Category: TECHNOLOGY

Banyan wants to unlock financing for a (more) sustainable future

When it comes to sustainable infrastructure development, technology is making terrific leaps and bounds. The money to make it happen, however? That leaves a thing or two to be desired. For one thing, the processes remain largely manual, with financing in this sector remaining reliant on emails, spreadsheets, and documents in a variety of formats. Streamlined, and indeed sustainable, it ain’t. With its $25 million Series B funding–which takes its total funding to over $42 million–Banyan Infrastructure is seeking to align sustainable project finance with the technology it is meant to support and develop.

Old-school systems probably didn’t quite do it for old-school oil and gas investments, but they damn sure don’t cut it for newer, greener, more sustainable technologies. These are usually smaller deals–typical commercial and industrial deals are between $1 million and $5 million– where financing comes from more distributed sources, which means that the time required to coordinate them and perform due diligence is sizable.

For Banyan, these inefficiencies in communication and monitoring are pain points it wants to solve with its purpose-built project finance software. With it, banks, financiers, and developers should be able to automate and track complex project finance transactions with a unified risk and data management system. It estimates that it can save up to 1,000 hours for every loan processed.

Farewell tedious and time-consuming manual systems, good morning digitized loans and workflows in addition to automating data ingestion, risk monitoring, and contractual compliance for each loan. This, Banyan hopes, will enable its customers to rapidly grow their sustainable infrastructure portfolio and help to close the estimated $3.5 trillion dollar per year investment gap in renewable infrastructure that is required in order to meet our net zero targets by 2050.

“Because standardization is lacking for sustainable technology, risk-averse investors are hesitant to move quickly in this relatively new industry,” said Will Greene, Banyan Infrastructure’s co-founder and CEO said in an interview with TechCrunch. “Our software focuses on reducing transaction costs and increasing transparency to create previously unseen speed and scale of project finance,”

Banyan believes that right now is the moment to push forwards with its software, following the introduction of the Inflation Reduction Act (IRA) in the USA. This injection of $369 billion of government money is aimed at supporting and developing clean energy technology, manufacturing, and innovation. There’s not just more money coming into the sector, but there’s more attention being paid to it, too. Being able to track, monitor, and complete deals with greater efficiency means that these funds can go further, faster. The theory is that it will make investment in sustainable infrastructure a more attractive proposition, too.

“The fresh commitment of $369B from the IRA is fantastic, but we believe we won’t be able to deploy it without technology to multiply human capacity,” Greene said. “We’re looking forward to building out new features to unlock the IRA and other opportunities that our customers need to act on”

The $25 million funding round was led by Climate software investor Energize Ventures. It was joined by new investors SE Ventures and Elemental Excelerator, and existing investors VoLo Earth and Ulu Ventures. Furthermore, Banyan announced that Juan Muldoon, partner at Energize, has joined its board of directors.

Banyan has two focal points for its new funds: people and product. When it comes to people, Banyan is looking to double its headcount over the next year, with particular emphasis on its product, success, and go-to-market teams. With an eye on international expansion, Banyan is keen to transition from product-led growth to sales-led growth.

“We’re also growing our product to build best practice new regulatory requirements,” says Greene, “including offering a robust product offering that can support our customers in unlocking the benefits of policies like the IRA, as well as support new and emerging technologies, like carbon capture, hydrogen, batteries and more.”.

Greene and his co-founder Amanda Li came together to found Banyan Infrastructure recognizing the skills they each brought ability to better finance infrastructures that can have an impact on climate change.

“Our combined unique backgrounds were exactly what was needed when starting Banyan Infrastructure: with Amanda bringing on-the-ground project finance experience, and myself bringing technical know-how of building enterprise SaaS companies at varying scales,” says Greene. “This company is deeply important to us both as we believe the biggest lever you can pull in changing the trajectory of climate change is investing in renewable infrastructure, and project finance is the underpinning industry and mechanism behind the funnel of investment from financiers to projects.”

For Greene, Banyan is about moving project finance from Web 1.0 to Web 3.0 and speeding up the rate at which capital can be deployed in sustainable industries. It’s about at least meeting, and ideally exceeding, climate goals by using technology to remove funding bottlenecks.

“In ten years, I would love to look back and know that the world has significantly more deployed renewable energy and other sustainable infrastructure projects because of what Banyan has enabled, Greene concluded.”

Banyan wants to unlock financing for a (more) sustainable future by Haje Jan Kamps originally published on TechCrunch

a16z-backed Uno launches a design-centric password manager

There are plenty of good reasons why you should use a password manager, from helping you generate and store complex and unique passwords to not needing to remember any of them. But for some folks, getting started with a password manager for the first time can be a hassle.

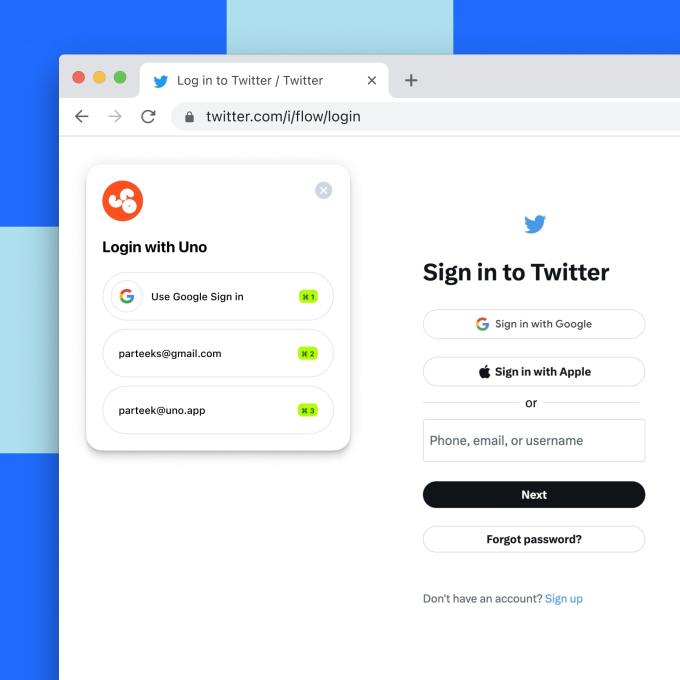

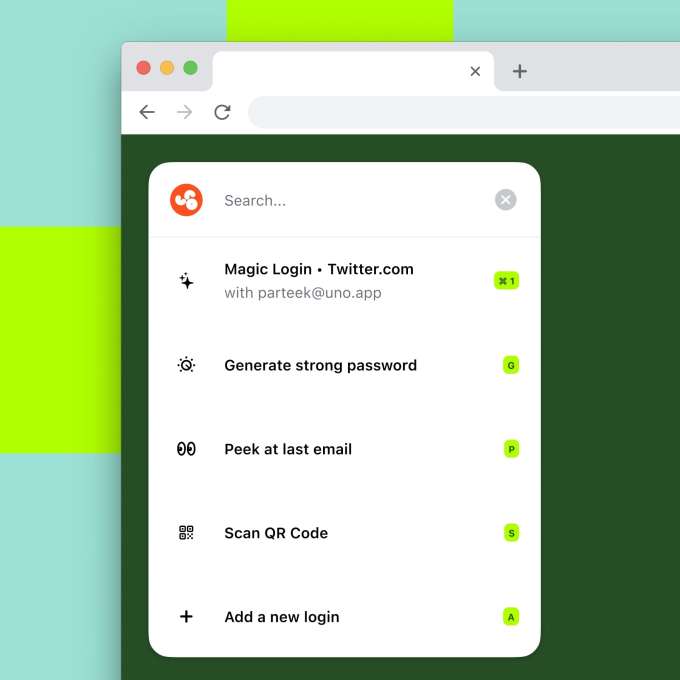

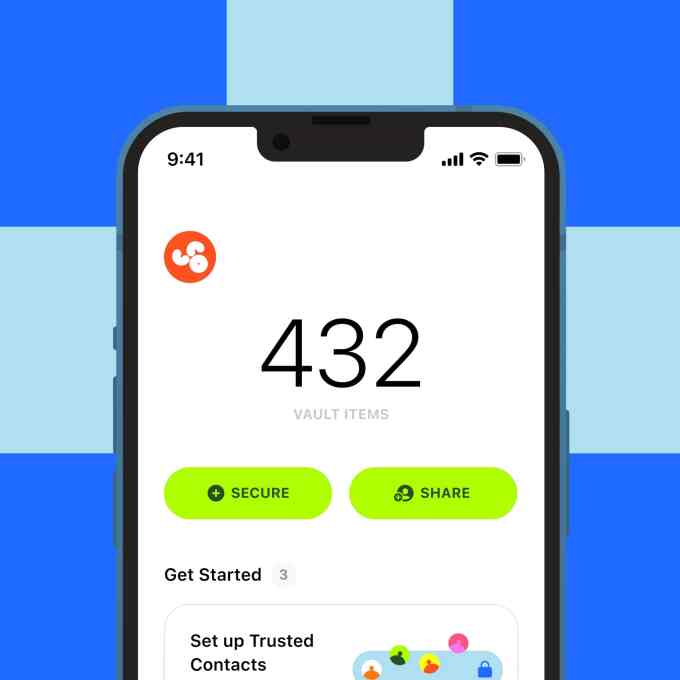

To cater to that problem, a16z-backed company Uno is launching a new password manager with design-centric thinking. The startup’s password manager is an app for iOS and Mac, and a Chrome extension, to make it easier for people to handle passwords and logins.

Uno packs a ton of features that aim to make login easier: one-click login, social password recovery through trusted contacts, customized and easy password sharing, and a secure vault to store private keys, credit card details, and addresses.

Uno’s debut password manager. Image Credits: Uno

The Chrome extension does most of the work for you when you log into sites on your desktop. If you have your login saved with Uno, the company handles all login processes with one click — including 2FA codes sent to emails. You have to sign in to Gmail and give permission to read your latest email to the app, but the company says all this process is handled on your device and no email data is sent to their servers.

The company says the extension can identify when to fill in address fields with data and when to fill in the login information.

Both iOS and Mac apps are in beta and have basic secure storage and password autofill capabilities. The startup said that it’s already working on an Android version, but it didn’t give a specific timeline for the launch.

Image Credits: Uno

If you lose your device, the app asks you to save a private key phrase for recovering your data. There is another — but slightly complicated — process for recovering your data. You can add trusted contacts to your Uno account, and for recovery, they can help you by verifying who you are with votes. But the catch is that all of them have to be Uno users. So unless you find folks who also use the app, you might be better sticking to traditional methods like recovering from another device or entering your private key phrase.

The company

Uno is founded by Parteek Saran, who has a background in design and worked on projects with Lady Gaga, Facebook, and Postmates. Saran also co-created an interaction design and prototyping tool named Form, which was acquired by Google in 2014. Post-acquisition, he worked at the search giant for five years working on products ranging from hardware design to software design — most notably working on Google’s Material Design approach.

The company has raised $3 million in seed funding until now led by Andreeson Horowitz with participation from Lookout founder Kevin Mahaffey, and Dug Song from Duo security.

Uno’s app for iOS. Image Credits: Uno

Saran said that the inspiration for Uno came from when hackers took control of his email, financial services, social accounts, and even Spotify playlists.

“After getting hacked, I was upgrading the security of my accounts, and I realized the process was technical and cumbersome. There were a lot of steps and terminology that could be difficult to understand for non-technical people,” Saran told TechCrunch. “Getting people to use a password manager on a regular basis is a behavioral issue. The way to influence that is to design a solution by looking at how humans interact with this kind of software.”

The founder said that with Uno, he wants to target a broader audience of folks — including users who don’t care much about password security.

The security

While password managers increase convenience by storing a ton of credentials, they also have a responsibility to protect that data and the user’s privacy.

Uno says that it collects minimal data from users and all the data stored on its servers is encrypted with the private key stored locally on users’ devices, which the company cannot access. It notes that only the email, phone number, and public key of the account are collected.

Saran said the app does not track any personal data using analytical tools. The company’s privacy policy notes that “in no event will the private contents of your secure vault ever be transmitted to Uno in a form that Uno can decipher.”

“We really care about people’s privacy and their security. I think people are kind of tired of giving away their data and like doing all these things. So our stance has been — we don’t want that. Our app requires bare minimum permissions to work,” Saran said.

There is also a question of security given that hackers — albeit very skilled ones — got access to LastPass’ data including customers’ password vaults. A starting point for Uno would be to limit what customer data its employees can access. The startup says it wants to avoid these kinds of incidents by keeping a local-first and client-first approach by storing sensitive data on the user’s device and not in its cloud. Also, Uno notes that since it encrypts all customer data including passwords, hackers can’t make sense of it even if they get hold of a person’s device.

As for convincing customers to trust its product, Uno said it has reached out to larger vendors to conduct a formal security audit of its apps.

“Uno has had independent security engineers audit code and conduct penetration testing and have kickstarted the process of reaching out to larger vendors for a formal audit. They’re currently in open beta, which is why this wasn’t kicked off sooner.” Uno said. Uno hasn’t said what the results were from early code audits and penetration testing, but said it plans to publish future findings from its audits.

The company’s target audience — non-technical folks — might not be asking these questions. But Uno has a duty towards its advanced users to provide enough assurance and data by being open and transparent about the password manager’s security practices.

a16z-backed Uno launches a design-centric password manager by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/03/07/a16z-backed-uno-launches-a-design-centric-password-manager/

Salesforce Ventures targets new $250M fund at generative AI startups

The enterprise is about to get hit by the generative AI hype train, as Salesforce prepares to invest in startups developing what it calls “responsible generative AI.”

The cloud software giant, via its Salesforce Ventures VC off-shoot, today announced a $250 million generative AI investment fund, which it said has already invested in four startupssearch engine upstart You.com, which introduced generative AI smarts a few months back; Anthropic, a heavily VC-backed AI startup from former employees of OpenAI, which developed ChatGPT; Cohere, a natural language processing (NLP) startup that recently partnered with Google; and a stealthy startup called Hearth.AI.

In truth, Salesforce has had a busy day at its annual TrailheadDX developer conference, announcing a generative AI pilot they’re calling Einstein GPT,’ which brings ChatGPT-like features to the broader Salesforce platform. This includes a new ChatGPT app for Slack, promising conversation summaries and writing assistance directly inside the enterprise communications app.

ChatGPT, for the uninitiated, is a chatbot-like technology trained on large language models (LLMs) that can generate essays, poems, lyrics, articles, and more from simple natural-language instructions.

Salesforce Ventures has launched a bunch of vertical-specific investment funds through the years, including funds aimed at particular geographies such as Japan or Canada. It has also previously launched a dedicated AI fund, targeting startups building AI smarts on top of Salesforce.

So it perhaps should come as little surprise that Salesforce Ventures is now looking to invest in companies working on what is one of the buzziest tech trends in recent times.

Salesforce Ventures targets new $250M fund at generative AI startups by Paul Sawers originally published on TechCrunch

Threecolts raises $90M to build out its toolkit for third parties selling on marketplaces like Amazon

Amazon rules the roost when it comes to e-commerce, with its marketplace outpacing everyone else when it comes to Threecolts, a London startup founded by an ex-Amazon exec that builds software for brands and retailers to manage their Amazon sales channel, has picked up some 22,000 customers since it first set up shop in 2021. Now, to feed its growth, it’s announcing that it has raised $90 million in funding.

The $90 million figure covers a Series A that Threecolts closed recently; an earlier, never-before disclosed pre-A investment; and some debt, with investors across those tranches including Crossbeam Venture Partners, General Global Capital, Stratos and CoVenture. Yoda Yee, Threecolts’ founder and CEO, would not disclose how much was invested in each of these areas, citing competitive advantage and the fact that there have been a number of others, like Brex, that are paving the way for being less precise when discussing how much and when financing events have taken place, since it provides too much signal to rivals. He declined to talk about valuation for the same reason.

Threecolts, however, is profitable, and says that revenues have grown 6x year-over-year. It’s used the debt to make acquisitions — 14 in all to date in less than two years, in a roll-up play that echoes those we have seen in other parts of the e-commerce ecosystem (specifically among those aggregating smaller e-commerce retailers that sell on Amazon).

That high number of acquisitions speaks to the bigger fragmentation in e-commerce, but also the consolidation that is taking place right now: a number of interesting ideas, breathed into life as startups by way of easy access to funding, have had a hard time more recently raising more funding. Now as they get to the end of their runway, or find it hard to scale, they are getting snapped up by those able to keep going.

Yee previously worked at Amazon coordinating with third parties selling on its marketplaces, and through that understood a little about what Amazon does provide, what it does not, and what could be done better.

Most importantly, he saw first-hand that Amazon’s position both as a enabler, but also competitor to retailers and brands, complicates its relationship with those third parties. Not only does Amazon sell items that directly compete with those that resellers or private-label retailers are selling on its platform, but ultimately, it will create algorithms that result in maximum conversion for Amazon itself, not that of any individual seller. And as a third-party seller, that could boost you, but it could also bury you.

“Because we are able to focus on tools alone, customers trust us more,” he said. “You just can’t trust Amazon with things like automated repricing. Amazon has its own incentives.”

Repricing is just one example here: the same goes for other functions, and beyond that, how Amazon chooses to use the data that it amasses about how people buy and sell on its platform. It is not the only startup that’s aiming to address this opportunity: the inherent conflict that Yee points out has spurred the rise of a number of companies building tools for third-party sellers, and these compete with Threecolts. They include Helium 10, Jungle Scout (which has raised a lot of money itself) and more.

But with more than 6 million businesses doing business on Amazon, the opportunity is clearly one with room for multiple players, and also approaches. The basic concept has driven Threecolts to develop (and acquire) a set of tools that include not just tools to monitor and adjust pricing, but also real-time listing and inventory alerts, customer service integrations across different channels, API dashboards, third-party data source monitoring, automation for feedback and product review monitoring, analytics around profit and sales, and more.

Some of those tools complement what Amazon has done a solid job in providing: Threecolts doesn’t offer a competitor to Fulfillment by Amazon, but it does have a tool to monitor FBA fees.

Threecolts says that its 22,000 customers collectively generate more than $30 billion in gross merchandise sales and have collectively added $200 million in profits due to Threecolts’ tools, as well as a 200% bump in detail page conversions.

That client list includes big names like Samsung, Panasonic and L’Oréal, but also a long tail of smaller sellers (which are 70% of Threecolts’ revenue) and even some of the roll-up companies that have been acquiring successful brands that sell on Amazon, attempting to create their own economies of scale either in supply chains or something else.

What Threecolts tracks is indicative of macro trends in the e-commerce universe. Yee said that Amazon accounts for the vast proportion, 90%, of where its customers currently sell, but he added that it is seeing some activity in requesting tools to cover other marketplaces like Walmart, eBay, or more localised or vertically focused sites. He also noted that recently there’s been a surge of resellers as customers, versus those selling their own, original “private label” products.

Although there has been an uptick in activity on platforms like Instagram for so-called social selling, this hasn’t made its way into requests for Threecolts to support those platforms. Yee said that the likes of WhatsApp and Instagram do come up in conversations, but it’s more to do with them as customer support channels, he said.

Crossbeam has carved out a niche in investing in e-commerce startups, specifically those that cater to businesses (which can be brands, retailers, or even influencers) that run their businesses online and via marketplaces, so it’s a natural fit as a backer for Threecolts and Sakib Jamal, the senior investment associate who lead on the deal, told TechCrunch the firm was “very excited” by the startup and opportunity.

“Threecolts’ impressive execution over the past year means that sellers can now access a one-stop shop solution for an increasing number of pain points, easing vendor fatigue and administrative loads,” he added in a statement. “Yoda and team have provided returns that are realized in quick feedback loops for customers of all shapes and sizes, from large enterprises to up-and-coming businesses.”

Threecolts raises $90M to build out its toolkit for third parties selling on marketplaces like Amazon by Ingrid Lunden originally published on TechCrunch

Gatik’s Gautam Narang on the importance of knowing your customer

Gatik is something of an outlier in the autonomous vehicle space. Whereas most companies are either trying to scale robotaxis or commercialize long-haul self-driving with Class 8 trucks, Gatik is more focused on smaller box trucks and middle-mile logistics.

Gatik CEO and co-founder Gautam Narang said there are two main reasons behind this go-to-market strategy. First, an autonomous solution for middle-mile logistics solves specific customer problems. Second, it’s a solution that can be deployed at scale, with no driver behind the wheel today — not in five years.

Gatik is the third company that Narang and his brother, Arjun, founded together. Their first company was in Delhi, India, a medical robotics startup that focused on the rehabilitation of stroke patients using robotic arms. The problem was that labor is cheap in India, and rehab centers and hospitals didn’t see the need for an expensive and unsociable robotic arm when they could hire nurses.

Narang said he and his brother took that lesson to heart and decided not to create technology for technology’s sake, but rather to focus on validating the real customer pain point.

The customers, in Gatik’s case, were grocers and retailers that were struggling to meet the expectations of the end consumer for same-day delivery. Those expectations have already created a shift in the logistics chain that Gatik has been able to grasp onto.

Gatik defines “middle mile” as distances or routes up to 300 miles. The company has around 40 trucks today that move goods in a hub-to-spoke model (rather than a hub-to-hub model) from a distribution center to microdistribution centers and from those centers to multiple retail locations.

Today, Gatik does daily driverless operations with Walmart and Georgia-Pacific in the U.S. and Loblaw in Canada.

We sat down with Narang to learn more about why Gatik doesn’t do free pilots or accept short-term partnerships, the importance of knowing your customer and what investors are looking for in today’s funding environment.

You and your co-founders have strong backgrounds in robotics. What made you want to pursue the box truck approach to self-driving technology?

Matching the customer needs to what was possible from a technology standpoint is how we started the company. When my co-founders and I decided to start Gatik, the criteria we had in mind was firstly starting with a real customer pain point. Back in 2015, 2016, many companies in our space were approaching this problem mainly from a technology angle, building technology for technology’s sake. The thinking was, we’ll figure out the tech and then worry about the use case and business model later. We wanted to do things differently.

Second, we wanted to focus on an application that was more near term, so that’s how we went after this middle-mile or B2B short-haul segment of the supply chain.

The insight we had was the world of supply chain logistics is moving closer to the end consumer. The online grocery segment was growing like crazy, but making that two-hour or three-hour delivery window was becoming more challenging for the grocers and retailers. In an effort to be able to meet that delivery window, they were moving their supply chain to the end consumer by building out microdistribution centers.

All this is to say the routes were getting shorter but more frequent, and the size of the trucks was getting smaller, as well. So that’s how we came up with the category of Class 3 to 6 vehicles going after this mid-mile. And the best part about this mid-mile was we had to operate the trucks back and forth on fixed and repeatable routes. The whole idea was, let’s not try to solve autonomy over a large geofenced area. Rather, let’s focus our efforts on these fixed and repeatable routes, overoptimize the technology for these routes and get to the point of driver-out faster and safer than the competition.

How fixed are these routes? Are your vehicles just driving from point to point?

We’re still operating Level 4 autonomy, but yes, the operational domain is narrower compared to a company that’s going after robotaxi or last-mile delivery. Instead of going after, let’s say, a large geofenced area like the city of San Francisco, we operate our trucks back and forth on these repeatable routes.

Today we are the only autonomous trucking company doing daily commercial deliveries on public roads without anyone on board. When we started out, we were doing shorter routes, like less than 10 miles point to point, so moving goods from one warehouse or distribution center to one retail location. Over the last few years, the technology has matured to a point where we can do pickups from multiple nodes and do deliveries to up to 50 retail locations as well as any combination in between.

To give you an example of a partnership where we’re doing exactly this is with Georgia-Pacific. So in Dallas, Gatik is moving Georgia-Pacific paper products from one of their distribution centers (DCs) to a network of 34 Sam’s Club locations. So on a daily basis, the exact route changes, and we are touching about five to seven stores. As long as the network is manageable and the routes are known and repeatable, we can handle those kinds of networks.

That’s how we think about our business as well. We focus on specific routes where the technology is solvable today, we get to the point of validation where we can take the driver out, and then we do that again across other markets.

Gatik’s Gautam Narang on the importance of knowing your customer by Rebecca Bellan originally published on TechCrunch

https://techcrunch.com/2023/03/07/gatiks-gautam-narang-on-the-importance-of-knowing-your-customer/

Sonos to add support for spatial audio on Apple Music on March 28

Sonos announced today that Sonos customers will have access to spatial audio on Apple Music starting March 28. The company says it’s Apple Music’s first partner to bring spatial audio to the home.

Spatial audio delivers a multi-dimensional immersive sound experience and is available on the new Sonos Era 300, Arc and Beam (Gen 2). Sonos says Apple Music with spatial audio will place listeners at the center of their music.

“It’s a thrilling time in music as spatial audio – and the artist creativity that comes with it – continues to grow,” said Giles Martin, the VP of Sound Experience at Sonos, in a press release. “Sonos continues to put its listeners at the forefront of sound innovation, ensuring they have access through Apple Music to transformative experiences like spatial audio with Dolby Atmos, so they can feel more from the content they love.”

The news about Apple Music comes the same day that Sonos announced a pair of speakers. The Era 100 is a $249 stereo system that replaces the popular One speaker in the company’s lineup. The $449 Era 300, on the other hand, is a new entry focused on bringing the emerging world of spatial audio to the product line. The speaker sports six amplifiers pointed in different directions to accommodate that sense of sound in three-dimensions.

Sonos to add support for spatial audio on Apple Music on March 28 by Aisha Malik originally published on TechCrunch

https://techcrunch.com/2023/03/07/sonos-support-spatial-audio-apple-music-march-28/

Apple releases new yellow iPhone 14 and 14 Plus

Apple has a tendency to introduce a new iPhone color in Spring. And this time, it’s yellow. The company is adding the color option to both iPhone 14 and iPhone 14 Plus. Last Spring, the company launched a new green color (Alpine green for the Pro models) for the iPhone 13 series, and in 2021, it unveiled a purple colorway for the iPhone 12 series.

The Cupertino-based phone maker already offers these devices in midnight (black), starlight, red, blue, and purple. I’m just sad they didn’t call the new color “banana”.

“People love their iPhone and rely on it every day for all that they do, and now there’s an exciting addition to the lineup with a new yellow iPhone 14 and iPhone 14 Plus,” said Bob Borchers, Apple’s vice president of Worldwide Product Marketing.

Devices with the new color are available for pre-order from March 10 and they will be available starting March 14 in-store and online.

Along with this, the company is also launching new cases in Canary Yellow, Olive, Sky (light blue), and Iris (purple) colorways.

Image Credits: Apple

What’s more, Apple is adding new bands to the spring lineup. Users can buy a $49 solo loop in Canary Yellow, Olive, Purple Fog, and Sprout Green colorways; a $49 sports band in Sky, Bright Orange, and Olive colorways; and a $99 braided solo loop in Purple, Bright Orange, and Olive colorways.

Apple releases new yellow iPhone 14 and 14 Plus by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/03/07/apple-releases-new-yellow-iphone-14-and-14-plus/

Tensor raises $3M for Solana-focused NFT trading platform

“What’s interesting about Solana NFTs, and NFTs in general, is that despite macro conditions there’s still excitement in the space and that’s indicative that NFTs aren’t a fad, there is something here,” Wu said. “For us, we want to provide the trading infrastructure and technological infrastructure for NFTs going forward. We think this is going to be the next trillion-dollar asset class and we want to be the financial trading rails for it.”

In recent months, Ethereum-focused NFT marketplace Blur stirred up some

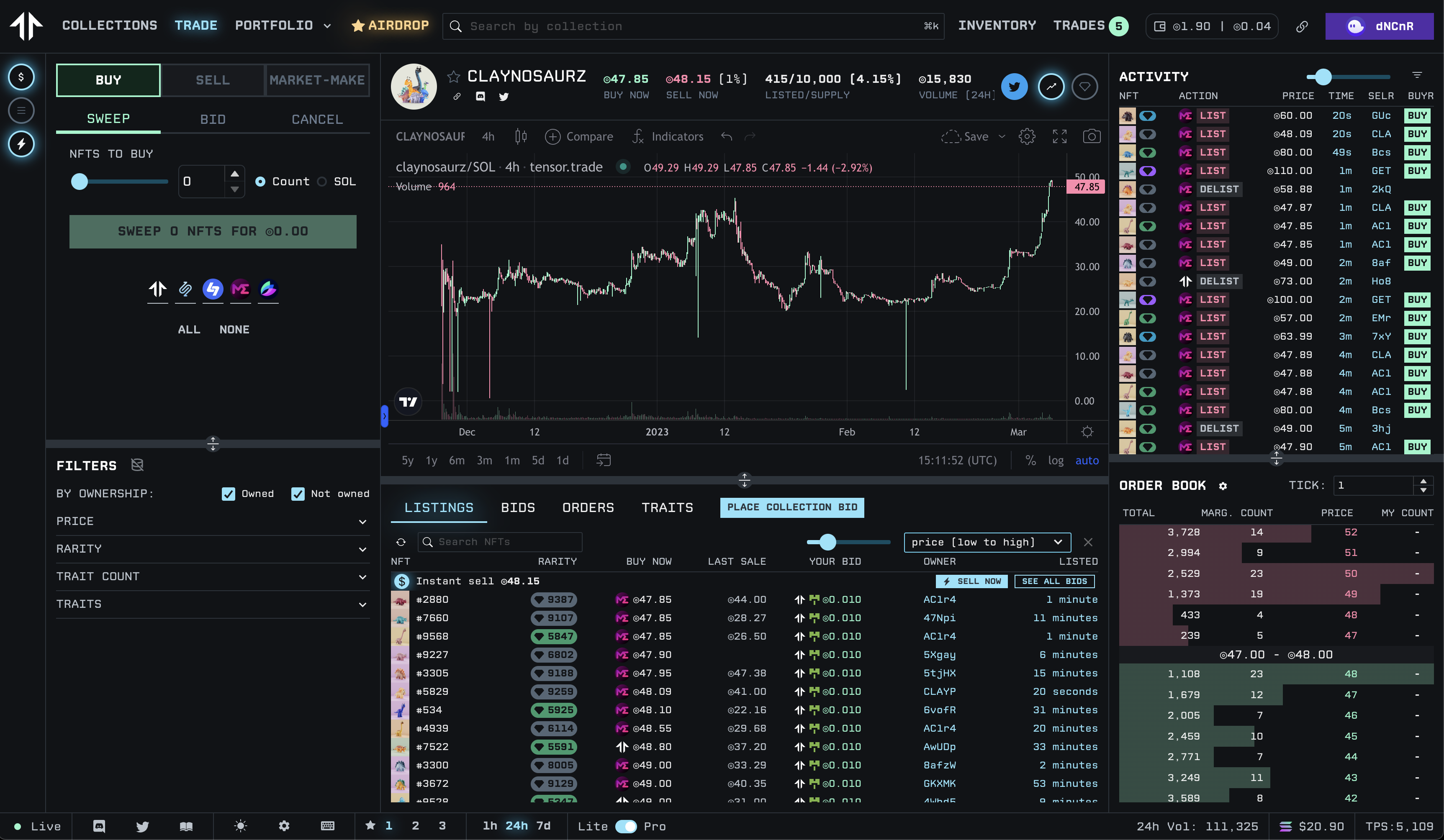

Tensor, a Solana-centric NFT trading platform, has raised $3 million in a seed round led by Placeholder, the team exclusively shared with TechCrunch.

The startup was co-founded by Ilja Moisejevs and Richard Wu, bringing a collective 10 years of experience in working on trading infrastructure and data-intensive systems. Until this point, Tensor was bootstrapped off about $60,000-$70,000 in prize money from winning two Solana hackathons in 2022, Moisejevs shared.

“We’re essentially trying to define the next meta for Solana NFTs,” Wu said. “A lot of things that have been done on Solana are carbon copies of Ethereum and we think Solana NFTs can be so much more.”

Investors in the seed round include Solana Ventures, Alliance DAO, Big Brain Holdings and Solana co-founders Anatoly Yakovenko and Raj Gokal, among others.

Tensor started raising capital around the time when FTX collapsed, Moisejevs said. Half of the money came from small angel investors or customers who have been using the platform “since day one,” he added.

“Going through the round, toward the end we didn’t really need the money ’cause at that point we were making quite a bit in fees,” Wu said. “We just crossed $1 million in annual run rate and we’re a three-person team now, so that covers more than our expenses and then some.”

Solana is the third largest blockchain for NFTs by sales volume with over $3.7 billion in sales all-time, according to data on NFT aggregator CryptoSlam. In the past 30 days, Solana NFT sales volume fell about 47.7%, to $76.5 million, the data showed.

The trading-focused platform offers advanced functionalities like TradingView integration, collection-wide bids and market making orders, Wu shared. It launched in private beta mode in June of 2022 and opened to the public the next month. Since then, Tensor has grown to over 30,000 monthly active users and has traded over $6.6 million in NFT volume, Moisejevs said.

Image Credits: Tensor (opens in a new window)

“What’s interesting about Solana NFTs, and NFTs in general, is that despite macro conditions there’s still excitement in the space and that’s indicative that NFTs aren’t a fad, there is something here,” Wu said. “For us, we want to provide the trading infrastructure and technological infrastructure for NFTs going forward. We think this is going to be the next trillion-dollar asset class and we want to be the financial trading rails for it.”

In recent months, Ethereum-focused NFT marketplace Blur stirred up some controversy in the ecosystem as it implemented a 0.5% creator royalty fee, which is so nominal to many that some view it as essentially zero. This small fee was a trigger that caused other major NFT marketplaces like OpenSea to amend their fee structure to include zero-cost trading for a “limited time” and minimal-at-best creator royalties — or risk losing even more market share.

While Blur is a part of the Ethereum NFT ecosystem, Tensor hopes to become a “similar but different” version of Blur in the Solana world, Moisejevs said. The Solana-focused platform allows collections the option to opt-in to a 1% fixed creator royalty on every trade, he added. Of that 1%, a majority, or 0.9% would go to the creator and 0.1% would go to Tensor.

To date, a handful of collections have opted-in to the fixed creator royalty, but the co-founders expect about 80% of collections to agree to the standard within three months. The platform also launched an incentive plan on Monday that will provide rewards and “boxes” with NFTs in them to community members, among other things, Wu said.

“In web3, your customers are your partners. You have to align them financially, motivationally and in many different ways,” Moisejevs added. “We’ve seen with other ecosystem participants and large marketplaces that they have failed to do it because they’ve shown up to web3 with a web2 mindset that they’re going to abstract value out of customers…We want to be the polar opposite of that and build a product that is owned by the community.”

Tensor raises $3M for Solana-focused NFT trading platform by Jacquelyn Melinek originally published on TechCrunch

https://techcrunch.com/2023/03/07/tensor-raises-3m-for-solana-focused-nft-trading-platform/

Assured Allies secures $42.5M Series B to help Americans ‘successfully age’

Assured Allies, an insurtech company focused on retirement savings, announced today the closing of $42.5 million in Series B funding.

It’s a pretty significant Series B size given the challenging fundraising environment for insurtech companies noted by several of my colleagues in recent stories.

For example, Kyle Wiggers reported that investment into the sector fell in the fourth quarter of 2022 to its “lowest level since Q1 2020,” Anna Heim spoke with investors who are still hanging in there and Mary Ann Azevedo wrote about M&A exits, which insurtech led in 2021.

All said, Assured Allies joins with insurtech companies around the world that did manage to secure some decent funding recently, including Equisoft, Naked Insurance, Turaco and Acko.

The round was co-led by FinTLV Ventures and existing investor Harel Insurance, which were joined by new and existing investors, including Lumir Ventures, Hamilton Lane, New Era Capital Partners, MS&AD Ventures, Core Innovation Capital, Poalim Equity, EquiTrust Life Insurance Co., Akilia Partners and Samsung Next. It brings the company’s total capital raise to $65 million.

The new funding follows a year where Assured Allies secured partnerships with several leading long-term care insurance carriers and saw 300% growth in the number of members using Assured Allies’ platform to, as co-founder and CEO Roee Nahir describes, “successfully age.”

He said as more Americans live longer and about 10,000 adults turn 65 every day, this means that more will need long-term care, an aspect of care that is well known as being a huge financial burden. Depending on the state you live in and the kind of care, the average cost for long-term care could start around $5,000 per month and go up from there.

Nahir and Afik Gal, a medical doctor, started Assured Allies in 2018 after their own experiences as caregivers to aging family members. The company uses technology like machine learning and predictive analytics, along with science-of-aging and essential human support to offer retirement products and programs.

Its first product, launched in 2020, was AgeAssured, which partners with long-term care insurers to reduce disability and support easier aging-at-home capabilities. It has been proven to reduce the cost of long-term insurance claims by roughly 20%, Nahir told TechCrunch. NeverStop, its second product, came in 2022 and uses artificial intelligence and science to create and underwrite retirement products.

Nahir explained that there is an “aging economy paradox” where older Americans have accumulated $80 trillion in assets, but also have a lot of real hard problems, like depression and loneliness. While there are lots of companies out there with good solutions, few large insurance companies are addressing it, which is where Nahir feels Assured Allies stands out.

“I believe that part of the problem is that this population are the last adopters of new technologies and so the go-to market is challenging for these companies,” Nahir said. “In order to sell something to an 80-year-old user, you should have partnerships with 100-year-old companies. You need very strong staying power because people won’t trust you with a pension or a policy if they don’t know you.”

Nahir intends to deploy the new capital, which was secured this year, into further growth of Assured Allies’ products and expansion of the company’s carrier and partner network.

Assured Allies secures $42.5M Series B to help Americans ‘successfully age’ by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/03/07/assured-allies-retirement-insurance-series-b/

Online food delivery platforms in Kenya under probe

The competition regulator in Kenya is probing the conduct of online food and groceries delivery platforms to inform its suggestions on regulatory and policy options, to bolster healthy competition, and enforcement of consumer protection.

The Competition Authority of Kenya (CAK) said it will investigate, amongst other issues, the “role of data” in their operations, data portability, how they acquire customers, consumer protection issues, and redress mechanisms used by the marketplaces. It also plans to use the inquiry to review if the existing regulatory framework can be applied in digital markets.

Regulation and competition enforcement in digital markets is one of the key areas of focus by CAK. It has in the past conducted similar market inquiries, recent one being in the digital lending space where it made suggestions (including on pricing transparency) that informed some aspects of the new Digital Credit Providers law.

“The market inquiry will seek to uncover how food delivery and groceries platforms work in practice and suggest regulatory and policy options for competition and consumer protection enforcement,” said CAK acting director general, Adano Wario.

“The inquiry will identify players and services involved in the food delivery and groceries platforms business model in Kenya and examine the relationships between the platforms and the users with focus on the competition parameters (market power and conduct) and concerns amongst the players,” said Wario.

The regulator said by understanding consumer protection concerns, it will be better placed to provide redress mechanisms for consumers shopping through the marketplaces.

There are a number of major online food delivery and groceries platforms in Kenya including Uber, Jumia, Bolt, Glovo, that have gained foothold in the country as internet and smartphone penetration grows, coupled by the uptake of services such as online shopping and deliveries.

The market inquiry follows the recent coming together of several competition watchdogs in Africa, including CAK, to collectively interrogate the market conduct of global digital firms over concerns related to competition and consumer welfare in Africa.

Members, that also include Egypt, Mauritius, Nigeria, South Africa, Morocco, Gambia and Zambia, aim at ensuring efficient enforcement of competition law and policy in digital markets guaranteeing a competitive market, and fostering the growth of African digital firms.

Online food delivery platforms in Kenya under probe by Annie Njanja originally published on TechCrunch

https://techcrunch.com/2023/03/07/online-food-delivery-platforms-in-kenya-under-probe/