Category: TECHNOLOGY

Bitcoin rises about 14% in 7-day span as US banking system wobbles

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Welcome back to Chain Reaction.

It’s been an insanely busy and chaotic past seven days. Unless you live under a rock, you probably know what I’m talking about. But for those who don’t (or just want a recap), let’s get into it.

Last week, a few massive U.S. banks made headlines. Signature Bank, a crypto-friendly New York regional bank, was closed by regulators due to systemic risk that could threaten the U.S. banking system. This closure came just days after Silicon Valley Bank crashed and Silvergate Capital wound down its operations.

Signature, known as one of the largest crypto lenders, was the second casualty from the ongoing banking crisis in the U.S., but regulators said that its customers will be made whole, meaning the government is stepping in to protect the economy from further damage.

For reference, Signature Bank had 40 branches across New York, California, Connecticut, North Carolina and Nevada. As of December 31, 2022, the bank had $110.4 billion in total assets and total deposits of $82.6 billion. Around 30% of the bank’s deposits came from the crypto industry.

Going forward, the crypto industry needs to watch closely for deposit flight from regional banks over the next week, Tegan Kline, chief business officer and co-founder of Edge & Node, said. “If it gets worse, the regulators have a tremendous problem on their hands. Many regional banks may have to close.”

In the wake of all the banking chaos, bitcoin and ether, the biggest cryptocurrencies by market cap, had a seven-day increase of about 15% and 8%, respectively, at the time of publication, according to CoinMarketCap data. The global market cap for all cryptocurrencies also increased 8.3% during the same time period to about $1.1 trillion, slightly down from a weekly high of $1.14 trillion on Tuesday, the data showed.

The overall market turmoil has seemingly created a bullish sentiment in the crypto economy, however, as traders responded positively to the news and the overall market cap rose on the week.

This week in web3

Chaos in US banks could push crypto industry toward decentralization (TC+)

The crypto industry lost a number of banking on- and off-ramps due to recent collapses in the U.S. banking industry, signaling that there may be a shift in the space toward decentralization and a need for regulation going forward. With these banks’ closure, it will become difficult for cryptocurrency businesses to move money between entities and access banking services, Mina Tadrus, CEO of quant investment management firm Tadrus Capital LLC and general partner of Tadrus Capital Fund, said. “Furthermore, such closures could mean reduced trust from investors who may no longer be aware of the necessary safeguards involved in their bank transactions.”

SVB’s mess could become stablecoins’ problem (TC+)

After USDC depegged from $1 last week, many in the crypto industry are questioning whether Silicon Valley Bank’s collapse will have bigger implications on the stablecoin ecosystem. If anything, this latest market event “will trigger more interest in the stablecoin sector among global regulators,” said Lucas Kiely, chief investment officer of digital wealth platform Yield App. “This can only be a good thing for the industry, which needs much clearer guidelines for more institutions to enter.”

Meta winds down support for NFTs on Instagram and Facebook

Looks like Meta is NGMI, as some might put it. Meta’s head of commerce and financial technologies, Stephane Kasriel, posted on Twitter that the company will sunset its NFT and digital collectibles features on Instagram and Facebook. This short-lived product only began testing with select Instagram creators last May, plus some Facebook users in June. By July, Meta expanded NFT support on Instagram for creators in 100 countries. Less than a year later, Meta is moving on from NFTs…RIP.

Hackers steal around $200 million from crypto lender Euler Finance

Euler Finance, a non-custodial DeFi protocol, was exploited of about $197 million in crypto on Monday. While this sounds like a lot of money — and it is — it’s only the 26th largest crypto theft ever, according to the Rekt Database, which tracks DeFi scams, hacks and exploits. Since then, the team behind the protocol has launched a $1 million reward for information leading to the attacker’s arrest and return of the funds.

India probing ‘several’ crypto cases for money laundering, seizes over $115 million

India’s Enforcement Directorate is investigating “several” crypto cases for money-laundering schemes and has seized $115.5 million to date in such crimes, the Ministry of Finance said, the latest in a series of crackdown by the authorities on the nascent space. The disclosure comes at a time when India is pushing ahead with rules to better scrutinize the activities of cryptocurrency firms, even as until now New Delhi has resisted formulating a blanket law to regulate the virtual digital assets.

The latest pod

For last week’s episode, Jacquelyn interviewed Jack Mallers, the founder and CEO of Strike, a bitcoin-based payment network and financial app that is trying to grow cross-border payments and remittance markets. Last year, Mallers’ company raised $80 million in a Series B round to grow into that space and also has partnered with major companies like Visa, Clover and Fiserv.

Mallers is also the CEO of Zap, a bitcoin investment and payments company that transacts on the Lightning Network, which is a second layer on Bitcoin’s blockchain that allows for off-chain transactions between parties.

We discussed Mallers’ backstory, how he got into the Bitcoin scene in his late teenage years, whether the lightning network could be better than the payment networks that exist today and how big players could get into the space. This episode was heavily focused on Bitcoin, so buckle up.

We also dove into:

- Lightning Network’s global potential

- El Salvador’s adoption of Bitcoin

- Creating new infrastructure to make Bitcoin more accessible

- Future of Strike and the Bitcoin ecosystem

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- Backed with $3 million, Soul Wallet aims to bring self-hosted crypto wallets to the next billion

- KuCoin and Circle back Chinese yuan-pegged stablecoin CNHC in $10 million round

- Virtual fashion platform DressX raises $15 million

- DWF Labs invests $10 million in blockchain infra provider Orbs Network

- NFT social platform Metalink raises $6 million in a seed round

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Bitcoin rises about 14% in 7-day span as US banking system wobbles by Jacquelyn Melinek originally published on TechCrunch

‘BRB, storing my money in gold’: Founders scramble to figure out which banks are safe

Founders are still shaking off the dust a week after Silicon Valley Bank’s collapse. Rumors are swirling about who might be looking to buy the beleaguered bank’s assets.

Some of the top firms urged their portfolio managers to diversify their assets as the bank was collapsing, and are continuing to do so, even though regulators have stepped in to guarantee that all depositors would get access to their stored cash.

And while diversifying assets feels obvious in retrospect, actually following that bit of advice is harder than it seems.

Nothing is guaranteed, except when it is, for now, right?

Stability is not yet a standard. First Republic Bank and other regional competitors have seen stock volatility since March 9, when SVB crashed. On Monday, shares of First Republic fell so sharply that the company’s trading had to be paused due to volatility.

‘BRB, storing my money in gold’: Founders scramble to figure out which banks are safe by Natasha Mascarenhas originally published on TechCrunch

https://techcrunch.com/2023/03/16/bank-volatility-svb-first-republic/

Mistaking performance for competence

A year or two before launching Actuator, someone on staff floated the idea of my writing a weekly robotics newsletter. I balked at the suggestion. Surely, I suggested, we would be struggling to fill the pages by week two. It’s not so much that I doubted whether there was enough robotics content to keep the engine running; it was more a question of whether there would be enough relevant robotics content.

We do a lot of vetting at TechCrunch. Not everything that crosses over the transom makes it on our site. There are a lot of reasons for this. For starters, we’re still a relatively small staff and there are just so many hours in the day. In addition to running our robotics coverage, I also run TC’s hardware coverage overall, including all the consumer news and reviews.

Curation is also an important part of the job. That involves due diligence, some research and choosing the stories we deem most relevant to our readers. That’s why so much of our robotics coverage revolves around startups and venture funding. It’s a lens through which we attempt to view technology at large.

I’d be lying if I told you that every week was an embarrassment of riches here at Actuator HQ (a one-bedroom in a Queens office managed by a mischievous lionhead rabbit mix), but I’ve thus far been happy with the flow of news. The pandemic truly transformed both the robotics industry and our coverage of it. Some weeks the pickings are slimmer than others, but by and large, I’ve been happy with the quantity and quality of stuff that crosses my desk.

Last week was a little slow. This week, not so much. In addition to the usual story roundup, I’ve asked a small cross section of investors a simple question with a complex answer: How will the SVB events impact robotics investing and startups? You’ll find some of those answers below, followed by a large and wide-ranging interview with robotics legend, Rodney Brooks.

Satellite imagery of the Midway Airport in Chicago, Illinois, USA. Image Credits: : DigitalGlobe via Getty Images

But first, a quick note on ProMat: I’m going to ProMat.

A slightly longer note on ProMat: I’ve never been to the show before, but it’s increasingly become apparent to me over the past few months that I probably ought to attend at least once. What’s long been billed as a supply chain and logistics show has sneakily become one of the year’s biggest robotics events.

One of the things that makes my beat a bit tricky is how difficult it is to convey many of these technologies in an email. It’s important to get out there and see as many of these systems in person as possible. Sometimes that means spending a week in places like Boston or Pittsburgh. Sometimes it means heading to Chicago for a trade show — and hopefully carving out some time for the Dali exhibit at the Art Institute and my customary trip to Quimby’s and Myopic in Wicker Park. Whatever the case, I’m excited to head back to one of America’s best cities after five years away.

The event is in a few days, but I’m still very much in the planning stages. One surefire way to get some face time with me is to follow me on Twitter and/or LinkedIn. I’m planning to carve out a couple of hours for an informal meetup/office hours to talk to some investors and startups, likely in one of the city’s many fine coffee shops. If you’re interested, please vote here. Likely Sunday afternoon and potentially something else during the week if enough people are interested. More info soon (still trying to piece together my schedule).

People line up outside of the shuttered Silicon Valley Bank (SVB) headquarters on March 10, 2023, in Santa Clara, California. Image Credits: Justin Sullivan/Getty Images

Meanwhile, I take a couple of days off and suddenly the entire tech industry screeches to a halt. Now, I’m not saying that my decision to make up for working through a few weekends directly impacted the Silicon Valley Bank run. I simply think that the timing merits a closer examination. Obviously the Big Tech story of the week, month and possibly year, assuming Elon doesn’t buy Facebook.

SVB’s dealings are less central to my own output than they are to most of TechCrunch’s staff, but as you’ve no doubt picked up on over the past week, ripples are being felt up and down the industry. Aside from those firms with funds in the bank, I’ve been working to map out how it will impact robotics companies in the longer term. There are a number of robotics and AI firms in the Bay, of course, but it’s not at the same level as a Pittsburgh or Boston at the moment. Of course, many — or even most — of the firms investing in those companies have strong presences in the South Bay and/or SF. So much of the money we write about here has flowed through SVB at some point.

Over the past several months, I’ve asked dozens of startups how the economic slow down has impacted their ability to raise. Most of them tell me that it’s been a challenge. That’s already a huge shift from all of the automation firms that were flying high during the pandemic. At very least, this is going to be a new hurdle. Confidence, caution — these things matter. That’s doubly the case if you’re a founder who can see the end of the runway looming on the horizon.

Will we see more closures? More M&A? I asked a few investors, “How will the SVB events impact robotics investing and startups?” Here is what they told me:

Peter Barrett, Playground Global: Why the venture community decided to call in an airstrike on their portfolio companies is quite beyond me. If SVB rises from the ashes (seems like there is a glimmer of hope thanks to folks like Ro Khanna) — and we act to mitigate the weaponization of concentrated digital media — money may not become impossibly expensive for capital intensive technologies like robotics. On the other hand, now that we have motor memory for bank runs, things could get messy. How best would an adversary attack innovation in robotics? We saw how destructive a handful of influential tweets and emails could be in unwinding a valued and respected 40-year-old institution. Why bother with a cyberattack when a few well-placed uppercased words from apparently reputable sources can wound thousands of our most innovative companies?

Kelly Chen, DCVC: Robotics startups have an additional layer to their banking relationship, typically tying equipment financing and other debt structures to banking. Robotics startups are cautiously optimistic, after the administration did the right thing with SVB. Still, diversification and flight to quality will be top of mind, even at the expense of the best rate.

Abe Murray, Alley Robotics: We remain unwaveringly optimistic about robotics. While we anticipate the VC fundraising environment will become more cautious across the board, we don’t see robotics being uniquely impacted. Robotics companies provide material value to their customers and earn good margins as a result, making them excellent customers and investments for capital lenders in any market. They also have more diverse sources of funding than most VC-backed businesses (including CAPEX leasing and project finance), and there are still plenty of institutions and innovative financing partners who are ready to partner with great companies delivering value.

Murielle Thinard McLane, Intuitive Ventures: Robotics capitalization strategies will shift. Robotics has always been capital-intensive and requires investment in hardware as well as software. Many startups in the space relied on SVB’s unique venture debt offering and it leaves a gap in capitalization strategies. Consider that to develop a digitally native product like a surgical robot — and bring it all the way through to commercialization — costs will include both the classic and complex medical device innovation needs, but also investment in an entire ecosystem of services, support, training and market development. That means robotics startups will more than ever need to focus on capital efficiency and access to sophisticated investors [who] understand the requirements. This is a time when I would argue, strategic investors in the cap table can help robotics startups reach that goal thanks to their unique ties into the broader ecosystem. In the aftermath of SVB’s shutdown, an already slow funding environment will be even slower. On the macro level, investors are likely going to wait to see how the market settles, which will make for a tough fundraising environment. This will be no different for robotics investment and it will be felt even more deeply by mid- and late-stage robotics startups who raised prior rounds at high valuations during the investment boom. With robotics companies more reliant on equity dollars, investors will be particularly valuation sensitive and the funding environment will be even more competitive.

Rodney Brooks (Rethink Robotics) at TechCrunch Disrupt NY 2017. Image Credits: TechCrunch

If you read Actuator with any frequency, you’re likely aware that I’m no techno-utopian. My skepticism, however, isn’t rooted in a lack of faith in human ingenuity (we can be quite clever when circumstances demand it) as much as a perceived lack of motive to implement technologies in fair, equitable ways that will benefit those who need them the most.

It’s something I’ve been mulling over this week, after rereading Rodney Brooks’ 2018 post, “My Dated Predictions.” The piece is an attempt to forecast the speed with which a spate of different technologies will arrive and be deployed. It’s something he’s promised to update at the start of every year until 2050, “as I will then be 95 years old, and I suspect I’ll be a little too exhausted by then to carry on arguments about why I was right or wrong on particular points.”

Fair enough. Though you’d be surprised by the level of spirited debate a 95-year-old is willing to engage in when it comes to deeply held beliefs. In the introduction to the initial piece, Brooks notes:

[R]ecently the early techno-utopianism of the Internet providing a voice to everyone and thus blocking the ability of individuals to be controlled by governments has turned to depression about how it just did not work out that way. And there has been discussion of how the good future we thought we were promised is taking much longer to be deployed than we had ever imagined. This is precisely a realization of the early optimism about how things would be deployed and used did just not turn out to be.

This is the “utopian” part of techno-utopianism. There’s a degree to which the TED Talkification of our brains has forced some blinders on us when it comes to predicting how technologies will be implemented. The truth is that many innovations are driven by profit motives, often by large corporations. That’s doubly the case with adoption. That means, in the case of the early internet, that we end up falling into the same patterns such technologies promised to liberate us from.

Brooks’ own pragmatism focuses on the limits of technology. He calls himself a “realist,” rather than a “pessimist,” and I tend to agree. I wrote about hype recently as it pertains to ChatGPT and its ilk. As I mentioned at the time, I had a front-row seat to the original 3D printing gold rush that has colored my view of subsequent hype cycles, including things like blockchain/web3. I don’t recommend the experience of having one’s faith shattered outright, but if you don’t come out the other end a little less credulous, you weren’t paying attention.

“In my view having ideas is easy,” Brooks writes in the 2018 post. “Turning them into reality is hard. Turning them into being deployed at scale is even harder. And in evaluating the likelihood of success at that I think it is possible to sort technology and technology deployment ideas into a spectrum running from relatively easier to very hard.”

I recommend serial entrepreneurs get some version of that tattooed somewhere on their person. On the fifth anniversary of the initial predictions post, Brooks added, “My current belief is that things will go, overall, even slower than I thought five years ago.” Who’d have thunk that he was actually being a secret optimist the first go-round? I would toss in some jokey reference about how “life comes at you fast,” but maybe the moral here is life actually travels a lot more slowly than any of us expect.

Amid late last week’s slow news cycle, someone reached out to ask if I’d like to interview Brooks on the occasion of his receiving the IEEE Founders Medal at the IEEE VIC Summit and Honors Ceremony in May. The pitch arrived along with a five-paragraph summary of his accomplishments. I didn’t need it, and if you’re reading this, you probably don’t need it either. Brooks has been a guiding voice in the robotics field for four decades, dating back to his long tenure on MIT’s faculty. Hell, he starred in an Errol Morris documentary about smart and interesting people.

I gladly agreed to speak to Brooks. Surprisingly, we’ve never spoken directly. Lora Kolodny interviewed him when he appeared at our first Robotics event back in 2017, and at last year’s show, Devin moderated a panel about HRI featuring Brooks and Clara Vu (with whom Brooks had worked when she was an intern at iRobot). We had a good chat earlier this week, which you can read here:

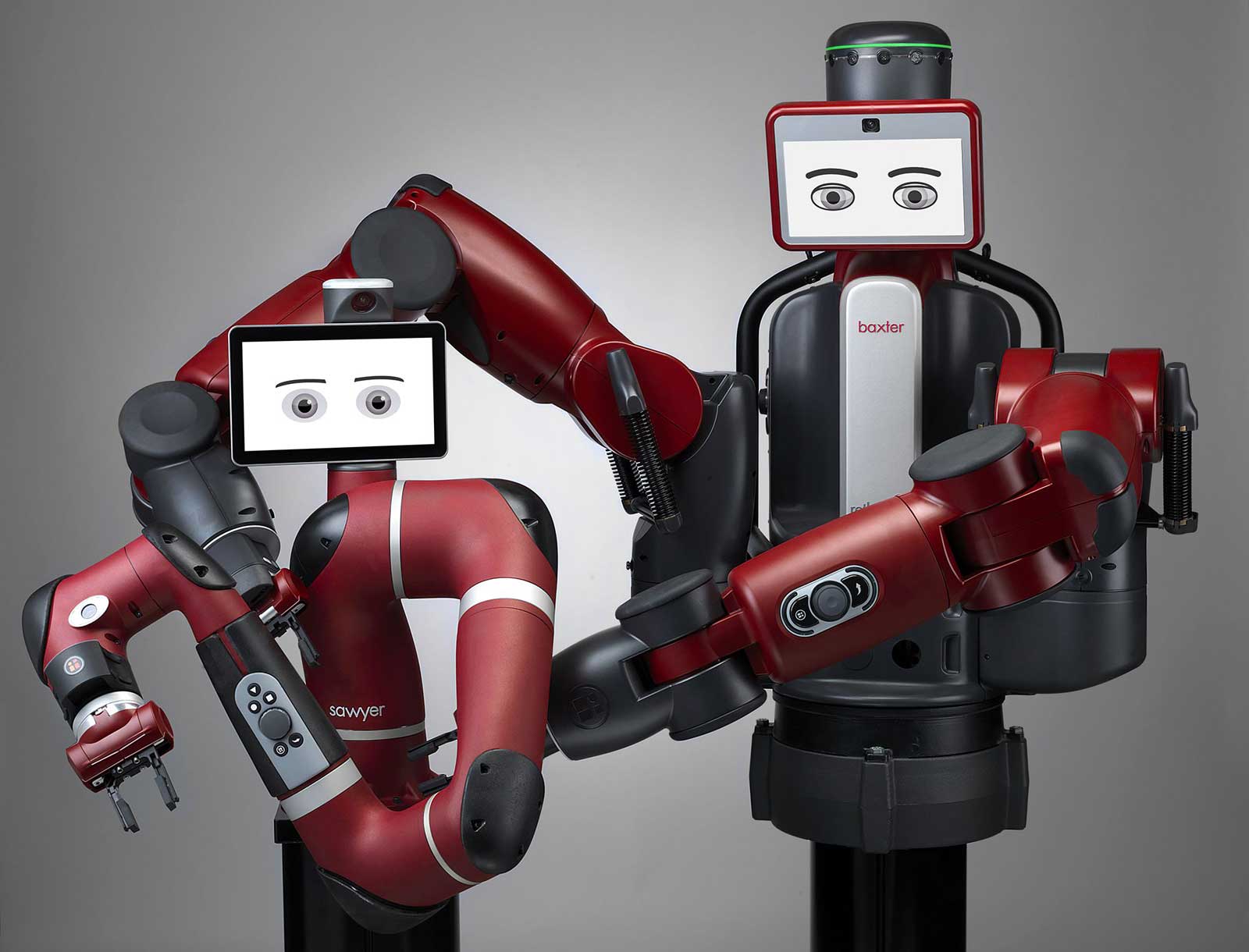

Image Credits: Rethink Robotics

TC: What does your day-to-day look like as a CTO?

RB: Well, if you don’t count the last few days, I try to provoke people.

So, nothing new on that front.

I call what I do “making provocations.” I either write some code or do some design. It’s not what’s going to go into the product, but I I just try to say to engineers, “Why don’t we try to do this?” They’ll say, “We couldn’t do that. It’s impossible.” So, I do a crappy job of it. Then I think about it for a while, and they try to make it better and eventually do something good.

You’re one of the more pragmatic people in the field, so it’s interesting to set a starting point of “impossible.”

If you don’t try something out that’s hard to do, then other people will do it before you. So you have to try hard to do it. But you also have to be realistic about how hard things are and how easy things are. I’ve read some of the stuff you’ve written recently, and you talked about the humanoid race that’s happening. I think they’re totally unrealistic. They have no idea how hard the things are they’re saying they’re going to do in a year or with 20 people. One company I saw recently said they have 100 years of robotics experience between them. Last time I built humanoid robots — and I built more humanoid robots than any other person on the planet — I started with 1,000 years of robotics experience, and we just got a little, tiny way.

My suspicion is that a lot of companies have been around for a while, but the Tesla announcement forced them all out of the woodwork. I’m very much not a roboticist, but to me the hardest part is more the general-purpose part than the humanoid part.

Yeah, and the general-purpose manipulator in particular is incredibly hard. We’ve been working on robot hands since the mid-’60s, and they haven’t really progressed much since then. The most common robot hands are still parallel jaw grippers or suction cups for moving stuff in fulfillment centers. Nothing remotely like general-purpose manipulation.

As someone who — as you said — has built more humanoid robots than anyone, are you still bullish on the form factor?

The argument they’re using is exactly the argument I used in 1992, when I started doing it.

That we build structures for ourselves, so we should be robots that can operate in those structures.

Exactly. I’ve become less enamored with that over time. I saw it was, and that you actually make much more progress in the shorter term — and by shorter term, I mean 50 to 100 years — by building special-purpose machines.

Humanoid robots were part of what Rethink was working on.

Before that, the Cog and other humanoid robots, but none with legs. A few companies are doing legged robots, but they recommend you don’t stand near them. They operate in a very different way from how humans walk and they pump a lot of energy into the system when there’s a slight imbalance. If you’re nearby, you might get hit pretty hard by the legs.

Cobots were a big part of what Rethink was working on — the ability for humans and robots to work closely together.

Right, and we did it with arms, but not legs. We had very quick reactions to anything that wasn’t appropriate, and we just got the servers to suck the energy out of the system really quickly.

I think that’s something that most people don’t realize when they see the robots operating in places like Amazon warehouses: that’s mostly done in cages.

Precisely. You don’t walk around near those moving robots. They have safety systems that shut it down if a person goes onto the floor.

What happened with Rethink?

There were a couple of lessons. The proximate cause was the trade war with China. We were building robots in the U.S. and shipping them to China, and suddenly we got hit with retaliatory tariffs from China, whereas our competitors in Europe didn’t have them. There was a more fundamental problem, which was probably my fault, in that I let us build an expensive robot. Once it was an expensive robot, people wanted to treat it like a regular industrial robot, and they wanted repeatability. It was force-based, and we needed a much better sales and training organization to train the end users about how to use that robot different.

I still see the robots a lot in universities and other research centers.

Yeah, well, I say we were a total artistic success. We just weren’t a financial success. We changed robot shows forever. All robots at shows were in cages, and now they’re not. We had to fight like crazy in Chicago in 2013 to get approval for that. It’s just the way things are now.

Years ago, Melonee Wise told me Fetch was still building Willow Garage–style research robots because they’re a great recruitment tool, but you can’t really sustain a business on them.

At iRobot, we did the Create version of the Roomba that you could buy a 10-pack for $1,000. So that’s the standard people use for teaching robotics. But it was never a major part of the market for iRobot. It was a side thing. We thought that we had to help create more roboticists.

I’ve asked Colin [Angle] and Helen [Greiner] the same thing over years. It took iRobot something like a decade to land on the Roomba. What was the aha moment for you?

For me, it was when I went to Taipei in 1997. I was taken under the wing of a guy who was doing manufacturing in China, and I stuck around with him for a couple of weeks, getting the feel for how to do it. We were trying to build toys, and we knew we had to build them cheaply. We did a partnership with Hasbro, and we built a product called “My Real Baby” that was sold in stores. That was a humanoid. We learned how to build things cheap, and the thing with the Roomba was, “how cheap can it go?” We didn’t try to take a complex design and scale it. Instead we went and tried to ask people how much they would pay for it. When the answer was $200, that was the first piece of design. It had to retail for $200.

There’s been a big push in recent years to develop hardware-agnostic software solutions to help companies deploy robotics. Is Robust AI operating in that world?

Yes and no. We feel that a lot of these companies — because they’re dealing with existing solutions — are missing the boat where silicon is going. Silicon is putting tremendous amounts of processing right next to cameras, doing narrow floating point operations. Now you can do a lot of stuff, where as, I think existing mobile robots are still relying on lidar — a single, one-dimensional laser scanner — and you just don’t get as rich a view of the world. These cameras with these processors are incredibly cheap. You can get and run a lot of neural models and get a very rich 3D and labeled description of what’s in the world.

One of the things I appreciated in revisiting your predictions was its focus on eldercare robots. It’s been a thing in Japan for some time, but I don’t think enough people in the U.S. are discussing it. That makes the most sense to me as far as bringing more robots into the home.

Yeah, and I think it’s going to be a tremendous pull for anything that can help the elderly stay in their homes with independence and dignity. I don’t know exactly what it’s going to look like, but you can say the Roomba helps people stay in their homes, because they can clean the floors without having to [do] much work. There will be a tremendous pull just because of the incredible demographic shift across the world, with less young people to look after older people. Anything that can happen there will be helpful.

I know Helen would staunchly disagree with me here, but the robot vacuum is still really the only game in town when it comes to mainstream home robot adoption. It’s been so long since the first Roomba came out. Why has it been so difficult to repeat?

I wish I knew, because I would go and do it!

Obviously you don’t know what the finish line looks like, but you have as good a grasp as anyone on what makes it so difficult.

Houses are cluttered, and they have steps. Even a one-inch step makes a wheeled robot’s life very, very difficult. I occasionally I see new solutions that can get up one-inch steps, but then they can’t get up four-inch steps. It’s an artifact of how houses are built and modified over time. That’s an incredibly hard problem. Staircases are killer.

I’ve heard a lot of discussion about the ways in which smartphone innovations have led to robotic innovations. I think the same can be said for self-driving cars. The key difference is that, unlike smartphones, we don’t actually have self-driving cars.

You’ve noticed. But we actually have a lot better driver assist than we had. That sensory information is being used and processed, but it’s still letting the executive decisions occur with the human because the long tail of weird cases is just endless. Just trying to have enough data to pull from is unlikely. Whenever we’ve changed the way transportation works in the past, we’ve changed the infrastructure. There was this promise of a one-for-one substitution, and I think that’s held up what could have been a lot of change to infrastructure.

It’s also just understood that there will be deaths with human drivers. The minute an autonomous car kills someone, it sets things back by years.

There are 35,000 deaths per year in the U.S. from car accidents. I’ve seen some technologists argue that if we cut it down to 30,000 with self-driving cars, everyone will think that’s a big success. I say no. The acceptable number of deaths from self-driving cars is probably about 10 per year, and if it gets more than that, we won’t have them. I’m not saying 10 people dying per year is acceptable, but 35,000, that’s a big difference. With self-driving, it’s going to have to be a much lower number, and it’s not rational, but that’s how it’s gonna be.

What’s your take on this latest ChatGPT hype cycle?

I think people are overly optimistic. They’re mistaking performance for competence. You see a good performance in a human, you can say what they’re competent at. We’re pretty good at modeling people, but those same models don’t apply. You see a great performance from one of these systems, but it doesn’t tell you how it’s going to work in adjacent space all around that, or with different data.

Have you seen anything in robotics over the past few years that’s really excited you?

The outcome from deep learning and image labeling. People call it “perception,” but I don’t think it’s the same as human perception. But how well you can label images is a real change, and we’re using it here, because you can do great stuff. As long as you don’t think you’re getting human-like performance, but a different sort of perception. It’s labeling, and as long as you stick with that and realize the limitations, you can build really interesting capabilities into robots, which were pretty unimaginable not too long ago.

Image Credits: Verity

First up on the link list is news that Verity just raised $32 million. The Series B comes as Ikea announces that it has deployed 100 of the Zurich-based firm’s inventory drones across 16 locations in Europe.

“We are investing in technology across the board so that our stores can better support customer fulfillment and become true centers for omnichannel retailing,” says Tolga Öncü of Dutch Ikea holding company, Ingka. “Introducing drones and other advanced tools — such as, for example, robots for picking up goods — is a genuine win-win for everybody. It improves our co-workers’ well-being, lowers operational costs, and allows us to become more affordable and convenient for our customers.”

Verity was founded in 2016 by Raffaello D’Andrea, who also helped launch Kiva, which was purchased in 2012 and eventually served as the basis for the behemoth that is now now Amazon Robotics. Warehouse inventory is one of the more intriguing applications I’ve seen for drones in recent years, levering their on-board image processing to keep track as goods move in and out.

Image Credits: Zipline

A bunch of news from Zipline this week as the company showcased a new drone delivery platform it says is capable of delivering cargo up to 10 miles in 10 minutes. The P2 is an innovative hybrid approach, hovering in place when it reaches its destination and then lowering down a little robot that can steer itself on the descent to take the package the rest of the way.

“Just like modern cars use sensors and cameras to understand the world around it, our droid will have a robust onboard sensor suite, including GPS and visual sensors, which it will use to maneuver and help ensure a delivery site is free from kids, dogs or other obstacles,” Zipline engineering head Joseph Mardell says of the system. Co-founder Keller Rinaudo adds a bit of flare in a statement, claiming, “We have built the closest thing to teleportation ever created — a smooth, ultrafast, convenient, and truly magical autonomous logistics system that serves all people equally, wherever they are.”

Zipline says it’s planning to conduct 10,000+ test flights with 100 drones this year. It’s set to start deploying the system to customers in 2024.

Image Credits: Nimble

Just this morning, we broke the news that Nimble raised another $65 million in a push to expand into third-party logistics services. The San Francisco–based startup has quiet launched multiple fulfillment centers across the U.S. Founder and CEO Simon Kalouche wouldn’t reveal the number or locations of the centers, only saying that there are “more than one and less than 10,” and they’re geographically dispersed.

He explained the shift in focus wasn’t the plan from the beginning, but rather a result of learning customer needs in the six years since the company was founded. “It evolved as we learned about the industry,” he tells TechCrunch. “I’ve been in hundreds of warehouses now, and as I went to more and more, I learned that everyone’s automating almost all the pieces of the warehouse, but picking is still the hardest part. Until you automate picking, you need people in the warehouse. You need to make warehouses ergonomic, safe and OSHA compliant for people. When you automate the picking step, you remove all of those constraints.”

The greenfield versus brownfield question has been a big ongoing debate in the industry. The former camp argues that the optimal factory model is one built from the ground up around automation, while the latter points out how prohibitively expensive that paradigm is. Nimble’s new offering embraces the greenfield approach, while offering a third way that lets retailers outsource inventory needs to a growing number of lights-out warehouses.

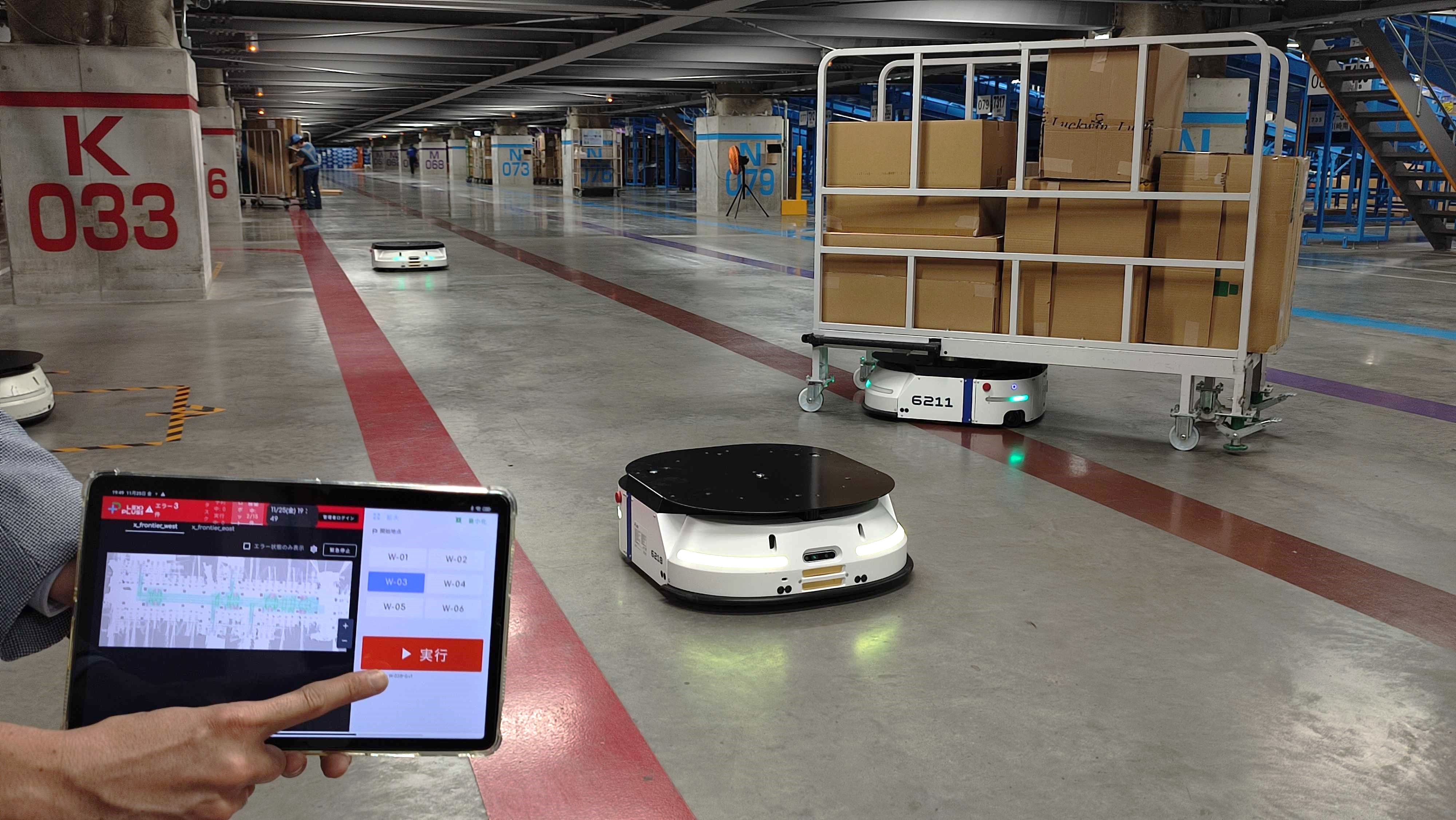

Image Credits: LexxPluss

Kate’s got the lowdown on LexxPluss this week. The young Japanese startup is using a fresh $10.7 million Series A to bring its Kiva-style mobile robots to the U.S. Drone Fund led the raise, which also features HAX (SOSV), Incubate Fund, SBI Investment and DBJ Capital. SOSV’s Duncan Turner had the following to say about the firm: “LexxPluss has a significant advantage over other warehouse automation companies as they leverage a large technical team in Japan, renowned for both industrial robotics (37% of the global market) and the automotive sector (35% of the U.S. automotive industry).”

LexxPluss is also attempting to distance itself from the competition with a more open approach to its hardware and software solutions. “Since we disclose lots of technical information, our partners can take a look into every detail of our technology,” founder and CEO Masaya Aso told TechCrunch. “So they can understand how it works and how it can be deployed and used in their warehouse or factories. They can even [handle] maintenance by themselves. Our approach is to maximize product transparency and make collaboration much easier.”

Image Credits: Built Robotics

ACR’s first system does the rebar tying, while the new one is designed to lift and move it on the job. “We are confident the combination of TyBot and IronBot generates a disruptive technology, meaning the time and cost savings are so significant on a job that it will disrupt the way our industry installs reinforcing steel,” says founder Stephen Muck.

Image Credits: CMU Robotics Institute

CMU’s Robotics Institute this week showed off a new head-worn system designed to deliver some autonomy to people with motor impairments. The Head-Worn Assistive Teleoperation (HAT) makes it possible to control a mobile manipulator using voice. And yes, it’s embedded in an actual hat.

“Speech recognition, using audio captured by a wireless microphone worn by the participant, is used for selection of four robot modes: drive, arm, wrist, and gripper, as shown in the figure on the left,” CMU notes on the project page. “Signals from the head-worn interface are communicated to the mobile manipulator via Bluetooth and mapped to velocity commands for the robot’s actuators based on the mode the user is in.”

Image Credits: Haje Kamps / TechCrunch

And finally, the application process is now open for TechCrunch’s Startup Battlefield 200. The top 200 startups will be invited to exhibit at Disrupt in September. Neesha notes:

Out of the Startup Battlefield 200, 20 companies will be selected as Startup Battlefield Finalists. The finalists will pitch on the Disrupt main stage in front of the entire TC audience, receive private pitch coaching and be featured on TechCrunch. Not to mention, founders will pitch in front of global tier 1 venture firms such as Sequoia, Mayfield, SOSV and more. The winner snags the $100,000 prize and the coveted Disrupt Cup.

I want to see some robotics startups in the mix. Do me proud.

Image Credits: Bryce Durbin/TechCrunch

We are strong. No one can tell us we’re wrong. Searching our hearts for so long. Both of us knowing you should subscribe to Actuator.

Mistaking performance for competence by Brian Heater originally published on TechCrunch

https://techcrunch.com/2023/03/16/mistaking-performance-for-competence/

First Republic Bank could see $30B in rescue deposits coming, report says

An agreement among a group of the nation’s largest banks to deposit some $30 billion with First Republic Bank could be coming this week, according to a Bloomberg report.

Bloomberg reports that banks said to be involved in this deal include JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp., Wells Fargo & Co., Morgan Stanley, U.S. Bancorp, Truist Financial Corp. and PNC Financial Services Group Inc.

A spokesperson from First Republic Bank declined to comment on the new deposits.

News of a possible rescue sent shares of First Republic Bank as high as $39 per share in early afternoon trading Thursday on the New York Stock Exchange.

As TechCrunch colleague Alex Wilhelm reported this week, First Republic’s trading week started off with a challenge with shares falling 62% on March 13 as the bank got caught up in the Silicon Valley Bank collapse. First Republic’s shares were rebounding as news about the potential new deposits went out.

The bank’s recent 8-K filing shows that while it does have some tech clients, that sector accounts for about 4% of its total deposits, according to Alex’s report.

Bloomberg also reported that First Republic was “exploring strategic options” that could include a possible sale. When asked about a sale, the bank declined to comment.

First Republic Bank could see $30B in rescue deposits coming, report says by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/03/16/first-republic-bank-rescue-deposits/

Top crypto app downloads rise over 15% following SVB collapse

The divergence in downloads points to general concern across the U.S. from customers amid the recent banking crisis.

Following a shakeup in the U.S. banking system over the past week, crypto exchanges and wallets gained momentum as some look for bankless alternatives.

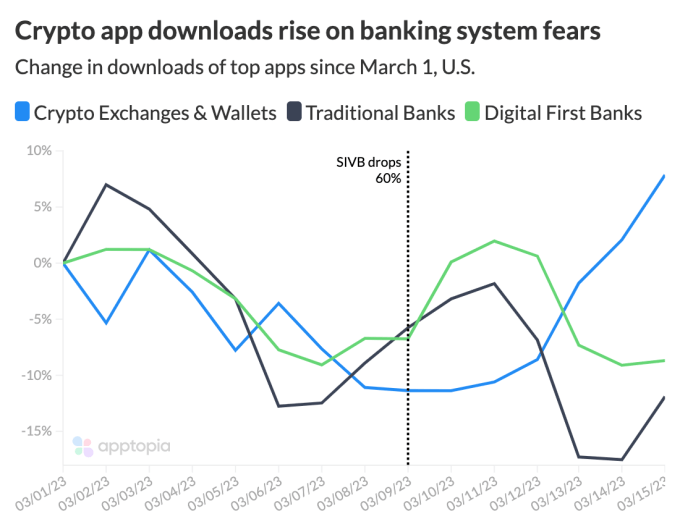

The top 10 crypto applications for exchanges and wallets have risen about 15% since Silicon Valley Bank’s stock fell 60% last week, according to a chart from real-time app data provider Apptopia. The top 10 crypto apps were defined as Coinbase, Crypto.com, Trust, Binance, Bitcoin and Crypto DeFi Wallet, Blockchain.com, KuKoin, Kraken, eToro and BitPay.

Meanwhile, the top 10 traditional banks and top 10 “digital first” bank app downloads have fallen during the same time frame about 5% and 3%, respectively. The top 10 banking apps include Capital One, Chase, Bank of America, Wells Fargo, Discover, Citi and U.S. Bank, among others. The top 10 digital first apps were Chime, Dave, Albert, Empower, Varo, MoneyLion, Current, Aspiration, Sable and Oxygen.

Image Credits: Apptopia (opens in a new window)

The divergence in downloads points to general concern across the U.S. from customers amid the recent banking crisis.

Last week, Silvergate Capital, Silicon Valley Bank and Signature Bank all shut down or were closed, which resulted in crypto companies and investors and traditional users alike scrambling to move their assets.

The shuttering of these banks brought on bigger questions around where people and companies should park assets and which banks they can (or can’t) trust.

Other midsize and regional banks, including First Republic, have been under pressure following SVB’s collapse. First Republic had the third-highest rate of uninsured U.S. deposits behind SVB and Signature with about $119.5 billion in uninsured deposits, according to Reuters.

The crypto market is showing a “positive contagion” after the SVB collapse, similar to what transpired in 2020 when investors fled traditional markets during the COVID-19 pandemic in favor of alternative assets, Stefan Rust, CEO of inflation data aggregator Truflation and former CEO of Bitcoin.com, previously said to TechCrunch+.

In the wake of all this chaos, bitcoin and ether, the biggest cryptocurrencies by market cap, had a seven-day increase of about 15% and 9%, respectively, at the time of publication, according to CoinMarketCap data. The global market cap for all cryptocurrencies also increased 8.3% during the same time period to about $1.1 trillion, slightly down from a weekly high of $1.14 trillion on Tuesday, the data showed.

The market madness has seemingly created a bullish sentiment in the crypto economy; as traders responded positively to the news, the overall market cap rose on the week and crypto app downloads increased.

Top crypto app downloads rise over 15% following SVB collapse by Jacquelyn Melinek originally published on TechCrunch

https://techcrunch.com/2023/03/16/top-crypto-app-downloads-rise-over-15-following-svb-collapse/

Pitch Deck Teardown: StudentFinance’s $41M Series A deck

Company-building is future-building, and being able to have a clear vision for the future is a crucial part of that. StudentFinance’s second pitch deck slide sets the tone for what’s about to come: It’s a BHAG, as it’s called in the industry —a big, hairy, audacious goal. StudentFinance has great clarity about what they are building and who they are building it for, and it really helps investors co-dream with the founders.

This slide invites investors to join the journey, something all startups should do when pitching. What is the big goal, the big change you want to see in the world? Bring that to life, and you’ve made a great first impression.

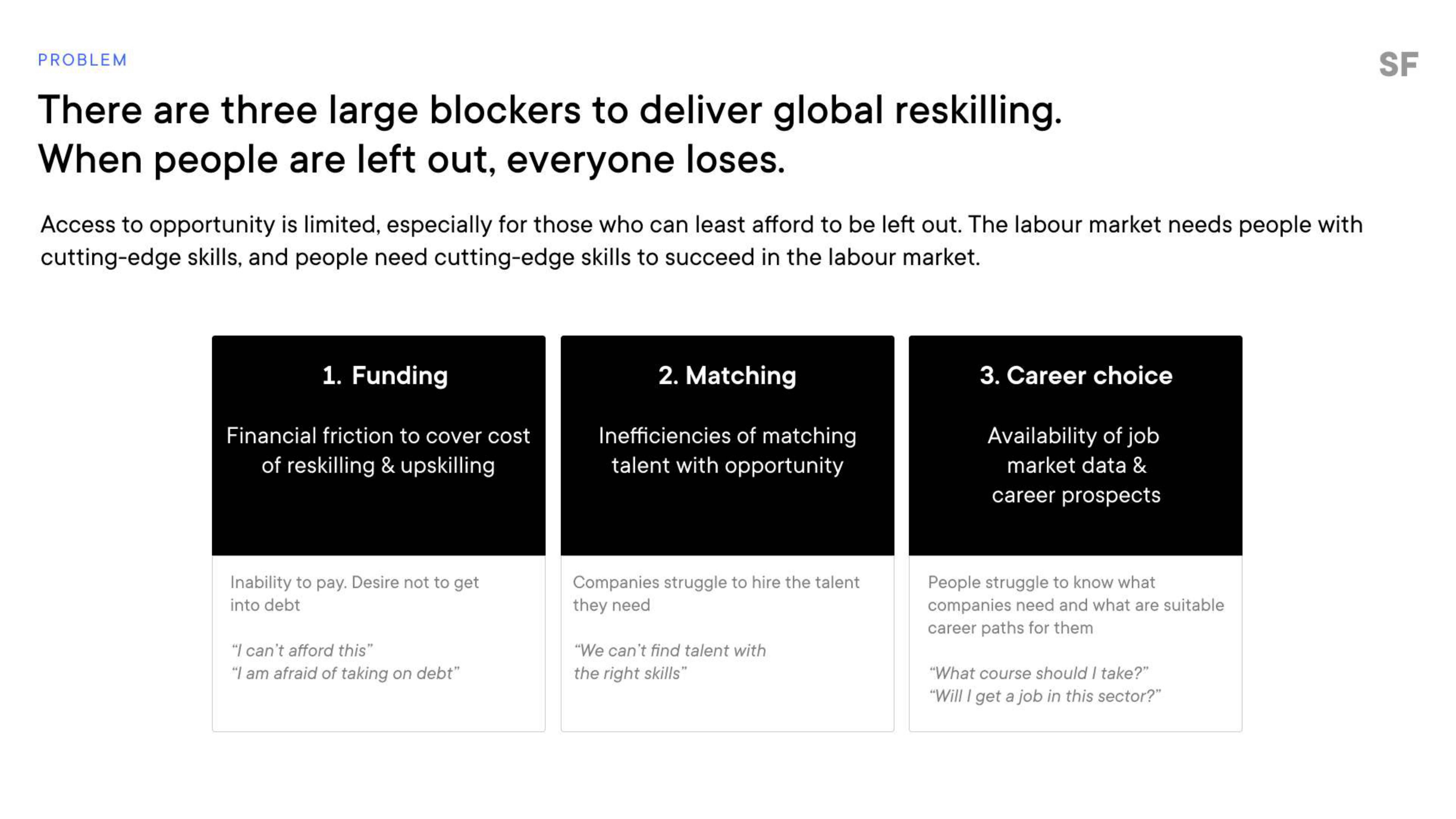

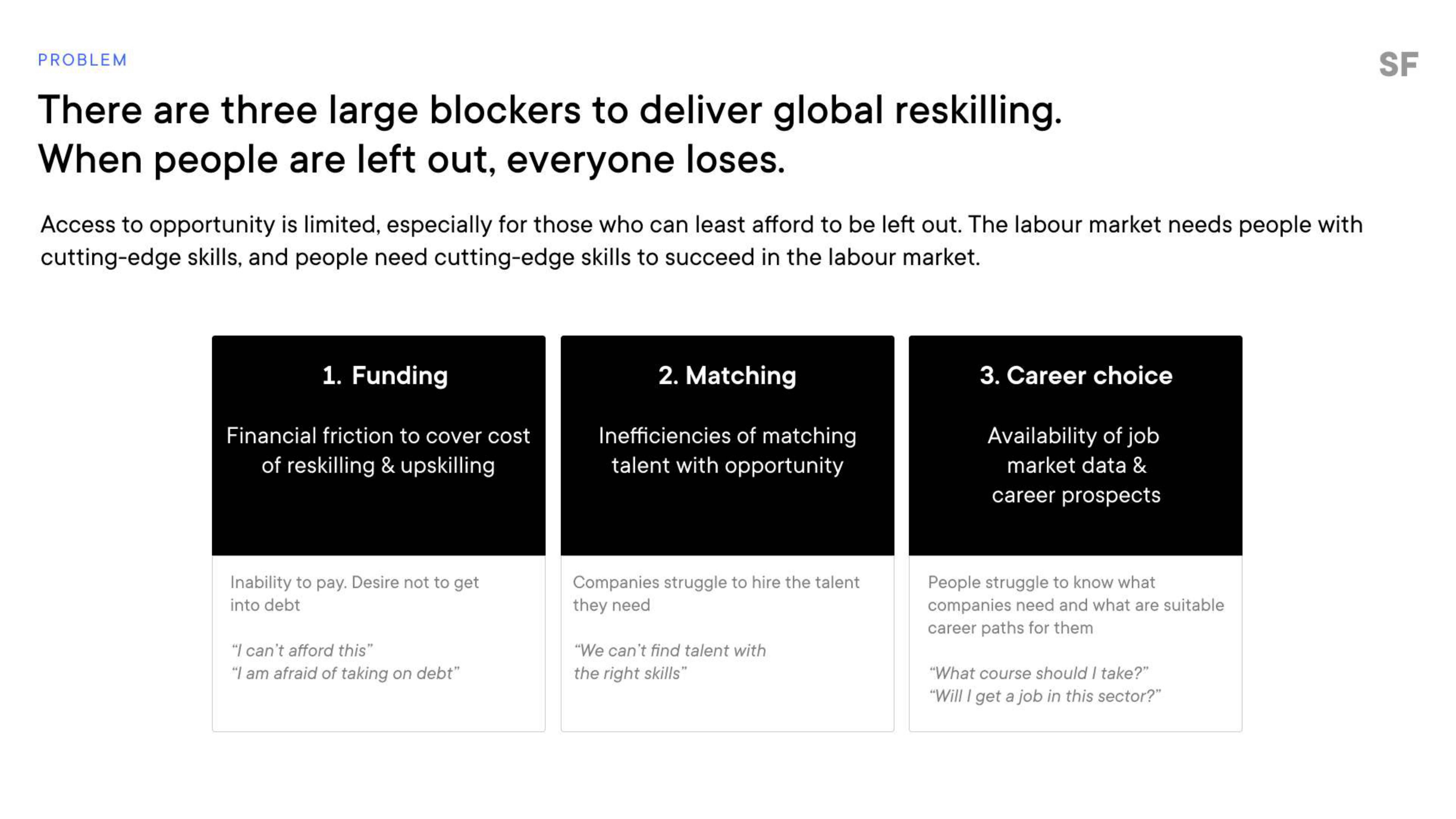

A clearly formulated problem space

[Slide 4] Gotta love a clear problem. Image Credits: StudentFinance

The company goes from a great mission to discussing what the opportunity looks like. From there, it moves on to this slide, talking about the three big problems getting in the way of a global, comprehensive approach to upskilling. Having a clear, well-articulated problem statement goes a long way toward helping an investor get a feeling for how big, how serious and how urgent the problem is. Ideally, it should also hint at how prevalent the problem is (i.e., how many people are experiencing it).

Breaking down the problem into three easy-to-grasp segments like this is particularly elegant. Funding is an obvious one‚ people are worried about money — but finding jobs and getting career guidance are less obvious slices of this challenge at first glance. Bringing it to life by using the short example questions underneath helps humanize the problem. All very well done.

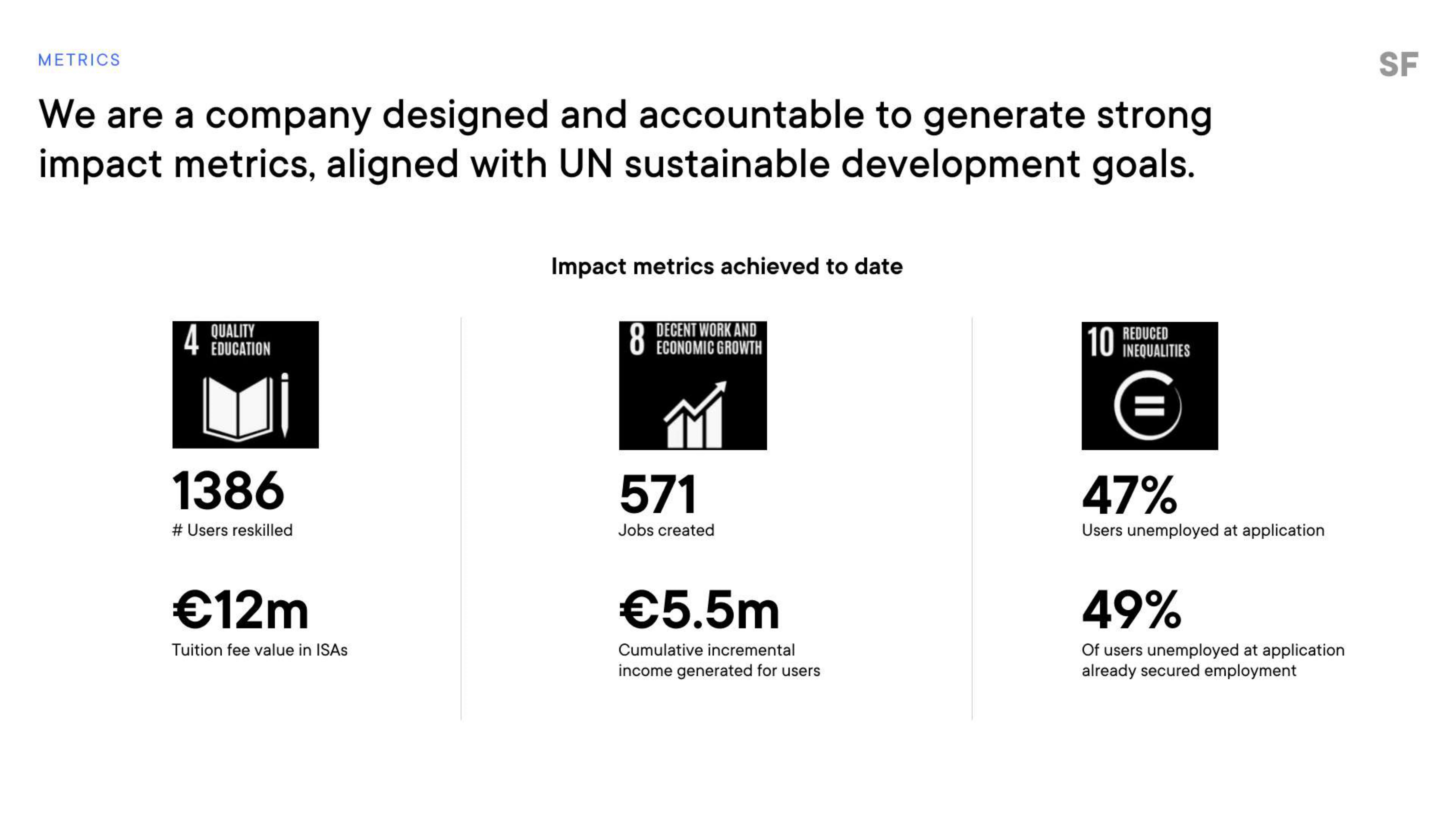

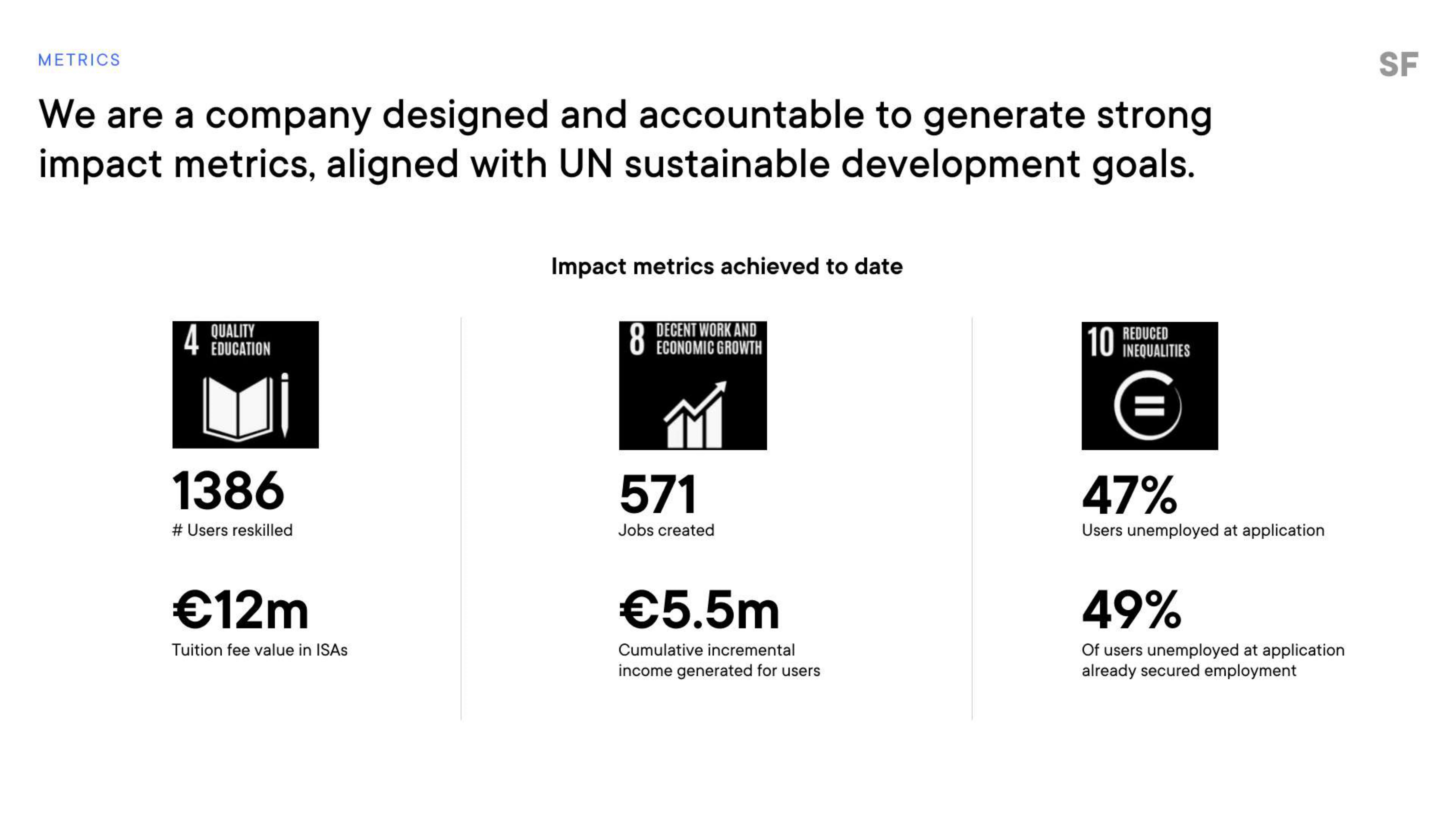

Promising early metrics

For a company raising more than $40 million, I would have expected pretty beefy metrics. Of course, I have nothing to benchmark it against, so I don’t know if these metrics are actually good or great, but the investors must have seen something. The win here, though, is identifying and reporting on metrics that seem key to the company:

[Slide 10] Metrics, metrics, metrics. Image Credits: StudentFinance

Some crucial numbers are missing here, and in any other circumstance, I would give the founders a hard time.

You can tell a lot from a company’s metrics — both the KPIs themselves, of course, but also the figures that a company believes are key to its growth. StudentFinance overlaps these metrics on

There’s no shortage of “upskilling” startups out there, but it’s rare to see one raise a $41 million round. That’s what Spanish startup StudentFinance pulled off a couple of weeks ago. Today, we are taking a closer look at the pitch deck the company used to make that happen.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

StudentFinance shared a slightly redacted slide deck; it removed sensitive revenue, cost and unit economics slides. Everything else is as pitched.

- Cover slide

- Mission slide

- Opportunity slide

- Problem slide

- Solution slide

- Value proposition slide part 1

- Value proposition slide part 2

- Business model slide

- Technology slide

- Metrics slide

- Road map slide (labeled “expansion” slide)

- Geographic expansion slide (labeled “expansion” slide)

- Growth history and trajectory slice (labeled “expansion” slide)

- Team slide

- Contact slide

Three things to love

To raise a $41 million round, a company needs solid traction and a huge market. I’m unsurprised to see that those parts of the story, in particular, were very well covered.

Clear, bold mission

[Slide 2] Off to a solid start. Image Credits: StudentFinance (opens in a new window)

Company-building is future-building, and being able to have a clear vision for the future is a crucial part of that. StudentFinance’s second pitch deck slide sets the tone for what’s about to come: It’s a BHAG, as it’s called in the industry —a big, hairy, audacious goal. StudentFinance has great clarity about what they are building and who they are building it for, and it really helps investors co-dream with the founders.

This slide invites investors to join the journey, something all startups should do when pitching. What is the big goal, the big change you want to see in the world? Bring that to life, and you’ve made a great first impression.

A clearly formulated problem space

[Slide 4] Gotta love a clear problem. Image Credits: StudentFinance

The company goes from a great mission to discussing what the opportunity looks like. From there, it moves on to this slide, talking about the three big problems getting in the way of a global, comprehensive approach to upskilling. Having a clear, well-articulated problem statement goes a long way toward helping an investor get a feeling for how big, how serious and how urgent the problem is. Ideally, it should also hint at how prevalent the problem is (i.e., how many people are experiencing it).

Breaking down the problem into three easy-to-grasp segments like this is particularly elegant. Funding is an obvious one‚ people are worried about money — but finding jobs and getting career guidance are less obvious slices of this challenge at first glance. Bringing it to life by using the short example questions underneath helps humanize the problem. All very well done.

Promising early metrics

For a company raising more than $40 million, I would have expected pretty beefy metrics. Of course, I have nothing to benchmark it against, so I don’t know if these metrics are actually good or great, but the investors must have seen something. The win here, though, is identifying and reporting on metrics that seem key to the company:

[Slide 10] Metrics, metrics, metrics. Image Credits: StudentFinance

Some crucial numbers are missing here, and in any other circumstance, I would give the founders a hard time.

You can tell a lot from a company’s metrics — both the KPIs themselves, of course, but also the figures that a company believes are key to its growth. StudentFinance overlaps these metrics on the UN sustainable development goals, which is a great way to signal how it can be a force for good in the world. Again, elegantly done.

The number of people reskilled and the value of tuition fees are both crucial numbers (although I can’t figure out what ISA stands for, so perhaps there’s an opportunity for a tweak there). Job creation, salary generation and finding that half of the folks who go through the program land jobs are all key indicators that make a lot of sense.

Some crucial numbers are missing here, and in any other circumstance, I would give the founders a hard time, but the team already let me know that “sensitive revenue, cost and unit economics slides” had been removed — and those are exactly the type of metrics that I would like to see here.

In the rest of this teardown, we’ll take a look at three things StudentFinance could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: StudentFinance’s $41M Series A deck by Haje Jan Kamps originally published on TechCrunch

https://techcrunch.com/2023/03/16/sample-series-a-pitch-deck-studentfinance/

Ledger launches browser extension to improve crypto wallet connectivity

Ledger, one of the largest cold storage crypto wallet providers, launched a browser extension to improve online security and connectivity for digital assets, the company exclusively told TechCrunch.

“You think of Web 1.0 as usernames and passwords, Web 2.0 as log in with Facebook, Google, iCloud, Twitter, and web3 is [about] connecting to your wallet,” Ian Rogers, chief experience officer at Ledger, said. “But that connectivity experience is still not super trivial and that’s what we’re talking about here and fixing this major usability problem of connectivity in web3.”

The Ledger Extension is compatible with Ethereum- and Polygon-based dApps and platforms and plans to support more EVM-compatible chains and Solana in the future, the company shared. It is only usable on Safari, iOS and MacOS today but will roll out additional support for Windows, Chrome and Chromium-based browsers like Brave, Opera and Edge “shortly after launch.”

It currently is available for use through a handful of dApps and platforms like NFT marketplace OpenSea and decentralized exchanges PancakeSwap and Curve, among others.

The extension aims to provide similar experiences to crypto wallets with browser extensions like MetaMask, but instead of being a hot wallet — which is connected to the internet and is more susceptible to online attacks — it will remain a cold wallet that allows users to interact directly with dApps through Bluetooth.

“A lot of people say web3 is hard to use, when you ask specifically how is it hard to use, they shrug, but I think it’s onboarding and connectivity,” Rogers said. “This is meant to fix that.”

It has two features that aim to keep users safe when interacting with crypto: It analyzes smart contracts and warns users whether a transaction is potentially malicious, Carl Anderson, VP of consumer engineering, shared. It will also simulate a transaction to show how it’ll impact the wallet, even when it’s a secure transaction. “Essentially what we’re doing here is showing users how to keep their keys secure,” Anderson added.

Ledger is a nine-year-old crypto hardware wallet and cold wallet provider that has sold more than 6 million devices across 200 countries and to more than 100 financial institutions and brands. About 20% of crypto assets globally are secured through Ledger, the company stated.

“We’re building on top of what we already have, which is hardware security,” Anderson said. “The Ledger Extension is about being easy to use and bringing in that security.”

In December, the company partnered with the designer behind the iPod, Tony Fadell, to create an easier, more accessible way for users to secure their crypto through their Ledger Stax product. Earlier in 2022, Ledger partnered with $1.5 billion venture capital firm Cathay Innovation to launch a $110 million fund dedicated to securing crypto assets. In 2021, it raised $380 million in a funding round led by 10T Holdings, valuing Ledger at $1.5 billion at the time.

“For us, our goal is to bring the world of crypto digital assets and wallet-connected apps from what Tony Fadell calls from ‘business to geek’ to ‘business to consumer,’” Rogers said. “There’s plenty of ground to cover there. But that doesn’t bother me at all.”

Rogers has a background in digital music and compared the crypto space to the early days of digital music. “Only the most technical people had an MP3 in the beginning and now, obviously, music is at everyone’s fingertips.”

These transitions into new technology always start with very difficult usability and limited consumer options, Rogers noted. “But over time they evolve and reach a large audience. The digital music path is analogous because it started as something only geeks were interested in and ultimately we got the iPod, iPhone and services like Spotify to become mainstream.”

Going forward, Ledger plans to focus on improving connectivity and security in the crypto space so it becomes easier for consumers and businesses to engage with dApps and platforms in the space, Rogers and Anderson shared.

“If you look at the puzzle pieces, it’s about making them better tomorrow, better than yesterday and getting adoption across dApps and making sure we have platforms covered,” Rogers said. “There’s always more ground to cover but the pieces are there.”

Fast-forward to 2030, and the industry won’t be talking about Web 2.0 versus web3, Anderson thinks. “It will just be the web. And for us, it’s about bringing security to it because of the immutable nature of blockchains. We want to bridge the gap between for ease of use.”

Ledger launches browser extension to improve crypto wallet connectivity by Jacquelyn Melinek originally published on TechCrunch

Mavn launches its app to connect influencers with brands and provide paid experiences

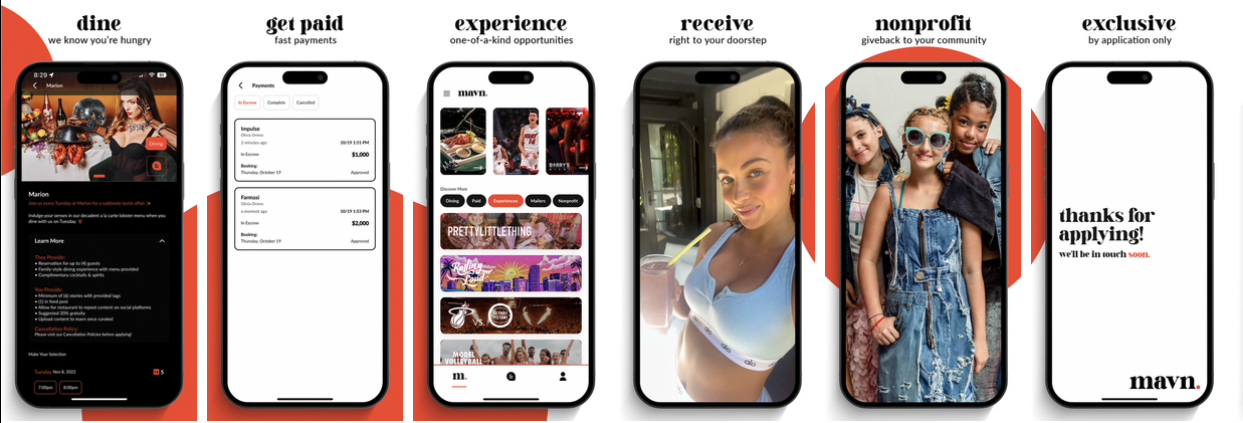

Mavn, a new female-founded startup that connects content creators with brands and other businesses, launched its app today, giving users access to a variety of experiences, from PR packages and paid posts to campaigns, photoshoots, events, dining at fancy restaurants and more.

The app is available on iOS and Android devices. Creators can scroll through categories like “Dining,” “Paid,” “Experiences,” “Mailers,” and “Nonprofit” and apply for any opportunity listed to be considered. Brands — which have access to an in-app dashboard with vetting tools, insights and a calendar feature — then review applicants and either accept, decline, or put them on a waitlist.

If a creator is accepted, they have the option to speak with the Mavn team or “concierge” via chat to discuss the next steps. Even before applying, users can message a Mavn employee to ask questions. Also, all contracts and payments are completed within the app. Influencers can upload photos and videos as well.

Mavn is currently only available for Miami-based experiences. The beta version rolled out on December 18, 2022.

The app will provide experiences in Los Angeles, California and New York later this year. Mavn also plans to eventually expand to international markets in the future, such as “select hot spot summer destinations” like St. Tropez, Mykonos, Tel Aviv and Ibiza, the company told TechCrunch.

Image Credits: Mavn

At launch, opportunities range from paid campaigns with Crown Royal Regal Apple, FitTea and swimwear brand Natki Swim to free products like skincare, clothing, fitness supplements and more. Mavn also partners with nonprofit organizations like Charity Buzz, Angel Watching Over Me Foundation, Jamie’s Rescue and The Playing for Change Foundation.

Founder Olivia Ormos noted that she is in talks with the Miami Open tennis tournament and NFL’s Miami Dolphins for future experiences.

The app is free to use, however, users must fill out a questionnaire first to be considered. Instead of prioritizing follower count, Mavn has an interesting acceptance process—at least, in our opinion.

“It’s not only about the followers for me,” Ormos told us. “I accepted somebody that had 9,000 followers.”

Mavn focuses on accepting users based on factors like diversity, engagement and creativity, among others. An example of poor engagement would be if a creator has one million followers and only 200 people like their posts. Creators that hide all their comments may also not be considered, Ormos said, depending on the situation.

“I also look at the level of content creation and creativity. I think that somebody who’s on their way is just as exciting for me as somebody that’s already established,” she added. “I also look for mutuals. Do any of our creators have any friends in common? We look for trustworthiness.”

Mavn doesn’t just accept the typical “pretty model,” Ormos said. “I have a magician on the app. I have somebody who specializes in boating content. It’s all kinds of stuff and that was my goal going into it. So, I’m happy to see the diverse applicants.”

Creators must be 18 years old or older to be accepted.

Mavn claims to have received thousands of applicants already yet it has only accepted about 300 users so far with a combined following of approximately 50 million, according to the company. While Ormos declined to share the names of notable Mavn users, she did reveal that NBA players, Netflix and HBO actresses as well as top streaming Spotify artists have signed up.

Once a creator is accepted, there are two plans to choose from: Mavn and Mavn+. The basic Mavn plan requires an Instagram account to sign up, and creators can only apply for non-paid experiences.

Mavn+, on the other hand, requires users to sign up with their Facebook account in order to share their insights via Meta. This is to ensure that brands can see all the users’ insights to confirm if they are the right influencer to partner with, Ormos explained. Users that sign up with Mavn+ get access to paid opportunities.

Mavn plans to eventually launch paid subscription plans in the future, with Mavn+ being the most expensive.

Although Mavn takes 0% commission from creators, brands are required to pay a fee to be featured on the app. The fee for businesses ranges from $2,000 to $7,000 per month “depending on how big of a job it is,” Ormos said.

Ormos is the founder of marketing agency OO & CO, which is mainly known for organizing the annual Model Volleyball Tournament, where models representing top agencies (Next, Elite, Ford and more) compete against each other. In addition to marketing and events, OO & CO also provides services like brand awareness and talent management.

She came up with the idea for Mavn in April after seeing a “massive influx” of demand for influencers– a term that has skyrocketed in popularity in recent years.

“Business development was coming out of nowhere I couldn’t have one conversation that didn’t involve the word ‘influencer,’” she said. “Whether it was people asking us to help support getting influencers to an event, my social media clients wanting to dive into doing more user-generated content, pay-to-play campaigns, restaurants coming to us to do dining programs instead of doing traditional advertising and really using the influencer space to accomplish those things. And it got to a point where I just couldn’t handle the amount of manual work that went into doing influencer marketing.”

Mavn was mainly created to combat the upkeep of building a creator database as well as simplify communication between brand and influencer. However, it was also built to “put the creator in the driver’s seat,” Ormos added.

While similar platforms focus on businesses and their needs, Mavn claims to be an app where creators aren’t lost in the process.

“What I realized about other competitors is they’re highly focused on the businesses,” Ormos said. “They’re very much like, ‘We can get you influencers. We can help you do this.’ And I think the creator gets lost in this process and isn’t really empowered… So yes, of course, I’m not the first person to do this, but I think I’ve utilized my experience in the space. So many influencers have come to me with positive feedback that they really feel [Mavn is] simplified for them, and it doesn’t feel confusing. So I think that we’ve done it in a way that feels right for [content creators.]”

Updated 3/16/23 at 10:48 a.m. with corrections to the statements “Mavn is currently only available to content creators who are based in Miami, Florida” and “Creators must also be verified on social media.” Mavn accepts creators regardless of location or verification.

Mavn launches its app to connect influencers with brands and provide paid experiences by Lauren Forristal originally published on TechCrunch

Artifact co-founder Kevin Systrom on the SVB crisis, its further impacts and future of tech

The wide-ranging interview touched on other topics as well, including Artifact’s ability to compete with Twitter, whether the U.S. should ban TikTok, the state of crypto, what’s going on with Instagram today, and his approach to Artifact as a second-time entrepreneur — where he’s expected to have learned and adapted from any missteps from building Instagram, among other things.

On the latter, he reflected that the tech industry is much different now than when he started Instagram.

“I think the era of tech just being able to kind of do whatever it wants is long gone, hopefully, because it’s important that people think through the implications of what their company will do before it gets there,” Systrom said.

He also noted that, while he believed in the underpinnings of Web3 and crypto, he saw too much hype, people losing money, and people manipulating the consumer.

“I think that’s why tech gets a bad rap,” he said.

On Instagram, Systrom lamented, “we’ve lost the soul of what made Instagram Instagram.”

“I used to be able to go on and see what my friends were doing and see what my family was doing. I think the problem is the incentives are always to go to more commercial, more creators, more deals, more ad dollars.”

As for Twitter, meanwhile, Systrom believes the jury’s still out.

“It’s unclear if the chaos will be positive chaos…sometimes chaos breeds creativity and new products and new ways of thinking.” But, he added, whatever is happening at Twitter won’t benefit Artifact because they’re very different products.

He also went on record as being against a full ban of TikTok in the U.S. but said it deserved scrutiny. After all, China doesn’t allow our social networks, like Facebook and Instagram.

“I don’t think it’s crazy to say that we should look at it really closely,” Systrom said of the ByteDance-owned video app. “I don’t think we should ban it. But I think we should figure out how to run it in an independent way inside the United States. I think that’s a really smart plan.”

Artifact, the new personalized news app from Instagram’s co-founders, is another startup whose funding was caught up in the Silicon Valley Bank failure, and co-founder Kevin Systrom believes there could be more trouble to come for Silicon Valley. The founder disclosed in a recent interview the team had 100% of Artifact’s funds at SVB prior to the bank’s failure. However, unlike many other startups impacted by the bank crisis, Artifact’s co-founders were in the fortunate position of being able to self-fund their startup, if need be, and were planning to loan the company money to keep it afloat.

As it turns out, Artificat’s financial crisis was short-lived. Systrom tells us that after the government took control of SVB, Artifact has since recovered all funds and has no more problems on that front.

The founder had earlier shared Artifact’s SVB exposure in a conversation with journalist Kara Swisher at SXSW, which has also been published to her “On With Kara Swisher” podcast.

When asked about Artifact’s exposure, Systrom responded “what’s 1% higher than 99%?,” before confirming that yes, 100% of Artifact’s funds were locked up at the failed bank, which is now under federal regulator control. However, he added, Artifact would have been able to move forward because it’s still small — only seven people — and because the co-founders had “enough personal liquidity” that they could have figured out how to loan the company money, he said.

Systrom also acknowledged in the interview the fortunate position he and Instagram co-founder Mike Krieger were in with regard to SVB’s failure and its impact on their new business.

“There are other companies with exactly the same percentage locked up who need not only to meet payroll, but they have all these bills — and people don’t just have this money lying around. You can’t just dish it out,” Systrom said.

Still, like many other entrepreneurs, the founder had been caught off-guard by the bank’s collapse, noting that even though you expect there to be a lot of challenges when starting a new company, losing access to your funds is the “last on the list of your expectations.”

He also suggested the problem with the bank may have been tied to the herd mentality in Silicon Valley, adding that there was no conscious decision on his part to work with SVB in the first place.

“As you find out in Silicon Valley — whether it’s wealth managers or accountants or lawyers — there’s this herd mentality and no one actually asks each other why they use whatever service they use. If you’re an entrepreneur, one of my lessons is ‘ask why’ — do some due diligence. And I think that’s important because you never really know what you’re getting into. But there’s a lot of like, oh, so-and-so company uses X, Y or Z, we should use them,” he said. “And that creates problems in the long run.”

He further cautioned that the bank crisis was only a hint of the “bad things” still to come for the Silicon Valley tech ecosystem, pointing to how every crisis has been precipitated by rising rates. And with a bank’s failure, there could have been cascading effects — for example, when one company can’t pay another, there’s potential for fallout.

“My sense is that whenever there are good times you should be really concerned in Silicon Valley,” such as “whenever companies that you know are dumb ideas are raising many tens of millions of dollars; when people are throwing excessive parties,” he said.

Systrom himself was just old enough to have watched the other boom-and-bust cycles in the Valley from a distance — in 2000, he was coming out of high school, and in 2008, he was just coming out of college.

“I saw both crises from afar. And the patterns just repeat over and over and over again. But what you realize is no one gives a shit. Because as long as you’re making money on the way up, it’s like musical chairs — if you can just find a seat before everything comes crashing down, you make a lot of money and you go away and you’re happy,” Systrom said. “But it turns out. there are a lot of people without seats at the end of that. And I think that’s crushing to the Bay Area, generally, that is already dealing with enormous wealth disparity.”

“My point is, it was very clear that the writing was on the wall — that bad things were going to happen…I think the SVB thing is like 5 or 4 percent of the bad stuff to come,” he added.

Image Credits: Artifact

The wide-ranging interview touched on other topics as well, including Artifact’s ability to compete with Twitter, whether the U.S. should ban TikTok, the state of crypto, what’s going on with Instagram today, and his approach to Artifact as a second-time entrepreneur — where he’s expected to have learned and adapted from any missteps from building Instagram, among other things.

On the latter, he reflected that the tech industry is much different now than when he started Instagram.

“I think the era of tech just being able to kind of do whatever it wants is long gone, hopefully, because it’s important that people think through the implications of what their company will do before it gets there,” Systrom said.

He also noted that, while he believed in the underpinnings of Web3 and crypto, he saw too much hype, people losing money, and people manipulating the consumer.

“I think that’s why tech gets a bad rap,” he said.

On Instagram, Systrom lamented, “we’ve lost the soul of what made Instagram Instagram.”

“I used to be able to go on and see what my friends were doing and see what my family was doing. I think the problem is the incentives are always to go to more commercial, more creators, more deals, more ad dollars.”

As for Twitter, meanwhile, Systrom believes the jury’s still out.

“It’s unclear if the chaos will be positive chaos…sometimes chaos breeds creativity and new products and new ways of thinking.” But, he added, whatever is happening at Twitter won’t benefit Artifact because they’re very different products.

He also went on record as being against a full ban of TikTok in the U.S. but said it deserved scrutiny. After all, China doesn’t allow our social networks, like Facebook and Instagram.

“I don’t think it’s crazy to say that we should look at it really closely,” Systrom said of the ByteDance-owned video app. “I don’t think we should ban it. But I think we should figure out how to run it in an independent way inside the United States. I think that’s a really smart plan.”

Artifact co-founder Kevin Systrom on the SVB crisis, its further impacts and future of tech by Sarah Perez originally published on TechCrunch

TikTok’s new feature lets you refresh your For You feed and retrain your algorithm

TikTok is introducing a new feature that lets you reset your For You feed and start fresh to retrain the app’s algorithm about content you enjoy. The company announced today that it’s rolling out “Refresh,” a new option for users who feel like their feed recommendations are no longer catered toward their interests.

The new feature shouldn’t be confused with the app’s pull-down refresh option, as the new tool basically resets your For You feed to its original setting in a way. When the refresh feature is enabled, the app will surface content on the For You page as if you have just signed up for TikTok. The app’s recommendation system will then begin to surface more content based on new interactions.

If you enable the new feature, your Following feed, profile and inbox won’t be affected. In other words, although your For You feed will get a fresh start, the rest of your app experience will remain untouched.

The new feature is welcome addition for people whose tastes may have changed over the past few years or for those who feel like their recommendation system doesn’t really understand their interests anymore. For instance, you may have liked watching baking recipe videos in the past, but are no longer interested in them, yet you may be flooded with them in your For You feed. Or, say you were totally obsessed with a TV show at one point and still see it all over your For You page even though you’ve moved on to other interests. The new feature could help in situations like these.

TikTok notes that the new feature complements its current content controls that allow you to shape your experience on the app. For example, you can choose to automatically filter out content that uses specific hashtags or phrases. There’s also a “not interested” option that you can select when you come across a video that’s not to your liking. Sometimes it can seem like the “not interested” button isn’t enough, which makes the refresh feature a handy option to have. It’s worth noting that the refresh feature won’t override any settings you’ve already chosen to enable or impact accounts you’ve followed.

Image Credits: TikTok

You can access the new feature by navigating to your settings, clicking on your content preferences and then selecting the “Refresh Your For You feed” option. From there, you have to click the “Refresh” button. TikTok will warn you that this action cannot be undone.

TikTok also provided an update on its efforts to ensure viewers are discovering a variety of content while minimizing content that doesn’t necessarily violate its policies. The company notes that it filters out content with mature themes from teen accounts. For example, more than 65,000 videos about cosmetic surgery were made ineligible from the viewing experience of teens in the first two months this year.

The company says it works to ensure its systems surface a variety of topic. For instance, it says viewers usually won’t be served two videos in a row made by the same creator or that use the same sound.

TikTok also works to limit some content that doesn’t violate its policies, but may impact users if it’s viewed repeatedly, particularly when it comes to content with themes of sadness, extreme exercise or dieting, or that’s sexually suggestive. TikTok allows recovery or educational content, but limits how often such content is eligible for recommendation.

“Our systems do this by looking for repetition among themes like sadness or extreme diets, within a set of videos that are eligible for recommendation,” TikTok said in a blog post. “If multiple videos with these themes are identified, they will be substituted with videos about other topics to reduce the frequency of these recommendations and create a more diverse discovery experience. This work is ongoing, and over the last year alone, we’ve implemented over 15 updates to improve these systems, along with expanding to support more languages.”

TikTok’s update on its progress comes as a report from the Center for Countering Digital Hate, a non-profit organization, recently revealed that the app pushes videos about eating disorders and self-harm to young users. TikTok isn’t the only social media platform facing scrutiny for its influence on young people, as Instagram has also been scrutinized for promoting disordered eating.

TikTok’s new feature lets you refresh your For You feed and retrain your algorithm by Aisha Malik originally published on TechCrunch