Category: TECHNOLOGY

TikTok’s new ‘Series’ feature lets creators put content behind a paywall

TikTok is launching a new feature called “Series” that allows eligible creators to post content behind a paywall, the company announced on Tuesday. The new monetization feature adds another way for creators to earn money for their content on the app. Series is current only available to select creators, with applications to join opening in the coming months.

Series enables eligible creators to post collections of premium content behind a paywall that viewers can purchase for access. One Series can include up to 80 videos, each up to 20 minutes long. Standard videos on TikTok can currently only be up to 10 minutes long, so the expanded video length for Series gives creators more time and flexibility when filming things like cooking demos, beauty tutorials, educational content, comedy sketches and more. The change marks yet another way that TikTok is inching further into YouTube’s territory.

Creators can select the price for their Series that they believe best reflects the value of their exclusive content. The content can be purchased for access via direct in-video links or through a creator’s profile. A spokesperson for the company told TechCrunch that creators will be able to keep 100% of their earnings after applicable fees for a limited time. TikTok will likely start taking a cut in the future, but didn’t say how much it would be.

It’s worth noting that users won’t be able to use Series as a way to post adult content, as Series content must abide by TikTok’s Community Guidelines.

“From the top collection of must-know spreadsheet shortcuts to the most effective workouts or the latest baked oats recipe, the diverse range of valuable and entertaining content on TikTok has quickly become a part of a billion people’s lives around the world,” the company said in a blog post. “Today we’re introducing Series, a new way for creators to share their stories, talents and creativity as premium content while further deepening their connection with the TikTok community.”

Today’s launch isn’t exactly a surprise, given that The Information reported last month that TikTok was working on a paywall feature. The new feature will allow TikTok to better reward creators, who are the driving factor of the app, as their viral videos have been vital to the app’s growth and popularity. However, the idea of exclusive content for paying users isn’t a new concept, as Instagram lets creators share subscriber-only content.

The new feature comes two weeks after TikTok launched the beta version of a revamped creator fund called the “Creativity Program.” The program is designed to generate higher revenue and unlock more opportunities for creators. The Creativity Program is available to select creators on an invite-only basis, with availability to all eligible creators coming soon.

TikTok said it developed the new program based on feedback from creators on its current earning opportunities, including its Creator Fund. The fund, which rewards creators for popular videos, launched in 2020 with a $1 billion commitment over three years. Its model has been criticized by creators who have complained about low payouts. TikTok is now acknowledging these concerns with the launch of the new program.

The new Series feature and Creativity Program are the latest additions to TikTok’s suite of monetization tools, which includes LIVE subscriptions and TikTok Pulse. The company also has tips and gifts monetization features.

The expansion of TikTok’s current payout offerings for creators comes as its competitors are ramping up their offerings. Last month, YouTube began sharing ad revenue with Shorts creators. No short-form video platform has quite figured out how to share ad revenue up until now, which gives Shorts a notable leg up on the competition.

TikTok’s latest announcements show that it’s looking to appease creators and give them more ways to earn money through its platform amid enhanced competition from other companies.

TikTok’s new ‘Series’ feature lets creators put content behind a paywall by Aisha Malik originally published on TechCrunch

Banyan wants to unlock financing for a (more) sustainable future

When it comes to sustainable infrastructure development, technology is making terrific leaps and bounds. The money to make it happen, however? That leaves a thing or two to be desired. For one thing, the processes remain largely manual, with financing in this sector remaining reliant on emails, spreadsheets, and documents in a variety of formats. Streamlined, and indeed sustainable, it ain’t. With its $25 million Series B funding–which takes its total funding to over $42 million–Banyan Infrastructure is seeking to align sustainable project finance with the technology it is meant to support and develop.

Old-school systems probably didn’t quite do it for old-school oil and gas investments, but they damn sure don’t cut it for newer, greener, more sustainable technologies. These are usually smaller deals–typical commercial and industrial deals are between $1 million and $5 million– where financing comes from more distributed sources, which means that the time required to coordinate them and perform due diligence is sizable.

For Banyan, these inefficiencies in communication and monitoring are pain points it wants to solve with its purpose-built project finance software. With it, banks, financiers, and developers should be able to automate and track complex project finance transactions with a unified risk and data management system. It estimates that it can save up to 1,000 hours for every loan processed.

Farewell tedious and time-consuming manual systems, good morning digitized loans and workflows in addition to automating data ingestion, risk monitoring, and contractual compliance for each loan. This, Banyan hopes, will enable its customers to rapidly grow their sustainable infrastructure portfolio and help to close the estimated $3.5 trillion dollar per year investment gap in renewable infrastructure that is required in order to meet our net zero targets by 2050.

“Because standardization is lacking for sustainable technology, risk-averse investors are hesitant to move quickly in this relatively new industry,” said Will Greene, Banyan Infrastructure’s co-founder and CEO said in an interview with TechCrunch. “Our software focuses on reducing transaction costs and increasing transparency to create previously unseen speed and scale of project finance,”

Banyan believes that right now is the moment to push forwards with its software, following the introduction of the Inflation Reduction Act (IRA) in the USA. This injection of $369 billion of government money is aimed at supporting and developing clean energy technology, manufacturing, and innovation. There’s not just more money coming into the sector, but there’s more attention being paid to it, too. Being able to track, monitor, and complete deals with greater efficiency means that these funds can go further, faster. The theory is that it will make investment in sustainable infrastructure a more attractive proposition, too.

“The fresh commitment of $369B from the IRA is fantastic, but we believe we won’t be able to deploy it without technology to multiply human capacity,” Greene said. “We’re looking forward to building out new features to unlock the IRA and other opportunities that our customers need to act on”

The $25 million funding round was led by Climate software investor Energize Ventures. It was joined by new investors SE Ventures and Elemental Excelerator, and existing investors VoLo Earth and Ulu Ventures. Furthermore, Banyan announced that Juan Muldoon, partner at Energize, has joined its board of directors.

Banyan has two focal points for its new funds: people and product. When it comes to people, Banyan is looking to double its headcount over the next year, with particular emphasis on its product, success, and go-to-market teams. With an eye on international expansion, Banyan is keen to transition from product-led growth to sales-led growth.

“We’re also growing our product to build best practice new regulatory requirements,” says Greene, “including offering a robust product offering that can support our customers in unlocking the benefits of policies like the IRA, as well as support new and emerging technologies, like carbon capture, hydrogen, batteries and more.”.

Greene and his co-founder Amanda Li came together to found Banyan Infrastructure recognizing the skills they each brought ability to better finance infrastructures that can have an impact on climate change.

“Our combined unique backgrounds were exactly what was needed when starting Banyan Infrastructure: with Amanda bringing on-the-ground project finance experience, and myself bringing technical know-how of building enterprise SaaS companies at varying scales,” says Greene. “This company is deeply important to us both as we believe the biggest lever you can pull in changing the trajectory of climate change is investing in renewable infrastructure, and project finance is the underpinning industry and mechanism behind the funnel of investment from financiers to projects.”

For Greene, Banyan is about moving project finance from Web 1.0 to Web 3.0 and speeding up the rate at which capital can be deployed in sustainable industries. It’s about at least meeting, and ideally exceeding, climate goals by using technology to remove funding bottlenecks.

“In ten years, I would love to look back and know that the world has significantly more deployed renewable energy and other sustainable infrastructure projects because of what Banyan has enabled, Greene concluded.”

Banyan wants to unlock financing for a (more) sustainable future by Haje Jan Kamps originally published on TechCrunch

a16z-backed Uno launches a design-centric password manager

There are plenty of good reasons why you should use a password manager, from helping you generate and store complex and unique passwords to not needing to remember any of them. But for some folks, getting started with a password manager for the first time can be a hassle.

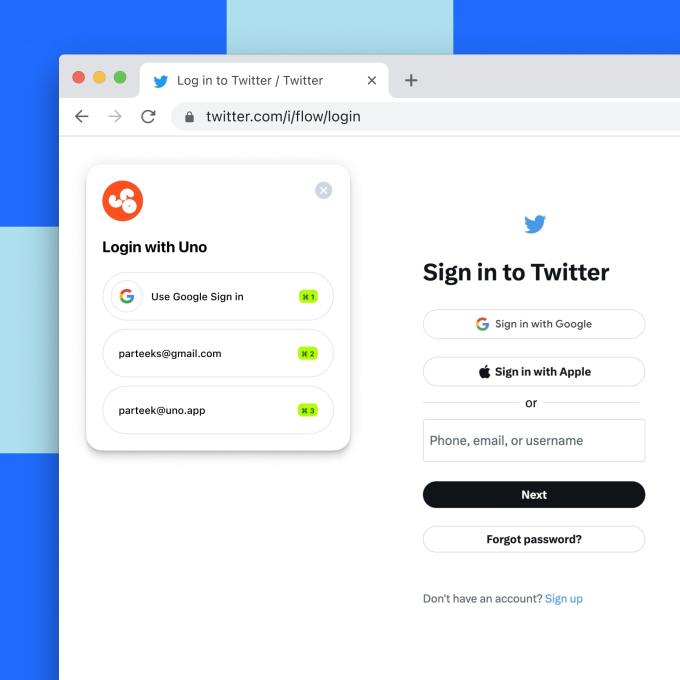

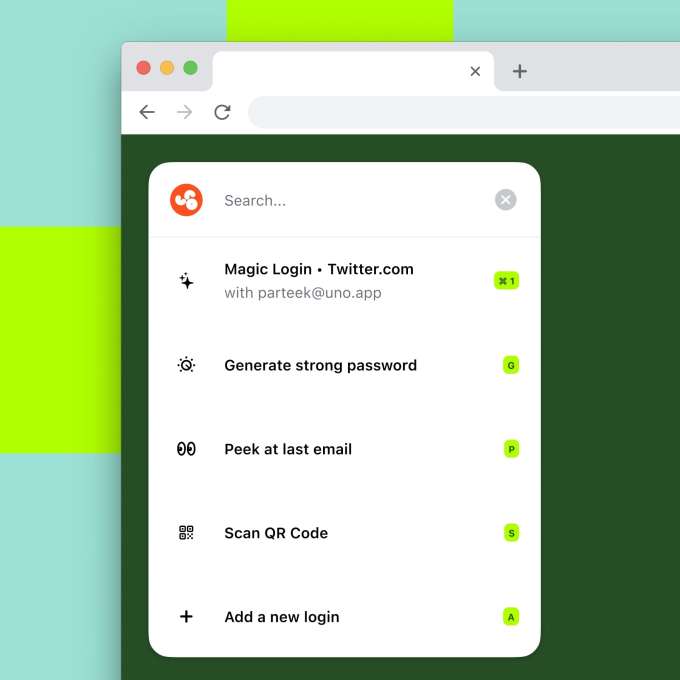

To cater to that problem, a16z-backed company Uno is launching a new password manager with design-centric thinking. The startup’s password manager is an app for iOS and Mac, and a Chrome extension, to make it easier for people to handle passwords and logins.

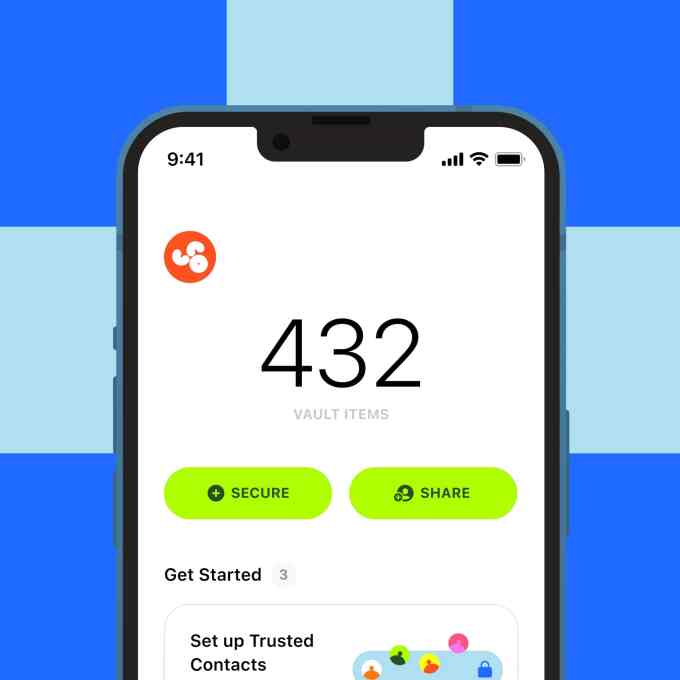

Uno packs a ton of features that aim to make login easier: one-click login, social password recovery through trusted contacts, customized and easy password sharing, and a secure vault to store private keys, credit card details, and addresses.

Uno’s debut password manager. Image Credits: Uno

The Chrome extension does most of the work for you when you log into sites on your desktop. If you have your login saved with Uno, the company handles all login processes with one click — including 2FA codes sent to emails. You have to sign in to Gmail and give permission to read your latest email to the app, but the company says all this process is handled on your device and no email data is sent to their servers.

The company says the extension can identify when to fill in address fields with data and when to fill in the login information.

Both iOS and Mac apps are in beta and have basic secure storage and password autofill capabilities. The startup said that it’s already working on an Android version, but it didn’t give a specific timeline for the launch.

Image Credits: Uno

If you lose your device, the app asks you to save a private key phrase for recovering your data. There is another — but slightly complicated — process for recovering your data. You can add trusted contacts to your Uno account, and for recovery, they can help you by verifying who you are with votes. But the catch is that all of them have to be Uno users. So unless you find folks who also use the app, you might be better sticking to traditional methods like recovering from another device or entering your private key phrase.

The company

Uno is founded by Parteek Saran, who has a background in design and worked on projects with Lady Gaga, Facebook, and Postmates. Saran also co-created an interaction design and prototyping tool named Form, which was acquired by Google in 2014. Post-acquisition, he worked at the search giant for five years working on products ranging from hardware design to software design — most notably working on Google’s Material Design approach.

The company has raised $3 million in seed funding until now led by Andreeson Horowitz with participation from Lookout founder Kevin Mahaffey, and Dug Song from Duo security.

Uno’s app for iOS. Image Credits: Uno

Saran said that the inspiration for Uno came from when hackers took control of his email, financial services, social accounts, and even Spotify playlists.

“After getting hacked, I was upgrading the security of my accounts, and I realized the process was technical and cumbersome. There were a lot of steps and terminology that could be difficult to understand for non-technical people,” Saran told TechCrunch. “Getting people to use a password manager on a regular basis is a behavioral issue. The way to influence that is to design a solution by looking at how humans interact with this kind of software.”

The founder said that with Uno, he wants to target a broader audience of folks — including users who don’t care much about password security.

The security

While password managers increase convenience by storing a ton of credentials, they also have a responsibility to protect that data and the user’s privacy.

Uno says that it collects minimal data from users and all the data stored on its servers is encrypted with the private key stored locally on users’ devices, which the company cannot access. It notes that only the email, phone number, and public key of the account are collected.

Saran said the app does not track any personal data using analytical tools. The company’s privacy policy notes that “in no event will the private contents of your secure vault ever be transmitted to Uno in a form that Uno can decipher.”

“We really care about people’s privacy and their security. I think people are kind of tired of giving away their data and like doing all these things. So our stance has been — we don’t want that. Our app requires bare minimum permissions to work,” Saran said.

There is also a question of security given that hackers — albeit very skilled ones — got access to LastPass’ data including customers’ password vaults. A starting point for Uno would be to limit what customer data its employees can access. The startup says it wants to avoid these kinds of incidents by keeping a local-first and client-first approach by storing sensitive data on the user’s device and not in its cloud. Also, Uno notes that since it encrypts all customer data including passwords, hackers can’t make sense of it even if they get hold of a person’s device.

As for convincing customers to trust its product, Uno said it has reached out to larger vendors to conduct a formal security audit of its apps.

“Uno has had independent security engineers audit code and conduct penetration testing and have kickstarted the process of reaching out to larger vendors for a formal audit. They’re currently in open beta, which is why this wasn’t kicked off sooner.” Uno said. Uno hasn’t said what the results were from early code audits and penetration testing, but said it plans to publish future findings from its audits.

The company’s target audience — non-technical folks — might not be asking these questions. But Uno has a duty towards its advanced users to provide enough assurance and data by being open and transparent about the password manager’s security practices.

a16z-backed Uno launches a design-centric password manager by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/03/07/a16z-backed-uno-launches-a-design-centric-password-manager/

Salesforce Ventures targets new $250M fund at generative AI startups

The enterprise is about to get hit by the generative AI hype train, as Salesforce prepares to invest in startups developing what it calls “responsible generative AI.”

The cloud software giant, via its Salesforce Ventures VC off-shoot, today announced a $250 million generative AI investment fund, which it said has already invested in four startupssearch engine upstart You.com, which introduced generative AI smarts a few months back; Anthropic, a heavily VC-backed AI startup from former employees of OpenAI, which developed ChatGPT; Cohere, a natural language processing (NLP) startup that recently partnered with Google; and a stealthy startup called Hearth.AI.

In truth, Salesforce has had a busy day at its annual TrailheadDX developer conference, announcing a generative AI pilot they’re calling Einstein GPT,’ which brings ChatGPT-like features to the broader Salesforce platform. This includes a new ChatGPT app for Slack, promising conversation summaries and writing assistance directly inside the enterprise communications app.

ChatGPT, for the uninitiated, is a chatbot-like technology trained on large language models (LLMs) that can generate essays, poems, lyrics, articles, and more from simple natural-language instructions.

Salesforce Ventures has launched a bunch of vertical-specific investment funds through the years, including funds aimed at particular geographies such as Japan or Canada. It has also previously launched a dedicated AI fund, targeting startups building AI smarts on top of Salesforce.

So it perhaps should come as little surprise that Salesforce Ventures is now looking to invest in companies working on what is one of the buzziest tech trends in recent times.

Salesforce Ventures targets new $250M fund at generative AI startups by Paul Sawers originally published on TechCrunch

Threecolts raises $90M to build out its toolkit for third parties selling on marketplaces like Amazon

Amazon rules the roost when it comes to e-commerce, with its marketplace outpacing everyone else when it comes to Threecolts, a London startup founded by an ex-Amazon exec that builds software for brands and retailers to manage their Amazon sales channel, has picked up some 22,000 customers since it first set up shop in 2021. Now, to feed its growth, it’s announcing that it has raised $90 million in funding.

The $90 million figure covers a Series A that Threecolts closed recently; an earlier, never-before disclosed pre-A investment; and some debt, with investors across those tranches including Crossbeam Venture Partners, General Global Capital, Stratos and CoVenture. Yoda Yee, Threecolts’ founder and CEO, would not disclose how much was invested in each of these areas, citing competitive advantage and the fact that there have been a number of others, like Brex, that are paving the way for being less precise when discussing how much and when financing events have taken place, since it provides too much signal to rivals. He declined to talk about valuation for the same reason.

Threecolts, however, is profitable, and says that revenues have grown 6x year-over-year. It’s used the debt to make acquisitions — 14 in all to date in less than two years, in a roll-up play that echoes those we have seen in other parts of the e-commerce ecosystem (specifically among those aggregating smaller e-commerce retailers that sell on Amazon).

That high number of acquisitions speaks to the bigger fragmentation in e-commerce, but also the consolidation that is taking place right now: a number of interesting ideas, breathed into life as startups by way of easy access to funding, have had a hard time more recently raising more funding. Now as they get to the end of their runway, or find it hard to scale, they are getting snapped up by those able to keep going.

Yee previously worked at Amazon coordinating with third parties selling on its marketplaces, and through that understood a little about what Amazon does provide, what it does not, and what could be done better.

Most importantly, he saw first-hand that Amazon’s position both as a enabler, but also competitor to retailers and brands, complicates its relationship with those third parties. Not only does Amazon sell items that directly compete with those that resellers or private-label retailers are selling on its platform, but ultimately, it will create algorithms that result in maximum conversion for Amazon itself, not that of any individual seller. And as a third-party seller, that could boost you, but it could also bury you.

“Because we are able to focus on tools alone, customers trust us more,” he said. “You just can’t trust Amazon with things like automated repricing. Amazon has its own incentives.”

Repricing is just one example here: the same goes for other functions, and beyond that, how Amazon chooses to use the data that it amasses about how people buy and sell on its platform. It is not the only startup that’s aiming to address this opportunity: the inherent conflict that Yee points out has spurred the rise of a number of companies building tools for third-party sellers, and these compete with Threecolts. They include Helium 10, Jungle Scout (which has raised a lot of money itself) and more.

But with more than 6 million businesses doing business on Amazon, the opportunity is clearly one with room for multiple players, and also approaches. The basic concept has driven Threecolts to develop (and acquire) a set of tools that include not just tools to monitor and adjust pricing, but also real-time listing and inventory alerts, customer service integrations across different channels, API dashboards, third-party data source monitoring, automation for feedback and product review monitoring, analytics around profit and sales, and more.

Some of those tools complement what Amazon has done a solid job in providing: Threecolts doesn’t offer a competitor to Fulfillment by Amazon, but it does have a tool to monitor FBA fees.

Threecolts says that its 22,000 customers collectively generate more than $30 billion in gross merchandise sales and have collectively added $200 million in profits due to Threecolts’ tools, as well as a 200% bump in detail page conversions.

That client list includes big names like Samsung, Panasonic and L’Oréal, but also a long tail of smaller sellers (which are 70% of Threecolts’ revenue) and even some of the roll-up companies that have been acquiring successful brands that sell on Amazon, attempting to create their own economies of scale either in supply chains or something else.

What Threecolts tracks is indicative of macro trends in the e-commerce universe. Yee said that Amazon accounts for the vast proportion, 90%, of where its customers currently sell, but he added that it is seeing some activity in requesting tools to cover other marketplaces like Walmart, eBay, or more localised or vertically focused sites. He also noted that recently there’s been a surge of resellers as customers, versus those selling their own, original “private label” products.

Although there has been an uptick in activity on platforms like Instagram for so-called social selling, this hasn’t made its way into requests for Threecolts to support those platforms. Yee said that the likes of WhatsApp and Instagram do come up in conversations, but it’s more to do with them as customer support channels, he said.

Crossbeam has carved out a niche in investing in e-commerce startups, specifically those that cater to businesses (which can be brands, retailers, or even influencers) that run their businesses online and via marketplaces, so it’s a natural fit as a backer for Threecolts and Sakib Jamal, the senior investment associate who lead on the deal, told TechCrunch the firm was “very excited” by the startup and opportunity.

“Threecolts’ impressive execution over the past year means that sellers can now access a one-stop shop solution for an increasing number of pain points, easing vendor fatigue and administrative loads,” he added in a statement. “Yoda and team have provided returns that are realized in quick feedback loops for customers of all shapes and sizes, from large enterprises to up-and-coming businesses.”

Threecolts raises $90M to build out its toolkit for third parties selling on marketplaces like Amazon by Ingrid Lunden originally published on TechCrunch

Gatik’s Gautam Narang on the importance of knowing your customer

Gatik is something of an outlier in the autonomous vehicle space. Whereas most companies are either trying to scale robotaxis or commercialize long-haul self-driving with Class 8 trucks, Gatik is more focused on smaller box trucks and middle-mile logistics.

Gatik CEO and co-founder Gautam Narang said there are two main reasons behind this go-to-market strategy. First, an autonomous solution for middle-mile logistics solves specific customer problems. Second, it’s a solution that can be deployed at scale, with no driver behind the wheel today — not in five years.

Gatik is the third company that Narang and his brother, Arjun, founded together. Their first company was in Delhi, India, a medical robotics startup that focused on the rehabilitation of stroke patients using robotic arms. The problem was that labor is cheap in India, and rehab centers and hospitals didn’t see the need for an expensive and unsociable robotic arm when they could hire nurses.

Narang said he and his brother took that lesson to heart and decided not to create technology for technology’s sake, but rather to focus on validating the real customer pain point.

The customers, in Gatik’s case, were grocers and retailers that were struggling to meet the expectations of the end consumer for same-day delivery. Those expectations have already created a shift in the logistics chain that Gatik has been able to grasp onto.

Gatik defines “middle mile” as distances or routes up to 300 miles. The company has around 40 trucks today that move goods in a hub-to-spoke model (rather than a hub-to-hub model) from a distribution center to microdistribution centers and from those centers to multiple retail locations.

Today, Gatik does daily driverless operations with Walmart and Georgia-Pacific in the U.S. and Loblaw in Canada.

We sat down with Narang to learn more about why Gatik doesn’t do free pilots or accept short-term partnerships, the importance of knowing your customer and what investors are looking for in today’s funding environment.

You and your co-founders have strong backgrounds in robotics. What made you want to pursue the box truck approach to self-driving technology?

Matching the customer needs to what was possible from a technology standpoint is how we started the company. When my co-founders and I decided to start Gatik, the criteria we had in mind was firstly starting with a real customer pain point. Back in 2015, 2016, many companies in our space were approaching this problem mainly from a technology angle, building technology for technology’s sake. The thinking was, we’ll figure out the tech and then worry about the use case and business model later. We wanted to do things differently.

Second, we wanted to focus on an application that was more near term, so that’s how we went after this middle-mile or B2B short-haul segment of the supply chain.

The insight we had was the world of supply chain logistics is moving closer to the end consumer. The online grocery segment was growing like crazy, but making that two-hour or three-hour delivery window was becoming more challenging for the grocers and retailers. In an effort to be able to meet that delivery window, they were moving their supply chain to the end consumer by building out microdistribution centers.

All this is to say the routes were getting shorter but more frequent, and the size of the trucks was getting smaller, as well. So that’s how we came up with the category of Class 3 to 6 vehicles going after this mid-mile. And the best part about this mid-mile was we had to operate the trucks back and forth on fixed and repeatable routes. The whole idea was, let’s not try to solve autonomy over a large geofenced area. Rather, let’s focus our efforts on these fixed and repeatable routes, overoptimize the technology for these routes and get to the point of driver-out faster and safer than the competition.

How fixed are these routes? Are your vehicles just driving from point to point?

We’re still operating Level 4 autonomy, but yes, the operational domain is narrower compared to a company that’s going after robotaxi or last-mile delivery. Instead of going after, let’s say, a large geofenced area like the city of San Francisco, we operate our trucks back and forth on these repeatable routes.

Today we are the only autonomous trucking company doing daily commercial deliveries on public roads without anyone on board. When we started out, we were doing shorter routes, like less than 10 miles point to point, so moving goods from one warehouse or distribution center to one retail location. Over the last few years, the technology has matured to a point where we can do pickups from multiple nodes and do deliveries to up to 50 retail locations as well as any combination in between.

To give you an example of a partnership where we’re doing exactly this is with Georgia-Pacific. So in Dallas, Gatik is moving Georgia-Pacific paper products from one of their distribution centers (DCs) to a network of 34 Sam’s Club locations. So on a daily basis, the exact route changes, and we are touching about five to seven stores. As long as the network is manageable and the routes are known and repeatable, we can handle those kinds of networks.

That’s how we think about our business as well. We focus on specific routes where the technology is solvable today, we get to the point of validation where we can take the driver out, and then we do that again across other markets.

Gatik’s Gautam Narang on the importance of knowing your customer by Rebecca Bellan originally published on TechCrunch

https://techcrunch.com/2023/03/07/gatiks-gautam-narang-on-the-importance-of-knowing-your-customer/

Sonos to add support for spatial audio on Apple Music on March 28

Sonos announced today that Sonos customers will have access to spatial audio on Apple Music starting March 28. The company says it’s Apple Music’s first partner to bring spatial audio to the home.

Spatial audio delivers a multi-dimensional immersive sound experience and is available on the new Sonos Era 300, Arc and Beam (Gen 2). Sonos says Apple Music with spatial audio will place listeners at the center of their music.

“It’s a thrilling time in music as spatial audio – and the artist creativity that comes with it – continues to grow,” said Giles Martin, the VP of Sound Experience at Sonos, in a press release. “Sonos continues to put its listeners at the forefront of sound innovation, ensuring they have access through Apple Music to transformative experiences like spatial audio with Dolby Atmos, so they can feel more from the content they love.”

The news about Apple Music comes the same day that Sonos announced a pair of speakers. The Era 100 is a $249 stereo system that replaces the popular One speaker in the company’s lineup. The $449 Era 300, on the other hand, is a new entry focused on bringing the emerging world of spatial audio to the product line. The speaker sports six amplifiers pointed in different directions to accommodate that sense of sound in three-dimensions.

Sonos to add support for spatial audio on Apple Music on March 28 by Aisha Malik originally published on TechCrunch

https://techcrunch.com/2023/03/07/sonos-support-spatial-audio-apple-music-march-28/

Apple releases new yellow iPhone 14 and 14 Plus

Apple has a tendency to introduce a new iPhone color in Spring. And this time, it’s yellow. The company is adding the color option to both iPhone 14 and iPhone 14 Plus. Last Spring, the company launched a new green color (Alpine green for the Pro models) for the iPhone 13 series, and in 2021, it unveiled a purple colorway for the iPhone 12 series.

The Cupertino-based phone maker already offers these devices in midnight (black), starlight, red, blue, and purple. I’m just sad they didn’t call the new color “banana”.

“People love their iPhone and rely on it every day for all that they do, and now there’s an exciting addition to the lineup with a new yellow iPhone 14 and iPhone 14 Plus,” said Bob Borchers, Apple’s vice president of Worldwide Product Marketing.

Devices with the new color are available for pre-order from March 10 and they will be available starting March 14 in-store and online.

Along with this, the company is also launching new cases in Canary Yellow, Olive, Sky (light blue), and Iris (purple) colorways.

Image Credits: Apple

What’s more, Apple is adding new bands to the spring lineup. Users can buy a $49 solo loop in Canary Yellow, Olive, Purple Fog, and Sprout Green colorways; a $49 sports band in Sky, Bright Orange, and Olive colorways; and a $99 braided solo loop in Purple, Bright Orange, and Olive colorways.

Apple releases new yellow iPhone 14 and 14 Plus by Ivan Mehta originally published on TechCrunch

https://techcrunch.com/2023/03/07/apple-releases-new-yellow-iphone-14-and-14-plus/

Believer, a new approach to gaming, raises $55M from Lightspeed, A16Z, and more

Gaming is at a crossroads these days: a decades-old business that has had remarkable staying power banked around classic concepts is now engaged in a battle royale with innovations in areas like mixed reality, AI, blockchain, and networking, as it strives to connect with an increasingly fragmented consumer base.

Today, a startup is announcing $55 million in funding from some big-name backers to mark its own approach on the field. Believer, founded by ex-Riot execs Michael Chow and Steven Snow, is still in stealth and it isn’t likely to launch anything for 3-5 years, the founders tell me. But it has very big ambitions to take on the big players and bring something new into the mix, particularly in large multi-player “open world” games.

“We believe that the open world genre has been capped by a single-player, boxed-product focus,” said Snow, Believer’s chief product officer, as part of an emailed interview with the two co-founders. “We love these games; adventuring in Ancient Egypt or a near-future dystopia is awesome! But it’s time we started having these adventures with our friends.”

It will be doing this with some impressive backing. Lightspeed Venture Partners is leading the Series A, with Andreessen Horowitz (a16z) also participating; alongside this, Bitkraft Ventures, Riot Games, 1Up Ventures, Don Thompson’s Cleveland Avenue, and Michael D. Eisner’s Tornante Company are among those in a previously undisclosed seed round. It’s not disclosing valuation at this time, the two co-founders told me.

Believer at its heart describes itself as a studio, and the money will go initially to picking up more talent to fill that out, complementing initial hires that include CTO Landon McDowell (Microsoft, Riot Games, Linden Lab), CCO Jeremy Vanhoozer (Bungie, Electronic Arts), COO Tim Hsu (Twitter, Riot Games), CMO Shankar Gupta-Harrison (Riot Games, Dentsu X), Director of Operations Grace Park (League of Legends: Wild Rift), and VP of Design Jeff Jew (League of Legends, Legends of Runeterra).

The focus at first will be to work on original IP and stories “where player choices matter,” the company said.

But alongside that, there will be both a technology play, as well as a pursuit of the piece that seems to be part and parcel these days of any budding media empire: a larger entertainment focus.

“We will definitely build new technologies, but judiciously: only in the highly differentiated cases where no technology exists to support the dreams of our players, and the needs of Believers to achieve those dreams,” said Chow. Yet tech, at least in some regards, not the pure focus at all there. When I asked about what platforms currently interest Believer most right now — given the boom in casual games for mobile, multiplayer brands on PCs and connected TVs, and the budding world of VR, the answer could be just about anything, really — I got a very non-specific response.

“The most compelling platform is all platforms,” Snow told me. “It really does feel like we are in one of the most exciting times where the desire for platform parity is also meeting the ability to deliver compelling gameplay models across said platforms. Therefore, we want to build game experiences that are shared broadly among groups of friends, and the way to truly deliver that is by having as few barriers to entry, like platform exclusivity, as possible.”

Chow, meanwhile, likens the choices that Believer will make to those that Pixar has had in the world of animation: it didn’t invent technology but “had to create completely new ways of making movies to work with it.”

The Pixar parallel is intentional. “Games companies are increasingly moving to the heart of the entertainment ecosystem,” Chow added. “In the past, we’ve seen media companies acquire games companies to extend the reach of their IPs into interactive media. Now, we increasingly see that dynamic reverse, where great IPs are born in video games, and are then surrounded by TV, film, music, and sport. We love this model, we lived and breathed it at Riot, and at Believer we strive to do even better.”

For investors like Eisner, the former head of Disney, this is key. “Truly great content franchises are not built with a single media type—they need to resonate with their audience across games, film, television, collectibles, and real-world interactive experiences,” said Eisner in a statement. “The Believer Company gets that, and we at Tornante are excited to advise them as they bring their vision to life across every platform.”

With little to go on in the way of what the company has built so far, or is planning to build — and before it’s been shown whether any of that can get traction with players, ultimately the biggest test of all — what’s perhaps interesting right now is to hear from the co-founders about what they will not be doing.

You can forget about NFTs, for one.

“We say no fucking thanks to NFTs,” said Snow. “These technologies are struggling in games because players aren’t asking for them, and no one as of yet has shown how they can make a game more fun. I believe games are supposed to be fun. We’re not here to meme on tech, that won’t enrich the industry for anyone, let alone players.”

That’s not to say that metaverse and Web3 — whatever you might think that means — are being written off completely.

“I think someone will come up with solutions using these concepts eventually but it’s not a goal we have right now. For us it’s how do these make the gameplay better, and right now we don’t see these technologies enriching that conversation specifically,” Snow said. “More R&D needs to happen here before the fun they offer players is clear and straightforward, and based on what we’ve seen to date, they may not get there.”

On the other hand, the company is hoping to do more with generative AI.

“We want to be leaders not just in building and making use of this tech, but also in the ethics of how it’s applied,” said Snow. He went to to emphasize that this would not be at the expense of a focus on human creators, which they view as “essential” to gaming. It’s more about new kinds of functionality that AI can enable, “the highest-powered tools that will unlock high-quality fun. AI and ML undoubtedly have a say here, especially as time moves on, but it’s up to us to be responsible with how it’s leveraged.”

Given how hard it is for any startup to raise money, let alone one with a totally unproven product aimed at the very fickle market of consumer gaming, it’s very notable that Believer has picked up such a huge sum. Snow knows that the round is big, but it was raised partly because they could do it, and because they don’t know what is around the corner.

“Normally a raise of this size isn’t warranted, but we also aren’t sure what fundraising looks like later this year or next,” he said. “Michael and I were willing to let go more of our own ownership to ensure we can remain player and product focused for the next three years or more. This was the best way to get the right support in place to solidify our future.”

Chow added that the “wide spectrum of backgrounds” of investors allowed for “rich diversity of thought, knowledge, and perspectives.”

“Once we found the right team of investors, beginning with Lightspeed and a16z, it became quite straightforward to find more partners with the right mindset for the current moment,” Chow added. “We believe we have the best investors and advisors a games company has ever had. There’s something about this climate that has people thinking big and long-term – a desire to take advantage of the present moment, with all its uncertainty and possibility, and swing big for disruptive impacts.”

Snow said that three to five years for its first product is a “reasonable” timeline, so hopefully those supportive investors are also… patient.

“We will do this in stages and ask players to engage with us earlier than later,” Snow added. “We have internal roadmaps, of course, because they’re critical to accountability, but a date is a promise to players, and we’re just not ready to make one yet.”

For now, the early signals of making key hires is somethng that the investors like so far.

“The team already assembled at Believer stands ready to change the industry through an unyielding devotion to players,” said Moritz Baier-Lentz, partner at Lightspeed Venture Partners, who is joining Believer’s Board of Directors. “Forget preconceived notions about building, selling, and marketing franchises atop $70 entry fees and strictly authored, immovable stories. As a life-long player and ‘believer’ myself who’s followed and admired the studio’s founders’ work for years, I know Michael, Snow, and their incredible team will make the next big thing by doing the right thing, at every turn. I’m inspired by their vision and honored to help make it possible.”

“When Michael, Snow, and their fellow founders at Believer speak about what’s next for video games, the industry stops and listens,” added Andrew Chen, general partner at a16z, in a statement. “Time and time again, through both innovative use of new technology and subversive design principles, they’ve defied convention and realized ambitions other developers hadn’t dreamed yet. We’re proud to join them at this moment in history and empower them to find the creativity in nascent technology.”

Believer, a new approach to gaming, raises $55M from Lightspeed, A16Z, and more by Ingrid Lunden originally published on TechCrunch

Candidly picks up student debt relief where new US policies leave off

Student debt relief has been a hot topic for years now, with some big things happening — policy-wise — in the past year: Last summer, the Biden administration announced a plan to cancel up to $20,000 for people holding federal student loans.

Then in December, Congress passed the SECURE ACT 2.0, which created provisions for employers to match student loan payments for those with debt while also adding to retirement accounts. Late in February, the Supreme Court heard arguments related to a lawsuit trying to block Biden’s debt relief program.

There has been a now three-year pause on federal student loan payments due to the global pandemic, and it’s widely known that nearly 47 million student loan borrowers owe around $1.8 trillion.

That, combined with the fact that a majority of Americans don’t have $500 to cover unexpected expenses, has provided an “in” for fintech companies to develop numerous technology approaches to solving the student debt problem.

While some fintech companies have taken the borrower approach, others are looking at it from an employee benefit perspective and attracting interest from venture capital investors. Those include Goodly, Highway Benefits, which announced $3.1 million in seed funding last week, and Candidly, which announced $20.5 million in Series B funding today.

Candidly, previously known as FutureFuel, partners with entities, including employers, financial institutions, retirement and wealth management firms, to embed artificial intelligence-driven student debt and savings optimization products into employee benefits engines.

“We exist to crush debt, and to empower hard-working Americans to go beyond student debt, into wellness, and ultimately wealth,” said Laurel Taylor, founder and CEO of Candidly, in an interview. “More specifically, most who have student debt are focused on achieving freedom from debt at the expense of building wealth. Our mission and our capabilities enable users to make simultaneous progress so that we don’t have to choose between our past and our future when it comes to financial health and wellness.”

Altos Ventures led the new financing and was joined by existing investor Cercano Management. In total, Candidly has raised $57 million.

The Series B financing follows a year of record growth in which the company saw 10x revenue growth and a 3,600% increase in payments flowing through the Candidly platform, Taylor said.

Candidly is earmarking some of the new funding to continue operationalize the advancement of the SECURE Act 2.0, which was up for a vote in Congress. The company is developing a suite of tools that allow employers to match employees’ student loan payments, emergency savings contributions and tax-advantaged retirement contributions.

On the borrower side, there are also public service loan forgiveness tools and Federal Forgiveness Finder to better access federal student debt relief programs. Borrowers who have used Candidly’s gamified repayment and auto-payment tools were able to send an average of $45 in extra payments to their loans each month, Taylor said.

In addition, 2022 was a big year for the company with regard to distribution partners, including Guild, Empower, Lincoln Financial Group and Vanguard, joining existing partners like UBS and Fiserv, which Taylor said enables Candidly to serve over 35 million Americans.

In February, the company announced that its customer, American Eagle Outfitters, used Candidly to help employees pay down more than $100,000 in student loan debt.

While the company is able to shave years off of debt payments and help a customer no longer miss out on savings and retirement, Candidly can also serve as a gap filler should the Biden administration’s one-time discharge for student debt be allowed to progress, or even if it doesn’t.

“The one-time discharge isn’t a painkiller, but it may be a vitamin,” Taylor said. “It helps a little bit, but there’s still a big amount of debt to slog through for the average American in our workforce today. The reason we raised this round was to scale our ability to transform financial outcomes for the users that we serve, for the employers that are providing us as a benefit and for the channels that are distributing us.”

Candidly picks up student debt relief where new US policies leave off by Christine Hall originally published on TechCrunch

https://techcrunch.com/2023/03/07/candidly-student-debt-relief-employee-benefit-fintech/