making your decision about the acquisition, take the time to evaluate the target company’s go-to-market (GTM) strategy and the ease of finding, buying and deploying their products. Focus on creating a new integrated version in the future to give yourself a longer runway to iron out any issues. This allows customers and employees to see a roadmap for future success.

Unlocking the M&A code: 5 factors that can make (or break) a deal by Walter Thompson originally published on TechCrunch

https://techcrunch.com/2023/05/11/unlocking-the-ma-code-5-factors-that-can-make-or-break-a-deal/

Microsoft makes strategic investment into Builder.ai, integrates its services into Teams

Builder.ai tapped into a new wave of businesses wanting their own native apps with a turnkey approach, accelerated by the rapid digitization of life during the pandemic. That led to led to a $100 million Series C funding round last year led by Insight Partners, taking the company’s total funding to $195 million.

It’s now landed a strategic collaboration with Microsoft, which includes an undisclosed equity investment in the startup. TechCrunch’s source’s indicate the investment was “significant”, though we couldn’t get anything more than that.

The collaboration will mean the two companies collaborating on AI solutions. Builder’s “Natasha” AI will be available to users of Teams, and made available when they are looking to build apps and software. Microsoft’s Q2 results showed Teams has hit more than 280 million monthly active users.

Builder.ai’s CEO Sachin Dev Duggal said in a statement: “From my first meeting with Microsoft to the moment we agreed to collaborate more strategically, one thing has been really clear-Microsoft’s commitment to helping everyone unlock their true potential.”

There will also be integrations across Azure OpenAI Service and other Azure Cognitive Services with Builder.ai’s software assembly line and adoption of the Microsoft Cloud and AI, alongside partnerships across the Microsoft Developer Platforms.

“We see Builder.ai creating an entirely new category that empowers everyone to be a developer and our new, deeper collaboration fuelled by Azure AI will bring the combined power of both companies to businesses around the world,” added Jon Tinter, Corporate Vice President, Business Development, Microsoft.

Microsoft makes strategic investment into Builder.ai, integrates its services into Teams by Mike Butcher originally published on TechCrunch

Google’s new Labs page lets you sign up for its AI experiments

This year’s Google IO was all about AI. The company announced a number of AI-powered features across its products on Wednesday. The search giant also launched a new page called Google Labs to let people sign up for these experiments and test out AI-powered features for feedback before the wider release.

Currently, you can look at four projects on the Google Labs home page. AI-powered Google search features; AI in Google Workspaces; Tailwind, which is the company’s new project about smarter note-taking; and MusicLM, a new tool that lets you generate music through text prompts. You can learn more about each project or sign up for the waitlist to try them out.

Google said that it will soon roll out some limited-time experiments. These will include search enhancements under Search Generative Experience (SGE), which will help people give a summary of search topics and prompts to explore more about them; Code Tips, which will give help users with coding problems directly from the search bar for languages like Java, Go, Python, Javascript, C++, Kotlin, shell, Docker and Git; and “Add to Sheets,” which will let you embed search results like vacation suggestion directly into a Google Sheet.

Image Credits: Google

At the moment, search labs are available in only US and in English. Plus, most experiments require users to be 18 and above to join the waitlist. Google Labs is available to access through the website or via the Labs icon on the Google app.

Apart from opening a new Labs page for AI experiments, Google also lifted the waitlist on the Bard chatbot and made it available to users in 180 countries along with support for Japanese and Korean.

Google’s new Labs page lets you sign up for its AI experiments by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/05/11/googles-new-labs-page-lets-you-sign-up-for-its-ai-experiments/

SoftBank Vision Fund yearly loss widens to $32B on startups valuation cut

In the meantime, it is attempting to paint a picture of stability across its existing portfolio, estimating that 94% of the companies across all funds currently have a cash runway of more than 12 months.

SoftBank Vision Fund and Tiger Global escalated the pace of their dealmaking in 2021 as many investors believed that the rally in public stock markets would continue for the foreseeable future. But a sharp decline in the markets — accentuated by the Fed increasing interest rates and the unfolding of geopolitical events such as Russia invading Ukraine — has left many tech companies exposed with drops in business and shadows over their earnings forecasts, devaluing the businesses themselves, and leaving many investors scrambling to find ways to cut losses.

More to follow.

SoftBank Vision Fund lost $32 billion in the financial year ending March as the Japanese investment giant, the most prolific global investor in tech startups, continues to suffer from valuation corrections across its portfolio of private and public tech companies amid a weakening global economy.

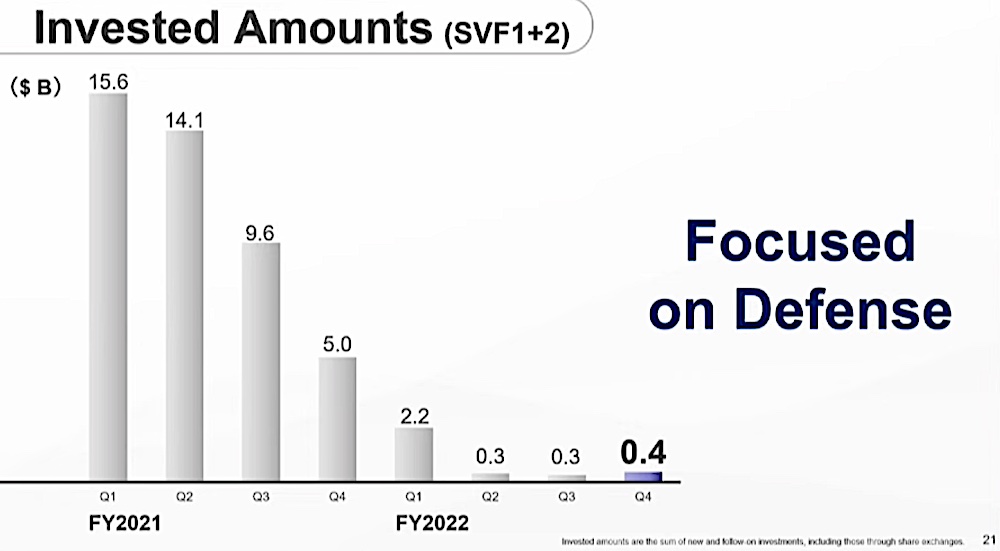

The loss surged about 70% from the same period a year prior, when SoftBank had reported $19 billion in losses at the Vision Fund unit. The losses come even as SoftBank has grown very cautious about deploying new capital to startups in recent quarters.

Among the losses, the Japanese conglomerate said its Vision Fund 1 made an unrealized loss of $1.6 billion each in SenseTime Group and GoTo and nearly $800 million in DoorDash.

The fair value of SoftBank’s portfolio was marked down over the quarter by $2.3 billion to $138 billion.

“For private portfolio companies, the fair value decreased in a wide range of investments, mainly reflecting markdowns of weaker-performing companies and share price declines among market comparable companies,” SoftBank Group said in earnings report Thursday.

SoftBank chief finance officer Yoshimitsu Goto said earlier this year that the firm had entered “defence mode” and was preparing for three different scenarios. SoftBank anticipates that the market may either start to show recovery linearly this year, or by second half of this year, or in a worst-case scenario stumble through until early 2024.

The tumultuous times at SoftBank Vision Fund means a tough time for many of its portfolio startups, many of whom themselves are loss-making. SoftBank has served as a high-conviction growth investor for its portfolio startups, often leading or co-leading later, and often large, financing rounds.

It’s logical that SoftBank is now going to be considerably more selective and judicious about investing going forward. The firm closed 25 deals in the last 12 months, totaling some $400 million in investments — but compare that to over 40 in its heyday in 2018 with total invested reaching well into the billions, sometimes even for single startups like WeWork and Grab.

SoftBank Vision Funds’ investments over the past two years. (Image credits: SoftBank Group)

In the meantime, it is attempting to paint a picture of stability across its existing portfolio, estimating that 94% of the companies across all funds currently have a cash runway of more than 12 months.

SoftBank Vision Fund and Tiger Global escalated the pace of their dealmaking in 2021 as many investors believed that the rally in public stock markets would continue for the foreseeable future. But a sharp decline in the markets — accentuated by the Fed increasing interest rates and the unfolding of geopolitical events such as Russia invading Ukraine — has left many tech companies exposed with drops in business and shadows over their earnings forecasts, devaluing the businesses themselves, and leaving many investors scrambling to find ways to cut losses.

More to follow.

SoftBank Vision Fund yearly loss widens to $32B on startups valuation cut by Manish Singh originally published on TechCrunch

Everseen raises over $70M for AI tech to spot potential retail theft

In 2007, Alan O’Herlihy, who previously worked with large SAP installations as well as retail, set out to find a way to help retailers minimize “shrinkage,” or where a store has fewer items in stock than in its recorded inventory. He settled on computer vision as the solution to the problem, and founded a company, Everseen, to commercialize the technology.

Everseen — which uses computer vision to, among other things, attempt to prevent theft at self-checkout counters — today announced that it raised €65 million (~$71.32 million) in a Series A round led by Crosspoint Capital Partners, a previous investor in the startup. The new funds bring Ireland-based Everseen’s total raised to nearly $90 million, which O’Herlihy says is being put toward scaling the startup’s business with a “targeted” roadmap.

“We’re experiencing significant demand for our technology from retailers grappling with the dual impact of declining customer spending and rising operational losses, including shrinkage,” O’Herlihy said. “The retail industry is also facing challenges such as labor shortages and labor cost inflation, making our technology even more valuable in addressing these issues.”

Shrinkage in particular can be a serious hit to retailers’ bottom lines, to O’Herlihy’s point. In 2017, stores lost an estimated 1.33% of revenues to shrinkage, totaling an estimated $47 billion, according to the National Retail Federation.

Everseen uses a combination of ceiling-mounted cameras and computer vision software to — in theory — reduce theft at the point of sale in brick-and-mortar stores. According to O’Herlihy, Everseen’s algorithms can detect and track objects (e.g. SKUs) of interest, analyzing how they interact and recognizing “actions of interest” performed by shoppers and sales associates.

Beyond theft, Everseen claims to be able “know” when items on a shelf are almost out of stock and “pinpoint processes needing immediate attention to help staff solve issues, improve trends and reduce variances.” The platform, which processes video of hundreds of millions of products and tens of millions of customer interactions every day, can connect with a retailer’s existing tools such as an order management system to provide insights and near-real time analytics.

“All of these elements serve as input, allowing our solution to ‘nudge’ a customer to self-correct or instruct a store associate to engage and aid the customer in question,” O’Herlihy explained. “Our goal is to stop and recover loss, enable the retailer to intervene, promote great customer interactions and create fluid processes while improving the overall customer experience and positively impacting the bottom line.”

Everseen hasn’t always succeeded in this mission. Workers at Walmart, which was once a major Everseen customer, told Wired in a 2020 that the system often misidentified innacous behavior as theft and failed to stop actual instances of stealing.

In response to the allegations, Walmart said that it made “significant improvements” to its Everseen system that resulted in fewer alerts overall. But the relationship between the two companies deteriorated soon after. Everseen sued Walmart, claiming the retailer had misappropriated the Irish firm’s technology and then built its own product similar to Everseen’s. (Everseen and Walmart settled in December 2021.)

Everseen’s tech monitoring for anomalies.

It’s tough to gauge the accuracy of any system without access to its backend. But history has taught us that computer vision tech — especially tech designed for anti-shoplifting purposes — is susceptible to bias and other flaws.

Consider an algorithm trained to spot “suspicious” activity from a shopper. If the data set used to train it was imbalanced — say, contained an overwhelming amount of footage of Black shoppers stealing — it’d likely flag the overrepresented shoppers more often than others.

Some AI-powered anti-theft solutions, moreover, are explicitly designed to detect shoplifting track gait — patterns of limb movements — among other physical characteristics. It’s a potentially problematic approach considering that disabled shoppers, among others, might have gaits that appear suspicious to an algorithm trained on video of able-bodied shoppers.

But assuming for a moment that Everseen is largely bias-free, there’s still the elephant in the room with every camera-based tracking system: privacy. In an email exchange, Crosspoint’s Greg Clark mentioned using Everseen’s tech to possibly capture purchasing intent and behavior to “market to specific demographics,” a touchy prospect, to be sure.

I asked O’Herlihy about how it treats customer data, including any footage it records of shoppers and store associates. He said that Everseen defers to customers on data retention policies and — for what it’s worth — is “fully compliant” with GDPR.

Whether shoppers — or associates, for that matter — implicitly trust Everseen is another question. But the potentially thorny ethical issues don’t appear to be dissuading customers from signing up for the startup’s services.

O’Herlihy claims that Everseen counts over half of the world’s top 15 retailers among its customers, with deployments in over 6,000 retail stores and at more than 80,000 checkout lines.

“The speed of adoption of this transformational technology increased during the pandemic as retailers looked for different ways to sell and shoppers looked for different ways to buy,” O’Herlihy said. “In terms of tech spend, we have seen a reallocation of budgets as the challenges for retailers are evolving with tackling shrink being viewed as a top priority in the industry … Everseen is squarely aligned with current trends.”

In a general sense, it’s true that retailers are embracing — or at least showing an interest in — AI. A recent KPMG survey found that 90% of retail business leaders believe their employees are prepared and have the skills for AI adoption, while 53% agree that the pandemic increased their company’s pace of adoption.

In the future, Everseen — no doubt under pressure from rivals like AI Guardsman and VaakEye — plans to broaden its tech to sectors besides retail, like supply chain and manufacturing. The startup currently has around 1,000 employees across its headquarters in Cork as well as hubs in the U.S., Barcelona, India and Australia and elsewhere.

“Starting with retail allowed Everseen to develop both a foundation and library of computer vision AI use cases that are relevant for other adjacent industries,” O’Herlihy said. “Computer vision solutions are currently very siloed and targeted at solving specific problems. We are seeing increased demand for our platform as customers are seeking to solve other problems across the retail store estate.”

Everseen raises over $70M for AI tech to spot potential retail theft by Kyle Wiggers originally published on TechCrunch

Wingcopter, Germany’s drone delivery startup, raises another $44M from the EIB

Wingcopter’s raise is coming at a key moment in the wider vertical take-off and landing space overall. In addition to Zipline’s raise, just a week ago, the VTOL business Lilium, which is developing an air taxi business,

Wingcopter, a startup out of Germany that has made a name for itself in the world of delivery drones used primarily for delivery of medicine and other goods to remote areas, has picked up some more financing to expand its business. The European Investment Bank is putting €40 million (close to $44 million) into the startup, funding that it will use in two areas: further developing its hardware line; and to kick off a new business in logistics and delivery services, anchored by a fleet of its drones.

The funding is being described as “quasi-equity” — and it’s a common approach taken by the EIB (other examples here and here) that involves one portion of the funding coming in as equity and the rest as a venture loan. Tom Plümmer, Wingcopter’s CEO and co-founder, would not disclose the proportions of either in an interview. He said the plan is to raise a significant Series B next year — or whenever the markets turn around.

For now, this latest infusion brings the total raised by Wingcopter to €100 million, which has also been backed in two previous fundraises by a mix of strategic and financial backers such as the retail giant REWE, Xplorer Capital, Japan’s ITOCHU, and Expa, the investment firm started by Garrett Camp of Uber.

And it more than doubles Wingcopter’s previous valuation — a figure that it is not disclosing, either. But if you consider that its bigger U.S. counterpart Zipline last month raised $330 million at a valuation of $4.2 billion, Wingcopter clearly sees the opportunity in the market — and given it has raised only around one-tenth the amount overall, where it likely is right now.

Image Credits: Wingcopter

Wingcopter’s raise is coming at a key moment in the wider vertical take-off and landing space overall. In addition to Zipline’s raise, just a week ago, the VTOL business Lilium, which is developing an air taxi business, disclosed that it was raising another $250 million, with $100 million committed so far from Tencent. The company is publicly listed in on NasdaqGS and its stock has been floundering and got a tiny bump from the news.

Indeed, in the more dicey financial waters of today, companies like Wingcopter, Zipline, and others in the space like Flytrex, have something that the air taxi businesses do not: active deployments, albeit small ones. The company has been working with Unicef in Malawi to help it deliver medicines to hard-to-reach areas, and the plan is to expand that service to more geographies and in more partnerships.

Wingcopter, like Zipline, has focused most of its efforts on the emerging region of Africa, and on very specific use cases.

While the company is still awaiting regulatory clearance to start pilots, and eventually services, in Europe, he said that he was approached by the German government to see if Wingcopter’s drones could help form part of the fleet of drones being sent to Ukraine to help it with its defense against Russia.

Wingcopter refused: the company, he said, is committed to its drones never being used in combat situations. That won’t rule out, however, potentially using them at some point to deliver goods when the fighting ceases and Ukraine becomes more focused on reconstruction.

In the meantime, the plan will be to expand business development into other emerging regions alongside Africa, including Asia and Latin America. And that is where the services element comes into the picture. To be clear, Wingcopter will continue to develop and sell drones to individual organizations as it has done up to now. In the wings is a hydrogen-powered model that will, Plümmer said, extend the range of its aircraft by five times compared to models that currently run on batteries. “We will do Frankfurt to Berlin on one charge,” he said.

But more realistically, the unit cost of Wingcraft’s models continues to be typically too high for the kinds of organizations that might be the most likely to use them, and so that is why the startup will also be looking at ways of providing services on top of fleets that it will lease out instead.

Currently, Wingcopter, in working with Unicef, uses a mixture of its own proprietary software on its own devices alongside ERP software from third parties like SAP. But the plan is to build its own logistics and delivery backend to manage this service and work with its fleet, and any other device that it might make sense to use for other legs of a delivery.

“We will integrate our existing drone software into a logistics system that we will design, and we will track the orders,” he said. “This is partly why Garrett [Camp] was interested in us. But yes, as a logistics provider we’ll need to be more platform agnostic and open. We want to build the best logistics service so we are looking at a combination of air and ground vehicles and we are open for more partnerships than we would have been as just a drone company.”

Part of the EIB’s mandate is to finance promising startups out of Europe to push forward the region’s technology industry, but another part is to invest in projects that further the region’s ecological mandates, which is the case here, since the use of drones not only reduces the amount of traffic and emissions from delivery vehicles, but also furthers the work being done to build more clean energy systems, as is the case with Wingcopter’s hydrogen-powered model that is currently in development.

“Europe is currently the global leader in cleantech, and we must work hard to maintain this lead. Backing European cleantech pioneers with global reach like Wingcopter is central to our mission,” said EIB VP Ambroise Fayolle, who oversees Germany, in a statement. “Electric cargo drones are an important vertical segment for a future of sustainable transport and logistics. This investment underlines our commitment to supporting entrepreneurs growing and building advanced green technology businesses in the European Union, strengthening our technological competitiveness, creating highly skilled jobs and opening up new markets, while preserving nature. We are proud to be supporting this European success story.”

Wingcopter, Germany’s drone delivery startup, raises another $44M from the EIB by Ingrid Lunden originally published on TechCrunch

https://techcrunch.com/2023/05/10/wingcopter-drone-delivery-startup-eib/

Disney’s Hotstar loses 8.4 million subscribers as Ambani’s JioCinema ascends

Disney, the global entertainment conglomerate operating a variety of streaming platforms, suffered a 2% contraction in its total subscriber base for the quarter ending March this year. The decline is largely attributed to one specific streaming service: Hotstar.

The Disney+ Hotstar platform, catering to viewers in India and Southeast Asia, lost 4.6 million subscribers during the aforementioned quarter. This marks the second consecutive quarter witnessing a drop in the platform’s subscriber count. Since October of last year, Hotstar’s total subscriber loss has reached 8.4 million, per Disney’s earnings reports. Hotstar, which counts India as its largest market, still has about 53 million subscribers.

The issues for Disney extend beyond subscriber attrition. The company is also witnessing reduced revenue from those who maintain their subscriptions to the streaming service. Hotstar’s average revenue per subscriber fell from 74 cents to 59 cents in the quarter ending March.

Once a prized asset in Disney’s acquisition of Fox, Hotstar is scrambling to find ways to keep its subscribers base happy. The Indian streaming platform attracted customers by providing live streaming of cricket matches, particularly the local IPL tournament. However, Disney was outbid for this season’s IPL digital rights by Viacom18, a company backed by billionaire Mukesh Ambani’s Reliance Industries. To aggressively win customers, JioCinema is streaming this year’s IPL for free in India.

“Lower impressions were attributable to decreases in average viewership at our sports and non-sports channels. The decrease at our sports channels was primarily due to cricket programming, which reflected airing fewer Indian Premier League (IPL) matches in the current quarter compared to the prior-year quarter as the 2023 IPL season started approximately one week later than the 2022 season,” Disney said in its earnings report Wednesday.

Hotstar’s prospects remain bleak as the streaming service grapples with the recent termination of its licensing agreement with HBO. The entertainment titan promptly withdrew its entire catalog from the Indian platform, with Viacom18 securing the rights to HBO and additional Warner Bros. content.

Industry analysts forecast Hotstar’s subscriber loss to escalate, potentially reaching an additional 7 million by year-end.

Disney’s Hotstar loses 8.4 million subscribers as Ambani’s JioCinema ascends by Manish Singh originally published on TechCrunch