Category: TECHNOLOGY

FTC warns ‘no CEO or company is above the law’ if Twitter shirks privacy order

The FTC has telegraphed what appears to be a now-inevitable investigation into Twitter’s internal data handling practices, as the company continues to shed important staff and improvise new features. “No CEO or company is above the law,” the agency said in a statement — and if Elon Musk’s Twitter continues its current spree, they may find themselves in violation of the FTC’s order and facing serious consequences.

To be clear at the outset, the FTC has not announced any investigation into Twitter or Elon Musk, or even that they are gathering information in service of such an investigation. Nor would it be able to confirm it was investigating if it was. But circumstantial evidence, common sense, and the ominous statement issued today leave little doubt that the company is in the agency’s crosshairs.

In the course of its ordinary oversight duties, the FTC looks into complaints by consumers, companies, and anyone with a bone to pick about things like misleading advertising, broken privacy promises, illicit business arrangements, and so on. But in 2011, Twitter agreed to a consent decree with the regulator after being found to have misused user data. It was also found to have done so again for many years in an investigation culminating in a $150 million settlement earlier this year, so this isn’t some bygone red tape.

This decree required Twitter to establish and maintain a program to ensure and regularly report that its new features do not further misrepresent “the extent to which it maintains and protects the security, privacy, confidentiality, or integrity of any nonpublic consumer information.” The revised order adds more oversight and gives the FTC more power, since evidently Twitter needed a stick as well as a carrot.

The gist of it is that Twitter is in the doghouse with the FTC already, and it has specific and legally binding requirements regarding what it can and can’t do with data, and how it verifies that it is in compliance.

Around the time of the settlement, Elon Musk entered the stage and now we have all…this. But the news that last night several data handling executives, no doubt important to walking the line with a watchful regulator, all reportedly left at once. Literally minutes after I wrote this paragraph, the company’s head of trust and safety, Yoel Roth, was reported to be leaving as well.

NEW: A senior member of Twitter’s legal team just posted this message in Slack:“Everyone should know that our CISO, Chief Privacy Officer and Chief Compliance Officer ALL resigned last night. This news will be buried in the return-to-office drama. I believe that is intentional.”

— Zoë Schiffer (@ZoeSchiffer) November 10, 2022

This would be troubling at any company, at any time, under any level of federal scrutiny. But for Twitter, the departing chiefs might as well have hired a skywriter to spell out “INVESTIGATE ME” in huge letters above Twitter HQ. (Of course, normally that might apply to any number of companies in downtown San Francisco, but right now there’s little question.)

The amount of changes, new products, eliminations of various departments and processes (many of which had to do with privacy, fairness, data handling and other crucial topics) don’t mean Twitter is necessarily in violation of the consent decree. But with things going the way they are, it’s quite hard to imagine that it is in compliance now, or if it is, will it remain so for long.

It’s important, though, to understand that the FTC isn’t like the FBI, kicking doors down and arranging evidence in damning dioramas. The FTC conducts its investigations privately and at great length — they can’t and don’t publicize the fact that they are looking into a company for some violation or another until there is a legally binding consequence like a signed consent decree, settlement, or a decision to go to trial via the Department of Justice.

Although many expected the FTC, under the leadership of tech skeptic and very smart person Lina Khan, to be more proactive, it is limited by law as to what it can do. It’s actually a bit surprising that the agency got as spicy as it did in the full statement:

We are tracking recent developments at Twitter with deep concern. No CEO or company is above the law, and companies must follow our consent decrees. Our revised consent order gives us new tools to ensure compliance, and we are prepared to use them.

Though it stops short of saying, “We are sharpening our knives,” this statement nevertheless is about as strong an implication that they will be giving Twitter a call as soon as they can justify it. (A juicy tidbit uncovered by CNN’s Brian Fung, while enticing, could relate to ongoing discussions regarding the $150 million settlement, so don’t get too excited.)

If they decide to pursue an investigation, which would probably happen if there are any red flags at all, let alone this many, it will be done confidentially — but importantly, it is not secret.

That means that although it is the FTC’s policy not to reveal or comment on an investigation, a company or person being investigated may do so at any time if they wish. So if the FTC makes a formal request for certain data from Twitter, or deposes its executives (present or former), they may decide to publicize that information.

In fact, Twitter did this in late 2020, long before the settlement with the FTC was finalized. After all, you don’t want your investors to be the last to hear about something like a $150 million charge, even though in telling them you risk discovery by hawk-eyed journalists.

So if the FTC investigates Twitter, it’s far more likely that we will hear about it from the company — in a filing with investors or, more likely, from its incautious and prolix CEO during one of his increasingly frequent emergency meetings.

The state of chaos at Twitter makes the commonplace observation that we don’t know what it will look like in six months into a gross understatement, however, meaning the entire company might have changed hands or business models before the FTC has finished its (hypothetical) work. Still, that won’t get the flailing company off the hook. Twitter’s leadership, or what’s left of it, may want to prioritize survival and compliance with federal regulators before returning to its now regularly scheduled mayhem.

FTC warns ‘no CEO or company is above the law’ if Twitter shirks privacy order by Devin Coldewey originally published on TechCrunch

Tumblr’s only viable business model is shitposting

As Elon Musk struggles to make people give Twitter $8 a month for a blue check, Tumblr had an idea: What if they offered users $8 for not one, but two blue checks?

Yes, you can legitimately buy two blue checks for your Tumblr blog. For the low, low price of $7.99. As Tumblr wrote in an official post, “That’s cheaper than some other places, when you consider that you get not one but TWO checkmarks for your blog.”

A checkmark isn’t cool, you know what’s cool? Two checkmarks. https://t.co/orGIoHFMYZ pic.twitter.com/Ln7NQ94iHN

— Matt Mullenweg (@photomatt) November 10, 2022

If you keep paying Tumblr, you can get even more blue checks. Want 10 blue checks? That’ll be about $40.

Tumblr has struggled to monetize for its entire existence. Tumblr was acquired by Yahoo (TechCrunch’s parent company) for $1 billion in 2013, but when it sold again to Verizon (TechCrunch’s former parent company) in 2019, it was worth just $3 million.

Tumblr’s success as a social media platform has been in even more jeopardy since it banned porn in 2018 to protect its presence on the App Store. In the last year alone, Automattic has tried to get Tumblr to make money through paid ad-free browsing, a subscription product and a tip jar, marking some of the first paid creator features on the longstanding blogging site. Yet despite growing nostalgia for Tumblr, the platform has failed to grow its user base significantly since the porn ban, when it lost 30% of web traffic.

Tumblr’s initial rollout of its Post+ subscription rollout was a mess, as users worried how the harsh reality of capitalism would change their fandom paradise. But Tumblr users have proven to be extremely willing to pay money for two things: ad-free browsing and shitposting.

According to data from SensorTower, Tumblr’s mobile app has seen approximately $507,000 in consumer spending since April. That was the month when Tumblr announced Blaze, a feature that lets users promote their own posts. Not coincidentally, Blaze debuted on 4/20 with price points ending in $4.20.

On a platform like Facebook, promoted posts are usually for businesses. On Tumblr, Blazed posts are commonly used to make other people bear witness to your cursed content.

Tumblr’s top in-app purchases (April to November 10, 2022). Image Credits: SensorTower

Since the launch of Blaze, Tumblr’s top five in-app purchases have been ad-free browsing (monthly and annual), two price points for Blaze and … crabs. Yes, crabs. In July, Tumblr added a feature that allows you to send someone crabs that dance around their dashboard for a day, and now, crabs have generated more in-app purchases than Post+.

Tumblr’s paid jab at Twitter verification has only just launched, so we can’t say yet how profitable it will be. But if Tumblr’s history is any indication, this should be a financial slam dunk, since Tumblr users seem to just really want to buy things that are useless.

that’s not a bug,

that’s a feature.https://t.co/t52eO66xDt https://t.co/vC8NRBwVGD— tumblr dot com the website and app (@tumblr) November 10, 2022

According to analytics firm Similarweb, Tumblr did not experience a significant uptick in monthly visits worldwide on mobile and desktop after it launched creator monetization features in summer 2021. However, Tumblr is generating some more interest now that we live in a world in which Elon Musk owns Twitter. Other alternative social networks have seen an influx of new users too — Mastodon nearly doubled its user base so far this month.

Matt Mullenweg, CEO of Automattic (the company that owns Tumblr), tweeted that Tumblr app downloads are up about 58% in the last week. This could be because Twitter now seems like more of a hellsite than Tumblr under Musk’s ownership, or because Tumblr just changed its community guidelines. Now, Tumblr allows nudity, but not “visual depictions of sexually explicit acts.” Some internet denizens took this policy change to mean that porn is back, but the last time we checked, porn generally falls into the category of “visual depictions of sexually explicit acts.”

For @Tumblr: Over the past 7 days, iOS downloads are up 58% with 30% more impressions in the App Store. Android downloads are up 57% with 50% more impressions in the Play Store.

— Matt Mullenweg (@photomatt) November 8, 2022

If you’re looking to jump ship from Twitter as Elon Musk gets settled in as its new owner, I hate to break it to you: Tumblr may not be your saving grace (unless if you’re a former “Superwholock” fan whose new favorite book is “Gideon the Ninth,” in which case, you’re probably still on Tumblr anyway). But to be fair, it’s likely that none of the Twitter alternatives that are floating around — no, not even Mastodon — will become the new Twitter.

Regardless, Tumblr now has something that Twitter doesn’t: two blue checkmarks.

Tumblr’s only viable business model is shitposting by Amanda Silberling originally published on TechCrunch

https://techcrunch.com/2022/11/10/tumblr-blue-check-shitposting-business-model/

Google says surveillance vendor targeted Samsung phones with zero-days

Google says it has evidence that a commercial surveillance vendor was exploiting three zero-day security vulnerabilities found in newer Samsung smartphones.

The vulnerabilities, discovered in Samsung’s custom-built software, were used together as part of an exploit chain to target Samsung phones running Android. The chained vulnerabilities allow an attacker to gain kernel read and write privileges as the root user, and ultimately expose a device’s data.

Google Project Zero security researcher Maddie Stone said in a blog post that the exploit chain targets Samsung phones with a Exynos chip running a specific kernel version. Samsung phones are sold with Exynos chips primarily across Europe, the Middle East, and Africa, which is likely where the targets of the surveillance are located.

Stone said Samsung phones running the affected kernel at the time include the S10, A50, and A51.

The flaws, since patched, were exploited by a malicious Android app, which the user may have been tricked into installing from outside of the app store. The malicious app allows the attacker to escape the app sandbox designed to contain its activity, and access the rest of the device’s operating system. Only a component of the exploit app was obtained, Stone said, so it isn’t known what the final payload was, even if the three vulnerabilities paved the way for its eventual delivery.

“The first vulnerability in this chain, the arbitrary file read and write, was the foundation of this chain, used four different times and used at least once in each step,” wrote Stone. “The Java components in Android devices don’t tend to be the most popular targets for security researchers despite it running at such a privileged level,” said Stone.

Google declined to name the commercial surveillance vendor, but said the exploitation follows a pattern similar to recent device infections where malicious Android apps were abused to deliver powerful nation-state spyware.

Earlier this year security researchers discovered Hermit, an Android and iOS spyware developed by RCS Lab and used in targeted attacks by governments, with known victims in Italy and Kazakhstan. Hermit relies on tricking a target into downloading and installing the malicious app, such as a disguised cell carrier assistance app, from outside of the app store, but then silently steals a victim’s contacts, audio recordings, photos, videos, and granular location data. Google began notifying Android users whose devices have been compromised by Hermit. Surveillance vendor Connexxa also used malicious sideloaded apps to target both Android and iPhone owners.

Google reported the three vulnerabilities to Samsung in late 2020, and Samsung rolled out patches to affected phones in March 2021, but did not disclose at the time that the vulnerabilities were being actively exploited. Stone said that Samsung has since committed to begin disclosing when vulnerabilities are actively exploited, following Apple and Google, which also disclose in their security updates when vulnerabilities are under attack.

“The analysis of this exploit chain has provided us with new and important insights into how attackers are targeting Android devices,” Stone added, intimating that further research could unearth new vulnerabilities in custom software built by Android device makers, like Samsung.

“It highlights a need for more research into manufacturer specific components. It shows where we ought to do further variant analysis,” said Stone.

Google says surveillance vendor targeted Samsung phones with zero-days by Zack Whittaker originally published on TechCrunch

https://techcrunch.com/2022/11/10/google-surveillance-samsung-spyware/

Daily Crunch: Sequoia Capital writes off its $210M investment in crypto exchange FTX

Founding teams usually select a corporate structure like an LLC or S-Corp, but those who hope to exit for $10 million or more should consider starting up as a Qualified Small Business (QSB) C-Corporation, advises tax attorney Vincent Aiello.

Under IRS Code Section 1202, founders who hold QSB stock for five years or longer will be exempt from paying capital gains tax after a sale.

“It constitutes a significant tax savings benefit for entrepreneurs and small business investors,” Aiello says. “However, the effect of the exclusion ultimately depends on when the stock was acquired, the trade or business being operated, and various other factors.”

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Tech reporting is a lot of things, but it sure ain’t boring, as the chaos around Twitter, crypto, and layoffs continues. We’re just trying to hang on for dear life to try to make some sense of it all. We think we did a pretty decent job, and here, we’ve got a selection of what’s been happening in the past 24 hours of tech. — Christine and Haje.

The TechCrunch Top 3

- Another domino falls: It was probably already a fiasco, but Binance deciding to not buy FTX led Sequoia Capital to claim its minority stake in FTX as nothing more than some unrealized gains, Connie reports. Investor letter and everything.

- Meanwhile, over at our other favorite hot mess: Elon Musk was right when he tweeted that the company would be doing “lots of dumb things.” Darrell reports on one of its latest take-backs (because they seem to accumulate before we even have time to take a breath), where all of these accounts were promised that little blue checkmark in exchange for $8, but as you all know, when you make fake accounts, that means we can’t have nice things.

- More Twitter changes: Another group of top dogs at Twitter decided to leave the nest. This time it is chief information security officer Lea Kissner, followed by chief compliance officer Marianne Fogarty and chief privacy officer Damien Kieran. The latter two have reportedly resigned today, according to Zack and Ingrid, who teamed up to chase down the details.

Startups and VC

Denver-based VC firm SpringTime Ventures is pivoting away from its original focus on its home state of Colorado, despite being the only local fund in two of the state’s 10 unicorn companies, Becca reports. It’s also now able to expand its team thanks to raising three times as much money for Fund II, giving SpringTime enough cash on hand to allow its partners to finally pay themselves “a real salary.”

New crypto startups forged ahead during Alliance DAO’s demo day on Wednesday amid the FTX implosion. The most recent cohort, known as All9, for Alliance DAO, a web3 accelerator and builder community, presented their ideas on Wednesday during a demo day, exclusively covered by Jacquelyn.

And here’s a smattering of other things that caught our beady little eyes today:

- If you’re only moderately broken, these startups can moderately fix youMike reports how “Self-therapy” startups are blooming in the “moderate mental health” space.

- We shall know you by your high five: With $7 million raised, Brian reports, Keyo launches a biometric palm verification network.

- Your Excel, up to the minuteCoefficient wants to bring live data into your existing spreadsheets, writes Kyle.

- Tracking pollution with sensorsAirly fights air pollution with a network of affordable sensors, Catherine reports.

- Subscriptions finding their grooveIngrid reports that Ordergroove picks up $100 million to grow e-commerce subscriptions as a service.

Use IRS Code Section 1202 to sell your multimillion-dollar startup tax-free

Image Credits: BrianAJackson (opens in a new window) / Getty Images

Founding teams usually select a corporate structure like an LLC or S-Corp, but those who hope to exit for $10 million or more should consider starting up as a Qualified Small Business (QSB) C-Corporation, advises tax attorney Vincent Aiello.

Under IRS Code Section 1202, founders who hold QSB stock for five years or longer will be exempt from paying capital gains tax after a sale.

“It constitutes a significant tax savings benefit for entrepreneurs and small business investors,” Aiello says. “However, the effect of the exclusion ultimately depends on when the stock was acquired, the trade or business being operated, and various other factors.”

Three more from the TC+ team:

- Smart dog collars, smart pitch deck?Pitch Deck Teardown: Syneroid’s $500K seed deck, by Haje.

- Hitting rock bottom…maybe?Alex wonders, As inflation slows, did we just see the bottom for tech stocks?

- In a crisis, don’t hide — double down!: Guest author Vadym Synegin writes that in times of crisis, fintech startups should take the long view instead of hibernating.

TechCrunch+ is our membership program that helps founders and startup teams get ahead of the pack. You can sign up here. Use code “DC” for a 15% discount on an annual subscription!

Big Tech Inc.

Elon Musk wants Twitter workers in the office and wants them battling spam. Those were some of the messages the new owner had for his social media staff, Ivan writes. Oh, he also told them to be ready for “difficult times ahead,” which is always something you want to hear from your leader with regard to the future of your job.

After the Binance deal fell through, FTX founder Sam Bankman-Fried has some new focuses: winding down trading at Alameda Research and winding up his fundraising prowess, Manish reports.

We promise, no more FTX or Twitter below:

- Want to see a bin-picking robot?: You’re in luck! Meet the Amazon Sparrow. Brian has more.

- Ole, Ole Ole Ole: Starting November 20, FIFA World Cup fans will have an easier time following their favorite teams thanks to Google’s new cross-platform features, Ivan writes.

- Californians want more electric cars but don’t want to pay for themOne of the losers this week was Prop 30, a Lyft-backed plan that would have taxed California residents so that the price of electric cars and public charging stations could be subsidized, Harri reports.

- Arrested development: Police arrest suspected LockBit operator just as the ransomware gang leaks more data, Carly writes.

- Mute fast, mute often: Reddit users who don’t want to see a certain community can now mute it. Aisha has more.

Daily Crunch: Sequoia Capital writes off its $210M investment in crypto exchange FTX by Christine Hall originally published on TechCrunch

Even Healthcare lands additional capital to advance primary care adoption in India

Even Healthcare, an Indian “healthcare membership” company, landed new financial support in the form of $15 million to further drive its mission of providing affordable care to communities across India.

Even isn’t insurance, but allows members to access primary and preventative care at any of over 100 partnered hospitals. Typically, the way Indians access healthcare is through emergency services as opposed to the preventative care model followed in Western countries. They most often pay for services out of pocket, but Even provides what it describes as a more affordable, comprehensive care model. The company said last year when they last raised money that less than 5% of the Indian population has insurance and plans that do exist mainly cover emergency services.

“For us, Even is about giving members access to complete healthcare and building trust like a family doctor,” said co-founder Matilde Giglio. “Right from preventive care to diagnostics to hospitalization, our members will be assured of our support throughout their healthcare journey.”

Depending on a user’s financial capabilities, there are three plans they can choose from. The cheapest is ₹ 40 per month ($0.50 USD) which includes unlimited consultations and a care team, but according to the company is meant for individuals looking to still pay for some services out of pocket. The plan gives users a glimpse at the care provided to then transition individuals to the second tier plan, Even Lite. Even Lite costs users ₹ 320 ($4 USD) per month and includes tests, consultations and a care team. For ₹ 528 ($6.54 USD) per month care becomes more comprehensive including COVID-19-specific services, emergency care across India and cashless hospitalization.

The company’s standard pricing is for individuals, but it does have group plans for companies and groups.

Even currently has 20,000 active members and has partnered with over 100 hospitals since its launch in 2020. Just a year ago the company had 5,000 on a waitlist.

The Bangalore-based company asks new users to talk to a doctor to collect health information and assess risk for underlying conditions. According to Giglio, conditions like diabetes, high cholesterol, high BP and obesity are common in India, but often go uncontrolled due to a lack of primary care. The company claims half their new users learned they suffered from diabetes during the onboarding process.

The new capital raised comes from Alpha Wave and Aspada (Lightrock). They are joining existing investors Khosla Ventures, Founders Fund, Lachy Groom, Palo Alto Networks CEO Nikesh Arora, CRED CEO Kunal Shah and DST Global partner Tom Stafford. Even first raised a $5 million seed round in 2021 led by Khosla Ventures.

This round’s funds will be used to expand its clinical team and scale preventive care in conditions like diabetes, PCOS (polycystic ovary syndrome) and obesity.

Even Healthcare lands additional capital to advance primary care adoption in India by Andrew Mendez originally published on TechCrunch

Galaxy, Gradient and Lux VCs will judge the TC Sessions: Crypto pitch-off

One of the most popular activities at a TechCrunch conference is watching top-notch early-stage founders square off in a pitch competition. Seriously, who doesn’t love a pitch-off? And the Crypto Pitch-off is just one more compelling reason to go to TechCrunch Sessions: Crypto on November 17 in Miami. Let’s take a look at the judges our intrepid startups will need to impress.

But first (hey, you had to see this coming), if you have not yet done the deed, buy your pass right now. Changes in the crypto world are fast and furious — like Binance aiming to purchase FTX but just over 24 hours later backing out. Did you know Binance founder CZ will speak at the event? You do not want to miss that.

Okay, back to the pitch-off. Be in the room when three of the brightest early-stage crypto startups take the stage in front of a live audience — for glory, for media and investor interest, and, drumroll please, for an automatic spot in the Startup Battlefield 200 at Disrupt 2023. TechCrunch handpicks a cohort of 200 early-stage startups to receive a VIP Disrupt experience that includes, for starters, exhibiting all three days of the show — for free.

The contenders will pitch their tech to this panel of expert VCs: Grace Isford, principal, Lux Capital; Wen-Wen Lam, partner, Gradient Ventures; and Will Nuelle, general partner, Galaxy Ventures — check out their bonafides below.

Grace Isford invests at the nexus of web3, data infrastructure and applications of AI/ML. She focuses on crypto and blockchain infrastructure companies building the next-gen web3 stack, as well as on data and machine-learning startups that hyper-personalize user experiences and transform legacy industries.

At Lux, Isford works with companies such as Tactic, Goldsky and RunwayML. Prior to joining Lux, she worked at Canvas Ventures and Handshake (in product management), and she earned her BS and MS from Stanford University.

Before joining Gradient Ventures, Wen-Wen Lam was the CEO and co-founder of NexTravel (YCW15), a leading corporate travel solution that serviced thousands of customers like Lyft, Twilio and Stripe. She grew the business to over $100 million in annual sales before exiting to TravelPerk in 2020.

Prior to founding NexTravel, Lam worked with startups in leadership roles. She received a BA in economics from UC Berkeley and her MBA from the USC Marshall School of Business, and she began her career in tech at LinkedIn.

Will Nuelle focuses on early-stage investments in protocol layer infrastructure, DeFi applications and software products. Nuelle started at Galaxy Ventures in research, where he developed quantitative risk software for trading.

Prior to joining Galaxy, he built incentive simulations for Ethereum protocol FOAM as an intern. He holds BS degrees in mathematics and architecture from Stanford University. He is a board member for Skolem Technologies and has led more than 13 investments for Galaxy.

TC Sessions: Crypto takes place on November 17 in Miami. Don’t miss your opportunity to connect with our partners and to tap into the tech, trends and controversy spanning the blockchain, cryptocurrency, DeFi, NFT and web3 cryptoverse. Buy your ticket today!

Is your company interested in sponsoring or exhibiting at TC Sessions: Crypto? Contact our sponsorship sales team by filling out this form.

Galaxy, Gradient and Lux VCs will judge the TC Sessions: Crypto pitch-off by Lauren Simonds originally published on TechCrunch

Crypto’s crown prince stumbles

Welcome back to Chain Reaction.

Last week on the podcast, we talked about trouble brewing for bitcoin miners. This week, we had to tear up our plans to cover pretty much anything else and turn our attention to what we think is the biggest story in crypto to unfold this year: the fall from grace of once-revered crypto exchange FTX and its former billionaire founder Sam Bankman-Fried (SBF).

Do you want Chain Reaction in your inbox every Thursday? Sign up here: techcrunch.com/newsletters.

this week in web3

Here are some of the biggest crypto stories TechCrunch has covered this week.

Sam Bankman-Fried says FTX in talks to raise capital, Alameda Research to wind down trading

Sam Bankman-Fried said on Thursday that he will be winding down the trading firm Alameda Research and is attempting to raise liquidity for the troubled FTX International, as he scrambles to keep the world’s second largest crypto exchange alive after a bailout deal with Binance failed earlier this week. Bankman-Fried said in a series of tweets that he is engaging with a “number of players” to raise capital for FTX’s international business and those discussions are at various stages, including letters of intent and term sheet deliberations.

Troubled crypto exchange FTX investigated by US regulators over customer funds

Crypto trading behemoth FTX fell from grace this week after the exchange experienced a liquidity crunch and agreed to give its rival, Binance, the option to purchase the company’s non-U.S. operations in what appears to be a bailout. Now, U.S. regulators, including the SEC and CFTC, are looking into whether FTX potentially mishandled customer funds on its platform.

Say hello to the newest crypto startups from web3 accelerator Alliance DAO’s demo day

New crypto startups forged ahead during Alliance DAO’s demo day on Wednesday amid the FTX implosion. The most recent cohort, known as All9, for Alliance DAO, a web3 accelerator and builder community, presented their ideas on Wednesday during a demo day, exclusively covered by TechCrunch. There were about 953 applications for this cohort, but only 17 teams were chosen and graduated from the program.

Sequoia Capital marks its FTX investment down to zero dollars

Sequoia Capital just marked down to zero the value of its stake in the cryptocurrency exchange FTX — a stake that accounted for a minor percentage of Sequoia’s capital but as of last week likely represented among the most sizable unrealized gains in the venture firm’s 50-year history. It alerted its limited partners in a letter that it sent out to them this evening, a copy of which TechCrunch obtained and shared in this article.

Some crypto VCs see decentralization as the future following FTX collapse (TC+)

As the crypto market digests the past few days of chaos, venture capitalists see the moment as a warning, but also as an opportunity for the growth of decentralization and maturation of the larger blockchain space. TechCrunch spoke with some investors to understand their long-term view of the industry following this week’s news from FTX.

the latest pod

We had to talk about the news that rocked the crypto world this week in our Thursday episode: the Binance/FTX deal that never was. To begin, we gave you a rundown of WTF just happened with the beef between two of the largest crypto exchanges in the world and how Sam Bankman-Fried’s storied exchange fell so far so fast, bringing down investors, cryptocurrencies and other companies in the space tumbling down with it.

Once we ran through the background behind the situation that’s been unfolding in real time this week, we shared our thoughts on the massive implications this fiasco might have for the rest of the crypto industry, from venture capitalists and startups to regulation across the globe.

It’s a fascinating backdrop for our conversation at our crypto event in Miami next week, where we’ll be chatting with Binance CEO Changpeng Zhao (CZ), the billionaire who is seen as the catalyst for FTX’s downfall. You can use the promo code REACT for 15% off a General Admission ticket to the event to hear from CZ and plenty of other crypto market players about what the future of this tumultuous industry might hold in the coming months.

Chain Reaction comes out every Tuesday and Thursday at 12:00 p.m. PT, so be sure to subscribe to us on Apple Podcasts, Spotify or your favorite pod platform to keep up with the action.

follow the money

- Web3 messaging infrastructure platform Notifi raised a $10 million seed round co-led by Hashed and Race Capital.

- Web3 API provider Ramp secured $70 million in a Series B funding round, co-led by Mubadala Capital and Korelya Capital.

- Blockchain fraud prevention startup TRM Labs expanded its Series B funding round by $70 million led by Thoma Bravo with participation from existing investors PayPal, American Express and Citigroup.

- Eterlast emerged from stealth with $4.5 million to develop web3 games for sports fans.

- Decentralized search engine Sepana raised $10 million from Hack VC, Pitango First and others.

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Hear CZ for free at TC Sessions: Crypto

Who better to give an insider take on the recent Binance/FTX news than Binance chief executive CZ himself? Score a free ticket, get the lowdown and explore the many conversations and networking opportunities at TC Sessions: Crypto on November 17 in Miami. The first 25 readers to register with this will join us in Miami on November 17 for free!

Crypto’s crown prince stumbles by Anita Ramaswamy originally published on TechCrunch

https://techcrunch.com/2022/11/10/cryptos-crown-prince-stumbles/

We may all be #RatVerified forever

I rarely update my Twitter display name, except maybe when I am on vacation and want to warn people that if you email me, I will either not see it or I will become very annoyed that you emailed me about NFTs. But I was convinced to add a little emoji to my name by Alex Cohen, an internet funny guy whom I’ve crossed paths with since the days of weird Facebook, Post Aesthetics and “Jeb! The Musical.”

“why would i pay $8 to get a blue check if i could put a rat next to my name for free???” Cohen tweeted last week. “i’m calling on everyone to join me in becoming #RatVerified.”

why would i pay $8 to get a blue check if i could put a rat next to my name for free???

i’m calling on everyone to join me in becoming #RatVerified

— alex (@tinysnekcomics) November 1, 2022

To become “rat verified,” all you have to do is edit your Twitter display name and add a rat emoji. That’s it. You did it. You are now rat verified. Cohen’s tweet went so viral that it even reached TechCrunch’s own Alex Wilhelm, who is so disconnected from this corner of Weird Internet that I once had to explain “My Immortal” to him. The hashtag #RatVerified even reached number one on the Twitter’s list of trending topics in the United States.

Of course, Cohen is making fun of new Twitter owner Elon Musk’s boneheaded idea to charge users $8 per month to be verified, which has already imploded into a chaotic mess. But since impersonation has become so rampant with the advent of the “I paid Elon $8” variant of blue check — which looks the same as the “I am a public figure” blue check — Twitter is currently not letting verified users change their usernames.

i am rat verified forever https://t.co/dZoHQqOcTM

— amanda silberling (@asilbwrites) November 10, 2022

Even Doja Cat, who had changed her display name to “christmas,” has pleaded with the Chief Twit to free her from perpetual festivity.

i don’t wanna be christmas forever @elonmusk please help i’ve made a mistake

— christmas (@DojaCat) November 10, 2022

This whole rollout has been a mess — #tbt to yesterday when TechCrunch was Grey Check Official Super Double Verified for like two hours. And now as a result, what was supposedly a fleeting internet gag is now a bit more permanent. May my little rat friend prosper forever.

We may all be #RatVerified forever by Amanda Silberling originally published on TechCrunch

Pitch Deck Teardown: Syneroid’s $500K seed deck

Because the company is throwing itself into a market that is relatively well understood, its challenge isn’t to explain what it is doing but how it is moving the market forward. The company’s second slide is labeled an “overview” slide, which rapidly helps get a picture of the overall challenge this particular market segment is facing.

An investor likely knows at least some of this, but these bullets augment (or gently correct) any preconceived notions an investor might have, smoothing the delta between their perception of the market and the realities of being in that market. This slide — while fairly wordy — does a really good job of ironing out any misunderstandings an investor may have.

Having said that, it also brings up some important questions. Lost pets are just one part of the challenge; stolen pets will have their collars removed, and animals that go astray are on occasion able to shed their collars. Syneroid doesn’t really address either scenario.

Great competition overview

It’s pretty rare to see a startup put its competitor overview front and center, but I think that was a really shrewd move in this case. Again, this is not a deep tech play or a market shrouded in mystery. I suspect that most would-be investors would be able to come up with the two major competitors. Tackling that head-on does seem a little defensive, but given the market, I think it makes a lot of sense in this case. Here’s how the company addressed it:

[Slide 3] Tackling competitive alternatives this early in a slide deck is unusual but probably a good move in this case. Image Credits: GPC Smart Tags

There are a number of obvious competitors in this space, including the most common ones, existing engraved metal tags or injected microchips, which both have their own pros and cons. There’s also the latest generation of GPS-enabled dog collars, such as the ones from

Syneroid recently raised a $500,000 round of funding to bring something halfway between microchips and dog collars to market. The company is finding some interesting slices of the market, but the deck, overall, leaves a few things to be desired. We learn more from mistakes than from perfection, so I figured it’d be a great one to dive into for this week’s pitch deck teardown!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Throughout this pitch deck teardown, you’ll see the company referred to as Syneroid and GPC Smart — the company’s official name is the former, but the brand they are using for the pitch deck and its products is the latter. The company told me it raised this round at a $3.9 million valuation.

The company used a tight, 12-slide deck for its pitch, and no information has been redacted or omitted.

- Cover slide

- Problem slide

- Competition slide

- Solution slide

- Competitive advantages slide

- History/traction slide

- Market-size slide

- Target markets/go-to-market slide

- Team slide

- Operational financials slide

- Ask slide

- Contact slide

Three things to love

Syneroid is entering a market that’s very easy to understand: Lost animals are something that most of us have an experience with in one way or another. That’s an advantage in that you don’t have to explain the market in detail. It also means that the company is facing a wall of potential competitors even as it is trying to gain traction. That’s a challenge, and it’s interesting to see how Syneroid is tackling it.

Cover the gap between the perceived and the actual

[Slide 2] The overview slide does a great job of getting investors up to speed. Image Credits: GPC Smart Tags

Because the company is throwing itself into a market that is relatively well understood, its challenge isn’t to explain what it is doing but how it is moving the market forward. The company’s second slide is labeled an “overview” slide, which rapidly helps get a picture of the overall challenge this particular market segment is facing.

An investor likely knows at least some of this, but these bullets augment (or gently correct) any preconceived notions an investor might have, smoothing the delta between their perception of the market and the realities of being in that market. This slide — while fairly wordy — does a really good job of ironing out any misunderstandings an investor may have.

Having said that, it also brings up some important questions. Lost pets are just one part of the challenge; stolen pets will have their collars removed, and animals that go astray are on occasion able to shed their collars. Syneroid doesn’t really address either scenario.

Great competition overview

It’s pretty rare to see a startup put its competitor overview front and center, but I think that was a really shrewd move in this case. Again, this is not a deep tech play or a market shrouded in mystery. I suspect that most would-be investors would be able to come up with the two major competitors. Tackling that head-on does seem a little defensive, but given the market, I think it makes a lot of sense in this case. Here’s how the company addressed it:

[Slide 3] Tackling competitive alternatives this early in a slide deck is unusual but probably a good move in this case. Image Credits: GPC Smart Tags

There are a number of obvious competitors in this space, including the most common ones, existing engraved metal tags or injected microchips, which both have their own pros and cons. There’s also the latest generation of GPS-enabled dog collars, such as the ones from Fi, Whistle, Fitbark and others, which aren’t addressed in this competitive landscape.

If the animal is stolen, the thief will simply discard the collar, and at that point, it doesn’t really matter what’s on the collar.

This slide shows an understanding of the competitive landscape. I love that the company chose to tackle this upfront. I think it’s important, and it’s a great way to get out ahead of the most obvious pushback from investors.

Like on the previous slide, although its presence is encouraging, it raises some questions. I think an NFC/QR code dog collar is interesting, but I’m struggling to see how they are inherently better than standard engraved tags. The exact laser-engraved tag in the photo doesn’t cost $15, as listed on the slide, but can be ordered from Amazon — fully personalized — for $4, with four lines of text on each side of the metal tag.

Sure, you can’t “update” the information, but pet owners are probably able to afford the $4 every time they move or change their phone numbers. You can’t include location information, but someone who is willing to catch a stray pup is probably able to text or call the owner with an address and details. Again, if the animal is stolen, the thief will simply discard the collar altogether, and at that point, it doesn’t really matter what’s on the collar. As far as tracking goes, an Apple AirTag might be a good solution for those situations (but it’s as easy to throw an AirTag into the bushes as any other collar).

This slide shows that the founders understand the challenges with their messaging and positioning, but it also shows that its answers are a work in progress.

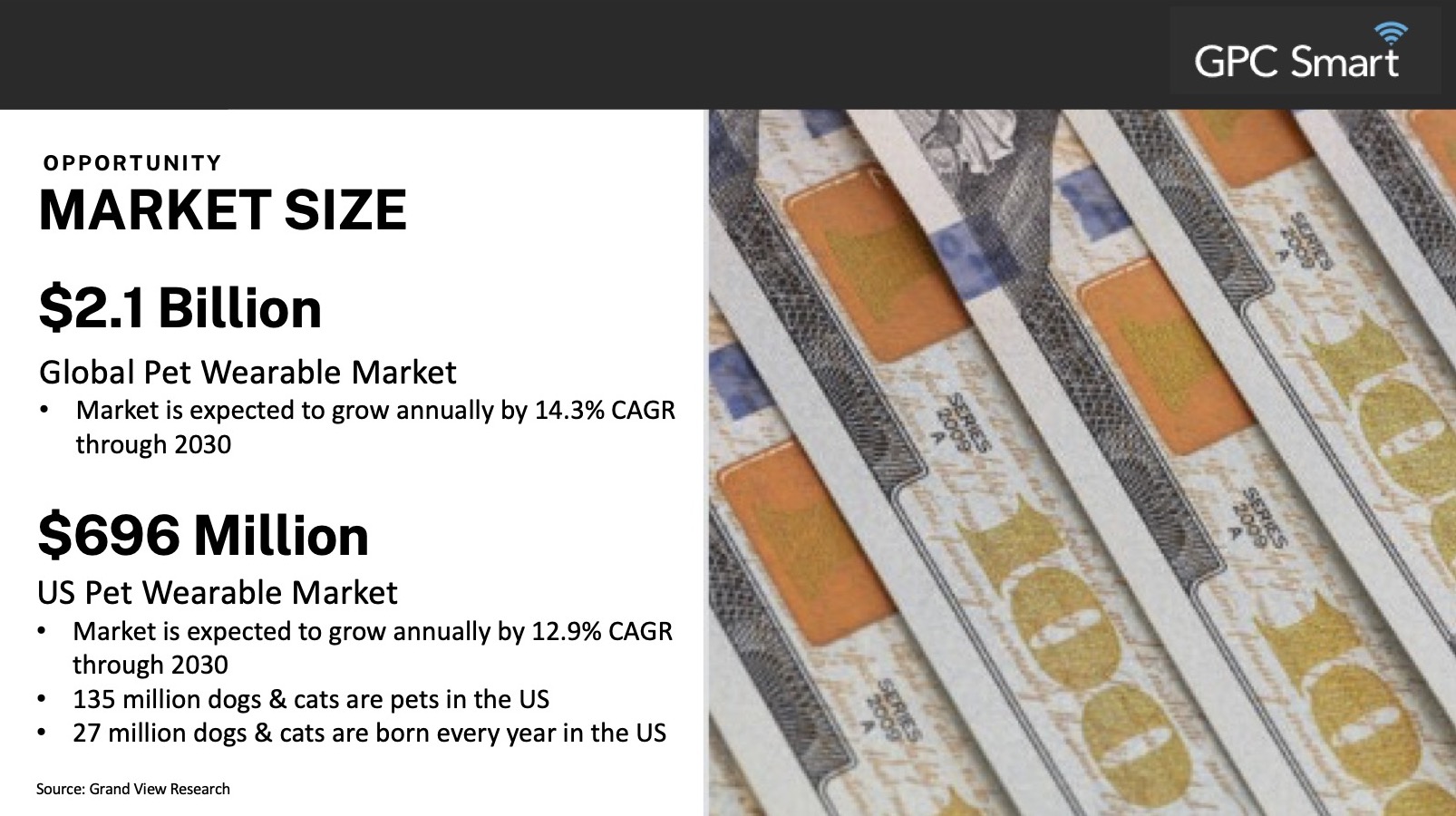

A beast of a market

The pet market, both in the U.S. and globally, is fantastically big. Investors know that, but adding a reminder can’t hurt. You don’t have to capture that big of a market share to build a very significant business here.

[Slide 7] Hellooooo market size. Image Credits: GPC Smart Tags

One of the things investors love more than anything else is a huge and growing market. Pet wearables definitely qualify in that world, and my gut tells me that smart wearables (especially GPS-type trackers) are going to be the value driver on that front. There probably is a space for a product like GPC in there, if it is able to play its cards right and find a good beachhead market for its customers. Pricing is going to be crucial here; this will be a product for people who want something fancier than an engraved tag but something simpler (or cheaper/easier to use) than a GPS tracker.

This slide shows the overall size of the market, which is awesome, but I would have liked it even better if the company said something about what it believes its serviceable market is and how it is going to go after those customers.

The thing you can learn from this slide as a startup? Have clarity on your market size and show off that it is big and trending toward growth.

In the rest of this teardown, we’ll take a look at three things Syneroid could have improved or done differently, along with its full pitch deck!

Pitch Deck Teardown: Syneroid’s $500K seed deck by Haje Jan Kamps originally published on TechCrunch

https://techcrunch.com/2022/11/10/sample-seed-pitch-deck-syneroid-technologies-corp/

Who’ll get the last laugh over Musk toying with Twitter’s veracity?

Twitter’s painstakingly layered infosphere looks to be light-speeding back to chaotic noise under new owner Elon Musk. The billionaire is no fan of meritocratic signals nor, it seems, a friend to genuine information — preferring anyone pay him $8/m to have their account on his microblogging social network badged with a check-mark that looks like the old Twitter verification check yet does not involve Musk’s Twitter checking they are who they say they are.

In short, it’s a joke made real.

Now, in order to verify if a check mark displayed on a Twitter account is a legacy verification of actual identity — or just a late stage capitalism status symbol for Musk’s most loyal fanboys — users must click on the check symbol next to an account name and read the small print that pops up and will either read: “This account is verified because it’s notable in government, news, entertainment, or another designated category” (aka, it’s pre-Musk Twitter verified); or “This account is verified because it’s subscribed to Twitter Blue” (aka, not verified; but yes probably a Musk super fan).

At the time of writing, there is no ‘at a glance’ way to distinguish between the old ‘identify verified’ Twitter check mark and non-verified paying subscribers. It’s inherently confusing — presumably intentionally so, given Musk’s love of trolling.

He certainly wasted no time laughing about the informational chaos he’d wrought… (At least, we *think* the below account posting crying-with-laughter emojis is him but who can tell anything on Twitter these days?)

Screengrab: Natasha Lomas/TechCrunch

Musk’s new Twitter Blue subscription product enables imposters and other purveyors of misinformation to assume (and, if they wish, trash) reputations of others, one check-marked tweet at a time — as immediately started happening on launch — just so long as they can sign up for an $8 charge to pay for Musk’s “leveller” tool.

Early targets for impersonation by Twitter Blue subscribers have included basketball star LeBron James, former president George W Bush, former UK prime minister Tony Blair, and tech and gaming brands Apple, Nintendo and Valve Software among others. Account bans followed for some of these impersonator accounts soon after — but the barrier to entry to Musk’s chaos game is incredibly low so plenty more trolls will surely follow. (Hence Twitter’s new nickname being ‘$8chan’.)

Twitter Blue is also touted to boost the visibility of subscribers’ tweets vs non-subscribers thereby skewing the information surfaced by the platform’s algorithms — and most likely eroding the visibility of quality information (based on who’s happy to pay vs who’s not).

Who could possibly have predicted this!

https://t.co/0VlOwUyIS4

— Natasha ($0)

(@riptari) November 10, 2022

As we’ve reported before, the risks aren’t just reputational (nor to information quality on Twitter): Scams and fraud could easily result if genuine Twitter users are taken in by a fake that’s seeking to harvest their personal information for identity theft or pointing them towards malicious websites to try to run phishing scams to compromise financial information or other sensitive data.

Still, as Twitter users everywhere feel the chill of Twitter Blue diluting the veracity of verification signals available on the platform (is it an actual politician or a troll? Maybe that is Musk’s joke?), spare a thought for the European Union — whose reputation as a global regulator risks taking a major nose dive in the Musk-Twitter era.

Thing is, Twitter is an existing signatory to the EU’s recently beefed up Code of Practice on Disinformation — a voluntary set of “commitments and measures” platforms agree to apply with the goal of combating the spread of misinformation and disinformation online.

Seriously. Musk-owned Twitter is technically already signed up to actively fight disinformation.

Yes, we lol’d too.

If you take a look at the specifics of what Twitter’s prior leadership team signed the business up for it makes especially awkward reading for Musk-Twitter (and/or the European Commission) — with a requirement on the platform to “limit impermissible manipulative behaviours and practices” by having in place (and/or further bolstering) policies against “impersonation” (emphasis ours); and against “the creation and use of fake accounts“, to name just two especially relevant “behaviors and practices” Twitter is supposed to be discouraging rather than amplifying per this EU Code.

Twitter is also signed up to Commitment 18 of the Code — which is summarized in its subscription document as (again, with our emphasis):

“Relevant Signatories commit to minimise the risks of viral propagation of misinformation or disinformation by adopting safe design practices as they develop their systems, policies, and features.”

Hands up anyone who thinks Musk’s chaotic product iteration at Twitter since taking over as “Chief Twit” fits the bill for “safe design practices”?

Er… anyone? No, of course not.

It took Musk a matter of hours to kill an “official” extra layer of verification — which took the confusing form of a duplicate check mark and ‘official’ label (yes, srsly) — and had been (very) briefly applied to a sub-set of (legacy) verified accounts by certain of the remaining Twitter staff after Musk fired the other half of the company in a massive cost cutting drive immediately on taking over.

“I just killed it,” Musk tweeted yesterday in response to (legacy verified) YouTuber Marques Brownlee — who had just spotted that the ‘Official’ badge he’d also just spotted was now missing; aka, AWOL soon after materializing. So, basically: Ohhai chaos!

“Blue check will be the great leveler,” was all Musk offered by way of public explanation at the time.

Blue check will be the great leveler

— Elon Musk (@elonmusk) November 9, 2022

Trust & safety features that come and go within a matter of days/hours/minutes — and product launches that drastically impact trust & safety being rushed out without zero care and attention to their impact on, um, trust & safety — is the new normal at Musk-Twitter.

The Chief Twit said as much — tweeting soon after nixing the extra ‘Official’ label: “Please note that Twitter will do lots of dumb things in coming months. We will keep what works & change what doesn’t.”

Which is really another way of Musk taking a pen to the Disinformation Code and doing this:

“Relevant Signatories commit to minimise the risks of viral propagation of misinformation or disinformation by adopting safe design practices as they develop their systems, policies, and features.”

Please note that Twitter will do lots of dumb things in coming months.

We will keep what works & change what doesn’t.

— Elon Musk (@elonmusk) November 9, 2022

Oh and it keeps getting worseTwitter’s CISO just abandoned ship too. Next upFTC intervention?

Pre-Musk Twitter had problems too, of course. Most notably, it was fined $150M by the FTC earlier this year for misrepresenting the security and privacy of user data over several years, for example. (And one can only imagine the scale of regulatory penalties that could rain down on Musk-Twitter if it fails to live up to its existing consent decree commitments to the FTC.)

What blowback is Musk going to face in the EU for thumbing his nose at regional lawmakers’ carefully constructed Code of Practice on Disinformation? In the short term probably not a lot — although some EU lawmakers are calling for Musk to testify in front of the European Parliament, as Bloomberg reported earlier. MEP Sophie in ‘t Veld told the news outlet she’s worried the platform will become a threat to democracy under Musk.

However it’s the European Commission that’s responsible for the Code of Practice on Disinformation — and for monitoring how it’s being applied.

We reached out to the Commission to ask if it has any concerns about Musk’s intentional levelling of Twitter’s verification system. A spokesman responded by telling us it is in contact with Twitter “in the context of the Code of Practice”.

“As Commissioner Breton recalled again recently we expect Twitter to respect all EU rules, this also includes the Code of Practice,” they added.

Last month, the EU’s internal market commissioner, Thierry Breton, wasted not time in schooling Musk on his taking ownership of Twitter that the bird must ‘fly by the EU’s rules’. But at press time we’d received no direct response from his office on the question of whether he has any concerns about account impersonations on Twitter spreading disinformation in the wake of Musk torching the value of verification.

The next batch of reports from Disinformation Code signatories aren’t due til January — so the EU’s executive may be trying to keep its head down to watch what unfolds in the coming, uhhhh, hours and minutes of Musk’s chaotic reign.

The Commission spokesperson did also imply that it’s watching to see if Musk launches Twitter Blue in the Single Market (the product has not yet been made available in the EU — in Europe it’s only available to UK users so far) — so, again, it could be keeping its powder dry to see if he adapts the feature-set for an EU launch to make it less, er, disinformation friendly. (That said, EU users are already being exposed to confusingly labelled tweets from Twitter Blue subscribers located outside the bloc so limiting scrutiny to local product launches would entirely miss the big picture confusion and risk letting Musk off the hook.)

It should be noted that the EU Code of Practice on Disinformation, while recently toughened up, remains a voluntary framework — so Musk violating commitments and measures that Twitter’s prior leadership signed up to can’t attract legal sanction at present.

It’s just a piece of paper — and the ink on the dotted line wasn’t even his to spill. So Musk doubtless does not feel beholden, if he’s even noticed this tiny detail. (Yes we also reached out to Twitter for comment but received no response.)

That said, the situation is set to change next year as the EU’s new flagship digital regulatory framework, the Digital Services Act (DSA), starts to come into application for larger platforms.

This is relevant because the Commission has intentionally linked following the Disinformation Code to compliance with the DSA — and the latter is legally binding across the EU (and can carry fines of up to 6% of global annual turnover for violations). So larger platforms that flout the bloc’s Code on Disinformation are risking the Commission finding them in breach of the DSA. Which will be a lot harder to ignore — at least for normal companies and CEOs.

Whether the EU will designate Twitter a VLOP (aka very large online platform) under the DSA is the big, burning question for regional Internet users at this point. And, really, for anyone concerned about Twitter’s slide into chaos under Musk — because the regulation looks to be one of the few meaningful checks (ha!) on Musk-Twitter in core areas of democratic risk like disinformation.

The real $44BN question, then, is who will pay the biggest price for Musk’s decision to devalue veracity on Twitter? The billionaire lord — assuming he gets slapped with hefty (enough) fines for intentionally wreaking havoc on trust & safety — or everyone else; the ‘peasants’ in this analogy, who can do nothing but wait to find out; aka, all the Internet users and people whose societies and democracies are being targeted for levelling down by disinformation purveyors (whether they’ve paid $8 to tweet or $44BN to own Twitter).

For now, clearly, Musk’s chaos reigns.

Who’ll get the last laugh over Musk toying with Twitter’s veracity? by Natasha Lomas originally published on TechCrunch

https://techcrunch.com/2022/11/10/elon-musk-twitter-verification-disinformation/