Category: TECHNOLOGY

Jason Sudeikis teases possible ‘Ted Lasso’ extended cinematic universe for Apple TV+

While “Ted Lasso” writers and co-stars Jason Sudeikis and Brett Goldstein have confirmed multiple times in interviews that the Apple TV+ original series will likely end after three seasons, the story of AFC Richmond may not be over. Sudeikis recently mentioned that he’s open to the idea of a spin-off, which would be a first for the streaming service.

“The fact that folks will want more and are curious beyond more than what they don’t even know yet—that being Season 3—it’s flattering,” Sudeikis said during an interview with Deadline on Monday. “I think that we’ve set the table for all sorts of folks…to get to watch the further telling of these stories. The fact that people want more, even if it’s a different avenue, is lovely.”

Even co-writer Bill Lawrence made a comment in 2021 that leans into the possibility of a spin-off. “This story is going to be over [in Season 3], regardless, even if the show finds another story to tell and goes on,” Lawrence told The Hollywood Reporter.

Although this isn’t confirmation that a spin-off is for sure happening, the prospect would certainly be exciting for many fans. “Ted Lasso” has pulled on the heartstrings of millions of Apple TV+ subscribers who definitely want to see their favorite characters live on in more storylines or “avenues” as Sudeikis puts it. The show has won several awards since it premiered in 2020, including eight Emmys and two Golden Globes.

TechCrunch reached out to Apple for comment.

“Ted Lasso” has been a big hit for Apple TV+, a streamer that has claimed it will continue to focus on quality rather than quantity. It would be a major move if the company agreed to a “Ted Lasso” universe with many of its rivals — especially Disney+ and HBO Max — heavily investing in franchises.

Plus, a spin-off will also be a satisfying turn of events for the soon-to-end series. Sudeikis reiterated this to Deadline, saying, “This is the end of this story that we wanted to tell, that we were hoping to tell, that we loved to tell.”

Goldstein (who plays Roy Kent) also said that the plan all along was to end the show after three seasons. “We are writing it like that. It was planned as three,” he told The Sunday Times in June 2022.

Season 3 of “Ted Lasso” will get 12 episodes and premiere on the streaming service on March 15.

Jason Sudeikis teases possible ‘Ted Lasso’ extended cinematic universe for Apple TV+ by Lauren Forristal originally published on TechCrunch

Walt Disney Imagineering snags Chief Creative Officer Bruce Vaughn back from Airbnb

Walt Disney Imagineering, the workshop that makes all of the cool things you experience at the Disney Parks, is bringing back a veteran to co-lead the division. Bruce Vaughn was previously at WDI for 22 years, leaving for VR experience company Dreamscape before landing at Airbnb.

Vaughn will take the role of Chief Creative Officer and co-lead of WDI. This news is likely to be shockwave-level (in a good way) among Imagineers present and past and those of us who follow the Parks and the people that create them.

Vaughn has been at Airbnb for a year and a half leading its Experiential Creative Product team. He was hired to develop more ‘immersive’ experiences at Airbnb, who had also hired former Disney Parks exec Catherine Powell to help them build out packages of excursions for Airbnb guests in an effort to go beyond lodging bookings.

Vaughn previously co-lead WDI as Chief Creative Executive for 9 years where he worked on projects across the company — including the renovation of EPCOT’s Spaceship Earth early on in his career.

“I’ve remained an Imagineer at heart, so I’m thrilled to join Barbara and reunite with this phenomenal global team of creators and innovators during this pivotal time,” Vaughn said in a provided statement.

Bruce Vaughn, Chief Creative Officer, Walt Disney Imagineering

Imagineering is a unique organization with a very different way of working. Leads inside the division pool resources across a group of people that blend a melange of art, engineering, organization, supply chain and storytelling into environmental works that are inhabited by millions of people a year. The internal process for creating and maintaining a flow of unique ideas balances fiscal restrictions, personalities and revenue goals against the much more nebulous questions of art and emotion.

It’s a startup that was born in 1952 and still manages to maintain a sense that the projects being built are somehow being formed organically from chaos. It’s a rare environment that draws really talented people, but has also been shedding them rapidly.

WDI has seen a huge shakeup in recent years under the company’s previous CEO, Bob Chapek. Long-time Imagineers which led huge projects and carried an enormous amount of institutional knowledge like Joe Rohde, Jon Snoddy, former Imagineering co-President Bob Weis and others have all moved on recently – along with a spate of departures surrounding Disney’s stop-start move of WDI to Florida.

Effective leaders of that organization have to understand them and how to perform that balancing act. Weis was co-President with Barbara Bouza – a project executive who rose to the role in 2021. Bouza will now be the solo President but co-lead of Imagineering with Vaughn in the CCO role. Both will report directly to Josh D’Amaro, Chairman of Disney Parks. He officially joins on March 20th.

“With so many exciting projects under way and tremendous opportunities ahead of us, I look forward to partnering with Bruce to fuel creativity and deliver next-level experiences,” said Bouza in a statement.

Disney is betting here that a veteran, respected, leader who previously worked as a co-lead will offset some recent brain drain and loss of history. Though it’s easy to ascribe every movement made since Bob Iger resumed the CEO role as ‘fixing problems’ – this move seems to be more of a maintenance and upkeep maneuver that will offset Weis’ departure and pair Bouza with an (almost) equally experienced leader for WDI.

D’Amaro sent an internal note to Imagineers today as well:

DATE: March 7, 2023

TO: DPEP Executives, All WDI

FROM: Josh D’Amaro, Chairman, Disney Parks, Experiences and Products

SUBJECT: WDI Organizational Announcement: Welcome Back Bruce VaughnAs Bob Iger often says, creativity is the heart and soul of who we are and what we do at

Disney. In fact, as we look at our company’s 100-year history of bringing captivating and

memorable storytelling to life, the consistent thread that binds us together as a company

across all segments is our ability to drive innovation through creative projects.In Disney Parks, Experiences and Products, we continue to invest in new endeavors

that deliver the most compelling experiences, immersing our guests around the world in

the stories they love most. In the past few years, we have found ourselves at the

crossroads of a wave of new technology and a seemingly unlimited amount of new

stories and franchises, allowing us to develop groundbreaking new experiences. Of

course, none of this comes to life without a strong commitment to creativity and

innovation by the amazing team at Walt Disney Imagineering.With this in mind, I’m pleased to share that effective March 20, Bruce Vaughn is

returning to Walt Disney Imagineering as the Chief Creative Officer. Bruce will co-lead

the organization with WDI President Barbara Bouza, with both leaders reporting

directly to me.Together, Bruce and Barbara will partner closely to connect visionary creative thinking

with project opportunities and flawless execution and delivery. With significant

developments under way and more on the horizon, this dedicated focus toward

creativity and innovation will help us deliver next-level experiences well into the future.

To best accomplish this, they will be working together to swiftly identify the most

effective way to structure Imagineering.Many of you have had the opportunity to work with Bruce previously. He has a deep

history with Imagineering, serving for more than two decades in leadership roles

including with WDI R&D, as well as co-leading the entire WDI organization as Chief

Creative Executive for nine years. Bruce left Disney in 2016 to become CEO and CCO

of Dreamscape Immersive where he worked with teams to advance virtual reality

technologies for mainstream location-based entertainment, and most recently was with

Airbnb where he developed and led the Experiential Creative Product team.Please join me in welcoming Bruce back to Disney.

Walt Disney Imagineering snags Chief Creative Officer Bruce Vaughn back from Airbnb by Matthew Panzarino originally published on TechCrunch

Talking trash with Matt Rogers from Mill

Welcome back to Found, where we get the stories behind the startups.

This week Darrell and Becca are joined by Matt Rogers, the founder and CEO of Mill, a startup that helps its customers turn their food scraps into farm feed. The former founder of Nest talked about what compelled him to jump back into entrepreneurship after years of investing, why he decided to focus on food waste, and how they built the startup’s closed-loop system. Plus, Matt talks about how his days designing the original iPhone influenced his design choices now.

Subscribe to Found to hear more stories from founders each week.

Connect with us:

Talking trash with Matt Rogers from Mill by Rebecca Szkutak originally published on TechCrunch

https://techcrunch.com/2023/03/07/talking-trash-with-matt-rogers-from-mill/

7 investors reveal what’s hot in fintech in Q1 2023

The global downturn has impacted every sector, but fintech bore the brunt of it as public-market valuations fell off a cliff last year.

However, it appears that even though VCs are proceeding more cautiously than before and taking their time with due diligence, they are still investing.

CB Insights recently found that two of the largest global VC firms, Sequoia Capital and Andreessen Horowitz, actually backed more fintech companies in 2022 than any other category. In both cases, about 25% of their overall investments went into fintech startups.

And, while global fintech funding slid by 46% to $75.2 billion in 2022 from 2021, it was still up 52% compared to 2020 and made up 18% of all funding globally, proving that investors still have faith in fintech’s future.

You could even say some are bullish: “If anything, I expect our investment pace to increase this year as early-stage fintech companies prioritize operational discipline and product differentiation,” said Emmalynn Shaw, managing partner of Flourish Ventures.

We’re widening our lens, looking for more investors to participate in TechCrunch+ Surveys, where we poll top professionals about challenges in their industry.

If you’re an investor and would like to participate in future surveys, fill out this form.

The tougher conditions created in the past year has resulted in down (and smaller) rounds, M&A, and an emphasis on fundamentals. Gone are the days of investing on a whim.

But for Ansaf Kareem, venture partner at Lightspeed, the tough times can be seen as a good thing because they often create the best companies. “If you study previous compression periods in the ecosystem (e.g., 2008 and 2000), not only have we seen outstanding companies being formed, we’ve also witnessed great venture firm performance during these windows,” he said.

“The last two years in the venture ecosystem were an anomaly, but I believe we are coming back to a healthy ‘normal.’ Diligence cycles have extended, better relationships with founders can be formed, investors can enter new spaces with more preparation, and a thoughtful approach to early-stage venture capital can emerge,” Kareem added.

Challenging market conditions drive a sense of discipline and perspective that can be a gift. Emmalyn Shaw, managing partner, Flourish Ventures

So whether you’re seeking to raise your first round or your third, make sure you focus on fundamentals, save cash and don’t shy away from raising a down round if you think your idea may change the world, several investors said.

“Grow in a way that’s smart and sustainable for the long run,” advises Michael Sidgmore, a partner at Broadhaven Ventures. “We can’t control the macro environment, and today’s geopolitical climate means that there may always be the threat of exogenous shocks on the market. But the markets will bounce back at some point. So just grow in a manner that lets you focus on unit economics and profitability so that you can control your own destiny no matter what market we are in.”

To help TechCrunch+ readers understand what fintech investors are looking for right now (and what they’re not!) as well as what you should know before approaching them, we interviewed seven active investors over the last couple of weeks.

Spoiler alert: B2B payments and infrastructure remain on fire and most investors expect to see more flat and down rounds this year. Plus, they were gracious enough to share some of the advice they’re giving to their portfolio companies.

We spoke with:

- Charles Birnbaum, partner, Bessemer Venture Partners

- Aunkur Arya, partner, Menlo Ventures

- Ansaf Kareem, venture partner, Lightspeed Venture Partners

- Emmalyn Shaw, managing partner, Flourish Ventures

- Michael Sidgmore, partner, Broadhaven Ventures

- Ruth Foxe Blader, partner, Anthemis

- Miguel Armaza, co-founder and general partner, Gilgamesh Ventures

Charles Birnbaum, partner, Bessemer Venture Partners

Many people are calling this a downturn. How has your investment thesis changed over the last year? Are you still closing deals at the same velocity?

We continue to invest in great companies regardless of the market. However, many entrepreneurs have opted to remain heads down and build more efficiently instead of testing this new valuation environment.

While our investment theses are always evolving, the shift in the macro environment has not changed which areas we are most excited about.

Do you expect to see more down rounds in 2023? Are you seeing more companies raising extensions or down rounds compared to 2021 and 2022?

We do expect more flat and down rounds to come later this year as runway tightens for many companies that raised more than two years ago.

Private market valuations, at any point in time, are not only a reflection of a team’s hard work and progress, but are also impacted by the financing environment.

What are you most excited about in the fintech space? What do you feel might be overhyped?

We see tremendous opportunity for innovation in the world of B2B payments. The infrastructure groundwork laid by modern developer platforms over the past decade and the upcoming catalysts in the real-time payments world, with the launch of FedNow, could spark much faster adoption.

We are excited to see how entrepreneurs leverage these tools to enhance our archaic B2B payments ecosystem.

Consumer fintech businesses without long-term, durable customer acquisition advantages are overhyped and will continue to struggle to live up to the lofty expectations set by investors over the past several years.

We’re expecting to see significant consolidation across the consumer fintech landscape this year.

What criteria do you use when deciding which companies to invest in? Would you say you are conducting more due diligence?

We look deep into all areas of innovation, including fintech, and focus on startups that align with our theses. We try to predict where there will be opportunities for seismic innovation before we find the entrepreneur. This helps us with diligence, as we work to understand the market before we make any investments.

We also work hard to perform due diligence on every investment opportunity we pursue by spending significant time with the company, with a deep market study, and as many references as possible on the teams we back.

Have fintechs gotten close to growing into their 2021 valuations? How many will not manage the task in 2023?

Given the sharp run up in valuation over the past few years in the private market and the precipitous fall in the public market over the past year, it is difficult to say how many companies have grown into 2021 valuations.

For the top tier of companies that were able to raise larger rounds, the reality is they don’t need to answer that question for quite some time.

What advice are you giving to your portfolio companies?

The most important thing for me is to not give the same advice across different companies. There is no one-size-fits-all solution. Every business is at a different point along their journey to find product-market fit, prove the sustainability of a business model, execute on a repeatable go-to-market motion, etc.

Rethinking growth targets, in light of the rising cost of capital, to focus more on efficiency in this environment is a consistent thread in board meetings these days.

How do you prefer to receive pitches? What’s the most important thing a founder should know before they get on a call with you?

From my experience, you often have to find the most exciting companies and earn the right to invest. We are always reaching out proactively to founders building in the areas where we have active investment theses.

We are also always looking at exciting opportunities that come in through referrals from entrepreneurs we work with or have worked with in the past, and other investors in the ecosystem. We do our best to review and evaluate inbound messages we receive.

Aunkur Arya, partner, Menlo Ventures

Many people are calling this a downturn. How has your investment thesis changed over the last year? Are you still closing deals at the same velocity?

We’re definitely seeing the reset we expected to see after a decade of operating in a macro environment where the cost of capital was near zero. It’s a difficult but very healthy reshuffling of the deck.

I’d say that our core theses within fintech have largely remained the same: we’re investing in developer infrastructure and embedded finance APIs, vertical banking, end-to-end consumer and business financial services, and the Office of the CFO. We’re also looking at thoughtful enterprise applications of AI that intersect with each of these segments of our fintech thesis.

We continue to avoid balance-sheet heavy businesses that take undue risk to generate revenue, and ultimately look less like pure technology companies and more like insurance companies or lenders. These are the first businesses to suffer during a downturn because they’re heavily indexed to the macro environment.

We were less active in 2022, but are already seeing an uptick in deal flow in fintech in the first few months of 2023.

7 investors reveal what’s hot in fintech in Q1 2023 by Mary Ann Azevedo originally published on TechCrunch

https://techcrunch.com/2023/03/07/7-investors-reveal-whats-hot-in-fintech-in-q1-2023/

Facebook’s latest test brings back in-app messaging

Facebook head Tom Alison announced today that the company is testing the ability for users to access their Messenger inbox within the Facebook app. Back in 2016, Facebook removed messaging capabilities from its mobile web application to push people to the Messenger app, in a move that angered many users.

Now, the company is testing a reversal of this decision. In a blog post, Alison said the social network is currently testing this change, and noted that Facebook plans to expand the test soon. The change comes as Facebook, and other Meta-owned platforms, are looking to compete with TikTok.

“Over the coming year, we’ll build more ways to integrate messaging features in Facebook,” Alison said in the blog post. “Ultimately, we want it to be easy and convenient for people to connect and share, whether in the Messenger app or directly within Facebook.”

Over the past year, Facebook has been moving away from focusing on being an app for close friends and family, and has instead been positioning itself as a discovery platform. Last June, the social network revamped its “Home” feed to enhance content discovery. At the time, Facebook said the Home feed serves as a discovery engine for users to find new content and creators through algorithmic recommendations.

The move indicated Meta’s continued desire to chase TikTok, its greatest threat. Given that Facebook has been focusing on being a discovery engine, it’s not surprising that it’s looking to bring back in-app messaging. By doing so, it can present itself as a place for users to directly discuss content after discovering it. Alison notes that it’s important for Facebook to make it easier for people to share what they discover on Facebook via messaging, without having to switch to another app. Since TikTok surfaces new content to its users, and also provides a place to discuss it via DMs, Facebook likely thinks it needs to the same to compete with it.

As part of today’s announcement, Alison said that Facebook is off to a great start this year and that the social network is “thriving.”

“Contrary to reports otherwise, Facebook is not dead nor dying, but in fact alive and thriving with 2 billion daily active users,” Alison wrote. “People are using Facebook for more than connecting with friends and family, but also to discover and engage around what is most important to them.”

In its fourth-quarter earnings reported last month, the company reported revenue of $32.17 billion in Q4, topping estimates, though still down 4% year-over-year and representing the third straight quarter of declines. However, the stock popped after its earnings beat thanks to Meta’s promises of “a year of efficiency” and its deemphasized focus on the metaverse in favor of AI work.

Facebook’s latest test brings back in-app messaging by Aisha Malik originally published on TechCrunch

https://techcrunch.com/2023/03/07/facebooks-latest-test-brings-back-in-app-messaging/

The first-ever Black Friday NFL game will stream for free on Prime Video

It’s a glorious day for football fans. Amazon announced that the exclusive Black Friday NFL game is set to be free to watch on Prime Video, regardless of if you aren’t a subscriber.

This is the first time that the NFL has had a game the day after Thanksgiving, which the league announced in October. So, to celebrate the occasion, Amazon is letting viewers watch it for no cost whatsoever.

The Black Friday game is expected to kick off at 3 p.m. ET on November 24. The NFL will announce the competing teams later this year when the full 2023 schedule is released.

“We’re excited to expand our relationship with the NFL and build a new holiday tradition for our customers with the first Black Friday NFL game,” Jay Marine, vice president of Prime Video and global head of Sports, said in a statement. “As families look to spend time together over the holiday weekend, we are excited to provide an opportunity for everyone to enjoy this new day of NFL action.”

The NFL is notorious for its Thanksgiving games. For instance, the Las Vegas Raiders vs. Dallas Cowboys mashup in 2021 delivered a whopping 38.5 million viewers. It’s likely that the new Black Friday game will deliver impressive numbers since everyone will be at home during the holiday weekend.

The NFL and Amazon have had a relationship since 2017 when Prime Video broadcasted Thursday Night Football (TNF) games alongside NBC, CBS and the NFL Network. In 2022, Prime Video became the first streaming service to get exclusive rights to the sports package, becoming the home of TNF. The 15 regular-season broadcasts were only available to paid subscribers, with the first game garnering 15.3 million viewers.

The first-ever Black Friday NFL game will stream for free on Prime Video by Lauren Forristal originally published on TechCrunch

Reddit gets a TikTok-style feature that introduces a separate video feed

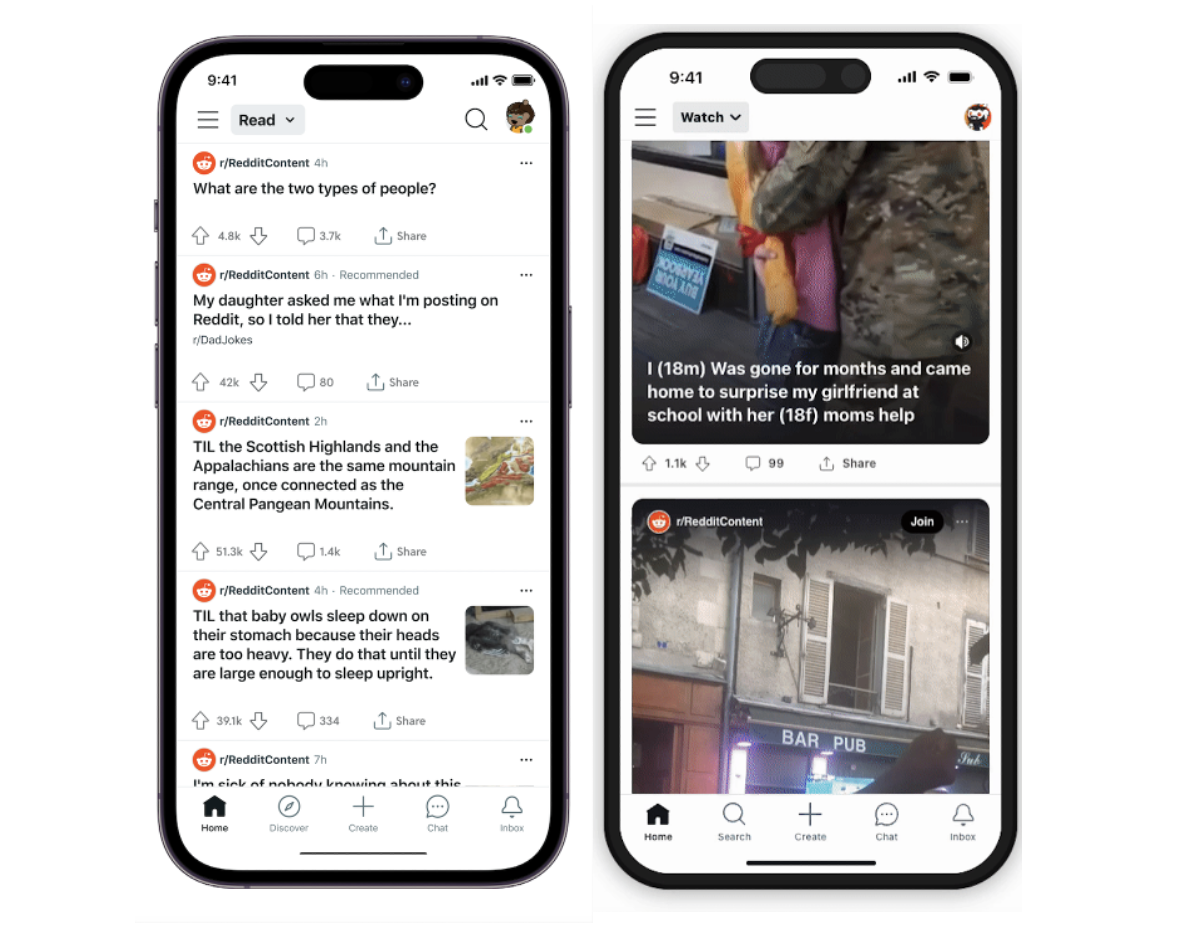

Today Reddit announced updates to its platform, including the test of a TikTok-like feature that separates text and video content into individual feeds. Dubbed “Read” and “Watch,” the two split-view feeds will allow users to switch from browsing text-based posts to videos, depending on their mood.

The new feeds are currently being tested but will roll out fully in the coming weeks, a Reddit spokesperson told TechCrunch. As part of the test, both the “Read” and “Watch” feeds will include posts that users are subscribed to as well as recommendations, at least for now, the spokesperson added.

The update is an attempt to simplify the discovery experience for Reddit users and let them choose the feed that they actually want to see (or read).

“By focusing on the core tenets of Reddit, new and existing users coming to Reddit will be greeted by better experiences and options to discover new and interesting content and communities in uncluttered spaces,” Pali Bhat, chief product officer of Reddit, said in an official statement.

Image Credits: Reddit

Reddit wrote in its official blog post today that it also plans to launch updates to its video player to let users “easily engage in conversations while watching.” The company launched its native video platform in 2017.

Other updates coming soon to Reddit include a re-organized interface to decrease clutter as well as chat upgrades, storefront improvements and more. The most recent feature to launch was a new search capability, where users can search comments within a post on desktop and iOS and Android devices.

For the past few years, Reddit has incorporated video on its platform in many ways to try and compete with TikTok. In 2020, the company acquired a short-form TikTok-like video platform, Dubsmash, to integrate its video creation tools into Reddit. In August 2021, Reddit rolled out a TikTok-style video feed on its iOS app.

The company confirmed last year that it was exploring the idea of bringing more user-generated video content to its online discussion forums as well as a feature that would allow users to react to other videos.

A lot of companies have videofied their apps, including Amazon, SoundCloud and Spotify, which has been spotted testing vertical video feeds. Instagram and YouTube have also launched TikTok-style features, “Reels” and “Shorts,” respectively. Snapchat launched its “Spotlight” feature in 2020.

Updated 3/7/23 at 1:35 p.m. ET with responses from a Reddit spokesperson.

Reddit gets a TikTok-style feature that introduces a separate video feed by Lauren Forristal originally published on TechCrunch

Microsoft’s computer vision model will generate alt text for Reddit images

Two years ago, Microsoft announced Florence, an AI system that it pitched as a “complete rethinking” of modern computer vision models. Unlike most vision models at the time, Florence was both “unified” and “multimodal,” meaning it could (1) understand language as well as images and (2) handle a range of tasks rather than being limited to specific applications, like generating captions.

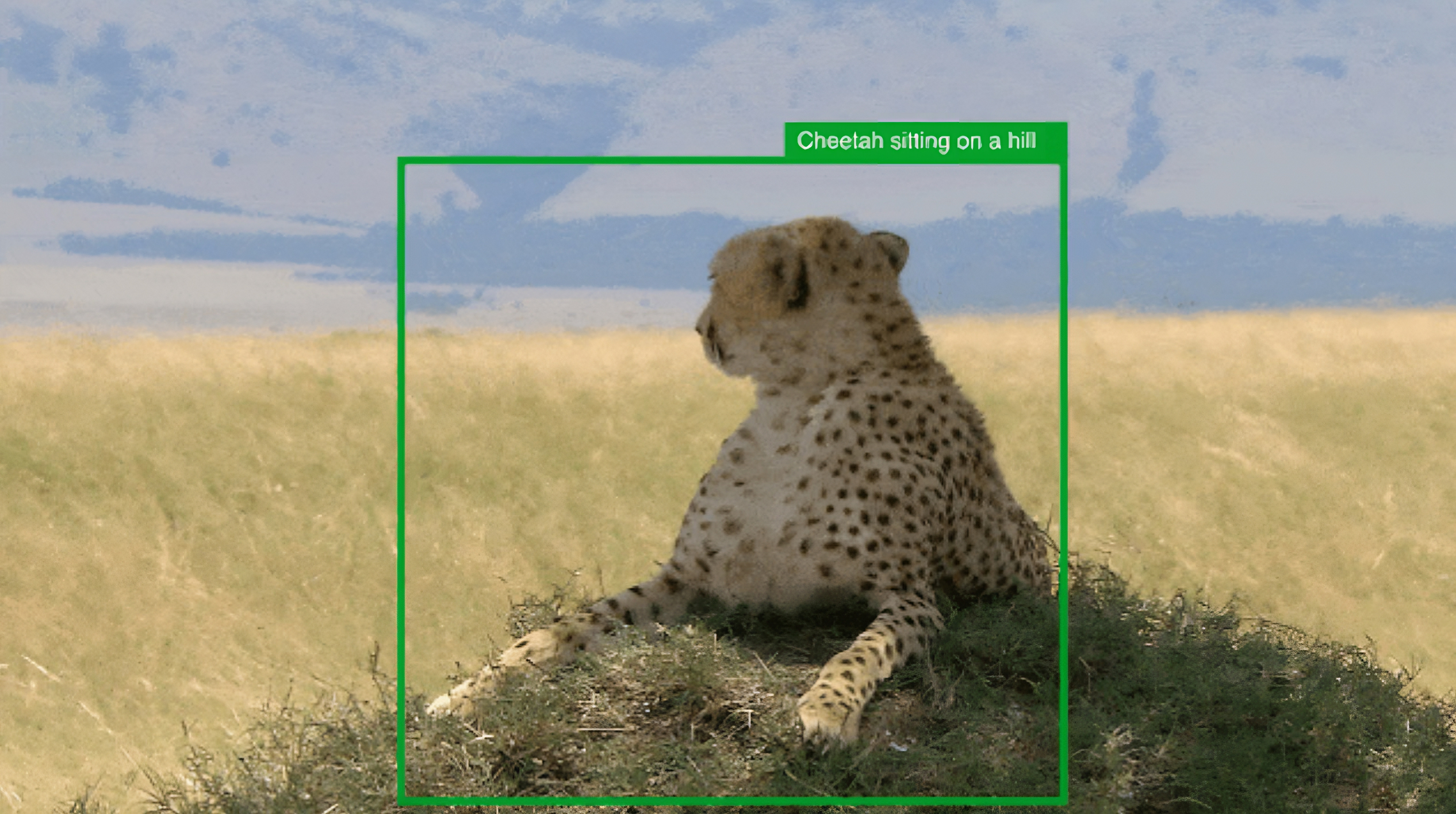

Now, as a part of Microsoft’s broader, ongoing effort to commercialize its AI research, Florence is arriving as a part of an update to the Vision APIs in Azure Cognitive Services. The Florence-powered Microsoft Vision Services launches today in preview for existing Azure customers, with capabilities ranging from automatic captioning, background removal and video summarization to image retrieval.

“Florence is trained on billions of image-text pairs. As a result, it’s incredibly versatile,” John Montgomery, CVP of Azure AI, told TechCrunch in an email interview. “Ask Florence to find a particular frame in a video, and it can do that; ask it to tell the difference between a Cosmic Crisp apple and a Honeycrisp apple, and it can do that.”

The AI research community, which includes tech giants like Microsoft, have increasingly coalesced around the idea that multimodal models are the best path forward to more capable AI systems. Naturally, multimodal models — models that, once again, understand multiple modalities, such as language and images or videos and audio — are able to perform tasks in one shot that unimodal models simply cannot (e.g., captioning videos).

Why not string several “unimodal” models together to achieve the same end, like a model that understands only images and another that understands exclusively language? A few reasons, the first being that multimodal models in some cases perform better at the same task than their unimodal counterpart thanks to the contextual information from the additional modalities. For example, an AI assistant that understands images, pricing data and purchasing history is likely to offer better-personalized product suggestions than one that only understands pricing data.

The second reason is, multimodal models tend to be more efficient from a computational standpoint — leading to speedups in processing and (presumably) cost reductions on the backend. Microsoft being the profit-driven business that it is, that is, no doubt, a plus.

So what about Florence? Well, because it understands images, video and language and the relationships between those modalities, it can do things like measure the similarity between images and text or segment objects in a photo and paste them onto another background.

I asked Montgomery which data Microsoft used to train Florence — a timely question, I though, in light of pending lawsuits that could decide whether AI systems trained on copyrighted data, including images, are in violation of the rights of intellectual property holders. He wouldn’t give specifics, save that Florence uses “responsibly-obtained” data sources “including data from partners.” In addition, Montgomery said that Florence’s training data was scrubbed of potentially problematic content — another all-too-common feature of public training datasets.

“When using large foundational models, it is paramount to assure the quality of the training dataset, to create the foundation for the adapted models for each Vision task,” Montgomery said. “Furthermore, the adapted models for each Vision task has been tested for fairness, adversarial and challenging cases and implement the same content moderation services we’ve been using for Azure Open AI Service and DALL-E.”

Image Credits: Microsoft

We’ll have to take the company’s word for it. Some customers are, it seems. Montgomery says that Reddit will use the new Florence-powered APIs to generate captions for images on its platform, creating “alt text” so users with vision challenges can better follow along in threads.

“Florence’s ability to generate up to 10,000 tags per image will give Reddit much more control over how many objects in a picture they can identify and help generate much better captions,” Montgomery said. “Reddit will also use the captioning to help all users improve article ranking for searching for posts.”

Microsoft is also using Florence across a swath of its own platforms, products and services.

On LinkedIn, as on Reddit, Florence-powered services will generate captions to edit and support alt text image descriptions. In Microsoft Teams, Florence is driving video segmentation capabilities. PowerPoint, Outlook and Word are leveraging Florence’s image captioning abilities for automatic alt text generation. And Designer and OneDrive, courtesy of Florence, have gained better image tagging, image search and background generation.

Montgomery sees Florence being used by customers for much more down the line, like detecting defects in manufacturing and enabling self-checkout in retail stores. None of those use cases require a multimodal vision model, I’d note. But Montgomery asserts that multimodality adds something valuable to the equation.

“Florence is a complete re-thinking of vision models,” Montgomery said. “Once there’s easy and high-quality translation between images and text, a world of possibilities opens up. Customers will be able to experience significantly improved image search, to train image and vision models and other model types like language and speech into entirely new types of applications and to easily improve the quality of their own customized versions.”

Microsoft’s computer vision model will generate alt text for Reddit images by Kyle Wiggers originally published on TechCrunch

Overhaul, which taps AI to secure physical supply chains, raises $73M in equity and debt

Businesses dependent on the physical supply chain face a number of potential roadblocks. Customers expect fast deliveries with visibility into each step, but costs — including transportation and raw materials costs — are rising thanks to inflation and other factors. Meanwhile, there’s a talent shortage, particularly in areas like logistics and operations management, and technical barriers to keeping track of inventory.

Aiming to help overcome a few of the challenges, Barry Conlon and David Broe co-founded FreightWatch, a logistics security services company that they later sold to supply chain visibility platform Sensitech in 2012. After the sale, Conlon and Broe say that they saw a gap in the market to address cargo theft in a more innovative way, harnessing data, telemetry and software.

“Supply chain was moved to the front pages of the newspaper, amplifying the industry with pain points right in the spotlight,” Conlon told TechCrunch in an email interview. “It proved how fragile supply chains are, especially when things go wrong. It forced companies to shift their primary focus to greater transparency and resiliency to course correct immediately, while consumers demand more visibility and expect all brands to deliver the ‘Amazon’ experience.”

So in 2016, Conlon and Broe co-launched Overhaul, which provides visibility software that attempts to anticipate and mitigate freight shipping delays. Using real-time operational and behavioral data, Overhaul provides alerting and performance monitoring alongside basic organizational tools like checklists.

In a show investors are buying into the vision, Overhaul today announced that it raised $38 million in a Series B round led by Edison Partners, with participation from eGateway Capital, StepStone Group and TRM Ventures. Overhaul, in addition, secured a $35 million loan from Stifel Bank, bringing the startup’s total raised to date to just under $100 million.

Conlon says that the cash will be used primarily for R&D and customer acquisition efforts. “We are committed to keeping our investment requirements low, maintaining capital efficiency and to achieve profitability in 2023, setting us apart from our competitors and others in the industry,” he added.

Overhaul’s monitoring dashboard. Image Credits: Overhaul

Overhaul doesn’t exist in a vacuum. Tive, a startup developing supply chain visibility tools, raised $54 million last April. Altana, another rival supply chain visibility platform, bagged $100 million just a few months ago.

What differentiates Overhaul is a strong emphasis on AI and machine learning, Conlon asserts. The platform pulls in all available in-transit telemetry and contextual data, which Overhaul’s data scientists use to build and train AI models for a range of different purposes. For example, Conlon says, one of the models can detect when a cargo load’s security is at risk and alert a security operations team as well as law enforcement.

“Our platform can ingest complex datasets with zero need for new architecture or data structure,” Conlon said. “In the visibility space, companies like Project44 and FourKites have large ambitions but we provide a unique solution with our risk management capabilities that set us apart.”

Whatever the case, Overhaul appears to be growing healthily, with a customer base that now totals over 350 companies. Conlon forecasts that annual recurring revenue will reach $90 million by the end of the year as Overhaul inches its way toward profitability.

One step toward those growth goals was Overhaul’s acquisition of SensiGuard security services from Sensitech in February. In addition to bolstering Overhaul’s platform with visibility and risk monitoring tech, the purchase extended Overhaul’s book of business, adding customers in the tech and pharma industries, while extending Overhaul’s geographic footprint to Brazil, Mexico and the Czech Republic.

One niggle might be securing the next round of funding — not necessarily by any fault of Overhaul. There’s evidence to suggest that supply chain startups, once the darlings of VCs, are less attractive than they once were. According to PitchBook, global supply chain tech startups raised roughly $9 billion in Q2 2022, down 39% from a year earlier.

Conlon tried to assure us that Overhaul hasn’t been massively impacted by the macroeconomics — at least not yet. He pointed to the company’s robust workforce, which now numbers over 650 thanks in part to the SensiGuard acquisition.

“Overhaul has a sustainable model with best in class metrics through customer validation and an enterprise rolodex in pharma, healthcare, technology, 3PLs and food services,” Conlon continued. “We are playing offense while most of the market is reducing investment to extend the runway.”

Overhaul, which taps AI to secure physical supply chains, raises $73M in equity and debt by Kyle Wiggers originally published on TechCrunch

Plus One raises $50M for its parcel robotics vision systems

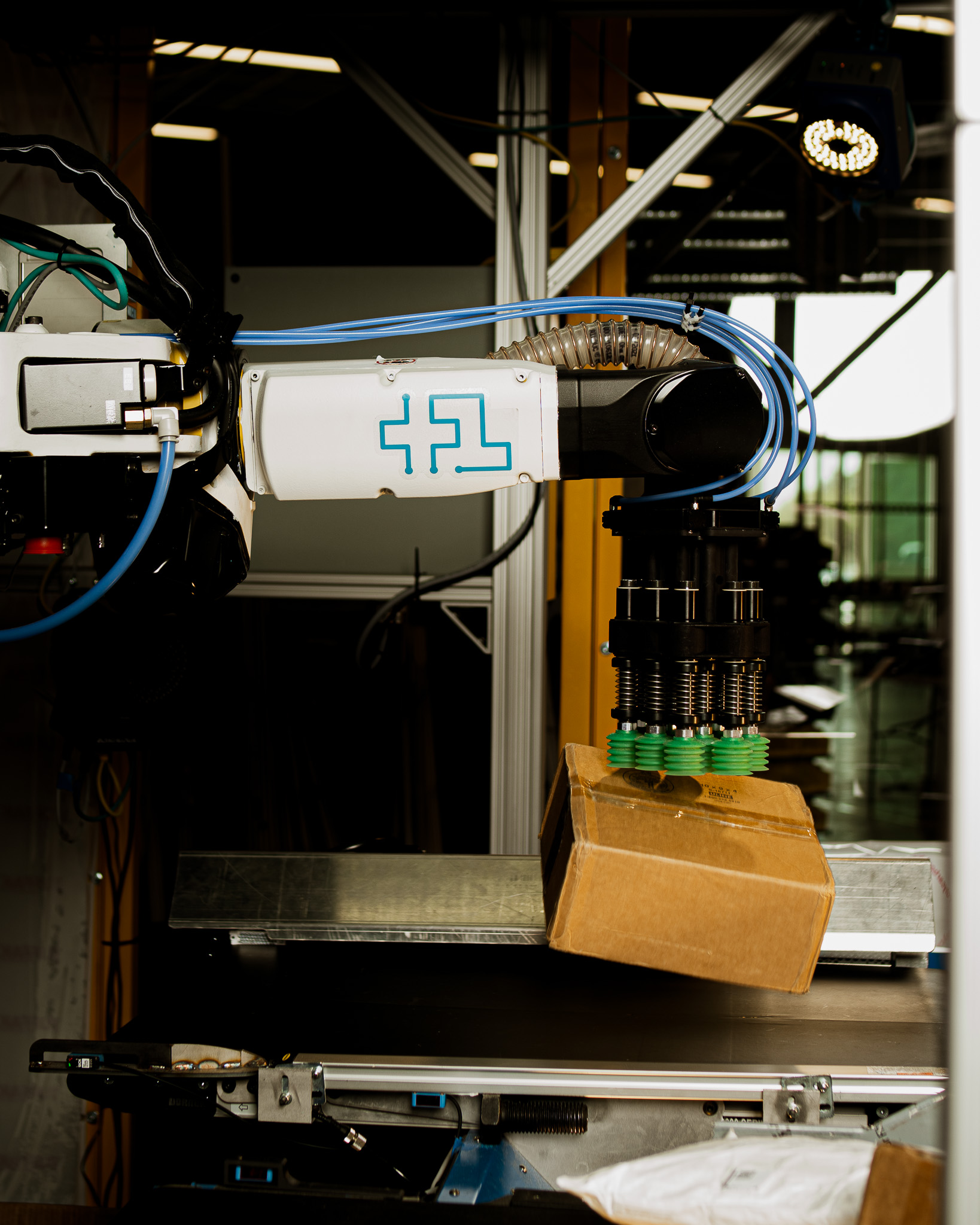

Another industrial automation firm is bucking VC slowdown, as Plus One Robotics this morning announces a $50 million raise. The Series C brings the San Antonio-based firm’s total funding up to $94 million to date (including a $33 million Series B back in 2021). Scale Venture Partners led the round, which also features participation from Top Tier Capital Partners, Tyche Partners and ROBO Global Ventures.

The bulk of the funding is slated for sales expansion,” founder and CEO Erik Nieves tells TechCrunch. “Since our inception, we have punched above our weight when it comes to sales; our team is small but has managed to win the major accounts in this space. This cash infusion means we can double down on our success and have more account managers onboarding new customers. As always, a portion of the cash is earmarked for product development.”

The continued interest is due, in part, to the vertical. Warehouse/logistics remains the biggest category for automation expansion. Interest in automation that was spurred on by the beginning of the pandemic has arguably only grown in the face of an ongoing labor crunch and supply chain constraints.

Plus One specifically operates on the logistics side of the equation — an industry that never had an opportunity to slow down. If anything, shipping and package delivery became a kind of lifeline for people who suddenly found themselves isolated from the rest of the world. Nieves points to the essential nature of the clients it serves as a key to a relatively quick raise during a global economic downturn.

Image Credits: Plus One Robotics

“The world needs what we do, and our financial performance supported that premise,” he says. “Once Scale Ventures leaned in, the round came together quickly and we closed in six weeks from term sheet to wires.”

Partners certainly help. The firm has signed up some global giants as clients, including logistics heavyweights FedEx and DHL. Today’s announcement also finds them adding e-commerce firm Pitney Bowes (best known by many for their mailing equipment) to that list.

“Our partnership with an automation leader, like Plus One, reinforces our goals to drive profitability and sustainability of our physical operations,” Pitney Bowes SVP Stephanie Cannon says in a release. “The continued increase in demand we’ve seen in the ecommerce space makes modernizing the way we approach ecommerce logistics imperative.”

Nieves won’t disclose how many units the Pitney Bowes deal includes, only noting, “we have over 130 robots deployed globally using our vision systems, plus many other licenses of our software being used independent of robot arms.” For its part, Plus One remains a lean team, seven years after its founding.

“We are currently at 83 full-time employees, the bulk of which are based at our headquarters in Texas,” Nieves says. “We also have facilities in Boulder and Pittsburgh, along with a subsidiary in the Netherlands (given the global reach of our users, we have a lot of systems deployed in Europe).”

Plus One raises $50M for its parcel robotics vision systems by Brian Heater originally published on TechCrunch

https://techcrunch.com/2023/03/07/plusone-raises-50m-for-its-parcel-robotics-vision-systems/