Category: TECHNOLOGY

Dispatches from the conference room

Greetings on a brisk New England morning. I’m finally here on my long threatened trip to Boston. I was planning to be here in early July ahead of our robotics event, but SARS-CoV-2 and its many variants had different ideas. I narrowly avoided another reschedule on my third time around with COVID, but now I’m in that brief (and ever narrowing) window of relative immunity. It’s like I’m Superman or something (probably shouldn’t have gone with one of the few DC superheroes without a mask).

Given the fact that I haven’t been out since 2019, I may well have overbooked. Met with four startups yesterday afternoon after arriving at Logan, spent this morning meeting with a couple of VCs/accelerators and startups, and am currently writing to you from a MassRobotics conference room (shoutout to Joyce, who kindly reserved me a conference room to chat with some founders ahead of a panel and more meetings tonight).

An aerial general view during a game between the Boston Red Sox and the New York Yankees on August 13, 2022 at Fenway Park in Boston, Massachusetts. Image Credits:Billie Weiss/Boston Red Sox/Getty Images

Call it a fact-finding mission. Or maybe a temperature check. We’ve entered an interesting moment, where superpowered robotic VC investments are finally having to contend with the realities of market forces. For a moment there, the industry appeared relatively immune to the slowdown, but in spite of continued bullish feelings about automation at large, nothing here can appropriately be labeled “recession proof.”

Anecdotally, we may have also entered the stage in which the key players in already well-represented categories such as logistics/fulfillment are already in place. That isn’t to say there isn’t room for key new players to enter the picture, but I suspect it’s a lot harder to get tens of millions in funding by telling investors that you’re an Amazon Robotics killer than it was at the beginning of the pandemic.

At the moment, I’ve got a keen eye out for two things:

First, the companies solving the extremely unsexy problems. There are still a lot of extremely bad — and impossible-to-staff — jobs out there that are ripe for automation. I spoke with a company that’s a great representation of that phenomenon, which I’ll dive into when I debrief my Boston trip in next week’s Actuator.

Second, the key components of the broader robotics experience. I know a lot of well-funded companies are looking to create their full-stack solutions, but as these technologies grow in application, a ton of smaller industries are going to sprout up around that. If you’ve got a sufficiently adaptable piece of that puzzle, you’ve got a great — and perhaps overlooked — business on your hands.

There’s value in well-placed myopia. Sometimes thinking small is the right business move. I realize and respect that a lot of folks enter the space with plans to change the world, but they think globally and act locally and all of that good stuff.

Roughly 24 hours into this trip, and I’m realizing how much I missed landing in a place and talking to as many startups as possible. Glad I’m able to do this in Boston again, and hoping to be in more cities soon to see what companies are cooking and, perhaps, check the temperature of the industry from a much closer vantage point. Again, lots more on all of the above next week.

Image Credits: Iron OX

For now, two things are top of mind on this newsletter. One is fun. The other less so. We’ll start with the bad news first. Layoffs. Almost overnight, half the staff at Iron Ox is out of work. Even forgetting the extremely real and immediate human impact of such a move, it’s very disheartening for the industry. There are a lot of questions here. Is this a broader indictment of fully automated greenhouses? Is it something specific to Iron Ox? Perhaps the company’s solution was more proprietary and less adaptable to existing systems than a startup needs to be in the space.

Either way, it’s hard not to walk away from this with the sense that such a well-funded firm is something of a bellwether for automation’s hard road ahead, as the space grapples with bigger macroeconomic issues.

Chief legal officer Myra Pasek confirmed the layoffs this week with TechCrunch. All told, they amount to just under half of Iron Ox’s staff, and appear to run across the organization. It’s a gutting of a company that is clearly doing some soul searching around which existing elements to capitalize on going forward. Says Pasek:

We’ve decided to hyperfocus on our core competence of engineering and technology; as a result, we eliminated many roles that are not core to our renewed focus. However, the layoff was comprehensive and included positions throughout the organization — i.e., not limited to only certain departments.

Reducing the Iron Ox team was a painful decision — one we did not take lightly. We are working with our board members and leaning into our extensive ecosystem throughout Silicon Valley to help employees find meaningful new work at mission-aligned companies. Iron Ox has always hired world-class talent, and I’m confident that the individuals we unfortunately had to cut this week will have many options open to them. As a matter of policy, we are not going to provide additional details or comment on specific personnel, and we ask that you respect their privacy at this sensitive time.

This was precisely the caveat I was alluding to in last week’s newsletter when talking about climate robotics firms. Not everything is a surefire bet, but that shouldn’t distract founders from the fact that there’s a lot of good to be done and money to be made in this space.

Image Credits: NimbRo

The more pleasant news this week is around teleoperation. Our TC Sessions: Robotics pitch-off winner Touchlab made it to the semifinals, but ultimately, the XPrize Avatar trophy went to NimbRo, which hails from the Autonomous Intelligent Systems group at the University of Bonn, Germany. The company won the $5 million prize at the finals competition in Long Beach, California.

“NimbRo’s work demonstrates the remarkable potential of avatar technology to transcend time and distance and help address urgent human challenges, from health care access to disaster relief,” Xprize CEO Anousheh Ansari said in a release. “The final testing event was an exciting opportunity to share the power of telepresence with thousands of people in-person and around the world. We are grateful to all the participating teams for their impressive work and their efforts to boldly push technological boundaries.”

NimbRo beat out 98 other teams, completing the 10 teleoperation tasks in five minutes, 50 seconds. The second-place team Pollen Robotics took ten minutes, 50 seconds, and the third-place team from Northeastern did so in 21 minutes, nine seconds. Here’s a breakdown of the event’s numerous stages, straight from NimbRo.

If I wasn’t on the road this like, I likely would have contributed a significant portion of this week’s newsletter to the topic of telepresence. Namely, it seems like the automotive market dominated the conversation and caused many folks in the space to skip directly to full automation. But there’s some important middle ground here to explore. Remote operation makes a lot of sense in a lot of contexts, especially as many are recognizing precisely how difficult a problem full automation truly is.

Ouster demo vehicle Image Credits: Ouster

Earlier this week, two major lidar companies agreed to become one. Both Ouster and Velodyne signed a deal on November 4 that finds the two firms maintaining 50% of the stock in the newly formed company. The key factors at play here, as Rebecca points out in her article, are (1) there are a lot of companies in the lidar space — A LOT, a lot — and (2) things are returning to Earth after the big SPAC land grab. Ouster co-founder and CEO Angus Pacala will become the CEO of the combined firms, while Velodyne CEO Ted Tewksbury will serve as executive chairman of the board.

Image Credits: Wing

Meanwhile, drone delivery service Wing continues to expand its Australian operations. The Alphabet-owned firm struck a deal with DoorDash that will provide drone delivery of convenience and grocery items in 15 minutes or less through the popular app.

“While Wing has traditionally provided delivery services directly to residential and business customers, to further accelerate our technology development, we’ll be increasingly working with marketplaces and logistics partners to expand their delivery options,” says Wing Australia GM Simon Ross. “[We’re focused on] making fast drone delivery affordable and sustainable for them and their customers.”

Image Credits: Bryce Durbin/TechCrunch

Read next week’s dispatches next week by subscribing to Actuator.

Dispatches from the conference room by Brian Heater originally published on TechCrunch

https://techcrunch.com/2022/11/10/dispatches-from-the-conference-room/

Okta CEO opens up about Auth0 acquisition, SaaS slump and Lapsus$ attack

Okta launched a cloud identity product back in 2009 when most people were locked into Microsoft Active Directory, an on-prem incumbent so entrenched that nobody believed that anyone could touch it. It took a little audacity to go after a giant like that, but Okta took a cloud-first approach, a markedly different strategy from Active Directory at the time.

The company raised over $230 million before going public in 2017. It reached unicorn status with a $75 million raise on a $1.2 billion valuation back in 2015 when the designation meant a little more than it does these days.

With ownership of the workforce side of the market, Okta decided to make another bold move when it acquired Auth0 for $6.5 billion during the stock market bubble that accelerated in 2020. The idea behind the deal was not simply to own an identity tool favored by developers — although that was certainly a big part of it — it was really about owning another large piece of the market, one that could make Okta a one-stop identity shop.

“There’s a very deep divide between legacy and modern in this market.” Okta CEO Todd McKinnon

Okta wanted to own both the workforce market, the core of its approach to that point, as well as the customer identity market where Auth0 lived. And Okta made a substantial bet for a company of its size to make that happen.

Okta isn’t alone in the identity space; competitors include companies large and small like ForgeRock, SAP, IBM, Ping Identity, Salesforce, Microsoft and Akamai, among others.

Like every other SaaS company out there, Okta has had a rough year in the public markets, down over 80% in the past year (although it was up almost 10% in midday trading Thursday). It also had to deal with an attack spearheaded by the group Lapsus$ that happened in January but was reported in March — and the fallout from its response.

Despite these headwinds, the company has big long-term goals to own the cloud identity market and believes it can ride out the current temporary macroeconomic conditions and the legacy vendors to get there.

We sat down with CEO and co-founder Todd McKinnon recently and asked him about how he is navigating these times — and the lessons he’s learned along the way.

Growing Auth0

McKinnon emphasized that he spent 14% of his stock value at the time to acquire Auth0, a number he knows off the top of his head, because he wants his company to own the cloud identity market, and he doesn’t think he could do it without Auth0.

“We bought them to change, and we bought them because we needed change to win this customer identity market,” he told TechCrunch. “Our strategy is that we have to win both the workforce market and the customer identity market. And the only way we’re going to turn identity into one of these most important platforms for every company is we have to [own] both use cases.”

He said integrating two companies like this didn’t come without challenges, and he may have moved too quickly to bring the products together.

Okta CEO opens up about Auth0 acquisition, SaaS slump and Lapsus$ attack by Ron Miller originally published on TechCrunch

Even Healthcare lands additional capital to advance primary care adoption in India

Even Healthcare, an Indian “healthcare membership” company, landed new financial support in the form of $15 million to further drive its mission of providing affordable care to communities across India.

Even isn’t insurance, but allows members to access primary and preventative care at any of over 100 partnered hospitals. Typically, the way Indians access healthcare is through emergency services as opposed to the preventative care model followed in Western countries. They most often pay for services out of pocket, but Even provides what it describes as a more affordable, comprehensive care model. The company said last year when they last raised money that less than 5% of the Indian population has insurance and plans that do exist mainly cover emergency services.

“For us, Even is about giving members access to complete healthcare and building trust like a family doctor,” said co-founder Matilde Giglio. “Right from preventive care to diagnostics to hospitalization, our members will be assured of our support throughout their healthcare journey.”

Depending on a user’s financial capabilities, there are three plans they can choose from. The cheapest is ₹ 40 per month ($0.50 USD) which includes unlimited consultations and a care team, but according to the company is meant for individuals looking to still pay for some services out of pocket. The plan gives users a glimpse at the care provided to then transition individuals to the second tier plan, Even Lite. Even Lite costs users ₹ 320 ($4 USD) per month and includes tests, consultations and a care team. For ₹ 528 ($6.54 USD) per month care becomes more comprehensive including COVID-19-specific services, emergency care across India and cashless hospitalization.

The company’s standard pricing is for individuals, but it does have group plans for companies and groups.

Even currently has 20,000 active members and has partnered with over 100 hospitals since its launch in 2020. Just a year ago the company had 5,000 on a waitlist.

The Bangalore-based company asks new users to talk to a doctor to collect health information and assess risk for underlying conditions. According to Giglio, conditions like diabetes, high cholesterol, high BP and obesity are common in India, but often go uncontrolled due to a lack of primary care. The company claims half their new users learned they suffered from diabetes during the onboarding process.

The new capital raised comes from Alpha Wave and Aspada (Lightrock). They are joining existing investors Khosla Ventures, Founders Fund, Lachy Groom, Palo Alto Networks CEO Nikesh Arora, CRED CEO Kunal Shah and DST Global partner Tom Stafford. Even first raised a $5 million seed round in 2021 led by Khosla Ventures.

This round’s funds will be used to expand its clinical team and scale preventive care in conditions like diabetes, PCOS (polycystic ovary syndrome) and obesity.

Even Healthcare lands additional capital to advance primary care adoption in India by Andrew Mendez originally published on TechCrunch

Galaxy, Gradient and Lux VCs will judge the TC Sessions: Crypto pitch-off

One of the most popular activities at a TechCrunch conference is watching top-notch early-stage founders square off in a pitch competition. Seriously, who doesn’t love a pitch-off? And the Crypto Pitch-off is just one more compelling reason to go to TechCrunch Sessions: Crypto on November 17 in Miami. Let’s take a look at the judges our intrepid startups will need to impress.

But first (hey, you had to see this coming), if you have not yet done the deed, buy your pass right now. Changes in the crypto world are fast and furious — like Binance aiming to purchase FTX but just over 24 hours later backing out. Did you know Binance founder CZ will speak at the event? You do not want to miss that.

Okay, back to the pitch-off. Be in the room when three of the brightest early-stage crypto startups take the stage in front of a live audience — for glory, for media and investor interest, and, drumroll please, for an automatic spot in the Startup Battlefield 200 at Disrupt 2023. TechCrunch handpicks a cohort of 200 early-stage startups to receive a VIP Disrupt experience that includes, for starters, exhibiting all three days of the show — for free.

The contenders will pitch their tech to this panel of expert VCs: Grace Isford, principal, Lux Capital; Wen-Wen Lam, partner, Gradient Ventures; and Will Nuelle, general partner, Galaxy Ventures — check out their bonafides below.

Grace Isford invests at the nexus of web3, data infrastructure and applications of AI/ML. She focuses on crypto and blockchain infrastructure companies building the next-gen web3 stack, as well as on data and machine-learning startups that hyper-personalize user experiences and transform legacy industries.

At Lux, Isford works with companies such as Tactic, Goldsky and RunwayML. Prior to joining Lux, she worked at Canvas Ventures and Handshake (in product management), and she earned her BS and MS from Stanford University.

Before joining Gradient Ventures, Wen-Wen Lam was the CEO and co-founder of NexTravel (YCW15), a leading corporate travel solution that serviced thousands of customers like Lyft, Twilio and Stripe. She grew the business to over $100 million in annual sales before exiting to TravelPerk in 2020.

Prior to founding NexTravel, Lam worked with startups in leadership roles. She received a BA in economics from UC Berkeley and her MBA from the USC Marshall School of Business, and she began her career in tech at LinkedIn.

Will Nuelle focuses on early-stage investments in protocol layer infrastructure, DeFi applications and software products. Nuelle started at Galaxy Ventures in research, where he developed quantitative risk software for trading.

Prior to joining Galaxy, he built incentive simulations for Ethereum protocol FOAM as an intern. He holds BS degrees in mathematics and architecture from Stanford University. He is a board member for Skolem Technologies and has led more than 13 investments for Galaxy.

TC Sessions: Crypto takes place on November 17 in Miami. Don’t miss your opportunity to connect with our partners and to tap into the tech, trends and controversy spanning the blockchain, cryptocurrency, DeFi, NFT and web3 cryptoverse. Buy your ticket today!

Is your company interested in sponsoring or exhibiting at TC Sessions: Crypto? Contact our sponsorship sales team by filling out this form.

Galaxy, Gradient and Lux VCs will judge the TC Sessions: Crypto pitch-off by Lauren Simonds originally published on TechCrunch

Crypto’s crown prince stumbles

Welcome back to Chain Reaction.

Last week on the podcast, we talked about trouble brewing for bitcoin miners. This week, we had to tear up our plans to cover pretty much anything else and turn our attention to what we think is the biggest story in crypto to unfold this year: the fall from grace of once-revered crypto exchange FTX and its former billionaire founder Sam Bankman-Fried (SBF).

Do you want Chain Reaction in your inbox every Thursday? Sign up here: techcrunch.com/newsletters.

this week in web3

Here are some of the biggest crypto stories TechCrunch has covered this week.

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading

Sam Bankman-Fried said on Thursday that he will be winding down the trading firm Alameda Research and is attempting to raise liquidity for the troubled FTX International, as he scrambles to keep the world’s second largest crypto exchange alive after a bailout deal with Binance failed earlier this week. Bankman-Fried said in a series of tweets that he is engaging with a “number of players” to raise capital for FTX’s international business and those discussions are at various stages, including letters of intent and term sheet deliberations.

Troubled crypto exchange FTX investigated by US regulators over customer funds

Crypto trading behemoth FTX fell from grace this week after the exchange experienced a liquidity crunch and agreed to give its rival, Binance, the option to purchase the company’s non-U.S. operations in what appears to be a bailout. Now, U.S. regulators, including the SEC and CFTC, are looking into whether FTX potentially mishandled customer funds on its platform.

Say hello to the newest crypto startups from web3 accelerator Alliance DAO’s demo day

New crypto startups forged ahead during Alliance DAO’s demo day on Wednesday amid the FTX implosion. The most recent cohort, known as All9, for Alliance DAO, a web3 accelerator and builder community, presented their ideas on Wednesday during a demo day, exclusively covered by TechCrunch. There were about 953 applications for this cohort, but only 17 teams were chosen and graduated from the program.

Sequoia Capital marks its FTX investment down to zero dollars

Sequoia Capital just marked down to zero the value of its stake in the cryptocurrency exchange FTX — a stake that accounted for a minor percentage of Sequoia’s capital but as of last week likely represented among the most sizable unrealized gains in the venture firm’s 50-year history. It alerted its limited partners in a letter that it sent out to them this evening, a copy of which TechCrunch obtained and shared in this article.

Some crypto VCs see decentralization as the future following FTX collapse (TC+)

As the crypto market digests the past few days of chaos, venture capitalists see the moment as a warning, but also as an opportunity for the growth of decentralization and maturation of the larger blockchain space. TechCrunch spoke with some investors to understand their long-term view of the industry following this week’s news from FTX.

the latest pod

We had to talk about the news that rocked the crypto world this week in our Thursday episode: the Binance/FTX deal that never was. To begin, we gave you a rundown of WTF just happened with the beef between two of the largest crypto exchanges in the world and how Sam Bankman-Fried’s storied exchange fell so far so fast, bringing down investors, cryptocurrencies and other companies in the space tumbling down with it.

Once we ran through the background behind the situation that’s been unfolding in real time this week, we shared our thoughts on the massive implications this fiasco might have for the rest of the crypto industry, from venture capitalists and startups to regulation across the globe.

It’s a fascinating backdrop for our conversation at our crypto event in Miami next week, where we’ll be chatting with Binance CEO Changpeng Zhao (CZ), the billionaire who is seen as the catalyst for FTX’s downfall. You can use the promo code REACT for 15% off a General Admission ticket to the event to hear from CZ and plenty of other crypto market players about what the future of this tumultuous industry might hold in the coming months.

Chain Reaction comes out every Tuesday and Thursday at 12:00 p.m. PT, so be sure to subscribe to us on Apple Podcasts, Spotify or your favorite pod platform to keep up with the action.

follow the money

- Web3 messaging infrastructure platform Notifi raised a $10 million seed round co-led by Hashed and Race Capital.

- Web3 API provider Ramp secured $70 million in a Series B funding round, co-led by Mubadala Capital and Korelya Capital.

- Blockchain fraud prevention startup TRM Labs expanded its Series B funding round by $70 million led by Thoma Bravo with participation from existing investors PayPal, American Express and Citigroup.

- Eterlast emerged from stealth with $4.5 million to develop web3 games for sports fans.

- Decentralized search engine Sepana raised $10 million from Hack VC, Pitango First and others.

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Hear CZ for free at TC Sessions: Crypto

Who better to give an insider take on the recent Binance/FTX news than Binance chief executive CZ himself? Score a free ticket, get the lowdown and explore the many conversations and networking opportunities at TC Sessions: Crypto on November 17 in Miami. The first 25 readers to register with this will join us in Miami on November 17 for free!

Crypto’s crown prince stumbles by Anita Ramaswamy originally published on TechCrunch

https://techcrunch.com/2022/11/10/cryptos-crown-prince-stumbles/

We may all be #RatVerified forever

I rarely update my Twitter display name, except maybe when I am on vacation and want to warn people that if you email me, I will either not see it or I will become very annoyed that you emailed me about NFTs. But I was convinced to add a little emoji to my name by Alex Cohen, an internet funny guy whom I’ve crossed paths with since the days of weird Facebook, Post Aesthetics and “Jeb! The Musical.”

“why would i pay $8 to get a blue check if i could put a rat next to my name for free???” Cohen tweeted last week. “i’m calling on everyone to join me in becoming #RatVerified.”

why would i pay $8 to get a blue check if i could put a rat next to my name for free???

i’m calling on everyone to join me in becoming #RatVerified

— alex (@tinysnekcomics) November 1, 2022

To become “rat verified,” all you have to do is edit your Twitter display name and add a rat emoji. That’s it. You did it. You are now rat verified. Cohen’s tweet went so viral that it even reached TechCrunch’s own Alex Wilhelm, who is so disconnected from this corner of Weird Internet that I once had to explain “My Immortal” to him. The hashtag #RatVerified even reached number one on the Twitter’s list of trending topics in the United States.

Of course, Cohen is making fun of new Twitter owner Elon Musk’s boneheaded idea to charge users $8 per month to be verified, which has already imploded into a chaotic mess. But since impersonation has become so rampant with the advent of the “I paid Elon $8” variant of blue check — which looks the same as the “I am a public figure” blue check — Twitter is currently not letting verified users change their usernames.

i am rat verified forever https://t.co/dZoHQqOcTM

— amanda silberling (@asilbwrites) November 10, 2022

Even Doja Cat, who had changed her display name to “christmas,” has pleaded with the Chief Twit to free her from perpetual festivity.

i don’t wanna be christmas forever @elonmusk please help i’ve made a mistake

— christmas (@DojaCat) November 10, 2022

This whole rollout has been a mess — #tbt to yesterday when TechCrunch was Grey Check Official Super Double Verified for like two hours. And now as a result, what was supposedly a fleeting internet gag is now a bit more permanent. May my little rat friend prosper forever.

We may all be #RatVerified forever by Amanda Silberling originally published on TechCrunch

Pitch Deck Teardown: Syneroid’s $500K seed deck

Because the company is throwing itself into a market that is relatively well understood, its challenge isn’t to explain what it is doing but how it is moving the market forward. The company’s second slide is labeled an “overview” slide, which rapidly helps get a picture of the overall challenge this particular market segment is facing.

An investor likely knows at least some of this, but these bullets augment (or gently correct) any preconceived notions an investor might have, smoothing the delta between their perception of the market and the realities of being in that market. This slide — while fairly wordy — does a really good job of ironing out any misunderstandings an investor may have.

Having said that, it also brings up some important questions. Lost pets are just one part of the challenge; stolen pets will have their collars removed, and animals that go astray are on occasion able to shed their collars. Syneroid doesn’t really address either scenario.

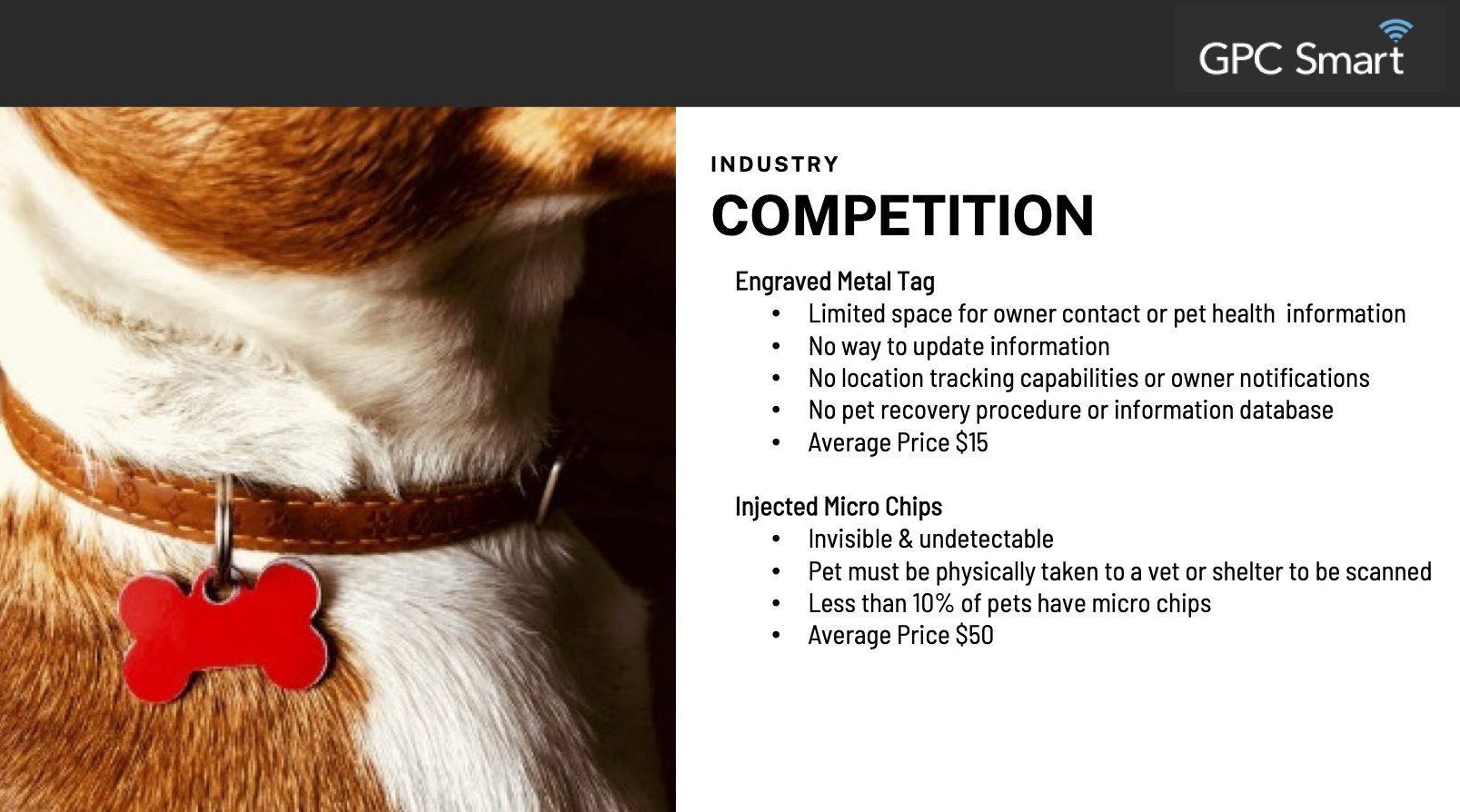

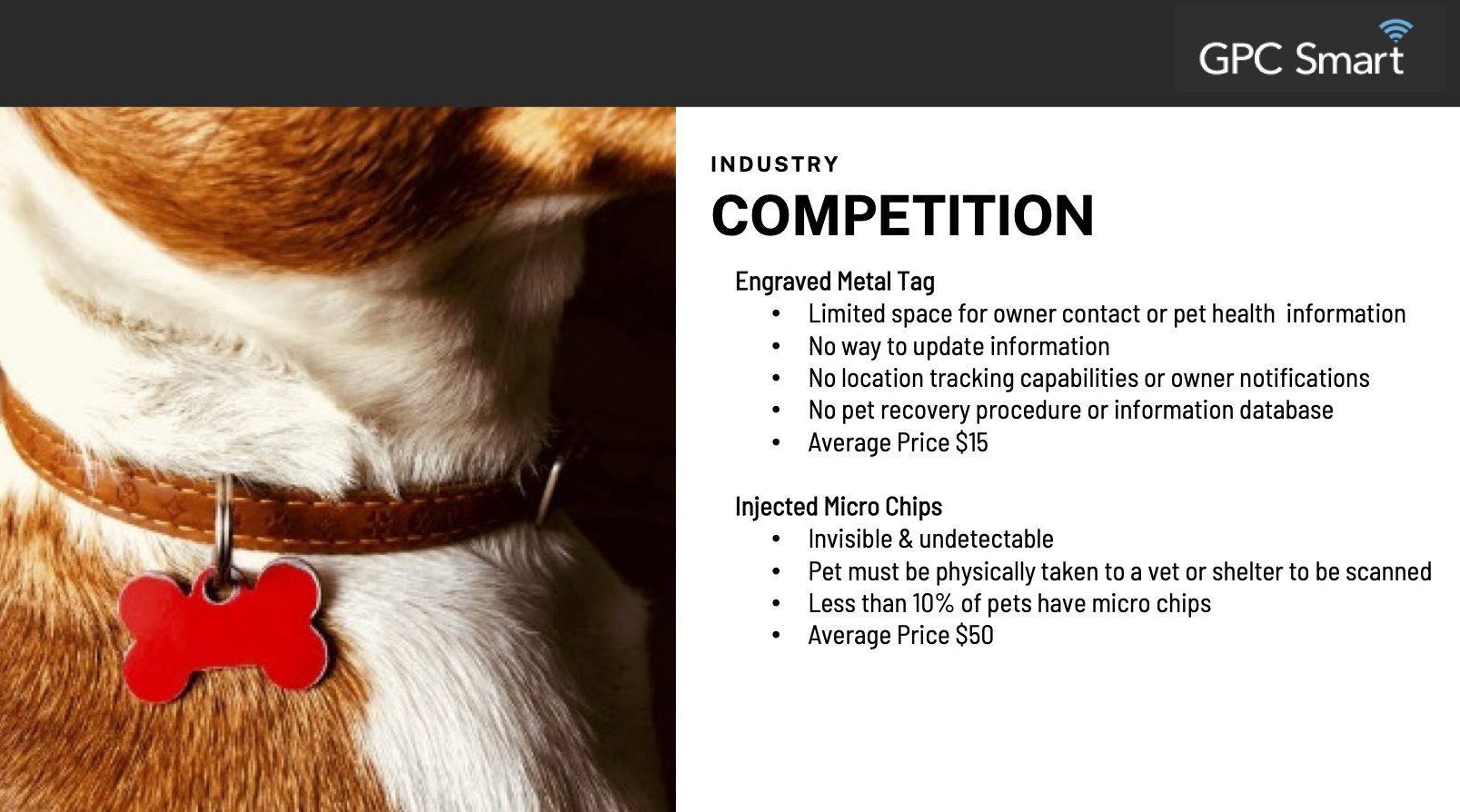

Great competition overview

It’s pretty rare to see a startup put its competitor overview front and center, but I think that was a really shrewd move in this case. Again, this is not a deep tech play or a market shrouded in mystery. I suspect that most would-be investors would be able to come up with the two major competitors. Tackling that head-on does seem a little defensive, but given the market, I think it makes a lot of sense in this case. Here’s how the company addressed it:

[Slide 3] Tackling competitive alternatives this early in a slide deck is unusual but probably a good move in this case. Image Credits: GPC Smart Tags

There are a number of obvious competitors in this space, including the most common ones, existing engraved metal tags or injected microchips, which both have their own pros and cons. There’s also the latest generation of GPS-enabled dog collars, such as the ones from

Syneroid recently raised a $500,000 round of funding to bring something halfway between microchips and dog collars to market. The company is finding some interesting slices of the market, but the deck, overall, leaves a few things to be desired. We learn more from mistakes than from perfection, so I figured it’d be a great one to dive into for this week’s pitch deck teardown!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Throughout this pitch deck teardown, you’ll see the company referred to as Syneroid and GPC Smart — the company’s official name is the former, but the brand they are using for the pitch deck and its products is the latter. The company told me it raised this round at a $3.9 million valuation.

The company used a tight, 12-slide deck for its pitch, and no information has been redacted or omitted.

- Cover slide

- Problem slide

- Competition slide

- Solution slide

- Competitive advantages slide

- History/traction slide

- Market-size slide

- Target markets/go-to-market slide

- Team slide

- Operational financials slide

- Ask slide

- Contact slide

Three things to love

Syneroid is entering a market that’s very easy to understand: Lost animals are something that most of us have an experience with in one way or another. That’s an advantage in that you don’t have to explain the market in detail. It also means that the company is facing a wall of potential competitors even as it is trying to gain traction. That’s a challenge, and it’s interesting to see how Syneroid is tackling it.

Cover the gap between the perceived and the actual

[Slide 2] The overview slide does a great job of getting investors up to speed. Image Credits: GPC Smart Tags

Because the company is throwing itself into a market that is relatively well understood, its challenge isn’t to explain what it is doing but how it is moving the market forward. The company’s second slide is labeled an “overview” slide, which rapidly helps get a picture of the overall challenge this particular market segment is facing.

An investor likely knows at least some of this, but these bullets augment (or gently correct) any preconceived notions an investor might have, smoothing the delta between their perception of the market and the realities of being in that market. This slide — while fairly wordy — does a really good job of ironing out any misunderstandings an investor may have.

Having said that, it also brings up some important questions. Lost pets are just one part of the challenge; stolen pets will have their collars removed, and animals that go astray are on occasion able to shed their collars. Syneroid doesn’t really address either scenario.

Great competition overview

It’s pretty rare to see a startup put its competitor overview front and center, but I think that was a really shrewd move in this case. Again, this is not a deep tech play or a market shrouded in mystery. I suspect that most would-be investors would be able to come up with the two major competitors. Tackling that head-on does seem a little defensive, but given the market, I think it makes a lot of sense in this case. Here’s how the company addressed it:

[Slide 3] Tackling competitive alternatives this early in a slide deck is unusual but probably a good move in this case. Image Credits: GPC Smart Tags

There are a number of obvious competitors in this space, including the most common ones, existing engraved metal tags or injected microchips, which both have their own pros and cons. There’s also the latest generation of GPS-enabled dog collars, such as the ones from Fi, Whistle, Fitbark and others, which aren’t addressed in this competitive landscape.

If the animal is stolen, the thief will simply discard the collar, and at that point, it doesn’t really matter what’s on the collar.

This slide shows an understanding of the competitive landscape. I love that the company chose to tackle this upfront. I think it’s important, and it’s a great way to get out ahead of the most obvious pushback from investors.

Like on the previous slide, although its presence is encouraging, it raises some questions. I think an NFC/QR code dog collar is interesting, but I’m struggling to see how they are inherently better than standard engraved tags. The exact laser-engraved tag in the photo doesn’t cost $15, as listed on the slide, but can be ordered from Amazon — fully personalized — for $4, with four lines of text on each side of the metal tag.

Sure, you can’t “update” the information, but pet owners are probably able to afford the $4 every time they move or change their phone numbers. You can’t include location information, but someone who is willing to catch a stray pup is probably able to text or call the owner with an address and details. Again, if the animal is stolen, the thief will simply discard the collar altogether, and at that point, it doesn’t really matter what’s on the collar. As far as tracking goes, an Apple AirTag might be a good solution for those situations (but it’s as easy to throw an AirTag into the bushes as any other collar).

This slide shows that the founders understand the challenges with their messaging and positioning, but it also shows that its answers are a work in progress.

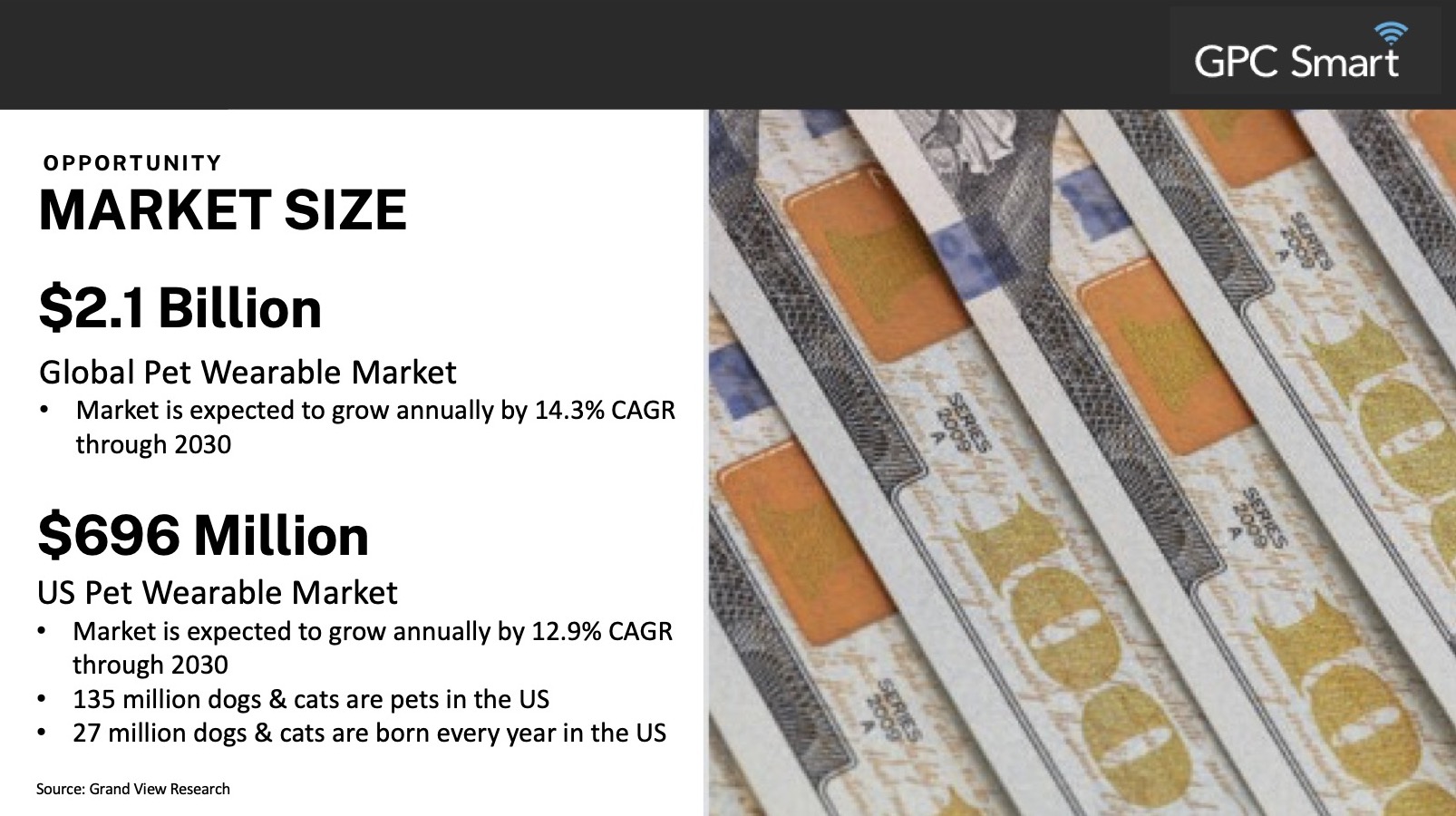

A beast of a market

The pet market, both in the U.S. and globally, is fantastically big. Investors know that, but adding a reminder can’t hurt. You don’t have to capture that big of a market share to build a very significant business here.

[Slide 7] Hellooooo market size. Image Credits: GPC Smart Tags

One of the things investors love more than anything else is a huge and growing market. Pet wearables definitely qualify in that world, and my gut tells me that smart wearables (especially GPS-type trackers) are going to be the value driver on that front. There probably is a space for a product like GPC in there, if it is able to play its cards right and find a good beachhead market for its customers. Pricing is going to be crucial here; this will be a product for people who want something fancier than an engraved tag but something simpler (or cheaper/easier to use) than a GPS tracker.

This slide shows the overall size of the market, which is awesome, but I would have liked it even better if the company said something about what it believes its serviceable market is and how it is going to go after those customers.

The thing you can learn from this slide as a startup? Have clarity on your market size and show off that it is big and trending toward growth.

In the rest of this teardown, we’ll take a look at three things Syneroid could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: Syneroid’s $500K seed deck by Haje Jan Kamps originally published on TechCrunch

https://techcrunch.com/2022/11/10/sample-seed-pitch-deck-syneroid-technologies-corp/

Who’ll get the last laugh over Musk toying with Twitter’s veracity?

Twitter’s painstakingly layered infosphere looks to be light-speeding back to chaotic noise under new owner Elon Musk. The billionaire is no fan of meritocratic signals nor, it seems, a friend to genuine information — preferring anyone pay him $8/m to have their account on his microblogging social network badged with a check-mark that looks like the old Twitter verification check yet does not involve Musk’s Twitter checking they are who they say they are.

In short, it’s a joke made real.

Now, in order to verify if a check mark displayed on a Twitter account is a legacy verification of actual identity — or just a late stage capitalism status symbol for Musk’s most loyal fanboys — users must click on the check symbol next to an account name and read the small print that pops up and will either read: “This account is verified because it’s notable in government, news, entertainment, or another designated category” (aka, it’s pre-Musk Twitter verified); or “This account is verified because it’s subscribed to Twitter Blue” (aka, not verified; but yes probably a Musk super fan).

At the time of writing, there is no ‘at a glance’ way to distinguish between the old ‘identify verified’ Twitter check mark and non-verified paying subscribers. It’s inherently confusing — presumably intentionally so, given Musk’s love of trolling.

He certainly wasted no time laughing about the informational chaos he’d wrought… (At least, we *think* the below account posting crying-with-laughter emojis is him but who can tell anything on Twitter these days?)

Screengrab: Natasha Lomas/TechCrunch

Musk’s new Twitter Blue subscription product enables imposters and other purveyors of misinformation to assume (and, if they wish, trash) reputations of others, one check-marked tweet at a time — as immediately started happening on launch — just so long as they can sign up for an $8 charge to pay for Musk’s “leveller” tool.

Early targets for impersonation by Twitter Blue subscribers have included basketball star LeBron James, former president George W Bush, former UK prime minister Tony Blair, and tech and gaming brands Apple, Nintendo and Valve Software among others. Account bans followed for some of these impersonator accounts soon after — but the barrier to entry to Musk’s chaos game is incredibly low so plenty more trolls will surely follow. (Hence Twitter’s new nickname being ‘$8chan’.)

Twitter Blue is also touted to boost the visibility of subscribers’ tweets vs non-subscribers thereby skewing the information surfaced by the platform’s algorithms — and most likely eroding the visibility of quality information (based on who’s happy to pay vs who’s not).

Who could possibly have predicted this!

https://t.co/0VlOwUyIS4

— Natasha ($0)

(@riptari) November 10, 2022

As we’ve reported before, the risks aren’t just reputational (nor to information quality on Twitter): Scams and fraud could easily result if genuine Twitter users are taken in by a fake that’s seeking to harvest their personal information for identity theft or pointing them towards malicious websites to try to run phishing scams to compromise financial information or other sensitive data.

Still, as Twitter users everywhere feel the chill of Twitter Blue diluting the veracity of verification signals available on the platform (is it an actual politician or a troll? Maybe that is Musk’s joke?), spare a thought for the European Union — whose reputation as a global regulator risks taking a major nose dive in the Musk-Twitter era.

Thing is, Twitter is an existing signatory to the EU’s recently beefed up Code of Practice on Disinformation — a voluntary set of “commitments and measures” platforms agree to apply with the goal of combating the spread of misinformation and disinformation online.

Seriously. Musk-owned Twitter is technically already signed up to actively fight disinformation.

Yes, we lol’d too.

If you take a look at the specifics of what Twitter’s prior leadership team signed the business up for it makes especially awkward reading for Musk-Twitter (and/or the European Commission) — with a requirement on the platform to “limit impermissible manipulative behaviours and practices” by having in place (and/or further bolstering) policies against “impersonation” (emphasis ours); and against “the creation and use of fake accounts“, to name just two especially relevant “behaviors and practices” Twitter is supposed to be discouraging rather than amplifying per this EU Code.

Twitter is also signed up to Commitment 18 of the Code — which is summarized in its subscription document as (again, with our emphasis):

“Relevant Signatories commit to minimise the risks of viral propagation of misinformation or disinformation by adopting safe design practices as they develop their systems, policies, and features.”

Hands up anyone who thinks Musk’s chaotic product iteration at Twitter since taking over as “Chief Twit” fits the bill for “safe design practices”?

Er… anyone? No, of course not.

It took Musk a matter of hours to kill an “official” extra layer of verification — which took the confusing form of a duplicate check mark and ‘official’ label (yes, srsly) — and had been (very) briefly applied to a sub-set of (legacy) verified accounts by certain of the remaining Twitter staff after Musk fired the other half of the company in a massive cost cutting drive immediately on taking over.

“I just killed it,” Musk tweeted yesterday in response to (legacy verified) YouTuber Marques Brownlee — who had just spotted that the ‘Official’ badge he’d also just spotted was now missing; aka, AWOL soon after materializing. So, basically: Ohhai chaos!

“Blue check will be the great leveler,” was all Musk offered by way of public explanation at the time.

Blue check will be the great leveler

— Elon Musk (@elonmusk) November 9, 2022

Trust & safety features that come and go within a matter of days/hours/minutes — and product launches that drastically impact trust & safety being rushed out without zero care and attention to their impact on, um, trust & safety — is the new normal at Musk-Twitter.

The Chief Twit said as much — tweeting soon after nixing the extra ‘Official’ label: “Please note that Twitter will do lots of dumb things in coming months. We will keep what works & change what doesn’t.”

Which is really another way of Musk taking a pen to the Disinformation Code and doing this:

“Relevant Signatories commit to minimise the risks of viral propagation of misinformation or disinformation by adopting safe design practices as they develop their systems, policies, and features.”

Please note that Twitter will do lots of dumb things in coming months.

We will keep what works & change what doesn’t.

— Elon Musk (@elonmusk) November 9, 2022

Oh and it keeps getting worseTwitter’s CISO just abandoned ship too. Next upFTC intervention?

Pre-Musk Twitter had problems too, of course. Most notably, it was fined $150M by the FTC earlier this year for misrepresenting the security and privacy of user data over several years, for example. (And one can only imagine the scale of regulatory penalties that could rain down on Musk-Twitter if it fails to live up to its existing consent decree commitments to the FTC.)

What blowback is Musk going to face in the EU for thumbing his nose at regional lawmakers’ carefully constructed Code of Practice on Disinformation? In the short term probably not a lot — although some EU lawmakers are calling for Musk to testify in front of the European Parliament, as Bloomberg reported earlier. MEP Sophie in ‘t Veld told the news outlet she’s worried the platform will become a threat to democracy under Musk.

However it’s the European Commission that’s responsible for the Code of Practice on Disinformation — and for monitoring how it’s being applied.

We reached out to the Commission to ask if it has any concerns about Musk’s intentional levelling of Twitter’s verification system. A spokesman responded by telling us it is in contact with Twitter “in the context of the Code of Practice”.

“As Commissioner Breton recalled again recently we expect Twitter to respect all EU rules, this also includes the Code of Practice,” they added.

Last month, the EU’s internal market commissioner, Thierry Breton, wasted not time in schooling Musk on his taking ownership of Twitter that the bird must ‘fly by the EU’s rules’. But at press time we’d received no direct response from his office on the question of whether he has any concerns about account impersonations on Twitter spreading disinformation in the wake of Musk torching the value of verification.

The next batch of reports from Disinformation Code signatories aren’t due til January — so the EU’s executive may be trying to keep its head down to watch what unfolds in the coming, uhhhh, hours and minutes of Musk’s chaotic reign.

The Commission spokesperson did also imply that it’s watching to see if Musk launches Twitter Blue in the Single Market (the product has not yet been made available in the EU — in Europe it’s only available to UK users so far) — so, again, it could be keeping its powder dry to see if he adapts the feature-set for an EU launch to make it less, er, disinformation friendly. (That said, EU users are already being exposed to confusingly labelled tweets from Twitter Blue subscribers located outside the bloc so limiting scrutiny to local product launches would entirely miss the big picture confusion and risk letting Musk off the hook.)

It should be noted that the EU Code of Practice on Disinformation, while recently toughened up, remains a voluntary framework — so Musk violating commitments and measures that Twitter’s prior leadership signed up to can’t attract legal sanction at present.

It’s just a piece of paper — and the ink on the dotted line wasn’t even his to spill. So Musk doubtless does not feel beholden, if he’s even noticed this tiny detail. (Yes we also reached out to Twitter for comment but received no response.)

That said, the situation is set to change next year as the EU’s new flagship digital regulatory framework, the Digital Services Act (DSA), starts to come into application for larger platforms.

This is relevant because the Commission has intentionally linked following the Disinformation Code to compliance with the DSA — and the latter is legally binding across the EU (and can carry fines of up to 6% of global annual turnover for violations). So larger platforms that flout the bloc’s Code on Disinformation are risking the Commission finding them in breach of the DSA. Which will be a lot harder to ignore — at least for normal companies and CEOs.

Whether the EU will designate Twitter a VLOP (aka very large online platform) under the DSA is the big, burning question for regional Internet users at this point. And, really, for anyone concerned about Twitter’s slide into chaos under Musk — because the regulation looks to be one of the few meaningful checks (ha!) on Musk-Twitter in core areas of democratic risk like disinformation.

The real $44BN question, then, is who will pay the biggest price for Musk’s decision to devalue veracity on Twitter? The billionaire lord — assuming he gets slapped with hefty (enough) fines for intentionally wreaking havoc on trust & safety — or everyone else; the ‘peasants’ in this analogy, who can do nothing but wait to find out; aka, all the Internet users and people whose societies and democracies are being targeted for levelling down by disinformation purveyors (whether they’ve paid $8 to tweet or $44BN to own Twitter).

For now, clearly, Musk’s chaos reigns.

Who’ll get the last laugh over Musk toying with Twitter’s veracity? by Natasha Lomas originally published on TechCrunch

https://techcrunch.com/2022/11/10/elon-musk-twitter-verification-disinformation/

Google Play to pilot third-party billing in new markets, including U.S.; Bumble joins Spotify as early tester

Google today announced it’s expanding its user choice billing pilot, which allows Android app developers to use other payment systems besides Google’s own. The program will now become available to new markets, including the U.S., Brazil and South Africa, and Bumble will now join Spotify as one of the pilot testers. Google additionally announced Spotify will now begin rolling out its implementation of the program starting this week.

The company had first announced its intention to launch a third-party billing option back in March of this year, with Spotify as the initial tester.

Since then, the program has steadily expanded. Last month, for example, Google invited other non-game developers to apply for the user choice billing program in select markets, including India, Australia, Indonesia, Japan and the European Economic Area (EEA). The company also introduced a similar policy for developers in the EEA region in July, but the new guidelines raised the commission discount from 3% to 4% for developers who opted in. With today’s expansion, user choice billing will be made available to 35 countries worldwide.

Google says it’s been working with Spotify to help develop the experience and now the streaming music service will begin to put the new features into action in supported markets. The experience could still change over time, Google warned, as this is still the early days of the pilot test.

In addition, Bumble has now joined Google to test user choice billing in its own app, with plans to roll out the options to users in select countries in the coming months.

Developers interested in adopting user choice billing have to follow certain UX guidelines set by Google that detail how to implement the feature in their apps. These guidelines currently require developers to display an information screen and a separate billing choice screen. The information screen only has to be shown to each user the first time they initiate a purchase, but the billing choice screen must be shown before every purchase, the rules state. There are other requirements around when and how to display the screens and how the user interface should appear.

With the launch, Spotify users on Android will see a new user interface that allows them to choose how they want to pay for their Spotify subscription (see image below.). For the first time, the two options — Google Play billing and Spotify billing — will appear side-by-side. If the user selects Google Play billing, they’ll be transitioned to the usual experience and will be able to track their subscription in the Google Play Store’s Subscription Center. If the user selects Spotify billing, they’ll then continue within Spotify’s own checkout process and user experience.

This test will become available in a few markets at first, then expand to others over the coming weeks, Spotify says.

Image Credits: Spotify

“Spotify has been publicly advocating for platform fairness and expanded payment options for years. We believe that fair and open platforms enable better, frictionless consumer experiences that also empower developers to imagine, innovate, and thrive,” a Spotify blog post stated.

While the general terms offer a 4% reduction in commissions paid to Google when user choice billing is used, Spotify wouldn’t comment on its confidential deal with Google, but notes it meets the company’s standards of fairness. It’s unclear if the streamer has been offered more favorable terms as an early adopter.

These changes follow a period when the major app stores from Apple and Google have been under pressure from lawmakers and regulators in global markets to open up their app ecosystems. This includes pressure to give developers the ability to use third-party payment systems and allow developers to inform customers of other ways to pay, among other things.

In addition, some developers have taken to suing the app giants directly. In the U.S., for instance, Fortnite maker Epic Games sued both Apple and Google for their alleged monopolistic practices due to their restrictions around in-app payments and for the right to distribute apps and games directly to end users outside the official app stores. Dating app giant Match is suing Google as well. (Which makes Google’s choice to invite Bumble into the program that much more interesting!)

Other companies have been lobbying lawmakers for more app store openness, too, through organizations like the Coalition for App Fairness, which includes big-name developers like Epic Games, Spotify, Tile and others, including indie developers.

Google and Apple are also under investigation in various markets, with the Justice Department in the early stages of filing an antitrust suit against Apple and EU antitrust officials investigating the Play Store.

In a blog post, Google says the goal of its pilot is to “understand complexities involved in supporting user choice billing for developers and users in countries across the world while maintaining a safe and positive user experience.” The company has yet to say when it expects the pilot test to wrap.

Google Play to pilot third-party billing in new markets, including U.S.; Bumble joins Spotify as early tester by Sarah Perez originally published on TechCrunch

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading

Sam Bankman-Fried said on Thursday that he will be winding down the trading firm Alameda Research and is attempting to raise liquidity for the troubled FTX International, as he scrambles to keep the world’s second largest crypto exchange alive after a bailout deal with Binance failed earlier this week.

Bankman-Fried said in a series of tweets that he is engaging with a “number of players” to raise capital for FTX’s international business and those discussions are at various stages including letter of intents and term sheets deliberations.

FTX’s U.S. business is “fine” and “100% liquid,” he said.

He did not disclose the names of the firms or individuals he is engaging, but one of them appears to be Justin Sun, the founder of Tron blockchain. Axios reported on Thursday that Bankman-Fried is also in talks with Kraken, another large crypto exchange.

The 30-year-old entrepreneur, hailed as wunderkind, said he assumes all responsibility for the mess FTX’s at and any capital he raises for FTX International unit will be first used to do right by the customers. “I’m sorry. That’s the biggest thing. I fucked up, and should have done better,” he said.

“Every penny of [any fundraise] that–and of the existing collateral–will go straight to users, unless or until we’ve done right by them. After that, investors–old and new–and employees who have fought for what’s right for their career, and who weren’t responsible for any of the fuck ups,” he said.

FTX International faced liquidity crunch earlier this month when it saw withdrawals worth $5 billion on Sunday, he said.

Binance founder Changpeng Zhao said last week that Binance, the world’s largest exchange and an early backer of FTX, was selling its holdings of FTT, the native token of FTX exchange, that it had received as part of an exit from the firm last year.

Zhao said the firm was liquidating its FTT holdings as a “post-exit risk management,” giving some credence to a widely circulated rumor about Alameda Research’s concerning financial health. The comment contributed to a bank run on FTX and resulted in voluminous withdrawals. Binance earlier this week signed a letter of intent to acquire FTX, but backed out a day later after reviewing the younger firm’s finances.

“At some point I might have more to say about a particular sparring partner, so to speak. But you know, glass houses. So for now, all I’ll say is: well played; you won,” Bankman-Fried tweeted Thursday.

Troubles are mounting for FTX. The exchange’s sudden collapse has attracted scrutiny from regulators and many players are beginning to cut ties. Tether, the issuer of the world’s most used stable crypto coin, has frozen $46 million of USDT on the Tron blockchain in compliance with a request from law enforcement, it said Thursday.

FTX was valued at $32 billion in its most recent funding round (a Series C) in January this year. The firm counts Sequoia, BlackRock, Tiger Global, Paradigm, SoftBank, Ribbit Capital, Insight Partners, Lightspeed Venture Partners, Bond and Iconiq Growth among its long list of backers.

Sequoia Capital, one of the largest backers of FTX, marked down its investment in the crypto exchange to zero on Wednesday.

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading by Manish Singh originally published on TechCrunch